false000143472800014347282022-07-272022-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 3, 2024

GLOBAL WATER RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-37756 | | 90-0632193 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | |

| 21410 N. 19th Avenue #220 | | | | |

| Phoenix, | Arizona | | | | 85027 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (480) 360-7775

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act.

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

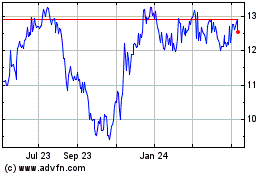

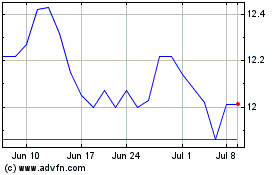

| Common Stock, par value $0.01 per share | GWRS | The NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, on October 26, 2023, Global Water Resources, Inc. (the “Company”) entered into a note purchase agreement (the “Note Purchase Agreement”) for the issuance of an aggregate principal amount of $20,000,000 of 6.91% Senior Secured Notes due on January 3, 2034 (the “Notes”). Pursuant to the terms of the Note Purchase Agreement, the Company issued the Notes on January 3, 2024.

In connection with the issuance of the Notes, on January 3, 2024, each of Global Water, LLC, Global Water Holdings, Inc., and West Maricopa Combine, LLC, each a wholly owned subsidiary of the Company (each, a “Guarantor”), entered into a guaranty agreement for the benefit of the holder of the Notes (collectively, the “Guaranty Agreements”) pursuant to which each Guarantor jointly and severally guaranteed the Company’s obligations under the Note Purchase Agreement and the Notes. The foregoing summary of the terms of the Guaranty Agreements is qualified in its entirety by the Guaranty Agreements, each of which is attached as Exhibits 10.2, 10.3, and 10.4 to this Current Report on Form 8-K and incorporated herein by reference.

The obligations evidenced by the Notes are secured by a lien against the stock and equity interests of all direct and indirect subsidiaries of the Company and other property constituting collateral. In furtherance thereof, on January 3, 2024, the Company and each Guarantor entered into a pledge and security agreement with U.S. Bank Trust Company, National Association, as collateral agent for the holder of the Notes, relating to the collateral securing the Notes (collectively, the “Pledge and Security Agreements”). The foregoing summary of the terms of the Pledge and Security Agreements is qualified in its entirety by the Pledge and Security Agreements, each of which is attached as Exhibits 10.5, 10.6, 10.7, and 10.8 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The material terms of the Note Purchase Agreement and the Notes were described in the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on November 1, 2023, under the caption “Note Purchase Agreement,” which description is incorporated herein by reference into this Item 2.03. Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. |

Description |

| 4.1 | Form of 6.91% Senior Secured Notes due on January 3, 2034 (included in Exhibit 10.1) |

| 10.1 | Note Purchase Agreement, dated October 26, 2023, by and between Global Water Resources, Inc. and Jackson National Life Insurance Company (incorporated by reference to the Company’s Current Report on Form 8-K filed with the SEC on November 1, 2023) |

| 10.2 | |

| 10.3 | |

| 10.4 | |

| 10.5 | |

| 10.6 | |

| 10.7 | |

| 10.8 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | GLOBAL WATER RESOURCES, INC. |

