By Julie Wernau and Yoko Kubota

BEIJING-- Amazon.com Inc. is checking out of China's fiercely

competitive domestic e-commerce market.

The company told sellers on Thursday that it will no longer

operate its third-party online marketplace or provide seller

services on its Chinese website, Amazon.cn, beginning July 18. As a

result, domestic companies will no longer be able to sell products

to Chinese consumers on its e-commerce platform.

The decision marks an end to a long struggle by America's

e-commerce giants in the Chinese market. The firms entered the

Chinese market with great fanfare in the early 2000s only to wither

in the face of competition from China's faster-moving internet

titans.

Amazon has been in talks to merge its cross-border e-commerce

business with a Chinese competitor, NetEase Inc.'s Kaola, in a

stock-for-stock transaction, according to a person familiar with

the matter. That would remove the Amazon name from consumer-facing

e-commerce in China. Neither company would confirm the progress or

details of those talks, nor would they say if they are ongoing.

In a statement, Amazon said it remains committed to China

through its global stores, Kindle businesses and its web

services.

NetEase Chief Financial Officer Zhaoxuan Yang said in a call

with analysts in February that the company is "open-minded to

embrace stakeholders, strategic partners [and] business partners

that can bring synergy and win-win to our e-commerce segment."

When Amazon first entered China in 2004 with the purchase of

Joyo.com, it was the largest online vendor for books, music and

video there. Most Chinese consumers were using cash-on-delivery as

their top form of payment. Today, Amazon China chiefly caters to

customers looking for imported international goods like cosmetics

and milk powder and is a minuscule player in the booming Chinese

e-commerce market.

Amazon China commanded just 6% of gross merchandise volume in

the niche cross-border e-commerce market in the fourth quarter of

2018, versus NetEase Kaola's 25% share and the 32% held by Alibaba

Group Holding Ltd.'s Tmall International, according to Nomura

Securities Co.

"Everyone has merged with someone," said Chris Reitermann, chief

executive for Asia and Greater China at Ogilvy, which advises

Alibaba. "It became clear that as a Western internet company you

wouldn't be able to succeed at scale without a Chinese

partner."

For Nasdaq-listed NetEase, which has a market capitalization of

$35 billion, the Amazon matchup is a way to expand beyond its

lucrative videogame business. It is also a play to gain more trust

from Chinese consumers who have complained about knockoff products

on NetEase platforms, according to industry analysts.

In January, a customer accused Kaola of selling her a fake

Canada Goose jacket and the incident went viral. Customers

questioned whether the e-commerce firm could sufficiently maintain

oversight of its platform, according to Azoya Group, which advises

global retailers and brands who are setting up e-commerce

businesses in China. Kaola pledged to investigate the matter.

Nomura believes that an Amazon tie-up, if it materializes, could

help Kaola win the confidence of leading global brands. And that

could lead to an increased supply of goods offered to Chinese

consumers.

And those consumers are becoming more enamored with domestic

brands. In 2011, 85% of Chinese consumers said they would always

buy a foreign brand over a domestic one, according to

Shanghai-based China Market Research Group. By 2016, 60% of

respondents said they preferred domestic over foreign brands.

Shaun Rein, China Market Research's founder, said American

e-commerce giants stumbled in China because they haven't offered

the products or user experience that consumers are looking for.

"All the big e-commerce players in the United States have

largely failed in China," he said.

In 2003, eBay Inc. paid $150 million to buy EachNet, which was

China's top e-commerce site at the time. It later invested an

additional $100 million. It struggled to keep up with Alibaba's

rival Taobao service, hobbled in part by a foreign management team

that underestimated the competition and a payment system that was

difficult for Chinese consumers to use. In 2006, eBay sold its

China operations to internet company TOM Online.

Walmart Inc. also struggled to run an independent e-commerce

business in China. It sold its e-commerce business to JD.com Inc.

in 2016 rather than trying to crack the market on its own.

Groupon Inc. entered China in 2011 by setting by up a joint

venture with Tencent Holdings Ltd. Before operations commenced, the

company broadcast a commercial during the Super Bowl that included

a reference to Tibet, which has been controlled by China for

decades. Many Chinese people were offended and Groupon's brand

image was damaged. The company was unable to recruit local talent

and to gain brand recognition despite a rapid expansion. Within 18

months, it merged with another Chinese daily-deal site also backed

by Tencent.

Single-brand e-commerce companies like as Zara SA, Nike Inc. and

Estée Lauder Cos. have been more successful than multibrand players

in China, said Ivy Shen, vice president of international business

at Azoya. Other smaller foreign firms have also made gains, she

said, by offering products that are different from the ones carried

by China's major e-commerce companies.

"Everyone thought China is quite a huge cake," she said. "But

they didn't realize there are so many aggressive domestic players

fighting for the cake."

Xiao Xiao

contributed to this article.

Write to Julie Wernau at Julie.Wernau@wsj.com and Yoko Kubota at

yoko.kubota@wsj.com

(END) Dow Jones Newswires

April 18, 2019 04:54 ET (08:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

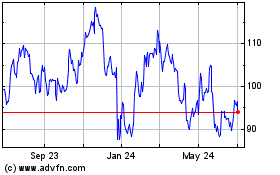

NetEase (NASDAQ:NTES)

Historical Stock Chart

From Oct 2024 to Nov 2024

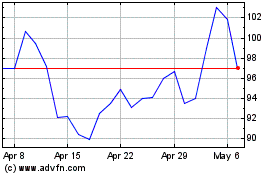

NetEase (NASDAQ:NTES)

Historical Stock Chart

From Nov 2023 to Nov 2024