KEWAUNEE SCIENTIFIC CORP /DE/ false 0000055529 0000055529 2023-08-23 2023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2023

Kewaunee Scientific Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-5286 |

|

38-0715562 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

| 2700 West Front Street Statesville, North Carolina |

|

28677 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 704-873-7202

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $2.50 par value |

|

KEQU |

|

NASDAQ Global Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

Kewaunee Scientific Corporation (the “Company”) has posted an investor presentation and related script to the “Investor Information” section of the Company’s website at http://www.kewaunee.com/about/investor-information/. The presentation and related script are attached hereto as Exhibits 99.1 and 99.2. The information included in Exhibits 99.1 and 99.2 is incorporated by reference in this Item 7.01, and is deemed to be furnished, not filed, pursuant to Item 7.01 of Form 8-K. The presentation will be delivered during the Company’s Annual Meeting of Stockholders, which is being conducted virtually at 11:00 a.m. Eastern time on August 23, 2023 via a live webcast which can be accessed at www.virtualshareholdermeeting.com/KEQU2023. A replay of the audio webcast of the Annual Meeting will be made available on the Company’s website for approximately one year.

The Company is making reference to non-GAAP financial information in both the presentation and the Annual Meeting. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached presentation, and will be included in the “Investor Information” section of the Company’s website at http://www.kewaunee.com/about/investor-information/.

Certain statements made in the attached presentation and related script constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding the Company’s future performance, as well as management’s expectations, beliefs, intentions, plans, estimates or projections relating to the future. Management believes that these forward-looking statements are reasonable. However, the Company cannot guarantee that its actual results will be consistent with the forward-looking statements and you should not place undue reliance on them. These statements are based on current expectations and speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise. Important factors regarding the Company that may cause results to differ from expectations are included in the Company’s Annual Report on Form 10-K for the year ended April 30, 2023, under Item 1A. “Risk Factors,” and in the Company’s other filings with the SEC.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits:

Exhibit No.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

(Registrant) Kewaunee Scientific Corporation |

|

|

|

|

| Date: August 23, 2023 |

|

|

|

|

|

/s/ Donald T. Gardner III |

|

|

|

|

|

|

Donald T. Gardner III |

|

|

|

|

|

|

Vice President, Finance and Chief Financial Officer |

Exhibit 99.1 Annual Shareholder Meeting encouraging new

discovery…Worldwide August 23, 2023

Safe Harbor Statement Certain statements in this document constitute

“forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All statements other than statements of historical fact included in this document, including

statements regarding the Company’s future financial condition, results of operations, business operations and business prospects, are forward-looking statements. Words such as “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “predict,” “believe” and similar words, expressions and variations of these words and expressions are intended to identify forward-looking

statements. Such forward- looking statements are subject to known and unknown risks, uncertainties, assumptions, and other important factors that could significantly impact results or achievements expressed or implied by such forward-looking

statements. Such factors, risks, uncertainties and assumptions include, but are not limited to, competitive and general economic conditions, both domestically and internationally; changes in customer demands; technological changes in our operations

or in our industry; dependence on customers’ required delivery schedules; risks related to fluctuations in the Company’s operating results from quarter to quarter; risks related to international operations, including foreign currency

fluctuations; changes in the legal and regulatory environment; changes in raw materials and commodity costs; and acts of terrorism, war, governmental action, natural disasters, and other Force Majeure events. The cautionary statements made pursuant

to the Reform Act herein and elsewhere by us should not be construed as exhaustive. We cannot always predict what factors would cause actual results to differ materially from those indicated by the forward-looking statements. Over time, our actual

results, performance, or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such difference might be significant and harmful to our

stockholders’ interest. Many important factors that could cause such a difference are described under the caption “Risk Factors,” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended April 30, 2023, which you

should review carefully, and in our subsequent quarterly reports on Form 10-Q. These reports are available on our investor relations website at www.kewaunee.com and on the SEC website at www.sec.gov. 2 | NASDAQ: KEQU

Agenda Annual Shareholder Meeting • Kewaunee Scientific Overview

• Fiscal Year 2023 Review • Strategic Direction and Outlook • Q&A 3 | NASDAQ: KEQU

