Johnson Outdoors Inc. (Nasdaq:JOUT), a leading global outdoor

recreation company, today announced sales of $77.1 million for the

fourth quarter ended September 30, 2005, an increase of 2% compared

to $75.6 million for the prior year quarter. Net earnings for the

quarter improved to a net loss of $3.4 million ($0.39 per diluted

share) versus a net loss of $3.8 million ($0.44 per diluted share)

for the prior year quarter. For the full year, the Company reported

sales of $380.7 million compared to $355.3 million for fiscal 2004,

representing a 7% increase year-over-year. Net earnings for the

year were $7.1 million ($0.81 per diluted share), an 18% decrease

versus prior year. FOURTH QUARTER RESULTS Fourth quarter results

historically reflect a loss due to the slowing of sales and

production of the Company's seasonal outdoor recreation products.

Sales growth in the Company's core brands more than offset the

expected decrease in military revenues for the quarter. Key changes

included: -- Watercraft continued on the upswing with sales 25%

ahead of last year's fourth quarter due to favorable reception of

new products. -- Marine Electronics saw a 34% jump in quarterly

sales due to double-digit growth of both Minn Kota(R) and

Humminbird(R) brands across key distribution channels. -- Diving

revenues increased slightly due to solid growth in North America

and favorable currency translation, as weakness in key

international markets continued. -- Outdoor Equipment revenues

decreased 35% due to the 46% decline in military tent sales. Total

Company operating loss of $4.6 million in the fourth quarter was

flat compared to the same period last year. Operating losses

resulted due to a number of factors, including among others: -- The

significant drop in military sales compared with the prior year

quarter resulting in a $2.9 million decline in Outdoor Equipment

profits. -- Increased commodity costs, particularly metal and resin

costs affecting the Company's Marine Electronics and Watercraft

divisions, along with higher freight charges. -- Restructuring

costs of $1.6 million compared with $2.5 million in the prior year

quarter as the Company continues efforts to improve efficiency and

profitability long-term in the Watercraft and Diving divisions. --

Sarbanes-Oxley Section 404 compliance costs of $0.9 million

compared to none in the prior year quarter. The Company reported a

net loss during the seasonally slow fourth quarter of $3.4 million

or $0.39 per diluted share, an improvement over the net loss of

$3.8 million or $0.44 per diluted share in the prior year quarter.

An improved tax effect on losses in the current year quarter was

the primary driver of the lower net loss. FULL YEAR RESULTS For the

year, the Company achieved net sales of $380.7 million compared to

$355.3 million for the full year 2004, an increase of 7%. Sales

growth in the Company's core brands more than offset the decrease

in military revenues for the year. Key factors impacting the solid

year-over-year sales results included: -- The successful

integration of the Humminbird(R) brand into the Company's Marine

Electronics division. As a result, Marine Electronics saw sales

increase 32% year-over-year driven primarily by a full year of

Humminbird(R) results versus only five months in the prior fiscal

year. Humminbird(R) performance was driven primarily by product

innovations, particularly the new Matrix(TM) 900 fishfinder series

which utilizes side-imaging technology never before available in

the consumer marketplace. -- The Watercraft division grew 6%

year-over-year as a result of a strong line-up of new canoe, kayak

and paddle sport accessory products which drove double-digit growth

in international markets and among the division's top 30 domestic

customers. The Old Town(R) Dirigo(TM) kayak introduced this year

was a major contributor to new product sales for the year. --

Diving sales were down slightly despite a strong performance in

North American markets and favorable currency translation which did

not fully offset weakness in international markets. The UWATEC(R)

Smart Tec(TM) computer is on track to become the Company's most

successful dive computer introduction in its history. -- Outdoor

Equipment reported a year-over-year 16% decline in division sales

driven primarily by the 21% decline in military sales. Operating

profit for the year was $15.5 million compared to $19.1 million in

2004 during which Diving profits benefited from a $2.0 million

litigation settlement with a former employee. Other key factors

driving the year-over-year changes in operating profit included: --

The conclusion of contracts for higher margin military tents and

the overall decrease in military sales. -- Restructuring and

severance costs of $4.1 million in 2005 versus $2.9 million in

fiscal 2004. -- $2.7 million in costs related to the terminated

buy-out transaction which compared unfavorably to $1.5 million in

related costs reported during fiscal 2004. -- Sarbanes-Oxley

Section 404 compliance costs in 2005 of $1.2 million. "We are

committed to enhancing profitability and shareholder value

long-term by expanding our markets, our great brand equities and

our leading technology portfolio. We believe we have created good

momentum in our core businesses around these key strategic growth

areas, despite difficult year-over-year comparisons due to record

high military sales last year and unusual one-time items in both

years. Importantly, excluding unusual one-time items in this and

the previous fiscal year, profitability would have improved," said

Helen Johnson-Leipold, Chairman and Chief Executive Officer.

