false

0000926326

0000926326

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.

C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): November 2, 2023

OMNICELL, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

000-33043 |

|

94-3166458 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

4220 North Freeway

Fort Worth, TX 76137

(Address of principal

executive offices, including zip code)

(877) 415-9990

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading Symbol | |

Name of each exchange on which registered |

| Common Stock, $0.001 par value | |

OMCL | |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, Omnicell, Inc.

(“Omnicell” or the “Company”) issued a press release announcing its financial results for the quarter ended September 30,

2023 and updating its guidance for the full year 2023. The full text of the press release issued in connection with the announcement is

attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 2.02 of this

Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 2.05 Costs Associated

with Exit or Disposal Activities.

On

November 2, 2023, Omnicell committed to a plan to reduce the Company’s headcount

and real estate footprint (the “2023 Plan”) as part of the Company’s expense containment initiatives and other

actions to reduce discretionary spending being implemented due to challenging industry dynamics and macroeconomic conditions. The Company

expects to reduce its workforce across a majority of its functions by more than 230 employees, representing approximately 7%

of the Company’s workforce.

In

connection with the 2023 Plan, the Company estimates that it will incur approximately $12 - $18 million of nonrecurring restructuring

and related charges. The estimated nonrecurring restructuring and related charges consist of (i) approximately $9 - $12

million of cash-based charges related to the reduction in headcount, consisting primarily of employee severance and benefits costs and

(ii) approximately $3 - $6 million of non-cash charges related to office closure, which the

Company expects to incur the majority of charges in the fourth quarter of 2023 with remaining charges incurred in future periods. The

Company expects to substantially complete the 2023 Plan, including cash payments, by the end of the second quarter of 2024, subject

to local law and consultation requirement.

The Company currently

estimates that the 2023 Plan, along with other expense containment initiatives and actions to reduce discretionary spending, will result

in approximately $45 - $55 million of annualized cost savings of which approximately 75% is expected to be in operating expenses. The

Company anticipates that a majority of the savings from the cost actions will be realized starting in first quarter 2024 with a smaller

portion expected over the rest of the year. However, the Company also expects that a portion of the annualized savings will be offset

by year-over-year increases in employee compensation and vendor price increases.

The estimates of the

charges and costs that the Company expects to incur and the annualized savings the Company expects to achieve, in connection with the

foregoing, and the timing thereof, are subject to a number of assumptions, including local law and consultation requirements, and actual

results may differ materially. In addition, the Company may incur other charges or cash expenditures not currently contemplated due to

unanticipated events that may occur as a result of or in connection with the implementation of the 2023 Plan.

Forward-Looking Statements

This Current Report on

Form 8-K contains forward-looking statements, including, but not limited to, statements related to the expected timing of incurring

costs and completion of the 2023 Plan, and the expected costs, related charges, and savings under the 2023 Plan. Words such as “expects,”

“estimate,” “will,” "likely," "anticipates,” “intend,” “may,” “plan,”

“potential,” “believe,” “forecast,” “guidance,” “outlook,” and similar expressions

are intended to identify forward-looking statements. These forward-looking statements are based upon the Company’s current plans,

assumptions, beliefs, and expectations. Forward-looking statements are subject to the occurrence of many events outside the Company’s

control. Actual results and the timing of events may differ materially from those contemplated by such forward-looking statements due

to numerous factors that involve substantial known and unknown risks and uncertainties. These risks and uncertainties include, among other

things, the risk that the restructuring may take longer than expected, costs may be greater than anticipated or that the savings may be

less than anticipated; the risk that the Company’s efforts may have an adverse impact on the Company’s internal programs,

and Omnicell’s ability to recruit and retain skilled and motivated personnel and may be distracting to management; and other risks

and uncertainties further described in the “Risk Factors” section of Omnicell’s most recent Annual Report on Form 10-K,

as well as in Omnicell’s other reports filed with or furnished to the United States Securities and Exchange Commission (“SEC”),

available at www.sec.gov. Forward-looking statements should be considered in light of these risks and uncertainties. Investors and others

are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained herein speak only as

of the date hereof. Omnicell assumes no obligation to update any such statements publicly, or to update the reasons actual results could

differ materially from those expressed or implied in any forward-looking statements, whether as a result of changed circumstances, new

information, future events, or otherwise, except as required by law.

Item 7.01. Regulation FD Disclosure

On November 2,

2023, the Company issued a press release that includes a discussion of the 2023 Plan. A copy of which is attached as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 7.01 of this

Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed

to be incorporated by reference into any Company filing under the Securities Act or the Exchange Act, except as expressly set forth by

specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly

authorized.

| |

OMNICELL, INC. |

| |

|

| Date: November 2, 2023 |

/s/ Nchacha E. Etta |

| |

Nchacha E. Etta, |

| |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| Contact: |

|

|

| Kathleen Nemeth |

|

Omnicell, Inc. |

| Senior Vice President, Investor

Relations |

|

4220 North Freeway |

| 650-435-3318 |

|

Fort Worth, TX 76137 |

| Kathleen.Nemeth@Omnicell.com |

|

|

Omnicell Announces

Third Quarter 2023 Results;

Updates Fiscal

Year 2023 Guidance and Announces Reduction in Force

Total GAAP revenues

of $299 million

GAAP net income

per diluted share of $0.12

Non-GAAP net

income per diluted share of $0.62

FORT

WORTH, Texas -- November 2, 2023 -- Omnicell, Inc. (NASDAQ:OMCL) (“Omnicell,”

“we,” “our,” “us,” “management,” or the “Company”), a leader in transforming

the pharmacy care delivery model, today announced results for its third quarter ended September 30, 2023.

Randall Lipps, chairman, president,

chief executive officer, and founder of Omnicell, said, “The team delivered strong cost management and operational discipline this

quarter. However, I am disappointed with the weakness in demand that we are seeing and accordingly, we have updated our near-term

outlook. We are taking actions to manage the business that are intended to reduce our cost structure and to better align with our anticipated

top line performance heading into 2024, while also positioning the Company to continue investing in our innovation agenda. We have taken

steps to strengthen our leadership team and we have already begun to reduce discretionary expenses. We remain encouraged that hospitals,

health systems, and retail pharmacies continue to rely on Omnicell to help them improve patient and health system outcomes — especially

during this dynamic time in the industry. The need for the healthcare industry to automate, optimize, and modernize is more important

than ever and we believe Omnicell is well positioned to deliver value to all of our stakeholders over the long-term.”

