false000083785200008378522023-11-242023-11-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 24, 2023

IDEANOMICS, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Nevada | 001-35561 | 20-1778374 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

114 Broadway, Suite 5116 | |

New York, NY | 10018 |

| (Address of principal executive offices) | (Zip Code) |

212-206-1216

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | IDEX | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On November 21, 2023, Ideanomics, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under Item 2.02 and Item 9.01, including Exhibit 99.1 hereto, of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference into any registration statement or other filings of the Company made under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On November 21, 2023, the Company held a conference call to discuss the Company’s financial results for the quarter ended September 30, 2023 A copy of the conference call transcript is attached hereto as Exhibit 99.2. An archived version of the conference call webcast is available on the Investor Relations section of the Company’s website.

The information furnished under Item 7.01 and Item 9.01, including Exhibits 99.2 and 99.3 hereto, of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference into any registration statement or other filings of the Company made under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. The furnishing of the transcript is not intended to constitute a representation that such furnishing is required by Regulation FD or that the transcript includes material investor information that is not otherwise publicly available.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

This Current Report on Form 8-K contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. While the Company believes its plans, intentions and expectations reflected in those forward-looking statements are reasonable, these plans, intentions or expectations may not be achieved. The Company’s actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. For information about the factors that could cause such differences, please refer to the Company’s Annual Report on Form 10-K for the year ended year ended December 31, 2022, including the information discussed under the captions “Item 1 Business,” “Item 1A. Risk Factors” and “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as the Company’s various other filings with the SEC. Given these uncertainties, you should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update any forward-looking statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | IDEANOMICS, INC. |

| | |

| | By: | /s/ Alfred P. Poor |

Date: November 24, 2023 | Name: Alfred P. Poor |

| | Title: Chief Executive Officer |

Exhibit 99.1

Ideanomics, Inc. Reports Q3 2023 Financial Results

New York, NY November 21, 2023/PRNewswire/ -- Ideanomics (NASDAQ: IDEX) ("Ideanomics" or the "Company"), a global company focused on accelerating the commercial adoption of electric vehicles, announced today its third quarter 2023 operating results for the period ended September 30, 2023.

During the third quarter Ideanomics continued executing its commitment to shareholders to exit non-core businesses and finalize a reorganization of the business to focus on last-mile and local delivery vehicles and associated charging products.

Third Quarter Highlights

•Energica selected by police services in France and Barbados to provide electric motorcycles for police fleets.

•WAVE completes an OEM-approved installation of wireless charging on a Kenworth truck in collaboration with Kenworth and Dana.

•WAVE continues testing with major logistics fleet customer.

Ideanomics Third Quarter 2023 Operating Results

Revenue for continuing operations in the quarter, excluding a change in accounting estimate, was $3.5 million, 57 percent lower than the same time last year. Revenue for continuing operations for the first nine months of 2023, excluding a change in accounting estimate, was 14.5 million dollars, 24 percent lower than the same period last year.

Gross Profit

Gross Profit from continuing operations, excluding the change in accounting estimate, was a loss of 0.5 million dollars, representing a gross margin of negative 14.8% percent. This is an increase of roughly 0.1 million dollars compared to a loss of 0.6 million dollars last year.

Note: As described in the company’s 10-Q filing, some business components have been classified as discontinued operations, and a change in accounting estimate occurred as a result of new sales data. This means certain revenues are no longer included in our results, and the figures above represent continuing operations only and exclude the change in accounting estimate, to ensure an appropriate comparison between periods.

Conference Call Information

Ideanomics' management, including Alf Poor (Chief Executive Officer) and Scott Morrison (Chief Financial Officer), will host a live earnings release conference call at 4:30 pm ET, Tuesday, November 21, 2023. Time permitting, Ideanomics management will answer questions during the Q&A session. A replay of the earnings call will be available soon after the conclusion of the event.

To join the call, please visit https://investors.ideanomics.com/Q32023 for dial-in information.

