Meridian Corp0001750735false00017507352023-07-282023-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

July 28, 2023

Date of Report (Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Pennsylvania | | 000-55983 | | 83-1561918 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Ident. No.) |

| | | | | |

9 Old Lincoln Highway, Malvern, Pennsylvania | | 19355 |

| (Address of principal executive offices) | | (Zip Code) |

| |

(484) 568-5000 Registrant’s telephone number, including area code |

| |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

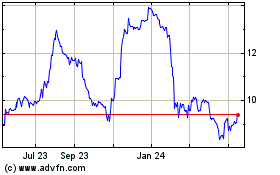

Common Stock, $1 par value | | MRBK | | The NASDAQ Stock Market |

Item 2.02. Results of Operations and Financial Condition.

On July 28, 2023 Meridian Corporation issued a press release discussing the Corporation’s Second Quarter 2023 Results. A copy is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto and incorporated by reference into Item 2.02 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that Section. Furthermore, such information, including the exhibit attached hereto, shall not be deemed incorporated by reference into any of the Corporation’s reports or filings with the SEC under the Securities Exchange Act of 1933, as amended (the "Securities Act"), or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such report or filing. The information in this Current Report on Form 8-K, including the exhibit attached hereto, shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 7.01. Regulation FD Disclosures.

In connection with the issuance of its earnings for the three months ended June 30, 2023, Meridian Corporation has also made available on its website materials that contain supplemental information about the Corporation's financial results (“Earnings Supplement”). A copy of the earnings supplement is attached hereto as Exhibit 99.2 and is incorporated by reference in this Item 7.01. The information contained in this Item 7.01 of this Report on Form 8-K, including Exhibit 99.2, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Exchange Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

Quarterly Dividend

On July 27, 2023, Meridian Corporation’s Board of Directors declared a quarterly cash dividend of $0.125 per common share, payable August 21, 2023, to shareholders of record as of August 14, 2023.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is furnished herewith:

99.1 Press Release, issued July 28, 2023

99.2 Earnings Supplement, issued July 28, 2023

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit No. | | Description of Exhibit |

| | | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | MERIDIAN CORPORATION

(Registrant) |

| | | |

Dated: July 28, 2023 | | |

| | | |

| | By: | /s/ Denise Lindsay | |

| | | | Denise Lindsay |

| | | | Executive Vice President and Chief Financial Officer |

| | | | |

Meridian Corporation Reports Second Quarter 2023 Results and Announces a Quarterly Dividend of $0.125 per Common Share.

MALVERN, PA., July 28, 2023 — Meridian Corporation (Nasdaq: MRBK) today reported:

•Net income of $4.6 million and diluted earnings per share of $0.41 for the second quarter ended June 30, 2023.

•Return on average assets and return on average equity for the second quarter of 2023 were 0.86% and 12.08%, respectively.

•Net interest margin was 3.33% for the second quarter of 2023, with loan yield of 6.89%.

•Total assets at June 30, 2023 were $2.2 billion, compared to $2.2 billion at March 31, 2023 and $1.9 billion at June 30, 2022.

•Second quarter commercial loan growth was $27.4 million, or 7.2% annualized; residential and home equity loans increased by $14.2 million on a combined basis, or 18.9% annualized.

•Second quarter deposit growth was $12.2 million, or 2.8% annualized.

•Non-interest bearing deposits were up $6.5 million, or 10% annualized.

•The Company repurchased 127,849 shares of its common stock at an average price of $12.21 per share during the second quarter. The repurchase plan expired mid April.

•On July 27, 2023, the Board of Directors declared a quarterly cash dividend of $0.125 per common share, payable August 21, 2023 to shareholders of record as of August 14, 2023.

Christopher J. Annas, Chairman and CEO commented “Meridian’s second quarter revenue of $43.0 million generated earnings of $4.6 million, or $0.41 per diluted share. Annual loan growth in the core CRE, C&I and SBA portfolios are expected to again approach 15%. These groups also bring deposits and other referrals, which enhances overall yields. Construction lending for residential and multi-family is still robust because of high demand, as for-sale homes are at historical lows. Credit has not deteriorated meaningfully in any segment and we remain diligent with our credit process and diversification."

Mr. Annas added, "Total business deposits increased to 58% of total deposits, with non-interest bearing accounts up in the quarter by 10% on annualized basis. The margin was down from the prior quarter mostly due to higher deposit expense, as customers have increasing awareness of rate moves. The historical lag effect is gone. We have adjusted well to the tumultuous environment created by the historic Federal Reserve interest rate moves, but the impact on margins continues. We are well positioned for a rise or fall and will not bet on either event.

The mortgage segment is following the historical seasonal pattern, as operations improved throughout the quarter. Despite increased hiring of mortgage loan officers, the lack of homes for sale limits production. Another factor is the thousands of homes purchased by investors and private equity over the past 10 years, being rented and not available for sale. We will continue to monitor the impact of market conditions on our mortgage operations and are prepared to make further adjustments if warranted."

Mr. Annas concluded, "Our exceptional growth results from being highly visible in our regions, and being the preferred bank in the Delaware Valley. We are focusing less on opportunities that do not bring other business, such as portfolio mortgages or equipment leases."

Select Condensed Financial Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of or for the quarter ended (Unaudited) |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

| (Dollars in thousands, except per share data) |

| Income: | | | | | | | | | |

Net income | $ | 4,645 | | | $ | 4,021 | | | $ | 4,557 | | | $ | 5,798 | | | $ | 5,938 | |

| Basic earnings per common share | 0.42 | | | 0.36 | | | 0.40 | | | 0.49 | | | 0.49 | |

| Diluted earnings per common share | 0.41 | | | 0.34 | | | 0.39 | | | 0.48 | | | 0.48 | |

Net interest income | 17,098 | | | 17,677 | | | 18,518 | | | 18,026 | | | 17,551 | |

| | | | | | | | | |

| Balance Sheet: | | | | | | | | | |

| Total assets | $ | 2,206,877 | | | $ | 2,229,783 | | | $ | 2,062,228 | | | $ | 1,921,924 | | | $ | 1,853,019 | |

Loans, net of fees and costs | 1,859,839 | | | 1,818,189 | | | 1,743,682 | | | 1,610,349 | | | 1,518,893 | |

| Total deposits | 1,782,605 | | | 1,770,413 | | | 1,712,479 | | | 1,673,553 | | | 1,568,014 | |

| Non-interest bearing deposits | 269,174 | | | 262,636 | | | 301,727 | | | 290,169 | | | 291,925 | |

Stockholders' equity | 153,962 | | | 153,049 | | | 153,280 | | | 151,161 | | | 156,087 | |

| | | | | | | | | |

| Balance Sheet (Average Balances): | | | | | | | | | |

| Total assets | $ | 2,166,575 | | | $ | 2,088,599 | | | $ | 1,962,915 | | | $ | 1,868,194 | | | $ | 1,811,335 | |

| Total interest earning assets | 2,070,640 | | | 1,995,460 | | | 1,877,967 | | | 1,791,255 | | | 1,736,547 | |

Loans, net of fees and costs | 1,847,736 | | | 1,783,322 | | | 1,674,215 | | | 1,565,861 | | | 1,484,696 | |

| Total deposits | 1,775,444 | | | 1,759,571 | | | 1,698,597 | | | 1,597,648 | | | 1,567,325 | |

| Non-interest bearing deposits | 266,675 | | | 296,037 | | | 312,297 | | | 295,975 | | | 296,521 | |

Stockholders' equity | 154,183 | | | 153,179 | | | 151,791 | | | 157,614 | | | 158,420 | |

| | | | | | | | | |

| Performance Ratios (Annualized): | | | | | | | | | |

Return on average assets | 0.86 | % | | 0.78 | % | | 0.92 | % | | 1.23 | % | | 1.31 | % |

Return on average equity | 12.08 | % | | 10.65 | % | | 11.91 | % | | 14.59 | % | | 15.03 | % |

Income Statement - Second Quarter 2023 Compared to First Quarter 2023

Net income of $4.6 million, increased $624 thousand from $4.0 million for the first quarter driven by higher levels of non-interest income. Net interest income decreased $580 thousand, or 3.3%, on a tax equivalent basis due to a lower interest margin. Non-interest income increased $2.5 million or 37.5%, while non-interest expense increased $1.8 million, or 10.3%. Detailed explanations of the major categories of income and expense follow below.