Kewaunee Scientific Corporation Overview 4 | NASDAQ: KEQU

5 | NASDAQ: KEQU

Kewaunee Scientific Overview EDUCATION HEALTHCARE LIFE SCIENCES •

Market includes K-12 and • Market includes hospitals, surgery • Market includes life sciences, colleges and universities centers, testing centers, elderly pharmaceutical, bio-technology and • Increasing investments being care

communities, etc. other manufacturers made in STEM requiring new or • Macro population and aging trends • Continued global investment in upgraded facilities support continued investment in research and development • State and local

governments health-related initiatives requiring • Expanding spend on infrastructure beginning to fund education laboratories infrastructure improvements 6 | NASDAQ: KEQU

Kewaunee’s History Over a century of innovation and enabling

discovery 7 | NASDAQ: KEQU

Kewaunee Scientific Overview CAGR Kewaunee Revenue by Region ($ in

millions) 2021 2022 2023 2024 2027 '22 - '27 Participation R North America $ 727 $ 952 $ 1,076 $ 1,175 $ 1,417 8.3% Europe 524 580 620 655 764 5.7% R Asia 809 907 975 1,037 1,225 6.2% Rest of World 132 141 148 155 172 4.1% Total Market

Revenue $ 2,192 $ 2,580 $ 2,819 $ 3,022 $ 3,578 6.8% R Lab Furniture & Fixtures $ 1,106 $ 1,285 $ 1,388 $ 1,482 $ 1,732 6.2% R Fume Hoods 541 625 681 729 848 6.3% Clean Bench and BSC 545 670 751 811 998 8.3% Total Market Revenue $ 2,192

$ 2,580 $ 2,819 $ 3,022 $ 3,578 6.8% R Colleges and Universities 575 732 802 855 961 5.6% R Government 333 381 414 442 523 6.6% R K-12 105 110 113 116 126 2.8% R Industrial 208 224 236 245 275 4.1% R Life Science 710 849 951

1,042 1,323 9.3% R Applied Sciences 261 284 304 322 369 5.4% Total Market Revenue $ 2,192 $ 2,580 $ 2,819 $ 3,022 $ 3,578 6.8% Source: The Scientific and Equipment Furniture Association (“SEFA”) TDA 2023 Laboratory Enclosures and

Furniture Market Report 8 | NASDAQ: KEQU

FY 2023 REVIEW 9 | NASDAQ: KEQU

FY 2023 Review – Consolidated Results Sales EBITDA* ($ in

millions) ($ in millions) $240 $9.0 $7.5 $210 $219 $180 $7.0 $150 $169 $120 $5.0 $147 $90 $3.0 $60 $30 $0.4 $1.0 $0.2 $- FY21 FY22 FY23 $(1.0) FY21 FY22 FY23 Net Earnings (Loss) ($ in millions) Diluted EPS $2 $0.50 $0.25 $1 $- $- FY21 FY22 FY23 FY21

FY22 FY23 $(0.50) $(2) $(4) $(1.00) $(1.33) $(4) $(1.50) $(6) $(6) $(2.20) $(2.00) $(8) $(2.50) *EBITDA is a non-GAAP measure; please see the Appendix for a reconciliation to net earnings. 10 | NASDAQ: KEQU

FY 2023 Review – Domestic Segment Kewaunee is the leader in

designing and manufacturing laboratory, healthcare, and technical furniture in North and South America. Kewaunee’s Domestic Segment primarily relies on its exclusive dealer and distribution network to sell its products to end users. Designs

and manufactures laboratory, healthcare, and technical furniture products Products sold through exclusive dealers and national stocking distributor Products manufactured in Statesville, North Carolina 11 | NASDAQ: KEQU

FY 2023 Review – Domestic Segment Domestic Sales Domestic Net

Earnings and EBITDA* ($ in thousands) ($ in thousands) $160,000 $7,000 $5,802 $6,000 $140,000 $146,716 $5,000 $120,000 $126,848 $3,560 $3,408 $4,000 $100,000 $111,035 $3,000 $2,223 $80,000 $2,000 $921 $60,000 $1,000 $(229) $40,000 $- $20,000 FY21

