Current Report Filing (8-k)

April 04 2019 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 29, 2019

NanoVibronix, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36445

|

|

01-0801232

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

525 Executive Boulevard

Elmsford, New York

|

|

10523

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (914) 233-3004

(Former name or former address, if changed since last

report)

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On March 29, 2019,

NanoVibronix, Inc. (the “Company”) issued and sold to an accredited investor a convertible promissory note (the “First

Note”) in the principal amount of $125,000 and a seven-year warrant (the “First Warrant”) to purchase 50,000,

shares of the Company’s common stock or series C preferred stock and on April 1, 2019, the Company issued and sold to another

accredited investor a convertible promissory note (a “Second Note” and together with the First Note, the “Notes”)

in the principal amount of $100,000 and a seven-year warrant (the “Second Warrant” and together with the First Warrant,

the “Warrants”) to purchase 40,000 shares of the Company’s common stock or series C preferred stock. The exercise

price for each Warrant is equal to the

lesser

of: (a) 80%

(

i.e

., a 20% discount) of the exercise price per share of

the warrants to purchase shares of the Company’s capital stock issued in the first equity financing of the Company following

the date of issuance, or (b) $4.80.

The principal amount

and all accrued but unpaid interest on the Notes are due and payable on the date (the “Maturity Date”) that is the

earlier of the (i) 5-year anniversary of the date of issuance, or (ii) the date the Company completes an equity financing pursuant

to which the Company issues and sells shares of capital stock resulting in aggregate proceeds of at least $2,000,000 (a “Qualified

Financing”). The Notes bear interest at a rate of 6% per annum, payable on the Maturity Date. To the extent not previously

converted, on the Maturity Date, the investors will receive, at the option of each the investor, either (a) cash equal to the original

principal amount of the Note and interest then accrued and unpaid thereon, or (b) shares of common stock or series C convertible

preferred stock of the Company, at a price per share equal to the lesser of: (x) 80% of the amount equal to the quotient obtained

by dividing (i) the estimated value of the Company as of the Maturity Date, as determined in good faith by the Company’s

board of directors, by (ii) the aggregate number of outstanding shares of the Company’s common stock, as of the Maturity

Date on a fully diluted basis, and (y) $4.00 per share, as such amount may be adjusted for any stock split, stock dividend, reclassification

or similar events affecting the capital stock of the Company. Upon consummation of a Qualified Financing, each investor may elect

to have the outstanding principal and accrued but unpaid interest thereon converted into (a) shares of the same class and series

of equity securities sold in such Qualified Financing, (b) shares of series C convertible preferred stock or (c) common stock,

at a price per share equal to the lesser of: (1) 80% of the price per share at which such securities are sold in such Qualified

Financing and (2) $4.00 per share, as such amount may be adjusted for any stock split, stock dividend, reclassification or similar

events affecting the Company’s capital stock.

The Warrants are immediately

exercisable. The Warrants may be exercised on a cashless basis if there is no effective registration statement registering the

resale of the shares issuable upon exercise of the Warrants after the six-month anniversary of the issuance date of the Warrants.

The exercise price of each Warrant is adjustable for certain events, such as distribution of stock dividends, stock splits or fundamental

transactions including mergers or sales of assets. The holders of the Warrants will not have the right to exercise any portion

of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 9.99% of the number of shares of

the Company’s common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined

in accordance with the terms of the Warrant. In no event will the number of shares to be issued upon (A) exercise of the Warrants

and (B) conversion of the Notes exceed, in the aggregate, 9.9% of the total shares outstanding or the voting power outstanding

on the date immediately preceding the date of issuance.

The foregoing description

of the Notes and the Warrants is a summary and does not purport to be complete, and is subject to, and qualified in its entirety

by reference to, the Notes and the Warrants, copies of which will be filed with the Company’s next periodic report.

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided in Item 1.01 of

this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

|

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The issuances of the Notes and the Warrants

were exempt from the requirements of the Securities Act of 1933, as amended, pursuant to an exemption provided by Section 4(a)(2)

thereof and Rule 506 of Regulation D thereunder as transactions by an issuer not involving a public offering. The information provided

in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.02.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

NanoVibronix, Inc.

|

|

|

|

|

|

Date: April 4, 2019

|

By:

|

/s/ Stephen

Brown

|

|

|

|

Name:

Stephen Brown

|

|

|

Title:

Chief Financial Officer

|

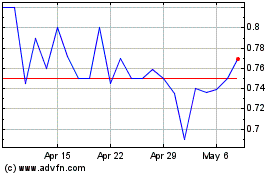

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jun 2024 to Jul 2024

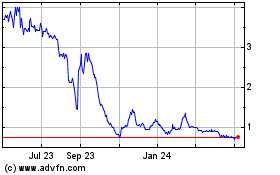

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jul 2023 to Jul 2024