As

filed with the Securities and Exchange Commission on September 23, 2024

Registration

No. 333-272274

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Amendment

No. 7 to

Form

F-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

MERCURITY

FINTECH HOLDING INC.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

6199 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification Number) |

Shi

Qiu

Chief

Executive Officer

1330

Avenue of the Americas, Fl 33,

New

York, NY 10019

Tel:

+1(949)-678-9653

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

(212)

947-7200

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Huan

Lou, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the America, 31st Fl

New

York, NY 10036

Telephone:

+1-212-930-9700

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † |

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012. |

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

SEPTEMBER 23, 2024 |

46,338,911

ordinary shares

Mercurity

Fintech Holding Inc.

This

prospectus relates to the resale by the selling shareholders identified in this prospectus of up to 46,338,911 ordinary shares,

par value US$0.004 per share, as further described below under “Prospectus Summary—Private Placements.”

The

selling shareholders are identified in the table commencing on page 41. No ordinary shares are being registered hereunder for

sale by us. We will not receive any proceeds from the sale of the ordinary shares by the selling shareholders. All net proceeds from

the sale of the ordinary shares covered by this prospectus will go to the selling shareholders (see “Use of Proceeds”).

The selling shareholders are offering their securities to further enhance liquidity in the public trading market for our equity securities

in the United States. Unlike an initial public offering, any sale by the selling shareholders of the ordinary shares is not being underwritten

by any investment bank. The selling shareholders may sell all or a portion of the ordinary shares from time to time in market transactions

through any market on which our ordinary shares are then traded, in negotiated transactions or otherwise, and at prices and on terms

that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may

act as agent or as principal or by a combination of such methods of sale (see “Plan of Distribution”).

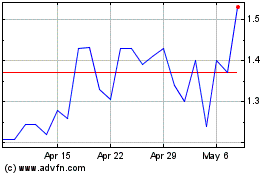

Our

ordinary shares currently trade on The Nasdaq Capital Market under the symbol “MFH.” The last reported closing price of our

ordinary shares on September 20, 2024 was $1.28.

We

are not a “controlled company” as defined under the Listing Rules of The Nasdaq Stock Market LLC (“Nasdaq”),

but we qualify as a “foreign private issuer,” as defined in Rule 405 under the U.S. Securities Act of 1933, as

amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

Mercurity

Fintech Holding Inc. or “MFH Cayman” is not a Chinese operating company but a Cayman Islands holding company with our operations

conducted through our U.S., Hong Kong and PRC subsidiaries. Under this holding company structure, investors are purchasing equity interests

in MFH Cayman, a Cayman Islands holding company, and obtaining indirect ownership interests in our U.S., Hong Kong and Chinese operating

companies. PRC regulatory authorities could decide to limit foreign ownership in our industry in the future, in which case there could

be a risk that we would be unable to do business in China as we are currently structured. In such event, despite our efforts to restructure

to comply with the then applicable PRC laws and regulations in order to continue our operations in China, we may experience material

changes in our business and results of operations, our attempts may prove to be futile due to factors beyond our control, and the value

of the ordinary shares you invest in may significantly decline or become worthless.

Prior

to 2022, the majority of our operations were based in mainland China. During 2022, we divested our software development business in mainland

China, established a new management team, and relocated our headquarters to the United States with the newly established Hong Kong office

as the operational hub for our business in the Asia Pacific region. As a result of the recent operational reorganization, the majority

of our operations are currently based in the U.S. while part of our back-office team are in mainland China.

To

a certain extent, we are subject to legal and operational risks associated with having part of our operations in mainland China,

including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the

United States, and changes in Chinese laws and regulations. Recently, the PRC government initiated a series of regulatory actions and

made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down

on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures

to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. On December 28, 2021, thirteen governmental

departments of the PRC, including the Cyberspace Administration of China (the “CAC”), issued the Cybersecurity Review Measures,

which became effective on February 15, 2022. The Cybersecurity Review Measures provide that an online platform operator, which possesses

personal information of at least one million users, must apply for a cybersecurity review by the CAC if it intends to be listed in foreign

countries. We do not believe that we are subject to the cybersecurity review by the CAC, as advised by Beijing Chuting Law Firm, our

PRC legal adviser. In addition, as of the date of this prospectus, we have not been involved in any investigations on cybersecurity

review initiated by any PRC regulatory authority, nor have we received any inquiry, notice, or sanction related to cybersecurity review

under the Cybersecurity Review Measures. As of the date of this prospectus, based on the opinion of Beijing Chuting Law Firm, we believe

no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission

(the “CSRC”) or any other PRC governmental authorities for our overseas listing or securities offering plan, nor have we

(including any of our subsidiaries) received any inquiry, notice, warning or sanctions regarding our planned offering of securities from

the CSRC or any other PRC governmental authorities. Also, as of the date of this prospectus, we do not believe we are in a monopolistic

position in the industry in which we operate. However, since these statements and regulatory actions by the PRC government are newly

published and official guidance and related implementation rules have not been issued, it remains uncertain what the potential impact

such modified or new laws and regulations will have on our daily business operations. The Standing Committee of the National People’s

Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing

rules that would require our Chinese subsidiaries to obtain regulatory approval from Chinese authorities before future offerings of securities

in the U.S. These risks could result in a material change in our operations in China and potentially the value of our securities being

registered herein for sale. The CSRC regulatory risks could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

In

addition, our ordinary shares may be prohibited from trading on a national exchange or over-the-counter market under the Holding

Foreign Companies Accountable Act (the “HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the

“PCAOB”) is unable to inspect our auditors for three consecutive years. In addition, on June 22, 2021, the U.S. Senate passed

the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022,

reducing the period of time for foreign companies to comply with the PCAOB audits to two consecutive years instead of three, thus reducing

the time period for triggering the prohibition on trading. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December

16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in:

(i) Mainland China of the PRC, and (ii) Hong Kong; and such report identified the specific registered public accounting firms which are

subject to these determinations. On August 26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and China’s Ministry

of Finance in respect of cooperation on the oversight of PCAOB-registered public accounting firms based in Mainland China and Hong Kong.

Pursuant to the Statement of Protocol, the PCAOB conducted inspections on select registered public accounting firms subject to the Determination

Report in Hong Kong between September 2022 and November 2022. On December 15, 2022, the PCAOB issued a report that vacated its December

16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate

completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely

audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full

access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered

in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified

Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not

be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we

would become subject to the prohibition on trading under the HFCAA. Our auditor, Onestop Assurance PAC, is headquartered in Singapore,

and has been inspected by the PCAOB on a regular basis. Our auditor is not headquartered in Mainland China or Hong Kong and was not identified

in the Determination Report as a firm subject to the PCAOB’s determinations.