About Ideanomics

Ideanomics (NASDAQ: IDEX) is a global group with a simple mission: to accelerate the commercial adoption of electric vehicles. By bringing together vehicles and charging technology with design, implementation, and financial services, we provide the completeness of solutions needed for the commercial world to commit to an EV future. To keep up with Ideanomics, please follow the company on social @ideanomicshq or visit https://ideanomics.com.

Safe Harbor Statement

This press release contains "forward-looking statements" within the meaning of the federal securities laws. All statements other than statements of historical fact included herein are "forward-looking statements." These forward-looking statements are often identified by the use of forward-looking terminology such as "believes," "expects," or similar expressions, involve known and unknown risks and uncertainties, and include the statement regarding the completion of the business combination within a certain period of time, if ever. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, they do involve assumptions, risks, and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company's actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of risks and uncertainties, such as risks related to: our ability to obtain necessary regulatory approvals and other risks and uncertainties disclosed under the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent Form 10-K and Form 10-Q filed with the Securities and Exchange Commission, and similar disclosures in subsequent reports filed with the SEC, which are available on the SEC website at www.sec.gov. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these risk factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking statements.

Contact:

Tony Sklar, SVP of Investor Relations

1441 Broadway, Suite 5116, New York, NY 10018

ir@ideanomics.com

IDEANOMICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Revenue from sales of products | $ 583 | | $ 7,625 | | $ 11,038 | | $ 17,428 |

Revenue from sales of services | 19 | | 426 | | 99 | | 1,205 |

| Other revenue | 63 | | 170 | | 506 | | 310 |

| Total revenue | 665 | | 8,221 | | 11,643 | | 18,943 |

Cost of revenue from sales of products | 1,047 | | 8,712 | | 11,841 | | 17,834 |

Cost of revenue from sales of services | 255 | | 110 | | 451 | | 829 |

| Cost of other revenue | 816 | | 56 | | 1,639 | | 198 |

| Total cost of revenue | 2,118 | | 8,878 | | 13,931 | | 18,861 |

| Gross (loss) profit | (1,453) | | (657) | | (2,288) | | 82 |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Selling, general and administrative expenses | 8,146 | | 31,024 | | 69,830 | | 91,604 |

| Research and development expense | 1,540 | | 830 | | 9,563 | | 2,420 |

| Asset impairments | 104,386 | | 298 | | 142,370 | | 699 |

| Goodwill impairments | 10,712 | | — | | 10,712 | | — |

| Depreciation and amortization | 5,635 | | 1,652 | | 15,399 | | 4,011 |

| Change in fair value of contingent consideration, net | (61,469) | | — | | (74,416) | | (131) |

| Other general expenses | (261) | | — | | 89 | | — |

| Total operating expenses | 68,689 | | 33,804 | | 173,547 | | 98,603 |

| | | | | | | |

| Loss from operations | (70,142) | | (34,461) | | (175,835) | | (98,521) |

| | | | | | | |

| Interest and other income (expense): | | | | | | | |

| Interest income | — | | 941 | | 401 | | 2,522 |

| Interest expense | (1,366) | | (222) | | (2,636) | | (1,256) |

| Gain on remeasurement of investment | — | | — | | — | | 10,965 |

| Loss on disposal of investment | (1,153) | | (30) | | (1,153) | | (218) |

| Other income, net | 9,560 | | 567 | | 11,598 | | 1,143 |

| Loss before income taxes | (63,101) | | (33,205) | | (167,625) | | (85,365) |

| | | | | | | |

| Income tax benefit | 876 | | 312 | | 4,258 | | 742 |

| Impairment of and equity in loss of equity method investees | — | | (429) | | — | | (2,357) |

| | | | | | | |

| Net loss from continuing operations | (62,225) | | (33,322) | | (163,367) | | (86,980) |

| Net loss from discontinued operations, net of tax | (2,368) | | (5,531) | | (24,206) | | (20,237) |