Financial Results

Total GAAP revenues for the third quarter

of 2023 were $299 million, down $49 million, or 14%, from the third quarter of 2022. The year-over-year decrease in total GAAP revenues

reflects lower point-of-care revenues primarily as a result of ongoing health systems capital budget and labor constraints.

Total GAAP net income for the third

quarter of 2023 was $6 million, or $0.12 per diluted share. This compares to GAAP net income of $17 million, or $0.37 per diluted share,

for the third quarter of 2022.

Total non-GAAP net income for the third

quarter of 2023 was $28 million, or $0.62 per diluted share. This compares to non-GAAP net income of $45 million, or $1.00 per diluted

share, for the third quarter of 2022.

Total non-GAAP EBITDA for the third

quarter of 2023 was $41 million. This compares to non-GAAP EBITDA of $61 million for the third quarter of 2022.

Balance Sheet

As of September 30, 2023, Omnicell’s

balance sheet reflected cash and cash equivalents of $447 million, total debt (net of unamortized debt issuance costs) of $569 million,

and total assets of $2.22 billion. Cash flows provided by operating activities in the third quarter of 2023 totaled $57 million. This

compares to cash flows provided by operating activities totaling $21 million in the third quarter of 2022.

As of September 30, 2023, the Company

had $500 million of availability under its revolving credit facility with no outstanding balance. Subsequent to the quarter end,

on October 10, 2023, the Company refinanced its revolving credit facility to provide for $350 million of funds available, which

availability is subject to reduction in order to maintain compliance with certain financial covenants.

Corporate Highlights

| · | Health systems continue to choose

Omnicell as a long-term partner for their pharmacy technology strategy, with several customers

extending their sole-source agreements and one competitive conversion achieved during the

quarter. |

| · | Omnicell’s Central Pharmacy

Dispensing Service appears to be gaining momentum in the market as many health systems seem

to be recognizing the benefits to patient safety and workflow efficiency of automating central

pharmacy operations through a comprehensive solution encompassing advanced robotics, dispensing

optimization tools, and expert services. |

| · | As health systems expand pharmacy

care beyond the four walls of the hospital, Omnicell’s Specialty Pharmacy Services

offering should provide a revenue-generating opportunity, while helping to support important

patient care initiatives. Health systems are choosing Omnicell’s management services

expertise to help drive financial and clinical outcomes for this rapidly growing area of

healthcare. |

Restructuring

Omnicell plans to take action as it

relates to cost containment across the business, including a headcount reduction across our business functions, and is expecting approximately

$12 million - $18 million of non-recurring restructuring and related charges related to the cost containment plan. The Company expects

to incur a majority of the charges in fourth quarter of 2023 and substantially complete the plan by end of second quarter of 2024, subject

to local law and consultation requirement. Annualized cost savings of $45 million - $55 million, approximately 75 percent of which are

expected to be in Operating Expenses, are expected. A majority of the benefit from the cost actions is anticipated to be realized beginning

in the first quarter of 2024 with a smaller portion of the savings expected as the year progresses. The cost actions should be

partially offset by year over year increases in compensation and vendor price increases.

Updated 2023 Guidance

For the full year 2023, the Company

expects bookings to be between $850 million and $950 million. The Company expects full year 2023 total revenues to be between $1.135

billion and $1.155 billion. The Company expects full year 2023 product revenues to be between $705 million and $715 million, and full

year 2023 service revenues to be between $430 million and $440 million. The Company expects full year 2023 technical services revenues

to be between $222 million and $227 million, and full year 2023 Advanced Services revenues to be between $208 million and $213 million.

The Company expects full year 2023 non-GAAP EBITDA to be between $123 million and $133 million. The Company expects full year 2023 non-GAAP

earnings per share to be between $1.65 and $1.80 per share.

For the fourth quarter of 2023, the

Company expects total revenues to be between $247 million and $267 million. The Company expects fourth quarter 2023 product revenues

to be between $142 million and $152 million, and fourth quarter 2023 service revenues to be between $105 million and $115 million. The

Company expects fourth quarter 2023 non-GAAP EBITDA to be between $9 million and $19 million. The Company expects fourth quarter 2023

non-GAAP earnings per share to be between $0.07 and $0.22 per share.

The Company’s fourth quarter and

full year 2023 guidance has been adjusted to include the anticipated effects and expected impact of current macroeconomic headwinds.

The table below summarizes Omnicell’s

fourth quarter and updated full year 2023 guidance outlined above.

| |

Q4’23 |

2023 |

| Bookings |

Not

guided |

$850

million - $950 million |

| Total

Revenues |

$247

million - $267 million |

$1.135

billion - $1.155 billion |

| Product

Revenues |

$142

million - $152 million |

$705

million - $715 million |

| Service

Revenues |

$105

million - $115 million |

$430

million - $440 million |

| Technical

Services Revenues |

Not

guided |

$222

million - $227 million |

| Advanced

Services Revenues |

Not

guided |

$208

million - $213 million |

| Non-GAAP

EBITDA |

$9

million - $19 million |

$123

million - $133 million |

| Non-GAAP

Earnings Per Share |

$0.07

- $0.22 |

$1.65

- $1.80 |

The Company does not provide guidance

for GAAP net income or GAAP earnings per share, nor a reconciliation of these forward-looking non-GAAP financial measures to the most

directly comparable GAAP financial measures on a forward-looking basis because it is unable to predict certain items contained in the

GAAP measures without unreasonable efforts. These forward-looking non-GAAP financial measures do not include certain items, which may

be significant, including, but not limited to, unusual gains and losses, costs associated with future restructurings, acquisition-related

expenses, and certain tax and litigation outcomes.

Omnicell Conference Call Information

Omnicell will hold a conference call

today, Thursday, November 2, 2023 at 8:30 a.m. ET to discuss third quarter 2023 financial results. The conference call

can be monitored by dialing (888) 550-5424 in the U.S. or (646) 960-0819 in international locations. The Conference ID is 9581556. A

link to the live and archived webcast will also be available on the Investor Relations section of Omnicell’s website at http://ir.omnicell.com/events-and-presentations/.

About Omnicell

Since 1992, Omnicell has been committed

to transforming the pharmacy care delivery model in an effort to optimize financial and clinical outcomes across all settings of care.

Through a comprehensive portfolio of automation and advanced services, Omnicell is uniquely positioned to address evolving healthcare

challenges, connect settings of care, and streamline the medication management process. Healthcare facilities worldwide partner with

Omnicell to help increase operational efficiency, reduce medication errors, improve patient safety, and enhance patient engagement and

adherence, helping to reduce costly hospital readmissions. To learn more, visit omnicell.com.

