Filed Pursuant to Rule 424(b)(5)

Registration No. 333-257670

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 9, 2021)

Lightwave Logic, Inc.

Up to $35,000,000 of Common Stock

We have entered into a sales agreement

with Roth Capital Partners, LLC (“Roth Capital Partners”, or the “sales agent”) relating to the issuance and sale

of our common stock offered by this prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares of our

common stock under this prospectus having an aggregate offering price of up to $35,000,000 from time to time through or to Roth Capital

Partners, as sales agent or principal.

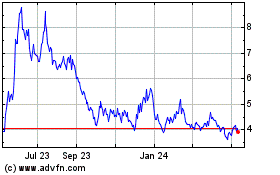

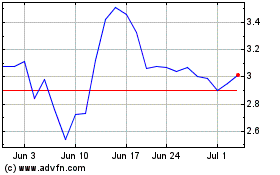

Our common stock is traded on

the Nasdaq Capital Market (“NASDAQ”) under the symbol “LWLG”. On December 6, 2022, the closing sale price of our

common stock on NASDAQ was $6.91 per share.

Sales of shares of our common

stock under this prospectus supplement, if any, may be made by any method deemed to be an “at the market offering” as defined

in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”).

The sales agent is not

required to sell any specific number of shares of our common stock. The sales agent has agreed to use its commercially reasonable

efforts consistent with its normal trading and sales practices, on mutually agreed terms between the sales agent and us. There is no

arrangement for funds to be received in any escrow, trust or similar arrangement. The sales agent will be entitled to compensation

under the terms of the sales agreement at a commission rate equal to 3% of the gross proceeds of the sales price of common stock

that they sell. The net proceeds from any sales under this prospectus supplement will be used as described under “Use of

Proceeds” on page S-5 of this prospectus supplement. The proceeds we receive from sales of our common stock, if any, will

depend on the number of shares actually sold and the offering price of such shares.

In connection with the sale of

common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act, and its

compensation as the sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to Roth Capital Partners with respect to certain liabilities, including liabilities under the Securities Act.

Investing in our securities

involves a high degree of risk. You should read carefully and consider the information contained in and incorporated by reference under

“Risk Factors” beginning on page S-4 of this prospectus supplement, and the risk factors contained in other documents incorporated

by reference.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus supplement is December

9, 2022.

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a registration

statement that was filed with the Securities and Exchange Commission (“SEC”), using a “shelf” registration process

and consists of two parts. The first part is the prospectus supplement, including the documents incorporated by reference herein, which

describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference

therein, provides more general information. Under the shelf registration process, we may from time to time offer and sell any combination

of the securities described in the accompanying prospectus up to a total dollar amount of $100,000,000 of which this offering is a part.

In general, when we refer only to the prospectus, we are referring to both parts of this document combined. Before you invest, you should

carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein,

as well as the additional information described under the heading “Where You Can Find More Information”. These documents contain

information you should carefully consider when deciding whether to invest in our common stock.

This prospectus supplement may

add, update or change information contained in the accompanying prospectus. To the extent there is a conflict between the information

contained in this prospectus supplement and the accompanying prospectus, you should rely on information contained in this prospectus supplement,

provided that if any statement in, or incorporated by reference into, one of these documents is inconsistent with a statement in another

document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement. Any statement

so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed

not to constitute a part of this prospectus.

You should rely only on the information

contained in this prospectus supplement, the accompanying prospectus, any document incorporated by reference herein or therein, or any

free writing prospectuses we may provide to you in connection with this offering. Neither we nor the sales agent has authorized anyone

to provide you with any different information. We take no responsibility for, and can provide no assurance as to the reliability of, any

other information that others may provide to you. The information contained in this prospectus supplement, the accompanying prospectus,

and in the documents incorporated by reference herein or therein is accurate only as of the date such information is presented. Our business,

financial condition, results of operations and prospects may have changed since that date.

This prospectus supplement and

the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the shares

of common stock to which it relates, nor do this prospectus supplement and the accompanying prospectus constitute an offer to sell or

the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction.

This prospectus supplement and

the accompanying prospectus, and any documents incorporated by reference herein or therein, include statements that are based on various

assumptions and estimates that are subject to numerous known and unknown risks and uncertainties. Some of these risks and uncertainties

are described under the heading “Risk Factors” beginning on page S-4 of this prospectus supplement and in the section titled

“Risk Factors” in our most recent Quarterly Report on Form 10-Q and in our most recent Annual Report on Form 10-K, each of

which is incorporated by reference into the prospectus. These and other important factors could cause our future results to be materially

different from the results expected as a result of, or implied by, these assumptions and estimates. The information in this prospectus

supplement is not complete. You should read the information contained in this prospectus supplement and the accompanying prospectus,

and the documents incorporated by reference herein and therein, completely and with the understanding that future results may be materially

different and worse from what we expect. See the information included under the heading “Cautionary Note Regarding Forward-Looking

Statements”.

We note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

None of Lightwave Logic, Inc.,

Roth Capital Partners, or any of their representatives are making any representation to you regarding the legality of an investment in

our common stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related

aspects of an investment in our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains

forward-looking statements. Forward-looking statements involve risks and uncertainties, such as statements about our plans, objectives,

expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,”

“estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,”

“we believe,” “we intend,” “may,” “should,” “will,” “could” and

similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates,

assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future

results, performances or achievements expressed or implied by the forward-looking statements. You should not place undue reliance on these

forward-looking statements.

Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements.

