Johnson Outdoors Inc. (NASDAQ:JOUT), a leading global outdoor

recreation company, today announced net sales of $107.4 million for

the second quarter ended March 31, 2006, an increase of 1% compared

to $106.2 million for the prior year quarter. Net earnings were

$0.46 per diluted share compared to $0.54 per diluted share in the

prior year quarter. SECOND QUARTER RESULTS Second quarter sales

reflect initial shipments to customers in anticipation of the

primary consumer retail selling period for the Company's seasonal

outdoor products. Significant gains in the Marine Electronics and

Watercraft business units were offset by anticipated declines in

military sales and lower European Diving sales. Excluding the

anticipated $3.7 million decline in military sales, total Company

net sales would have increased $4.9 million. Key changes included:

-- Marine Electronics sales grew more than 9% driven by

Humminbird(R) and the acquisition of the Cannon(R) and

Bottomline(R) brands completed on October 3, 2005, which added a

combined $3.3 million in net sales to the unit during the quarter.

-- Watercraft sales were more than 6% ahead of the last year's

second quarter results due to continued strength of Old Town(R) and

Ocean Kayak(R) brands. -- Diving revenues declined 11% due in large

part to unfavorable currency translation and lower sales in the

European region. Excluding the currency impact, Diving revenues

would have declined 5.3%. -- Outdoor Equipment revenues decreased

11% due almost entirely to a 28% decline in military sales from the

prior year quarter. Consumer camping benefited significantly this

quarter from first-time specialty market sales. Total Company

operating profit of $8.3 million in the second quarter was slightly

below operating profit of $8.4 million in the prior year quarter

due to the following factors: -- Lower profits in Marine

Electronics due to pacing of current year orders resulting in a

short-term unfavorable product mix; continued weakness in Northern

Tier boat markets; rising commodity costs; and increased investment

in marketing, sales and R&D initiatives. -- Significant

increases in commodity costs. -- Lower sales in European Diving. --

Reduced overhead costs at corporate and operational levels. Net

income was $4.2 million, or $0.46 per diluted share, for the

quarter versus $4.7 million, or $0.54 per diluted share, in the

prior year quarter. Net income and operating profit were affected

by the same previously stated factors. Also, the Company incurred

pretax currency losses of $0.2 million this quarter compared to

pretax currency gains of $0.6 million during the same period last

year. The Company's tax rate for the second quarter is favorable

compared to the same period last year and consistent with

expectations for the full year. "Marine Electronics continues to be

a growth engine, with our Watercraft business picking up steam as

we move into the critical consumer retail season. Importantly, we

are benefiting from our investments in new product innovation, with

revenue growth in our core brands out-pacing the projected decline

in military sales," observed Helen Johnson-Leipold, Chairman and

Chief Executive Officer. "An ongoing emphasis on disciplined

cost-control measures and improved operational efficiency has

helped to reduce the impact of rising commodity prices and freight

charges on profitability. Our portfolio is stronger and better

positioned for growth than ever, and we feel good about the

future." YEAR-TO-DATE RESULTS Net sales in the first six months of

fiscal 2006 were $179.9 million versus $181.2 million in the same

six-month period last year. Excluding the anticipated $8.3 million

decline in military sales, total Company net sales would have

increased $7.1 million. Key drivers in the year-to-date period

were: -- The $8.3 million anticipated decline in military sales

during the period. -- Unfavorable currency translation which

reduced Diving sales by $2.1 million year-to-date. -- Cannon(R) and

Bottomline(R) brands which added $4.4 million in year-to-date

sales. Total Company operating profit was $7.5 million during the

first six months compared to $8.3 million during the prior

year-to-date period, which included $2.0 million in costs

associated with the terminated buy-out proposal. The primary