From time to time, Omnicell may use

the Company’s investor relations website and other online social media channels, including its Twitter handle www.twitter.com/omnicell,

LinkedIn page www.linkedin.com/company/omnicell, and Facebook page www.facebook.com/omnicellinc, to disclose material non-public

information and comply with its disclosure obligations under Regulation Fair Disclosure (“Reg FD”).

OMNICELL and the Omnicell logo are registered

trademarks of Omnicell, Inc. or one of its subsidiaries.

Forward-Looking Statements

To

the extent any statements contained in this press release deal with information that is not historical, these statements are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Without limiting the foregoing, statements

including the words “expect,” “intend,” “may,” “will,” “should,” “would,”

“could,” “plan,” “potential,” “anticipate,” “believe,” “forecast,”

“guidance,” “outlook,” “goals,” “target,” “estimate,” “seek,”

“predict,” “project,” and similar expressions are intended to identify forward-looking statements. Forward-looking

statements are subject to the occurrence of many events outside Omnicell’s control. Such statements include, but are not limited

to, Omnicell’s projected bookings, revenues, including product, service, technical services and Advanced Services revenues, non-GAAP

EBITDA, and non-GAAP earnings per share; expectations regarding our products and services and the expected benefits; our ability to deliver

long-term value; statements related to the expected timing of incurring costs and completion of

the cost containment plan, and the expected costs, related charges, and savings under the cost containment plan; and statements about

Omnicell’s strategy, plans, objectives, goals, vision, and planned investments. Actual results and other events may differ significantly

from those contemplated by forward-looking statements due to numerous factors that involve substantial known and unknown risks and uncertainties.

These risks and uncertainties include, among other things, (i) unfavorable general economic and market conditions, including the

impact and duration of inflationary pressures, (ii) ability to realize the benefits of our expense containment initiatives, (iii) restructuring

may take longer than expected, costs may be greater than anticipated or that the savings may be less than anticipated; (iv) the

Company’s efforts may have an adverse impact on the Company’s internal programs, and Omnicell’s ability to recruit

and retain skilled and motivated personnel and may be distracting to management, (iv) Omnicell’s ability to take advantage

of growth opportunities and develop and commercialize new solutions and enhance existing solutions, (v) reduction in demand in the

capital equipment market or reduction in the demand for or adoption of our solutions, systems, or services, (vi) delays in installations

of our medication management solutions or our more complex medication packaging systems, (vii) risks related to Omnicell’s

investments in new business strategies or initiatives, including its transition to selling more products and services on a subscription

basis, and its ability to acquire companies, businesses, or technologies and successfully integrate such acquisitions, (viii) risks

related to failing to maintain expected service levels when providing our Advanced Services or retaining our Advanced Services customers,

(ix) Omnicell’s ability to meet the demands of, or maintain relationships with, its institutional, retail, and specialty pharmacy

customers, (x) risks related to climate change, legal, regulatory or market measures to address climate change and related emphasis

on ESG matters by various stakeholders, (xi) changes to the 340B Program, (xii) Omnicell’s substantial debt, which could

impair its financial flexibility and access to capital, (xiii) covenants in our credit agreement could restrict our business and

operations, (xiv) continued and increased competition from current and future competitors in the medication management automation

solutions market and the medication adherence solutions market, (xv) risks presented by government regulations, legislative changes,

fraud and anti-kickback statues, products liability claims, the outcome of legal proceedings, and other legal obligations related to

healthcare, privacy, data protection, and information security, including any potential governmental investigations and enforcement actions,

litigation, fines and penalties, exposure to indemnification obligations or other liabilities, and adverse publicity as a result of the

previously disclosed ransomware incident, (xvi) any disruption in Omnicell’s information technology systems and breaches of

data security or cyber-attacks on its systems or solutions, including the previously disclosed ransomware incident and any potential

adverse legal, reputational, and financial effects that may result from it and/or additional cybersecurity incidents, as well as the

effectiveness of business continuity plans during any future cybersecurity incidents, (xvii) risks associated with operating in

foreign countries, (xviii) Omnicell’s ability to recruit and retain skilled and motivated personnel, (xix) Omnicell’s

ability to protect its intellectual property, (xx) risks related to the availability and sources of raw materials and components

or price fluctuations, shortages, or interruptions of supply, (xxi) Omnicell’s dependence on a limited number of suppliers

for certain components, equipment, and raw materials, as well as technologies provided by third-party vendors, (xxii) fluctuations

in quarterly and annual operating results may make our future operating results difficult to predict, (xxiii) failing to meet (or

significantly exceeding) our publicly announced financial guidance, and (xxiv) other risks and uncertainties further described in

the “Risk Factors” section of Omnicell’s most recent Annual Report on Form 10-K, as well as in Omnicell’s

other reports filed with or furnished to the United States Securities and Exchange Commission (“SEC”), available at www.sec.gov.

Forward-looking statements should be considered in light of these risks and uncertainties. Investors and others are cautioned not to

place undue reliance on forward-looking statements. All forward-looking statements contained in this press release speak only as of the

date of this press release. Omnicell assumes no obligation to update any such statements publicly, or to update the reasons actual results

could differ materially from those expressed or implied in any forward-looking statements, whether as a result of changed circumstances,

new information, future events, or otherwise, except as required by law.

Use of Non-GAAP Financial Information

This press release contains financial

measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Management evaluates

and makes operating decisions using various performance measures. In addition to Omnicell’s GAAP results, we also consider non-GAAP

revenues, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP operating

margin, non-GAAP net income, non-GAAP net income per diluted share, non-GAAP diluted shares, non-GAAP EBITDA, non-GAAP EBITDA margin,

and non-GAAP free cash flow. These non-GAAP results and metrics should not be considered as an alternative to revenues, gross profit,

operating expenses, income from operations, net income, net income per diluted share, diluted shares, net cash provided by operating

activities, or any other performance measure derived in accordance with GAAP. We present these non-GAAP results and metrics because management

considers them to be important supplemental measures of Omnicell’s performance and refers to such measures when analyzing Omnicell’s

strategy and operations.