| Net loss | (64,593) | | (38,853) | | (187,573) | | (107,217) |

| | | | | | | |

| Net loss attributable to non-controlling interest | 1,586 | | 1,439 | | 4,753 | | 3,525 |

| | | | | | | |

| Net loss attributable to Ideanomics, Inc. common shareholders | $ (63,007) | | $ (37,414) | | $ (182,820) | | $ (103,692) |

| | | | | | | |

| Basic and diluted loss per share from continuing operations | $ (5.19) | | $ (8.07) | | $ (17.07) | | $ (21.02) |

| Basic and diluted loss per share from discontinued operations | $ (0.20) | | $ (1.40) | | $ (2.61) | | $ (5.10) |

| Basic and diluted loss per share | $ (5.39) | | $ (9.47) | | $ (19.68) | | $ (26.11) |

| Weighted average shares outstanding: | | | | | | | |

| Basic and diluted | 11,692,394 | | 3,952,490 | | 9,291,974 | | 3,971,139 |

IDEANOMICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | | | | | | | | | |

(in thousands, except share and per share data) | September 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ 1,884 | | $ 3,245 |

| Accounts receivable, net | 3,066 | | 4,269 |

| Contract assets | 1,926 | | 3,579 |

| Amount due from related parties | 90 | | 90 |

| Notes receivable from third parties, net | 41 | | 31,653 |

| Inventory, net | 16,781 | | 23,192 |

| Prepaid expenses | 6,863 | | 9,618 |

| Other current assets | 5,046 | | 5,096 |

| Current assets of discontinued operations | 10,463 | | 33,296 |

| Total current assets | 46,160 | | 114,038 |

| Property and equipment, net | 11,128 | | 7,845 |

| Intangible assets, net | 39,980 | | 43,622 |

| Goodwill | 37,254 | | 37,775 |

| Operating lease right of use assets | 10,814 | | 10,533 |

| Long-term investments | — | | 7,500 |

| Other non-current assets | 2,866 | | 2,276 |

| Non-current assets of discontinued operations | 3,082 | | 19,212 |

| Total assets | $ 151,284 | | $ 242,801 |

| | | |

| LIABILITIES, CONVERTIBLE REDEEMABLE PREFERRED STOCK, AND EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ 56,271 | | $ 25,448 |

| Accrued salaries | 4,119 | | 6,851 |

| Accrued expenses | 2,436 | | 2,674 |

| Deferred revenue | 2,900 | | 2,105 |

| Amount due to related parties | 1,942 | | 1,927 |

| Current portion of operating lease liabilities | 2,828 | | 2,031 |

| Promissory note due to related party | 2,286 | | 2,021 |

| Promissory note due to third parties | 7,957 | | 5,814 |

| Convertible note due to third party | 6,149 | | 3,928 |

| Current contingent consideration | 78 | | 867 |

| Other current liabilities | 14,874 | | 9,288 |

| Current liabilities of discontinued operations | 7,499 | | 13,909 |

| Total current liabilities | 109,339 | | 76,863 |

| Promissory note due to third parties | 1,673 | | 1,957 |

| Operating lease liabilities - long term | 11,244 | | 8,566 |

| Deferred tax liabilities | 2,841 | | 2,511 |

| Other long-term liabilities | 1,116 | | 1,131 |

| Non-current liabilities of discontinued operations | 1,938 | | 5,210 |

| Total liabilities | 128,151 | | 96,238 |

Commitments and contingencies (Note 14) | | | |

| Convertible redeemable preferred stock | | | |

Series A - 7,000,000 shares issued and outstanding, liquidation and deemed liquidation preference of $3,500,000 as of September 30, 2023 and December 31, 2022 | 1,262 | | 1,262 |

Series B - 50,000,000.00 shares authorized, 20,000,000 and 10,000,000 shares issued and 2,105,200 and 10,000,000 shares outstanding as of September 30, 2023 and December 31, 2022, respectively | 1,863 | | 8,850 |