Remittance

of dividends by a wholly foreign-owned company out of China is subject to examination by the banks designated by State Administration

of Foreign Exchange (“SAFE”). Our PRC subsidiary has not paid dividends and will not be able to pay dividends until they

generate accumulated profits and meet the requirements for statutory reserve funds. For PRC and United States federal income tax considerations

in connection with an investment in our shares, see “Taxation.”

Under

our current corporate structure, to fund any liquidity requirements an entity in our corporate group may have, a subsidiary may rely

on loans or payments from MFH Cayman and MFH Cayman may receive distributions or cash transfers from our subsidiaries. Additionally,

the transfer of funds and assets between MFH Cayman and its subsidiaries is not subject to any Chinese currency exchange restrictions.

As of the date of this prospectus, during the past two completed fiscal years, none of our subsidiaries has made any dividends or distributions

to MFH Cayman and neither has MFH Cayman made any dividends or distributions to its shareholders or subsidiaries. We intend to keep any

future earnings to finance the expansion of our business, and we do not anticipate any cash dividends will be paid in the foreseeable

future. If MFH Cayman determines to pay dividends on any of its ordinary shares in the future, as a holding company, it may derive funds

for such distribution from its own cash position or contributions from its subsidiaries. During the past three completed fiscal years,

some transfers of non-cash assets occurred between MFH Cayman and its subsidiaries, in which MFH Cayman repaid the debts of its PRC subsidiary,

MFH Cayman advanced expenses for its Hong Kong subsidiary, MFH Cayman transferred fixed assets to MFH Tech and MFH Cayman collected money

on behalf of certain other subsidiaries. As of the date of this prospectus, neither MFH Cayman nor its subsidiaries had a cash management

policy. See “The Company–Cash Distribution” on page 25.

Investing

in our ordinary shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk

Factors” starting on page 29 to read about the factors you should consider before buying the Ordinary Shares.

Neither

the Securities and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved

these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to

which we have referred you. Neither we nor any of the selling shareholders have authorized anyone to provide you with different information.

Neither we nor any of the selling shareholders are making an offer of these securities in any jurisdiction where the offer is not permitted.

You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other

than the date of the applicable document. Since the date of this prospectus, our business, financial condition, results of operations

and prospects may have changed.

For

investors outside of the United States: Neither we nor any of the selling shareholders have done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of

this prospectus.

In

this prospectus, “we,” “us,” “our” and the “Company” refer to Mercurity Fintech

Holding Inc. and its wholly owned subsidiaries, (i) Mercurity Fintech Technology Holding Inc., (ii) Mercurity Limited,

(iii) Ucon Capital (HK) Limited, (iv) Beijing Lianji Future Technology Co., Ltd. and (v) Chaince Securities,

Inc.

Our

reporting currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus

to “dollars” or “$” are to U.S. dollars.

This

prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent

industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports

generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy

or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information

contained in such publications.

Our

consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United

States of America, or U.S. GAAP.

The

number of ordinary shares currently issued and outstanding was 60,829,897 as of September 16, 2024. No new shares

are being issued by the Company pursuant to this offering.

ABOUT

THIS PROSPECTUS

This

prospectus describes the general manner in which the selling shareholders identified in this prospectus may offer from time to time up

to 46,338,911 ordinary shares. If necessary, the specific manner in which the ordinary shares may be offered and sold will be

described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this

prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you

should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent

with a statement in another document having a later date—for example, any prospectus supplement—the statement in the document

having the later date modifies or supersedes the earlier statement.

GLOSSARY

OF DEFINED TERMS

In

this prospectus, unless otherwise indicated or the context otherwise requires, references to:

| |

● |

“we,”

“us,” “company,” “our company” or “our” refers to Mercurity Fintech

Holding Inc. and its consolidated subsidiaries, including (i) Mercurity Fintech Technology Holding Inc., (ii) Mercurity

Limited, (iii) Ucon Capital (HK) Limited, (iv) Beijing Lianji Future Technology Co., Ltd. and (v) Chaince Securities; |

| |

|

|

| |

● |

“ADR”

refers to American depositary receipt, which was canceled on February 28, 2023 upon termination of the ADR facility; |

| |

|

|

| |

● |

“ADS”

refers to our American depositary shares, each of which represented 360 ordinary shares before

the mandatory exchange of the ADS for ordinary shares and removal of the ADR facility, effective

February 28, 2023; |

| |

|

|

| |

● |

“Chaince Securities” refers to Chaince Securities,

Inc. |

| |

|

|

| |

● |

“China”

or “PRC” are to the People’s Republic of China, including Hong Kong and Macau; however the only time such jurisdictions

are not included in the definition of PRC and China is when we reference to the specific laws that have been adopted by the PRC.

The same legal and operational risks associated with operations in China also apply to operations in Hong Kong. The term “Chinese”

has a correlative meaning for the purpose of this prospectus; |

| |

|

|

| |

● |

“MFH Cayman” refers to Mercurity Fintech

Holding Inc., the holding company of our group. |

| |

|

|

| |

● |

“MFH Tech” refers to Mercurity Fintech Technology

Holding Inc., a wholly-owned subsidiary of MFH Cayman; |

| |

|

|

| |

● |

“ordinary shares” refer to our ordinary

shares, par value US$0.004 per share; |

| |

|

|

| |

● |

“Renminbi” or “RMB” refers to

the legal currency of China; |

| |

|

|

| |

● |

“SEC” or “Commission” refers

to the Securities and Exchange Commission; |

| |

|

|

| |

● |

“Ucon” refers to Ucon Capital (HK) Limited,

a subsidiary of the Company; |

| |

|

|

| |

● |

“VIEs” refers to (i) Mercurity (Beijing)

Technology Co., Ltd, or Mercurity Beijing, and (ii) Beijing Lianji Technology Co., Ltd., or Lianji, which, together with Mercurity

Beijing, were consolidated by us solely for accounting purposes as variable interest entities, and which have ceased to be our consolidated

entities, following the termination of our VIE structure on January 15, 2022; |

| |

|

|

| |

● |

“WFOE” or “Lianji Future” refers

to Beijing Lianji Future Technology Co., Ltd., our subsidiary in China that is a wholly foreign-owned enterprise; and |

| |

|

|

| |

● |

“$,”

“US$,” “dollar” or “U.S. dollar” refers to the legal currency of the United States. |

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully,

including the “Risk Factors” section and the financial statements and related notes appearing at the end of this prospectus.

Historical

Business Overview

Prior

to July 2019, we provided integrated B2B services to food service suppliers and customers in China. On July 22, 2019, we divested our

B2B services to food service suppliers and customers by selling all the issued and outstanding shares of New Admiral Limited, or New

Admiral, our former wholly-owned subsidiary operating the B2B business, to Marvel Billion Development Limited, or Marvel Billion. After

this divestment, we were no longer engaged in B2B services and our principal business at that point in time was focused

on providing blockchain technical services. In the past, we designed and developed digital asset transaction platforms

based on blockchain technologies for customers to facilitate crypto asset trading and asset digitalization and provided supplemental

services for such platforms, such as customized software development services, maintenance services and compliance support services.