FY22 FY23 $(1,000) $- Domestic Net Earnings Domestic EBITDA FY21 FY22 FY23 FY 2023 Impacts: FY 2023 Accomplishments: • Pricing of new orders in response to higher raw material input • Backlog at FY23 year-end was $91M, down $2M when

costs resulting in increased revenue per unit product when compared to prior year. Health of backlog continued to compared to the prior year. improve throughout the year as replacement of awards • Sustained manufacturing volumes throughout the

year with were priced based on raw material inflation headwinds. significant contributions from the life sciences sector. • Direct transition substantially completed at fiscal year-end. • Delivering of majority of performance obligations

related to • Capital program progressing with approximately $3.3M of fixed priced direct projects awarded prior to broad based capital being invested in the Statesville, NC metal inflation negatively impacting profitability. fabrication

facility. • $15M credit facility with Mid Cap Funding IV Trust secured. *EBITDA is a non-GAAP measure; please see the Appendix for a reconciliation to net earnings. 12 | NASDAQ: KEQU

FY 2023 Review – Domestic Segment Kewaunee is a leader in

manufactured laboratory, healthcare, and technical furniture. Kewaunee’s Domestic Segment primarily relies on its dealer and distribution network to sell its products to end users. 13 | NASDAQ: KEQU

FY 2023 Review – Domestic Segment Kewaunee is a leader in

manufactured laboratory, healthcare, and technical furniture. Kewaunee’s Domestic Segment primarily relies on its dealer and distribution network to sell its products to end users. 14 | NASDAQ: KEQU

FY 2023 Review – International Segment Kewaunee’s

International segment participates more broadly across the laboratory construction value chain, from pre- construction through providing facility maintenance services for customers with market-leading positions in India and the Middle East. Turn-key

provider of total laboratory solutions – design, construction, manufacture, installation Current EMEA & Asia-Pacific Footprint and maintenance Sold principally direct to end-users Products for international markets manufactured in

Statesville, NC and in Bangalore, India Market leader in India and Middle East geographies International Sales Offices 15 | NASDAQ: KEQU

FY 2023 Review – International Segment International Sales

International Net Earnings and EBITDA* ($ in thousands) ($ in thousands) $6,650 $80,000 $7,000 $6,000 $70,000 $72,778 $4,511 $5,000 $60,000 $3,571 $4,000 $50,000 $3,164 $3,000 $40,000 $2,333 $2,049 $42,024 $2,000 $30,000 $36,434 $1,000 $20,000 $-

$10,000 FY21 FY22 FY23 $- International Net Earnings International EBITDA FY21 FY22 FY23 FY 2023 Accomplishments: FY 2023 Impacts: • Strong revenue, net earnings and EBITDA growth driven by • Strength in the Indian market driven by

strong investments the delivery of a number of large projects in the Africa and across the life sciences, petroleum, and technology markets. Indian markets. • The increase in sales was driven by the delivery of several • Continued

investment in talent and capability in a large projects throughout the fiscal year in India, Asia, and competitive labor market. Africa. • Quoting pipeline remains especially strong in India as the *EBITDA is a non-GAAP measure; please see the

Appendix for a reconciliation to net earnings. economy continues to rapidly transform. 16 | NASDAQ: KEQU

FY 2023 Review – International Segment Kewaunee’s

International segment participates more broadly across the laboratory construction value chain, from pre-construction through providing facility maintenance services for customers with market-leading positions in India and the Middle East. Current

EMEA & Asia-Pacific Footprint 17 | NASDAQ: KEQU

FY 2023 Review – Corporate Segment Corporate Segment: • CEO

and CFO compensation • Corporate finance and global treasury • Stock-based incentive compensation • Public company costs • Pension administration • Expenses related to the amortization of the underfunded pension

liability • Other expenses 18 | NASDAQ: KEQU

Strategic Direction and Outlook OUR GUIDING PRINCIPLES We will be easy

to do business with. We will get closer to our customer(s). We will do everything with excellence. We will lead and not follow (we are innovators). 19 | NASDAQ: KEQU

Associates, Our Foundation We are a Company of passionate, talented,

and motivated people. We embrace collaboration and creativity to find innovative solutions to the complex challenges in today’s marketplace. Our Associates are critical for our continued success, and we are committed to maintaining an

environment where every person at Kewaunee can thrive. We offer competitive benefits and programs to take care of the diverse needs of our Associates and their families, including opportunities for career growth and development, education and tools

to support their financial health, and access to excellent healthcare options through our community partners. 20 | NASDAQ: KEQU