Series C - 2,000,000 shares authorized, 1,159,276 and 0 shares issued and 608,680 and 0 shares outstanding as of September 30, 2023 and December 31, 2022, respectively | 4,825 | | — |

| Equity | | | |

Common stock - $0.001 par value; 12,000,000 shares authorized, 11,992,765 and 4,786,290 shares issued and 11,923,955 and 4,786,290 shares outstanding as of September 30, 2023 and December 31, 2022, respectively | 1,499 | | 597 |

| Additional paid-in capital | 1,071,219 | | 1,004,082 |

| Accumulated deficit | (1,049,603) | | (866,450) |

| Accumulated other comprehensive loss | (6,684) | | (6,104) |

| Total Ideanomics, Inc. stockholders' equity | 16,431 | | 132,125 |

| Non-controlling interest | (1,248) | | 4,326 |

| Total equity | 15,183 | | 136,451 |

| Total liabilities, convertible redeemable preferred stock, and equity | $ 151,284 | | $ 242,801 |

Exhibit 99.2

Ideanomics

Third Quarter 2023 Earnings

Presenters

Alf Poor, CEO

Tony Sklar, SVP of Investor Relations

Scott Morrison, CFO

Operator

Greetings and welcome to Ideanomics' Third Quarter 2023 Earnings Call. At this time, all participants are in a listen-only mode. A question and answer session will follow the formal presentation. If anyone should require operator assistance during the conference, please press star, zero, on your telephone keypad. As reminder, this conference is being recorded.

It is now my pleasure to introduce Tony Sklar, Senior Vice President of Investor Relations. Thank you. You may begin.

Tony Sklar

Thank you very much, operator, and welcome everyone to the Ideanomics' Third Quarter Earnings Conference Call. Joining me today, I am pleased to have Mr. Alf Poor, Chief Executive Officer, Mr. Scott Morrison, Chief Financial Officer. The recording of today's call will be archived and available in our events and presentations section of our corporate website for a minimum of 30 days. During the call, we will make forward-looking statements such as dialogue regarding our revenue expectations or forecasts for the remaining quarters and the full fiscal year of 2023, and 2024.

These statements are based on our current expectations and information available as of today, and are subject to a variety of risks, uncertainties and assumptions. Actual results may differ materially as a result of various risk factors that have been described in our periodic filings with the SEC. As a result, we caution you against placing undue reliance on these forward-looking statements. We assume no obligation to update any forward-looking statements as a result of new information or future events except as required by law.

In addition, other risks are more fully described in our Ideanomics' periodic filings with the U.S. Securities and Exchange Commission, which can be viewed at www.sec.gov. Today, November 21, 2023, the company filed with the SEC on form 10-Q, its results for Q3 2023, and afterwards, issued a press release announcing those financial results. So participants of this call who may not have already done so, may wish to look at those documents as we provide a summary of the results on this call. The format of today's call will be as follows, Mr. Alf Poor will begin our comments today and speak to the company's progress and strategic developments. Mr. Scott Morrison, our CFO, will speak to the company's operating and financial results for third quarter 2023. And then finally, Mr. Alf Poor will make management's closing remarks.

I now hand the phone and line over to Alf Poor, Ideanomics' CEO. Thank you.

Alf Poor

Thank you, Tony, and thank you to everyone joining our Q3 2023 Earnings Call today. As I've mentioned on previous earnings calls this year, we are currently in the midst of executing a

InComm Conferencing Page 1 www.incommconferencing.com

series of divestitures, with a strong push to complete them before the end of this year. This is a strategic move to streamline our operations. It will provide us with relief from the liabilities in those businesses and enable us to enter Q1 of next year as a leaner, more focused Ideanomics.

With the capital from these divestitures, we can begin addressing our remaining liabilities for suppliers and partners, as well as invest into growing our business. As I have mentioned previously, our core concentration going forward will be on local and last mile delivery, as well as charging solutions. This realignment is crucial for positioning Ideanomics, so that we may take advantage of the anticipated growth in a rapidly evolving EV market.