Factors that are known to us that

could cause a different result than projected by the forward-looking statement, include, but are not limited to:

| |

· |

inability to generate revenue or to manage growth; |

| |

· |

lack of available funding; |

| |

· |

lack of a market for or market acceptance of our products; |

| |

· |

competition from third parties; |

| |

· |

general economic and business conditions; |

| |

· |

intellectual property rights of third parties; |

| |

· |

changes in the price of our stock and dilution; |

| |

· |

regulatory constraints and potential legal liability; |

| |

· |

ability to maintain effective internal controls; |

| |

· |

security breaches, cybersecurity attacks and other significant disruptions in our information technology systems; |

| |

· |

changes in technology and methods of marketing; |

| |

· |

delays in completing various engineering and manufacturing programs; |

| |

· |

changes in customer order patterns and qualification of new customers; |

| |

· |

changes in product mix; |

| |

· |

success in technological advances and delivering technological innovations; |

| |

· |

shortages in components; |

| |

· |

production delays due to performance quality issues with outsourced components; |

| |

· |

the novel coronavirus (“COVID-19”) and its potential impact on our business; |

| |

· |

those events and factors described by us in “Risk Factors” in “Part I, Item 1A” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021; |

| |

· |

other risks to which our Company is subject; and |

| |

· |

other factors beyond the Company’s control. |

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information that

you should consider before making an investment decision. You should read this entire prospectus supplement, the accompanying base prospectus

and the documents incorporated herein by reference for a more complete understanding of this offering of common stock. Please read “Risk

Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for information regarding risks you should

consider before investing in our common stock.

Throughout this prospectus

supplement, when we use the terms “Lightwave,” “we,” “us,” “our” or the “Company,”

we are referring either to Lightwave Logic, Inc. in its individual capacity or to Lightwave Logic, Inc. and its operating subsidiaries

collectively, as the context requires.

Overview

Lightwave Logic, Inc. is a development

stage company moving toward commercialization of next generation electro-optic photonic devices made on its P2IC™ technology

platform which we have detailed as: 1) Polymer Stack™, 2) Polymer Plus™, and Polymer Slot™. Our unique polymer

technology platform uses in-house proprietary high-activity and high-stability organic polymers. Electro-optical devices called modulators

convert data from electric signals into optical signals for multiple applications.

Our differentiation at the modulator

device level is in higher speed, lower power consumption, simplicity of manufacturing, small footprint (size), and reliability. We have

demonstrated higher speed and lower power consumption in packaged devices, and during 2022, we continue to make advances in techniques

to translate material properties to efficient, reliable modulator devices. We are currently focused on testing and demonstrating the simplicity

of manufacturability and reliability of our devices, including in conjunction with the silicon photonics manufacturing ecosystem. In 2022

we discussed the addition of a number of silicon-based foundry partners to help scale in volume our polymer modulator devices. Silicon-based

foundries are large semiconductor fabrication plants developed for the electronics IC business, that are now engaging with silicon photonics

to increase their wafer throughput. Partnering with silicon-based foundries not only demonstrates that our polymer technology can be transferred

into standard production lines using standard equipment, and also allows us to efficiently utilize our capital.

Our extremely strong and broad

patent portfolio allows us to optimize our business model in three areas: 1) Traditional focus on product development, 2) Patent licensing

and 3) Technology transfer to foundries.

We are initially targeting applications

in data communications and telecommunications markets and are exploring other applications that include automotive/LIDAR, sensing, displays

etc., for our polymer technology platform. Our goal is to have our unique polymer technology platform become ubiquitous.

Materials Development

Our Company designs and synthesizes

organic chromophores for use in its own proprietary electro-optic polymer systems and photonic device designs. A polymer

system is not solely a material, but also encompasses various technical enhancements necessary for its implementation. These include host

polymers, poling methodologies, and molecular spacer systems that are customized to achieve specific optical properties. Our organic electro-optic

polymer systems compounds are mixed into solution form that allows for thin film application. Our proprietary electro-optic polymers are

designed at the molecular level for potentially superior performance, stability, and cost-efficiency. We believe our proprietary and unique

polymers have the potential to replace more expensive, higher power consuming, slower-performance materials such as semiconductor modulator

devices that are used in fiber-optic communication networks today.

Our patented and patent pending

molecular architectures are based on a well-understood chemical and quantum mechanical occurrence known as aromaticity. Aromaticity

provides a high degree of molecular stability that enables our core molecular structures to maintain stability under a broad range of

operating conditions.

We expect our patented and patent-pending

optical materials along with trade secrets and licensed materials, to be the core of and the enabling technology for future generations

of optical devices, modules, sub-systems, and systems that we will develop or potentially out-license to electro-optic device manufacturers,

contract manufacturers, original equipment manufacturers, etc. Our Company contemplates future applications that may address the needs

of semiconductor companies, optical network companies, Web 2.0/3.0 media companies, high performance computing companies, telecommunications

companies, aerospace companies, automotive companies, as well as for example, government agencies.

Device Design and Development

Electro-optic Modulators

Our Company designs its own proprietary

electro-optical modulation devices. Electro-optical modulators convert data from electric signals into optical signals that can then be

transmitted over high-speed fiber-optic cables. Our modulators are electro-optic, meaning they work because the optical properties of

the polymers are affected by electric fields applied by means of electrodes. Modulators are key components that are used in fiber optic

telecommunications, data communications, and data centers networks etc., to convey the high data flows that have been driven by applications

such as pictures, video streaming, movies etc., that are being transmitted through the Internet. Electro-optical modulators are expected

to continue to be an essential element as the appetite and hunger for data increases every year as well as the drive towards lower power

consumption, and smaller footprint (size).

Polymer Photonic Integrated Circuits

Our Company also designs its own

proprietary polymer photonic integrated circuits (otherwise termed a polymer PIC). A polymer PIC is a photonic device that integrates

several photonic functions on a single chip. We believe that our technology can enable the ultra-miniaturization needed to increase the

number of photonic functions residing on a semiconductor chip to create a progression like what was seen in the computer integrated circuits,

commonly referred to as Moore’s Law. One type of integration is to combine several instances of the same photonic functions such

as a plurality of modulators to create a multi-channel polymer PIC. The number of channels can be varied depending on application. For

example, the number of photonic components could increase by a factor of 8 or 16. Another type of integration is to combine different

types of devices including from different technology bases such as the combination of a semiconductor laser with a polymer modulator.

