– Conference Call Today at 4:30 p.m. ET

–

Omeros Corporation (Nasdaq: OMER), a clinical-stage

biopharmaceutical company committed to discovering, developing and

commercializing small-molecule and protein therapeutics for

large-market as well as orphan indications targeting inflammation

and immunologic diseases, including complement-mediated diseases

and cancers, today announced recent highlights and developments as

well as financial results for the second quarter ended June 30,

2022, which include:

- For the quarter ended June 30, 2022, Omeros earned royalties of

$17.2 million on net sales of the company’s former ophthalmology

product OMIDRIA®. Royalties earned in the quarter represent 50

percent of net sales of OMIDRIA by Rayner Surgical, Inc. (Rayner),

which purchased Omeros’ ophthalmology assets in December 2021.

Rayner’s reported net sales of $34.5 million for the second quarter

of 2022, all of which were in the U.S., establish a new all-time

high for quarterly OMIDRIA sales and represent a $5.7 million

increase over net sales of $28.8 million reported by Omeros for the

second quarter of last year.

- Net loss in 2Q 2022 was $30.9 million, or $0.49 per share,

which included $3.7 million of non-cash expenses, or $0.06 per

share. This compares to a net loss of $28.6 million, or $0.46 per

share for the prior year quarter, which included $3.9 million of

non-cash expenses, or $0.06 per share.

- At June 30, 2022, Omeros had $122.6 million of cash, cash

equivalents and short-term investments available for operations,

which is a reduction of $19.7 million from March 31, 2022. In

addition, Omeros had $14.5 million in net receivables available for

operations at June 30, 2022.

- In June 2022, Omeros submitted to the United States Food and

Drug Administration (FDA) a request for Formal Dispute Resolution

regarding the Complete Response Letter (CRL) issued by FDA last

year regarding the Company’s biologics license application (BLA)

for narsoplimab in the treatment of hematopoietic stem cell

transplant-associated thrombotic microangiopathy (TA-TMA). Formal

dispute resolution is an official pathway that enables a sponsor to

appeal a decision by an FDA division to a higher authority within

FDA, in this case the Office of New Drugs (OND). Last month, in

accordance with the standard dispute resolution procedure, Omeros

had a formal meeting with the OND official assigned to decide the

dispute. A decision is expected in August 2022.

“We remain confident that approval of narsoplimab in TA-TMA is

warranted, and we look forward to OND’s decision later this month,”

said Gregory A. Demopulos, M.D., Omeros’ chairman and chief

executive officer. “In addition to FDA’s decision on narsoplimab

approval, a series of value-driving milestones have aligned over

the next few quarters: data from our Phase 3 trial of narsoplimab

in IgA nephropathy are on track for readout by mid-next year; our

MASP-3 inhibitor OMS906 is starting trials in PNH and C3

glomerulopathy with efficacy data targeted by early next year;

about that same time, we expect data from our Phase 1 trial of

OMS1029, our long-acting MASP-2 inhibitor, which began dosing

earlier this week; also in early 2023, our PDE7 inhibitor OMS527

should have data available in a clinically predictive primate model

of levodopa-induced dyskinesias; and, with separate payment for

OMIDRIA reconfirmed by CMS in its recently released proposed rule

for the Outpatient Prospective Payment System, we expect continuing

growth in our royalty stream and, should OMIDRIA obtain long-term

reimbursement, to secure the $200-million milestone payment.”

Second Quarter and Recent Clinical Developments

- Recent developments regarding narsoplimab, Omeros’ lead

monoclonal antibody targeting mannan-binding lectin-associated

serine protease-2 (MASP-2) in advanced clinical programs for the

treatment of TA-TMA, immunoglobulin A (IgA) nephropathy, atypical

hemolytic uremic syndrome (aHUS) and severely ill COVID-19

patients, include the following:

- Enrollment in Omeros’ Phase 3 ARTEMIS-IGAN trial continues to

progress toward an anticipated readout of 9-month data on

proteinuria by mid-next year.

- The Omeros teams in Cambridge, UK and Seattle recently

published two manuscripts detailing the company’s latest

COVID-19-related discoveries, the first by Ali et al. in Frontiers

in Immunology and the second by Lynch et al. in Clinical and

Translational Medicine. Together, these publications describe the

findings that:

- Patients with severe COVID-19 early in disease show marked

complement consumption driven by lectin pathway hyperactivation,

causing secondary hypocomplementemia and loss of

complement-mediated immune protection against microbial infection.

This hypocomplementemia increases the risk of clinically severe

infections, a common cause of morbidity and death in COVID-19.

- Narsoplimab restores complement function and bactericidal

activity, preventing risk of secondary infection.