Net Interest income

The rate/volume analysis table below analyzes dollar changes in the components of interest income and interest expense as they relate to the change in balances (volume) and the change in interest rates (rate) of tax-equivalent net interest income for the periods indicated and allocated by rate and volume. Changes in interest income and/or expense related to changes attributable to both volume and rate have been allocated proportionately based on the relationship of the absolute dollar amount of the change in each category.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | |

| (dollars in thousands) | June 30,

2023 | | March 31,

2023 | | $ Change | | % Change | | Change due to rate | | Change due to volume |

| Interest income: | | | | | | | | | | | |

| Due from banks | $ | 275 | | | $ | 215 | | | $ | 60 | | | 27.9 | % | | $ | 35 | | | $ | 25 | |

| Federal funds sold | 3 | | | 2 | | | 1 | | | 50.0 | % | | 1 | | | — | |

Investment securities - taxable (1) | 992 | | | 959 | | | 33 | | | 3.4 | % | | 28 | | | 5 | |

Investment securities - tax exempt (1) | 426 | | | 430 | | | (4) | | | (0.9) | % | | 22 | | | (26) | |

| Loans held for sale | 407 | | | 217 | | | 190 | | | 87.6 | % | | 15 | | | 175 | |

Loans held for investment (1) | 31,810 | | | 29,202 | | | 2,608 | | | 8.9 | % | | 1,531 | | | 1,077 | |

| Total loans | 32,217 | | | 29,419 | | | 2,798 | | | 9.5 | % | | 1,546 | | | 1,252 | |

| Total interest income | 33,913 | | | 31,025 | | | 2,888 | | | 9.3 | % | | 1,632 | | | 1,256 | |

| Interest expense: | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,840 | | | $ | 1,855 | | | $ | (15) | | | (0.8) | % | | $ | 227 | | | $ | (242) | |

| Money market and savings deposits | 5,371 | | | 4,477 | | | 894 | | | 20.0 | % | | 874 | | | 20 | |

| Time deposits | 6,812 | | | 5,115 | | | 1,697 | | | 33.2 | % | | 1,029 | | | 668 | |

| Total deposits | 14,023 | | | 11,447 | | | 2,576 | | | 22.5 | % | | 2,130 | | | 446 | |

| Borrowings | 2,129 | | | 1,237 | | | 892 | | | 72.1 | % | | 72 | | | 820 | |

| Subordinated debentures | 586 | | | 586 | | | — | | | — | % | | — | | | — | |

| Total interest expense | 16,738 | | | 13,270 | | | 3,468 | | | 26.1 | % | | 2,202 | | | 1,266 | |

| Net interest income differential | $ | 17,175 | | | $ | 17,755 | | | $ | (580) | | | (3.27) | % | | $ | (570) | | | $ | (10) | |

| (1) Reflected on a tax-equivalent basis. | | | | | | | | | | |

Interest income increased $2.9 million on a tax equivalent basis, quarter-over-quarter, due to an extra day of interest earned in the period, as well as a higher yield on earning assets and higher levels of average earning assets. The yield on earnings assets rose 26 basis points during the period, while average earning assets increased by $75.2 million.

The yield on total loans increased 26 basis points and the yield on cash and investments increased 5 basis points combined, reflecting the impact on rates caused by the Federal Reserve’s monetary policy. Nearly $682 million in loans repriced during the quarter with an average increase of 41 basis points. Average total loans, excluding residential loans for sale, increased $64.4 million. Construction, commercial real estate, and small business loans, which increased $47.9 million on average, combined, made up the majority of the increase. Home equity loans and residential real estate loans held in portfolio increased $44.8 million on average, combined. Residential loans for sale increased $11.7 million.

Total interest expense increased $3.5 million, quarter-over-quarter, due primarily to market interest rate rises, and increases in both deposit and borrowing balances, as well as an extra day of interest. Interest expense on deposits increased $2.6 million as total average deposits increased $45.2 million and the cost of interest-bearing deposits increased 56 basis points to 3.73%. Interest expense on borrowings increased $892 thousand as total average short-term borrowings increased $63.1 million and the cost increased 22 basis points.

Net interest margin decreased 28 basis points to 3.33% for the second quarter from 3.61% for the first quarter, as the cost of funds outpaced the increase in yield on earnings assets. The margin was also affected by a reduction in average non-interest bearing deposits, which although have increased from March 31, 2023, were down on average by $29.4 million for the quarter.

The provision for credit losses decreased to $705 thousand for the second quarter from $1.4 million for the first quarter. The favorable decline of $694 thousand was largely due to a $467 thousand decline in charge-offs period over period, as well as the improvement in certain qualitative factors considered in our allowance for credit losses. As we are focusing on loan portfolios that provide other business opportunities and higher yields, we have put less emphasize on growing other portfolios and therefore certain qualitative factors were adjusted as growth in and concentration of our lease portfolio has diminished.

Non-interest income

The following table presents the components of non-interest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | |

| (Dollars in thousands) | June 30,

2023 | | March 31,

2023 | | $ Change | | % Change |

| Mortgage banking income | $ | 5,050 | | | $ | 3,272 | | | $ | 1,778 | | | 54.3 | % |

| Wealth management income | 1,235 | | | 1,196 | | | 39 | | | 3.3 | % |

| SBA loan income | 1,767 | | | 713 | | | 1,054 | | | 147.8 | % |

| Earnings on investment in life insurance | 193 | | | 192 | | | 1 | | | 0.5 | % |

| Net change in the fair value of derivative instruments | 183 | | | (69) | | | 252 | | | (365.2) | % |

| Net change in the fair value of loans held-for-sale | (199) | | | (1) | | | (198) | | | 19800.0 | % |

| Net change in the fair value of loans held-for-investment | (219) | | | 117 | | | (336) | | | (287.2) | % |

| Net gain on hedging activity | (1) | | | — | | | (1) | | | (100.0) | % |

| Net loss on sale of investment securities available-for-sale | (54) | | | — | | | (54) | | | (100.0) | % |

| Service charges | 37 | | | 35 | | | 2 | | | 5.7 | % |

| Other | 1,132 | | | 1,183 | | | (51) | | | (4.3) | % |

| Total non-interest income | $ | 9,124 | | | $ | 6,638 | | | $ | 2,486 | | | 37.5 | % |

Total non-interest income increased $2.5 million, or 37.5%, quarter-over-quarter. Mortgage banking income increased $1.8 million or 54.3% quarter-over-quarter, due to higher levels of loan originations. Although interest rates remain high, seasonality is a key factor in the increase in loan originations, which were $59 million over the prior quarter. Partially offsetting the increase in loan volume, the gain on sale margins decreased 25 basis points over the prior quarter. The fair value of loans held for sale, derivatives instruments and net gain on hedging activity increased $53 thousand in total.

SBA loan income increased $1.1 million, or 147.8%, over the prior quarter as more than double the amount of SBA loans were sold into the secondary market in the second quarter. $27.8 million of loans were sold in the quarter-ending June 30, 2023 at a gross margin of 7.0%, compared to $10.9 million in loans sold in the quarter-ending March 31, 2023 at a gross margin of 7.7%.

Wealth management income increased $39 thousand, or 3.3%, for the quarter-ended June 30, 2023 over the prior quarter due to an increase in the number of individual account customers, combined with the effect of market conditions on assets under management. Other non-interest income decreased $51 thousand, or 4.3%, over the prior quarter due largely to swap fee income recorded in the prior quarter that was not repeated in the current quarter.

Non-interest expense

The following table presents the components of non-interest expense for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | |

| (Dollars in thousands) | June 30,

2023 | | March 31,

2023 | | $ Change | | % Change |

| Salaries and employee benefits | $ | 12,152 | | | $ | 11,061 | | | $ | 1,091 | | | 9.9 | % |

| Occupancy and equipment | 1,140 | | | 1,244 | | | (104) | | | (8.4) | % |

| Professional fees | 1,004 | | | 823 | | | 181 | | | 22.0 | % |

| Advertising and promotion | 1,091 | | | 861 | | | 230 | | | 26.7 | % |

| Data processing and software | 1,681 | | | 1,432 | | | 249 | | | 17.4 | % |

| Pennsylvania bank shares tax | 245 | | | 245 | | | — | | | — | % |

| Other | 2,302 | | | 2,123 | | | 179 | | | 8.4 | % |

| Total non-interest expense | $ | 19,615 | | | $ | 17,789 | | | $ | 1,826 | | | 10.3 | % |

Salaries and employee benefits increased $1.1 million overall, with bank and wealth segments combined having increased $665 thousand, and the mortgage segment increased $426 thousand. Bank and wealth segment salaries and employee benefits were up due to incentive and stock based compensation. Mortgage related salaries and benefits were up quarter-over-quarter due to the variable nature of such expenses at this segment related to origination volume.

Professional fees increased $181 thousand during the current quarter as we incurred OREO expense relating to the expected disposition and sale of the property and non-performing loan workout expenses. Advertising and promotion expense increased $230 thousand from the prior quarter as community outreach efforts, business development activities and related promotional costs were higher in the second quarter. Data processing and software costs were up quarter-over-quarter driven by an increase in customer account volume. Other non-interest expense increased $179 thousand over the prior quarter due largely to an increase in FDIC insurance expense, which reflected the new 2 basis point increase in assessment.

Balance Sheet - June 30, 2023 Compared to March 31, 2023

As of June 30, 2023, total assets decreased $22.9 million, or 1.0%, to $2.2 billion from March 31, 2023. This decline in assets was due to a reduction in cash and investments in support if higher yielding loans. Interest-bearing cash decreased $63.7 million, or 63.7%, to $36.3 million as of June 30, 2023 from March 31, 2023. Investments available for sale decreased $16.3 million, or 11.4%, as we sold $15.4 million in investments available for sale in the second quarter.

Portfolio loan growth was $41.7 million, or 2.3% quarter-over-quarter. Commercial mortgage loans increased $31.2 million, or 5.1%, construction loans increased $18.7 million, or 7.0%, residential real estate loans held in portfolio increased $9.0 million, or 3.8%, while home equity lines and loans increased $5.2 million, or 8.3% as well. Partially offsetting portfolio loan growth were commercial loans which decreased $20.8 million, or 6.3%, due to the sale of $21.8 million in shared national credits, and lease financings that decreased $1.0 million, or 0.7% from March 31, 2023. Both decreases were the result of reallocation of funds to higher yielding and relationship- based portfolios.

Total deposits increased $12.2 million, or 0.7%, quarter-over-quarter. Noninterest-bearing deposits and money market accounts increased $6.5 million, and $62.6 million, respectively, during the period, while interest-bearing demand deposits decreased $76.7 million during the period. Most of the changes in the interest-bearing checking and the money market accounts came from municipal deposits. Time deposits increased $19.7 million, or 3.1%, from retail and wholesale efforts as customers opt for higher term interest rates.