In response to what are currently very difficult market conditions in the EV sector, we have undertaken a comprehensive reorganization. This has involved making some challenging decisions, but they are unnecessary steps in preparing Ideanomics for the changing landscape of the EV industry. We've observed a great deal of turbulence in our sector, with some companies seizing operations and others consolidating. Our proactive approach in navigating these tough conditions, particularly in cost management, is aimed at safeguarding and enhancing shareholder value.

Current market conditions have made it difficult for us to raise capital to invest in our businesses, which has resulted in reduced revenue for this quarter. However, under Robin's stewardship, our business leaders have been resourceful and have continued to make progress, and I'd like to share a few examples with you now. Energica continues to expand its dealer network has been selected by more and more governments to provide electric police motorcycles. This quarter, Energica's bikes were selected as the electric motorcycle provider for a number of law enforcement divisions in France and by the Barbados police service.

Moving on to WAVE, on previous earnings calls, Rob and I have spoken to pilot projects we've secured with large logistics fleets. The team has made great progress on these projects. In collaboration with Boehner and Kenworth, the WAVE team have perfected an OEM approved installation of wireless charging onto a medium-duty battery electric truck for testing by a mutual customer. As far as we know, this is the first in the industry. Our customer is currently putting both our wireless charging installation and the Kenworth trucks that charges, through their paces, and we hope to be able to bring you some compelling PR and media assets of this project in the near future as a project expands and matures.

The WAVE installation is underpinned by the telematics and energy cloud platform that the Ideanomics' digital team has developed in-house. The WAVE team and our customers can use the platform to manage their vehicle and charging assets in a fully integrated manner, and we built the platform for easy integration into our customers' own systems. While the third quarter was a challenging quarter, within what has been a very challenging year, I'm proud of the work our teams are doing to keep things moving forward in spite of the difficulties we have faced. In focusing on reducing our cost base, or simultaneously generating capital from our divestitures, our objective is to make Ideanomics more dynamic, more agile, and positioned for profitable growth, rather than growth at any cost.

Despite the tough market conditions that have coincided with a critical phase in our journey, we're focused on laying the groundwork for future success. Lastly, we remain open and vigilant to opportunities for consolidation in adjacent sectors that promise to differentiate our offerings and accelerate our growth. Our goal is to seize on these opportunities judiciously, ensuring that they align with our core focus and long-term vision and to only act as they will enhance shareholder value.

InComm Conferencing Page 2 www.incommconferencing.com

I will now hand you over to Scott Morrison, who will take you through our financial results for the quarter before I provide my closing remarks and our outlook for 2024.

Scott Morrison

Thank you, Alf, and thank you to everyone listening to this call. Revenue for continuing operations in the quarter, excluding a change in accounting estimate was $3.5 million, 57% lower than the same time last year. Revenue for continuing operations for the first nine months of 2023, excluding a change in accounting estimate was $14.5 million, 24% lower than the same period last year.

The change in accounting estimate is an adjustment to prior revenue recognized in the Select Track business unit. Because there was no history of customer return rates when its dealer program began in 2022, Select Track did not have past data on which to base its reserve for return. Accounting for the history of returns that has now been established, it became apparent that a reserve should be recorded on the balance sheet. This resulted in a change of accounting estimate to the revenue recognized to date. This debited sale is $2.8 million and credited cost of goods sold, $1.9 million. Creating a liability and an asset on the balance sheet, each quarter, the reserve amounts will be assessed and adjusted according to historical run rates, dealer inventory, and current market conditions.

The reduction in revenue for continuing operations this quarter was largely due to the capital constraints Alf mentioned previously. Our businesses continued to maintain and expand their sales pipelines, so we believe that demand remains very strong, but we have been constrained in our ability to service that demand quickly due to limited capital availability. We hope that generating capital through asset divestiture and direct investment, our businesses will be better able to serve as the demand they've been experiencing.

