Federal Shutdown Hurts Marriott -- WSJ

May 11 2019 - 3:02AM

Dow Jones News

By Aisha Al-Muslim

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 11, 2019).

Marriott International Inc., the world's largest hotel company,

posted weaker than expected revenue growth from guest stays in the

latest period, but said its business is stable as fee revenue rises

and it continues to expand its hotel count.

Marriott, the parent of hotel brands including Ritz-Carlton,

Westin and Renaissance, said Friday that comparable systemwide

revenue per available room rose 1.1% excluding currency

fluctuations in the first quarter. RevPAR, which reflects pricing

power, grew at a faster pace outside North America than it did on

the continent, but both regions still missed Marriott's outlook for

the quarter.

RevPAR growth in North America was hurt by the partial U.S.

government shutdown in December and January and the lingering

impact from a labor strike in Hawaii last year. For two months,

about 8,000 Marriott union workers in several markets were on

strike. The year-earlier period also benefited from strong bookings

related to hurricane-recovery efforts in Florida and Texas.

"We're quite prepared to sacrifice a few tenths on the top line

if it makes sense to drive enhanced profitability," Marriott Chief

Executive Arne Sorenson told analysts on a conference call.

Overall, revenue was flat from a year earlier at $5.01 billion,

and lower than analysts' consensus forecast of $5.11 billion.

Revenue generated from bookings through online travel agencies like

Expedia declined 4%, while direct digital revenue bookings

increased more than 20%.

Shares fell 2.8% to $131.71 in Friday trading, as Marriott's

results weighed on other lodging stocks including Hyatt Hotels

Corp. and Wyndham Hotels & Resorts Inc.

Despite a sluggish start to the year, Marriott maintained its

full-year forecast for RevPAR to rise 1% to 3% world-wide. The

company said it still plans for its hotel room count to increase

about 5.5% for the year.

Hotel companies have signaled they expect RevPAR to slow down

this year compared with 2018 because of pressure from a maturing

global economy, a relative slowdown in China and worries about the

impact of Brexit on Europe.

In recent weeks, Hilton Worldwide Holdings Inc., Hyatt and

Wyndham have also reaffirmed their full-year RevPAR growth outlook

of about 1% to 3%. On Thursday, Choice Hotels International Inc.

lowered the high end of its prior RevPAR guidance.

In the latest period, Marriott's first-quarter profit fell to

$375 million, or $1.09 a share, from $420 million, or $1.16 a

share, a year earlier. Last year's results benefited from one-time

gains from hotels sold.

Excluding special items, adjusted earnings were $1.41 a share,

higher than the $1.34 a share expected by analysts polled by

Refinitiv. If not for nonoperating items, earnings would have

fallen short of consensus expectations, Sanford C. Bernstein

analysts said in a note.

Marriott raised its full-year adjusted profit forecast on

Friday, due in part to a lower effective tax rate. Marriott guided

earnings per share of $5.97 to $6.19, compared with its prior

estimate of $5.87 to $6.10. It also raised its forecast on gross

fee revenue this year due to unit growth as well as higher

incentive fees and credit-card branding fees.

The company said it incurred $44 million of expenses and had $46

million of insurance recoveries related to a data breach disclosed

in November. Marriott has said a hack in the reservation system for

its Starwood properties may have exposed the personal information

of up to 500 million guests, but that number was later revised

lower.

Last week, Marriott said Mr. Sorenson, 60 years old, was

diagnosed with stage-2 pancreatic cancer and would undergo

chemotherapy. Mr. Sorenson, who has been CEO since 2012, said he

expects to remain in his role.

"They believe we have caught it early, that it is operable and

that the course of treatment is proven," he said Friday. "With the

support of an extraordinary, strong team of Marriott executives, we

are going to soldier on."

Marriott also plans to move deeper into the home-sharing space,

competing even more with Airbnb Inc., Expedia Group Inc.'s Vrbo and

others. In late April, Marriott said it would begin offering

accommodations starting this week in about 2,000 high-end homes

throughout 100 markets across the U.S., Europe and Latin

America.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 11, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

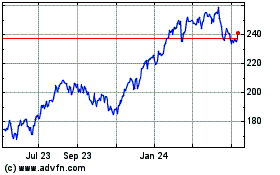

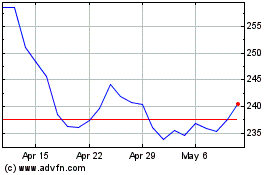

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024