Current Report Filing (8-k)

May 09 2019 - 4:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2019

————————————

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

————————————

|

|

|

|

|

|

|

Delaware

|

0-22818

|

22-3240619

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Former name or former address, if changed since last report: N/A

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

¨

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

HAIN

|

|

The NASDAQ

®

Global Select Market

|

Item 1.01 Entry into a Material Definitive Agreement

On May 8, 2019, The Hain Celestial Group, Inc. (the “Company”) entered into the Third Amendment (the “Amendment”) to its Third Amended and Restated Credit Agreement, dated as of February 8, 2018, as amended by the First Amendment to Third Amended and Restated Credit Agreement, dated as of November 7, 2018 and the Second Amendment to Third Amended and Restated Credit Agreement, dated as of February 6, 2019 (the “Credit Agreement”). Among other things, pursuant to the Amendment, the Company’s allowable consolidated leverage ratio increased to no more than 5.0 to 1.0 from March 31, 2019 to December 31, 2019, no more than 4.75 to 1.0 at March 31, 2020, no more than 4.25 to 1.0 at June 30, 2020 and no more than 4.0 to 1.0 on September 30, 2020 and thereafter. The Company’s allowable consolidated leverage ratio for each period will be decreased by 0.25 upon the consummation of the sale of Hain Pure Protein Corporation (“HPPC”). Additionally, the Company’s required consolidated interest coverage ratio was reduced to no less than 3.0 to 1 through March 31, 2020, no less than 3.75 to 1 through March 31, 2021 and no less than 4.0 to 1 thereafter.

As part of the Amendment, HPPC was released from its obligations as a borrower and a guarantor under the Credit Agreement. The Amendment also required that the Company and the subsidiary guarantors enter into a Security and Pledge Agreement (the “Security Agreement”), pursuant to which all of the obligations under the Credit Agreement will be secured by liens on assets of the Company and its material domestic subsidiaries, including the equity interest in each of their direct subsidiaries and intellectual property, subject to agreed upon exceptions.

The Credit Agreement, as amended by the Amendment, provides that loans will bear interest at rates based on (a) the Eurocurrency Rate plus a rate ranging from 0.875% to 2.50% per annum; or (b) the Base Rate plus a rate ranging from 0.00% to 1.50% per annum, the relevant rate being the Applicable Rate. The Applicable Rate will be determined in accordance with a leverage-based pricing grid, as set forth in the Credit Agreement. Swing Line Loans and Global Swing Line Loans denominated in U.S. dollars will bear interest at the Base Rate plus the Applicable Rate, and Global Swing Line Loans denominated in foreign currencies shall bear interest based on the overnight Eurocurrency Rate for loans denominated in such currency plus the Applicable Rate. Additionally, the Credit Agreement, as amended by the Amendment, contains a Commitment Fee on the amount unused under the Credit Agreement ranging from 0.20% to 0.45% per annum, and such Commitment Fee is determined in accordance with a leverage-based pricing grid.

Unless otherwise defined in the forgoing description, capitalized terms shall have the meaning set forth in the Credit Agreement, as amended by the Amendment. The forgoing description of the Amendment and the Security Agreement is not complete and is qualified in its entirety by the terms and provisions of the Amendment and the Security Agreement, copies of which are filed herewith as Exhibit 10.1 and 10.2, respectively and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed herewith:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Third Amendment to the Third Amended and Restated Credit Agreement dated May 8, 2019 by and among the Company, certain wholly-owned subsidiaries of the Company party thereto from time to time, the Lenders party thereto and Bank of America, N.A., as administrative agent.

|

|

10.2

|

|

Security and Pledge Agreement dated May 8, 2019 by and among the Company, certain wholly-owned subsidiaries of the Company party thereto from time to time, and Bank of America, N.A., as administrative agent.

|

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 9, 2019

|

|

|

|

|

|

THE HAIN CELESTIAL GROUP, INC.

(Registrant)

|

|

|

|

By:

|

/s/ James Langrock

|

|

Name:

|

James Langrock

|

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

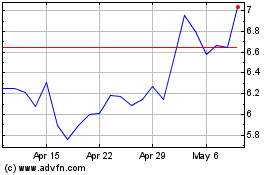

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Jul 2024 to Aug 2024

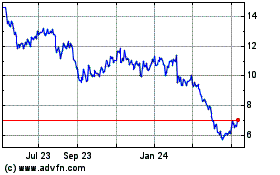

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Aug 2023 to Aug 2024