Securities Registration: Employee Benefit Plan (s-8)

June 26 2023 - 4:37PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on June 26, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LONGEVERON INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

47-2174146 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. employer

identification number) |

1951 NW 7th Avenue, Suite 520

Miami, Florida 33136

Telephone: (305) 909-0840

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Amended and Restated Longeveron Inc. 2021 Incentive

Award Plan

(Full title of the Plan)

Wa’el Hashad

Chief Executive Officer

Longeveron Inc.

1951 NW 7th Ave., Suite 520

Miami, FL 33136

(305) 909-0840

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Jennifer Minter, Esq.

Adam G. Wicks, Esq.

Buchanan Ingersoll & Rooney PC

Union Trust Building

501 Grant Street, Suite 200

Pittsburgh, PA 15219

(412) 562-8800

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a nonaccelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Longeveron Inc. (referred to as the “Registrant,”

“the Company,” “we,” “us” or “our” unless specified otherwise) is filing this registration

statement on Form S-8 (the “Registration Statement”) for the purpose of registering an additional 1,500,000 shares of our

Class A Common Stock, par value $0.001 per share, for issuance under the Amended and Restated Longeveron Inc. 2021 Incentive Award Plan

(the “Plan”). The 1,500,000 shares of Class A Common Stock being registered pursuant to this Registration Statement are in

addition to the 2,074,402 shares of Class A Common Stock under the Plan currently registered on our Registration Statement on Form S-8

filed on February 16, 2021, file number 333-253141 (the “2021 Registration Statement”). This Registration Statement relates

to the same class of securities to which the 2021 Registration Statement relates and is submitted pursuant to General Instruction E to

Form S-8. Pursuant to General Instruction E, this Registration Statement incorporates by reference the contents of the 2021 Registration

Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

In

addition to the 2021 Registration Statement, the following documents, which have been heretofore filed by the Company with the SEC pursuant

to the Securities Exchange Act of 1934 (the “Exchange Act”), other than any portions of the respective filings that were furnished,

rather than filed, pursuant to Item 2.02 or Item 7.01 of Current Reports on Form 8-K (including exhibits related thereto) or other applicable

SEC rules, shall be deemed incorporated by reference herein and to be a part of this Registration Statement from the date of filing of

such documents:

| (a) | Our Annual Report on Form 10-K

for the fiscal year ended December 31, 2022 filed with the SEC on March 14, 2023; |

| (b) | All other reports filed by

us pursuant to Section 13(a) or 15(d) of the Exchange Act since December 31, 2022 (in each case, except for the information furnished

under Items 2.02 or 7.01 in any current report on Form 8-K); and |

| (c) | The description of the Registrant’s

common stock set forth in the Registrant’s registration statement on Form 8-A (File No. 001-40060), filed by

the Registrant with the SEC under Section 12(b) of the Exchange Act on February 11, 2021, including Exhibit 4.2 to the

Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 14, 2023 and any other

amendments or reports filed for the purpose of updating such description. |

In addition, all documents

filed by the Registrant pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of this Registration

Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which

de-registers all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration Statement and

to be a part hereof from the date of filing such documents, except as to specific sections of such statements as set forth therein. Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document

which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement contained

herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained

in any subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a

part of this Registration Statement.

Under no circumstances

shall any information furnished under Item 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless such Form 8-K

expressly provides to the contrary.

Item 5. Interests of Named Experts and Counsel.

The validity of the securities registered hereby has

been passed upon for the Company by Buchanan Ingersoll & Rooney PC (“Buchanan”), Pittsburgh, Pennsylvania. Certain

attorneys affiliated with Buchanan beneficially own an aggregate of 20,000 shares of our Class A Common Stock.

Item 6. Indemnification of Directors and Officers.

Section 102 of the Delaware General Corporation

Law (“DGCL”) permits a corporation to eliminate the personal liability of directors and officers of a corporation to the corporation

or its stockholders for monetary damages for a breach of fiduciary duty as a director or officer, except where the director or officer

breached his duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, or obtained

an improper personal benefit, or in the case of directors authorized the payment of a dividend or approved a stock repurchase in violation

of Delaware corporate law. Our certificate of incorporation provides that no director shall be personally liable to us or our stockholders

for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability, except

to the extent that the DGCL prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section 145 of the DGCL provides that a corporation

has the power to indemnify a director, officer, employee, or agent of the corporation, or a person serving at the request of the corporation

for another corporation, partnership, joint venture, trust or other enterprise in related capacities against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with an action, suit

or proceeding to which he was or is a party or is threatened to be made a party to any threatened, ending or completed action, suit or

proceeding by reason of such position, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed

to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable cause to believe his conduct was

unlawful, except that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect

to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the

extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all

of the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery

or such other court shall deem proper.