Consolidated stockholders’ equity of the Corporation increased by $913 thousand from March 31, 2023, to $154.0 million as of June 30, 2023. Changes to equity for the current quarter included net income of $4.6 million, partially offset by a $952 thousand decline in other comprehensive income, dividends paid of $1.4 million, and share repurchases of $1.6 million. The Community Bank Leverage Ratio for the Bank was 9.22% at June 30, 2023.

The following table presents capital ratios of the Bank, unless otherwise noted, at the dates indicated:

| | | | | | | | | | | |

| June 30,

2023 | | March 31,

2023 |

| Stockholders' equity to total assets - Corporation | 6.98 | % | | 6.86 | % |

| Tangible common equity to tangible assets - Corporation (1) | 6.81 | % | | 6.70 | % |

| Tier 1 leverage ratio - Bank | 9.22 | % | | 7.65 | % |

| Common tier 1 risk-based capital ratio - Bank | 10.35 | % | | 8.44 | % |

| Tier 1 risk-based capital ratio - Bank | 10.35 | % | | 8.44 | % |

| Total risk-based capital ratio - Bank | 11.43 | % | | 11.63 | % |

| (1) See Non-GAAP reconciliation in the Appendix | | |

Asset Quality Summary

The ratio of non-performing loans to total loans increased to 1.44% as of June 30, 2023, from 1.25% at March 31, 2023, while non-performing assets to total assets was 1.32% as of June 30, 2023, compared to 1.11% at March 31, 2023. There was $1.7 million in other real estate owned included in non-performing assets, the result of taking possession of a well collateralized residential real estate property at the prior year end. Total non-performing loans of $27.4 million as of June 30, 2023, increased $4.3 million from $23.1 million as March 31, 2023 due to downgrades of 4 SBA loans, 1 commercial loan and several small balance equipment leases as of June 30, 2023.

Meridian realized net charge-offs of 0.05% of total average loans for the quarter ended June 30, 2023, down from the quarter ended March 31, 2023 level of 0.08%. Net charge-offs for the quarter ended June 30, 2023 were $986 thousand, comprised of $1.2 million in charge-offs, with $169 thousand in recoveries for the quarter. While nearly all of the charge-offs for the quarter ended June 30, 2023 continue to be from small ticket equipment leases, the level of charge-offs in this portfolio declined by $689 thousand, while we also realized $149 thousand of recoveries related to the small ticket equipment lease portfolio.

The ratio of allowance for credit losses to total loans held for investment, excluding loans at fair value and PPP loans (a non-GAAP measure, see reconciliation in the Appendix), was 1.10% as of June 30, 2023 compared to 1.13% as of March 31, 2023. As of June 30, 2023 there were specific reserves of $2.6 million against non-performing loans, an increase from $2.5 million as of March 31, 2023 due to the establishment of a specific reserve on a commercial loan that was classified as a non-performing loan during the current quarter.

Bank Sector Concerns

Meridian is a regional community bank with loans and deposits that are well diversified in size, type, location and industry. We manage this diversification carefully, while avoiding concentrations in business lines. Meridian’s model continues to build on our strong and stable financial position, which serves our regional customers and communities with the banking products and services needed to help build their prosperity.

As a commercial bank, the majority of Meridian's deposit base is comprised of business deposits (58%), with consumer deposits amounting to 11% at June 30, 2023. Municipal deposits (8%) and brokered deposits (23%) provide growth funding. Historically, business deposits lag loan fundings. A typical business relationship maintains operating accounts, investment accounts or sweep accounts and business owners may also have personal savings or wealth accounts. Deposit balances in business accounts have a tendency to be higher on average than consumer accounts. At June 30, 2023, 63% of business accounts and 87% of consumer accounts were fully insured by the FDIC. The municipal deposits are 100% collateralized and brokered deposits are 100% FDIC insured. The level of uninsured deposits for the entire deposit base was 23% at June 30, 2023.

Total balance sheet liquidity, which is derived from cash and investments, as well as salable commercial loans and residential mortgage loans held for sale, was $276.8 million at June 30, 2023, down from $317.8 million at March 31, 2023. Meridian maintains a high-quality investment bond portfolio comprised of U.S Treasuries, government agencies, government agency mortgage-backed securities, and general obligation municipal securities with an average duration of 4 years. Meridian’s investment portfolio represented 7.5% of total assets at June 30, 2023, compared to 8.1% at March 31, 2023. Total cash at June 30, 2023 was $47 million compared to $109 million at March 31, 2023 and $37.1 million at June 30, 2022.

Meridian also maintains borrowing arrangements with various correspondent banks to meet short-term liquidity needs and has access to approximately $853.3 million in liquidity from numerous sources, including its borrowing capacity with the FHLB and other financial institutions, as well as funding through the CDARS program or through brokered CD arrangements. In addition, the Bank is eligible to receive funds under the new Bank Term Funding Program ("BTFP") announced by the Federal Reserve. At June 30, 2023 Meridian elected to secure $33 million in borrowings from the Federal Reserve under the BTFP due to the favorable rate. Management believes that the above sources of liquidity provide Meridian with the necessary resources to meet its short-term and long-term funding requirements.

About Meridian Corporation

Meridian Bank, the wholly owned subsidiary of Meridian Corporation, is an innovative community bank serving Pennsylvania, New Jersey, Delaware and Maryland. Through more than 20 offices, including banking branches and mortgage locations, Meridian offers a full suite of financial products and services. Meridian specializes in business and industrial lending, retail and commercial real estate lending, electronic payments, and wealth management solutions through Meridian Wealth Partners. Meridian also offers a broad menu of high-yield depository products supported by robust online and mobile access. For additional information, visit our website at www.meridianbanker.com. Member FDIC.

“Safe Harbor” Statement

In addition to historical information, this press release may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Meridian Corporation’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Meridian Corporation’s control). Numerous competitive, economic, regulatory, legal and technological factors, risks and uncertainties that could cause actual results to differ materially include, without limitation, the impact of the COVID-19 pandemic and government responses thereto; on the U.S. economy, including the markets in which we operate; actions that we and our customers take in response to these factors and the effects such actions have on our operations, products, services and customer relationships; and the risk that the Small Business Administration may not fund some or all Paycheck Protection Program (PPP) loan guaranties; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and the effects of inflation, a potential recession, among others, could cause Meridian Corporation’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements. Meridian Corporation cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Meridian Corporation’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022 and subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Meridian Corporation does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Meridian Corporation or by or on behalf of Meridian Bank.

MERIDIAN CORPORATION AND SUBSIDIARIES

FINANCIAL RATIOS (Unaudited)

(Dollar amounts and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Earnings and Per Share Data: | | | | | | | | | |

| Net income | $ | 4,645 | | | $ | 4,021 | | | $ | 4,557 | | | $ | 5,798 | | | $ | 5,938 | |

| Basic earnings per common share | $ | 0.42 | | | $ | 0.36 | | | $ | 0.40 | | | $ | 0.49 | | | $ | 0.49 | |

| Diluted earnings per common share | $ | 0.41 | | | $ | 0.34 | | | $ | 0.39 | | | $ | 0.48 | | | $ | 0.48 | |

| Common shares outstanding | 11,178 | | | 11,305 | | | 11,466 | | | 11,689 | | | 12,074 | |

| | | | | | | | | |

Performance Ratios: | | | | | | | | | |

Return on average assets | 0.86 | % | | 0.78 | % | | 0.92 | % | | 1.23 | % | | 1.31 | % |

Return on average equity | 12.08 | | | 10.65 | | | 11.91 | | | 14.59 | | | 15.03 | |

Net interest margin (tax-equivalent) | 3.33 | | | 3.61 | | | 3.93 | | | 4.01 | | | 4.07 | |

| | | | | | | | | |

Yield on earning assets (tax-equivalent) | 6.57 | | | 6.31 | | | 5.88 | | | 5.10 | | | 4.65 | |

| | | | | | | | | |

| Cost of funds | 3.39 | | | 2.83 | | | 2.07 | | | 1.17 | | | 0.61 | |

Efficiency ratio | 74.80 | % | | 73.16 | % | | 75.61 | % | | 71.72 | % | | 70.49 | % |

| | | | | | | | | |

Asset Quality Ratios: | | | | | | | | | |

| Net charge-offs (recoveries) to average loans | 0.05 | % | | 0.08 | % | | 0.05 | % | | 0.02 | % | | 0.04 | % |

Non-performing loans to total loans | 1.44 | | | 1.25 | | | 1.20 | | | 1.40 | | | 1.46 | |

Non-performing assets to total assets | 1.32 | | | 1.11 | | | 1.11 | | | 1.20 | | | 1.24 | |

Allowance for credit losses to: | | | | | | | | | |

Total loans held for investment | 1.09 | | | 1.12 | | | 1.08 | | | 1.18 | | | 1.24 | |

Total loans held for investment (excluding loans at fair value and PPP loans) (1) | 1.10 | | | 1.13 | | | 1.09 | | | 1.20 | | | 1.27 | |

Non-performing loans | 73.97 | % | | 88.41 | % | | 88.66 | % | | 82.20 | % | | 81.82 | % |

| | | | | | | | | |

Capital Ratios: | | | | | | | | | |

| Book value per common share | $ | 13.77 | | | $ | 13.54 | | | $ | 13.37 | | | $ | 12.93 | | | $ | 12.93 | |

| Tangible book value per common share | $ | 13.42 | | | $ | 13.18 | | | $ | 13.01 | | | $ | 12.58 | | | $ | 12.58 | |

| Total equity/Total assets | 6.98 | % | | 6.86 | % | | 7.43 | % | | 7.87 | % | | 8.42 | % |

Tangible common equity/Tangible assets - Corporation (1) | 6.81 | | | 6.70 | | | 7.25 | | | 7.67 | | | 8.22 | |