Our non-GAAP revenues, non-GAAP gross

profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP operating margin, non-GAAP net

income, non-GAAP net income per diluted share, non-GAAP EBITDA, and non-GAAP EBITDA margin are exclusive of certain items to facilitate

management’s review of the comparability of Omnicell’s core operating results on a period-to-period basis because such items

are not related to Omnicell’s ongoing core operating results as viewed by management. We define our “core operating results”

as those revenues recorded in a particular period and the expenses incurred within such period that directly drive operating income in

such period. Management uses these non-GAAP financial measures in making operating decisions because, in addition to meaningful supplemental

information regarding operating performance, the measures give us a better understanding of how we believe we should invest in research

and development, fund infrastructure growth, and evaluate the effectiveness of marketing strategies. In calculating the above non-GAAP

results: non-GAAP revenues excludes from its GAAP equivalent item a) below; non-GAAP gross profit and non-GAAP gross margin exclude from

their GAAP equivalents items a), b), c), f), and h) below; non-GAAP operating expenses excludes from its GAAP equivalents items b), c),

d), e), f), g), h), and j) below; non-GAAP income from operations and non-GAAP operating margin exclude from their GAAP equivalents items

a), b), c), d), e), f), g), h) and j) below; and non-GAAP net income and non-GAAP net income per diluted share exclude from their GAAP

equivalents items a) through j) below. Non-GAAP EBITDA is defined as earnings before interest income and expense, taxes, depreciation,

amortization, and share-based compensation, as well as excluding certain other non-GAAP adjustments. Non-GAAP EBITDA and non-GAAP EBITDA

margin exclude from their GAAP equivalents items a), b), d), e), f), g), h), i), and j) below:

| a) | Acquisition accounting impact related

to deferred revenues. In connection with the acquisition of FDS Amplicare on September 9,

2021, we recorded a fair value adjustment to acquired deferred revenues as part of the purchase

accounting in accordance with GAAP. The adjustment represents revenues that would have been

recognized in the normal course of business by FDS Amplicare if the acquisition had not occurred,

but was not recognized due to GAAP purchase accounting requirements. The non-GAAP adjustment

to our revenues is intended to include the full amounts of such revenues. We believe the

adjustment to these revenues is useful as a measure of the ongoing performance of our business. |

| b) | Share-based compensation expense. We

excluded from our non-GAAP results the expense related to equity-based compensation plans

as it represents expenses that do not require cash settlement from Omnicell. |

| c) | Amortization of acquired intangible

assets. We excluded from our non-GAAP results the intangible assets amortization

expense resulting from our past acquisitions. These non-cash charges are not considered by

management to reflect the core cash-generating performance of the business and therefore

are excluded from our non-GAAP results. |

| d) | Acquisition-related expenses.

We excluded from our non-GAAP results the expenses related to recent acquisitions, including

amortization of representations and warranties insurance. These expenses are unrelated to

our ongoing operations, vary in size and frequency, and are subject to significant fluctuations

from period to period due to varying levels of acquisition activity. We believe that excluding

these expenses provides more meaningful comparisons of the financial results to our historical

operations and forward-looking guidance, and to the financial results of less acquisitive

peer companies. |

| e) | Impairment and abandonment of operating

lease right-of-use and other assets related to facilities. We excluded from our non-GAAP

results the impairment and abandonment of certain operating lease right-of-use assets, as

well as property and equipment, incurred in connection with restructuring activities for

optimization of certain leased facilities. These non-cash charges are not considered by management

to reflect the core cash-generating performance of the business and therefore are excluded

from our non-GAAP results. |

| f) | Ransomware-related expenses, net

of insurance recoveries. We excluded from our non-GAAP results the net expenses related

to the previously disclosed ransomware incident identified by the Company on May 4,

2022. Expenses include costs to investigate and remediate the ransomware incident, as well

as legal and other professional services, and are presented net of expected insurance recoveries.

These expenses are unrelated to our ongoing operations and would not have otherwise been

incurred by us in the normal course of business. We believe that excluding these expenses

provides more meaningful comparisons of the financial results to our historical operations

and forward-looking guidance, and to the financial results of peer companies. |

| g) | Executives transition costs.

We excluded from our non-GAAP results the executives transition costs associated with the

departure of certain executive officers, primarily consisting of severance expenses. These

expenses are unrelated to our ongoing operations and we do not expect them to occur in the

ordinary course of business. We believe that excluding these expenses provides more meaningful

comparisons of the financial results to our historical operations and forward-looking guidance,

and to the financial results of peer companies. |

| h) | Severance-related expenses.

We excluded from our non-GAAP results the expenses related to restructuring events, partially

offset by reversals of previously recognized severance expenses in subsequent periods. These

expenses are unrelated to our ongoing operations, vary in size and frequency, and are subject

to significant fluctuations from period to period due to varying levels of restructuring

activity. We believe that excluding these expenses provides more meaningful comparisons of

the financial results to our historical operations and forward-looking guidance, and to the

financial results of peer companies. |

| i) | Amortization of debt issuance costs. Debt

issuance costs represent costs associated with the issuance of term loan and revolving credit

facilities, as well as the issuance of convertible senior notes. The costs include underwriting

fees, original issue discount, ticking fees, and legal fees. These non-cash expenses are

not considered by management to reflect the core cash-generating performance of the business

and therefore are excluded from our non-GAAP results. |

| j) | Certain litigation costs. We

excluded non-recurring charges and benefits, including litigation expenses and settlements,

related to litigation matters that are outside of the ordinary course of our business or

that are not representative of those that we historically have incurred. These expenses are

unrelated to our ongoing operations and we do not expect them to occur in the ordinary course

of business. We believe that excluding these expenses provides more meaningful comparisons

of the financial results to our historical operations and forward-looking guidance, and to

the financial results of peer companies. |

Management adjusts for the above items

because management believes that, in general, these items possess one or more of the following characteristics: their magnitude and timing

is largely outside of Omnicell’s control; they are unrelated to the ongoing operation of the business in the ordinary course; they

are unusual and we do not expect them to occur in the ordinary course of business; or they are non-operational or non-cash expenses involving

stock compensation plans or other items.