- Narsoplimab is also being evaluated for the treatment of

hospitalized COVID-19 patients in the I-SPY COVID-19 platform trial

sponsored by Quantum Leap Healthcare Collaborative (QLHC). Omeros

looks forward to QLHC’s disclosure of the narsoplimab results.

Recent developments regarding OMS906, Omeros’ lead monoclonal

antibody targeting MASP-3, the key activator of the alternative

pathway, and OMS1029, the company’s long-acting, next-generation

MASP-2 inhibitor, include the following:

- In July, OMS906 received designation from FDA as an orphan drug

for the treatment of paroxysmal nocturnal hemoglobinuria (PNH).

Orphan-drug designation is granted by FDA to encourage development

of a drug that targets a condition affecting fewer than 200,000

U.S. patients annually. The benefits of orphan drug designation

include seven years of market exclusivity following marketing

approval, tax credits on U.S. clinical trials, eligibility for

orphan drug grants, and waiver of certain administrative fees.

- To accelerate obtaining OMS906 efficacy data, in addition to

the Phase 1b trial expected to begin enrolling soon and evaluating

OMS906 in patients with PNH who have had an unsatisfactory response

to the C5 inhibitor ravulizumab, Omeros is expanding its program of

OMS906 clinical trials to include treatment-naïve PNH patients and

complement 3 (C3) glomerulopathy patients as well as one or more

related indications. Efficacy data in these indications are

targeted by early 2023.

- Omeros has submitted an abstract describing the results of the

OMS906 Phase 1 study for presentation at a major medical congress

later this year. Preliminary results from the Phase 1 study were

previously reported and no safety signals of concern were

noted.

- A Phase 1 clinical trial assessing safety, tolerability and

pharmacokinetics/pharmacodynamics (PK/PD) of OMS1029 in healthy

subjects is underway, with the first dose administered earlier this

week. Designed for convenient dosing, OMS1029 is expected to enable

Omeros to pursue a range of indications complementary to those for

narsoplimab. Based on animal PK/PD data to date, dosing in humans

is expected to be once-monthly to once-quarterly by subcutaneous or

intravenous administration.

Financial Results

On December 23, 2021, Rayner acquired OMIDRIA and certain

related assets and liabilities. The completion of the sale required

Omeros to reclassify all revenues and expenses related to OMIDRIA

as discontinued operations for fiscal year 2021 in its financial

statements.

During the second quarter of 2022, Omeros earned royalties of

$17.2 million on sales of OMIDRIA, which were recorded as a

reduction from the OMIDRIA contract royalty asset. The company also

recorded $10.1 million of income in discontinued operations,

primarily representing interest income and remeasurement

adjustments to the OMIDRIA contract royalty asset.

Total costs and expenses for the second quarter of 2022 were

$37.4 million compared to $45.6 million for the second quarter of

2021. The decrease was primarily due to the timing of narsoplimab

manufacturing activities and a reduction in U.S. TA-TMA pre-launch

activities.

Net loss was $30.9 million in the second quarter of 2022, or

$0.49 per share, which included $3.7 million of non-cash expenses,

or $0.06 per share. This compares to a net loss of $28.6 million,

or $0.46 per share, including $3.9 million of non-cash expenses, or

$0.06 per share, in 2Q 2021.

As of June 30, 2022, the company had $122.2 million of cash,

cash equivalents and short-term investments with an additional

$14.5 million in receivables, net.

Conference Call Details

To access the live conference call via phone, please dial (833)

634-2592 from the United States and Canada or (412) 902-4100

internationally and ask to be placed into the Omeros earnings call.

Please dial in approximately 10 minutes prior to the start of the

call. A telephone replay will be available for one week following

the call and may be accessed by dialing (877) 344-7529 from the

United States, (412) 317-0088 internationally, and (855) 669-9658

from Canada. The replay access code is 4990130.

For online access to the live or subsequently archived webcast

of the conference call, go to Omeros’ website at

https://investor.omeros.com/upcoming-events.

About Omeros Corporation

Omeros is an innovative biopharmaceutical company committed to

discovering, developing and commercializing small-molecule and

protein therapeutics for large-market and orphan indications

targeting immunologic disorders including complement-mediated

diseases, cancers, and addictive and compulsive disorders. Omeros’

lead MASP-2 inhibitor narsoplimab targets the lectin pathway of

complement and is the subject of a biologics license application

pending before FDA for the treatment of hematopoietic stem cell

transplant-associated thrombotic microangiopathy (TA-TMA).

Narsoplimab is also in multiple late-stage clinical development

programs focused on other complement-mediated disorders, including

IgA nephropathy, COVID-19, and atypical hemolytic uremic syndrome.

