Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 22 2024 - 9:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-33602

HOLLYSYS AUTOMATION TECHNOLOGIES LTD.

No.2 Disheng

Middle Road

Beijing Economic-Technological Development Area

Beijing, People’s Republic of China, 100176

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

| HOLLYSYS AUTOMATION TECHNOLOGIES LTD. |

|

|

|

| By |

|

: |

|

/s/ Changli WANG |

| Name |

|

: |

|

Changli WANG |

| Title |

|

: |

|

Chief Executive Officer |

Date: January 22, 2024

3

Exhibit 99.1

No Spacing;January 22, 2024 Vote “FOR” the All Cash Transaction to Secure Certain and Immediate Value On February 8, 2024,

Hollysys Automation Technologies Ltd. (“Hollysys” or the “Company”) will hold an extraordinary general meeting of shareholders (the “EGM”) to consider and vote on the proposal to authorize and approve the merger

agreement between the Company and a buyer controlled by Ascendent Capital Partners (“Ascendent”), pursuant to which the buyer will acquire all outstanding shares of Hollysys that it does not currently own for US$26.50 per share in cash.

Your vote is important, regardless of the number of shares you own. The acquisition by Ascendent is in the best interests of the Company and its shareholders. The board of directors of the Company (the ”Board”) recommends you vote FOR the

merger agreement for the following reasons: RESULT OF AN EXTENSIVE AND TRANSPARENT PROCESS A special committee of independent directors (the “Special Committee”) of the Company conducted a rigorous sale process, receiving several competing

proposals to acquire the Company. The Board unanimously determined Ascendent’s US$26.50 per share all-cash transaction is in the best interests of the Company and its shareholders based on value as well as Ascendent’s ability to secure

funding and execute the transaction expeditiously. COMPELLING VALUATION 42% premium to the unaffected price of Hollysys’ shares of US$18.66 as of August 23, 2023. 52% premium over Hollysys’ 30-day volume-weighted average price through

August 23, 2023, compared with a median reference range of ~30% to 40% among precedent China ADR and US take private transactions. Substantial downside risk beyond unaffected price of US$18.66 if a transaction is not completed. CERTAIN AND IMMEDIATE

VALUE REALIZATION FOR SHAREHOLDERS Presents committed financing and high closing certainty . Represents an optimal risk-adjusted outcome for the Company. Macro backdrop and uncertain market outlook pose risks to remaining an independent publicly

-traded company. S&P China Select ADR Index down 22% last 12 months as of January 19, 2024. Transaction is expected to close in Q1 2024, assuming required regulatory approvals are timely obtained and all other closing conditions will have been

satisfied or waived. Details of the background to the transaction and the process run by the Special Committee can be found in the proxy statement available on the Company’s investor relation website at https://hollysys.investorroom.com/. If

you have any questions, or need assistance in voting, please contact Morrow Sodali LLC, Hollysys’ proxy solicitor, at (800) 662-5200 (toll-free in US) or +1 (203) 658-9400 or email at HOLI@info.morrowsodali.com.

Safe Harbor Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of historical facts included herein are “forward-looking statements,” including statements regarding the ability of the Company to achieve its commercial objectives; the business

strategy, plans and objectives of the Company; growth in financial and operational performance of the Company; and any other statements of non -historical information. These forward-looking statements are often identified by the use of

forward-looking terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident,”

or similar expressions involving known and unknown risks and uncertainties. Such forward-looking statements, based upon the current beliefs and expectations of Hollysys’ management, are subject to risks and uncertainties, which could cause

actual results to differ from the forward -looking statements. Although the Company believes that the expectations reflected in these forward -looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. Investors should not place undue reliance on these forward -looking statements, which speak only as of the date of this communication. The Company’s actual results could differ materially from those

anticipated in these forward -looking statements as a result of a variety of factors, including those discussed in the Company’s reports that are filed with the Securities and Exchange Commission and available on its website

(http://www.sec.gov). All forward -looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not

assume a duty to update these forward-looking statements. Additional Information and Where to Find It Additional information regarding the EGM to consider and vote on, among other things, the proposal to authorize and approve the merger agreement

for acquisition by Ascendent can be found in the proxy statement furnished to the SEC, which can be obtained, along with other filings containing information about the Company, the proposed merger and related matters, without charge, from the SEC

‘s website (http://www sec gov). In addition, the Company’s proxy materials, including the proxy statement, will be mailed to the shareholders of the Company. Requests for additional copies of the proxy statement should be directed to

Morrow Sodali LLC, the proxy solicitor, at 800 662 5200 (toll free in US) or 1 203 658 9400 or email at HOLI@info.morrowsodali.com. SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE MATERIALS AND OTHER MATERIALS FILED WITH OR

FURNISHED TO THE SEC WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE PROPOSED MERGER AND RELATED MATTERS. Participants in the Solicitation The Company and certain of its directors and executive officers

may, under SEC rules, be deemed to be “participants” in the solicitation of proxies from the shareholders with respect to the proposed merger with Ascendent. Information regarding the persons who may be considered “participants”

in the solicitation of proxies is set forth in the proxy statement. Further information regarding persons who may be deemed participants, including any direct or indirect interests they may have, is also set forth in the proxy statement. No Offer or

Solicitation This communication is for information purposes only. The information contained herein or on the Company’s investor relation website does not constitute an offer to purchase, or the solicitation of an offer to sell, any securities

or a solicitation of any proxy, vote or approval with respect to the proposed transaction or otherwise, nor shall it be a substitute for any proxy statement or other filings that have been or will be made with the SEC.

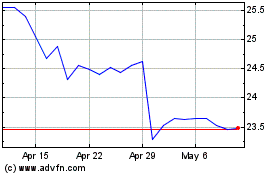

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

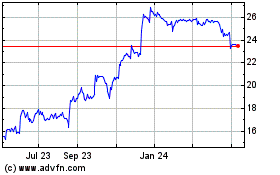

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Apr 2023 to Apr 2024