Johnson Outdoors Inc. (NASDAQ:JOUT), a leading global outdoor

recreation company, today announced net sales of $135.5 million for

the third quarter ended June 30, 2006, an increase of 11% compared

to $122.4 million for the prior year quarter. Net earnings were

$6.6 million or $0.72 per diluted share compared to $6.8 million or

$0.77 per diluted share in the prior year quarter. THIRD QUARTER

RESULTS Third quarter sales are historically the highest of the

year, reflecting consumer demand during the key retail selling

period of the Company's seasonal outdoor products. Significant

gains in the Marine Electronics and Watercraft business units more

than offset anticipated declines in military sales and lower Diving

sales. Excluding military sales in both the current and the prior

year third quarter, total Company net sales would have increased

$15.6 million. Key changes included: -- Marine Electronics sales

grew 21% driven by Humminbird(R) and the acquisition of the

Cannon(R) and Bottomline(R) brands completed on October 3, 2005,

which added a combined $3.3 million in net sales to the unit during

the quarter. -- Watercraft sales jumped 14% ahead of last year's

third quarter results due to strong double-digit growth in Old

Town(R) and Ocean Kayak(TM) brands. -- Diving revenues declined 2%

due primarily to weakness in European and US markets and

unfavorable currency exchange rates. -- Outdoor Equipment revenues

were 1% behind last year due entirely to a 25% decline in military

sales from the prior year quarter. Consumer camping continued to

benefit significantly this quarter from specialty market sales.

Temporary closure of the Company's Outdoor Equipment operations,

due to flooding caused by heavy rains in the Northeast, halted

shipments of finished goods during the final week of the quarter.

Total Company operating profit in the quarter increased 18% to

$13.9 million compared with $11.8 million in the prior year

quarter. Operating profit during the period was impacted by the

following factors: -- Significant growth in Marine Electronics and

Watercraft sales due to successful new product introductions. --

One-time charges totaling $1.2 million related to the temporary

closure of the Company's Outdoor Equipment operations due to

flooding caused by heavy rains in the Northeast. -- Lower margins

on lower sales in Diving due partly to business disruption from

European restructuring. -- Investment in sales and marketing for

Escape(R) electric boats. -- Reduced overhead costs at corporate

and operational levels. Net income was $6.6 million, or $0.72 per

diluted share, for the quarter versus $6.8 million, or $0.77 per

diluted share, in the prior year quarter. In addition to the same

stated factors which impacted operating profit, net income was also

affected by increased net interest expense due to short-term

borrowings related to working capital growth, and by recognized

charges of $0.9 million related to foreign tax audits. "We had a

solid quarter as investments in new businesses, new products and

new systems began to drop to the bottom-line. Marine Electronics

delivered another outstanding performance, and Watercraft is moving

in the right direction on the strength of paddlesports' brands,

despite continued investment in building sales and distribution for

the Escape brand. In Diving, more time and more investment is

needed to complete restructuring and generate positive momentum,

and I am confident we are taking the right actions to return Diving

to historical levels of profitability in the future. As we look

ahead to the fourth quarter, we are focused on bringing military

tent production back on-line as quickly as possible, and on working

to minimize the continued impact of restructuring on Diving,"

observed Helen Johnson-Leipold, Chairman and Chief Executive

Officer, Johnson Outdoors Inc. "Our vision is to own the outdoor

adventure with innovation and passion, and by doing so, to deliver

sustainable profitable growth and enhanced shareholder value. Our

performance this year demonstrates we have the capability and

capacity to realize our vision as we begin to set our sights on

growing revenues to half a billion dollars over the next few

years." YEAR-TO-DATE RESULTS Net sales for the first nine months of

fiscal 2006 were $315.5 million, a 4% increase over $303.6 million

during the same period last year. Excluding the anticipated $10.8

million decline in military sales year-to-date, total Company net

sales would have increased $22.7 million. Key drivers in the

nine-month period were: -- Cannon(R) and Bottomline(R) brands,

which added $7.7 million to year-to-date sales. -- Increased sales

in Humminbird(R), Old Town(R) and Ocean Kayak(TM) brands. -- The

anticipated decline in military sales and lower Diving revenues

during the period. -- Unfavorable currency exchange which reduced

revenues by $1.7 million year-to-date. -- Temporary closure of the

Company's Outdoor Equipment operations, due to flooding caused by

heavy rains in the Northeast, which halted shipments of finished

goods during the final week of the year-to-date period. Total

Company operating profit was $21.4 million during the nine-month

period compared to $20.1 million during the prior year-to-date

period which reflected $2.5 million in costs associated with the

terminated buy-out proposal. Key factors impacting the year-to-date

results were: -- Improved results in Watercraft due to increased

sales and enhanced operational efficiency in paddlesports' brands.