drivers behind the unfavorable comparison were: -- The significant

drop in military sales versus the prior year six-month period which

resulted in the $1.8 million unfavorable comparison in Outdoor

Equipment profits versus the prior year period. -- Lower profits in

Marine Electronics due to pacing of current year orders resulting

in a short-term unfavorable product mix; continued weakness in

Northern Tier boat markets, rising commodity costs; and increased

investment in marketing, sales and R&D initiatives. Net income

for the first six months of the year was $3.1 million, or $0.34 per

diluted share, versus net income of $3.7 million, or $0.42 per

diluted share, in the prior year six months. OTHER FINANCIAL

INFORMATION The Company's debt to total capitalization stood at 31%

at the end of the fiscal second quarter versus 23% at April 1, 2005

as a result of short-term borrowings to meet higher working capital

needs. Debt, net of cash and short-term investments, increased to

$45.1 million at the end of this quarter versus $40.0 million at

the end of the prior year quarter due to the acquisition of

Cannon(R) and Bottomline(R) brands this fiscal year. Depreciation

and amortization is $5.1 million year-to-date compared to $5.0

million last year-to-date. Capital spending totaled $4.0 million

year-to-date, compared with $3.5 million in the prior year first

six months. "Increased working capital resulted primarily from

higher-than-expected receivables from the U.S. military, along with

incremental inventory associated with the Cannon(R)/Bottomline(R)

acquisition. We expect to manage down both working capital and

short-term debt balances as the season progresses," said David W.

Johnson, Vice President and Chief Financial Officer. MILITARY

UPDATE The quarterly decline in military sales is consistent with

the Company's stated expectations throughout fiscal 2004 and 2005.

On April 25, 2006, the Company announced the receipt of two (2) new

orders for its Modular General Purpose Tent Systems (MGPTS)

totaling $5.5 million. At this time, the Company expects fiscal

2006 military sales to be in the $35-$40 million range. INNOVATION

UPDATE Johnson Outdoors delivers meaningful innovation to the

outdoor recreation marketplace driven by unique consumer insights.

The Company's new product designers utilize sophisticated,

rapid-prototyping technology to ensure continuous consumer feedback

from product concept to commercialization. Smart innovation

delivers meaningful results, with new products this quarter

representing about one-third of total Company net sales, led by the

performance of new products from Marine Electronics and Watercraft

business units, such as: -- The new Minn Kota(R) 15 amp series of

battery chargers offering the highest output and fastest recharge

available, with a new industrial design housing for easy drop-in

mounting to enhance the appeal in the OEM channel (boat

manufacturers). The new MK 230, MK 345 and MK 460 chargers are

driving double-digit growth in charger sales this year. -- The

Ocean Kayak(TM) Prowler(TM) series continues to grow in size and

popularity, with the Prowler(TM) Big Game(TM) featuring a unique,

flat foot-well area for standing or kneeling, and covered cockpit

storage. The Ocean Kayak(TM) Venus(TM) 11 and the Necky(R)

Eliza(TM) are the newest "designed for women" kayaks targeting the

fast-growing female paddler segment. New products represent more

than half of Ocean Kayak(TM) sales this year and more than

two-thirds of Necky(R) sales. WEBCAST The Company will host a

conference call and audio web cast on Wednesday, May 3, 2006 at

10:00 a.m. Central Time. A live listen-only web cast of the

conference call may be accessed at Johnson Outdoors' home page. A

replay will also be available on Johnson Outdoors' home page, or by

dialing (888) 286-8010 or (617) 801-6888 and providing confirmation

code 59171752. The replay will be available through May 10, 2006 by

phone and for 30 days on the Internet. ABOUT JOHNSON OUTDOORS INC.

Johnson Outdoors is a leading global outdoor recreation company

that turns ideas into adventure with innovative, top-quality

products. The Company designs, manufactures and markets a portfolio

of winning, consumer-preferred brands across four categories:

Watercraft, Marine Electronics, Diving and Outdoor Equipment.