We believe that the presentation of

non-GAAP revenues, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income, non-GAAP net income per diluted share, non-GAAP EBITDA, and non-GAAP EBITDA margin is warranted

for several reasons:

| a) | Such non-GAAP financial measures provide

an additional analytical tool for understanding Omnicell’s financial performance by

excluding the impact of items which may obscure trends in the core operating results of the

business. |

| b) | Since we have historically reported

non-GAAP results to the investment community, we believe the inclusion of non-GAAP numbers

provides consistency and enhances investors’ ability to compare our performance across

financial reporting periods. |

| c) | These non-GAAP financial measures are

employed by management in its own evaluation of performance and are utilized in financial

and operational decision-making processes, such as budget planning and forecasting. |

| d) | These non-GAAP financial measures facilitate

comparisons to the operating results of other companies in our industry, which also use non-GAAP

financial measures to supplement their GAAP results (although these companies may calculate

non-GAAP financial measures differently than Omnicell does), thus enhancing the perspective

of investors who wish to utilize such comparisons in their analysis of our performance. |

Set forth below are additional reasons

why share-based compensation expense is excluded from our non-GAAP financial measures:

| i) | While share-based compensation calculated

in accordance with Accounting Standards Codification (“ASC”) 718 constitutes

an ongoing and recurring expense of Omnicell, it is not an expense that requires cash settlement

by Omnicell. We therefore exclude these charges for purposes of evaluating core operating

results. Thus, our non-GAAP measurements are presented exclusive of share-based compensation

expense to assist management and investors in evaluating our core operating results. |

| ii) | We present ASC 718 share-based payment

compensation expense in our reconciliation of non-GAAP financial measures on a pre-tax basis

because the exact tax differences related to the timing and deductibility of share-based

compensation under ASC 718 are dependent upon the trading price of Omnicell’s

common stock and the timing and exercise by employees of their stock options. As a result

of these timing and market uncertainties, the tax effect related to share-based compensation

expense would be inconsistent in amount and frequency and is therefore excluded from our

non-GAAP results. |

Non-GAAP diluted shares is defined as

our GAAP diluted shares, excluding the impact of dilutive convertible senior notes for which the Company is economically hedged through

its anti-dilutive convertible note hedge transaction. We believe non-GAAP diluted shares is a useful non-GAAP metric because it provides

insight into the offsetting economic effect of the hedge transaction against potential conversion of the convertible senior notes.

Non-GAAP free cash flow is defined as

net cash provided by operating activities less cash used for software development for external use and purchases of property and equipment.

We believe free cash flow is important to enable investors to better understand and evaluate our ongoing operating results and allows

for greater transparency in the review and understanding of our overall financial, operational, and economic performance, because free

cash flow takes into account certain capital expenditures and cash used for software development necessary to operate our business.

As stated above, we present non-GAAP

financial measures because we consider them to be important supplemental measures of performance. However, non-GAAP financial measures

have limitations as an analytical tool and should not be considered in isolation or as a substitute for Omnicell’s GAAP results.

In the future, we expect to incur expenses similar to certain of the non-GAAP adjustments described above and expect to continue reporting

non-GAAP financial measures excluding such items. Some of the limitations in relying on non-GAAP financial measures are:

| a) | Omnicell’s equity incentive plans

and stock purchase plans are important components of incentive compensation arrangements

and will be reflected as expenses in Omnicell’s GAAP results for the foreseeable future

under ASC 718. |

| b) | Other companies, including companies

in Omnicell’s industry, may calculate non-GAAP financial measures differently than

Omnicell, limiting their usefulness as a comparative measure. |

| c) | A limitation of the utility of free

cash flow as a measure of financial performance is that it does not represent the total increase

or decrease in Omnicell’s cash balance for the period. |

A detailed reconciliation between Omnicell’s

non-GAAP and GAAP financial results is set forth in the financial tables at the end of this press release. Investors are advised to carefully

review and consider this information strictly as a supplement to the GAAP results that are contained in this press release as well as

in Omnicell’s other reports filed with or furnished to the SEC.

Omnicell, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited, in

thousands, except per share data)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Product revenues | |

$ | 188,755 | | |

$ | 246,565 | | |

$ | 562,906 | | |

$ | 706,246 | |

| Services

and other revenues | |

| 109,908 | | |

| 101,494 | | |

| 325,359 | | |

| 292,027 | |

| Total revenues | |

| 298,663 | | |

| 348,059 | | |

| 888,265 | | |

| 998,273 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Cost of product revenues | |

| 106,311 | | |

| 134,023 | | |

| 323,800 | | |

| 374,175 | |

| Cost of

services and other revenues | |

| 60,388 | | |

| 54,941 | | |

| 173,029 | | |

| 156,864 | |

| Total cost

of revenues | |

| 166,699 | | |

| 188,964 | | |

| 496,829 | | |

| 531,039 | |

| Gross profit | |

| 131,964 | | |

| 159,095 | | |

| 391,436 | | |

| 467,234 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 24,281 | | |

| 25,171 | | |

| 70,296 | | |

| 76,556 | |

| Selling,

general, and administrative | |

| 103,971 | | |

| 115,459 | | |

| 332,643 | | |

| 354,644 | |

| Total operating

expenses | |

| 128,252 | | |

| 140,630 | | |

| 402,939 | | |

| 431,200 | |

| Income (loss) from operations | |

| 3,712 | | |

| 18,465 | | |

| (11,503 | ) | |

| 36,034 | |

| Interest

and other income (expense), net | |

| 3,670 | | |

| (1,148 | ) | |

| 9,912 | | |

| (2,973 | ) |

| Income (loss) before income

taxes | |

| 7,382 | | |

| 17,317 | | |

| (1,591 | ) | |

| 33,061 | |

| Provision

for (benefit from) income taxes | |

| 1,829 | | |

| 543 | | |

| 4,405 | | |

| (995 | ) |

| Net

income (loss) | |

$ | 5,553 | | |

$ | 16,774 | | |

$ | (5,996 | ) | |

$ | 34,056 | |

| Net income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.12 | | |

$ | 0.38 | | |

$ | (0.13 | ) | |

$ | 0.77 | |

| Diluted | |

$ | 0.12 | | |

$ | 0.37 | | |

$ | (0.13 | ) | |

$ | 0.73 | |

| Weighted-average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 45,333 | | |

| 44,441 | | |

| 45,117 | | |

| 44,304 | |

| Diluted | |

| 45,595 | | |

| 45,819 | | |

| 45,117 | | |

| 46,759 | |

Omnicell, Inc.