| | |

| Date: January 4, 2024 | | /s/ Michael J. Liebman |

| | | Michael J. Liebman |

| | | Chief Financial Officer |

| | |

Guaranty Agreement

Dated as of January 3, 2024

of

Global Water, LLC

Table of Contents

Section Heading Page

| | | | | |

Section 1. Guaranty | |

Section 2. Obligations Absolute | |

Section 3. Waiver | |

Section 4. Obligations Unimpaired | |

Section 5. Subrogation and Subordination | |

Section 6. Reinstatement of Guaranty | |

Section 7. Rank of Guaranty | |

Section 8. Term of guaranty agreement | |

Section 9. Survival of Representations and Warranties; Entire Agreement | |

Section 10. Amendment and Waiver | |

Section 10.1. Requirements | |

Section 10.2. Solicitation of Holders of Notes | |

Section 10.3. Binding Effect | |

Section 10.4. Notes held by Guarantor, Company, Etc | |

Section 11. Representations and Warranties of the Guarantor | |

Section 11.1. Organization; Power and Authority | |

Section 11.2. Authorization, Etc | |

Section 11.3. Governmental Authorizations, Etc | |

Section 12. Notices | |

Section 13. Miscellaneous | |

Section 13.1. Successors and Assigns | |

Section 13.2. Severability | |

Section 13.3. Construction | |

Section 13.4. Further Assurances | |

Section 13.5. Governing Law | |

Section 13.6. Jurisdiction and Process; Waiver of Jury Trial | |

Section 13.7. Reproduction of Documents; Execution | |

Guaranty Agreement

This Guaranty Agreement, dated as of January 3, 2024 (this “Guaranty Agreement”), is made by Global Water, LLC, a Delaware limited liability company (the “Guarantor”) in favor of the Purchasers (as defined below) and the other holders from time to time of the Notes (as defined below). The Purchasers and such other holders from time to time of the Notes are herein collectively called the “holders” and individually a “holder.”

Preliminary statements:

I. Global Water Resources, Inc., a Delaware corporation (the “Company”), entered into a Note Purchase Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Note Agreement”) with the Persons listed on the signature pages thereto (the “Purchasers”). Capitalized terms used herein have the meanings specified in the Note Agreement unless otherwise defined herein.

II. The Company, the purchasers of the notes issued pursuant to the 2016 Note Purchase Agreement, and U.S. Bank National Association, in its capacity as collateral agent for the benefit of the Secured Parties (as defined therein) (the “Collateral Agent”) entered into a Third Amended and Restated Collateral Agency Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Collateral Agreement”). On or about the date hereof, the Purchasers have executed and delivered a Joinder Agreement, pursuant to which the Purchasers have become parties to the Collateral Agreement and “Secured Parties” thereunder, all as more particularly provided in such Joinder Agreement.

III. The Company has authorized the issuance, pursuant to the Note Agreement, of 6.91% Senior Secured Notes due January 3, 2034 in the aggregate principal amount of $20,000,000. Pursuant to the Note Agreement, the Company proposes to issue and sell $20,000,000 aggregate principal amount of its 6.91% Senior Secured Notes due January 3, 2034 (the “Initial Notes”). The Initial Notes and any other Notes that may from time to time be issued pursuant to the Note Agreement (including any notes issued in substitution for any of the Notes) are herein collectively called the “Notes” and individually a “Note”.

IV. Pursuant to the Note Agreement, the Company is required to cause the Guarantor to deliver this Guaranty Agreement to the holders.

V. The Guarantor will receive direct and indirect benefits from the financing arrangements contemplated by the Note Agreement. The member and the managers of the Guarantor have determined that the incurrence of such obligations is in the best interests of the Guarantor.

Now Therefore, in compliance with the Note Agreement, and in consideration of, the execution and delivery of the Note Agreement and the purchase of the Notes by each of the Purchasers, the Guarantor hereby covenants and agrees with, and represents and warrants to each of the holders as follows:

Global Water, LLC Guaranty Agreement

Section 1. Guaranty.

The Guarantor hereby irrevocably and unconditionally guarantees to each holder, the due and punctual payment in full of (a) the principal of, Make-Whole Amount, if any, and interest on (including, without limitation, interest accruing after the filing of any petition in bankruptcy, or the commencement of any insolvency, reorganization or like proceeding, whether or not a claim for post-filing or post-petition interest is allowed in such proceeding), and any other amounts due under, the Notes when and as the same shall become due and payable (whether at stated maturity or by required or optional prepayment or by acceleration or otherwise) and (b) any expenses, indemnities and other sums which may become due to the holders or the Collateral Agent under the terms and provisions of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document (all such obligations described in clauses (a) and (b) above are herein called the “Guaranteed Obligations”).

