Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-270503

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated April 12, 2023)

HEARTCORE

ENTERPRISES, INC.

Up

to $1,988,229 of

Shares

of Common Stock

We have entered into an At-The-Market Offering Agreement

for an at-the-market offering (the “ATM Agreement”) with H.C. Wainwright & Co., LLC, as sales agent (“Wainwright”),

dated as of October 23, 2023 relating to the offer and sale of shares of our common stock from time to time through Wainwright acting

as sales agent or principal. In accordance with the terms of the ATM Agreement, under this prospectus supplement and the accompanying

base prospectus, we may offer and sell up to a maximum aggregate amount of $1,988,229 of shares of our common stock, par value $0.0001

per share, from time to time through the sales agent in this offering.

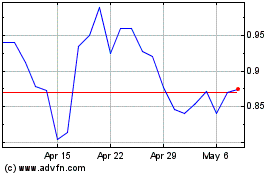

Our common stock is listed on the Nasdaq Capital Market

(the “Nasdaq Capital Market”), under the symbol “HTCR.” On October 20, 2023, the last reported sale price of our

common stock on the Nasdaq Capital Market was $0.899 per share. You are urged to obtain current market quotations for our common stock.

Sales of our common stock, if any, under this prospectus

supplement and the accompanying base prospectus may be made in sales deemed to be “at the market offerings” as defined in

Rule 415(a)(4) under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on or through

the Nasdaq Capital Market or any other existing trading market in the United States for our common stock, sales made to or through a market

maker other than on an exchange or otherwise, directly to Wainwright as principal, in negotiated transactions at market prices prevailing

at the time of sale or at prices related to such prevailing market prices, and/or in any other method permitted by law. If we and Wainwright

agree on a method of distribution other than sales of shares of our common stock on or through the Nasdaq Capital Market or another existing

U.S. trading market at market prices, we will file a further prospectus supplement providing all information about such offering as required

by Rule 424(b) under the Securities Act. Under the ATM Agreement, Wainwright is not required to sell any certain number of shares or dollar

amount of our common stock, but as instructed by us it will act as sales agent on a commercially reasonable efforts basis consistent with

its normal trading and sales practices and applicable laws and regulations, subject to the terms and conditions of the ATM Agreement on

mutually agreed terms. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. This offering pursuant

to this prospectus supplement will terminate upon the earlier of (1) the sale of common stock pursuant to this prospectus supplement having

an aggregate sales price of $1,988,229 and (2) the termination by us or Wainwright of the ATM Agreement pursuant to its terms. We provide

more information about how the shares of common stock will be sold in the section entitled “Plan of Distribution.”

The sales

agent will be entitled to cash compensation at a fixed commission rate equal to 4.0% of the gross sales price per share sold under the

ATM Agreement. In connection with the sale of the common stock on our behalf, the sales agent may be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of the sales agent may be deemed to be underwriting commissions or discounts.

We have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities

under the Securities Act. We have also agreed to reimburse certain expenses of the sales agent in connection with the offering as further

described in the “Plan of Distribution” section beginning on page S-10 of this prospectus supplement.

We are an “emerging growth company” as

that term is used in the Jumpstart Our Business Startups Act of 2012 and as such, are subject to reduced public company disclosure standards

for this prospectus supplement, the accompanying base prospectus and our filings with the Securities and Exchange Commission. See “Prospectus

Supplement Summary—Implications of Being an Emerging Growth Company.”

As of October 23, 2023, the aggregate

market value of our outstanding common equity held by non-affiliates, or public float, was $5,964,688, based on 20,842,690 shares

of common stock outstanding as of October 20, 2023, of which 5,278,485 shares were held by non-affiliates, and a per share price of $1.13

based on the closing price of such common stock on August 25, 2023 as reported on the Nasdaq Capital Market. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to this prospectus supplement with a value of more than one-third

of the aggregate market value of our common stock held by non-affiliates in any twelve-month period, so long as the aggregate market

value of our common stock held by non-affiliates is less than $75,000,000. In the event that subsequent to the date of this prospectus,

the aggregate market value of our outstanding common stock held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation

on sales shall not apply to additional sales made pursuant to this prospectus. We have not offered any securities pursuant to General

Instruction I.B.6 of Form S-3 during the twelve calendar months prior to and including the date of this prospectus supplement.

Investing

in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors”

on page S-4 of this prospectus supplement, on page 6 of the accompanying base prospectus, any related free writing prospectus and

other documents and information contained or incorporated by reference in this prospectus supplement and the accompanying base

prospectus, before making a decision to invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined

if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is October 23, 2023

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus form part of a registration statement on Form S-3 (File No. 333-270503)

that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration

process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with specific

information about this offering. The second part, the accompanying base prospectus, provides more general information, some of which

may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts

combined. This prospectus supplement may add, update or change information contained in the accompanying base prospectus. To the

extent that any statement we make in this prospectus supplement is inconsistent with statements made in the accompanying base

prospectus or any documents incorporated by reference herein or therein, the statements made in this prospectus supplement will be

deemed to modify or supersede those made in the accompanying base prospectus and such documents incorporated by reference herein and

therein.

In

this prospectus supplement, “HeartCore,” the “Company,” “we,” “us,” “our”

and similar terms refer to HeartCore Enterprises, Inc., a Delaware corporation, and its consolidated subsidiaries. References to our

“common stock” refer to the common stock, par value $0.0001 per share, of HeartCore Enterprises, Inc.

All

references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the

related notes thereto incorporated by reference hereto.

The

industry and market data and other statistical information contained in the documents we incorporate by reference in the prospectus

supplement and accompanying base prospectus are based on management’s own estimates, independent publications, government

publications, reports by market research firms or other published independent sources, and, in each case, are believed by management

to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the

information.

