0001654595

false

0001654595

2023-07-12

2023-07-12

0001654595

us-gaap:CommonStockMember

2023-07-12

2023-07-12

0001654595

MDRR:SeriesACumulativeRedeemablePreferredStock8.0PercentMember

2023-07-12

2023-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): July 12, 2023

Medalist Diversified REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | |

001-38719 | |

47-5201540 |

(State or other

jurisdiction of incorporation

or organization) | |

(Commission File Number) | |

(I.R.S. Employer

Identification No.) |

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

(Address

of principal executive offices)

(804) 344-4435

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

|

Name of each Exchange

on Which

Registered |

|

Trading

Symbol(s) |

| Common Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRR |

| 8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRRP |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On

July 12, 2023, Medalist Diversified REIT, Inc. (the “Company”) issued a press release, a copy of which is furnished

as Exhibit 99.1 to this Current Report on Form 8-K. The information, including the press release, furnished under this Item 7.01 shall

not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any other

filing by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

MEDALIST DIVERSIFIED REIT, INC. |

| |

|

|

| Dated: July 12, 2023 |

By: |

/s/ C. Brent Winn, Jr. |

| |

|

C. Brent Winn, Jr. |

| |

|

Chief Financial Officer |

Exhibit 99.1

Medalist

Diversified REIT, Inc. Concludes Strategic Alternatives Process with

POTENTIAL Asset Sale and eXPECTED Transition to Internalized Management

RICHMOND, Va., July 12, 2023--Medalist Diversified

REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes

in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., announced today that the Special Committee

(the "Special Committee”) of the Company’s Board of Directors (the “Board”) has completed its exploration

of strategic alternatives.

Upon the recommendation of the Special Committee,

the Board has approved the Company’s negotiation of the sale of its interests in four properties from the Company's portfolio. Consummation

of the sale is subject to negotiation of, and entry into, definitive agreements and related loan assumptions, and there can be no assurance

as to the sales prices or other terms of the sales, or the timing of any of the sales, or whether such sales will occur. Further

information about this potential transaction will be disclosed, as appropriate.

Simultaneously, the Company announced that it

is exploring diverse opportunities that might include mergers, investments, or other strategic combinations, with a focused objective

of enhancing shareholder value.

In line with these strategic shifts, Medalist

has commenced discussions with its external manager as to an internalization of the Company’s management. If completed, the internalization

would be expected to lead to streamlined operations, reduced costs, and increased agility, while also fostering a closer alignment between

management's interests and those of the Company’s shareholders. The transition to an internal management structure, if completed,

would result in changes in several key leadership roles. Medalist is committed to a smooth transition process and ensuring continuity

of leadership, with the primary focus on preserving and enhancing shareholder value. Consummation of an internalization is subject to

negotiation of, and entry into, definitive agreements, and there can be no assurance as to the timing or terms of the internalization.

Further information about this transaction will be disclosed, as appropriate.

Recognizing the need for financial stability during

this transitional phase, the Board has approved the temporary suspension of dividends on the Company’s outstanding common stock

and preferred stock for at least the next six months.

The Board extends its gratitude to shareholders

for their patience and feedback throughout this process. As the Company ventures into this significant period of change, the Board reaffirms

its commitment to enhancing shareholder value and improving company performance.

Throughout this strategic journey, the Special

Committee was supported by Jones Lang Lasalle Securities Inc., as financial advisor, and Troutman Pepper Hamilton Sanders LLP, as legal

counsel.

About Medalist Diversified

REIT

Medalist Diversified

REIT Inc. is a Virginia-based real estate investment trust that specializes in acquiring, owning and managing value-add commercial real

estate in the Mid-Atlantic and Southeast regions. The Company’s strategy is to focus on value-add and opportunistic commercial

real estate which is expected to provide an attractive balance of risk and returns. Medalist utilizes a rigorous, consistent and replicable

process for sourcing and conducting due diligence of acquisitions. The Company seeks to maximize operating performance of current properties

by utilizing a hands-on approach to property management while monitoring the middle market real estate markets in the southeast for acquisition

opportunities and disposal of properties as considered appropriate. For more information on Medalist, please visit the Company website

at www.medalistreit.com.

Forward-Looking

Statements

This

press release contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 and other federal securities laws. Forward looking statements are not historical and are typically identified by such

words as “believe,” “expect,” “anticipate,” “intend,” “estimate, “may,”

“will,” “should” and “could” and include statements about the potential asset sales, the Company’s

exploration of diverse opportunities, the temporary suspension of dividends on the Company’s outstanding common stock and preferred

stock and the potential transition to internalized management and the impact, if any, of such actions on the Company and the trading price

of the Company’s common stock. Forward-looking statements are based upon the Company’s present expectations but are not guarantees

or assurances as to future developments or results. Factors that may cause actual developments or results to differ from those reflected

in forward-looking statements include, without limitation, adverse changes in the pricing of the Company’s assets, disruptions associated

with management internalizations, increased costs of, and reduced availability of, capital and those included in the Company’s most

recent Annual Report on Form 10-K and in the Company’s other filings with the Securities and Exchange Commission. Investors should

not place undue reliance upon forward-looking statements. The Company disclaims any obligation to publicly update or revise any forward-looking

statements to reflect changes and new developments except as required by law or regulation.

Contacts

Brent Winn

Medalist Diversified REIT, Inc.

804-338-7708

brent.winn@medalistprop.com

v3.23.2

Cover

|

Jul. 12, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 12, 2023

|

| Entity File Number |

001-38719

|

| Entity Registrant Name |

Medalist Diversified REIT, Inc.

|

| Entity Central Index Key |

0001654595

|

| Entity Tax Identification Number |

47-5201540

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1051 E. Cary Street Suite 601

|

| Entity Address, Address Line Two |

James Center Three

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

804

|

| Local Phone Number |

344-4435

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

MDRR

|

| Security Exchange Name |

NASDAQ

|

| 8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value

|

| Trading Symbol |

MDRRP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MDRR_SeriesACumulativeRedeemablePreferredStock8.0PercentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

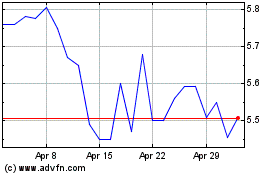

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Jul 2023 to Jul 2024