OMS906, Omeros’ inhibitor of MASP-3, the key activator of the

alternative pathway of complement, is advancing in clinical

programs for paroxysmal nocturnal hemoglobinuria (PNH), complement

3 (C3) glomerulopathy and one or more related indications. For more

information about Omeros and its programs, visit

www.omeros.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are

subject to the “safe harbor” created by those sections for such

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“goal,” “intend,” “likely,” “look forward to,” “may,” “objective,”

“plan,” “potential,” “predict,” “project,” “should,” “slate,”

“target,” “will,” “would” and similar expressions and variations

thereof. Forward-looking statements, including expectations with

regard to Omeros’ pursuit of regulatory approval for narsoplimab in

TA-TMA, including expectations regarding the potential or

anticipated outcomes of its formal dispute resolution request, and

expectations regarding the initiation or continuation of clinical

trials evaluating Omeros’ drug candidates and the anticipated

availability of data therefrom, and expectations regarding growth

in royalty-generating sales, are based on management’s beliefs and

assumptions and on information available to management only as of

the date of this press release. Omeros’ actual results could differ

materially from those anticipated in these forward-looking

statements for many reasons, including, without limitation,

unanticipated or unexpected outcomes of regulatory processes in

relevant jurisdictions, unproven preclinical and clinical

development activities, the impact of COVID-19 on our business,

financial condition and results of operations, regulatory processes

and oversight, challenges associated with manufacture or supply of

our investigational or clinical products, changes in reimbursement

and payment policies by government and commercial payers or the

application of such policies, intellectual property claims,

competitive developments, litigation, and the risks, uncertainties

and other factors described under the heading “Risk Factors” in the

company’s Annual Report on Form 10-K filed with the Securities and

Exchange Commission on March 1, 2022. Given these risks,

uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and the company

assumes no obligation to update these forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

OMEROS CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

and per share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2021

2022

2021

Costs and expenses:

Research and development

$

23,516

$

30,126

$

47,603

$

62,630

Selling, general and administrative

13,922

15,484

24,881

28,270

Total costs and expenses

37,438

45,610

72,484

90,900

Loss from continuing operations

(37,438

)

(45,610

)

(72,484

)

(90,900

)

Interest expense

(4,927

)

(4,910

)

(9,868

)

(9,807

)

Other income

670

333

1,163

751

Net loss from continuing operations

(41,695

)

(50,187

)

(81,189

)

(99,956

)

Net income from discontinued

operations

10,846

21,594

17,329

36,273

Net loss

$

(30,849

)

$

(28,593

)

$

(63,860

)

$

(63,683

)

Basic and diluted net income (loss) per

share

Net loss from continuing operations

(0.66

)

(0.80

)

$

(1.30

)

$

(1.61

)

Net income from discontinued

operations

0.17

0.34

0.28

0.59

Net loss

$

(0.49

)

$

(0.46

)

$

(1.02

)

$

(1.02

)

Weighted-average shares used to compute

basic and diluted net income (loss) per share

62,730,015

62,373,521

62,727,395

62,154,714

(1)

The sale of OMIDRIA has been accounted for

as the sale of an asset. Accordingly, we have reclassified all

revenues and expenses related to OMIDRIA to net income from

discontinued operations for the three and six months ended June 30,

2021 in our financial statements.

OMEROS CORPORATION

UNAUDITED CONSOLIDATED BALANCE

SHEET DATA

(In thousands)

June 30,

December 31,

2022

2021

Cash and cash equivalents

$

122,562

$

157,266

OMIDRIA contract royalty asset

170,606

184,570

Total assets

345,638

419,268

Total current liabilities

38,501

51,789

Lease liabilities

28,665

34,381

Unsecured convertible senior notes,

net

314,358

313,458

Total shareholders’ equity (deficit)

(32,702

)

23,780

Working capital

154,221

196,167

OMEROS CORPORATION

UNAUDITED CONSOLIDATED

SUPPLEMENTAL DATA

(In thousands)

The following schedule presents a

rollforward of the OMIDRIA contract royalty asset:

OMIDRIA contract royalty asset at December

31, 2021

$

184,570

Royalties earned

(31,062

)

Royalty interest income and remeasurement

adjustments

17,098

OMIDRIA contract royalty asset at June 30,

2022

$

170,606

Net income from discontinued operations is

as follows:

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2021

2022

2021

(In thousands)

Product sales, net

$

—

$

28,823

$

—

$

49,884

Royalty interest income and remeasurement

adjustments

10,102

—

17,098

—

Total

10,102

28,823

17,098

49,884

Other income, costs and expenses, net

(744

)

7,229

(231

)

13,611

Net income from discontinued

operations

$

10,846

$

21,594

$

17,329

$

36,273

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220809006009/en/

Jennifer Cook Williams Cook Williams Communications, Inc.

Investor and Media Relations IR@omeros.com

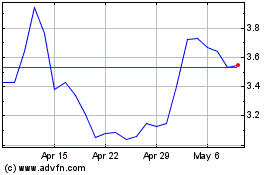

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Apr 2023 to Apr 2024