Why Choose Kewaunee? Attractive End-Use Portfolio Dealer/Distribution

Financial Stability Experience Markets Network The industries served Kewaunee offers total Our global network of • 30.0% top-line Founded in 1906, by Kewaunee continue lab solutions with a experienced dealers grown in Fiscal Kewaunee brings to

invest in research portfolio of products stand ready with local Year 2023 over 117 years of and development, that meet every expertise to simplify the manufacturing requiring Kewaunee furniture need within building process and • $219.5 Million

in excellence to products in diverse the laboratory space. bring each project from Revenue every project. markets. thought to finish with support at every stage. 21 | NASDAQ: KEQU

Thank You & Questions 22 | NASDAQ: KEQU

Appendix 23 | NASDAQ: KEQU

Non-GAAP Reconciliations Kewaunee Scientific Corporation Kewaunee

Scientific Corporation Annual Shareholder Meeting | August 23, 2023 EBITDA and Segment EBITDA Appendix: Non-GAAP Measures (Dollars in Thousands) The following unaudited tables reconcile Net Earnings to EBITDA, by Segment and Consolidated We

calculate EBITDA and Segment EBITDA as net earnings, less interest expense and income, income Year Ended April 30, 2021 Domestic International Corporate Consolidated taxes, depreciation, and amortization. We believe Net Earnings (Loss) $ 921 $ 2,049

$ (6,642) $ (3,672) Add/(Less): EBITDA and Segment EBITDA allow management and Interest Expense - 4 385 389 our investors to compare our performance to other Interest Income - (216) (7) (223) Income Taxes 245 1,063 (318) 990 companies on a

consistent basis without regard to Depreciation and Amortization 2,394 264 29 2,687 depreciation and amortization, which can vary EBITDA $ 3,560 $ 3,164 $ (6,553) $ 171 significantly between companies depending upon many Year to Date April 30, 2022

Domestic International Corporate Consolidated factors. EBITDA and Segment EBITDA are not Net Earnings (Loss) $ (229) $ 2,333 $ (8,230) $ (6,126) calculations based upon generally accepted accounting Add/(Less): Interest Expense - 30 602 632

principles and our method for calculating EBITDA and Interest Income - (197) (202) (399) Segment EBITDA can vary as compared to other Income Taxes 50 1,129 2,339 3,518 Depreciation and Amortization 2,402 276 91 2,769 companies. The amounts included

in the EBITDA and EBITDA $ 2,223 $ 3,571 $ (5,400) $ 394 Segment EBITDA calculations, however, are derived Year to Date April 30, 2023 Domestic International Corporate Consolidated from amounts included in the historical statements of Net Earnings

(Loss) $ 3,408 $ 4,511 $ (7,181) $ 738 earnings. EBITDA and Segment EBITDA should not be Add/(Less): considered an alternative to net earnings or operating Interest Expense - 210 1,524 1,734 Interest Income - (603) (358) (961) earnings as an

indicator of the Company’s operating Income Taxes - 2,250 889 3,139 performance, or as an alternative to operating cash Depreciation and Amortization 2,394 282 191 2,867 EBITDA $ 5,802 $ 6,650 $ (4,935) $ 7,517 flows as a measure of liquidity.

24 | NASDAQ: KEQU

Exhibit 99.2

ANNUAL SHAREHOLDER SPEECH AUGUST 23, 2023

Annual Shareholder Meeting Speech

August 23, 2023

Good morning. I

would like to extend a warm welcome to our shareholders who have set aside time to join us today at Kewaunee’s 2023 annual shareholder meeting. This year’s meeting is again being conducted virtually, providing our shareholders with a more

accessible format in which to participate.

Before proceeding, a brief comment regarding forward-looking statements.

Today I will share with you highlights from our recently completed fiscal year ended April 30, 2023, as well as an update on our outlook and strategic

direction.

As I am getting started with my comments, I would be remiss not to acknowledge the difficult period that the Company has come through and the

patience of our shareholders in seeing us through the past couple of years. I am very pleased with the progress we have made and am very optimistic about Kewaunee’s future.