Condensed Consolidated

Balance Sheets

(Unaudited, in

thousands)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 446,840 | | |

$ | 330,362 | |

| Accounts receivable and unbilled

receivables, net | |

| 272,584 | | |

| 299,469 | |

| Inventories | |

| 116,144 | | |

| 147,549 | |

| Prepaid expenses | |

| 27,947 | | |

| 27,070 | |

| Other current

assets | |

| 50,236 | | |

| 77,362 | |

| Total current assets | |

| 913,751 | | |

| 881,812 | |

| Property and equipment, net | |

| 106,880 | | |

| 93,961 | |

| Long-term investment in sales-type

leases, net | |

| 41,631 | | |

| 32,924 | |

| Operating lease right-of-use

assets | |

| 25,444 | | |

| 38,052 | |

| Goodwill | |

| 734,328 | | |

| 734,274 | |

| Intangible assets, net | |

| 218,861 | | |

| 242,906 | |

| Long-term deferred tax assets | |

| 35,964 | | |

| 22,329 | |

| Prepaid commissions | |

| 53,950 | | |

| 59,483 | |

| Other long-term

assets | |

| 90,766 | | |

| 105,017 | |

| Total

assets | |

$ | 2,221,575 | | |

$ | 2,210,758 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’

EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 49,920 | | |

$ | 63,389 | |

| Accrued compensation | |

| 44,065 | | |

| 73,455 | |

| Accrued liabilities | |

| 150,385 | | |

| 172,655 | |

| Deferred

revenues, net | |

| 124,991 | | |

| 118,947 | |

| Total current liabilities | |

| 369,361 | | |

| 428,446 | |

| Long-term deferred revenues | |

| 55,053 | | |

| 37,385 | |

| Long-term deferred tax liabilities | |

| 1,565 | | |

| 2,095 | |

| Long-term operating lease liabilities | |

| 32,845 | | |

| 39,405 | |

| Other long-term liabilities | |

| 6,428 | | |

| 6,719 | |

| Convertible

senior notes, net | |

| 568,887 | | |

| 566,571 | |

| Total liabilities | |

| 1,034,139 | | |

| 1,080,621 | |

| Total stockholders’

equity | |

| 1,187,436 | | |

| 1,130,137 | |

| Total

liabilities and stockholders’ equity | |

$ | 2,221,575 | | |

$ | 2,210,758 | |

Omnicell, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in

thousands)

| | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Operating Activities | |

| | | |

| | |

| Net income (loss) | |

$ | (5,996 | ) | |

$ | 34,056 | |

| Adjustments to reconcile net

income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 65,596 | | |

| 64,843 | |

| Loss on disposal of property

and equipment | |

| 2,110 | | |

| 331 | |

| Share-based compensation expense | |

| 43,113 | | |

| 50,731 | |

| Deferred income taxes | |

| (14,165 | ) | |

| (17,061 | ) |

| Amortization of operating lease

right-of-use assets | |

| 6,238 | | |

| 9,709 | |

| Impairment and abandonment of

operating lease right-of-use assets related to facilities | |

| 7,815 | | |

| 5,390 | |

| Amortization of debt issuance

costs | |

| 3,139 | | |

| 3,121 | |

| Changes in operating assets

and liabilities: | |

| | | |

| | |

| Accounts receivable and unbilled

receivables | |

| 27,050 | | |

| (116,895 | ) |

| Inventories | |

| 31,690 | | |

| (32,269 | ) |

| Prepaid expenses | |

| (857 | ) | |

| (2,602 | ) |

| Other current assets | |

| 1,521 | | |

| 6,692 | |

| Investment in sales-type leases | |

| (8,839 | ) | |

| (17,336 | ) |

| Prepaid commissions | |

| 5,533 | | |

| 8,801 | |

| Other long-term assets | |

| 2,539 | | |

| 4,189 | |

| Accounts payable | |

| (13,358 | ) | |

| 2,043 | |

| Accrued compensation | |

| (29,390 | ) | |

| (27,940 | ) |

| Accrued liabilities | |

| 3,749 | | |

| 11,678 | |

| Deferred revenues | |

| 23,628 | | |

| 17,667 | |

| Operating lease liabilities | |

| (8,145 | ) | |

| (10,966 | ) |

| Other long-term

liabilities | |

| (291 | ) | |

| 1,446 | |

| Net cash

provided by (used in) operating activities | |

| 142,680 | | |

| (4,372 | ) |

| Investing Activities | |

| | | |

| | |

| External-use software development

costs | |

| (10,240 | ) | |

| (9,648 | ) |

| Purchases of property and equipment | |

| (32,404 | ) | |

| (33,861 | ) |

| Business acquisition, net of

cash acquired | |

| — | | |

| (3,392 | ) |

| Purchase

price adjustments from business acquisitions | |

| — | | |

| 5,484 | |

| Net cash

used in investing activities | |

| (42,644 | ) | |

| (41,417 | ) |

| Financing Activities | |

| | | |

| | |

| Proceeds from issuances under

stock-based compensation plans | |

| 23,035 | | |

| 39,539 | |

| Employees’ taxes paid

related to restricted stock units | |

| (6,130 | ) | |

| (11,442 | ) |

| Change in customer funds, net | |

| (6,615 | ) | |

| (402 | ) |

| Stock repurchases | |

| — | | |

| (52,210 | ) |

| Net cash

provided by (used in) financing activities | |

| 10,290 | | |

| (24,515 | ) |

| Effect

of exchange rate changes on cash and cash equivalents | |

| (464 | ) | |

| (1,425 | ) |

| Net increase (decrease) in cash,

cash equivalents, and restricted cash | |

| 109,862 | | |

| (71,729 | ) |

| Cash, cash

equivalents, and restricted cash at beginning of period | |

| 352,835 | | |

| 355,620 | |

| Cash,

cash equivalents, and restricted cash at end of period | |

$ | 462,697 | | |

$ | 283,891 | |

| Reconciliation of cash,

cash equivalents, and restricted cash to the Condensed Consolidated Balance Sheets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 446,840 | | |

$ | 266,402 | |

| Restricted

cash included in other current assets | |

| 15,857 | | |

| 17,489 | |

| Cash,

cash equivalents, and restricted cash at end of period | |

$ | 462,697 | | |

$ | 283,891 | |

Omnicell, Inc.

Reconciliation

of GAAP to Non-GAAP

(Unaudited, in

thousands, except per share data and percentage)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of GAAP revenues