In

March 2020, we acquired NBpay Investment Limited and its subsidiaries and VIE, a developer of asset transaction platform products based

on blockchain technologies, attempting to advance the blockchain technical services business.

In

August 2021, we added cryptocurrency mining as one of our business segments. We entered into cryptocurrency mining pools by executing

a business contract with a collective mining service provider on October 22, 2021 to provide computing power to the mining pool and derived

USD$664,307 related revenue in 2021 and USD$783,089 related revenue in the first half of 2022.

Due

to the extremely adverse regulatory measures taken by the Chinese government in 2021 in the field of digital currency production and

transaction, our Board of Directors (“Board”) decided on December 10, 2021 to divest the VIEs, which were the Chinese operating

companies of the related business controlled through VIE agreements, and the divestiture of such VIEs was completed on January 15, 2022.

On January 28, 2023, we decided to write off NBpay Investment Limited and its subsidiaries, which had no meaningful assets or business

nor employees.

In

late February 2022, Wei Zhu, our former acting Chief Financial Officer, former Co-Chief Executive Officer, and a former member and Co-Chairperson

of the Board, and Minghao Li, a former member of the Board, were suspected of certain criminal offenses unrelated to our company’s

operations and were detained by the Economic Crime Investigation Detachment of Sheyang County Public Security Bureau, Yancheng

City, Jiangsu Province, People’s Republic of China. At the same time, Sheyang Public Security Bureau wrongfully seized the

digital assets hardware cold wallet which belonged to the Company, along with the cryptocurrencies stored therein.

Due

to the dismantling of the VIEs and the cessation of all business related to the digital asset transaction platforms, the temporary

difficulties caused by the impoundment of our cryptocurrencies and substantial changes of our original technical team in

China in 2022, our blockchain technical services business did not generate any revenue in 2022.

Also considering the enormous

uncertainty brought by the cryptocurrency market turmoil in the past two years to the blockchain industry, as well as the regulatory

uncertainties, despite our ability to quickly reorganize the blockchain technical service team, we have decided not to continue conducting

blockchain technology service business related to the asset trading platform, asset digitalization platform and decentralized finance

(DeFi) platform.

On January 10, 2023, we

entered into an asset purchase agreement (the “S19 Pro Purchase Agreement”) with Jinhe Capital Limited (“Jinhe”),

providing for the purchase of 5,000 Antminer S19 PRO Bitcoin mining machines, for an aggregate consideration of USD$9,000,000. From April

to June 2023, our management reassessed the potential adverse effects of changes in the Company’s business environment, and readjusted

the Company’s business structure and the future development plan. Considering the increasing difficulty of Bitcoin mining and the

general losses by top Bitcoin mining enterprises, we had initially decided to reduce the scale of procurement of Bitcoin miners and reduce

the Company’s investment in Bitcoin mining. As such, the Company and Jinhe entered into an amendment (the “Amendment”)

to the S19 Pro Purchase Agreement, pursuant to which the parties agreed to reduce the purchase order to no more than 2,000 Bitcoin miners

for a total consideration of no more than $3.6 million. On March 10, 2024, the Company and Jinhe entered into a cancellation agreement

(the “Cancellation Agreement”) to cancel the orders under the S19 Pro Purchase Agreement in its entirety. The Company currently

does not mine Bitcoin and going forward, it has no plans to resume Bitcoin mining.

On March 7, 2024, considering

the uncertainties in the digital payment industry, the Company decided to suspend its development plan related to its digital payment

solutions and digital payment services, as well as its application for an MSB (Money Service Business) license. In particular, the Company

has obtained the approval of its board of directors on March 7, 2024 to terminate its “digital payment solutions” and “digital

payment services” businesses, which did not generate any meaningful revenue in the past.

Current Business Overview

After making the adjustments

of our business strategies in the past couple of years, the current focus of our operating subsidiaries are as follows: (i) MFH Tech

acting as the operating entity of distributed computing and storage services and business consultation services business in North America;

(ii) after completing the acquisition of all assets and liabilities of J.V. Delaney & Associates with FINRA approval, Chaince Securities

to operate our financial advisory services and online and traditional brokerage services in North America; and (iii) Ucon and Lianji

Future acting as the operating entities of the business consultation services in the Asia-Pacific region.

In

July 2022, we added consultation services to our business, providing business consulting services to global corporate clients,

especially those in the blockchain industry. Meanwhile, we conducted viability studies about the business models, license requirements

and operational costs of online and traditional brokerage services and digital payment business and have been expanding our business

into those two sectors, such as building up client base and acquiring the necessary licenses. However, due to resource restraints,

we have ceased our development plans in digital payment business, including digital payment services and solution consulting, and applications

for the required money transmit licenses since March 2024. Please refer to the section “Digital payment solutions and services

(Discontinued)” on page 12.

On

July 15, 2022, we incorporated Mercurity Fintech Technology Holding Inc. (“MFH Tech”) to develop distributed computing and

storage services (including Filecoin mining and providing cloud storage services for distributed application product operators)

and consultation services.

On

December 15, 2022, we entered into an asset purchase agreement with Huangtong International Co., Ltd., providing for the acquisition

and purchase of Web3 decentralized storage infrastructure, including cryptocurrency mining servers, cables, and other electronic devices,

for an aggregate consideration of USD$5,980,000, payable in our ordinary shares. The investment was made with an aim to own mining machines

capable of gathering, processing, and storing vast amounts of data and to advance the Filecoin mining business. On December

20, 2022, we commenced Filecoin (“FIL”) mining operations and derived USD$348 related revenue in the fiscal year

of 2022. In January 2023, we transferred all of the Web3 decentralized storage infrastructure to MFH Tech, which

serves as the operating entity for Filecoin mining and cloud storage services for distributed application product operators.

On

April 12, 2023, we completed the incorporation of another U.S. subsidiary, Chaince Securities, with which we plan to develop

financial advisory services, online and traditional brokerage services independently in the future. On May 3, 2023, Chaince Securities

entered into a Purchase and Sale Agreement for the acquisition of all assets and liabilities of J.V. Delaney & Associates, an investment

advisory firm and FINRA licensed broker dealer.