Our P2IC™ platform encompasses both these types of architecture.

Current semiconductor photonic

technology today is struggling to reach faster device speeds. Our modulator devices, enabled by our electro-optic polymer material systems,

work at extremely high frequencies (wide bandwidths) and possess inherent advantages over current crystalline electro-optic material contained

in most modulator devices such as bulk lithium niobate (LiNbO3), indium phosphide (InP), silicon (Si), and gallium arsenide GaAs). Our

advanced electro-optic polymer platform is creating a new class of modulators such as the Polymer Stack ™ , Polymer Plus™,

Polymer Slot™, and associated PIC platforms that can address higher data rates in a lower cost, lower power consuming manner, smaller

footprint (size) with much simpler data encoding techniques.

Our electro-optic polymers can

be integrated with other materials platforms because they can be applied as a thin film coating in a fabrication clean room such as may

be found in semiconductor foundries using standard clean room tooling. This approach we call Polymer Plus™. Our polymers are unique

in that they are stable enough to seamlessly integrate into existing CMOS, Indium Phosphide (InP), Gallium Arsenide (GaAs), and other

semiconductor manufacturing lines. Of particular relevance are the integrated silicon photonics platforms that combine optical and electronic

functions. These include a miniaturized modulator for ultra-small footprint applications in which we term the Polymer Slot™. This

design is based on a slot modulator fabricated into semiconductor wafers that include both silicon and indium phosphide.

Our Company has a fabrication

facility in Colorado to apply standard fabrication processes to our electro-optic polymers which create modulator devices. While our internal

fabrication facility is capable of manufacturing modulator devices, we have partnered with commercial silicon-based fabrication companies

that are called foundries who can scale our technology with volume quickly and efficiently. The process recipe for fabrication plants

or foundries is called a ‘process development kit’ or PDK. We are currently working with commercial foundries to implement

our electro-optic polymers into accepted PDKs by the foundries. Our work with the foundries is being focused with the Polymer Plus™

and the Polymer Slot™ polymer modulators.

Our Company

We were incorporated under the

laws of the State of Nevada on June 24, 1997. In 2008, we changed our name to Lightwave Logic, Inc. Unless the context otherwise requires,

all references to the “Company,” “we,” “our” or “us” and other similar terms means Lightwave

Logic, Inc., a Nevada corporation. Our trademarks in the United States include P2IC™ and Perkinamine™. All other

trademarks, service marks and trade names included or incorporated by reference in this prospectus are the property of their respective

owners.

Our principal executive office

is located at 369 Inverness Parkway, Suite 350, Englewood, CO 80112, and our telephone number is (720) 340-4949. Our website address is

www.lightwavelogic.com. No information found on our website is part of this prospectus.

THE OFFERING

The following summary contains basic information

about our common stock and the offering and is not intended to be complete. It does not contain all of the information that may be important

to you. For a more complete understanding of our common stock, you should read the section entitled “Description of Capital Stock”.

| Issuer |

|

Lightwave Logic, Inc. |

| |

|

|

| Common stock offered |

|

Shares of our common stock having an aggregate offering price of up to $35,000,000. |

| |

|

|

| Manner of offering |

|

“At the market offering” that may

be made from time to time through or to, Roth Capital Partners, as sales agent or principal. See “Plan of Distribution” beginning

on page S-8 of this prospectus supplement.

|

| |

|

|

| Common stock to be outstanding after this offering(1) |

|

Up to 117,902,457 shares, assuming sales of 5,065,123 shares of our common stock in this offering at an offering price of $6.91 per share, which was the closing price of our common stock on NASDAQ on December 6, 2022. The actual number of shares issued will vary depending on the sales price under this offering. |

| |

|

|

| Risk Factors |

|

Your investment in our common stock involves substantial risks. You should read carefully the “Risk Factors” included and incorporated by reference in this prospectus, including the risk factors incorporated by reference from our filings with the SEC. |

| |

|

|

| NASDAQ symbol |

|

LWLG |

| |

|

|

| Use of Proceeds |

|

We intend to use net proceeds from this offering for general corporate purposes,

including, without limitation, sales and marketing activities, product development, making acquisitions of assets, businesses, companies

or securities, capital expenditures, and for working capital needs. See “Use of Proceeds” beginning on page S-5 of this prospectus

supplement. |

(1) The

common stock outstanding after the offering is based on 112,837,334 shares of our common stock outstanding as of December 6, 2022 and

the sale of 5,065,123 shares of our common stock at an assumed offering price of $6.91 per share, the last reported sale price of our

common stock on NASDAQ on December 6, 2022, and excludes the following:

| |

● |

7,239,173 shares of our common stock issuable upon the exercise of options outstanding as of December 6, 2022, having a weighted average exercise price of $2.00 per share; and |

| |

|

|

| |

● |

2,358,500 shares of our common stock reserved for future issuance under our 2016 Equity Incentive Plan as of December 6, 2022. |

RISK FACTORS

An investment in our common stock involves a significant

degree of risk. Before you invest in our common stock you should carefully consider those risk factors set forth under the heading “Risk

Factors” in Item 1A. of our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and in Part II,

Item 1A. of our most recent Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2022, June 30, 2022 and September 30,

2022, each of which are on file with the SEC and are incorporated by reference in this prospectus, and those risk factors that may be

included in any applicable prospectus supplement, together with all of the other information included in this prospectus supplement, the

accompanying base prospectus and the documents we incorporate by reference, in evaluating an investment in our common stock. If any of

the risks discussed in the foregoing documents were to occur, our business, financial condition, results of operations and cash flows

could be materially adversely affected. Please read “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to This Offering

You may experience immediate and substantial

dilution.