The guaranty in the preceding sentence is an absolute, present and continuing guaranty of payment and not of collectability and is in no way conditional or contingent upon any attempt to collect from the Company or any other guarantor of the Notes or other Guaranteed Obligations or upon any other action, occurrence or circumstance whatsoever. In the event that the Company shall fail to pay any of such Guaranteed Obligations, the Guarantor agrees to pay the same when due to the Collateral Agent and/or holders entitled thereto, without demand, presentment, protest or notice of any kind, in lawful money of the United States of America, pursuant to the requirements for payment specified in the Notes, the Note Agreement, the Collateral Agreement and the other Note Documents. Each default in payment of any of the Guaranteed Obligations shall give rise to a separate cause of action hereunder and separate suits may be brought hereunder as each cause of action arises. The Guarantor agrees that the Notes issued pursuant to the Note Agreement may (but need not) make reference to this Guaranty Agreement.

The Guarantor hereby acknowledges and agrees that the Guarantor’s liability hereunder is joint and several with any other Person(s) who may guarantee the Guaranteed Obligations.

Notwithstanding the foregoing provisions or any other provision of this Guaranty Agreement, by their acceptance of this Guaranty, the Purchasers (on behalf of themselves and their successors and assigns) and the Guarantor hereby agree that if at any time the Guaranteed Obligations exceed the Maximum Guaranteed Amount determined as of such time with regard to the Guarantor, then this Guaranty Agreement shall be automatically amended to reduce the Guaranteed Obligations to the Maximum Guaranteed Amount. Such amendment shall not require the written consent of the Guarantor or any holder and shall be deemed to have been automatically consented to by the Guarantor and each holder. The Guarantor agrees that the Guaranteed Obligations may at any time exceed the Maximum Guaranteed Amount without affecting or impairing the obligation of the Guarantor. “Maximum Guaranteed Amount” means as of the date of determination with respect to the Guarantor, the lesser of (a) the amount of the Guaranteed Obligations outstanding on such date and (b) the maximum amount that would not render the Guarantor’s liability under this Guaranty Agreement subject to avoidance under Section 548 of the United States Bankruptcy Code (or any successor provision) or any comparable provision of applicable state law.

Global Water, LLC Guaranty Agreement

Section 2. Obligations Absolute.

The obligations of the Guarantor hereunder shall be primary, absolute, irrevocable and unconditional, irrespective of the validity or enforceability of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, shall not be subject to any counterclaim, setoff, deduction or defense based upon any claim the Guarantor may have against the Company or any holder or otherwise, and shall remain in full force and effect without regard to, and shall not be released, discharged or in any way affected by, any circumstance or condition whatsoever (whether or not the Guarantor shall have any knowledge or notice thereof), including, without limitation: (a) any amendment to, modification of, supplement to or restatement of the Notes, the Note Agreement or any other Note Document (it being agreed that the obligations of the Guarantor hereunder shall apply to the Notes, the Note Agreement or any other Note Document as so amended, modified, supplemented or restated) or any assignment or transfer of any thereof or of any interest therein, or any furnishing, acceptance or release of any security for the Notes; (b) any waiver, consent, extension, indulgence or other action or inaction under or in respect of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document; (c) any bankruptcy, insolvency, arrangement, reorganization, readjustment, composition, liquidation or similar proceeding with respect to the Company or its property; (d) any merger, amalgamation or consolidation of the Guarantor or of the Company into or with any other Person or any sale, lease or transfer of any or all of the assets of the Guarantor or of the Company to any Person; (e) any failure on the part of the Company for any reason to comply with or perform any of the terms of any other agreement with the Guarantor; (f) any failure on the part of the Collateral Agent or any holder to obtain, maintain, register or otherwise perfect any security; or (g) any other event or circumstance which might otherwise constitute a legal or equitable discharge or defense of a guarantor (whether or not similar to the foregoing), and in any event however material or prejudicial it may be to the Guarantor or to any subrogation, contribution or reimbursement rights the Guarantor may otherwise have.