Tangible common equity/Tangible assets - Bank (1) | 8.54 | | | 8.26 | | | 8.80 | | | 9.61 | | | 10.17 | |

| Tier 1 leverage ratio - Corporation | 7.46 | | | 7.65 | | | 8.13 | | | 8.54 | | | 8.87 | |

| Tier 1 leverage ratio - Bank | 9.22 | | | 9.32 | | | 9.95 | | | 10.52 | | | 10.86 | |

Common tier 1 risk-based capital ratio - Corporation | 8.38 | | | 8.44 | | | 8.77 | | | 9.28 | | | 9.79 | |

| Common tier 1 risk-based capital ratio - Bank | 10.35 | | | 10.27 | | | 10.73 | | | 11.44 | | | 11.98 | |

| Tier 1 risk-based capital ratio - Corporation | 8.38 | | | 8.44 | | | 8.77 | | | 9.28 | | | 9.79 | |

| Tier 1 risk-based capital ratio - Bank | 10.35 | | | 10.27 | | | 10.73 | | | 11.44 | | | 11.98 | |

| Total risk-based capital ratio - Corporation | 11.49 | | | 11.63 | | | 12.05 | | | 12.80 | | | 13.50 | |

| Total risk-based capital ratio - Bank | 11.43 | % | | 11.41 | % | | 11.87 | % | | 12.70 | % | | 13.33 | % |

| (1) See Non-GAAP reconciliation in the Appendix | | | | | | | | |

MERIDIAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(Dollar amounts and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Interest income: | | | | | | | | | |

| Loans and other finance receivables, including fees | $ | 32,215 | | | $ | 29,417 | | | $ | 19,120 | | | $ | 61,632 | | | $ | 36,339 | |

| Securities - taxable | 992 | | | 959 | | | 525 | | | 1,951 | | | 951 | |

| Securities - tax-exempt | 351 | | | 354 | | | 340 | | | 705 | | | 646 | |

| Cash and cash equivalents | 278 | | | 217 | | | 52 | | | 495 | | | 65 | |

| Total interest income | 33,836 | | | 30,947 | | | 20,037 | | | 64,783 | | | 38,001 | |

| Interest expense: | | | | | | | | | |

| Deposits | 14,023 | | | 11,447 | | | 1,818 | | | 25,470 | | | 3,107 | |

| Borrowings | 2,715 | | | 1,823 | | | 668 | | | 4,538 | | | 1,308 | |

| Total interest expense | 16,738 | | | 13,270 | | | 2,486 | | | 30,008 | | | 4,415 | |

| Net interest income | 17,098 | | | 17,677 | | | 17,551 | | | 34,775 | | | 33,586 | |

| Provision for credit losses | 705 | | | 1,399 | | | 602 | | | 2,104 | | | 1,217 | |

| Net interest income after provision for credit losses | 16,393 | | | 16,278 | | | 16,949 | | | 32,671 | | | 32,369 | |

| Non-interest income: | | | | | | | | | |

| Mortgage banking income | 5,050 | | | 3,272 | | | 6,942 | | | 8,322 | | | 14,038 | |

| Wealth management income | 1,235 | | | 1,196 | | | 1,254 | | | 2,431 | | | 2,558 | |

| SBA loan income | 1,767 | | | 713 | | | 437 | | | 2,480 | | | 2,957 | |

| Earnings on investment in life insurance | 193 | | | 192 | | | 137 | | | 385 | | | 275 | |

| Net change in the fair value of derivative instruments | 183 | | | (69) | | | (674) | | | 114 | | | (840) | |

| Net change in the fair value of loans held-for-sale | (199) | | | (1) | | | 268 | | | (200) | | | (856) | |

| Net change in the fair value of loans held-for-investment | (219) | | | 117 | | | (835) | | | (102) | | | (1,613) | |

| Net gain on hedging activity | (1) | | | — | | | 1,715 | | | (1) | | | 4,542 | |

| Net gain (loss) on sale of investment securities available-for-sale | (54) | | | — | | | — | | | (54) | | | — | |

| Service charges | 37 | | | 35 | | | 31 | | | 72 | | | 58 | |

| Other | 1,132 | | | 1,183 | | | 1,128 | | | 2,315 | | | 2,386 | |

| Total non-interest income | 9,124 | | | 6,638 | | | 10,403 | | | 15,762 | | | 23,505 | |

| Non-interest expense: | | | | | | | | | |

| Salaries and employee benefits | 12,152 | | | 11,061 | | | 12,926 | | | 23,213 | | | 28,224 | |

| Occupancy and equipment | 1,140 | | | 1,244 | | | 1,176 | | | 2,384 | | | 2,428 | |

| Professional fees | 1,004 | | | 823 | | | 913 | | | 1,827 | | | 1,761 | |

| Advertising and promotion | 1,091 | | | 861 | | | 1,189 | | | 1,952 | | | 2,175 | |

| Data processing and software | 1,681 | | | 1,432 | | | 1,308 | | | 3,113 | | | 2,497 | |

| Pennsylvania bank shares tax | 245 | | | 245 | | | 212 | | | 490 | | | 411 | |

| Other | 2,302 | | | 2,123 | | | 1,982 | | | 4,425 | | | 3,643 | |

| Total non-interest expense | 19,615 | | | 17,789 | | | 19,706 | | | 37,404 | | | 41,139 | |

| Income before income taxes | 5,902 | | | 5,127 | | | 7,646 | | | 11,029 | | | 14,735 | |

| Income tax expense | 1,257 | | | 1,106 | | | 1,708 | | | 2,363 | | | 3,262 | |

| Net income | $ | 4,645 | | | $ | 4,021 | | | $ | 5,938 | | | $ | 8,666 | | | $ | 11,473 | |

| | | | | | | | | |

| Basic earnings per common share | $ | 0.42 | | | $ | 0.36 | | | $ | 0.49 | | | $ | 0.78 | | | $ | 0.95 | |

| Diluted earnings per common share | $ | 0.41 | | | $ | 0.34 | | | $ | 0.48 | | | $ | 0.75 | | | $ | 0.92 | |

| | | | | | | | | |

| Basic weighted average shares outstanding | 11,062 | | | 11,272 | | | 11,998 | | | 11,167 | | | 12,022 | |

| Diluted weighted average shares outstanding | 11,304 | | | 11,656 | | | 12,398 | | | 11,494 | | | 12,458 | |

MERIDIAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CONDITION (Unaudited)

(Dollar amounts and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

| Assets: | | | | | | | | | |

| Cash and due from banks | $ | 10,576 | | | $ | 8,473 | | | $ | 11,299 | | | $ | 12,114 | | | $ | 8,280 | |

| Interest-bearing deposits at other banks | 36,290 | | | 100,030 | | | 27,092 | | | 20,774 | | | 28,813 | |

| | | | | | | | | |

| Cash and cash equivalents | 46,866 | | | 108,503 | | | 38,391 | | | 32,888 | | | 37,093 | |

| Securities available-for-sale, at fair value | 126,668 | | | 142,933 | | | 135,346 | | | 127,999 | | | 129,288 | |

| Securities held-to-maturity, at amortized cost | 36,463 | | | 36,525 | | | 37,479 | | | 37,922 | | | 37,111 | |

| Equity investments | 2,097 | | | 2,110 | | | 2,086 | | | 2,092 | | | 2,153 | |

| Mortgage loans held for sale, at fair value | 40,422 | | | 35,701 | | | 22,243 | | | 33,800 | | | 58,938 | |

| Loans and other finance receivables, net of fees and costs | 1,859,839 | | | 1,818,189 | | | 1,743,682 | | | 1,610,349 | | | 1,518,893 | |

| Allowance for credit losses | (20,242) | | | (20,442) | | | (18,828) | | | (18,974) | | | (18,805) | |

| Loans and other finance receivables, net of the allowance for credit losses | 1,839,597 | | | 1,797,747 | | | 1,724,854 | | | 1,591,375 | | | 1,500,088 | |

| Restricted investment in bank stock | 9,157 | | | 10,173 | | | 6,931 | | | 5,217 | | | 4,719 | |

| Bank premises and equipment, net | 13,234 | | | 13,281 | | | 13,349 | | | 12,835 | | | 12,185 | |

| Bank owned life insurance | 28,440 | | | 28,247 | | | 28,055 | | | 22,916 | | | 22,778 | |

| Accrued interest receivable | 7,651 | | | 7,651 | | | 7,363 | | | 6,008 | | | 5,108 | |

| Other real estate owned | 1,703 | | | 1,703 | | | 1,703 | | | — | | | — | |

| Deferred income taxes | 4,258 | | | 4,017 | | | 3,936 | | | 5,722 | | | 4,467 | |

| Servicing assets | 12,193 | | | 12,125 | | | 12,346 | | | 12,807 | | | 12,860 | |

| Goodwill | 899 | | | 899 | | | 899 | | | 899 | | | 899 | |

| Intangible assets | 3,073 | | | 3,124 | | | 3,175 | | | 3,226 | | | 3,277 | |

| Other assets | 34,156 | | | 25,044 | | | 24,072 | | | 26,218 | | | 22,055 | |

| Total assets | $ | 2,206,877 | | | $ | 2,229,783 | | | $ | 2,062,228 | | | $ | 1,921,924 | | | $ | 1,853,019 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Non-interest bearing | $ | 269,174 | | | $ | 262,636 | | | $ | 301,727 | | | $ | 290,169 | | | $ | 291,925 | |

| Interest bearing | | | | | | | | | |

| Interest checking | 155,907 | | | 232,616 | | | 219,838 | | | 236,562 | | | 205,298 | |