The offering price per share

in this offering may exceed the net tangible book value per share of our common stock. Assuming that an aggregate of 5.065,123 shares

of our common stock are sold at a price of $6.91 per share pursuant to this prospectus, which was the last reported sale price of our

common stock on NASDAQ on December 6, 2022, for aggregate proceeds of $33,865,000 after deducting commissions and estimated aggregate

offering expenses payable by us, you would experience immediate dilution of $6.39 per share, representing a difference between our as

adjusted net tangible book value per share as of September 30, 2022 after giving effect to this offering and the assumed offering price. The

exercise of outstanding stock options may result in further dilution of your investment. See the section entitled “Dilution”

on page S-6 of this prospectus supplement for a more detailed illustration of the dilution you would incur if you participate in this

offering.

Management will have broad discretion as to

the use of the proceeds from this offering and may not use the proceeds effectively.

Because we have not designated

the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the

application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering.

Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

Future sales of substantial amounts of our common

stock, or the possibility that such sales could occur, could adversely affect the market price of our common stock.

We may issue up to $35,000,000

of common stock from time to time in this offering. The issuance from time to time of shares in this offering, as well as our ability

to issue such shares in this offering, could have the effect of depressing the market price or increasing the market price volatility

of our common stock. See “Plan of Distribution” on page S-8 of this prospectus supplement for more information about the

possible adverse effects of our sales under the sales agreement.

It is not possible to predict the actual number

of shares we will sell under the sales agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations

in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the sales agent at

any time throughout the term of the sales agreement. The number of shares that are sold through the sales agent after delivering a placement

notice will fluctuate based on a number of factors, including the market price of the common stock during the sales period, the limits

we set with the sales agent in any applicable placement notice, and the demand for our common stock during the sales period. Because the

price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares

that will be sold or the gross proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold

in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different

outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares

sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience

a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

USE OF PROCEEDS

We may receive up to $35,000,000

in aggregate gross proceeds under the Purchase Agreement from any sales we make after the date of this prospectus supplement pursuant

to the sales agreement with Roth Capital Partners. The amount of proceeds from this offering will depend upon the number of shares of

our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under

or fully utilize the sales agreement with Roth Capital Partners.

We intend to use net proceeds from this offering for

general corporate purposes, including, without limitation, sales and marketing activities, product development, making acquisitions of

assets, businesses, companies or securities, capital expenditures, and for working capital needs.

DILUTION

If you invest in our common stock,

your ownership interest will be diluted to the extent of the difference between the public offering price per share and the as-adjusted

net tangible book value per share after this offering. Our net tangible book value of our common stock on September 30, 2022 was approximately

$27,553,329, or approximately $0.25 per share of common stock based on 112,374,427 shares outstanding. We calculate net tangible book

value per share by dividing the net tangible book value, which is tangible assets less total liabilities, by the number of outstanding

shares of our common stock.

After giving effect to the sale

of our common stock pursuant to this prospectus in the aggregate amount of $35,000,000 at an assumed offering price of $6.91 per share,

the last reported sale price of our common stock on NASDAQ on December 6, 2022, and after deducting commissions and estimated aggregate

offering expenses payable by us, our net tangible book value as of September 30, 2022 would have been $61,418,329, or $0.52 per share

of common stock. This represents an immediate increase in the net tangible book value of $0.29 per share to our existing stockholders

and an immediate dilution in net tangible book value of $6.39 per share to new investors. The following table illustrates this per share

dilution:

| Assumed offering price per share |

|

|

|

|

|

$ |

6.91 |

|

| Net tangible book value per share as of September 30, 2022 |

|

$ |

0.24 |

|

|

|

|

|

| Increase in net tangible book value per share after this offering |

|

$ |

0.28 |

|

|

|

|

|

| As-adjusted net tangible book value per share after this offering |

|

|

|

|

|

$ |

0.52 |

|

| |

|

|

|

|

|

|

|

|

| Dilution per share to new investors in this offering |

|

|

|

|

|

$ |

6.39 |

|

The common stock outstanding after the offering is

based on 112,374,427 shares of our common stock outstanding as of September 30, 2022 and the sale of 5,065,123 shares of our common stock

at an assumed offering price of $6.91 per share, the last reported sale price of our common stock on NASDAQ on December 6, 2022, and excludes

the following:

| |

● |

7,242,298 shares of our common stock issuable upon the exercise of options outstanding as of September 30, 2022, having a weighted average exercise price of $1.97 per share; and |

| |

|

|

| |

● |

2,390,125 shares of our common stock reserved for future issuance under our 2016 Equity Incentive Plan as of September 30, 2022. |

DIVIDEND POLICY

We do not currently anticipate

declaring or paying cash dividends on our capital stock in the foreseeable future. We currently intend to retain all of our future earnings,

if any, to finance the operation and expansion of our business. Any future determination relating to our dividend policy will be made

at the discretion of our board of directors and will depend on a number of factors, including future earnings, capital requirements, future

prospects, contractual restrictions and covenants and other factors that our board of directors may deem relevant.

PLAN OF DISTRIBUTION

We have entered into a sales agreement

with Roth Capital Partners on December 9, 2022, which we filed as an exhibit to our Current Report on Form 8-K on December 9, 2022 and

incorporated by reference in this prospectus supplement and the accompanying prospectus. Under the terms of the sales agreement, we may

offer and sell up to $35,000,000 of shares of our common stock under this prospectus (the “Offering”), from time to time through

or to Roth Capital Partners, as sales agent or principal. Sales of shares of our common stock, if any, under this prospectus may be made

by any method deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act. We may instruct the

sales agent not to sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or the

sales agent may suspend the offering of common stock upon notice and subject to other conditions.

The sales agent will offer our

common stock subject to the terms and conditions of the sales agreement as agreed upon by us and the sales agent. Each time we wish to

issue and sell common stock under the sales agreement, we will notify the sales agent of the number or dollar value of shares to be issued,

the time period during which such sales are requested to be made, any limitation on the number of shares that may be sold in one day,

any minimum price below which sales may not be made and other sales parameters as we deem appropriate. Once we have so instructed the

sales agent, unless the sales agent declines to accept the terms of the notice, the sales agent has agreed to use its commercially reasonable

efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations

of the sales agent under the sales agreement to sell our common stock are subject to a number of conditions that we must meet.