to non-GAAP revenues: |

| GAAP revenues | |

$ | 298,663 | | |

$ | 348,059 | | |

$ | 888,265 | | |

$ | 998,273 | |

| Acquisition

accounting impact related to deferred revenues | |

| — | | |

| 183 | | |

| — | | |

| 863 | |

| Non-GAAP

revenues | |

$ | 298,663 | | |

$ | 348,242 | | |

$ | 888,265 | | |

$ | 999,136 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of GAAP

gross profit to non-GAAP gross profit: | |

| | | |

| | | |

| | | |

| | |

| GAAP gross profit | |

$ | 131,964 | | |

$ | 159,095 | | |

$ | 391,436 | | |

$ | 467,234 | |

| GAAP gross margin | |

| 44.2 | % | |

| 45.7 | % | |

| 44.1 | % | |

| 46.8 | % |

| Share-based compensation expense | |

| 2,213 | | |

| 2,203 | | |

| 6,489 | | |

| 6,607 | |

| Amortization of acquired intangibles | |

| 2,633 | | |

| 3,238 | | |

| 8,558 | | |

| 10,089 | |

| Acquisition accounting impact

related to deferred revenues | |

| — | | |

| 183 | | |

| — | | |

| 863 | |

| Ransomware-related expenses,

net of insurance recoveries | |

| — | | |

| 95 | | |

| — | | |

| 317 | |

| Severance-related

expenses, net of reversals | |

| (280 | ) | |

| 444 | | |

| 102 | | |

| 600 | |

| Non-GAAP

gross profit | |

$ | 136,530 | | |

$ | 165,258 | | |

$ | 406,585 | | |

$ | 485,710 | |

| Non-GAAP gross margin | |

| 45.7 | % | |

| 47.5 | % | |

| 45.8 | % | |

| 48.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of GAAP operating

expenses to non-GAAP operating expenses: | |

| | | |

| | | |

| | | |

| | |

| GAAP operating expenses | |

$ | 128,252 | | |

$ | 140,630 | | |

$ | 402,939 | | |

$ | 431,200 | |

| GAAP operating expenses % to

total revenues | |

| 42.9 | % | |

| 40.4 | % | |

| 45.4 | % | |

| 43.2 | % |

| Share-based compensation expense | |

| (12,769 | ) | |

| (15,107 | ) | |

| (36,624 | ) | |

| (44,124 | ) |

| Amortization of acquired intangibles | |

| (5,050 | ) | |

| (5,507 | ) | |

| (15,402 | ) | |

| (16,554 | ) |

| Acquisition-related expenses | |

| (246 | ) | |

| (251 | ) | |

| (738 | ) | |

| (1,909 | ) |

| Impairment

and abandonment of operating lease right-of-use and other assets related to facilities (a) | |

| — | | |

| (297 | ) | |

| (8,420 | ) | |

| (5,390 | ) |

| Ransomware-related expenses,

net of insurance recoveries | |

| 184 | | |

| (932 | ) | |

| 184 | | |

| (2,084 | ) |

| Executives transition costs | |

| (1,348 | ) | |

| — | | |

| (2,189 | ) | |

| — | |

| Severance-related

and other expenses, net of reversals (b) | |

| 301 | | |

| (2,050 | ) | |

| (5,352 | ) | |

| (5,421 | ) |

| Non-GAAP

operating expenses | |

$ | 109,324 | | |

$ | 116,486 | | |

$ | 334,398 | | |

$ | 355,718 | |

| Non-GAAP operating expenses

as a % of total non-GAAP revenues | |

| 36.6 | % | |

| 33.4 | % | |

| 37.6 | % | |

| 35.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of GAAP income

(loss) from operations to non-GAAP income from operations: | |

| | | |

| | | |

| | | |

| | |

| GAAP income (loss) from operations | |

$ | 3,712 | | |

$ | 18,465 | | |

$ | (11,503 | ) | |

$ | 36,034 | |

| GAAP operating income (loss)

% to total revenues | |

| 1.2 | % | |

| 5.3 | % | |

| (1.3 | )% | |

| 3.6 | % |

| Share-based compensation expense | |

| 14,982 | | |

| 17,310 | | |

| 43,113 | | |

| 50,731 | |

| Amortization of acquired intangibles | |

| 7,683 | | |

| 8,745 | | |

| 23,960 | | |

| 26,643 | |

| Acquisition accounting impact

related to deferred revenues | |

| — | | |

| 183 | | |

| — | | |

| 863 | |

| Acquisition-related expenses | |

| 246 | | |

| 251 | | |

| 738 | | |

| 1,909 | |

| Impairment

and abandonment of operating lease right-of-use and other assets related to facilities (a) | |

| — | | |

| 297 | | |

| 8,420 | | |

| 5,390 | |

| Ransomware-related expenses,

net of insurance recoveries | |

| (184 | ) | |

| 1,027 | | |

| (184 | ) | |

| 2,401 | |

| Executives transition costs | |

| 1,348 | | |

| — | | |

| 2,189 | | |

| — | |

| Severance-related

and other expenses, net of reversals (b) | |

| (581 | ) | |

| 2,494 | | |

| 5,454 | | |

| 6,021 | |

| Non-GAAP

income from operations | |

$ | 27,206 | | |

$ | 48,772 | | |

$ | 72,187 | | |

$ | 129,992 | |

| Non-GAAP operating margin (non-GAAP

operating income as a % of total non-GAAP revenues) | |

| 9.1 | % | |

| 14.0 | % | |

| 8.1 | % | |

| 13.0 | % |

Omnicell, Inc.

Reconciliation

of GAAP to Non-GAAP

(Unaudited, in

thousands, except per share data and percentage)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of GAAP net income

(loss) to non-GAAP net income: |

| GAAP net income

(loss) | |

$ | 5,553 | | |

$ | 16,774 | | |

$ | (5,996 | ) | |

$ | 34,056 | |

| Share-based compensation expense | |

| 14,982 | | |

| 17,310 | | |

| 43,113 | | |

| 50,731 | |

| Amortization of acquired intangibles | |

| 7,683 | | |

| 8,745 | | |

| 23,960 | | |

| 26,643 | |

| Acquisition accounting impact

related to deferred revenues | |

| — | | |

| 183 | | |

| — | | |

| 863 | |

| Acquisition-related expenses | |

| 246 | | |

| 251 | | |

| 738 | | |

| 1,909 | |

| Impairment

and abandonment of operating lease right-of-use and other assets related to facilities (a) | |

| — | | |

| 297 | | |

| 8,420 | | |

| 5,390 | |

| Ransomware-related expenses,

net of insurance recoveries | |

| (184 | ) | |

| 1,027 | | |

| (184 | ) | |

| 2,401 | |

| Executives transition costs | |

| 1,348 | | |

| — | | |

| 2,189 | | |

| — | |

| Severance-related

and other expenses, net of reversals (b) | |

| (581 | ) | |

| 2,494 | | |

| 5,454 | | |

| 6,021 | |

| Amortization of debt issuance

costs | |

| 1,048 | | |

| 1,042 | | |

| 3,139 | | |

| 3,121 | |

| Tax

effect of the adjustments above (c) | |

| (2,008 | ) | |

| (2,948 | ) | |

| (9,181 | ) | |

| (9,734 | ) |

| Non-GAAP

net income | |

$ | 28,087 | | |

$ | 45,175 | | |

$ | 71,652 | | |

$ | 121,401 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation

of GAAP net income (loss) per share - diluted to non-GAAP net income per share - diluted: | |

| | | |

| | | |

| | | |

| | |

| Shares - diluted GAAP | |

| 45,595 | | |

| 45,819 | | |

| 45,117 | | |

| 46,759 | |

| Shares

- diluted non-GAAP (d) | |

| 45,595 | | |

| 45,384 | | |

| 45,410 | | |

| 45,597 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net income (loss) per share