Section 3. Waiver.

The Guarantor unconditionally waives to the fullest extent permitted by law, (a) notice of acceptance hereof, of any action taken or omitted in reliance hereon and of any default by the Company in the payment of any amounts due under the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, and of any of the matters referred to in Section 2 hereof, (b) all notices which may be required by statute, rule of law or otherwise to preserve any of the rights of the Collateral Agent or any holder against the Guarantor, including, without limitation, presentment to or demand for payment from the Company or the Guarantor with respect to any Note, notice to the Company or to the Guarantor of default or protest for nonpayment or dishonor and the filing of claims with a court in the event of the bankruptcy of the Company, (c) any right to require the Collateral Agent or any holder to enforce, assert or exercise any right, power or remedy including, without limitation, any right, power or remedy conferred in the Note Agreement, the Notes, the Collateral Agreement or any other Note Document, (d) any requirement for diligence on the part of the Collateral Agent or any holder and (e) any other act or omission or thing or delay in doing any other act or thing which might in any manner or to any extent vary the risk of the Guarantor or otherwise operate as a discharge of the Guarantor or in any manner lessen the obligations of the Guarantor hereunder.

Global Water, LLC Guaranty Agreement

Section 4. Obligations Unimpaired.

The Guarantor authorizes the Collateral Agent and/or the holders (as applicable), without notice or demand to the Guarantor and without affecting its obligations hereunder, from time to time: (a) to renew, compromise, extend, accelerate or otherwise change the time for payment of, all or any part of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document; (b) to change any of the representations, covenants, events of default or any other terms or conditions of or pertaining to the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, including, without limitation, decreases or increases in amounts of principal, rates of interest, the Make-Whole Amount or any other obligation; (c) to take and hold security for the payment of the Notes, the Note Agreement, this Guaranty Agreement or any other Note Document, for the performance of this Guaranty Agreement or otherwise for the Indebtedness guaranteed hereby and to exchange, enforce, waive, subordinate and release any such security; (d) to apply any such security and to direct the order or manner of sale thereof as the Collateral Agent (in accordance with the Collateral Agreement) or the holders in their sole discretion may determine; (e) to obtain additional or substitute endorsers or guarantors; (f) to exercise or refrain from exercising any rights against the Company and others (including other guarantors); and (g) to apply any sums, by whomsoever paid or however realized, to the payment of the Guaranteed Obligations and all other obligations owed hereunder. Neither the holders nor the Collateral Agent shall have any obligation to proceed against any additional or substitute endorsers or guarantors or to pursue or exhaust any security provided by the Company, the Guarantor any other guarantor or any other Person or to pursue any other remedy available to the Collateral Agent or the holders.

If an event permitting the acceleration of the maturity of the principal amount of any Notes shall exist and such acceleration shall at such time be prevented or the right of any holder to receive any payment on account of the Guaranteed Obligations shall at such time be delayed or otherwise affected by reason of the pendency against the Company, the Guarantor or any other guarantor of a case or proceeding under a bankruptcy or insolvency law, the Guarantor agrees that, for purposes of this Guaranty Agreement and its obligations hereunder, the maturity of such principal amount shall be deemed to have been accelerated with the same effect as if the holder thereof had accelerated the same in accordance with the terms of the Note Agreement, and the Guarantor shall forthwith pay such accelerated Guaranteed Obligations.

Section 5. Subrogation and Subordination.

(a) The Guarantor will not exercise any rights which it may have acquired by way of subrogation under this Guaranty Agreement, by any payment made hereunder or otherwise, or accept any payment on account of such subrogation rights, or any rights of reimbursement, contribution or indemnity or any rights or recourse to any security for the Notes or this Guaranty Agreement unless and until all of the Guaranteed Obligations shall have been indefeasibly paid in full in cash.

