0001716583FALSE00017165832023-10-252023-10-250001716583us-gaap:CommonStockMember2023-10-252023-10-250001716583us-gaap:WarrantMember2023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

___________________________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-3962 | 82-2726724 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

475 Quaker Meeting House Road Honeoye Falls, NY | | 14472 |

| (Address of principal executive offices) | | (Zip Code) |

(585)-484-9337 |

(Registrant's telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | HYZN | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | HYZNW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 24, 2023, Hyzon Motors Inc. (“Hyzon” or the “Company”) announced the appointment of Stephen Weiland, age 44, as Chief Financial Officer, effective November 1, 2023. Effective as of November 1, 2023, JiaJia Wu, who has served Interim Chief Financial Officer and Chief Accounting Officer since April 2023, will assume the role of Senior Vice President, Finance and Accounting, reporting to Mr. Weiland.

From 2022 to 2023, Mr. Weiland served as Chief Financial Officer for BOOM Supersonic, a supersonic aircraft manufacturer, where he led Financial Planning & Analysis, Accounting, and IT/Security. Prior to this role, from 2015 to 2022, Mr. Weiland worked at Caterpillar, a manufacturer of construction, mining, and other equipment, where he served as Division CFO, Integrated Components & Solutions from 2020 to 2022, and Division CFO of Caterpillar’s Cat Digital division from 2018 to 2020. From 2015 to 2018, Mr. Weiland led the transaction process, including acquisitions and divestitures, as Director of Corporate Development, Caterpillar Strategic Investments. Prior to his roles at Caterpillar, from 2012 to 2014, Mr. Weiland served as Director, Investment Banking at KPMG Corporate Finance, and prior to this role, served as an investment banker at various institutions. He holds an MBA, Finance, Management & Strategy, and Accounting, from the Northwestern University Kellogg School of Management, and a Bachelor of Science in Accountancy and Technology & Management from the University of Illinois at Urbana-Champaign.

None of Mr. Weiland’s prior employers are a parent, subsidiary, or other affiliate of the Company. Mr. Weiland does not have a direct or indirect material interest in any transaction with the Company that requires disclosure pursuant to Item 404(a) of Regulation S-K, and there is no arrangement or understanding between Mr. Weiland and any other person pursuant to which Mr. Weiland was selected to serve as Hyzon’s Chief Financial Officer. Mr. Weiland is not related to any member of the board of directors of Hyzon or any executive officer of the Company.

In connection with his appointment as Chief Financial Officer, Hyzon entered into an employment agreement with Mr. Weiland (the “Agreement”). The Agreement provides for a base salary of $450,000, an annual target cash bonus opportunity of 70% of base salary and Mr. Weiland’s eligibility to receive an annual long-term incentive opportunity in an amount determined by the Company’s Board of Directors or a committee thereof. Subject to the approval of the Company’s Compensation Committee, Mr. Weiland will receive a grant of 1,000,000 restricted stock units under the Company’s 2021 Equity Incentive Plan that will vest equally over the course of four years, subject to Mr. Weiland’s continued employment, as well as a sign-on incentive consisting of a one-time grant of restricted stock units valued at $215,000 using a trailing 30-day volume weighted average price (“VWAP”) under the Company’s 2021 Equity Incentive Plan, and vesting on the one-year anniversary of the grant date. Mr. Weiland will be entitled to participate in Hyzon’s employee health/welfare and retirement benefit plans and programs. Upon a termination of Mr. Weiland’s employment without Cause or for Good Reason (each as defined in the Agreement and such termination, a “Qualifying Termination”), Mr. Weiland will receive: (i) a lump sum equal to 18 months of Mr. Weiland’s base salary (if such Qualifying Termination occurs within the 3 month period prior to or 12 month period following a change in control, a “Qualifying CIC Termination”) or 12 months of Mr. Weiland’s base salary (if such Qualifying Termination is not a Qualifying CIC Termination), (ii) a prorated annual bonus for the year of termination, (iii) continued medical benefits for up to 18 months (if such Qualifying Termination is a Qualifying CIC Termination) or 12 months (if such Qualifying Termination is not a Qualifying CIC Termination) and (iv) (A) full acceleration of unvested equity-based awards (if such Qualifying Termination is a Qualifying CIC Termination) or (B) an additional 12 months of accelerated vesting of unvested equity-based awards (if such Qualifying Termination is not a Qualifying CIC Termination).

The foregoing description of the terms of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement, which the Company intends to file as an exhibit with its Quarterly Report for the period ended September 30, 2023.

Item 7.01. Regulation FD Disclosure.

