Kellogg's Brand Investments Temper Profit -- 2nd Update

February 07 2019 - 4:53PM

Dow Jones News

By Annie Gasparro

Kellogg Co. said investments in new snacks and cereals are

denting profits but fueling a turnaround in sales.

The Battle Creek, Mich.-based maker of Special K, Pringles and

Pop-Tarts, is adding more single-serve snacks, developing recipes

for healthier cereals and ramping up marketing.

That damped Kellogg's earnings in the fourth quarter. The

company said Thursday that its comparable sales in North America

fell 2%, while adjusted operating profit declined by about 13%,

excluding foreign-exchange effects related to its Canada

business.

Kellogg's shares, which have fared better than those of its

peers in the past year, fell nearly 6% Thursday.

"It's difficult to turn around trends that have existed in the

marketplace for some time," Chief Executive Steve Cahillane said in

an interview.

Shares in Hain Celestial Inc., meanwhile, were down about 9%

after the maker of natural and organic snacks and household

products reported an unexpected loss in its latest quarter.

Hain long dominated that trendier area of the market but has

lost ground over the past few years to Kellogg and other companies

trying to appeal to customers looking for new and more healthful

products.

Hain hired Mark Schiller as CEO in November. Mr. Schiller said

Thursday that Hain had introduced too many items in pursuit of

sales growth. Unpopular products had to be discounted, he said,

hurting profit.

"These issues are largely self-inflicted," he said on a

conference call. "If we can put more resources against fewer things

that have higher potential, we will have a much greater

outcome."

Hain said sales in its last quarter were $584.2 million, short

of analysts' target for $612 million. The company also lowered its

earnings outlook for its fiscal year ending at the end of June.

Kellogg views 2019 as a turnaround year. It said it is spending

more on new brands and products like a digestive-health cereal

brand called Happy Inside and a Pop-Tarts cereal.

The company said its adjusted operating profit will be flat this

year, excluding currency fluctuations.

"We're not apologetic about this investment or the fact that it

is holding down profit for a couple more quarters," Mr. Cahillane

said. "We know that this investment is building a stronger

foundation for future growth."

Kellogg estimates its comparable sales will rise 1% to 2% this

year -- up from last year's flat results.

Kellogg said that in the U.S., brands such as Pringles, Cheez-It

and Rice Krispies Treats are growing. In the cereal aisle,

Kellogg's Kashi, Frosted Flakes and Froot Loops brands are selling

more, while others have struggled.

To boost sales, Kellogg in 2017 bought the clean-label protein

bar brand Rxbar for $600 million. Kellogg is also considering

selling its Keebler cookie business so it can focus on other brands

that are more central to its strategy.

For the fourth quarter, Kellogg reported revenue of $3.32

billion, a 4.2% rise from the year-ago period and generally in line

with analysts' estimate, according to FactSet. Earnings per share,

adjusted to exclude one-time charges, fell 2.2% to 91 cents,

topping analysts' 88-cent target.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

February 07, 2019 16:38 ET (21:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

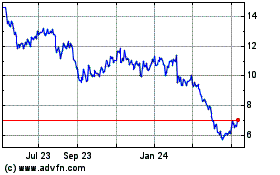

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Jul 2024 to Aug 2024

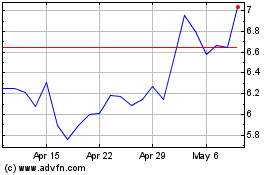

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Aug 2023 to Aug 2024