(b) The Guarantor hereby subordinates the payment of all Indebtedness and other obligations of the Company or any other guarantor of the Guaranteed Obligations owing to the Guarantor, whether now existing or hereafter arising, including, without limitation, all rights and

Global Water, LLC Guaranty Agreement

claims described in clause (a) of this Section 5, to the indefeasible payment in full in cash of all of the Guaranteed Obligations. Subject to the Collateral Agreement, if the Collateral Agent or the Required Holders so request, any such Indebtedness or other obligations shall be enforced and performance received by the Guarantor as trustee for the holders and the proceeds thereof shall be paid over to the holders promptly, in the form received (together with any necessary endorsements) to be applied to the Guaranteed Obligations, whether matured or unmatured, as may be directed by the Required Holders, but without reducing or affecting in any manner the liability of the Guarantor under this Guaranty Agreement.

(c) If any amount or other payment is made to or accepted by the Guarantor in violation of any of the preceding clauses (a) and (b) of this Section 5, such amount shall be deemed to have been paid to the Guarantor for the benefit of, and held in trust for the benefit of, the holders and shall be paid over to the holders promptly (or as otherwise provided in Section 5(b)), in the form received (together with any necessary endorsements) to be applied to the Guaranteed Obligations, whether matured or unmatured, as may be directed by the Required Holders (or as otherwise provided in Section 5(b)), but without reducing or affecting in any manner the liability of the Guarantor under this Guaranty Agreement.

(d) The Guarantor acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated by the Note Agreement and that its agreements set forth in this Guaranty Agreement (including this Section 5) are knowingly made in contemplation of such benefits.

Section 6. Reinstatement of Guaranty.

This Guaranty Agreement shall continue to be effective, or be reinstated, as the case may be, if and to the extent at any time payment, in whole or in part, of any of the sums due to any holder on account of the Guaranteed Obligations is rescinded or must otherwise be restored or returned by a holder upon the insolvency, bankruptcy, dissolution, liquidation or reorganization of the Company or any other guarantor, or upon or as a result of the appointment of a custodian, receiver, trustee or other officer with similar powers with respect to the Company or any other guarantor or any part of its or their property, or otherwise, all as though such payments had not been made.

Section 7. Rank of Guaranty.

The Guarantor will ensure that its payment obligations under this Guaranty Agreement will at all times rank at least pari passu, without preference or priority, with all other unsecured and unsubordinated Indebtedness of the Guarantor now or hereafter existing.

Section 8. Term of guaranty agreement.

This Guaranty Agreement and all guarantees, covenants and agreements of the Guarantor contained herein shall continue in full force and effect and shall not be discharged until such time

Global Water, LLC Guaranty Agreement

as all of the Guaranteed Obligations and all other obligations hereunder shall be indefeasibly paid in full in cash and shall be subject to reinstatement pursuant to Section 6.

Section 9. Survival of Representations and Warranties; Entire Agreement.

All representations and warranties contained herein shall survive the execution and delivery of this Guaranty Agreement and may be relied upon by any subsequent holder, regardless of any investigation made at any time by or on behalf of any Purchaser or any other holder. All statements contained in any certificate or other instrument delivered by or on behalf of the Guarantor pursuant to this Guaranty Agreement shall be deemed representations and warranties of the Guarantor under this Guaranty Agreement. Subject to the preceding sentence, this Guaranty Agreement embodies the entire agreement and understanding between each holder and the Guarantor and supersedes all prior agreements and understandings relating to the subject matter hereof.

Section 10. Amendment and Waiver.

Section 10.1. Requirements. Except as otherwise provided in the fourth paragraph of Section 1 of this Guaranty Agreement, this Guaranty Agreement may be amended, and the observance of any term hereof may be waived (either retroactively or prospectively), with (and only with) the written consent of the Guarantor and the Required Holders, except that no amendment or waiver (a) of any of the first three paragraphs of Section 1 or any of the provisions of Section 2, 3, 4, 5, 6, 7, 8, or 12 hereof, or any defined term (as it is used therein), or (b) which results in the limitation of the liability of the Guarantor hereunder (except to the extent provided in the fourth paragraph of Section 1 of this Guaranty Agreement) will be effective as to any holder unless consented to by such holder in writing.

