Current Report Filing (8-k)

February 22 2019 - 4:48PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 22, 2019

NanoVibronix,

Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36445

|

|

01-0801232

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer Identification

No.)

|

|

525 Executive

Blvd

|

|

|

|

Elmsford,

New York

|

|

10523

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

Registrant’s

telephone number, including area code: (914) 233-3004

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

February 21, 2019, NanoVibronix, Inc. (the “Company”) entered into a consulting agreement (the “Agreement”)

with Bespoke Growth Partners, Inc. (“Bespoke”), pursuant to which Bespoke will provide the Company with consulting

services with respect to, among other things, advancement of the Company’s business plan, possible joint ventures, strategic

alliances, mergers and acquisitions and related development activities (the “Services”).

In

consideration for the Services, the Company paid Bespoke a cash fee of $50,000 and issued to Bespoke 275,000 shares of the Company’s

common stock (“Common Stock”) upon signing the Agreement. In addition, if the Company has not previously terminated

the Agreement, the Company has agreed to issue Bespoke (i) an additional 75,000 shares of Common Stock on the three (3) month

anniversary of the Agreement, (ii) an additional 200,000 shares of Common Stock on the seven (7) month anniversary of the Agreement,

and (iii) an additional 100,000 shares of Common Stock on the ten (10) month anniversary of the Agreement. The Agreement contains

a blocker provision that prohibits the issuance of Common Stock to Bespoke during the term of the Agreement which would cause

the beneficial ownership of Bespoke and its affiliates to exceed 9.99% of the Company’s outstanding shares of Common Stock.

The

Agreement has an initial term of one (1) year, unless earlier terminated by the Company. The Company may terminate the Agreement

before the end of the initial term upon 30 calendar days’ notice to Bespoke. The Agreement provides for indemnification

of Bespoke, its officers, directors, members, employees, affiliates, and agents by the Company of all losses, expenses, damages

and costs, including reasonable attorneys’ fees, resulting from any act, action or omission, except for acts of Bespoke

of willful misconduct, bad faith or gross negligence related to the Agreement.

|

Item

3.02

|

Unregistered

Sales of Equity Securities.

|

The

information set forth under Item 1.01 with respect to the issuance of 275,000 shares of Common Stock to Bespoke pursuant to the

Agreement is incorporated herein by reference. Such issuance was undertaken in reliance upon the exemption from the registration

requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof and Rule 506 of Regulation D promulgated

thereunder.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

NanoVibronix, Inc.

|

|

|

|

|

Date: February 22, 2019

|

By:

|

/s/ Stephen Brown

|

|

|

|

|

Name: Stephen Brown

|

|

|

|

Title: Chief Financial Officer

|

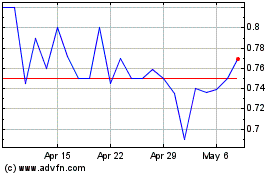

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jun 2024 to Jul 2024

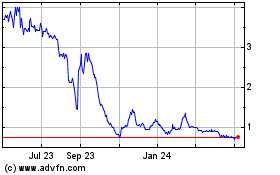

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jul 2023 to Jul 2024