Our Current Business and Corporate Structure

Our

current corporate structure is as follows:

Business

Segment 1 – Business consultation

services

We

provide comprehensive business consultation services and industry resource support to global corporate clients based on the resource

advantages we have accumulated over the years. We also assist corporate clients in the Asia Pacific region in developing business in

the United States, such as helping the clients improve operations and compliance, achieving market entry and expansion, introducing and

coordinating professional service institutions.

| ● | Target

customers or clients: Our business consulting services mainly serves clients from Greater

China, Southeast Asia, and North America. |

| | | |

| ● | Fee

structure: Our general fee structure is composed of cash payment and/or bonus shares upon reaching certain milestones or meeting

certain performance requirements. |

| | | |

| ● | Location:

Our business consulting services will be based in our offices in Shenzhen, Hong Kong and

New York, covering Greater China, Southeast Asia and North America. |

For

example, in August 2022, we signed a Consulting Agreement with a Chinese media company, pursuant to which we served as a business

consultant in order to: a) assist the client in establishing an operating entity in the United States and assist its operations; b) introduce

American entertainment media industry related resources; and c) introduce capital market related resources, including auditors,

lawyers and investment banks, to assist the client in developing financing strategies and plans in the US capital markets. On August

1, 2023, the Company signed a supplementary comprehensive service agreement with the same Chinese media company, pursuant to which the

Company continued to assist the client in providing management consulting services and introducing professional service agency resources.

The Company recognized consultation services revenue of $140,000 in 2023 based on the percentage-of-completion. The

Company expects to receive no less than $90,000 in revenue from this new agreement within 2024.

We signed a consulting

agreement with an American logistics company in November 2023 to act as a business consultant to help the client improve the corporate

governance and internal accounting management in preparation for its becoming a public company in the future. The Company expects to

receive $50,000 in revenue from this agreement within 2024 in accordance with the terms of such consulting agreement. In March 2024,

we signed another two consulting agreements with two clients from China to act as the business consultant for the similar work scope

for the American logistics enterprise client.

We are establishing our Asia

business consulting services team in Hong Kong and Shenzhen, and we seek to acquire more new clients in the Asia Pacific region and provide

better services to these clients. Presently, we are in advance negotiations with several Asian clients to provide them with comprehensive

business consulting to enter the US market. It is expected that we will reach agreements and sign contracts with one or two new corporate

clients in 2024.

Business

Segment 2 – Financial advisory

services and Brokerage services

On

April 12, 2023, we completed the incorporation of another U.S. subsidiary, Chaince Securities, with which we plan to develop

the financial advisory services, online and traditional brokerage services independently in the future. On May 3, 2023, Chaince

Securities entered into a Purchase and Sale Agreement for the acquisition of all assets and liabilities of J.V. Delaney & Associates

(“Delaney”), an investment advisory firm and FINRA licensed broker dealer. We commenced the application process for continued

membership application of the Financial Industry Regulatory Authority (FINRA) in August 2023. Based on the current FINRA review process,

the acquisition of Delaney is expected to receive Financial Industry Regulatory Authority (FINRA) approval in 2024. Benefiting from this,

we will be able to provide more comprehensive professional services to corporate clients that want to become publicly traded in the United

States, including financial advisory services and brokerage services.

| ● | Target

customers or clients: Our financial advisory services and brokerage services business mainly

targets clients from Greater China, Southeast Asia, and North America. |

| | | |

| ● | Fee

structure: Our fees are generally payable by the client by tranches upon reaching

certain project milestones, such as upon first filing with the relevant regulator or upon completion of a project. |

| | | |

| ● | Location:

Financial advisory services and brokerage services will be based in our offices in Shenzhen,

Hong Kong and New York, covering Greater China, Southeast Asia and North America, respectively. |

| | | |

| ● | Milestones

or Timetables: Our fees are generally payable by the client by tranches upon reaching certain project milestones, such as upon first

filing with the relevant regulator or upon completion of a project.

|

We

are building a professional team of 7 to 8 persons in New York to carry out financial advisory services and brokerage services,

and we are also building a market promotion and customer service team of 3 to 4 persons spanning Hong Kong and Shenzhen to attract

more potential clients.

1)

Financial advisory services

Our

financial advisory services will focus on providing comprehensive financial services to corporate clients in emerging countries

and regions planning to enter the US capital markets, such as providing capital operation plans, private equity financing services, investment

consulting services, and mergers and acquisitions services to the clients.

Our

financial advisory services will be based in our offices in Shenzhen, Hong Kong and New York, covering Greater China, Southeast Asia

and North America, respectively. We already have a financial advisory service team in New York, and we are establishing our Asian financial

advisory service teams in Hong Kong and Shenzhen to seek more new clients in the Asia Pacific region and provide better services for

these clients in the future.

2)

Brokerage services

In

addition to our financial advisory business, we may make securities underwriting an important part of our brokerage services business,

in order to provide more comprehensive financial services for our corporate clients. We will

decide whether to carry out other brokerage services, such as securities brokerage and asset management based on the Company’s future

business development.

Our

brokerage services will mainly be located in our New York office, serving clients in Greater China, Southeast Asia, and North America.

We will also promote our brokerage services to clients through our offices in Hong Kong and Shenzhen.

It

should be emphasized that our financial advisory services and brokerage services (securities underwriting and other brokerage services)

can only be carried out after we have completed the acquisition of J.V. Delaney & Associates and obtained the financial license and

FINRA approval required for such business.

Business Segment 3 –

Distributed computing and storage

services

In

August 2021, we added cryptocurrency mining as one of our main businesses going forward. Cryptocurrency mining is an important

part of our distributed computing and storage services business. As of the date of this prospectus, all of our distributed storage

and computing service revenue comes from cryptocurrency mining business, specifically from the Bitcoin mining (discontinued) and Filecoin mining.

| ● | Blockchain

and Cryptocurrencies Generally |

Distributed

blockchain technology is a decentralized and encrypted ledger that is designed to offer a secure, efficient, verifiable, and permanent

way of storing records and other information without the need for intermediaries. Cryptocurrencies serve multiple purposes. They can

serve as a medium of exchange, store of value or unit of account. Examples of cryptocurrencies include: Bitcoin, Ethereum, and Filecoin.

Blockchain technologies are being evaluated for a multitude of industries due to the belief in their ability to have a significant impact

in many areas of business, finance, information management, and governance.

Cryptocurrencies

are decentralized currencies that enable near instantaneous transfers. Transactions occur via an open source, cryptographic protocol

platform which uses peer-to-peer technology to operate with no central authority. The online network hosts the public transaction ledger,

known as the blockchain, and each cryptocurrency is associated with a source code that comprises the basis for the cryptographic and

algorithmic protocols governing the blockchain. In a cryptocurrency network, every peer has its own copy of the blockchain, which contains

records of every historical transaction - effectively containing records of all account balances. Each account is identified solely by

its unique public key (making it effectively anonymous) and is secured with its associated private key (kept secret, like a password).

The combination of private and public cryptographic keys constitutes a secure digital identity in the form of a digital signature, providing

strong control of ownership.