Further commenting, Ms. Johnson-Leipold said: "Cost reduction

programs across all businesses were also critical, particularly in

the face of dramatically higher commodity and compliance costs,

enabling us to invest appropriately in strengthening our operations

and competitive position in the future. Throughout the year we

continued to benefit from the acquisition of Humminbird(R), and

from investments made to simplify, streamline and increase

efficiency in Watercraft. Similar restructuring efforts are well

underway to strengthen European Diving, bolstered by a new

management team in that region. As a result of our progress across

all divisions this year, we are better-positioned to capitalize on

growth opportunities for the future." OTHER FINANCIAL INFORMATION

The Company's debt to total capitalization stood at 23% at the end

of the year versus 29% at October 1, 2004. Cash, net of debt,

increased $18.8 million to $21.3 million by year end. Depreciation

and amortization was $9.5 million year-to-date, slightly higher

than last year's $8.7 million due to the impact from the

acquisition of Humminbird(R). Capital spending totaled $6.8 million

in 2005 compared with last year's $7.8 million. "Our continued

focus on inventory management and other cost-control measures

enabled us to reduce working capital and deliver over $25 million

in operating cash flow despite much higher commodity costs this

year. Our strong cash position and lower debt level should give us

the financial strength and flexibility to execute our strategic

growth plans," said David Johnson, Interim Chief Financial Officer

MILITARY OUTLOOK The quarterly and year-over-year decline in

military tent sales is consistent with the Company's stated

projections throughout fiscal 2004 and 2005. During the fourth

quarter of the current year, the Company reported it was one of

four vendors awarded a multi-product military contract. As

announced on October 6, 2005, orders to-date against the new

contract totaled $12.5 million. The Company plans to bid on other

future contracts, and at this time, expects fiscal 2006 military

sales to be in the $30 - 40 million range. CONSUMER MARKET DYNAMICS

Johnson Outdoors' unique market research capability is used to

identify and track relevant consumer market dynamics to enable

development of meaningful and successful new product innovations. A

number of these dynamics highlight a positive outlook for growth in

outdoor recreation markets. These include: -- A marked increase in

participation in outdoor activities and purchases among females and

aging, affluent baby boomers. -- Advancements in technology

allowing for the development of more comfortable products that

incorporate additional features and benefits. -- The desire by

retailers and consumers for products and activities which are

instantly gratifying, including activities that can be 'learned in

an hour, done in a day.' -- The move among outdoor enthusiasts to

consistently 'trade up' equipment to have the 'newest and best'

available. The Company's market research expertise represents a

competitive advantage in developing winning new products, as

demonstrated by many of this year's successful introductions,

including, among others: the Ocean Kayak(R) Venus(TM) II sit-on-top

kayak for women; the Ocean Kayak(R) Prowler(TM) fishing kayak; the

Old Town(R) Dirigo(TM) for beginner and intermediate kayakers; the

Minn Kota(R) Maxxum Pro(TM) easy-to-lift fishing motor; the

Extrasport(R) comfort seating systems for kayaks; and the

new-to-world Escape(R) line of electric boats. WEBCAST The Company

will host a conference call and audio web cast on Thursday,

November 17, 2005 at 10:00 a.m. Central Time. A live listen-only

web cast of the conference call may be accessed at Johnson

Outdoors' home page. A replay will also be available on Johnson

Outdoors' home page, or by dialing (888) 286-8010 or (617) 801-6888

and providing confirmation code 42480047. The replay will be

available through November 24, 2005 by phone and for 30 days on the

Internet. ABOUT JOHNSON OUTDOORS INC. Johnson Outdoors is a leading

global outdoor recreation company that turns ideas into adventure

with innovative, top-quality products. The company designs,

manufactures and markets a portfolio of winning, consumer-preferred

brands across four categories: Watercraft, Marine Electronics,

Diving and Outdoor Equipment. Johnson Outdoors' familiar brands

include, among others: Old Town(R) canoes and kayaks; Ocean

Kayak(R) and Necky(R) kayaks; Escape(R) electric boats; Minn

Kota(R) motors; Cannon(R) downriggers; Humminbird(R), Bottomline(R)