Our certificate of incorporation provides that

we will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending or completed action, suit

or proceeding (other than an action by or in the right of us) by reason of the fact that he or she is or was, or has agreed to become,

a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee

of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise (all such persons being

referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted in such capacity, against

all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection

with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith and in a manner he or she reasonably

believed to be in, or not opposed to, our best interests, and, with respect to any criminal action or proceeding, he or she had no reasonable

cause to believe his or her conduct was unlawful. Our certificate of incorporation provides that we will indemnify any Indemnitee who

was or is a party to an action or suit by or in the right of us to procure a judgment in our favor by reason of the fact that the Indemnitee

is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director,

officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other

enterprise, or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’

fees) and, to the extent permitted by law, amounts paid in settlement actually and reasonably incurred in connection with such action,

suit or proceeding, and any appeal therefrom, if the Indemnitee acted in good faith and in a manner he or she reasonably believed to be

in, or not opposed to, our best interests, except that no indemnification shall be made with respect to any claim, issue or matter as

to which such person shall have been adjudged to be liable to us, unless a court determines that, despite such adjudication but in view

of all of the circumstances, he or she is entitled to indemnification of such expenses. Notwithstanding the foregoing, to the extent that

any Indemnitee has been successful, on the merits or otherwise, he or she will be indemnified by us against all expenses (including attorneys’

fees) actually and reasonably incurred in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances.

We have entered into indemnification agreements

with each of our directors and officers. These indemnification agreements may require us, among other things, to indemnify our directors

and officers for some expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by a director or officer

in any action or proceeding arising out of his or her service as one of our directors or officers, or any of our subsidiaries or any other

company or enterprise to which the person provides services at our request.

We maintain a general liability insurance policy

that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their

capacities as directors or officers.

Item 8. Exhibits.

Signatures

Pursuant to the requirements of the Securities Act, the registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Miami, Florida, on June 26, 2023.

| |

LONGEVERON Inc. |

| |

|

| |

By: |

/s/ Wa’el Hashad |

| |

|

Wa’el Hashad |

| |

|

Chief Executive Officer |

SIGNATURES

AND POWER OF ATTORNEY

We, the undersigned officers and directors of Longeveron Inc., hereby

severally constitute and appoint Wa’el Hashad (with full power to act alone), our true and lawful attorneys-in-fact and agent, with

full power of substitution and resubstitution in each of them for him and in his name, place and stead, and in any and all capacities,

to sign any and all amendments (including post-effective amendments) to this Registration Statement (or any other registration statement

for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same,

with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorneys-in-fact and agents, full power and authority to do and perform each and every act and thing requisite or necessary to be done

in and about the premises, as full to all intents and purposes as he might or could do in person, hereby ratifying and confirming all

that said attorneys-in-fact and agents or any of them, or their or his substitute or substitutes, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration

Statement has been signed by the following persons in the capacities held on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Wa’el

Hashad |

|

Chief Executive Officer and Director |

|

June 26, 2023 |

| Wa’el Hashad |

|

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/ James

Clavijo |

|

Interim Chief Financial Officer |

|

June 26, 2023 |

| James Clavijo |

|

(principal financial officer and principal accounting

officer) |

|

|

| |

|

|

|

|

| /s/ Joshua

M. Hare |

|

Director |

|

June 26, 2023 |

| Joshua M. Hare |

|

|

|

|

| |

|

|

|

|

| /s/ Neil E.

Hare |

|

Director |

|

June 26, 2023 |

| Neil E. Hare |

|

|

|

|

| |

|

|

|

|

| /s/ Rock Soffer |

|

Director |

|

June 26, 2023 |

| Rock Soffer |

|

|

|

|

| |

|

|

|

|

| /s/ Douglas

Losordo |

|

Director |

|

June 26, 2023 |

| Douglas Losordo |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

June , 2023 |

| Khoso Baluch |

|

|

|

|

| |

|

|

|

|

| /s/ Cathy

Ross |

|

Director |

|

June 26, 2023 |

| Cathy Ross |

|

|

|

|

| |

|

|

|

|

| /s/ Ursula

Ungaro |

|

Director |

|

June 26, 2023 |

| Ursula Ungaro |

|

|

|

|

| |

|

|

|

|

|

|

Director |

|

June , 2023 |

| Jeffrey Pfeffer |

|

|

|

|

II-4

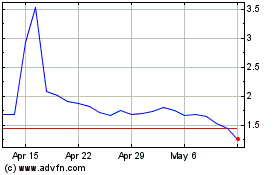

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Apr 2024 to May 2024

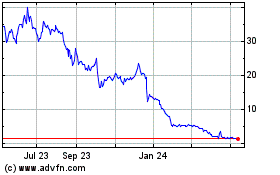

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From May 2023 to May 2024