There will be time for questions at the end of the presentation, and we will take as many as possible. If you do have questions, you may submit them online

through the chat function during the presentation. Finally, all materials will be posted to the investor relations section of our website for future reference.

Company Overview:

To begin, we will kick things

off with a brief overview of the Company.

Kewaunee is a global organization with over 900 associates serving customers across the Americas, Asia, the

Middle East, and Africa. Kewaunee is a leading designer, manufacturer, and installer of laboratory technical furniture, ventilated products, and epoxy resin worktops, which our customers use to furnish a variety of environments.

Our customers operate within multiple end-use markets, which require high-quality laboratory furniture and technical

products to furnish their environments. These markets tend to enjoy a durable, long-term growth trend with consistent funding from private and public parties.

Kewaunee’s mission, which the Company has been proudly pursuing since its founding in 1906, is to support organizations that are “encouraging new

discovery…Worldwide.” Kewaunee has evolved into the most competitive supplier in the laboratory furniture industry based on prudent management and consistent reinvestment in the Company’s capabilities over time. Kewaunee is the only

industry participant that can provide a complete, one-stop laboratory solution to customers, based on its extensive investment in manufacturing capabilities to produce wood and metal casework, flexible metal

table systems, fume hoods, ventilated products, and epoxy resin worktops.

1

The industries served by Kewaunee continue to receive prioritization for investment as companies,

governments, and institutions look to encourage discovery that requires specialized environments. The data presented is from the recently published 2023 SEFA Laboratory Enclosures and Furniture Market Report. This remains the most

reliable data set available to assess the size and growth trajectory of the markets we serve. As the market leader, I believe Kewaunee is uniquely positioned to capitalize on what continues to be favorable industry growth trends.

Now a discussion on fiscal year 2023:

Fiscal 2023

was a good year for Kewaunee on multiple fronts, resulting in a strengthened organization, well situated to capitalize on its market leading position. Our team continues to execute against our strategic direction, making important progress on

multiple initiatives.

Sales during fiscal year 2023 were $219.5M, an increase of 30.0% compared to sales of $168.9M from the prior year. Pre-tax earnings for the fiscal year were $4.5M compared to a pre-tax loss of $2.5M for the prior year. Net earnings for the fiscal year were $738,000, compared to a net loss

of $6.1M for the prior year. EBITDA for the fiscal year was $7.5M compared to $394,000 for the prior fiscal year. Diluted earnings per share were $0.25, as compared to a loss per share of $2.20 in the prior fiscal year.

Kewaunee’s Domestic operating segment designs and manufactures laboratory, healthcare, and technical furniture sold within the US marketplace and

exported to Canada, Latin and South America, and the Middle East. Our products are designed to meet the highest quality and performance standards, complying with a variety of industry standard-setting bodies.

We work with architects, laboratory planners, general contractors, and owners to develop products that are utilized to furnish laboratories enabling

scientists, students, and other practitioners to conduct work that is furthering economic and social progress. Our manufactured products are sold to end-users through our exclusive dealer network and

distribution partners.

Domestic sales for fiscal year 2023 were $146.7M, an increase of 15.7% from sales of $126.8M in the prior year. This increase was

primarily driven by the pricing of new orders in response to higher raw material input costs. Domestic segment net earnings were $3.4M compared to a net loss of $229,000 in the prior fiscal year. Domestic segment EBITDA was $5.8M compared to $2.2M

for the prior year. Domestic segment profitability was negatively impacted during the year by the completion of direct contracts, which were priced and awarded prior to the broad-based inflation experienced in the prior fiscal year. Many of these

direct contracts were delivered at a loss for the Company.

Further, as previously disclosed, we made the decision to transition territories where we have

historically sold directly to either general contractors or end-users to two of our dealers, Nycom and ISEC. This transition is substantially complete as we close out fiscal year 2023. Additionally, our

dealers have invested in both territories, building their pipeline of opportunities, which will begin to result in new awards in the upcoming fiscal year. We expect ISEC and Nycom to serve these territories at a high level based on their strength

and our long-standing relationship with both organizations.