No

single entity owns or operates the network. The infrastructure is collectively maintained by a decentralized public user base. As the

network is decentralized, it does not rely on either governmental authorities or financial institutions to create, transmit or determine

the value of the currency units. Rather, the value is determined by market factors, supply and demand for the units, the prices being

set in transfers by mutual agreement or barter among transacting parties, as well as the number of merchants that may accept the cryptocurrency.

Since transfers do not require involvement of intermediaries or third parties, there are currently little to no transaction costs in

direct peer-to-peer transactions. Units of cryptocurrency can be converted to fiat currencies, such as the US dollar, at rates determined

on various exchanges, such as Coinbase, Binance, and others. Cryptocurrency prices are quoted on various exchanges and fluctuate with

extreme volatility.

Blockchains

are decentralized digital ledgers that record and enable secure peer-to-peer transactions without third party intermediaries. Blockchains

enable the existence of digital assets by allowing participants to confirm transactions without the need for a central certifying authority.

When a participant requests a transaction, a peer-to-peer network consisting of computers, known as “nodes”, validate the transaction and

the user’s status using known algorithms. After the transaction is verified, it is combined with other transactions to create a

new block of data for the ledger. The new block is added to the existing blockchain in a way that is permanent and unalterable, and the

transaction is complete.

Digital

assets (also known as cryptocurrency) are a medium of exchange that uses encryption techniques to control the creation of monetary units

and to verify the transfer of funds. Many consumers use digital assets because it offers cheaper and faster peer-to-peer payment options

without the need to provide personal details. Every single transaction and the ownership of every single digital asset in circulation

is recorded in the blockchain. Miners use powerful computers that tally the transactions to run the blockchain. These miners update each

time a transaction is made and ensure the authenticity of information. The miners receive a transaction fee for their service in the

form of a portion of the new digital “coins” that are issued.

Bitcoin

mining is the process through which new bitcoins are created and transactions are added to the blockchain. Miners play a crucial role

by using specialized hardware to solve complex mathematical problems, securing the network and validating transactions. In return for

their efforts, miners are rewarded with newly minted bitcoins and transaction fees, making mining a vital component of the decentralized

Bitcoin ecosystem. Bitcoin mining operates on a proof-of-work consensus mechanism, where miners must demonstrate computational work to

validate transactions. This energy-intensive process ensures the security and immutability of the Bitcoin blockchain, making it resistant

to censorship and fraud. In addition to creating new bitcoins, mining offers benefits such as network security, decentralization, and

the maintenance of a transparent and tamper-resistant ledger.

Bitcoin

mining may be undertaken in two forms: 1) solo mining and 2) pooled mining.

Solo Bitcoin mining refers to the practice where the Bitcoin miner generates new blocks on his own, with the proceeds from the block reward

and transaction fees going entirely to himself, allowing him to receive large payments with a higher variance. On the other hand pooled

Bitconi mining allows a group of Bitcoin miners pool their resources to find blocks on the Bitcoin network, with the Bitcoin rewards/

mining proceeds being shared among the pool miners in rough correlation to the amount of hashing power each miner contributes, generally

resulting in the individual miner in the pooled mining practice to receive small payments with a lower variance compared to the solo miners.

There

are currently millions of mining machines on the Bitcoin network. Bitcoin mining rewards are mathematically set to pay a fixed

amount of bitcoin every ten minutes to one Bitcoin wallet address. This means that the chance of an individual miner earning this

reward on their own is very small. As the hash-rate on the Bitcoin network increases, the chances of earning a reward through solo

mining decreases. By joining a mining pool, Bitcoin miners can pool their computing power (or hash-rate) together and split the

block reward equally between pool participants based on the number of shares they contributed to mining a block.

From

October 2021 to April 2022, we had the usage rights of a certain number and specific models of Bitcoin mining machines and specific

business premises as we were a contracting partner with a pooled Bitcoin mining service provider. During such period,

we registered as users on the F2 pool website, complied with the general terms and conditions required to join the

mining pool published on the F2 pool website, and contributed computing power to the mining pool. In exchange for providing

computing power, we were entitled to and received a fractional share of the fixed Bitcoin awards the mining pool

operator received. Our fractional share was commensurate to the proportion of computing power we contributed to

the mining pool operator as part of the total computing power contributed by all mining pool participants in solving the current

algorithm. Providing computing power in digital asset transaction verification services was an output of part of our ordinary

activities. The provision of such computing power was the only performance obligation in the general terms of the mining pool

website. The transaction consideration we received, if any, was noncash, in the form of Bitcoins, which we

measured at fair value on the date received, which was not materially different than the fair value at contract inception

or the time we earned the award from the pools. These considerations are all variable. Since significant reversals of cumulative revenue

were possible given the nature of the assets, the consideration was constrained until the mining pool operator successfully

placed a block (by being the first to solve an algorithm) and we received confirmation of the consideration it would

receive, at which time revenue was recognized. There was no significant financing component related to these transactions.

Fair value of the digital assets award received was determined using the quoted price of the related digital assets at the time

of receipt. We earned $783,090 in Bitcoin mining revenue from the pooled mining operations for the year ended December

31, 2022, and $664,307 for the year ended December 31, 2021.

On

January 10, 2023, we entered into the S19 Pro Purchase Agreement with Jinhe,

providing for the purchase of 5,000 Antminer S19 PRO Bitcoin mining machines, for an aggregate consideration of US$9,000,000 in cash.

The S19 Pro offered cutting-edge technology and were the highest quality machines then available on the market in early 2023. The decision

to purchase these machines was made with the intention of providing our Company with a competitive edge in the cryptocurrency mining sector,

and an increase in revenue relative to cost, due to their efficiency and overall cost-effectiveness. However, from April to June 2023,

our management reassessed the potential adverse effects of changes in the Company’s business environment and readjusted the Company’s

business structure and the future development plan. Considering the increasing difficulty of Bitcoin mining in general and certain losses

suffered by a number top Bitcoin mining enterprises, we initially decided to reduce the procurement scale of Bitcoin miners and reduce

the Company’s investment in Bitcoin mining. On May 31, 2023, the Company and Jinhe Capital Limited entered into an amendment to

the S19 Pro Purchase Agreement (the “Amendment”), pursuant to which the parties had agreed to reduce the purchase order to

no more than 2,000 Bitcoin miners for a total amount of no more than $3.6 million. On March 10, 2024, the Company and Jinhe entered into

the Cancellation Agreement, cancelling the orders under the S19 Pro Purchase Agreement in its entirety . Copies of the S19 Pro Purchase

Agreement, Amendment and Cancellation Agreement have been filed as exhibits to this Registration Statement on Form F-1, of which this

prospectus forms a part. No Bitcoin mining machines were delivered to us by Jinhe, due to supply chain disruptions, and we are currently

in talks with Jinhe regarding the refund of the monies of $3 million paid by us.