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus

and in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and the sales agent

has not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. You should assume that the information in this prospectus supplement, the accompanying base prospectus, the

documents incorporated by reference in the accompanying base prospectus, and in any free writing prospectus that we have authorized for

use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition,

results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying

base prospectus, the documents incorporated by reference in the accompanying base prospectus, and any free writing prospectus that we

have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read

and consider the information in the documents to which we have referred you in the sections of the accompanying base prospectus entitled

“Where You Can Find More Information” and “Incorporation by Reference of Certain Documents.” We are not, and

the sales agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying base prospectus and our SEC filings that are incorporated by reference into this prospectus supplement contain or incorporate by

reference forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical

fact, included or incorporated by reference in this prospectus supplement regarding our development of our strategy, future operations,

future financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. Forward-looking

statements may include, but are not limited to, statements about:

| | ● | the level of demand for our products and services; |

| | ● | competition in our markets; |

| | ● | our ability to grow and manage growth profitably; |

| | ● | our ability to access additional capital; |

| | ● | changes in applicable laws or regulations; |

| | ● | our ability to attract and retain qualified personnel; |

| | ● | the possibility that we may be adversely affected by other economic, business, and/or competitive factors; |

| ● | any

statements of the plans, strategies and objectives of management for future operations; |

| ● | any

statements concerning proposed new products, services or developments; |

| ● | any

statements regarding future economic conditions or performance; |

| ● | our

ability to protect our intellectual property and operate our business without infringing

upon the intellectual property rights of others; |

| ● | our

estimates regarding the sufficiency of our cash resources and our need for additional funding;

and |

| ● | our

intended use of the net proceeds from the offerings of shares of common stock under this

prospectus supplement. |

The

words “believe,” “anticipate,” “design,” “estimate,” “plan,”

“predict,” “seek,” “expect,” “intend,” “may,” “could,”

“should,” “potential,” “likely,” “projects,” “continue,”

“will,” and “would” and similar expressions are intended to identify forward-looking statements, although

not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with

respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually

will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue

reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from

those indicated or implied by forward-looking statements. These important factors include those discussed under the heading

“Risk Factors” on page S-4 of this prospectus supplement, on page 6 of the accompanying base prospectus,

under the similar headings of documents incorporated by reference herein, any free writing prospectus we may authorize for use and

certain other matters discussed in this prospectus supplement, the accompanying base prospectus and the information incorporated by

reference herein. These factors and the other cautionary statements made in this prospectus supplement and the accompanying base

prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus

supplement and the accompanying base prospectus. Except as required by law, we do not assume any obligation to update any

forward-looking statement. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying base prospectus and in the

documents we incorporate by reference herein and therein. This summary does not contain all of the information you should consider before

investing in our common stock. You should read this entire prospectus supplement and the accompanying base prospectus carefully, including

the documents incorporated by reference herein and therein, especially the risks of investing in our common stock discussed under “Risk

Factors” beginning on page S-4 of this prospectus supplement, page 6 of the accompanying base prospectus and page 32 of our Annual

Report on Form 10-K for the year ended December 31, 2022, as amended, our most recent Quarterly Report on Form 10-Q, and any subsequent

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus

supplement which is incorporated by reference in this prospectus supplement, along with our consolidated financial statements and notes

to those consolidated financial statements and the other information incorporated by reference in this prospectus supplement and the

accompanying base prospectus, before making an investment decision.

ABOUT

HEARTCORE

Business

Overview

We

are a leading software development company based in Tokyo, Japan. We provide software through two business units. We also provide consulting services to Japanese private companies seeking to go public in the United States.

Software Business

The

first business unit includes a customer experience management business that has been in existence for 13 years. Our customer experience

management platform (the “CXM Platform”) includes marketing, sales, service and content management systems, as well as other

tools and integrations, that enable companies to attract and engage customers throughout the customer experience. We also provide education,

services and support to help customers be successful with our CXM Platform.

The

second business unit is a digital transformation business which provides customers with robotics process automation, process mining and

task mining to accelerate the digital transformation of enterprises. We also have an ongoing technology innovation team to develop software

that supports the narrow needs of large enterprise customers.

As

of December 31, 2022, our combined business units (customer experience management business unit and digital transformation business unit)

had a total of 903 customers in Japan.

“Go

IPO” Consulting Services

Since

we concluded our initial public offering and listed on the Nasdaq Capital Market in February 2022, we have been offering “Go IPO”

consulting services to a number of private Japanese companies where we assist such private Japanese companies and/or their affiliates

(“issuers”) with their initial public offerings in the United States as well as their simultaneous listings onto the Nasdaq

Stock Market, the New York Stock Exchange or the NYSE American. More specifically, these consulting services (collectively, “Services”)

include the following:

| |

● |

Assistance

with the selection and negotiation of terms for a law firm, underwriter and auditing firm; |

| |

|

|

| |

● |

Provision

of process mining and task mining licenses for internal audit and internal control; |

| |

|

|

| |

● |

Assisting

in the preparation of documentation for internal controls required for an initial public offering and simultaneous listing on the

Nasdaq Stock Market, the New York Stock Exchange or the NYSE American; |

| |

|

|

| |

● |

Providing

support services to remove problematic accounting accounts upon listing support; |

| |

● |

Translation

of requested documents into English; |

| |

|

|

| |

● |

Attend

and, if requested by the other party, lead, meetings of management and employees; |

| |

|

|

| |

● |

Provide

support services related to the Nasdaq, the New York Stock Exchange or the NYSE American listing; |

| |

|

|

| |

● |

Conversion

of accounting data from Japanese standards to U.S. GAAP; |

| |

|

|

| |

● |

Assist

in the preparation of S-1 or F-1 filings; |

| |

|

|

| |

● |

Creation

of English web page; and |

| |

|

|

| |

● |

Preparing

an investor presentation/deck and executive summary of the operations. |

In

providing the Services, we do not perform accounting services, and do not act as an investment advisor or broker/dealer. Pursuant to

the terms of the consulting agreements with the issuers, the parties agree that we will not provide the following services, among others:

negotiation of the sale of the issuers’ securities; participation in discussions between the issuers and potential investors; assisting

in structuring any transactions involving the sale of the issuers’ securities; pre-screening of potential investors; due diligence

activities; and providing advice relating to valuation of or financial advisability of any investments in the issuers.