Third quarter gross profit from continuing operations, excluding the change in accounting estimate was a loss of $0.5 million, representing a gross margin of negative 14.8%. This is an improvement of roughly $0.1 million compared to a loss of $0.6 million last year. The third quarter operating expenses from continuing operations, excluding impairments and an adjustment to contingent liabilities were $16.9 million, a reduction of 46% from the $31.4 million spent in the second quarter. Reducing costs and efficiently managing resources enables us to navigate the current challenges that Alf had discussed, positioning us to use our capital more effectively to benefit Ideanomics and our shareholders.

Now, back to Alf for closing remarks.

Alf Poor

Thank you, Scott. Having spoken about this year so far, I want to take a few moments to speak about the fourth quarter, our upcoming shareholder meeting and our prospects for 2024 and beyond. We are midway through Q4, and my primary focus for the remainder of the year is twofold. Firstly, divesting those assets we will let go in order to ensure we are completely focused on our core business objectives. And secondly, growing the order book in our businesses and successfully delivering on those orders to help finalize the reshaping of the business for growth in 2024.

There are some important proposals in our upcoming shareholder vote that are critical we receive your support on. While we have a proposal for future financing, this is to provide us with the optionality needed in uncertain capital markets. Our focus now is to demonstrate confidence to the market such that we see positive gains in our share price. Our share price is

InComm Conferencing Page 3 www.incommconferencing.com

beaten down, and our enterprise significantly undervalued. This will be seen in the divestitures, which we anticipate realizing more capital than our current market cap.

The intention then is to get proof points out into the market that reflect positively in our share price and talk to our investor base before future equity financing. The management team, including myself and our Chairman, have suffered the same as all shareholders, in that we have seen our holdings in Ideanomics eroded in value in 2022, and 2023. Going forward, we are going to focus on share price growth as a key driver in all of our decision-making.

2022 and 2023 were difficult to survive. 2024 is the time to thrive, and I believe we have the technology, the products and people, and most importantly, the customer base to come out of this with a company we can all be proud of. 2024, we'll see resets and executive compensation, which will include performance related bonus and compensation that rewards share price growth. This includes my own compensation, which has been largely deferred since October of 2022.

I haven't been comfortable receiving compensation while reducing employee headcount and asking suppliers and partners to stretch their terms to help Ideanomics survive. Once the divestitures are complete, we expect to provide shareholders with a clearer picture of our revenues, our customers, our orderbook and our ability to execute. While the divestitures will see revenues leaving the group, it will allow new and existing shareholders to benefit from a leaner, more focused company, with a core focus that is not as fragmented as we have today.

Going into 2024, we have outstanding people, products and technologies remaining in the group, such that we can build a compelling business that is understood by our customers, shareholders and industry analysts alike. Our target market will be the large fleet buyers who have been supportive of our products during the last couple of years of testing and evaluation. Those customers have the financial capacity to place large orders, which can enable us to predict everything from our cost, through to our revenues and profitability.

Now that we've begun to penetrate the fleet operators with meaningful sales activities, it is time for us to perform in all aspects of business, and we will focus on excellence in all we do, ranging from our pre-sale activities through to our post-sale delivery, installation and maintenance programs. We've built an enviable technologies at Ideanomics, that customers can rely on for their transition to zero emission transportation. We'd like you all to come on the next stage of that journey with us as we mature our business lines and strive to profitably grow our business. That's all for my remarks today. Thank you all for tuning in. And from everyone at Ideanomics, have a happy Thanksgiving, and thank you for your continued interest and support.

Tony Sklar

Thank you very much, Alf Poor, and to Scott Morrison. We do have time for two questions that were the top two questions sent into the Ideanomics' inbox. I'm going to pose these questions to the executives on the call. Question number one, given the reverse split resulted in less than 15 million shares being outstanding, what is your expectation for share price appreciation on the float of that size?