We will pay the sales agent commissions

for its services in acting as agent in the sale of our common stock at a commission rate equal to up to 3% of the gross sale price per

share sold. We estimate that the total expenses for the offering, excluding compensation and reimbursement payable to the sales agent

under the sales agreement, will be approximately $85,000. We have also agreed to reimburse the sales agent for its reasonable out-of-pocket

expenses, including attorney’s fees, for this Offering, in an amount not to exceed $35,000.

Settlement for sales of common

stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon

by us and the sales agent in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of

the common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act, and

its compensation as sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to Roth Capital Partners against certain civil liabilities, including liabilities under the Securities Act.

The offering pursuant to the sales

agreement will terminate upon the earlier of (1) the issuance and sale of all shares of our common stock subject to the sales agreement;

and (2) the termination of the sales agreement as permitted therein.

The prospectus in electronic format

may be made available on websites maintained by the sales agent. The sales agent and its affiliates have in the past and may in the future

provide various investment banking and other financial services for us and our affiliates, for which services it may in the future receive

customary fees. To the extent required by Regulation M, the sales agent will not engage in any market making activities involving our

common stock while the offering is ongoing under this prospectus supplement. This summary of the material provisions of the sales agreement

does not purport to be a complete statement of its terms and conditions.

LEGAL MATTERS

The validity of the securities

offered by this prospectus has been passed upon for us by Snell & Wilmer, L.L.P., Reno, Nevada. Certain legal matters will be passed

upon for Roth Capital Partners by Pryor Cashman LLP, New York, New York.

EXPERTS

The financial statements as of

December 31, 2021 and 2020 and for each of the two years in the period ended December 31, 2021 and management’s assessment of the

effectiveness of internal control over financial reporting as of December 31, 2021 incorporated by reference in this prospectus have been

so incorporated in reliance on the reports of Morison Cogen LLP, an independent registered public accounting firm, incorporated herein

by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and

other reports and other information with the SEC under the Exchange Act. Our filings with the SEC are also available to the public from

commercial document retrieval services and at the SEC’s website at www.sec.gov.

We make available free of charge

on our internet website at www.lightwavelogic.com/investors/ our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our

current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material

with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this prospectus supplement

and you should not consider such information as part of this prospectus supplement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain information that we file with the SEC, which means that we can disclose important information

to you by referring you to other documents separately filed by us with the SEC that contain such information. The information we incorporate

by reference is considered to be part of this prospectus and information we later file with the SEC will automatically update and supersede

the information in this prospectus. The following documents filed by us with the SEC pursuant to Section 13(a) of the Exchange Act and

any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange Act, except for information furnished under Item

2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before the termination of the offering are incorporated

by reference herein:

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 1, 2021; |

| |

|

|

| |

● |

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, June 30, 2022 and September 30, 2022, filed with the SEC on May 10, 2022, August 9, 2022 and November 9, 2022, respectively; |

| |

|

|

| |

● |

our Current Report on Form 8-K filed on January 18, 2022, as amended by our

Amendment No. 1 on Form 8-K/A filed on January 21, 2022, and our Current Reports on Form 8-K filed on January 21, 2022, May 31, 2022

and August 30, 2022; |

| |

|

|

| |

● |

the description of our common stock contained in the Registration Statement on Form 8-A (File No. 001-40766) filed with the SEC on August 27, 2021 |

Any statement contained herein

or in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the

purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is

or is deemed to be incorporated by reference herein modifies or replaces such statement. Any such statement so modified or superseded

shall not be deemed to constitute a part of this prospectus, except as so modified or superseded.

We will provide to each person,

including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated

by reference in the prospectus contained in the registration statement but not delivered with the prospectus, other than an exhibit to

these filings unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request and at

no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Lightwave Logic, Inc.

369 Inverness Parkway, Suite 350

Englewood, CO 80112

720-340-4949

PROSPECTUS

Lightwave Logic, Inc.

$100,000,000 of Common Stock

Lightwave Logic, Inc., a Nevada corporation (“us”,

“we”, “our”, or the “Company”) may offer and sell from time to time, in one or

more series or issuances and on terms that we will determine at the time of the offering, shares of our common stock, par value $0.001

per share (“Common Stock”) described in this prospectus, up to an aggregate amount of $100,000,000.

This prospectus provides you with a general description

of the securities offered. Each time we offer and sell securities, we will file a prospectus supplement to this prospectus that contains

specific information about the offering and, if applicable, the amounts, prices and terms of the securities. Such supplements may also

add, update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus

supplement before you invest in any of our securities. This prospectus may not be used to consummate sales of securities unless accompanied

by a prospectus supplement.

We may offer and sell the securities described

in this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our behalf or

through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these

securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commission

or discounts.

Our Common Stock is currently quoted on the OTCQX

under the symbol “LWLG”. On July 1, 2021 the last reported sale price of our Common Stock on the OTCQX was $10.85 per share.

Investing in our securities involves a high

degree of risk. See the section entitled “Risk Factors” on page 3 of this prospectus and in the

documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks

and uncertainties you should consider.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

This prospectus is dated July 9, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus of Lightwave Logic, Inc., a Nevada

corporation (collectively with all of its subsidiaries, the “Company”, or “we”, “us”, or “our”)

is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”) utilizing

a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell the securities described

in this prospectus in one or more offerings up to a total dollar amount of $100,000,000 as described in this prospectus.

The registration statement of which this prospectus

is a part provides additional information about us and the securities offered under this prospectus. The registration statement, including

the exhibits and the documents incorporated herein by reference, can be read on the SEC website or at the SEC offices mentioned under

the heading “Where You Can Find More Information.”

We will provide a prospectus supplement containing

specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus supplement may add,

update or change information in this prospectus. If the information in the prospectus is inconsistent with a prospectus supplement, you

should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable, any prospectus

supplement. See “Prospectus Summary — Where You Can Find More Information” for more information.