Pursuant

to the terms of the consulting agreements with the issuers, the issuers agree to compensate us as follows in return for the provision

of Services during the initial term of the consulting agreements:

| |

(a) |

A

cash fee payable in installment payments; and |

| |

|

|

| |

(b) |

Issuance

by issuers to us of a warrant or stock acquisition rights to acquire a number of shares of capital stock of the issuer, to initially

be equal to a designated percentage of the fully diluted share capital of the issuer, subject to adjustment as set forth in the warrant

or stock acquisition rights. |

Implications

of Being an Emerging Growth Company

We are an emerging growth company

as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We may remain an “emerging growth company”

until as late as December 31, 2028 (the fiscal year-end following the fifth anniversary of the completion of our initial public offering,

which closed during February 2022), though we may cease to be an “emerging growth company” earlier under certain circumstances,

including (1) if the market value of our common stock that is held by nonaffiliates exceeds $700 million as of any June 30, in which case

we would cease to be an “emerging growth company” as of the following December 31, or (2) if our gross revenue exceeds $1.235

billion in any fiscal year. “Emerging growth companies” may take advantage of certain exemptions from various reporting requirements

that are applicable to other public companies, including not being required to comply with the auditor attestation requirements of Section

404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy

statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval

of any golden parachute payments not previously approved. Investors could find our common stock less attractive because we may rely on

these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our

common stock and our stock price may be more volatile.

In addition, Section 102 of the JOBS Act also provides

that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the

Securities Act, for complying with new or revised accounting standards. An “emerging growth company” can therefore delay the

adoption of certain accounting standards until those standards would otherwise apply to private companies.

Corporate Information

We were incorporated in the State of Delaware on May 18, 2021, and are

currently in good standing in the state of Delaware. On February 10, 2022, our shares of common stock began trading on the Nasdaq Capital

Market under the symbol, “HTCR.” Our principal executive offices are located at 1-2-33, Higashigotanda, Shinagawa-ku, Tokyo,

Japan, and our telephone number is +81-3-6409-6966. Our website address is https://heartcore-enterprises.com. The information contained

on our website is not incorporated by reference into this prospectus supplement or the accompanying base prospectus, and you should not

consider any information contained on, or that can be accessed through, our website as part of this prospectus supplement or the accompanying

base prospectus or in deciding whether to purchase our common shares.

THE

OFFERING

| Common

stock offered by us |

2,211,600

shares of our common stock having an aggregate offering price of up to $1,988,229 (at an assumed offering price of $0.899 per share,

which was the closing price of our common stock on the Nasdaq Capital Market on October 20, 2023). The actual number of shares to

be issued will vary depending on the sales price in this offering. |

| |

|

| Total

shares of common stock outstanding before the offering(1) |

20,842,690

shares of common stock. |

| |

|

| Common

stock to be outstanding after the offering(1) |

Up

to 23,054,290 shares of common stock, assuming the sale of all of the shares of common stock being offered by us in this offering

(at an assumed offering price of $0.899 per share, which was the closing price of our common stock on the Nasdaq Capital Market on

October 20, 2023). The actual number of shares to be issued will vary depending on the sales price at which shares may be sold from

time to time in this offering. |

| |

|

| Manner

of offering |

“At

the market offering” as defined in Rule 415(a)(4) under the Securities Act that may be made from time to time on the Nasdaq Capital

Market or other market for our common stock in the U.S. through our sales agent, Wainwright. Wainwright will make all sales using commercially

reasonable efforts consistent with its normal trading and sales practices and applicable laws and regulations, on mutually agreeable

terms between Wainwright and us. See “Plan of Distribution” on page S-10.

|

| |

|

| Use

of proceeds |

We

will use the net proceeds from this offering, if any, for general corporate purposes, which include, but are not limited to,

business expansion, including possible acquisitions, and software product development. Pending the use of any net proceeds, we

expect to invest the net proceeds in interest-bearing, marketable securities. See “Use of Proceeds” on page

S-9. |

| |

|

| Risk

factors |

An

investment in our shares of common stock is highly speculative and involves a number of risks.

You should carefully consider the information contained in the “Risk Factors”

section beginning on page S-4 of this prospectus supplement, on page 6 of the accompanying

base prospectus, and the information and documents we incorporate by reference, before making

your investment decision.

|

| |

|

| Nasdaq

Capital Market Symbol |

Our

common stock is traded on the Nasdaq Capital Market under the ticker symbol “HTCR.” |

| (1) | The

number of shares of common stock to be outstanding before and after this offering is based on 20,842,690 shares of common stock outstanding

on October 20, 2023. The number of shares of common stock excludes: |

| (a) | 425,125

shares of common stock issuable upon the exercise of options outstanding as of October 20, 2023, with a weighted average exercise price

of $2.34 per share; and |

| | | |

| | (b) | 64,365 shares of our common stock issuable upon the vesting of outstanding

Restricted Stock Units (“RSUs”) |

RISK

FACTORS

An investment in our securities involves

a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below and

discussed under the sections captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December

31, 2022, our most recent Quarterly Report on Form 10-Q, and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q

or Current Reports on Form 8-K we file after the date of this prospectus supplement, which are incorporated by reference into this prospectus

supplement and the accompanying base prospectus in their entirety, together with other information in this prospectus supplement, the

accompanying base prospectus, the information and documents incorporated by reference herein and therein, and in any free writing prospectus

that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition,

results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting

in a loss of all or part of your investment.

Risks Related to our Intellectual Property

If we fail to adequately

protect our proprietary rights, in Japan and abroad, our competitive position could be impaired and we may lose valuable assets, experience

reduced revenue and incur costly litigation to protect our rights.