Johnson Outdoors' familiar brands include, among others: Old

Town(R) canoes and kayaks; Ocean Kayak(TM) and Necky(R) kayaks;

Escape(R) electric boats; Minn Kota(R) motors; Cannon(R)

downriggers; Humminbird(R), Bottomline(R) and Fishin' Buddy(R)

fishfinders; Scubapro(R) and UWATEC(R) dive equipment; Silva(R)

compasses and digital instruments; and Eureka!(R) tents. Visit us

on line at http://www.johnsonoutdoors.com SAFE HARBOR STATEMENT

Certain matters discussed in this press release are

"forward-looking statements," intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. Statements other than statements of

historical fact are considered forward-looking statements. Such

forward-looking statements are subject to certain risks and

uncertainties, which could cause actual results or outcomes to

differ materially from those currently anticipated. Factors that

could affect actual results or outcomes include changes in consumer

spending patterns; the Company's success in implementing its

strategic plan, including its focus on innovation; actions of

companies that compete with the Company; the Company's success in

managing inventory; movements in foreign currencies or interest

rates; the Company's success in restructuring of its European

Diving operations; unanticipated issues related to the Company's

military sales; the success of suppliers and customers; the ability

of the Company to deploy its capital successfully; adverse weather

conditions; events related to the terminated Buy-Out transaction;

and other risks and uncertainties identified in the Company's

filings with the Securities and Exchange Commission. Shareholders,

potential investors and other readers are urged to consider these

factors in evaluating the forward-looking statements and are

cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements included herein are only

made as of the date of this press release and the Company

undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances. - - -

FINANCIAL TABLES FOLLOW - - - -0- *T JOHNSON OUTDOORS INC.

(thousands, except per share amounts)

----------------------------------------------------------------------

Operating Results THREE MONTHS ENDED SIX MONTHS ENDED

----------------------------------------------------------------------

March 31 April 1 March 31 April 1 2006 2005 2006 2005

----------------------------------------------------------------------

Net sales $107,374 $106,168 $179,937 $181,150 Cost of sales 63,033

60,394 106,167 105,104

----------------------------------------------------------------------

Gross profit 44,341 45,774 73,770 76,046 Operating expenses 36,070

37,376 66,310 67,722

----------------------------------------------------------------------

Operating profit 8,271 8,398 7,460 8,324 Interest expense, net

1,218 1,027 2,120 2,118 Other (income) expense, net 222 (603) 293

(721)

----------------------------------------------------------------------

Income before income taxes 6,831 7,974 5,047 6,927 Income tax

expense 2,657 3,236 1,968 3,221

----------------------------------------------------------------------

Net income $4,174 $4,738 $3,079 $3,706

----------------------------------------------------------------------

Basic earnings per common share $0.46 $0.55 $0.34 $0.43 Diluted

earnings per common share $0.46 $0.54 $0.34 $0.42

----------------------------------------------------------------------

Diluted average common shares outstanding 9,127 8,776 9,135 8,777

----------------------------------------------------------------------

Segment Results Net sales: Marine electronics $51,572 $47,141

$81,546 $74,991 Outdoor equipment 18,514 20,868 33,037 39,719

Watercraft 20,244 19,011 32,528 31,077 Diving 17,119 19,243 32,937

35,568 Other/eliminations (75) (95) (111) (205)

----------------------------------------------------------------------

Total $107,374 $106,168 $179,937 $181,150

----------------------------------------------------------------------

Operating profit (loss): Marine electronics $8,445 $9,214 $10,861

$12,101 Outdoor equipment 2,970 3,060 4,618 6,467 Watercraft

(1,140) (964) (3,631) (3,783) Diving 969 1,450 1,035 1,314

Other/eliminations (2,973) (4,362) (5,423) (7,775)

----------------------------------------------------------------------

Total $8,271 $8,398 $7,460 $8,324

----------------------------------------------------------------------

Balance Sheet Information (End of Period) Cash and short-term

investments $31,710 $11,338 Accounts receivable, net 99,367 89,141

Inventories, net 73,664 69,411 Total current assets 219,858 187,533

Total assets 321,387 286,238 Short-term debt 56,000 13,488 Total

current liabilities 123,350 72,600 Long-term debt 20,800 37,800

Shareholders' equity 169,341 168,447

----------------------------------------------------------------------

*T

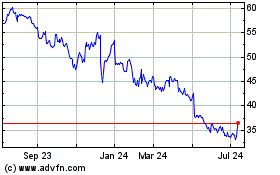

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Dec 2024 to Jan 2025

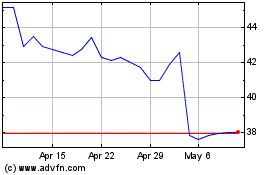

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2024 to Jan 2025