You should rely only on the information contained

or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you

with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making

offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation is not authorized or in which

the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You should not assume that the information in this prospectus or any prospectus supplement, as well as the information we file or previously

filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement, is accurate as of any date other

than the date of such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS

SUMMARY

The items in the following summary are described

in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in

our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning on page 3

and the financial statements incorporated by reference.

Overview

We are a development stage company

moving toward commercialization of next generation electro-optic photonic devices made on its P2ICTM technology

platform, which uses in-house proprietary high-activity and high-stability organic polymers. Electro-optical devices convert data from

electric signals into optical signals for multiple applications.

Our differentiation at the device

level is in higher speed, lower power consumption, simplicity of manufacturing and reliability. We have demonstrated higher speed and

lower power consumption in packaged devices, and during 2019, we developed new materials that promise to further lower power consumption.

We are currently focused on testing and demonstrating the simplicity of manufacturability and reliability of our devices, including in

conjunction with the silicon photonics manufacturing ecosystem.

We are initially targeting applications

in data communications and telecommunications markets and are exploring other applications for our polymer technology platform.

Materials Development

Our Company designs and synthesizes

organic chromophores for use in its own proprietary electro-optic polymer systems and photonic device designs. A polymer system

is not solely a material, but also encompasses various technical enhancements necessary for its implementation. These include host polymers,

poling methodologies, and molecular spacer systems that are customized to achieve specific optical properties. Our organic electro-optic

polymer systems compounds are mixed into solution form that allows for thin film application. Our proprietary electro-optic polymers are

designed at the molecular level for potentially superior performance, stability and cost-efficiency. We believe they have the potential

to replace more expensive, higher power consuming, slower-performance materials and devices used in fiber-optic communication networks.

Our patented and patent pending

molecular architectures are based on a well-understood chemical and quantum mechanical occurrence known as aromaticity. Aromaticity

provides a high degree of molecular stability that enables our core molecular structures to maintain stability under a broad range of

operating conditions.

We expect our patented and patent-pending

optical materials along with trade secrets and licensed materials, to be the core of and the enabling technology for future generations

of optical devices, modules, sub-systems and systems that we will develop or potentially out-license to electro-optic device manufacturers.

Our Company contemplates future applications that may address the needs of semiconductor companies, optical network companies, Web 2.0

media companies, high performance computing companies, telecommunications companies, aerospace companies, and government agencies.

Device Design and Development

Electro-optic Modulators

Our Company designs its own

proprietary electro-optical modulation devices. Electro-optical modulators convert data from electric signals into optical signals that

can then be transmitted over high-speed fiber-optic cables. Our modulators are electro-optic, meaning they work because the optical properties

of the polymers are affected by electric fields applied by means of electrodes. Modulators are key components that are used in fiber optic

telecommunications, data communications, and data centers networks etc., to convey the high data flows that have been driven by applications

such as pictures, video streaming, movies etc., that are being transmitted through the Internet. Electro-optical modulators are expected

to continue to be an essential element as the appetite and hunger for data increases every year.

Polymer Photonic Integrated Circuits (P2ICTM)

Our Company also designs its

own proprietary polymer photonic integrated circuits (otherwise termed a polymer PIC). A polymer PIC is a photonic device that integrates

several photonic functions on a single chip. We believe that our technology can enable the ultra-miniaturization needed to increase the

number of photonic functions residing on a semiconductor chip to create a progression like what was seen in the computer integrated circuits,

commonly referred to as Moore’s Law. One type of integration is to combine several instances of the same photonic functions such

as a plurality of modulators to create a 4 channel polymer PIC. In this case, the number of photonic components would increase by a factor

of 4. Another type is to combine different types of devices including from different technology bases such as the combination of a semiconductor

laser with a polymer modulator. Our P2IC™ platform encompasses both these types of architecture.

Current photonic technology

today is struggling to reach faster device speeds. Our modulator devices, enabled by our electro-optic polymer material systems, work

at extremely high frequencies (wide bandwidths) and possess inherent advantages over current crystalline electro-optic material contained

in most modulator devices such as lithium niobate (LiNbO3), indium phosphide (InP), silicon (Si), and gallium arsenide (GaAs). Our advanced

electro-optic polymer platform is creating a new class of modulators such as the Polymer Stack ™ and associated PIC platforms that

can address higher data rates in a lower cost, lower power consuming manner, with much simpler modulation techniques.

Our electro-optic polymers can

be integrated with other materials platforms because they can be applied as a thin film coating in a fabrication clean room such as may

be found in semiconductor foundries. This approach we call Polymer Plus™. Our polymers are unique in that they are stable enough

to seamlessly integrate into existing CMOS, Indium Phosphide (InP), Gallium Arsenide (GaAs), and other semiconductor manufacturing lines.

Of particular relevance are the integrated silicon photonics platforms that combine optical and electronic functions. These include a

miniaturized modulator for ultra-small footprint applications, which we term the Polymer Slot ™. This design is based on a slot

modulator fabricated into semiconductor wafers that include both silicon and indium phosphide.

Our Company

We were incorporated under the

laws of the State of Nevada on June 24, 1997. In 2004, we acquired PSI-TEC Corp., and in 2006 we merged with PSI-TEC Corp. PSI-TEC Corp.

was incorporated under the laws of the State of Delaware on September 12, 1995. In 2008, we changed our name to Lightwave Logic, Inc.

Unless the context otherwise requires, all references to the “Company,” “we,” “our” or “us”

and other similar terms means Lightwave Logic, Inc., a Nevada corporation. Our trademarks in the United States include P2ICTM

and PerkinamineTM. All other trademarks, service marks and trade names included or incorporated by reference in this prospectus

are the property of their respective owners.

Our principal executive office

is located at 369 Inverness Parkway, Suite 350, Englewood, CO 80112, and our telephone number is (720) 340-4949. Our website address is

www.lightwavelogic.com. No information found on our website is part of this prospectus.