Our success is dependent, in

part, upon protecting our proprietary technology. We rely on a combination of copyrights, trademarks, service marks, trade secret laws

and contractual restrictions to establish and protect our proprietary rights in our products and services. However, the steps we take

to protect our intellectual property may be inadequate. We will not be able to protect our intellectual property if we are unable to enforce

our rights or if we do not detect unauthorized use of our intellectual property. Any of our trademarks or other intellectual property

rights may be challenged by others or invalidated through administrative process or litigation. Furthermore, legal standards relating

to the validity, enforceability and scope of protection of intellectual property rights are uncertain. Despite our precautions, it may

be possible for unauthorized third parties to copy our technology and use information that we regard as proprietary to create products

and services that compete with ours. Some license provisions protecting against unauthorized use, copying, transfer and disclosure of

our offerings may be unenforceable under the laws of certain jurisdictions and foreign countries. In addition, the laws of some countries

do not protect proprietary rights to the same extent as the laws of Japan or the United States. To the extent we expand our international

activities, our exposure to unauthorized copying and use of our technology and proprietary information may increase.

Under some limited circumstances,

we enter into confidentiality and invention assignment agreements with our employees and consultants and confidentiality agreements with

some parties with whom we have strategic relationships and business alliances. No assurance can be given that these agreements will be

effective in controlling access to and distribution of our products and proprietary information. Further, these agreements may not prevent

our competitors from independently developing technologies that are substantially equivalent or superior to our software and offerings.

We may be required to spend

significant resources to monitor and protect our intellectual property rights. Litigation may be necessary in the future to enforce our

intellectual property rights and to protect our trade secrets. Such litigation could be costly, time consuming and distracting to management

and could result in the impairment or loss of portions of our intellectual property. Furthermore, our efforts to enforce our intellectual

property rights may be met with defenses, counterclaims and countersuits attacking the validity and enforceability of our intellectual

property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation,

could delay further sales or the implementation of our software and offerings, impair the functionality of our software and offerings,

delay introductions of new features or enhancements, result in our substituting inferior or more costly technologies into our software

and offerings, or injure our reputation.

In most cases, however, we do not maintain confidentiality or protect our

proprietary information from public disclosure. Such proprietary information can include technical and commercial information important

to our business. We prefer to share this knowledge and data with the public to encourage innovation and enable technical progress. We

believe that there are more benefits in being generous and sharing our intellectual property with others than in keeping it to ourselves.

We recognize the risks of openly providing such information to the public, including our competitors. Our competitors can freely take

the information and use it to improve their own products and services without fear of punishment. Any new or inventive development we

share would not be exclusive to us, but would be free for anyone to use. Still, we think it is more important to promote the dissemination

of knowledge and foster innovation in the software technology space.

Risks Related to this Offering

The common stock offered hereby will be sold

in “at the market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares of common stock in this

offering at different times will likely pay different prices. As a result, investors may experience different outcomes in their investment

results. We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and there is no maximum

sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the

prices they paid.

Our management will have broad discretion over

the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our management will have broad discretion over the

use of proceeds from this offering, and we could spend the proceeds from this offering in ways with which you may not agree or that do

not yield a favorable return. We intend to use the net proceeds from this offering for general corporate purposes, which include, but

are not limited to, business expansion, including possible acquisitions, and software product development. As of the date of this prospectus

supplement, we cannot specify with certainty all of the particular uses of the proceeds from this offering. Accordingly, our management

will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than those contemplated

at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use

of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are

being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable,

or any, return for our company.

If you purchase shares of common stock in this

offering, you may suffer immediate and substantial dilution in the book value of your investment.

The shares

sold in this offering, if any, will be sold from time to time at various prices; however, at the assumed offering price of our common

stock, which is substantially higher than the as adjusted net tangible book value per share of our common stock after giving effect to

this offering, investors purchasing shares of our common stock in this offering will pay a price per share that substantially exceeds

the as adjusted net tangible book value per share. Assuming that an aggregate of 2,211,600 shares of our common stock are sold at an

assumed offering price of $0.899 per share, the closing price of our common stock on the Nasdaq Capital Market on October 20, 2023 for

aggregate gross proceeds of approximately $1,988,229, after deducting sales commissions and estimated offering expenses payable by us,

new investors in this offering will experience immediate dilution of $0.609 per share, representing the difference between the assumed

offering price per share and our as adjusted net tangible book value per share after giving effect to this offering. See “Dilution”

on page S-9.

The actual number of shares of common stock

we will sell and the aggregate proceeds resulting from sales under the ATM Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the ATM Agreement

and compliance with applicable laws, we have the discretion to deliver a sales notice to the sales agent at any time throughout the term

of the ATM Agreement. The number of shares that are sold by the sales agent after we deliver a sales notice will fluctuate based on the

market price of our common stock during the sales period and limits we set with the sales agent. Because the price per share of each share

sold will fluctuate based on the market price of our common stock during the sales period and the demand for our common stock during the

sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued. Because the price per share

of each share sold will fluctuate during the sales period, it is not currently possible to predict the aggregate proceeds to be raised

in connection with those sales or the number of shares that will ultimately be issued.

Sales of a significant number of shares of our

common stock in the public markets, or the perception that such sales could occur, could cause our stock price to decline.

Sales of a substantial number of shares of our common

stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock and impair

our ability to raise capital through the sale of additional equity securities. It is possible that we could issue and sell additional

shares of our common stock in the public markets. Furthermore, if our existing stockholders sell a large number of shares of our common

stock, or the public market perceives that existing stockholder might sell shares of common stock, the market price of our common stock

could decline significantly. Sales of substantial amounts of shares of our common stock in the public market by our executive officers,

directors, 5% or greater stockholders or other stockholders, or the prospect of such sales, could adversely affect the market price of

our common stock. We cannot predict the effect that future sales of our common stock would have on the market price of our common stock.

