Highway Holdings Limited (Nasdaq: HIHO) today reported

results for its fiscal 2021 first quarter ended June 30, 2020.

Net loss for the fiscal first quarter was $223,000, or $0.06 per

share, compared with net loss of $102,000, or $0.03 per share, last

year. Net sales for the same period were $2.1 million compared with

$2.8 million a year earlier.

"The company’s financial results were negatively affected by the

COVID-19 pandemic and the temporary closure of operations during

the quarter at its Myanmar factory. The effects of the

COVID-19-related closure were exacerbated because workers at the

Myanmar factory could not return to work from year-end national

holidays due to the impact of the pandemic on transportation, which

essentially shut down operations for the month of April and

impacted the month of May. These factors contributed to

substantially lower sales volume in April and May. Both of our

factories are now in full operation and we are encouraged by

business trends,” said Roland Kohl, chairman, president and chief

executive officer.

Gross profit for the 2021 fiscal first quarter was $520,000

compared with $746,000 in the same period a year ago, with gross

profit as a percentage of sales approximately 25 percent compared

with 26 percent a year ago.

Selling, general and administrative expense for the 2021 fiscal

first quarter decreased by $182,000 – benefiting from sharp

cost-cutting initiatives. As a percentage of net sales, SG&A

expenses increased to 35 percent from 32 percent due to the sharp

sales decrease for the quarter.

The company realized a currency exchange loss of $20,000 in the

quarter compared with an exchange gain of $41,000 in the same

period last year, primarily due to weakness in the RMB during the

period.

Kohl highlighted the company’s solid financial position, with

cash and cash equivalents of $ 9.1 million -- exceeding combined

short- and long-term liabilities by $2.9 million. At June 30, 2020,

the company had working capital of $8 million.

Total shareholders’ equity at June 30, 2020 was $10.7 million

compared with $10.9 million as of March 31, 2020. The company’s

current ratio at June 30, 2020 was 2.9 :1.

About Highway Holdings

Highway Holdings is an international manufacturer of a wide

variety of high-quality parts and products for blue chip equipment

manufacturers based primarily in Germany. Highway Holdings’

administrative offices are located in Hong Kong and its

manufacturing facilities are located in Yangon, Myanmar and

Shenzhen, China.

Except for the historical information contained herein, the

matters discussed in this press release, including all statements

about operations in Yangon, Myanmar, the impact of the COVID-19

pandemic on the company’s longer-term business outlook, and the

prospects of establishing longer-term relationships with new

customers, are forward-looking statements which involve risks and

uncertainties, including but not limited to economic, competitive,

governmental, political and technological factors affecting the

company's revenues, operations, markets, products and prices, and

other factors discussed in the company’s various filings with the

Securities and Exchange Commission, including without limitation,

the company’s annual reports on Form 20-F.

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIES

Consolidated Statement of

Income

(Dollars in thousands, except per

share data)

(Unaudited)

Quarter Ended

June 30

2020

2019

Net sales

$

2,057

$

2,845

Cost of sales

1,537

2,099

Gross profit

520

746

Selling, general and administrative

expenses

730

912

Operating (loss) / income

(210

)

(166

)

Non-operating income (expense):

Exchange gain (loss), net

(20

)

41

Interest income

4

10

Gain/(loss) on disposal of asset

1

1

Other income (expense)

1

1

Total non-operating income (expenses)

(14

)

53

Net (loss)/income before income taxes

(224

)

(113

)

Income taxes

-

-

Net (loss)/ income

(224

)

(113

)

Less: net gain/(loss) attributable to

non-controlling interests

(1

)

(11

)

Net (loss)/income attributable to Highway

Holdings Limited’s

Shareholders

($

223

)

($

102

)

Net (loss)/income per share – Basic and

Diluted

($

0.06

)

($

0.03

)

Weighted average number of shares

outstanding:

Basic

3,910

3,802

Diluted

3,910

3,802

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIES

Consolidated Balance Sheet

(In thousands, except per share

data)

June 30

March 31

2020

2020

Current

assets:

Cash and cash equivalents

$

9,099

$

8,827

Accounts receivable, net of doubtful

accounts

1,119

2,008

Inventories

1,765

2,000

Prepaid expenses and other current

assets

221

388

Total current assets

12,204

13,223

Property, plant and equipment, net

891

878

Operating lease right-of-use assets

3,497

3,710

Long-term deposits

263

263

Long-term loan receivable

95

95

Investments in equity method investees

-

-

Total assets

16,950

18,169

Current

liabilities:

Accounts payable

$

749

$

997

Operating lease liabilities, current

806

782

Accrued expenses and other liabilities

2,066

2,294

Income tax payable

571

564

Dividend payable

2

351

Total current liabilities

4,194

4,988

Operating lease liabilities,

non-current

1,823

2,034

Deferred income taxes

229

229

Total liabilities

6,246

7,251

Shareholders'

equity:

Preferred shares, $0.01 par value

-

-

Common shares, $0.01 par value

40

40

Additional paid-in capital

11,552

11,537

Accumulated deficit

(1,089

)

(865

)

Accumulated other comprehensive

income/(loss)

190

196

Treasury shares, at cost – Nil shares as

of June 30, 2020; and on March 31, 2020

-

-

Non-controlling interest

11

10

Total shareholders' equity

10,704

10,918

Total liabilities and shareholders'

equity

$

16,950

$

18,169

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200831005203/en/

Gary S. Maier Maier & Company, Inc. (310) 471-1288

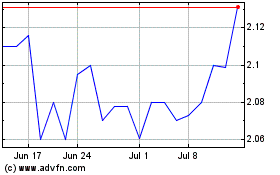

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

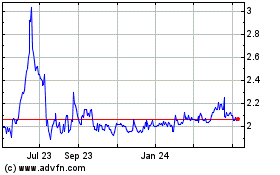

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Apr 2023 to Apr 2024