RISK FACTORS

An investment in our Common Stock involves

significant risks. You should carefully consider the risk factors contained in our filings with the SEC, as well as all of the information

contained in any prospectus supplement, free writing prospectus and amendments thereto, before you decide to invest in our Common Stock.

Our business, prospects, financial condition and results of operations may be materially and adversely affected as a result of any of

such risks. The value of our Common Stock could decline as a result of any of these risks. You could lose all or part of your investment

in our Common Stock. Some of our statements in sections entitled “Risk Factors” are forward-looking statements. You should

also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk Factors”

of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk Factors” in our most

recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may be amended,

supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have

described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial

may also affect our business, prospects, financial condition and results of operations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,”

“seek,” “believe,” “project,” “estimate,” “expect,” “continuing,”

“ongoing,” “strategy,” “future,” “likely,” “may,” “should,” “could,”

“will” and similar references to future periods. Examples of forward-looking statements include, among others, statements

we make regarding expected operating results, such as anticipated revenue; anticipated levels of capital expenditures for our current

fiscal year; our belief that we have, or will have, sufficient liquidity to fund our business operations during the next 12 months; strategy

for gaining customers, growth, product development, market position, financial results and reserves.

Forward-looking statements

are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations,

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others, the following: lack of available funding; general economic and business

conditions; deterioration in global economic and financial market conditions generally including as a result of pandemic health issues

caused by COVID-19 and its effects, competition from third parties; intellectual property rights of third parties; regulatory constraints;

changes in technology and methods of marketing; delays in completing various engineering and manufacturing programs; changes in customer

order patterns; changes in product mix; success in technological advances and delivering technological innovations; shortages in components;

production delays due to performance quality issues with outsourced components; and other factors beyond the Company’s control.

The ultimate correctness of

these forward-looking statements depends upon a number of known and unknown risks and events. We discuss our known material risks under

Item 1.A “Risk Factors” contained in our Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

Many factors could cause our actual results to differ materially from the forward-looking statements. In addition, we cannot assess the

impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Any forward-looking statement

made by us in this prospectus is based only on information currently available to us and speaks only as of the date on which it is made.

We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We will retain broad discretion over the use of

the net proceeds to us from the sale of our securities under this prospectus. Unless otherwise provided in the applicable prospectus supplement, we

currently expect to use the net proceeds that we receive from this offering for working capital and other general corporate purposes.

We may also use a portion of the net proceeds to acquire, license or invest in complementary technologies or businesses; however, we currently

have no agreements or commitments to complete any such transaction. The expected use of net proceeds of this offering represents our current

intentions based on our present plans and business conditions. We cannot specify with certainty all of the particular uses for the net

proceeds to be received upon the closing of this offering.

DESCRIPTION OF OUR COMMON

STOCK

The following description of our common stock

is a summary and does not purport to be complete. It is subject to and qualified in its entirety by reference to our Articles of Incorporation,

as amended (the “articles of incorporation”) and our Restated Bylaws (the “bylaws”), each of which are incorporated

by reference to this prospectus. We encourage you to read our articles of incorporation, our bylaws and the applicable provisions of the

Nevada Revised Statutes for additional information.

Authorized Share Capital. The Company’s

authorized capital stock consists of 250,000,000 shares of common stock, par value $0.001 per share and 1,000,000 shares of preferred

stock, par value $0.001 per share.

Voting. Each outstanding share of common

stock is entitled to one vote on all matters to be submitted to a vote of the shareholders. Holders do not have preemptive rights,

so we may issue additional shares that may reduce each holder’s voting and financial interest in our Company. Cumulative voting

does not apply to the election of directors, so holders of more than 50% of the shares voted for the election of directors can elect all

of the directors. All elections for directors shall be decided by a plurality vote; all other questions shall be decided by majority vote

except as otherwise provided by Nevada Revised Statutes. Our bylaws permit the holders of the same percentage of all shareholders entitled

to vote at a meeting to take action by written consent without a meeting.

Dividend Rights. Holders of common stock

are entitled to receive dividends when, as and if declared by the board of directors out of funds legally available therefor.

Liquidation Preferences. In the event of

liquidation, dissolution or winding up of our Company, holders of common stock are entitled to share ratably in all assets remaining available

for distribution to them after payment of liabilities and after provision has been made for each class of stock, if any, having preference

over the common stock.

Other Terms. Holders of common stock do

not have any conversion, redemption provisions or other subscription rights. All of the outstanding shares of common stock are fully paid

and non-assessable.

Anti-Takeover Provisions

Certain of our charter, statutory and contractual

provisions could make the removal of our management and directors more difficult and may discourage transactions that otherwise could

involve payment of a premium over prevailing market prices for our common stock. Furthermore, the existence of the foregoing provisions

could lower the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential

acquirers of our Company, thereby reducing the likelihood that you could receive a premium for your common stock in an acquisition.

Charter and Bylaw Provisions

Our articles of incorporation and bylaws contain

the following provisions that may have the effect of discouraging unsolicited acquisition proposals:

| · | authorize our board of directors to create and

issue, without shareholder approval, preferred stock, thereby increasing the number of outstanding shares, which can deter or prevent

a takeover attempt; |

| · | prohibit cumulative voting in the election of

directors, which would otherwise allow less than a majority of shareholders to elect director candidates; |

| · | empower our board of directors to fill any vacancy

on our board of directors, whether such vacancy occurs as a result of an increase in the number of directors or otherwise; |

| · | provide that our board of directors be divided

into three classes, with approximately one-third of the directors to be elected each year; |

| · | provide that our board of directors is expressly

authorized to adopt, amend or repeal our bylaws; and |

| · | provide that our directors will be elected by

a plurality of the votes cast in the election of directors. |

These provisions could lower the price that future

investors might be willing to pay for shares of our common stock.

Nevada Law

Nevada Revised Statutes sections 78.378 to 78.3793

provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation

or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not

state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire

control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things.