As of October 20, 2023, 20,842,690 shares of our common

stock were issued and outstanding, 425,125 shares of common stock are issuable upon the exercise of options outstanding, and 64,365 shares

of our common stock are issuable upon vesting of outstanding RSUs. Additional shares of common stock are authorized for issuance pursuant

to options and other stock-based awards under the 2021 Equity Incentive Plan and 2023 Equity Incentive Plan. To the extent that option

holders exercise outstanding options, there may be further dilution and the sales of shares issued upon such exercises could cause our

stock price to drop further.

A large number of shares may be sold in the

market following this offering, which may depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public

market following this offering could cause the market price of our common stock to decline. If there are more shares of common stock offered

for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers

are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares. All of the shares sold in this

offering will be freely tradable without restriction or further registration under the Securities Act.

Because

we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation

of the value of our common stock for any return on their investment.

We

have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings for the development,

operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition,

the terms of any future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price

of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

If

our common stock is delisted from the Nasdaq Capital Market and the price of our common stock declines below $5.00 per share, our

common stock would come within the definition of “penny stock”.

Transactions

in securities that are traded in the United States that are not traded on the Nasdaq Capital Market or on other securities exchange

by companies, with net tangible assets of $5,000,000 or less and a market price per share of less than $5.00, may be subject to the

“penny stock” rules. The market price of our common stock is currently less than $5.00 per share. If our common stock is

delisted from the Nasdaq Capital Market and the price of our common stock declines below $5.00 per share and our net tangible assets

remain $5,000,000 or less, our common stock would come within the definition of “penny stock”.

Under

these penny stock rules, broker-dealers that recommend such securities to persons other than institutional accredited investors:

● must

make a special written suitability determination for the purchaser;

●

receive the purchaser’s written agreement to a transaction prior to sale;

● provide

the purchaser with risk disclosure documents which identify risks associated with investing in “penny stocks” and which describe

the market for these “penny stocks” as well as a purchaser’s legal remedies; and

●

obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk

disclosure document before a transaction in a “penny stock” can be completed.

As

a result of these requirements, if our common stock is at such time subject to the “penny stock” rules, broker-dealers may

find it difficult to effectuate customer transactions and trading activity in these shares in the United States may be significantly

limited. Accordingly, the market price of the shares may be depressed, and investors may find it more difficult to sell the shares.

Our

common stock may be affected by limited trading volume and may fluctuate significantly.

Our

common stock is traded on the Nasdaq Capital Market. Although an active trading market has developed for our common stock, there can

be no assurance that an active trading market for our common stock will be sustained. Failure to maintain an active trading market for

our common stock may adversely affect our shareholders’ ability to sell our common stock in short time periods, or at all. Our

common stock has experienced, and may experience in the future, significant price and volume fluctuations, which could adversely affect

the market price of our common stock.

The market price of our

common stock may be volatile, and you could lose all or part of your investment.

We cannot predict the prices at which our common

stock will trade. The market price of our common stock depends on a number of factors, including those described in this “Risk Factors”

section, many of which are beyond our control and may not be related to our operating performance. In addition, the limited public float

of our common stock will tend to increase the volatility of the trading price of our common stock. These fluctuations could cause you

to lose all or part of your investment in our common stock, since you might not be able to sell your shares at or above the price you

paid for them. Factors that could cause fluctuations in the market price of our common stock include, but are not limited to, the following:

| |

● |

actual or anticipated changes

or fluctuations in our results of operations; |

| |

|

|

| |

● |

the financial projections

we may provide to the public, any changes in these projections, or our failure to meet these projections; |

| |

|

|

| |

● |

announcements by us or

our competitors of new products or new or terminated significant contracts, commercial relationships, or capital commitments; |

| |

|

|

| |

● |

industry or financial analyst

or investor reaction to our press releases, other public announcements, and filings with the SEC; |

| |

|

|

| |

● |

rumors and market speculation

involving us or other companies in our industry; |

| |

|

|

| |

● |

price and volume fluctuations

in the overall stock market from time to time; |

| |

|

|

| |

● |

changes in operating performance

and stock market valuations of other technology companies generally, or those in our industry in particular; |

| |

|

|

| |

● |

the expiration of market

stand-off or contractual lock-up agreements and sales of shares of our common stock by us or our stockholders; |

| |

|

|

| |

● |

failure of industry or

financial analysts to maintain coverage of us, changes in financial estimates by any analysts who follow our company, or our failure

to meet these estimates or the expectations of investors; |

| |

|

|

| |

● |

actual or anticipated developments

in our business, or our competitors’ businesses, or the competitive landscape generally; |

| |

|

|

| |

● |

litigation involving us,

our industry, or both, or investigations by regulators into our operations or those of our competitors; |

| |

● |

developments or disputes

concerning our intellectual property rights, our products, or third-party proprietary rights; |

| |

|

|

| |

● |

announced or completed

acquisitions of businesses or technologies by us or our competitors; |

| |

|

|

| |

● |

new laws or regulations

or new interpretations of existing laws or regulations applicable to our business; |

| |

|

|

| |

● |

any major changes in our

management or our board of directors, particularly with respect to Mr. Lai; |

| |

|

|

| |

● |

general economic conditions

and slow or negative growth of our markets; and |

| |

|

|

| |

● |

other events or factors,

including those resulting from war, incidents of terrorism, or responses to these events. |

In addition, the stock

market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating

performance of companies. Broad market and industry factors may seriously affect the market price of our common stock, regardless of our

actual operating performance. In addition, in the past, following periods of volatility in the overall market and the market prices of

a particular company’s securities, securities class action litigation has often been instituted against that company. Securities

litigation, if instituted against us, could result in substantial costs and divert our management’s attention and resources from

our business. This could materially adversely affect our business, financial condition, results of operations, and prospects.

You may experience future dilution as a result

of future equity offerings.

To raise additional capital, we may in the future offer additional shares of common stock or other securities convertible

into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell common

stock or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share

at which we sell additional shares of common stock, or securities convertible or exchangeable into common stock, in future transactions

may be higher or lower than the price per share paid by investors in this offering.

Our

substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, remain in compliance with

debt covenants and make payments on our indebtedness.

