UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: August 2023

Commission File Number: 001-36903

KORNIT DIGITAL LTD.

(Translation of Registrant’s name into English)

12 Ha’Amal Street

Park Afek

Rosh Ha’Ayin 4824096 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

Clarification of Outstanding Share Number in Proxy Statement

for Annual Shareholder Meeting

On July 20, 2023, Kornit Digital Ltd. (“Kornit”

or the “Company”) furnished a Report of Foreign Private Issuer on Form 6-K (the “Original Form 6-K”)

to the U.S. Securities and Exchange Commission (the “SEC”). This amended Report of Foreign Private Issuer on Form 6-K

(this “Form 6-K Amendment”) amends the Original Form 6-K in the manner described herein.

The Original Form 6-K attached the notice and

proxy statement, each dated July 20, 2023, for Kornit’s 2023 annual general meeting of shareholders (the “Annual Meeting”),

which took place at 12:00 p.m. (Israel time) on Monday, August 28, 2023, at Kornit’s offices at 12 Ha’Amal Street, Park Afek,

Rosh Ha’Ayin, Israel. For the results of the Meeting, please see “Results of Annual Shareholder Meeting”

below.

Pages 2 and 6 of the proxy

statement for the Annual Meeting (the “Proxy Statement”) indicated that as of July 5, 2023, there were 50,115,773 Kornit

ordinary shares, par value NIS 0.01 per share (“ordinary shares”) outstanding. That number of ordinary shares inadvertently

included 938,151 ordinary shares that had been repurchased by Kornit under its previously announced

share repurchase plan approved by the Israeli court in December 2022, under which Kornit may purchase up to US$75 million of its ordinary

shares. After excluding those repurchased shares from the outstanding ordinary shares (as is customary, due to their being held

in treasury by the Company, which does not possess voting rights or other rights related to ownership of those shares), the number of

outstanding ordinary shares as of July 5, 2023 was actually 49,177,622.

The update to the number of outstanding shares

reported in this Form 6-K Amendment did not impact any of the proposals for the Annual Meeting and did not impact, in a material manner,

any information in the proxy statement for the Annual Meeting or any other disclosures made by the Company in its reports under the Securities

Exchange Act of 1934, as amended. After adjusting the number of outstanding ordinary shares to 49,177,622, the shareholders beneficially

owning more than 5% of Kornit’s ordinary shares, as appeared in the Proxy Statement, possessed the following corrected beneficial

ownership percentages as of July 5, 2023 (based on their public filings):

| Name | |

Number of

Shares

Beneficially

Held | | |

Originally

Listed

Percentage | | |

Actual

Percentage | |

| 5% or Greater Shareholders | |

| | | |

| | | |

| | |

| Wasatch Advisors Inc. | |

| 4,691,897 | | |

| 9.4 | % | |

| 9.5 | % |

| Artisan Partners Limited Partnership | |

| 4,396,955 | | |

| 8.8 | % | |

| 8.9 | % |

| Granahan Investment Management, LLC | |

| 3,514,473 | | |

| 7.0 | % | |

| 7.1 | % |

| Senvest Management, LLC | |

| 4,145,259 | | |

| 8.3 | % | |

| 8.4 | % |

Please refer to the footnotes to the above table

on page 6 of the Proxy Statement for further information concerning the 5% or greater shareholders of the Company.

Results of Annual Shareholder Meeting

As scheduled, Kornit held the Annual Meeting at

12:00 p.m., Israel time, on August 28, 2023, at Kornit’s offices at 12 Ha’Amal Street, Park Afek, Rosh Ha’Ayin, Israel.

At the Annual Meeting, the Company’s shareholders voted on three proposals, which are listed below and which were described in

more detail in the Company’s notice and proxy statement for the Annual Meeting, which were attached as Exhibit 99.1 to the Report

of Foreign Private Issuer on Form 6-K that the Company furnished to the Securities and Exchange Commission (the “SEC”)

on June 30, 2022.