2

Additionally, we are in the process of commissioning approximately $3.3M in new capital that is being

invested in our Statesville, North Carolina, metal fabrication facility. This capital replaces several old, obsolete pieces of equipment, significantly increasing our manufacturing capacity and productivity. This investment will result in an

improved metal manufacturing cost structure, greater flexibility in responding to surges and demand, and less reliance on overtime to meet production requirements. Further, the increase in our capacity will support continued investment and growth by

our channel partners in their businesses.

Our International operating segment participates more comprehensively across the laboratory construction value

chain based on a broader set of capabilities. Our ability to provide “turn-key” solutions through the design, construction, manufacture, installation, and maintenance of the laboratory is a

competitive advantage that has resulted in our international team continuing to lead in the markets we serve. Currently, our International segment serves customers in India, Africa, Pan-Asia, and the Middle

East.

International sales for the fiscal year were $72.8M, an increase of 73.2% from sales of $42.0M in the prior year. The increase in sales was driven

by the delivery of several large projects throughout the fiscal year in India, Asia, and Africa. International segment net earnings were $4.5M compared to $2.3M in the prior fiscal year. International segment EBITDA was $6.7M compared to $3.6M for

the prior year.

Our international team was awarded a number of very large, high-profile projects over the past two years. These projects began to deliver

during the fiscal year, resulting in a significant increase in revenue and profitability for the International segment. These activities required the organization to rapidly scale to meet the demands of delivering multiple large projects across a

diverse set of territories (India, Africa, and Asia). Our team’s ability to do so, while continuing to develop and pursue new work, is proof of the depth of our international organization.

Corporate segment net loss was $7.2M for the fiscal year, as compared to $8.2M in the prior fiscal year. Corporate segment EBITDA loss for the fiscal year was

$4.9M, a favorable improvement of 8.6% from corporate segment EBITDA loss of $5.4M for the prior year. The change in EBITDA was driven by a change in our Corporate cost allocation methodology after completing a revised transfer pricing study,

partially offset by higher pension-related expenses and higher operating expenses.

Now, on to our strategic direction and outlook.

Our vision for Kewaunee is to be the global supplier of choice with customers in the laboratory furniture and infrastructure markets. In pursuing this vision,

we have set forth the following principles that continue to guide our actions:

| |

• |

|

We will be easy to do business with, |

| |

• |

|

We will get closer to our customers, |

3

| |

• |

|

We will do everything with the highest quality, and |

| |

• |

|

We will lead and not follow (we are innovators). |

Fiscal year 2023 was a transition year for Kewaunee as we emerged from an extremely disruptive three-year period where we dealt with a global pandemic, rapid

broad-based inflation, labor shortages, and supply chain disruptions. A testament to the character and drive of Kewaunee’s leadership team and Associates is that, while managing through these challenges, we continued to invest in and evolve our

business, guided by our principles, to better position the Company for the future. The benefits of these decisions became evident as we moved through the year, and our financial performance steadily improved. Kewaunee ends fiscal year 2023 with a

strong global management team, a healthy backlog, improved manufacturing capabilities, and end-use markets that continue to prioritize investment in projects that require the products Kewaunee designs and

manufactures.

Moving forward, Kewaunee will continue to invest in developing world-class manufacturing capabilities to support our dealer and

distribution partners in growing our businesses together. This investment in our capabilities better positions Kewaunee to be the brand of choice for customers building or renovating spaces requiring laboratory furniture and technical products.

As I close, I want to take a moment to thank the Company’s global Associates for their commitment and hard work over the past year. I also want to thank

our many loyal customers, dealers, and our national stocking distributor for their support.

I would also like to thank our many shareholders for your

continued support. As previously mentioned, Kewaunee has persevered through a difficult period during which we have been busy making impactful changes in the face of strong external headwinds, recapitalizing our financial footing, and investing with

our eyes on the future. We are now well positioned to win in a world and business environment that demands foresight and determination. Kewaunee’s future is bright, and I am excited to continue building on our momentum in fiscal 2024.

As I close, please note that Kewaunee will be releasing earnings for the first quarter of the Company’s fiscal year 2024 after the close of business on

August 31, 2023.

We will now open the floor for questions.

4

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

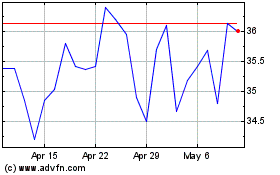

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From Apr 2024 to May 2024

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From May 2023 to May 2024