Our

substantial level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal

of, interest on or other amounts due with respect to our indebtedness. Our indebtedness could have other important consequences to you

as a stockholder. For example, it could:

| ● | make

it more difficult for us to satisfy our obligations with respect to our indebtedness and

any failure to comply with the obligations of any of our debt instruments, including financial

and other restrictive covenants, could result in an event of default under the senior secured

credit facility and the senior subordinated note; |

| | | |

| ● | make

us more vulnerable to adverse changes in general economic, industry and competitive conditions

and adverse changes in government regulation; |

| | | |

| ● | require

us to dedicate a substantial portion of our cash flow from operations to payments on our

indebtedness, thereby reducing the availability of our cash flows to fund working capital,

capital expenditures, acquisitions and other general corporate purposes; |

| | | |

| ● | limit

our flexibility in planning for, or reacting to, changes in our business and the industry

in which we operate; |

| | | |

| ● | place

us at a competitive disadvantage compared to our competitors that have less debt; and |

| | | |

| ● | limit

our ability to borrow additional amounts for working capital, capital expenditures, acquisitions,

debt service requirements, execution of our business strategy or other purposes. |

Any

of the above listed factors could materially adversely affect our business, financial condition and results of operations.

USE

OF PROCEEDS

We

may offer and sell shares of our common stock having aggregate sales proceeds of up to $1,988,229 from time to time, before deducting

the sales commissions and estimated offering expenses payable by us. However, we cannot guarantee if or when these net proceeds, if any,

will be received. The amount of proceeds from this offering will depend upon the number of shares of our common stock sold, if any, and

the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the

ATM Agreement with the sales agent as a source of financing. Because there is no minimum offering amount required as a condition of this

offering, the net proceeds to us, if any, are not determinable at this time.

We

intend to use the net proceeds for general corporate purposes in furtherance of the delivery and, where possible, acceleration, of our

strategic objectives, which include, but are not limited to business expansion, including through acquisitions, and software product

development.

We

have not determined the amount of net proceeds to be used specifically for such purposes and, as a result, management will retain broad

discretion over the allocation of net proceeds. The occurrence of unforeseen events or changed business conditions could result in the

application of the net proceeds from this offering in a manner other than as described in this prospectus supplement. Pending the use

of any net proceeds, we expect to invest the net proceeds in interest-bearing, marketable securities.

DILUTION

If

you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the price per

share you pay and the adjusted net tangible book value per share of our common stock after this offering.

The

net tangible book value of our common stock as of June 30, 2023, was approximately $4,921,896 or approximately $0.24

per share. Net tangible book value per share represents the amount of our total tangible assets, excluding goodwill and intangible

asset, less total liabilities, divided by the total number of shares of our common stock outstanding. Dilution per share to new

investors represents the difference between the amount per share paid by purchasers for each share of common stock in this offering

and the net tangible book value per share of our common stock immediately following the completion of this offering.

After giving effect to the sale of up to a maximum aggregate amount

of 2,211,600 shares of common stock at an assumed offering price of $0.899 per share, which was the closing price of our common stock

on the Nasdaq Capital Market on October 20, 2023, and after deducting sales commissions and estimated offering expenses payable by us,

our as-adjusted net tangible book value as of June 30, 2023 would have been approximately $6,755,596 or approximately $0.29 per share.

This represents an immediate increase in net tangible book value of approximately $0.05 per share to our existing stockholders and an

immediate dilution in net tangible book value of approximately $0.609 per share to purchasers of our common stock in this offering,

as illustrated by the following table:

| Assumed offering price per share | |

$ | 0.899 | |

| Net tangible book value per share as of June 30, 2023 | |

$ | 0.240 | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.050 | |

| As-adjusted net tangible book value per share as of June 30, 2023 after giving effect to this offering | |

$ | 0.290 | |

| Dilution in net tangible book value per share to new investors participating in this offering | |

$ | 0.609 | |

The

table above is based on 20,842,690 shares of common stock outstanding as of June 30, 2023, and excludes (i) 426,500 shares

of our common stock issuable upon exercise of outstanding options at a weighted average exercise price of $2.34 per share; and (ii)

64,365 shares of our common stock issuable upon vesting of outstanding RSUs.

To

the extent that after June 30, 2023, any outstanding options or RSUs were or are exercised, or we otherwise issued or issue

additional shares of common stock or securities exercisable or convertible into shares of common stock in the future at prices per

share below the price per share for any shares sold in this offering, there will be further dilution to new investors.

The information discussed above is illustrative

only and will adjust based on the actual number of shares that are sold in this offering, if any, and the prices at which such sales are made.

PLAN

OF DISTRIBUTION

We have entered into the ATM Agreement with Wainwright, pursuant to which

we may issue and sell from time to time shares of our common stock through Wainwright as our sales agent. Sales of the shares of common

stock, if any, will be made by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415

promulgated under the Securities Act. If we and Wainwright agree on any method of distribution other than sales of shares of common stock

on or through the Nasdaq Capital Market or another existing trading market in the United States at market prices, we will file a further

prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act.

Wainwright will offer shares

of our common stock at prevailing market prices subject to the terms and conditions of the ATM Agreement as agreed upon by us and Wainwright.

We will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any limitation

on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject to the terms and

conditions of the ATM Agreement, Wainwright will use its commercially reasonable efforts consistent with its normal trading and sales

practices and applicable laws and regulations to sell on our behalf all of the shares requested to be sold by us. We or Wainwright may

suspend the offering of the shares of common stock being made through Wainwright under the ATM Agreement at any time upon proper notice

to the other party.