Based on the presence in person or by proxy at

the Annual Meeting of 33,881,827, or 68.9%, of the Company’s 49,177,622 outstanding ordinary shares, par value 0.01 New Israeli

Shekels per share (“ordinary shares”), as of the July 20, 2023 record date for the Annual Meeting, constituting more

than the minimum percentage of outstanding shares (25%) required for a quorum under the Company’s Articles of Association, as amended

(the “Articles”), each of the following three proposals (and, as applicable, sub-proposals thereof) was approved by

the requisite majority of the Company’s ordinary shares under the Israeli Companies Law, 5759-1999 (the “Companies Law”)

and the Articles, based on the tallies of votes specified below:

| (1) |

Re-election of each of Ofer Ben-Zur and Gabi Seligsohn, and initial election of Naama Halevi Davidov, in each case for a three-year term as a Class II director of the Company, until the Company’s annual general meeting of shareholders in 2026 and until his or her successor is duly elected and qualified (majority needed for election of each director nominee: ordinary majority of votes cast, excluding abstentions): |

| Name of Director Nominee | |

Votes in Favor | | |

Votes Against | | |

Abstentions | |

| Ofer Ben-Zur | |

| 31,369,680 | | |

| 2,484,672 | | |

| 27,473 | |

| Naama Halevi Davidov | |

| 32,287,609 | | |

| 1,566,748 | | |

| 27,468 | |

| Gabi Seligsohn | |

| 22,812,474 | | |

| 10,220,977 | | |

| 848,374 | |

| (2) | Re-adoption and amendment of the compensation policy for the

Company’s office holders (as defined under the Companies Law) (general majority needed among all shareholders: ordinary majority

of votes cast, excluding abstentions) |

| Votes in Favor | | |

Votes Against | | |

Abstentions | |

| | 31,174,047 | | |

| 2,678,992 | | |

| 28,786 | |

The vote tally on Proposal 2 also achieved the requisite special majority under the Companies Law, as a majority of shareholders (excluding

abstentions) who (i) were not controlling shareholders and (ii) indicated that they lacked a “personal interest” (as defined

under the Companies Law) voted in favor of Proposal 2, as reflected in the below tally among those shareholders:

| Votes in Favor | | |

Votes Against | | |

Abstentions | |

| | 30,964,915 | | |

| 2,678,992 | | |

| 28,786 | |

| (3) |

Re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as the Company’s independent registered public accounting firm for the year ending December 31, 2022 and the additional period until the Company’s 2023 annual general meeting of shareholders, and authorization of the Company’s board of directors (or the audit committee thereof) to fix such accounting firm’s annual compensation (majority needed for approval: ordinary majority of votes cast, excluding abstentions): |

| Votes in Favor | | |

Votes Against | | |

Abstentions | |

| | 33,541,110 | | |

| 83,319 | | |

| 257,398 | |

Incorporation by Reference

The contents of this Form 6-K Amendment are

hereby incorporated by reference into the Proxy Statement and into the Company’s Registration Statements on Form

F-3 (File No. 333-248784) and Form S-8 (File No.’s 333-203970, 333-214015, 333-217039, 333-223794, 333-230567, 333-237346, 333-254749

and 333-263975).

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

KORNIT DIGITAL LTD. |

| |

|

|

| Date: August 28, 2023 |

By: |

/s/ Lauri Hanover |

| |

Name: |

Lauri Hanover |

| |

Title: |

Chief Financial Officer |

3

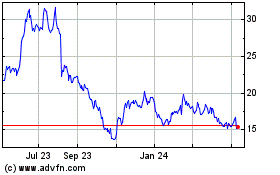

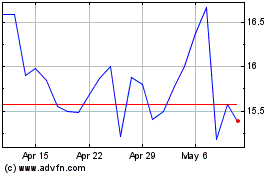

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Apr 2023 to Apr 2024