Alf Poor

That's a very interesting question. Thank you, Tony, and thank you for whoever sent that in. While obviously the reverse split was necessary for us to remain on the NASDAQ, one of the few upsides of post that reverse split, is when you do have a much smaller float, as we start to post improved earnings, as we start to show these proof points and inflection points in our business as we begin to deploy with our clients, the opportunity for customers to buy in to our

InComm Conferencing Page 4 www.incommconferencing.com

stock and shareholders to buy into our stock with such a small float means that it's more advantageous for share price appreciation. The smaller the float is, there are less shares available in the market and they'll have to compete harder in price to buy those shares.

So typically, when you have a smaller float, that is one of the upside advantages. There isn't a great deal of upside advantage for reverse split, of course, but as we come out of that, and the necessity to do it, I think the interesting thing is our business starts to evolve, results start to improve, and our customer visibility and our pipeline visibility is made available to the market. I think this is interesting. I think the dynamic will be, with so few shares, investors coming in will help push the share price up. That's typically what you would expect to see with a float of this size.

Tony Sklar

Fantastic. Thank you. And the next question, why do you feel your focus should be on local last mile and local delivery?

Alf Poor

That's a very good question as well. I've touched on this before. If you look at the different businesses, and some of them that we're in process to divest, as we said before, Energica, Select Track are two good examples. They're focused on a dealer distributor model, which means that they're selling out primarily to retail customers or retail type customers. In the case of Select Track, who sell tractors to farms.

We do do some direct sales through those companies, but we're reliant on the dealer distributors for the bulk of the revenues and the bulk of the sales that are made. And so we see those as opportunities that were in the millions to the hundreds of millions of dollars over time. Whereas the local last mile delivery and the charging of those fleets, we see that as the really big opportunity and that's why we're very focused on that. I think as the group starts to become smaller, and we do sell off some of those assets, to give us the capital to to get our expenses under control, our liabilities under control and allow us to invest in those businesses again, I think the opportunity to go after is the big local last mile delivery from the charging of those vehicles. That's the billion dollar opportunity. That's what I think Ideanomics' management and Ideanomics' shareholders would expect us to do and that's absolutely what we're doing.

Tony Sklar

Thank you very much, Alf Poor and Scott Morrison, this is all the time that we have for today, and this concludes the Ideanomics Q3 2023 Investor Earnings Conference Call. We encourage our community to continue to reach out to us and we can answer any additional questions that you may have individually. You can send your questions into us at IR@ideanomics.com. We would like to thank all of our listeners, shareholders, analysts and others who have taken the time to listen to this earnings call.

We urge you to refer to our latest SEC filings for any information that you need. This call will be available from our website in the investors' section, and you will find the link there. To be alerted to news, events and other information in a timely manner, we recommend you following us on our social media channels, sign up for our newsletter, and explore our website at www.ideanomics.com. Thank you everyone for participating and listening on this call today.

Operator

Ladies and gentlemen, this does conclude today's teleconference. Thank you for your participation. You may disconnect your lines at this time and have a wonderful day.

InComm Conferencing Page 5 www.incommconferencing.com

Cover

|

Nov. 24, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 24, 2023

|

| Entity Registrant Name |

IDEANOMICS, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-35561

|

| Entity Tax Identification Number |

20-1778374

|

| Entity Address, Address Line One |

114 Broadway

|

| Entity Address, Address Line Two |

Suite 5116

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

212

|

| Local Phone Number |

206-1216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

IDEX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000837852

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

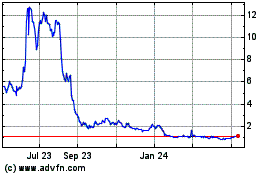

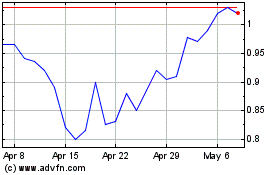

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2024 to May 2024

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From May 2023 to May 2024