Settlement for sales of common

stock will occur on the second trading day, and on and after May 28, 2024, on the first trading day or any such shorter settlement cycle

as may be in effect under Exchange Act Rule 15c6-1 from time to time, following the date on which any sales are made, or on some other

date that is agreed upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds to

us. Sales of our shares of our common stock as contemplated in this prospectus supplement and the accompanying base prospectus will be

settled through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There is no

arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Wainwright a cash

commission of 4.0% of the gross sales price of the shares of our common stock that Wainwright sells pursuant to the ATM Agreement. Because

there is no minimum offering amount required as a condition to this offering, the actual total offering amount, commissions and proceeds

to us, if any, are not determinable at this time. Pursuant to the terms of the ATM Agreement, we agreed to reimburse Wainwright for the

documented fees and costs of its legal counsel reasonably incurred in connection with entering into the transactions contemplated by the

ATM Agreement in an amount not to exceed $75,000 in the aggregate, in addition to up to a maximum of $2,500 per due diligence update session

conducted in connection with each such date the Company files its Quarterly Reports on Form 10-Q and $5,000 per due diligence session

conducted in connection with each such date the Company files its Annual Report on Form 10-K, for Wainwright’s counsel’s fees

and any incidental expenses to be reimbursed by us. We will report at least quarterly the number of shares of our common stock sold through

Wainwright under the ATM Agreement, the net proceeds to us and the compensation paid by us to Wainwright in connection with the sales

of shares of our common stock.

In connection with the sales

of shares of our common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed in the ATM Agreement

to provide indemnification and contribution to Wainwright against certain liabilities, including liabilities under the Securities Act.

The offering of our shares of

our common stock pursuant to this prospectus supplement will terminate upon the earlier of the sale of all of the shares of our common

stock provided for in this prospectus supplement or termination of the ATM Agreement as permitted therein.

To the extent required by Regulation

M, Wainwright will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus

supplement.

Wainwright and certain of its

affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us or

our affiliates. Wainwright and such affiliates may in the future receive customary fees and expenses for these transactions. In addition,

in the ordinary course of its various business activities, Wainwright and its affiliates may make or hold a broad array of investments

and actively trade debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans)

for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or

instruments of ours or our affiliates. Wainwright or its affiliates may also make investment recommendations and/or publish or express

independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire,

long and/or short positions in such securities and instruments.

This prospectus supplement and

the accompanying base prospectus may be made available in electronic format on a website maintained by Wainwright, and Wainwright may

distribute this prospectus supplement and the accompanying base prospectus electronically.

The foregoing does not purport to be a complete statement of the terms

and conditions of the At The Market Offering Agreement. A copy of the ATM Agreement is included as an exhibit to our Current Report on

Form 8-K that will be filed with the SEC and incorporated by reference into the registration statement of which this prospectus supplement

and the accompanying base prospectus form a part. See “Where You Can Find More Information” and “Incorporation of Documents

By Reference”.

INCORPORATION

BY REFERENCE OF CERTAIN DOCUMENTS

The

SEC allows us to “incorporate by reference” in this prospectus supplement and the accompanying base prospectus certain information

we file with the SEC, which means that we may disclose important information in this prospectus supplement and the accompanying base

prospectus by referring you to the document that contains the information. The information incorporated by reference is considered to

be an integral part of this prospectus supplement and the accompanying base prospectus, and information that we file later with the SEC

will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings

made with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, until the termination of

the offering:

| |

● |

our Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the SEC on March

31, 2023 (as amended on Form 10-K/A on October 23, 2023); |

| |

● |

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 22, 2023; |

| |

● |

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 filed with the SEC on August 14, 2023; |

| |

● |

our Current Reports on Form

8-K filed with the SEC on January 17, 2023, January 17, 2023, February 6, 2023 (as amended on Form 8-K/A on each of February 10, 2023 and April 14, 2023), March 16, 2023, March 28, 2023, April 12, 2023; May 8, 2023; May 31, 2023; June 5, 2023; June 5, 2023;

September 11, 2023; October 2, 2023; October 3, 2023; October 5, 2023; and October 12, 2023; |

| |

● |

the description of our common stock contained in our Form 8-A12B filed with the SEC on February 8, 2022, including any amendment or report filed for the purpose of updating that description; and |

| |

● |

all documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and before we stop offering the securities covered by this prospectus and any accompanying base prospectus supplement. |

Notwithstanding

the foregoing, information and documents that we elect to furnish, but not file, or have furnished, but not filed, with the SEC in accordance

with SEC rules and regulations is not incorporated into this prospectus supplement and the accompanying base prospectus and does not

constitute a part hereof.

Upon

written or oral request, at no cost we will provide to each person, including any beneficial owner, to whom a prospectus is delivered,

a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus.

Inquiries should be directed to:

HeartCore

Enterprises, Inc.

1-2-33,

Higashigotanda, Shinagawa-Ku

Tokyo,

Japan 1410022

Attn:

Chief Financial Officer

In

addition, you may access these filings on our website at www.heartcore-enterprises.com. Information on our website is not incorporated

by reference in this prospectus supplement or the accompanying base prospectus, and you should not consider our website to be a part

of either this prospectus supplement or the accompanying base prospectus.

WHERE

YOU CAN FIND MORE INFORMATION

This prospectus supplement is part of the registration statement on Form S-3 we filed with the SEC under the Securities

Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus

supplement to any of our contracts, agreements or other documents, the reference may not be complete, and you should refer to the exhibits

that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus

supplement and the accompanying base prospectus for a copy of such contract, agreement or other document.

We

are subject to the information reporting requirements of the Securities Exchange Act of 1934, as amended. Accordingly, we file

annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s web site at www.sec.gov. Also, using our website, www.heartcore-enterprises.com,

you can access electronic copies of documents we file with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q, and Current Reports on Form 8-K, and any amendments to those reports, free of charge. Information on our website is not

incorporated by reference in this prospectus supplement or the accompanying base prospectus, and

you should not consider our website to be a part of either this prospectus supplement or the accompanying base

prospectus.

LEGAL

MATTERS

The

validity of the shares of common stock offered under this prospectus supplement and the accompanying base prospectus will be passed

upon for us by Anthony L.G., PLLC, West Palm Beach, Florida. Wainwright is being represented by Haynes and Boone, LLP, New York, New York.

