Gracell Biotechnologies Announces Shareholders’ Approval of Merger Agreement

February 20 2024 - 7:45AM

Gracell Biotechnologies Inc. (“Gracell” or the “Company”, NASDAQ:

GRCL), a global clinical-stage biopharmaceutical company dedicated

to developing innovative and highly efficacious cell therapies for

the treatment of cancer and autoimmune disease, today announced

that at an extraordinary general meeting of shareholders (the

“EGM”) held on February 19, 2024, the Company’s shareholders voted

in favor of the proposal to approve and authorize the execution,

delivery and performance by the Company of the previously announced

Agreement and Plan of Merger, dated as of December 23, 2023 (the

“Merger Agreement”), by and among the Company, AstraZeneca Treasury

Limited, a private limited company incorporated under the laws of

England and Wales (“Parent”), and Grey Wolf Merger Sub, an exempted

company with limited liability incorporated under the laws of the

Cayman Islands and a wholly owned subsidiary of Parent (“Merger

Sub”), the Plan of Merger required to be filed with the Registrar

of Companies of the Cayman Islands (the “Plan of Merger”), and the

other agreements or documents contemplated by the Merger Agreement

or any document or instrument delivered in connection thereunder

(the “Transaction Documents”) to which the Company is a party and

the consummation of the transactions contemplated by the Merger

Agreement (including the Merger) and the Contingent Value Rights

Agreement, in the form attached as Exhibit B to the Merger

Agreement, (collectively, the “Transactions”), upon the terms and

subject to the conditions set forth therein. Pursuant to the Merger

Agreement, in accordance with the applicable provisions of the

Companies Act (As Revised) of the Cayman Islands, Merger Sub will

merge with and into the Company at the effective time of the

Merger, with the Company continuing as the surviving company and

becoming a wholly owned subsidiary of the Parent (the “Merger”).

At least 458,283,333 of the Company’s

total outstanding ordinary shares, par value of $0.0001 per share

(“Ordinary Shares”), including Ordinary Shares represented by the

Company’s American Depositary Shares (the “ADSs”), attended the EGM

in person or by proxy. Each shareholder has one vote for each

Ordinary Share. These shares represented approximately 94.8% of the

total outstanding votes represented by the Company’s total Ordinary

Shares outstanding at the close of business in the Cayman Islands

on the record date of January 8, 2024. The Merger Agreement, the

Plan of Merger and the Transactions, were approved by approximately

99.9% of the total votes cast at the EGM.

The Merger is expected to close on or around

February 22, 2024, subject to the satisfaction or waiver of the

conditions set forth in the Merger Agreement. If and when the

Merger is completed, it would result in the Company becoming a

private company and its ADSs would no longer be listed or traded on

any stock exchange, including the Nasdaq Global Select Market, and

the Company’s ADS program would be terminated.

About Gracell

Gracell is a global clinical-stage

biopharmaceutical company dedicated to discovering and developing

breakthrough cell therapies for the treatment of cancers and

autoimmune diseases. Leveraging its innovative FasTCAR and TruUCAR

technology platforms and SMART CART™ technology module, Gracell is

developing a rich clinical-stage pipeline of multiple autologous

and allogeneic product candidates with the potential to overcome

major industry challenges that persist with conventional CAR-T

therapies, including lengthy manufacturing time, suboptimal cell

quality, high therapy cost, and lack of effective CAR-T therapies

for solid tumors and autoimmune diseases. The lead candidate

BCMA/CD19 dual-targeting FasTCAR-T GC012F is currently being

evaluated in clinical studies for the treatment of multiple

myeloma, B-NHL and SLE. For more information on Gracell, please

visit www.gracellbio.com. Follow @GracellBio on LinkedIn.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements contained in this Form 6-K

contain “forward-looking statements” within the meaning of The

Private Securities Litigation Reform Act of 1995. Statements that

are not historical or current facts, including statements about the

beliefs and expectations and statements relating to the proposed

Transactions and the expected timing for the completion thereof,

are forward-looking statements. The words “anticipate,” “look

forward to,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Forward-looking statements involve inherent risks and

uncertainties, and important factors could cause actual results to

differ materially from those anticipated, including, but not

limited to: the satisfaction of the conditions precedent to the

consummation of the Transactions; the possibility that the

milestone related to the contingent value right will not be

achieved, even if the Transactions are consummated; unanticipated

difficulties or expenditures relating to the Transactions; legal

proceedings, judgments or settlements, including those that may be

instituted against the Company, the Company’s board of directors

and executive officers and others following the announcement of the

Transactions; disruptions of current plans and operations caused by

the announcement of the Transactions; potential difficulties in

employee retention due to the announcement of the Transactions; and

other risks and uncertainties and the factors discussed in the

section entitled “Risk Factors” in the Company’s most recent annual

report on Form 20-F, as well as discussions of potential risks,

uncertainties, and other important factors in the Company’s

subsequent filings with the Securities and Exchange Commission (the

“SEC”). Any forward-looking statements contained in this Form 6-K

speak only as of the date hereof. Except as may be required by law,

neither the Company nor Parent undertakes any duty to update these

forward-looking statements.

Media contact

Marvin Tang

marvin.tang@gracellbio.com

Investor contact

Gracie Tong

gracie.tong@gracellbio.com

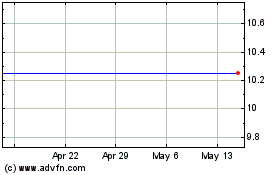

Gracell Biotechnologies (NASDAQ:GRCL)

Historical Stock Chart

From Oct 2024 to Nov 2024

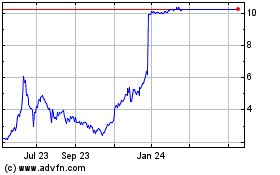

Gracell Biotechnologies (NASDAQ:GRCL)

Historical Stock Chart

From Nov 2023 to Nov 2024