From May 2022 to the

date of this prospectus, we have not engaged in any Bitcoin mining business, and we did not record any revenue from Bitcoin mining

in the year ended December 31, 2023. Going forward, we

have no plans to resume any Bitcoin mining business in the foreseeable future.

| a) | Filecoin

network, Filecoin, and Filecoin mining |

Public cloud data storage based on Web2 technologies has provided an alternative

to on-premises storage infrastructure and forced changes in how data storage is consumed and paid for, no matter where it is located.

Web2 technologies still have challenges; however, emerging Web3 technologies are designed to address these challenges. Web3 is a term

used to describe the next iteration of the internet, one that is built on blockchain technology and is communally controlled by its users.

Web3 is the idea of a new, decentralized internet built on blockchains, which are distributed ledgers controlled communally by participants.

The Filecoin network, which has been storing customer data since 2020, uses Web3 technologies, with the goal of offering integrity, security,

availability, data resilience, and low costs for storing enterprises and public data sets. Filecoin network applies blockchain technology

to record and verify the storage and retrieval of data. The Filecoin blockchain is based on both proof-of-replication

and proof-of-spacetime.

Filecoin

is an open-source, public cryptocurrency and digital payment

system intended to be a blockchain-based cooperative digital storage and data retrieval method. Filecoin is a peer-to-peer network that

stores digital files, with built-in economic incentives and cryptography to ensure files are stored reliably over time. In the Filecoin

network, data clients or users pay Filecoin to store their digital files/ data to the storage providers or Filecoin miners for storing,

searching, and retrieving the data on the Filecoin network. Storage providers or miners are computers responsible for storing, searching

and retrieving the customers’ digital files and proving they have stored them correctly over time. Anyone who wants to store their

digital files or get paid in Filecoin for storing other users’ files can join the Filecoin network. The Filecoin network facilitates

open markets for storing and retrieving files that anyone can participate in.

Compute

nodes in the Filecoin network supply the processing, memory, network, and storage that virtual machine instances need. Specifically

the compute nodes maintain copies of the blockchain’s entire transaction history and verify the validity of new transactions

and blocks. Running a node requires significant computational resources and storage capacity. There are two primary roles a node can

play in the Filecoin network: storage and retrieval. For storage providers, nodes have the ability to contract with clients,

offering to store their data for an agreed-upon period of time in exchange for Filecoins. Every storage provider proves that

they are maintaining their files in every 24-hour window. Nodes that supply storage to the Filecoin

network are termed storage providers (or miners).

In

Filecoin network, digital file storage and retrieval deals are negotiated in the open markets. Prices for storage and retrieval of data

are determined by supply and demand, not a central pricing department. Filecoin miners compete with each other based on their storage,

reliability, and speed and their track records are published on the blockchain.

Generally speaking, Filecoin miners need to

have the requisite collateral, hardware and technical expertise. Filecoin miners are generally existing service companies that provide

on-ramps for organizations to leverage the benefits of the Filecoin network. Filecoin miners must preserve the data for the duration

of each deal, which are on-chain agreements between a client and the storage provider or miner. Filecoin miners must be able to continuously

prove the availability and integrity of the data they are storing. Every storage sector of 32 GiB or 64 GiB gets verified once in each

24-hour period.

Filecoin

miners generally have Filecoin or FIL wallets and can add FIL to them. Providing storage capacity to the Filecoin network requires a

Filecoin miner to provide a number of FIL as collateral in accordance with the proof-of-stake protocols, which is proportional to the

storage hardware committed by the miner.

| b) | Our

Filecoin mining operations |

On

December 15, 2022, we entered into an asset purchase agreement with Huangtong International Co., Ltd., providing for the acquisition

and purchase of Web3 decentralized storage infrastructure, including cryptocurrency mining servers, cables, and other electronic devices,

for an aggregate consideration of USD$5.98 million, payable in our ordinary shares. Starting on December 20, 2022, we used some of the

storage capacity of these devices for Filecoin mining business. We have rented our Filecoin mining operating premises located

in New Jersey, United States from Cologix US, Inc. and we have entered into the Filecoin network as a storage provider

or miner by registering as a user on the Filecoin network, complying with the general terms and conditions required to

become a storage provider published on the Filecoin network.

We

utilize our Web3 decentralized storage infrastructure

to provide data storage services to the end customers through the Filecoin network. Providing storage capacity in

digital asset transaction verification services is an output of our ordinary activities. The provision of such storage capacity is the

only performance obligation in the general terms of the Filecoin network. The transaction consideration we receive, if any, is

Filecoins, being noncash consideration, which we measure at fair value on the date received, which is not materially different

than the fair value at contract inception or the time we have earned the award from the Filecoin network. These considerations

are all variable. Since significant reversals of cumulative revenue are possible given the nature of the assets, the consideration is

constrained until the all the miners successfully places a block (by being the first to solve an algorithm) and we receive confirmation

of the consideration it will receive, at which time revenue is recognized. There is no significant financing component related to these

transactions. Fair value of the digital assets award received is determined using the quoted price of the related digital assets at the

time of receipt. For the years ended December 31, 2022 and 2023, we earned $348 and $285,928 in revenue from

our Filecoin mining operations, respectively.

The

Web3 decentralized storage infrastructure we acquired in December 2022 is expected to achieve a maximum storage capacity of

approximately 100PiB. A pebibyte (PiB) is a unit of measure that describes data capacity. One pebibyte (PiB) equals 1,024

tebibyte (TiB) or 1,048,576 gibibyte (GiB) or 1,125,899,906,842,624 bytes. We originally planned to use the storage

capacity for Filecoin mining and provide cloud storage services to other distributed application product operators. However,

due to the continued low market prices of Filecoin in 2023, as well as the declining average return on unit computing power

of Filecoin mining, at the end of 2023, we had not opened enough compute nodes to achieve the initial target of

100PiB storage capacity. Therefore, the Web3 decentralized storage infrastructure was not fully utilized during fiscal

year 2023. However, these Web3 decentralized storage infrastructures were recognized for depreciation costs on a straight-line

basis, which resulted in significant losses for our business of providing distributed computing and storage services in 2023. Apart

from the Filecoin mining business, we have not utilized the infrastructure for any other cryptocurrency mining business, nor

have we provided cloud storage services to any other distributed application product operators.

We

established our first node account (f01997159) (“Filecoin Node 1”) on the Filecoin network in December 2022. As of June 30,

2024, this node ceased its operation due to its low effective storage capacity. We established our second node account (f02096915) (“Filecoin

Node 2”) on the Filecoin network in March 2023. As of June 30, 2024, the effective storage capacity of Filecoin Node 2 has been

reduced to 221.88 TiB and will be completely closed in the near future as a result of being replaced with new nodes of Filecoin Plus

technologies .