| Money market and savings deposits | 710,546 | | | 647,904 | | | 697,564 | | | 709,127 | | | 728,886 | |

| Time deposits | 646,978 | | | 627,257 | | | 493,350 | | | 437,695 | | | 341,905 | |

| Total interest-bearing deposits | 1,513,431 | | | 1,507,777 | | | 1,410,752 | | | 1,383,384 | | | 1,276,089 | |

| Total deposits | 1,782,605 | | | 1,770,413 | | | 1,712,479 | | | 1,673,553 | | | 1,568,014 | |

| Borrowings | 194,636 | | | 233,883 | | | 122,082 | | | 23,458 | | | 59,136 | |

| | | | | | | | | |

| Subordinated debentures | 40,348 | | | 40,319 | | | 40,346 | | | 40,597 | | | 40,567 | |

| Accrued interest payable | 5,612 | | | 3,836 | | | 2,389 | | | 1,154 | | | 146 | |

| Other liabilities | 29,714 | | | 28,283 | | | 31,652 | | | 32,001 | | | 29,069 | |

| Total liabilities | 2,052,915 | | | 2,076,734 | | | 1,908,948 | | | 1,770,763 | | | 1,696,932 | |

| | | | | | | | | |

| Stockholders’ equity: | | | | | | | | | |

| Common stock | 13,181 | | | 13,180 | | | 13,156 | | | 13,144 | | | 13,139 | |

| Surplus | 79,650 | | | 79,473 | | | 79,072 | | | 78,270 | | | 77,781 | |

| Treasury stock | (26,079) | | | (24,512) | | | (21,821) | | | (18,033) | | | (11,896) | |

| Unearned common stock held by employee stock ownership plan | (1,403) | | | (1,403) | | | (1,403) | | | (1,602) | | | (1,602) | |

| Retained earnings | 99,434 | | | 96,180 | | | 95,815 | | | 92,405 | | | 87,815 | |

| Accumulated other comprehensive loss | (10,821) | | | (9,869) | | | (11,539) | | | (13,023) | | | (9,150) | |

| Total stockholders’ equity | 153,962 | | | 153,049 | | | 153,280 | | | 151,161 | | | 156,087 | |

| Total liabilities and stockholders’ equity | $ | 2,206,877 | | | $ | 2,229,783 | | | $ | 2,062,228 | | | $ | 1,921,924 | | | $ | 1,853,019 | |

| | | | | | | | | |

| | | | | | | | | |

MERIDIAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND SEGMENT INFORMATION (Unaudited)

(Dollar amounts and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

| Interest income | $ | 33,836 | | | $ | 30,947 | | | $ | 27,763 | | | $ | 22,958 | | | $ | 20,037 | |

| Interest expense | 16,738 | | | 13,270 | | | 9,245 | | | 4,932 | | | 2,486 | |

| Net interest income | 17,098 | | | 17,677 | | | 18,518 | | | 18,026 | | | 17,551 | |

Provision for credit losses | 705 | | | 1,399 | | | 746 | | | 526 | | | 602 | |

| Non-interest income | 9,124 | | | 6,638 | | | 7,996 | | | 10,224 | | | 10,403 | |

| Non-interest expense | 19,615 | | | 17,789 | | | 20,047 | | | 20,261 | | | 19,706 | |

| Income before income tax expense | 5,902 | | | 5,127 | | | 5,721 | | | 7,463 | | | 7,646 | |

| Income tax expense | 1,257 | | | 1,106 | | | 1,164 | | | 1,665 | | | 1,708 | |

| Net Income | $ | 4,645 | | | $ | 4,021 | | | $ | 4,557 | | | $ | 5,798 | | | $ | 5,938 | |

| | | | | | | | | |

| Basic weighted average shares outstanding | 11,062 | | | 11,272 | | | 11,389 | | | 11,736 | | | 11,998 | |

| Basic earnings per common share | $ | 0.42 | | | $ | 0.36 | | | $ | 0.40 | | | $ | 0.49 | | | $ | 0.49 | |

| | | | | | | | | |

| Diluted weighted average shares outstanding | 11,304 | | | 11,656 | | | 11,795 | | | 12,118 | | | 12,398 | |

| Diluted earnings per common share | $ | 0.41 | | | $ | 0.34 | | | $ | 0.39 | | | $ | 0.48 | | | $ | 0.48 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment Information |

| Three Months Ended June 30, 2023 | | Three Months Ended June 30, 2022 |

| (dollars in thousands) | Bank | | Wealth | | Mortgage | | Total | | Bank | | Wealth | | Mortgage | | Total |

| Net interest income | $ | 17,102 | | | $ | (29) | | | $ | 25 | | | $ | 17,098 | | | $ | 16,923 | | | $ | 317 | | | $ | 311 | | | $ | 17,551 | |

Provision for credit losses | 705 | | | — | | | — | | | 705 | | | 602 | | | — | | | — | | | 602 | |

Net interest income after provision | 16,397 | | | (29) | | | 25 | | | 16,393 | | | 16,321 | | | 317 | | | 311 | | | 16,949 | |

| Non-interest income | 2,508 | | | 1,235 | | | 5,381 | | | 9,124 | | | 1,159 | | | 1,254 | | | 7,990 | | | 10,403 | |

| Non-interest expense | 12,325 | | | 889 | | | 6,401 | | | 19,615 | | | 10,624 | | | 822 | | | 8,260 | | | 19,706 | |

Income (loss) before income taxes | $ | 6,580 | | | $ | 317 | | | $ | (995) | | | $ | 5,902 | | | $ | 6,856 | | | $ | 749 | | | $ | 41 | | | $ | 7,646 | |

| Efficiency ratio | 63 | % | | 74 | % | | 118 | % | | 75 | % | | 59 | % | | 52 | % | | 100 | % | | 70 | % |

| | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 | | Six Months Ended June 30, 2022 |

| (dollars in thousands) | Bank | | Wealth | | Mortgage | | Total | | Bank | | Wealth | | Mortgage | | Total |

| Net interest income | $ | 34,721 | | | $ | 3 | | | $ | 51 | | | $ | 34,775 | | | $ | 32,533 | | | $ | 411 | | | $ | 642 | | | $ | 33,586 | |

Provision for credit losses | 2,104 | | | — | | | — | | | 2,104 | | | 1,217 | | | — | | | — | | | 1,217 | |

Net interest income after provision | 32,617 | | | 3 | | | 51 | | | 32,671 | | | 31,316 | | | 411 | | | 642 | | | 32,369 | |

| Non-interest income | 3,938 | | | 2,431 | | | 9,393 | | | 15,762 | | | 4,535 | | | 2,558 | | | 16,412 | | | 23,505 | |

| Non-interest expense | 23,024 | | | 1,877 | | | 12,503 | | | 37,404 | | | 20,833 | | | 1,700 | | | 18,606 | | | 41,139 | |

Income (loss) before income taxes | $ | 13,531 | | | $ | 557 | | | $ | (3,059) | | | $ | 11,029 | | | $ | 15,018 | | | $ | 1,269 | | | $ | (1,552) | | | $ | 14,735 | |

| Efficiency ratio | 60 | % | | 77 | % | | 132 | % | | 74 | % | | 56 | % | | 57 | % | | 109 | % | | 72 | % |

| | | | | | | | | | | | | | | |

MERIDIAN CORPORATION AND SUBSIDIARIES

APPENDIX: NON-GAAP MEASURES (Unaudited)

(Dollar amounts and shares in thousands, except per share amounts)

Meridian believes that non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts. The non-GAAP disclosure have limitations as an analytical tool, should not be viewed as a substitute for performance and financial condition measures determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of Meridian’s results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance For Loan Losses to Loans, Net of Fees and Costs, Excluding PPP Loans and Loans at Fair Value |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Allowance for credit losses (GAAP) | $ | 20,242 | | | $ | 20,442 | | | $ | 18,828 | | | $ | 18,974 | | | $ | 18,805 | |

| | | | | | | | | |

Loans, net of fees and costs (GAAP) | 1,859,839 | | | 1,818,189 | | | 1,743,682 | | | 1,610,349 | | | 1,518,893 | |

Less: PPP loans | (187) | | | (238) | | | (4,579) | | | (8,610) | | | (21,460) | |

Less: Loans fair valued | (14,403) | | | (14,434) | | | (14,502) | | | (14,702) | | | (16,212) | |

Loans, net of fees and costs, excluding loans at fair value and PPP loans (non-GAAP) | $ | 1,845,249 | | | $ | 1,803,517 | | | $ | 1,724,601 | | | $ | 1,587,037 | | | $ | 1,481,221 | |

| | | | | | | | | |

Allowance for credit losses to loans, net of fees and costs (GAAP) | 1.09 | % | | 1.12 | % | | 1.08 | % | | 1.18 | % | | 1.24 | % |

Allowance for credit losses to loans, net of fees and costs, excluding PPP loans and loans at fair value (non-GAAP) | 1.10 | % | | 1.13 | % | | 1.09 | % | | 1.20 | % | | 1.27 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tangible Common Equity Ratio Reconciliation - Corporation |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Total stockholders' equity (GAAP) | $ | 153,962 | | | $ | 153,049 | | | $ | 153,280 | | | $ | 151,161 | | | $ | 156,087 | |

Less: Goodwill and intangible assets | (3,972) | | | (4,023) | | | (4,074) | | | (4,125) | | | (4,176) | |

Tangible common equity (non-GAAP) | 149,990 | | | 149,026 | | | 149,206 | | | 147,036 | | | 151,911 | |

| | | | | | | | | |

Total assets (GAAP) | 2,206,877 | | | 2,229,783 | | | 2,062,228 | | | 1,921,924 | | | 1,853,019 | |

| Less: Goodwill and intangible assets | (3,972) | | | (4,023) | | | (4,074) | | | (4,125) | | | (4,176) | |

