Marriott International's Profit Falls--Update

May 10 2019 - 8:08AM

Dow Jones News

By Aisha Al-Muslim

Marriott International Inc., the world's largest hotel company,

reported a lower profit in the latest quarter as higher operating

costs offset modest growth in a key revenue metric that reflects

pricing power.

Marriott, the parent of such hotel brands as Ritz-Carlton,

Westin and Renaissance, reported a first-quarter profit of $375

million, or $1.09 a share, down from $420 million, or $1.16 a

share, a year earlier.

The Bethesda, Md.-based company had comparable systemwide

revenue per available room, or RevPAR, growth of 1.1% world-wide

excluding currency fluctuations. However RevPAR grew at a faster

pace outside of North America than it did on the continent,

Marriott said Friday.

The company said it incurred $44 million of expenses and

recognized $46 million of insurance proceeds related to the data

breach the company disclosed in November. Marriott has said a hack

in the reservation database for its Starwood properties may have

exposed the personal information of up to 500 million guests, but

that number was later revised lower.

Excluding merger-related costs, cost reimbursement revenue, and

other items, the company posted earnings of $1.41 a share, higher

than the $1.34 a share expected from polled by Refinitiv.

Revenue was roughly flat from a year earlier at $5.01 billion,

and was below the consensus forecast of $5.11 billion.

Marriott on Friday maintained its full-year forecast for RevPAR

to rise 1% to 3% world-wide. For 2018, world-wide RevPAR increased

2.9%, or 2.6% when excluding currency fluctuations. Marriott also

guided earnings per share of $5.97 to $6.19 for this year, compared

with its prior estimate of $5.87 to $6.10 a share.

For the second quarter, the company guided world-wide RevPAR of

1% to 3%. The company also guided earnings per share of $1.52 to

$1.58, compared with analysts' estimates of $1.34 a share.

In recent weeks, Hilton Worldwide Holdings Inc., Hyatt Hotels

Corp. and Wyndham Hotels & Resorts Inc. have also reaffirmed

their full-year RevPAR growth outlook of about 1% to 3%. On

Thursday, Choice Hotels International Inc. said its domestic RevPAR

is expected to increase 0.5% to 1%, a lower range compared to its

previous guidance of 0.5% to 2% growth for the full year.

Hotel companies have signaled that RevPAR is expected to slow

down this year compared with 2018 due to pressure from a maturing

global economy, a relative slowdown in China and worries about the

impact of Brexit on Europe.

Last week, Marriott said its chief executive, Arne Sorenson, 60

years old, was diagnosed with stage 2 pancreatic cancer and was

expected to undergo chemotherapy this week. Mr. Sorenson, who has

been CEO since 2012, will remain in his role, the company said.

Under his leadership, Marriott also plans to move deeper into

the home-sharing space, competing even more with Airbnb Inc.,

Expedia Group Inc.'s Vrbo and others. In late April, Marriott said

it was starting to offer this week accommodations in about 2,000

high-end homes throughout 100 markets across the U.S., Europe and

Latin America. Hilton Worldwide Holdings Inc. said last week

alternative accommodations isn't a business it is currently

pursuing.

Mr. Sorenson led the acquisition of Starwood Hotels &

Resorts Worldwide in September 2016, creating a giant with more

than 5,500 hotels and 30 hotel brands. In March, Marriott said it

is planning to open more than 1,700 hotels over the next three

years.

Marriott is still working through problems associated with its

Starwood acquisition, including the hack of the reservation

database for Starwood properties. There have also been problems

integrating the rewards-points system, and an activist investor had

criticized the company for having too many brands.

Recently, the company has been focusing on boosting its rewards

programs and driving customers to book directly on its websites. In

February, Marriott International changed the name of its loyalty

program to Marriott Bonvoy.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 10, 2019 07:53 ET (11:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

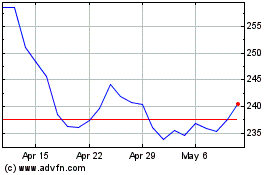

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

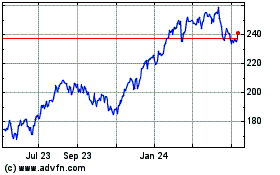

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024