-- Company-wide cost-saving and overhead reduction programs. -- The

continued, yet expected, decline in military sales versus the prior

year which resulted in the unfavorable comparison in Outdoor

Equipment profits versus the same period last year. -- Significant

increases in commodity and freight costs which had a combined

negative impact of 1.5 gross margin points. -- Lower profits in

Diving due to the impact of European restructuring and weak

markets. Net income year-to-date was $9.6 million, or $1.05 per

diluted share, versus net income of $10.5 million, or $1.20 per

diluted share, in the prior year nine-month period. OTHER FINANCIAL

INFORMATION The Company's debt to total capitalization stood at 26%

at the end of the fiscal third quarter versus 23% at July 1, 2005

as a result of short-term borrowings to meet higher working capital

needs. Debt, net of cash and short-term investments, increased to

$20.2 million at the end of this quarter versus $11.2 million at

the end of the prior year quarter. Depreciation and amortization is

$6.6 million year-to-date compared to $7.1 million last

year-to-date. Capital spending totaled $6.3 million year-to-date,

compared with $4.7 million in the prior year first nine months.

Gross margin percentage year-to-date was 41.6%, compared to 42.1%

in the prior year period, with each gross margin point contributing

approximately $0.19 to earnings per diluted share. "Short-term debt

has increased as we funded sales and working capital growth in our

Marine Electronics and Watercraft businesses. Our balance sheet

remains healthy and we expect our working capital levels to return

to seasonal levels next quarter," said David Johnson, Vice

President and Chief Financial Officer. OUTDOOR EQUIPMENT -

OPERATIONAL UPDATE On June 29, 2006 the Company announced the

temporary closure of its Binghamton, New York Outdoor Equipment

Group production facility and administrative offices due to

flooding caused by heavy rains in the Northeast. Extensive clean-up

and restoration efforts are ongoing and limited production is

expected to begin by mid-August. The Company has taken a charge of

$1.2 million in the third quarter; however, the full financial

impact of the business interruption is not yet known. The Company

will be able to make a determination near the end of the fiscal

fourth quarter on the total amount of recoverable losses, and

expects its insurance coverage will indemnify the balance of those

losses. MILITARY UPDATE The Company has received eleven (11)

separate orders year-to-date totaling $19.5 million awarded under

the multi-vendor, multi-product military contract announced on

September 7, 2005. Further orders are not expected until production

capacity is restored to pre-flood levels at the Company's

Binghamton, New York operation where military tents are

manufactured. As a result of the business interruption, the Company

now expects fiscal 2006 military sales will be in the $30-$35

million range. INNOVATION UPDATE Johnson Outdoors delivers

meaningful innovation to the outdoor recreation marketplace driven

by unique consumer insights, with new products this quarter

representing one-third of total Company net sales. Strong new

product growth continues to bolster the Company's already robust

existing brands and differentiate the Company in the industry.

Marine Electronics' innovative new product line-up for 2007

includes, among others: -- The Minn Kota(R) Terrova(TM), the most

advanced bow-mount trolling motor, showcases a breakthrough

effortless motor stow and deploy mechanism, enhanced precision

steering and an ergonomically-designed foot-pedal control to

enhance the fishing experience. The Terrova(TM) received the

boating accessory "Best of Show" honors at the 2006 ICAST in July,

the world's largest sportfishing show. -- The Humminbird(R) 797c SI

Combo Fishing System also took home "Best of Show" honors at the

2006 ICAST in the electronics category. The new 797c SI combines

the unique, award-winning Humminbird(R) Side Imaging(TM) technology

with the next generation high-resolution screen for a compact,

professional grade fishing system for broader appeal. -- Minn

Kota(R) Trim Tabs mark the brand's expansion into an estimated $25

million product category. Engineered with a proprietary curved and

winged composite design, Minn Kota(R) Trim Tabs provide up to 50%

more boat lift compared to standard tab designs, and work together

with the new Minn Kota(R) Trim-n-Troll(TM) electric propulsion

system to enable anglers to silently position the boat for maximum

fishing ease. CONFERENCE CALL AND WEBCAST The Company will host a

conference call and audio web cast on Wednesday, August 3, 2006 at

10:00 a.m. Eastern Time. A live listen-only web cast of the

conference call may be accessed at Johnson Outdoors' home page. A

replay will also be available on Johnson Outdoors' home page, or by

dialing (888) 286-8010 or (617) 801-6888 and providing confirmation

code 99988716. The replay will be available through August 10, 2006

by phone and for 30 days on the Internet. ABOUT JOHNSON OUTDOORS

INC. Johnson Outdoors is a leading global outdoor recreation

company that turns ideas into adventure with innovative,

top-quality products. The Company designs, manufactures and markets

a portfolio of winning, consumer-preferred brands across four

categories: Watercraft, Marine Electronics, Diving and Outdoor

Equipment. Johnson Outdoors' familiar brands include, among others:

Old Town(R) canoes and kayaks; Ocean Kayak(TM) and Necky(R) kayaks;

Escape(R) electric boats; Minn Kota(R) motors; Cannon(R)

downriggers; Humminbird(R), Bottomline(R) and Fishin' Buddy(R)

fishfinders; Scubapro(R) and UWATEC(R) dive equipment; Silva(R)

compasses and digital instruments; and Eureka!(R) tents. Visit us

on line at http://www.johnsonoutdoors.com SAFE HARBOR STATEMENT

Certain matters discussed in this press release are

"forward-looking statements," intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. Statements other than statements of

historical fact are considered forward-looking statements. Such

forward-looking statements are subject to certain risks and

uncertainties, which could cause actual results or outcomes to

differ materially from those currently anticipated. Factors that

could affect actual results or outcomes include changes in consumer

spending patterns; the Company's success in implementing its

strategic plan, including its focus on innovation; actions of

companies that compete with the Company; the Company's success in

managing inventory; movements in foreign currencies or interest

rates; the ability of the Company to recover losses through

insurance coverage; the Company's success in restructuring of its

European Diving operations; unanticipated issues related to the

Company's military sales; the success of suppliers and customers;

the ability of the Company to deploy its capital successfully;

adverse weather conditions; events related to the terminated

Buy-Out transaction; and other risks and uncertainties identified

in the Company's filings with the Securities and Exchange

Commission. Shareholders, potential investors and other readers are

urged to consider these factors in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements included

herein are only made as of the date of this press release and the

Company undertakes no obligation to publicly update such

forward-looking statements to reflect subsequent events or

circumstances. -0- *T - - - FINANCIAL TABLES FOLLOW - - - JOHNSON

OUTDOORS INC. (thousands, except per share amounts)

----------------------------------------------------------------------

Operating Results THREE MONTHS ENDED NINE MONTHS ENDED

----------------------------------------------------------------------

June 30 July 1 June 30 July 1 2006 2005 2006 2005

----------------------------------------------------------------------

Net sales $135,540 $122,445 $315,476 $303,595 Cost of sales 78,133

70,727 184,300 175,830

----------------------------------------------------------------------

Gross profit 57,407 51,718 131,176 127,765 Operating expenses

43,495 39,898 109,807 107,620

----------------------------------------------------------------------

Operating profit 13,912 11,820 21,369 20,145 Interest expense, net

1,455 996 3,575 3,114 Other (income) expense, net 167 (189) 458

(909)

----------------------------------------------------------------------

Income before income taxes 12,290 11,013 17,336 17,940 Income tax

expense 5,727 4,219 7,694 7,440

----------------------------------------------------------------------

Net income $6,563 $6,794 $9,642 $10,500

----------------------------------------------------------------------

Basic earnings per common share $0.73 $0.79 $1.07 $1.22 Diluted

earnings per common share $0.72 $0.77 $1.05 $1.20

----------------------------------------------------------------------

Diluted average common shares outstanding 9,151 8,781 9,151 8,779

----------------------------------------------------------------------

Segment Results Net sales: Marine electronics $57,585 $47,759

$139,132 $122,751 Outdoor equipment 20,430 20,715 53,467 60,434

Watercraft 35,533 31,286 68,061 62,364 Diving 22,265 22,782 55,203

58,350 Other/eliminations (273) (97) (387) (304)

----------------------------------------------------------------------

Total $135,540 $122,445 $315,476 $303,595

----------------------------------------------------------------------

Operating profit (loss): Marine electronics $9,852 $8,715 $20,713

$20,816 Outdoor equipment 2,476 3,001 7,094 9,469 Watercraft 3,047

1,753 (584) (2,030) Diving 2,143 3,790 3,178 5,104

Other/eliminations (3,606) (5,439) (9,032) (13,214)

----------------------------------------------------------------------

Total $13,912 $11,820 $21,369 $20,145

----------------------------------------------------------------------

Balance Sheet Information (End of Period) Cash and short-term

investments $43,629 $39,625 Accounts receivable, net 94,770 83,765

Inventories, net 65,388 55,127 Total current assets 220,439 193,741

Total assets 325,390 289,745 Short-term debt 43,001 13,001 Total

current liabilities 115,036 74,897 Long-term debt 20,806 37,800

Shareholders' equity 181,525 169,721

----------------------------------------------------------------------

*T

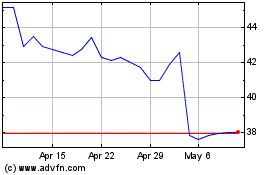

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Dec 2024 to Jan 2025

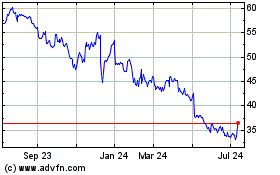

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2024 to Jan 2025