Tangible assets (non-GAAP) | $ | 2,202,905 | | | $ | 2,225,760 | | | $ | 2,058,154 | | | $ | 1,917,799 | | | $ | 1,848,843 | |

Tangible common equity to tangible assets ratio - Corporation (non-GAAP) | 6.81 | % | | 6.70 | % | | 7.25 | % | | 7.67 | % | | 8.22 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tangible Common Equity Ratio Reconciliation - Bank |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

| Total stockholders' equity (GAAP) | $ | 192,209 | | | $ | 187,954 | | | $ | 185,039 | | | $ | 188,386 | | | $ | 192,212 | |

| Less: Goodwill and intangible assets | (3,972) | | | (4,023) | | | (4,074) | | | (4,125) | | | (4,176) | |

| Tangible common equity (non-GAAP) | 188,237 | | | 183,931 | | | 180,965 | | | 184,261 | | | 188,036 | |

| | | | | | | | | |

| Total assets (GAAP) | 2,208,252 | | | 2,229,721 | | | 2,059,557 | | | 1,921,714 | | | 1,852,998 | |

| Less: Goodwill and intangible assets | (3,972) | | | (4,023) | | | (4,074) | | | (4,125) | | | (4,176) | |

| Tangible assets (non-GAAP) | $ | 2,204,280 | | | $ | 2,225,698 | | | $ | 2,055,483 | | | $ | 1,917,589 | | | $ | 1,848,822 | |

| Tangible common equity to tangible assets ratio - Bank (non-GAAP) | 8.54 | % | | 8.26 | % | | 8.80 | % | | 9.61 | % | | 10.17 | % |

| | | | | | | | | |

| Tangible Book Value Reconciliation |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

| Book value per common share | $ | 13.77 | | | $ | 13.54 | | | $ | 13.37 | | | $ | 12.93 | | | $ | 12.93 | |

| Less: Impact of goodwill /intangible assets | 0.35 | | | 0.36 | | | 0.36 | | | 0.35 | | | 0.35 | |

| Tangible book value per common share | $ | 13.42 | | | $ | 13.18 | | | $ | 13.01 | | | $ | 12.58 | | | $ | 12.58 | |

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 NASDAQ: MRBK Q2'2023 Earnings Supplement

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 2Meridian Corporation FORWARD-LOOKING STATEMENTS Meridian Corporation (the “Corporation”) may from time to time make written or oral “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Meridian Corporation’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Meridian Corporation’s control). Numerous competitive, economic, regulatory, legal and technological factors, risks and uncertainties that could cause actual results to differ materially include, without limitation, the impact of the COVID-19 pandemic and government responses thereto; on the U.S. economy, including the markets in which we operate; actions that we and our customers take in response to these factors and the effects such actions have on our operations, products, services and customer relationships; and the risk that the Small Business Administration may not fund some or all Paycheck Protection Program (PPP) loan guaranties; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and the effects of inflation, a potential recession, among others, could cause Meridian Corporation’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements. Meridian Corporation cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward- looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Meridian Corporation’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022 and subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Meridian Corporation does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Meridian Corporation or by or on behalf of Meridian Bank.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 3Meridian Corporation COMPANY SNAPSHOT (1) Includes home equity loans, residential mortgage loans held in portfolio and individual consumer loans. Profile and Business Lines • Core Banking: C&I, CRE, construction, SBA, and consumer lending; lease financing through Meridian Equipment Finance, ® title insurance, and deposit/ treasury services. • Meridian Mortgage: residential lending to homeowners and small scale investors originated in the PA, NJ, DE, VA, MD and DC and FL markets. • Wealth Management Services through Meridian Wealth Partners, ® a registered investment advisor and subsidiary of the Bank. Approx. $1.1 billion in AUM. Meridian specializes in business and industrial lending, retail and commercial real estate lending, electronic payments, along with a broad menu of high-yield depository products supported by robust online and mobile access. Cash & investments 10% C & I loans 27% CRE loans 29% Construction loans 13% Consumer loans (1) 14% Residential loans HFS 2% FF & E 1% Other assets 4% Asset Mix at June 30, 2023

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 4Meridian Corporation GEOGRAPHIC FOOTPRINT • Serves PA, NJ, DE & MD • Philadelphia MSA is 8th largest in the US • Regional Market • HQ in Malvern, PA • Six full service branches • Main office relocated to Wayne, PA • 11 mortgage loan production offices • Naples, FL • Reaches entire SW FL market *********************** Satellite Commercial Loan Production Office

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 5Meridian Corporation INVESTMENT HIGHLIGHTS • "Go to" bank in the Delaware Valley - comfortably handles all but largest companies. • Technology driven mission with valuable customer base trained to solely use electronic channel. • Demonstrated organic growth engine in diversified loan segments, capitalizing on sales culture and market disruption in the Delaware Valley tri-state market. • Financial services business model with significant non-interest revenue. • Historically well capitalized and strong asset growth with above peer net interest margin. • Loan production offices lead expansion into MD and FL markets. • Skilled management team with extensive in-market experience. • Excellent historical asset quality with diversified loan portfolio. • Nationally recognized as a great place to work; low employee turnover.

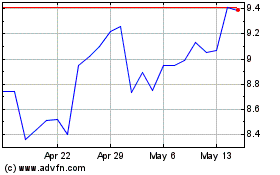

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 6Meridian Corporation Q2'2023 HIGHLIGHTS 1) As of and for the quarter ended and year ended June 30, 2023, per July 28, 2023 press release. 2) Includes PPP loans, loans held for sale and loans held for investment. 3) A Non-GAAP measure. See Non-GAAP reconciliation in the Appendix. Financial Highlights ¹ Balance Sheet ($ in Millions) Profitability (%) - June 30, 2023 Asset Quality (%) Balance Sheet: • Portfolio loan growth $47.7 million • Commercial loans grew $27.4 million, or 7.2% on an annualized basis • Deposits grew $12.2 million, or 3% on an annualized basis • Non-interest bearing deposits were up $6.5 million, or 10.0% on an annualized basis Income Statement (QTD): • Continued strong loan growth leading to a 9.3% increase in interest income. • Mortgage banking income up $1.8 million ◦ loan originations up $59 million • SBA loan income up $1.1 million ◦ $28 million in SBA loan sales Total Assets $ 2,207 Total Loans & Leases² $ 1,900 Deposits $ 1,783 Equity $ 154 Tangible Equity to Tangible Assets3 6.81 % QTR ROE 12.08% ROA 0.86% NIM 3.33% ACL / Loans & Leases3 1.10% NCOs (recoveries) / Loans 0.05% Nonaccrual Loans / Loans 1.44 % Net income $ 4,645 Earnings per share QTD $ 0.41 Price per common share $ 12.60 Quarterly dividends per share $ 0.125 Annualized dividend yield 5.1 % Payout ratio 29.8 % Net Income & Share Data - QTR Ended June 30, 2023