Mining under Filecoin Plus with technical support

from Origin Storage

In December 2023, we decided

to adopt the new Filecoin mining method “Filecoin Plus” to expand our Filecoin mining business and gradually replace Filecoin

Nodes 1 and 2 by opening new ones operating with Filecoin Plus.

On

December 5, 2023, the Company signed a Filecoin Mining Service Contract with Origin Storage PTE. LTD. (“Origin Storage”).

The Company has since used Origin Storage’s technology to identify and store more valuable data, such as commercial grade information,

on our Web3 decentralized storage infrastructure and conduct Filecoin mining business under the guiding principles of Filecoin

Plus, which is a set of principles focused on making Filecoin to become the decentralized storage network for humanity’s

important information.

The

material terms of the Filecoin Mining Service Contract with Origin Storage

are as follows:

| Scope

of services |

Origin

Storage will provide certain services to us, which are Storage Server services, Computing

Sealing Server services and technical services.

“Storage

Server” services generally refer to the hardware services that allow the storage of data for the purpose of mining on the

Filecoin network.

“Computing

Sealing Server” services generally refer to the provision of hardware used for Sector Sealing, which is the process to encode

the data in the Filecoin storage network.

Origin

Storage will distribute the earned mining rewards in the form of Filecoins to us on a daily basis, subject to relevant service fees

and blockchain transaction fees. MFH Tech shall provide the Filecoin collateral required for Filecoin mining.

|

Payment

terms

|

A

total of $48,648 is payable by us upon the signing of the agreement for storage software

services and data services. 4% of the mining rewards that we receive shall be payable to Origin Storage during

the term of this agreement.

|

| Term

of services |

The

term of services provided by Origin Storage will terminate 720 calendar days after the first

Filecoin block is generated. The agreement may be terminated in the event of violation of

law, breach of term or delay of payment due.

|

The above description of the Filecoin Mining Service Contract is not purported

to be complete and a copy of such is set out in Exhibit 10.19 of our registration statement on Form F-1 of which this prospectus

forms a part of.

The new Filecoin mining method

of Filecoin Plus is open-source information available on the Filecoin network. With the technical guidance and support of Origin Storage,

we have become capable of using and operating the open-sourced codes of Filecoin Plus to mine Filecoin and have been running two new

Filecoin mining nodes (f02843151 and f02886019) (“Filecoin Node 3” and “Filecoin Node 4” respectively)

since January 2024. Under the Filecoin Plus mining method, we can identify, store, search and retrieve commercial grade information for

clients and as a result, we have received ten times (also called “quality adjusted power” in the setting of Filecoin mining)

of the mining rewards in Filecoin for the same amount mining work we do using the regular Filecoin mining method. Origin Storage has

been providing technical services to our mining team for our mining operations to meet the standards of Filecoin Plus and receive the

quality adjusted power and increased amount of Filecoin rewards. The original storage capacity is the actual storage capacity taken up

by our Web3 decentralized storage infrastructure. The effective storage capacity refers to the rate or ability of Filecoin rewards each

unit of storage can generate. Because of the 10x quality adjusted power the Filecoin network is providing to miners using Filecoin Plus

method, we currently can use one unit of original storage to earn the same amount of Filecoin rewards that ten original storage units

used to earn in the past before we adopted Filecoin Plus. In that sense, we believe Origin Storage helped us use Filecoin Plus method

to increase our effective storage capacity by tenfold.

As

of June 30, 2024, the aggregate effective storage capacity of Filecoin Nodes 3 and 4 reached and maintained at

a level of 70PiB, exceeding our original target storage capacity of 60.4PiB, and taken up only 7PiB of the original storage capacity

(the “Raw Byte Power”) of our Web3 decentralized storage infrastructure.

In

this way, most of the original storage capacity (or the “Raw Byte Power”) of the Company’s Web3 decentralized storage

infrastructure will remain available for use, which we can utilize to expand our Filecoin mining business or provide cloud storage services

to other distributed application product operators. All such remaining storage capacity will be utilized and applied based on our cost-benefit

analysis, with a focus on legal compliance, economic return, and shareholder value. We will consult our legal advisers and strictly abide

by relevant SEC and U.S. court guidance on the legal classification of cryptocurrencies. However, such legal advice and assessment

is not foolproof, and whether our activities require registration or the crypto assets we hold would be considered securities is a risk-based

assessment, and not a legal standard binding on a regulatory body or court, and does not preclude legal or regulatory action despite

any legal advice we receive to the contrary. The Company currently does not have plans to mine, transact or invest in any type of

cryptocurrency, whether or not they constitute “securities” under U.S. law, other than Filecoins. In addition, the Company

does not intend to mine or invest in Bitcoins in the foreseeable future, other than disposing of Bitcoins it has held.

| c) | Our

arrangement with Coinbase |

In

January 2023, our U.S. subsidiary, MFH Tech signed a Coinbase Prime Broker Agreement with Coinbase, Inc., filed as Exhibit 99.1

to our registration statement on Form F-1. The agreement includes the Coinbase Custody Custodial Services Agreement (the “Custody

Agreement”) and the Coinbase Master Trading Agreement (the “MTA”). The agreement sets forth the terms and conditions

pursuant to which the Coinbase Entities will open and maintain the prime broker account for us and provide services relating to custody,

trade execution, lending or post-trade credit (if applicable), and other services for certain digital assets. As of the date of this

prospectus, we do not own and/or hold crypto assets on behalf of third parties. The material terms of the Coinbase Prime Broker Agreement

with Coinbase include the following:

| Scope

of services |

Coinbase

shall open a trading account for us as the client on its Trading Platform consisting of linked

accounts at Coinbase and Coinbase Custody, each accessible via the Trading Platform. The

Trading Platform shall provide us with access to trade execution and automated trade routing

services and Coinbase Execution Services to enable us to submit orders to purchase and sell

specified digital assets in accordance with the MTA and the Coinbase Trading Rules. |

| Acknowledgement

of risks |

We

are required to acknowledge that digital assets are not legal tender, are not backed by any

government, and are not subject to protections afforded by the Federal Deposit Insurance