- diluted | |

$ | 0.12 | | |

$ | 0.37 | | |

$ | (0.13 | ) | |

$ | 0.73 | |

| Share-based compensation expense | |

| 0.33 | | |

| 0.38 | | |

| 0.95 | | |

| 1.11 | |

| Amortization of acquired intangibles | |

| 0.16 | | |

| 0.19 | | |

| 0.52 | | |

| 0.58 | |

| Acquisition accounting impact

related to deferred revenues | |

| — | | |

| 0.00 | | |

| — | | |

| 0.02 | |

| Acquisition-related expenses | |

| 0.01 | | |

| 0.01 | | |

| 0.02 | | |

| 0.04 | |

| Impairment and abandonment of

operating lease right-of-use and other assets related to facilities | |

| — | | |

| 0.01 | | |

| 0.18 | | |

| 0.12 | |

| Ransomware-related expenses,

net of insurance recoveries | |

| (0.00 | ) | |

| 0.02 | | |

| (0.00 | ) | |

| 0.05 | |

| Executives transition costs | |

| 0.03 | | |

| — | | |

| 0.05 | | |

| — | |

| Severance-related and other

expenses, net of reversals | |

| (0.01 | ) | |

| 0.06 | | |

| 0.12 | | |

| 0.13 | |

| Amortization of debt issuance

costs | |

| 0.02 | | |

| 0.02 | | |

| 0.07 | | |

| 0.07 | |

| Non-GAAP

dilutive shares impact from convertible note hedge transaction (d) | |

| — | | |

| 0.00 | | |

| — | | |

| 0.02 | |

| Tax

effect of the adjustments above (c) | |

| (0.04 | ) | |

| (0.06 | ) | |

| (0.20 | ) | |

| (0.21 | ) |

| Non-GAAP

net income per share - diluted | |

$ | 0.62 | | |

$ | 1.00 | | |

$ | 1.58 | | |

$ | 2.66 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation

of GAAP net income (loss) to non-GAAP EBITDA(e): | |

| | | |

| | | |

| | | |

| | |

| GAAP net income (loss) | |

$ | 5,553 | | |

$ | 16,774 | | |

$ | (5,996 | ) | |

$ | 34,056 | |

| Share-based compensation expense | |

| 14,982 | | |

| 17,310 | | |

| 43,113 | | |

| 50,731 | |

| Interest (income) and expense,

net | |

| (5,247 | ) | |

| (1,136 | ) | |

| (12,731 | ) | |

| (1,311 | ) |

| Depreciation and amortization

expense | |

| 21,542 | | |

| 21,826 | | |

| 65,596 | | |

| 64,843 | |

| Acquisition accounting impact

related to deferred revenues | |

| — | | |

| 183 | | |

| — | | |

| 863 | |

| Acquisition-related expenses | |

| 246 | | |

| 251 | | |

| 738 | | |

| 1,909 | |

| Impairment

and abandonment of operating lease right-of-use and other assets related to facilities (a) | |

| — | | |

| 297 | | |

| 8,420 | | |

| 5,390 | |

| Ransomware-related expenses,

net of insurance recoveries | |

| (184 | ) | |

| 1,027 | | |

| (184 | ) | |

| 2,401 | |

| Executives transition costs | |

| 1,348 | | |

| — | | |

| 2,189 | | |

| — | |

| Severance-related

and other expenses, net of reversals (b) | |

| (581 | ) | |

| 2,494 | | |

| 5,454 | | |

| 6,021 | |

| Amortization of debt issuance

costs | |

| 1,048 | | |

| 1,042 | | |

| 3,139 | | |

| 3,121 | |

| Provision

for (benefit from) income taxes | |

| 1,829 | | |

| 543 | | |

| 4,405 | | |

| (995 | ) |

| Non-GAAP

EBITDA | |

$ | 40,536 | | |

$ | 60,611 | | |

$ | 114,143 | | |

$ | 167,029 | |

| Non-GAAP EBITDA margin (non-GAAP

EBITDA as a % of total non-GAAP revenues) | |

| 13.6 | % | |

| 17.4 | % | |

| 12.9 | % | |

| 16.7 | % |

| (a) | For

the nine months ended September 30, 2023, impairment charges of other assets were approximately

$0.6 million related to property and equipment in connection with restructuring activities

for optimization of certain leased facilities. |

| (b) | For

the three and nine months ended September 30, 2022, other expenses included approximately

$0.7 million of certain litigation costs. |

| (c) | Tax

effects calculated for all adjustments except share-based compensation expense, using an

estimated annual effective tax rate of 21% for both fiscal years 2023 and 2022. |

| (d) | For

the three and nine months ended September 30, 2022, non-GAAP diluted shares excluded

approximately 0.4 million and 1.2 million shares, respectively, related to the impact of

dilutive convertible senior notes for which the Company is economically hedged through its

anti-dilutive convertible note hedge transaction. |

| (e) | Defined

as earnings before interest income and expense, taxes, depreciation, amortization, and share-based

compensation, as well as excluding certain other non-GAAP adjustments. |

Omnicell, Inc.

Reconciliation

of GAAP to Non-GAAP

(Unaudited, in

thousands)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of GAAP net cash provided by (used in) operating activities to non-GAAP free cash flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net cash provided

by (used in) operating activities | |

$ | 57,007 | | |

$ | 21,175 | | |

$ | 142,680 | | |

$ | (4,372 | ) |

| External-use software development

costs | |

| (3,555 | ) | |

| (3,105 | ) | |

| (10,240 | ) | |

| (9,648 | ) |

| Purchases

of property and equipment | |

| (10,632 | ) | |

| (12,762 | ) | |

| (32,404 | ) | |

| (33,861 | ) |

| Non-GAAP

free cash flow | |

$ | 42,820 | | |

$ | 5,308 | | |

$ | 100,036 | | |

$ | (47,881 | ) |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

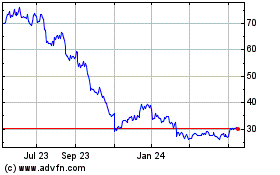

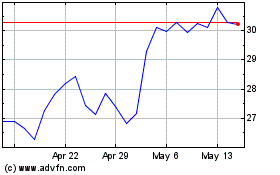

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2024 to May 2024

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From May 2023 to May 2024