and Fishin' Buddy(R) fishfinders; Scubapro(R) and UWATEC(R) dive

equipment; Silva(R) compasses and digital instruments; and

Eureka!(R) tents. Visit us on line at

http://www.johnsonoutdoors.com SAFE HARBOR STATEMENT Certain

matters discussed in this press release are "forward-looking

statements," intended to qualify for the safe harbors from

liability established by the Private Securities Litigation Reform

Act of 1995. Statements other than statements of historical fact

are considered forward-looking statements. Such forward-looking

statements are subject to certain risks and uncertainties, which

could cause actual results or outcomes to differ materially from

those currently anticipated. Factors that could affect actual

results or outcomes include changes in consumer spending patterns;

the Company's success in implementing its strategic plan, including

its focus on innovation; actions of companies that compete with the

Company; the Company's success in managing inventory; movements in

foreign currencies or interest rates; the Company's success in

restructuring of its European Diving operations; unanticipated

issues related to the Company's military tent business; the success

of suppliers and customers; the ability of the Company to deploy

its capital successfully; adverse weather conditions; unanticipated

events related to the terminated Buy-Out transaction; and other

risks and uncertainties identified in the Company's filings with

the Securities and Exchange Commission. Shareholders, potential

investors and other readers are urged to consider these factors in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. The

forward-looking statements included herein are only made as of the

date of this press release and the Company undertakes no obligation

to publicly update such forward-looking statements to reflect

subsequent events or circumstances. - - - FINANCIAL TABLES FOLLOW -

- - -0- *T JOHNSON OUTDOORS INC. AND SUBSIDIARIES (thousands,

except per share amounts) Operating Results THREE MONTHS ENDED YEAR

ENDED

----------------------------------------------------------------------

Sept 30 Oct 1 Sept 30 Oct 1 2005 2004 2005 2004

----------------------------------------------------------------------

Net sales $77,095 $75,572 $380,690 $355,274 Cost of sales 48,505

47,405 224,336 207,656

----------------------------------------------------------------------

Gross profit 28,590 28,167 156,354 147,618 Operating expenses

33,201 32,756 140,823 128,490

----------------------------------------------------------------------

Operating profit (loss) (4,611) (4,589) 15,531 19,128 Interest

expense, net 1,111 1,176 4,225 4,598 Other expense (income), net

116 (299) (796) (206)

----------------------------------------------------------------------

Income (loss) before income taxes (5,838) (5,466) 12,102 14,736

Income tax expense (benefit) (2,439) (1,708) 5,001 6,047

----------------------------------------------------------------------

Net income (loss) $(3,399) $(3,758) $7,101 $8,689

----------------------------------------------------------------------

Basic earnings (loss) per common share: $(0.39) $(0.44) $0.82 $1.01

----------------------------------------------------------------------

Diluted earnings (loss) per common share: $(0.39) $(0.44) $0.81

$0.99

----------------------------------------------------------------------

Diluted average common shares outstanding 8,629 8,591 8,795 8,774

----------------------------------------------------------------------

Segment Results Net sales: Marine electronics $22,481 $16,774

$145,231 $109,778 Outdoor equipment 14,906 23,019 75,340 90,193

Watercraft 18,485 14,802 80,849 75,964 Diving 21,054 20,857 79,404

80,074 Other/eliminations 169 120 (134) (735)

----------------------------------------------------------------------

Total $77,095 $75,572 $380,690 $355,274

----------------------------------------------------------------------

Operating profit (loss): Marine electronics $756 $(1,239) $21,572

$17,762 Outdoor equipment 1,740 4,673 11,208 16,365 Watercraft

(2,323) (4,853) (4,353) (9,787) Diving (203) 263 4,901 9,949

Other/eliminations (4,581) (3,433) (17,797) (15,161)

----------------------------------------------------------------------

Total $(4,611) $(4,589) $15,531 $19,128

----------------------------------------------------------------------

Balance Sheet Information (End of Period) Cash and short-term

investments $72,111 $69,572 Accounts receivable, net 48,274 49,727

Inventories, net 51,885 60,426 Total current assets 186,035 194,641

Total assets 283,318 293,714 Short-term debt 13,000 16,222 Total

current liabilities 69,196 75,332 Long-term debt 37,800 50,797

Shareholders' equity 166,434 160,644

----------------------------------------------------------------------

*T

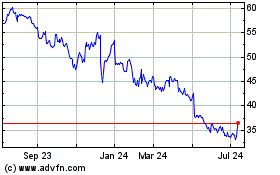

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Dec 2024 to Jan 2025

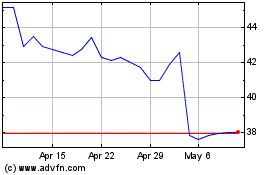

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2024 to Jan 2025