The statute contains certain limitations and it may not apply to our Company. These provisions may have the effect of deterring hostile

takeovers or delaying changes in control, which could depress the market price of our common stock and deprive shareholders of opportunities

to realize a premium on shares of common stock held by them.

Contractual Provisions

Our employee stock option agreements include change-in-control

provisions that allow us to grant options or stock purchase rights that may become vested immediately upon a change in control. The terms

of change of control provisions contained in certain of our senior executive employee agreements may also discourage a change in control

of our Company.

Our board of directors also has the power to adopt

a shareholder rights plan that could delay or prevent a change in control of our Company even if the change in control is generally beneficial

to our shareholders. These plans, sometimes called “poison pills,” are oftentimes criticized by institutional investors or

their advisors and could affect our rating by such investors or advisors. If our board of directors adopts such a plan, it might have

the effect of reducing the price that new investors are willing to pay for shares of our common stock.

Together, these charter, statutory and contractual

provisions could make the removal of our management and directors more difficult and may discourage transactions that otherwise could

involve payment of a premium over prevailing market prices for our common stock. Furthermore, the existence of the foregoing provisions,

could limit the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential

acquirers of our Company, thereby reducing the likelihood that you could receive a premium for your common stock in an acquisition.

PLAN OF DISTRIBUTION

We may sell securities:

| |

● |

directly to purchasers; or |

| |

● |

through a combination of any of these methods of sale. |

In addition, we may issue the securities as a

dividend or distribution to our existing securityholders.

We may directly solicit offers to purchase securities

or agents may be designated to solicit such offers. We will, in the prospectus supplement relating to such offering, name any agent that

could be viewed as an underwriter under the Securities Act and describe any commissions that we must pay. Any such agent will be acting

on a best-efforts basis for the period of its appointment or, if indicated in the applicable prospectus supplement, on a firm commitment

basis. This prospectus may be used in connection with any offering of our securities through any of these methods or other methods described

in the applicable prospectus supplement.

The distribution of the securities may be affected

from time to time in one or more transactions:

| |

● |

at a fixed price or prices that may be changed from time to time; |

| |

● |

at market prices prevailing at the time of sale; |

| |

● |

at prices related to such prevailing market prices; or |

Each prospectus supplement

will describe the method of distribution of the securities and any applicable restrictions.

The prospectus supplement

with respect to the securities of a particular series will describe the terms of the offering of the securities, including the following:

| |

● |

the name of the agent or any underwriters; |

| |

● |

the public offering or purchase price; |

| |

● |

any discounts and commissions to be allowed or paid to the agent or underwriters; |

| |

● |

all other items constituting underwriting compensation; |

| |

● |

any discounts and commissions to be allowed or paid to dealers; and |

| |

● |

any exchanges on which the securities will be listed. |

If any underwriters or agents are utilized in

the sale of the securities in respect of which this prospectus is delivered, we will enter into an underwriting agreement or other agreement

with them at the time of sale to them, and we will set forth in the prospectus supplement relating to such offering the names of the underwriters

or agents and the terms of the related agreement with them.

If a dealer is utilized

in the sale of the securities in respect of which the prospectus is delivered, we will sell such securities to the dealer, as principal.

The dealer may then resell such securities to the public at varying prices to be determined by such dealer at the time of resale.

Agents, underwriters, dealers and other persons

may be entitled under agreements that they may enter into with us to indemnification by us against certain civil liabilities, including

liabilities under the Securities Act.

Certain agents, underwriters and dealers, and

their associates and affiliates may be customers of, have borrowing relationships with, engage in other transactions with, and/or perform

services, including investment banking services, for us or one or more of our respective affiliates in the ordinary course of business.

In order to facilitate the offering of the securities,

any underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the securities or any other securities

the prices of which may be used to determine payments on such securities. Specifically, any underwriters may over-allot in connection

with the offering, creating a short position for their own accounts. In addition, to cover over-allotments or to stabilize the price of

the securities or of any such other securities, the underwriters may bid for, and purchase, the securities or any such other securities

in the open market. Finally, in any offering of the securities through a syndicate of underwriters, the underwriting syndicate may reclaim

selling concessions allowed to an underwriter or a dealer for distributing the securities in the offering if the syndicate repurchases

previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any

of these activities may stabilize or maintain the market price of the securities above independent market levels. Any such underwriters

are not required to engage in these activities and may end any of these activities at any time.

Under Rule 15c6-1 of the Exchange Act, trades

in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise.

The applicable prospectus supplement may provide that the original issue date for your securities may be more than two scheduled business

days after the trade date for your securities. Accordingly, in such a case, if you wish to trade securities on any date prior to the third

business day before the original issue date for your securities, you will be required, by virtue of the fact that your securities initially

are expected to settle in more than three scheduled business days after the trade date for your securities, to make alternative settlement

arrangements to prevent a failed settlement.

LEGAL MATTERS

The validity of the securities offered by this

prospectus has been passed upon for us by Snell & Wilmer L.L.P. If legal matters in connection with offerings made pursuant to this

prospectus are passed upon by counsel for the underwriters, dealers or agents, if any, such counsel will be named in the prospectus supplement

relating to such offering.

EXPERTS

Morison Cogen LLP, our independent registered

public accounting firm, has audited our balance sheets as of December 31, 2020 and 2019, and the related statements of operations, stockholders’

equity, and cash flows for each of the years in the three-year period ended December 31, 2020, and the related notes (herein referred

to as “financial statements”), as set forth in their report, which is incorporated by reference in the prospectus and elsewhere

in this registration statement. We have included our financial statements in this prospectus and elsewhere in the registration statement.

Our consolidated financial statements are incorporated by reference in reliance on Morison Cogen LLP’s report, given on their authority

as experts in accounting and auditing.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

Insofar as indemnification for liabilities arising

under the Securities Act, as amended, may be permitted to directors, officers, and controlling persons of the registrant pursuant to the

Company’s constituent documents, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling

person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person connected

with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

Where

You Can Find More Information

We are subject to the information requirements