Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

August 04 2022 - 4:07PM

Edgar (US Regulatory)

| | | | | |

Prospectus Supplement No. 1 (to prospectus dated June 7, 2022) | Filed pursuant to Rule 424(b)(3) Registration No. 333-264293 |

| | |

| | |

HYCROFT MINING HOLDING CORPORATION

Up to 94,258,841 shares of Common Stock Issuable upon Exercise of the Warrants

Up to 71,211,526 shares of Common Stock

Up to 60,125,009 Warrants

This prospectus supplement is being filed by Hycroft Mining Holding Corporation, a Delaware corporation (the “Company,” “we,” “our”, “us”) to update and supplement the information contained in the prospectus dated June 7, 2021 (the “Prospectus”) relating to the issuance of up to an aggregate of 94,258,841 shares of our Class A common stock, par value $0.0001 per share (“Common Stock”), which consists of (i) 34,289,898 shares of Common Stock that may be issued upon exercise of warrants, including the public warrants, private placement warrants, forward purchase warrants, and PIPE warrants (as each such terms is defined under “Selected Definitions” in the Prospectus) at an exercise price of $11.50 per share of Common Stock; (ii) 9,583,334 shares of Common Stock that may be issued upon exercise of the October 2020 warrants (as such term is defined under “Selected Definitions” in the Prospectus) at an exercise price of $10.50 per share of Common Stock; (iii) 3,569,129 shares of Common Stock that may be issued upon exercise of the Seller warrants (as such term is defined under “Selected Definitions” in the Prospectus) at an exercise price, determined as of January 19, 2021 pursuant to the Seller Warrant Agreement (as such term is defined under “Selected Definitions” in the Prospectus), of $40.31 per share upon the exercise of 12,721,623 Seller warrants, each currently exercisable into approximately 0.28055 shares of Common Stock, which exercise price and number of shares may fluctuate under the terms of the Seller Warrant Agreement; and (iv) 46,816,480 shares of Common Stock that may be issued upon exercise of the New Warrants (as such term is defined under “Selected Definitions” in the Prospectus) at an exercise price of $1.068 per share of Common Stock. The Prospectus also relates to the offer and sale, from time to time, by the selling security holders identified in the Prospectus (the “Selling Securityholders”), or their permitted transferees of up to (i) 71,211,526 shares of Common Stock, and (ii) up to 60,125,009 warrants to purchase shares of Common Stock, including the private placement warrants, forward purchase warrants, PIPE warrants, October 2022 warrants and New Warrants.

The Prospectus is being updated and supplemented with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) on August 4, 2022 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Stock, our public warrants, our October 2020 warrants and our Seller warrants (as such terms are defined under “Selected Definitions” in the Prospectus) are listed on The Nasdaq Capital Market, under the symbols “HYMC,” “HYMCW,” “HYMCL,” and “HYMCZ,” respectively. On August 3, 2022, the last reported sales price of our Common Stock listed under the symbol HYMC was $1.03 per share, the last reported sales price of our public warrants listed under the symbol HYMCW was $0.1904 per warrant, the last reported sales price of our October 2020 warrants listed under the symbol HYMCL was $0.3195 per warrant, and the last reported sales price of our Seller warrants listed under the symbol HYMCZ was $0.0727 per warrant.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 20 of the Prospectus and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 4, 2022.

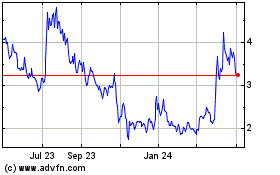

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

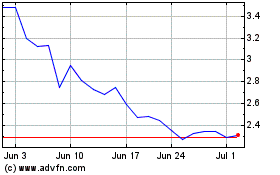

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Apr 2023 to Apr 2024