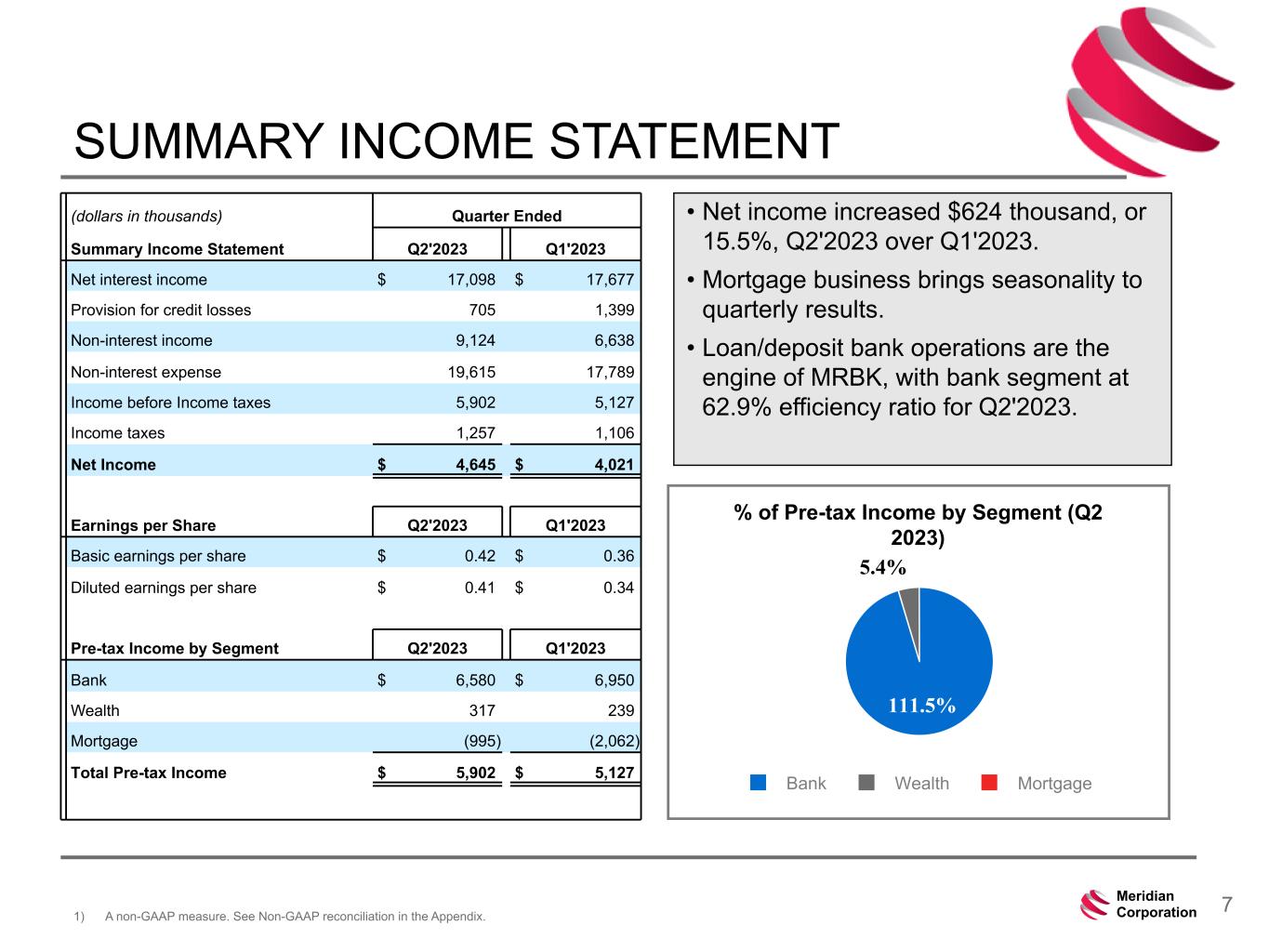

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 7Meridian Corporation SUMMARY INCOME STATEMENT • Net income increased $624 thousand, or 15.5%, Q2'2023 over Q1'2023. • Mortgage business brings seasonality to quarterly results. • Loan/deposit bank operations are the engine of MRBK, with bank segment at 62.9% efficiency ratio for Q2'2023. (dollars in thousands) Quarter Ended Summary Income Statement Q2'2023 Q1'2023 Net interest income $ 17,098 $ 17,677 Provision for credit losses 705 1,399 Non-interest income 9,124 6,638 Non-interest expense 19,615 17,789 Income before Income taxes 5,902 5,127 Income taxes 1,257 1,106 Net Income $ 4,645 $ 4,021 Earnings per Share Q2'2023 Q1'2023 Basic earnings per share $ 0.42 $ 0.36 Diluted earnings per share $ 0.41 $ 0.34 Pre-tax Income by Segment Q2'2023 Q1'2023 Bank $ 6,580 $ 6,950 Wealth 317 239 Mortgage (995) (2,062) Total Pre-tax Income $ 5,902 $ 5,127 % of Pre-tax Income by Segment (Q2 2023) 111.5% 5.4% Bank Wealth Mortgage 1) A non-GAAP measure. See Non-GAAP reconciliation in the Appendix.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 8Meridian Corporation Net Interest Margin Trend 4.07% 4.01% 3.93% 3.61% 3.33% 3.95% 3.99% 3.92% 3.59% 3.33% 0.12% 0.02% 0.01% 0.02% —% PPP Impact NIM Ex PPP Q2'2022 Q3'2022 Q4'2022 Q1'2023 Q2'2023 2.10% 2.40% 2.70% 3.00% 3.30% 3.60% 3.90% NET INTEREST MARGIN • Funding costs still out-paced increases in earning asset yields. • $682 million in loans repriced with avg. increase of 41 bps. • 6% of lower cost deposits shifted to higher cost term or insured sweep accounts. ◦ accounted for approx 10 bps of decline in NIM. • Net interest income sensitivity forecast shows neutral position. Yield on Earning Assets / Cost of Funds 4.65% 5.10% 5.88% 6.31% 6.57% 0.61% 1.17% 2.07% 2.83% 3.39% Yield on earning assets Cost of funds Q2'2022 Q3'2022 Q4'2022 Q1'2023 Q2'2023

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 9Meridian Corporation NON-INTEREST INCOME Non-interest income increased $2.5 million or 37.5% from Q1'2023 • Mortgage banking income increased $1.8 million, or 57.2%: ◦ $59 million increase in loan originations from Q1 • SBA loan income increased $1.1 million, or 147.8%: ◦ $27.8 million loans sold in 2Q ◦ gross margin of 7.0%, compared to 7.7% Q1 (Dollars in thousands) Q2'2023 Q1'2023 $ Change Mortgage banking income (incl. FV chg) 5,033 3,202 1,831 SBA income 1,767 713 1,054 Wealth management income 1,235 1,196 39 Other income 1,089 1,527 (438) Total $ 9,124 $ 6,638 $2,486 55.2% 13.5% 19.4% 11.9% Mortgage banking income (incl. FV change) Wealth management income SBA income Other income (% of total non-interest income during Q2'2023)

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 10Meridian Corporation MORTGAGE PERFORMANCE • Historically profitable, with exceptional profits in 2020 & 2021. • Seasonal business - performance typically strongest in 3Q • Continued expense reductions: ◦ Cumulative expense reduction of over $1.9 million. ◦ Reducing FTEs, administered pay cuts, other compensation changes. ◦ Closing loan production offices. Net Profit (000s) $20,899 $14,633 $(2,627) $(2,065) $(997) Revenue Expense Net profit 2020 2021 2022 Q1 2023 Q2 2023 $(25,000) $— $25,000 $50,000 $75,000 $100,000 $20,897$2,403 Cumulative Expense Reduction Measures (000s) $15 $336 $853 $1,593 $1,636 $1,903 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $— $500 $1,000 $1,500 $2,000

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 11Meridian Corporation MORTGAGE VOLUME & MARGIN TRENDS • Volume continues to be impacted by lack of home inventory, higher mortgage rates, and high property values. • Margin: 2Q 2023 margin of 2.89% down 25 bps from 3.14% for the prior quarter. • Moved to best efforts locks and exited hedge due to rate volatility. • Purchase market comprised 91% of the originations.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 12Meridian Corporation NON-INTEREST EXPENSE Non-Interest Expense increased $1.8 million or 10.3% • Salaries and benefits expense increased as a result of higher levels of mortgage loan officer commissions, incentive-based compensation and stock based compensation. • Professional fees were up due to legal fees incurred related to OREO and loan workout expenses. • Data processing expense was up from the prior quarter driven by customer account volume. • Other expenses were up in Q2'2023 due to an increase in FDIC insurance expense, which now reflects the mandated 2 basis points, and marketing expenses, which are seasonally higher. (% of total non-interest expense during Q2'2023) (Dollars in thousands) Q2'2023 Q1'2023 $ Change Salaries and employee benefits 12,152 11,061 1,091 Occupancy and equipment 1,140 1,244 (104) Professional fees 1,004 823 181 Data processing and information technology 1,681 1,432 249 Other 3,638 3,229 409 Total $19,615 $17,789 $1,826 62.0% 5.8% 5.1% 8.6% 18.5% Salaries and employee benefits Occupancy and equipment Professional fees Data processing and information technology Other

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 13Meridian Corporation LOAN PORTFOLIO TRENDS 2Q 2023 vs 1Q 2023 * Annualized growth impacted by sales during Q2 2023. (Dollars in thousands) June 2023 March 2023 $ Change Annual Growth % Commercial mortgage $ 646,673 $ 615,498 $ 31,175 20.3 % Home equity lines and loans 67,399 62,203 5,196 33.4 % Residential mortgage 252,420 243,268 9,152 15.0 % Construction 284,227 265,702 18,525 27.9 % Commercial and industrial 232,463 228,774 3,689 6.5 % Shared national credits 77,153 101,646 (24,493) * Small business loans 149,035 149,653 (618) * Consumer 440 388 52 53.6 % Leases, net 150,029 151,057 (1,028) (2.7) % Total portfolio loans $ 1,859,839 $ 1,818,189 $ 41,650 9.2 % Commercial mortgage, 35% Home equity lines and loans, 4% Residential mortgage, 13% Construction, 15% Commercial and industrial, 13% Shared national credits, 4% Small business loans, 8% Leases, 8% Commercial - 83% Residential - 13% Home Equity - 4% • Portfolio loan growth was $41.7 million or 2.3% (9.2% annualized). • Commercial CRE and construction loans combined grew $49.9 million. • Sales of $21.8 million in shared national credits. • Leases down $1.0 million, or 0.7% (3% annualized) • Reallocation of funds to higher yielding and relationship- based portfolios.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 14Meridian Corporation Construction, 20.1% RE Investment, 19.9% Residential Mtg, 13.0%Other, 7.0% Manufacturing, 7.9% Retail Trade, 3.3% WholesaleTrade, 3.9% Health & Social Serv, 5.6% Professional Serv, 4.1% HELOC, 3.6% Leisure, 4.0% Science & Tech, 3.6% Admin & Support, 2.3% RE & Rental Lease, 1.0% Waste Mgmt & Remediation, 0.5% Construction RE Investment Residential Mtg Other Manufacturing Retail Trade WholesaleTrade Health & Social Serv Professional Serv HELOC Leisure Science & Tech Admin & Support RE & Rental Lease Waste Mgmt & Remediation Consumer (<0.1%) LOAN PORTFOLIO DIVERSIFICATION Total Loans $1.9 Billion Note (1) (as a % of total loans) (1) Included in RE Investment loans are $58.4 million, or 3%, non-owner occupied office space loans with an average loan size of $1.2 million.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 15Meridian Corporation 1.46% 1.38% 1.27% 1.20% 1.09% 1.13% 1.10% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 —% 0.50% 1.00% 1.50% ASSET QUALITY 1) Includes loans held for sale and held for investment. 2) Excludes loans held for sale and PPP loans which is a non-GAAP measure. See Appendix for Non-GAAP to GAAP reconciliation 3) CECL standard adopted effective January 1, 2023, when we recorded an increase to allowance for credit losses of $1.6 million. Non-performing Loans & Assets Ratios(1) Net Charge-offs / Average Loans ACL / Loans (2)(3) 1.57% 1.51% 1.46% 1.40% 1.20% 1.25% 1.44% 1.34% 1.25% 1.24% 1.20% 1.11% 1.11% 1.32% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 0.00% 0.50% 1.00% 1.50% —% 0.04% 0.04% 0.02% 0.05% 0.08% 0.05% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 —% 0.05% 0.10% $(222) $615 $602 $526 $746 $1,399 $705 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 $(500) $— $500 $1,000 $1,500 Provision for Loan Losses ($000s)