EXPERTS

The

consolidated financial statements for the years ended December 31, 2022 and 2021 have been incorporated in this prospectus supplement

by reference to the Annual Report on Form 10-K for the year ended December 31, 2022, have been so incorporated in reliance on the report

of MaloneBailey, LLP, an independent registered public accounting firm, given on the authority of said firm as experts in accounting

and auditing.

PROSPECTUS

$100,000,000

HEARTCORE

ENTERPRISES, INC.

Common

Stock, Preferred Stock, Warrants, Rights,

Debt

Securities and Units

We

may offer and sell, from time to time in one or more offerings the following securities:

| ● |

shares

of common stock, par value $0.0001 per share; |

| |

|

| ● |

shares

of preferred stock, par value $0.0001 per share; |

| |

|

| ● |

warrants

to purchase shares of our common stock, preferred stock and/or debt securities; |

| |

|

| ● |

rights

to purchase shares of our common stock, preferred stock, warrants and/or debt securities; |

| |

|

| ● |

debt

securities consisting of senior notes, subordinated notes or debentures; |

| |

|

| ● |

units

consisting of a combination of the foregoing securities; or |

| |

|

| ● |

any

combination of these securities. |

We

may offer and sell up to $100,000,000 in the aggregate of the securities identified above from time to time in one or more offerings.

This prospectus provides a general description of the securities that we may offer. However, this prospectus may not be used to offer

or sell our securities unless accompanied by a prospectus supplement relating to the offered securities. Each time that we offer securities

under this prospectus, we will provide the specific terms of the securities offered, including the public offering price, in a related

prospectus supplement. Such prospectus supplement may add to, update or change information contained in this prospectus. To the extent

there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any prospectus

supplement, on the other hand, you should rely on the information in the prospectus supplement. You should read this prospectus and any

applicable prospectus supplement together with additional information described under the headings “Where You Can Find More Information”

and “Information Incorporated By Reference” before making your investment decision.

These

securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through

a combination of these methods. See “Plan of Distribution” in this prospectus for additional information on methods of sale.

We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents,

underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose

their names and the nature of our arrangements with them in that prospectus supplement. The net proceeds we expect to receive from any

such sale will also be included in the prospectus supplement.

Our

common stock is traded on the Nasdaq Capital Market under the ticker symbol “HTCR.” The closing price of our common stock

on April 5, 2023 was $0.935 per share.

As

of April 7, 2023, the aggregate market value of our outstanding common equity held by non-affiliates, or public float, was $6,403,823

based on 20,842,690 shares of common stock outstanding, of which 4,907,144 shares are held by non-affiliates, and a per share price of

$1.305 based on the average of the bid and asked prices of our common stock on the Nasdaq Capital Market on February 9, 2023 (within

60 days prior to the date of filing). Therefore, as of April 7, 2023, the aggregate market value of our common equity held by non-affiliates

was less than $75,000,000, as calculated in accordance with General Instruction I.B.1 of Form S-3. As of the date of this prospectus,

we have not offered and sold securities pursuant to General Instruction I.B.6 to Form S-3 during the 12-calendar month period that ends

on and includes the date hereof. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary

offering with a value exceeding more than one-third of our “public float” (the market value of our common stock held by our

non-affiliates) in any 12-month period so long as our public float remains below $75,000,000.

An

investment in our securities involves a high degree of risk. See the sections entitled “Risk Factors” included in our most

recent Annual Report on Form 10-K and in any subsequent Quarterly Report on Form 10-Q, which are incorporated by reference into this

prospectus, as well as in any prospectus supplement related to a specific offering we make pursuant to this prospectus. You should carefully

read this entire prospectus together with any related prospectus supplement and the information incorporated by reference into both before

you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

The

date of this prospectus is April 12, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using

a “shelf” registration process. Under this shelf registration process, we may offer from time to time securities having a

maximum aggregate offering price of $100,000,000. Each time we offer securities, we will prepare and file with the SEC a prospectus supplement

that describes the specific amounts, prices and terms of the securities we offer. The prospectus supplement also may add, update or change

information contained in this prospectus or the documents incorporated herein by reference. You should read carefully both this prospectus

and any prospectus supplement together with additional information described below under “Where You Can Find More Information”

and “Information Incorporated By Reference.”

This

prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information

about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC or directly

from us as described below under “Where You Can Find More Information.”

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in

any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any

prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of

the date of those documents only. Our business, financial condition, results of operations and prospects may have changed since those

dates.

We

may sell securities through underwriters or dealers, through agents, directly to purchasers or through any combination of these methods.

We and our agents reserve the sole right to accept or reject in whole or in part any proposed purchase of securities. The prospectus

supplement, which we will prepare and file with the SEC each time we offer securities, will set forth the names of any underwriters,

agents or others involved in the sale of securities, and any applicable fee, commission or discount arrangements with them. See “Plan

of Distribution.” In this prospectus, unless otherwise indicated, “the company,” “our company,” “we,”

“us” or “our” refer to HeartCore Enterprises, Inc., a Delaware corporation, and its consolidated subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements

in this prospectus and in the documents incorporated by reference in this prospectus contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934,

as amended, or the Exchange Act. Any statements contained herein, other than statements of historical fact, including statements regarding

the progress and timing of our product development programs; our future opportunities; our business strategy, future operations, anticipated

financial position, future revenues and projected costs; our management’s prospects, plans and objectives; and any other statements

about our management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. Examples

of such statements are those that include words such as “may,” “assume(s),” “forecast(s),” “position(s),”

“predict(s),” “strategy,” “will,” “expect(s),” “estimate(s),” “anticipate(s),”

“believe(s),” “project(s),” “intend(s),” “plan(s),” “budget(s),” “potential,”

“continue” and variations thereof. However, the words cited as examples in the preceding sentence are not intended to be

exhaustive and any statements contained in this prospectus regarding matters that are not historical facts may also constitute forward-looking

statements.

Because

these statements implicate risks and uncertainties, as well as certain assumptions, actual results may differ materially from those expressed