On October 24, 2023, the Company furnished a press release regarding the appointment of Mr. Stephen Weiland as Chief Financial Officer, as described above in Item 5.02 of this Current Report on Form 8-K. The press release is attached hereto as Exhibit 99.1 and incorporated in this Item 7.01 by reference.

The information set forth in Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HYZON MOTORS INC. |

| | |

| Date: October 25, 2023 | By: | /s/ Parker Meeks |

| Name: | Parker Meeks |

| Title: | Chief Executive Officer |

| | | | | | | | | | | |

| | | |

| | |

News release | | October 24, 2023 |

| | | |

HYZON MOTORS ANNOUNCES STEPHEN WEILAND AS CHIEF FINANCIAL OFFICER

Weiland Brings Deep Experience Leading Financial Operations, Growth Capital Programs and Cash Management

ROCHESTER, N.Y., – October 24, 2023 – Hyzon Motors Inc. (NASDAQ: HYZN) (Hyzon or the company), a high-power hydrogen fuel cell technology developer and global supplier of zero-emission, heavy-duty fuel cell electric vehicles (FCEVs), today announced the appointment of Stephen Weiland as Chief Financial Officer (CFO) of the company, effective November 1, 2023.

As CFO, Weiland will be responsible for overseeing Hyzon’s financial operations, including financial planning and analysis, accounting, treasury, investor relations, and IT. He brings two decades of experience that include leading financial operations as CFO, driving diverse growth capital programs, executing transactions in the cleantech sector, and implementing critical financial processes. Most recently, he served as CFO for Boom Supersonic where he was responsible for the supersonic aircraft manufacturer’s financial and information technology functions. Prior to his role at Boom, Weiland worked at Caterpillar as a Division CFO for manufacturing and engineering, digital, and procurement divisions.

“Stephen is a veteran in leading financial teams from his time as CFO at both an early-stage technology-led company and multiple divisions at Caterpillar,” said Hyzon’s Chief Executive Officer Parker Meeks. “With a background spanning capital markets, financial services and corporate financial leadership, Stephen brings experience critical to Hyzon’s continued drive toward long-term capital stability and innovation in fuel cell-powered decarbonization.”

Weiland’s career is rooted in accounting, having started his career in audit as a certified public accountant before transitioning to investment banking. His financial leadership and transaction experience span various industries, including transportation and emerging technology.

“Hyzon is at the center of the hydrogen transition, developing breakthroughs in its leading fuel cell technology and deploying heavy-duty, zero-emission hydrogen fuel cell electric vehicles around the world, and I am excited to join this team,” said Weiland. “I plan to build upon the company’s recent strides in expanding the financial capabilities, forecasting, and capital management.”

Weiland received his Bachelor of Science in Accountancy from the University of Illinois at Urbana-Champaign and his MBA from Northwestern University’s Kellogg School of Management.

Jiajia Wu, the company’s interim CFO since April 2023, will transition to the role of Senior Vice President, Finance and Accounting. As Interim CFO, Wu successfully led Hyzon through critical financial and accounting milestones in 2023, including the filing of multiple quarterly and annual periodic reports and the implementation of vital governance and controls processes.

# # #

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

About Hyzon

Hyzon Motors is a global supplier of high-power fuel cell technology focused on integrating the technology into zero-emission heavy-duty hydrogen fuel cell electric vehicles. Hyzon’s clean hydrogen infrastructure approach synchronizes supply with demand, accelerating the deployment of zero emission trucks. Utilizing its proven and proprietary hydrogen fuel cell technology, Hyzon aims to supply zero-emission heavy duty trucks to customers in North America, Europe, Australia, and New Zealand to mitigate emissions from diesel transportation - one of the single largest sources of global carbon emissions. Hyzon is contributing to the adoption of fuel cell electric vehicles through its demonstrated technology advantage, fuel cell performance, and history of rapid innovation. Visit www.hyzonmotors.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, are forward-looking statements. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyzon disclaims any duty to update any forward -looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Hyzon cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyzon, including risks and uncertainties described in the “Risk Factors” section of Hyzon’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 31, 2023, and other documents filed by Hyzon from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Hyzon gives no assurance that Hyzon will achieve its expectations.

For media inquiries:

Hyzon@Kivvit.com

For investors:

ir@hyzonmotors.com

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

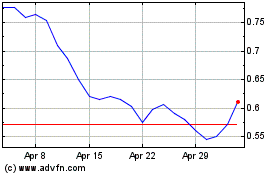

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Apr 2024 to May 2024

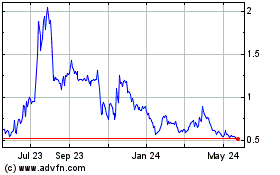

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From May 2023 to May 2024