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 16Meridian Corporation DEPOSIT COMPOSITION Business Accounts, 57.7% Consumer Accounts, 11.3% Municipal Deposits, 8.0% Brokered Deposits, 23.0% Business Accounts Consumer Accounts Municipal Deposits Brokered Deposits Total Deposits $1.8 Billion • At June 30, 2023, 63% of business accounts and 87% of consumer accounts were fully insured by the FDIC. • The average business money market account balance was $516 thousand at June 30, 2023. • The municipal deposits are 100% insured or collateralized and brokered deposits are 100% FDIC insured. • The level of uninsured deposits for the entire deposit base was 23% at June 30, 2023. (as a % of total deposits)

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 17Meridian Corporation INVESTMENT PORTFOLIO COMPOSITION • Total investment securities 7.5% of total assets: – 78% Available for sale (AFS). – 22% Held-to-maturity (HTM). • 100% investment grade: – w/90% >AA or higher. • Average TEY of 3.21% year-to-date. • Portfolio duration - 5.2 and average life - 5.6 years. • 12-month projected cash flow $15.6 million: – 6% of portfolio • Total unrealized loss of $16.9 million: – HTM $3.6 million. – AFS $13.3 million. – AOCI $10.8 million or 5% of Bank Tier 1 Capital. (1) Capital ratios reflect Meridian Bank ratios. US government agency, 37.0% State & municipal - tax free, 42.2% Other, 11.4% US asset backed, 7.4% State & municipal - taxable, 1.9% US government agency State & municipal - tax free Other US asset backed State & municipal - taxable Total Securities $163 Million (as a % of total investments)

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 18Meridian Corporation STRONG CAPITAL POSITION • All Bank capital ratios(1) exceed well capitalized regulatory requirements. ◦ Community Banking Leverage Ratio of 9.22% compared to minimum of 9.0% ◦ $4.8 million of excess capital. • On July 27, 2023, the Board of Directors declared a Q2'2023 dividend to $0.125 per common share. Excess Capital (000s) $91,888 $45,503 $74,608 $27,769 9.22% 10.35% 10.35% 11.43% Regulatory Minimum Excess Capital Ratio Tier 1 Leverage Ratio ($) Tier 1 Risk Based Ratio ($) CE Tier 1 Ratio ($) Total Risk Based Ratio ($) $— $50,000 $100,000 $150,000 $200,000 $250,000 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% (1) Capital ratios reflect Meridian Bank ratios.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 19Meridian Corporation APPENDIX - HISTORICAL FINANCIAL HIGHLIGHTS AND RECONCILIATIONS OF NON-GAAP MEASURES

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 20Meridian Corporation HISTORICAL FINANCIAL HIGHLIGHTS 1) Includes loans held for sale and held for investment. 2) Includes loans held for investment (excluding loans at fair value and PPP loans). 3) A Non-GAAP measure. See Appendix for Non-GAAP to GAAP reconciliation. As of or the Quarter Ended As of or the Year Ended (dollars in thousands) Q2'2023 Q1'2023 Q2'2022 2022Y 2021Y 2020Y Balance Sheet Total Assets $ 2,206,877 $ 2,229,783 $ 1,853,019 $ 2,062,228 $ 1,713,443 $ 1,720,197 Loans (1) 1,900,261 1,853,890 1,577,831 1,765,925 1,467,339 1,513,963 Deposits 1,782,605 1,770,413 1,568,014 1,712,479 1,446,413 1,241,335 Gross Loans / Deposits 106.60 % 104.72 % 100.63 % 103.12 % 101.45 % 121.96 % Capital Total Equity $ 153,962 $ 153,049 $ 156,087 $ 153,280 $ 165,360 $ 141,622 Tangible Common Equity / Tangible Assets - HC (3) 6.81 % 6.70 % 8.22 % 7.25 % 9.42 % 7.99 % Tangible Common Equity / Tangible Assets - Bank (3) 8.54 8.26 10.17 8.80 11.54 10.25 Tier 1 Leverage Ratio - HC 7.46 7.65 8.87 8.13 9.39 8.96 Tier 1 Leverage Ratio - Bank 9.22 9.32 10.86 9.95 11.51 11.54 Total Capital Ratio - HC 11.49 11.63 13.50 12.05 14.81 14.55 Total Capital Ratio - Bank 11.43 11.41 13.33 11.87 14.63 14.54 Commercial Real Estate Loans / Total RBC 262.0 % 240.7 % 187.6 % 232.8 % 167.2 % 172.2 % Earnings & Profitability Net Income $ 4,645 $ 4,021 $ 5,938 $ 21,829 $ 35,585 $ 26,438 ROA 0.86 % 0.78 % 1.31 % 1.18 % 2.06 % 1.78 % ROE 12.08 10.65 15.03 13.87 23.74 21.33 Net Interest Margin (NIM)(TEY) 3.33 3.61 4.07 3.98 3.77 3.40 Non-Int Inc. / Avg. Assets 1.69 1.29 2.30 2.26 5.09 5.85 Efficiency Ratio 74.80 % 73.16 % 70.49 % 72.81 % 68.65 % 68.50 % Asset Quality Nonaccrual Loans / Loans (1) 1.44 % 1.25 % 1.46 % 1.20 % 1.57 % 0.62 % NPAs / Assets 1.32 1.11 1.24 1.11 1.34 0.46 Reserves / Loans (2) (3) 1.10 1.13 1.27 1.09 1.46 1.65 NCOs / Average Loans 0.05 % 0.08 % 0.04 % 0.15 % 0.00 % 0.00 % Yield and Cost Yield on Earning Assets (TEY) 6.57 % 6.31 % 4.65 % 5.02 % 4.27 % 4.35 % Yield on Earning Assets (TEY), excluding PPP loans) (3) 6.57 6.28 4.54 4.99 4.26 4.51 Cost of Deposits 3.17 2.64 0.47 0.97 0.48 1.07 Cost of Interest-Bearing Liabilities 3.92 % 3.36 % 0.75 % 1.36 % 0.65 % 1.18 %

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 21Meridian Corporation Allowance For Credit Losses to Loans, Net of Fees and Costs, Excluding PPP Loans and Loans at Fair Value (dollars in thousands) June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 Allowance for credit losses (GAAP) $ 20,242 $ 20,442 $ 18,828 $ 18,974 $ 18,805 Loans, net of fees and costs (GAAP) 1,859,839 1,818,189 1,743,682 1,610,349 1,518,893 Less: PPP loans (187) (238) (4,579) (8,610) (21,460) Less: Loans fair valued (14,403) (14,434) (14,502) (14,702) (16,212) loans (non-GAAP) $ 1,845,249 $ 1,803,517 $ 1,724,601 $ 1,587,037 $ 1,481,221 Allowance for credit losses to loans, net of fees and costs (GAAP) 1.09 % 1.12 % 1.08 % 1.18 % 1.24 % PPP loans and loans at fair value (non-GAAP) 1.10 % 1.13 % 1.09 % 1.20 % 1.27 % RECONCILIATION OF NON-GAAP MEASURES Meridian believes that non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts. The non-GAAP disclosure have limitations as an analytical tool, should not be viewed as a substitute for performance and financial condition measures determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of Meridian’s results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 22Meridian Corporation (dollars in thousands) June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 Tangible common equity ratio - Consolidated: Total stockholders' equity (GAAP) $ 153,962 $ 153,049 $ 153,280 $ 151,161 $ 156,087 Less: Goodwill and intangible assets (3,972) (4,023) (4,074) (4,125) (4,176) Tangible common equity (non-GAAP) $ 149,990 $ 149,026 $ 149,206 $ 147,036 $ 151,911 Total assets (GAAP) $ 2,206,877 $ 2,229,783 $ 2,062,228 $ 1,921,924 $ 1,853,019 Less: Goodwill and intangible assets (3,972) (4,023) (4,074) (4,125) (4,176) Tangible assets (non-GAAP) $ 2,202,905 $ 2,225,760 $ 2,058,154 $ 1,917,799 $ 1,848,843 Tangible common equity ratio (non-GAAP) 6.81 % 6.70 % 7.25 % 7.67 % 8.22 % Tangible common equity ratio - Bank: Total stockholders' equity (GAAP) $ 192,209 $ 187,954 $ 185,039 $ 188,386 $ 192,212 Less: Goodwill and intangible assets (3,972) (4,023) (4,074) (4,125) (4,176) Tangible common equity (non-GAAP) $ 188,237 $ 183,931 $ 180,965 $ 184,261 $ 188,036 Total assets (GAAP) $ 2,208,252 $ 2,229,721 $ 2,059,557 $ 1,921,714 $ 1,852,998 Less: Goodwill and intangible assets (3,972) (4,023) (4,074) (4,125) (4,176) Tangible assets (non-GAAP) $ 2,204,280 $ 2,225,698 $ 2,055,483 $ 1,917,589 $ 1,848,822 Tangible common equity ratio (non-GAAP) 8.54 % 8.26 % 8.80 % 9.61 % 10.17 % RECONCILIATION OF NON-GAAP MEASURES

v3.23.2

Cover

|

Jul. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 28, 2023

|

| Entity Registrant Name |

Meridian Corp

|

| Entity Incorporation, State or Country Code |

PA

|