Corporation or Securities Investor Protection Corporation; transactions in digital assets

are irreversible, and, accordingly, digital assets lost due to fraudulent or accidental transactions

may not be recoverable; and any bond or trust account maintained by Coinbase entities for

the benefit of its customers may not be sufficient to cover all losses incurred by customers. |

| |

|

| Limitation

of liability |

Coinbase

has disclaimed all liability to us other than with respect to gross negligence, fraud or willful misconduct. Coinbase has also limited

its liability to not more than the greater of aggregate fees paid by us in the 12-month period before the event giving rise to liability

and the value of the supported digital assets on deposit in our custodial account, and subject to an upper limit of US$100,000,000. |

| |

|

| |

Coinbase also disclaims liability for force majeure

events. |

| |

|

| Termination |

Generally,

either party may terminate the Coinbase Prime Broker Agreement by providing at least 30 days’

prior written notice to the other party, subject to the fulfilment of our contractual obligations. |

| |

|

| |

Coinbase also has the right to suspend, restrict or

terminate our Prime Broker Services, including by suspending, restricting or closing our accounts, for cause, which includes contractual

breach or insolvency events, any facts regarding our financial, legal, regulatory or reputational position which may affect our ability

to comply with contractual obligations, in accordance with law, or if our account is subject to any pending litigation, investigation

or government proceeding. |

| |

|

| Payment

terms |

We

shall pay the initial Storage Fee on the earlier of: (i) the first date that Client’s Digital Asset balance on deposit in the Custodial

Account or Coinbase Inc. Custodial Account, as applicable, is equal to USD $50,000 notional; or (ii) three months from the Effective

Date. |

The

summary above does not purport to be complete and is qualified in its entirety by reference to the full text of the Coinbase Prime Broker

Agreement with Coinbase, Inc., filed as Exhibit 99.1 to our registration statement on Form F-1.

The

material terms of our custody arrangements with Custody Agreement include the following:

| Scope

of custodial services |

Coinbase

Custody shall provide us with a segregated custody account controlled and secured by Coinbase

Custody to store certain digital assets supported by Coinbase Custody, on our behalf.

Coinbase

Custody is a fiduciary under § 100 of the New York Banking Law and a qualified custodian for purposes of Rule 206(4)-2(d)(6)

under the Investment Advisers Act of 1940, as amended, and is licensed to custody Client’s Digital Assets in trust on our

behalf.

Digital

assets in our custodial account shall (i) be segregated from the assets held by Coinbase Custody as principal and the assets of other

customers of Coinbase Custody, (ii) not be treated as general assets of Coinbase Custody, and except as otherwise provided in the

agreement, Coinbase Custody shall have no right, title or interest in such digital assets, (iii) constitute custodial assets and

our property. In addition, Coinbase Custody shall maintain adequate capital and reserves to the extent required by applicable law

and shall not, directly or indirectly, lend, pledge, hypothecate or re-hypothecate any digital assets in the custodial account.

Coinbase

Custody reserved the right to refuse to process or to cancel any pending custody transaction to comply with applicable law or in response

to a subpoena, court order or other binding government order, or to enforce transaction, threshold and condition limits, or if Coinbase

Custody reasonably believes that the custody transaction may violate or facilitate the violation of an applicable law, regulation or

rule of a governmental authority or self regulatory organization. |

| |

|

| Custody

Obligations |

Coinbase

Custody shall keep timely and accurate records as to the deposit, disbursement, investment and reinvestment of the digital assets, as

required by applicable law and in accordance with Coinbase Custody’s internal document retention policies. Coinbase Custody shall

also obtain and maintain, at its sole expense, insurance coverage in such types and amounts as shall be commercially reasonable for the

custodial services provided to us. |

| |

|

| Supported

digital assets |

The

custodial services are available only in connection with those digital assets that Coinbase Custody, in its sole discretion, decides

to support, which may change from time to time. |

| |

|

| Transmission

delays |

Coinbase

Custody requires up to twenty-four hours between any request to withdraw digital assets from

our account and submission of our withdrawal to the applicable digital assets network. Since

Coinbase Custody securely stores all digital assets private keys in offline storage, it may

be necessary to retrieve certain information from offline storage in order to facilitate

a withdrawal, which may delay the initiation or crediting of such withdrawal. We acknowledged

and agreed that a custody transaction may be delayed.

Coinbase

Custody makes no representations or warranties with respect to the availability and/or accessibility of (1) the digital assets, (2)

a custody transaction, (3) the custodial account, or (4) the custodial services. |

| |

|

| Termination |

If

Coinbase Custody closes our Custodial Account or terminates our use of the Custodial Services, we will be permitted to withdraw Digital

Assets associated with our Custodial Account for a period of up to ninety (90) days following the date of deactivation or cancellation

to the extent not prohibited (i) under applicable law, including applicable sanctions programs, or (ii) by a facially valid subpoena,

court order or binding order of a government authority. |

| |

|

| Storage

Fee |

The

storage fee is $2,400 per year. |

The

following are additional terms regarding custody arrangements:

| ● | Manner

of Storage Cold Storage: (i) Coinbase offers two storage options for the Client’s

Digital Assets: Hot Vault Balance (hot storage) and Cold Vault Balance (cold storage). We

have the discretion to allocate our assets between these two storage options. |

| | | |

| ● | Coinbase

is not contractually obligated to hold our crypto assets in cold storage: The choice

of whether assets are held in hot or cold storage is at our sole discretion. However, transfers

from the Cold Vault Balance have specific withdrawal procedures. |

| | | |

| ● | Security

Precautions: Coinbase Custody mentions storing all Digital Asset private keys in

offline storage. It also details the procedures surrounding Digital Asset transactions, such

as the requirement for us to verify all deposit and withdrawal information. If Coinbase perceives

a risk of fraud or illegal activity, Coinbase Custody has the right to delay any Custody

Transaction. |

| | | |

| ● | Inspection

Rights: There is no explicit mention of inspection rights granted to us regarding

Coinbase’s operations, records or systems. Coinbase will provide electronic account

statements to us detailing our account activities, but it does not specify broader inspection

or audit rights for us. Our insurance providers do not have inspection rights associated

with the crypto assets held in storage of which the auditors have confirmed. |

| | | |

| ● | Insurance:

Coinbase Custody maintains, at its sole expense, insurance coverage in such types

and amounts as commercially reasonable for the Custodial Services provided in the Coinbase

Prime Broker Agreement. Coinbase maintains a commercial crime insurance policy which encompasses

losses due to employee collusion or fraud, physical loss or damage of critical material,

security breaches or hacks, and fraudulent transfers, including asset theft from both hot

and cold storage. Additionally, Coinbase maintains cyber insurance, which covers loss of

income and data recovery resulting from security failures leading to business interruptions,

covering computer forensic costs, incident response legal fees, notification expenses, and

privacy claims by regulators. Based on publicly available information, Coinbase maintains

a commercial crime insurance policy of up to $320 million. The insurance maintained by Coinbase

is shared among all of Coinbase’s customers, is not specific to our Company and may

not be available or sufficient to protect our Company from all possible losses or sources

of losses. Coinbase’s insurance may not cover the type of losses experienced by our

Company. Alternatively, we may be forced to share such insurance proceeds with other clients

or customers of Coinbase, which could reduce the amount of such proceeds that are available

to us. |

The

information of the Company’s cryptocurrencies as of June 30, 2024 is as follows:

| |

|