Pool Lags Consensus, Cuts Guidance - Analyst Blog

July 20 2012 - 4:15AM

Zacks

Pool Corp.’s

(POOL) second quarter 2012 adjusted earnings per share of $1.34

were a penny short of the Zacks Consensus Estimate but 13% above

the year-ago level. Earnings per share bore an unfavorable impact

of foreign currency translation by a penny.

The year-over-year increase in earnings was mainly driven by modest

top-line growth as well as reduced cost structure. Net sales in the

reported quarter increased 7.0% year over year to $757.2 million

but lagged the Zacks Consensus Estimate of $768.0 million.

Some demand was carried forward mostly to first quarter and early

second quarter as the season reached its peak much before than the

usual time because of milder winter. However, after outshining in

first-quarter and early second-quarter, sales began to loose

momentum from June.

Inside the Headline Numbers

Overall Base business sales of Pool improved 5% year over year even

after considering an adverse impact of 1% from currency

translation. Blue business sales increased only 4.8% in the

quarter, while Green business sales were up 10.7%. Swimming pool

side business in the three largest markets namely California,

Florida and Texas were strong, assisting overall sales growth in

the second quarter. In those markets, pool maintenance and repair

were crucial contributors to sales.

Gross profit grew 5% year over year to $222.4 million but gross

margin fell 50 basis points (bps) to 29.4% due to cutthroat

competition, tough year-over-year comparison owing to vendor price

increases last year and an adverse customer mix. Operating expenses

as a percentage of sales fell 110 bps to 14.9%.

Financials

Cash and cash equivalents increased 35% year over year to $50.3

million. Net receivables nudged up 2% from the prior-year period to

$270.1 million.

The inventory level upped 3% year over year to $402.3 million at

the end of the second quarter. Total long-term debt was $309.8

million versus $206.0 million in the year-ago quarter.

Pool bought back 1.2 million shares for $42.1 million in the first

half of 2012.

Guidance

After increasing the full-year earnings per share guidance in the

last quarter, management slashed it this time to the range of

$1.75–$1.82 from $1.75–$1.85. An early peak season in 2012 leaves

the second half of the year in uncertainty. Moreover, slowdown in

the global economic environment that led to a possible pullback in

consumers’ discretionary spending was another reason for lowering

the guidance.

Our Take

Pool’s management still hopes to grow earnings per share over 20%

this year which, if achieved, will be third year in a row. However,

management said tough seasonality and faltering consumer confidence

could prove detrimental for Pool’s second half. We are also

supportive of management’s view.

However, on a positive note, there are some commendable attributes

in the stock like efficient cost containment effort, a steady

turnaround of the Green business, which was once a struggling side,

and market share gains.

Pool, which competes with the likes of Johnson Outdoors

Inc. (JOUT) and Golfsmith International Holdings

Inc. (GOLF), holds a Zacks #2 Rank (short-term Buy

recommendation). We reiterate our long-term Neutral recommendation

on the stock.

GOLFSMITH INTL (GOLF): Free Stock Analysis Report

JOHNSON OUTDOOR (JOUT): Free Stock Analysis Report

POOL CORP (POOL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

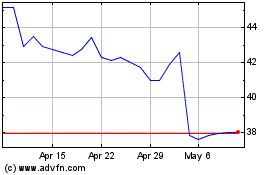

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

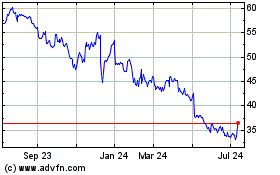

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jul 2023 to Jul 2024