UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January

10, 2024

NAUTICUS ROBOTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40611 |

|

87-1699753 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

17146 Feathercraft Lane, Suite 450, Webster,

TX 77598

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (281) 942-9069

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common Stock |

|

KITT |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

KITTW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On January 10, 2024, Nauticus

Robotics, Inc. issued a press release related to its recent activities. The press release is attached hereto as Exhibit 99.1 and incorporated

by reference herein.

The foregoing information,

including Exhibit 99.1, is being furnished pursuant to Item 7.01 and shall not be deemed “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of

that section, nor shall such information or Exhibit 99.1 be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: January 10, 2024 |

Nauticus Robotics, Inc. |

| |

|

|

| |

By: |

/s/ Nicholas J. Bigney |

| |

|

Name: |

Nicholas J. Bigney |

| |

|

Title: |

General Counsel |

2

Exhibit 99.1

Nauticus Robotics Secures Additional Funding, Appoints

New Executive Management, Improves

Operations and Cost Structures, and Engages Strategic Advisor

Nauticus Robotics, Inc. (NASDAQ: KITT) (“Nauticus” or the

“Company”), a developer of subsea autonomous robotic systems and software, today announced that it had secured an investment

before the close of 2023 and eliminated many of the dilutive warrants and ratchet provisions of the original de-SPAC financing in the

process. The new investment is the first tranche of financing led by existing investors. Nauticus anticipates executing a second tranche

of investment, discussions for which are ongoing and aimed at providing funding for the year.

The new investment shows continued support from existing stakeholders

and is an integral component of several strategic activities initiated by the Company’s Board of Directors to optimize its operations

and to improve its near and long-term financial viability. This includes the engagement of a new executive management team, culminating

in the promotion of John W. Gibson, Jr. to interim CEO on January 4, 2024.

“We currently have the intellectual property, prototypes, and

the talent to deliver robust products and services,” said Gibson. “Team Nauticus is now laser-focused on converting our intellectual

property, including both patents and trade secrets, into differentiated solutions that bring significant value to both commercial and

government customers. We are shifting from prototypes to creating reliable solutions for the blue economy. We are pleased that our financing

partners worked with us to address the ratchet provisions associated with earlier issued convertible securities, thereby enabling potential

equity investment from others. We appreciate the engagement of the Company’s Board in addressing earlier challenges, and, as a result

of our recent changes, are excited about the year ahead.”

Gibson has over 35 years of experience in the energy and IT industries,

including serving as President of Halliburton Energy Services. He has served as the President of Nauticus since last October and on the

Board of Directors since 2022.

He is joined by Victoria Hay, the Company’s interim Chief Financial

Officer, and Nicholas Bigney, the Company’s General Counsel, both of whom were appointed during Q4 of 2023. JD Yamokoski, the Company’s

long-time Chief Technology Officer, remains with Nauticus and rounds out the executive management team.

Hay has been a contracted CFO for several smaller private startups,

and was previously the Senior Director of Global Accounting and Reporting Services at Weatherford International plc.

Bigney has nearly 20 years of experience in the energy and infrastructure

sector, with a background in complex financing and M&A and has been general counsel of both public and private companies.

Nauticus’ new finance and corporate structure enables the Company

to realize its tightened strategic focus on providing proven and innovative solutions to the blue economy. This focus includes working

with oil and gas producers to improve subsea inspections in the near term and expanding into maintenance and repair with the next generation

of Aquanaut autonomous undersea robots. Nauticus expects to be offshore certifying its new Aquanaut Mk2 vehicle beginning in early 2024,

and, upon completion of the certification, anticipates transitioning to contracted operations at a deepwater field for a major oil and

gas producer.

The Company’s Board hired

Piper Sandler & Co. as its investment banking advisor to help facilitate the financing efforts and to assist in evaluating other strategic

alternatives, including pursuing closing of the recently announced merger with 3D at Depth.

About Nauticus Robotics

Nauticus Robotics, Inc. develops autonomous robots

for the ocean industries. Autonomy requires the extensive use of sensors, artificial intelligence, and effective algorithms for perception

and decision allowing the robot to adapt to changing environments. Nauticus’ robotic systems and services are designed to address

both commercial and government-facing customers. The company has targeted the Robotics-as-a-Service (RaaS) business model complemented

by direct product sales of vehicles, components, and licensing of related software. Nauticus has designed and is currently testing and

certifying a new generation of vehicles to reduce operational cost and gather data to maintain and operate a wide variety of subsea infrastructure.

Cautionary Language Regarding Forward-Looking

Statements

This press

release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the

“Act”), and are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Act as

well as protections afforded by other federal securities laws. Such forward-looking statements include, but are not limited to: the expected

timing of product commercialization or new product releases; customer interest in Nauticus’ products; estimated 2024 operating results

and use of cash; and Nauticus’ use of and needs for capital. Generally, statements that are not historical facts, including statements

concerning possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements.

These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,”

“projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,”

“scheduled,” “anticipates,” “intends,” or “continue” or similar expressions. Forward-looking

statements inherently involve risks and uncertainties that may cause actual events, results, or performance to differ materially from

those indicated by such statements. These forward-looking statements are based on Nauticus’ management’s current expectations

and beliefs, as well as a number of assumptions concerning future events. There can be no assurance that the events, results, or trends

identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are

made, and Nauticus is not under any obligation and expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking

statement, whether as a result of new information, future events, or otherwise, except as required by law. Readers should carefully review

the statements set forth in the reports which Nauticus has filed or will file from time to time with the Securities and Exchange Commission

(the “SEC”) for a more complete discussion of the risks and uncertainties facing the Company and that could cause actual outcomes

to be materially different from those indicated in the forward-looking statements made by the Company, in particular the sections entitled

“Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in documents filed from time to time

with the SEC, including Nauticus’ Annual Report on Form 10-K filed with the SEC on March 28, 2023 and Quarterly Report on

Form 10-Q, filed with the SEC on August 14, 2023. Should one or more of these risks, uncertainties,

or other factors materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results

may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected. The documents filed

by Nauticus with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov.

Important Information for Investors and Stockholders

This press release relates to a proposed transaction

between Nauticus and 3DAD. It does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any

securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. Nauticus intends to file a registration statement

on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will include a document that serves as a prospectus

and proxy statement of Nauticus, referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all Nauticus

stockholders. Nauticus will also file other documents regarding the proposed transaction with the SEC. Before making any voting decision,

investors and security holders of Nauticus are urged to read the registration statement, the proxy statement/prospectus and all other

relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because

they will contain important information about the proposed transaction.

Investors and security holders will be able to

obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be

filed with the SEC by Nauticus through the website maintained by the SEC at www.sec.gov.

Participants in the Solicitation

Nauticus, 3DAD and their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies from Nauticus’ stockholders in connection

with the proposed transaction. A list of the names of the respective directors and executive officers of Nauticus and 3DAD and information

regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. You may obtain

free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of

any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification

under the securities laws of such other jurisdiction.

3

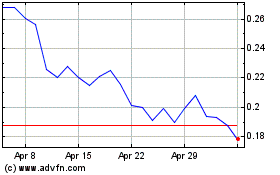

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From Apr 2024 to May 2024

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From May 2023 to May 2024