Section 10.2. Solicitation of Holders of Notes.

(a) Solicitation. The Guarantor will provide each holder of the Notes (irrespective of the amount of Notes then owned by it) with sufficient information, sufficiently far in advance of the date a decision is required, to enable such holder to make an informed and considered decision with respect to any proposed amendment, waiver or consent in respect of any of the provisions hereof. The Guarantor will deliver executed or true and correct copies of each amendment, waiver or consent effected pursuant to the provisions of this Section 10.2 to each holder promptly following the date on which it is executed and delivered by, or receives the consent or approval of, the requisite holders of Notes.

(b) Payment. The Guarantor will not directly or indirectly pay or cause to be paid any remuneration, whether by way of supplemental or additional interest, fee or otherwise, or grant any security or provide other credit support, to any holder as consideration for or as an inducement to the entering into by any holder of any waiver or amendment of any of the terms and provisions hereof unless such remuneration is concurrently paid, or security is concurrently granted or other credit support concurrently provided, on the same terms, ratably to each holder even if such holder did not consent to such waiver or amendment.

Global Water, LLC Guaranty Agreement

(c) Consent in Contemplation of Transfer. Any consent made pursuant to this Section 10 by a holder that has transferred or has agreed to transfer its Notes to the Company, or to any Subsidiary or any Affiliate (including the Guarantor) of the Company, and has provided or has agreed to provide such written consent as a condition to such transfer, shall be void and of no force or effect except solely as to such holder, and any amendments effected or waivers granted or to be effected or granted that would not have been or would not be so effected or granted but for such consent (and the consents of all other holders of Notes that were acquired under the same or similar conditions) shall be void and of no force or effect except solely as to such holder.

Section 10.3. Binding Effect. Any amendment or waiver consented to as provided in this Section 10 applies equally to all holders and is binding upon them and upon each future holder and upon the Guarantor without regard to whether any Note has been marked to indicate such amendment or waiver. No such amendment or waiver will extend to or affect any obligation, covenant or agreement not expressly amended or waived or impair any right consequent thereon. No course of dealing between the Guarantor and the holder nor any delay in exercising any rights hereunder or under any Note shall operate as a waiver of any rights of any holder. As used herein, the term “this Guaranty Agreement” and references thereto shall mean this Guaranty Agreement as it may be amended, modified, supplemented or restated from time to time.

Section 10.4. Notes held by Guarantor, Company, Etc. Solely for the purpose of determining whether the holders of the requisite percentage of the aggregate principal amount of Notes then outstanding approved or consented to any amendment, waiver or consent to be given under this Guaranty Agreement, or have directed the taking of any action provided herein to be taken upon the direction of the holders of a specified percentage of the aggregate principal amount of Notes then outstanding, Notes directly or indirectly owned by the Guarantor, the Company or any of their respective Affiliates shall be deemed not to be outstanding.

Section 11. Representations and Warranties of the Guarantor.

The Guarantor represents and warrants to each holder as follows:

Section 11.1. Organization; Power and Authority. The Guarantor has the corporate or similar power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts and proposes to transact, to execute and deliver this Guaranty Agreement and to perform the provisions hereof.

Section 11.2. Authorization, Etc. This Guaranty Agreement has been duly authorized by all necessary corporate or similar action on the part of the Guarantor, and this Guaranty Agreement constitutes upon execution and delivery thereof a legal, valid and binding obligation of the Guarantor enforceable against the Guarantor in accordance with its terms, except as such enforceability may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (b) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

Global Water, LLC Guaranty Agreement

Section 11.3. Governmental Authorizations, Etc. No consent, approval or authorization of, or registration, filing or declaration with, any Governmental Authority is required in connection with the execution, delivery or performance by the Guarantor of this Guaranty Agreement.

Section 12. Notices.

All notices and communications provided for hereunder shall be in writing and sent (a) by telecopy or electronic mail if the sender on the same day sends a confirming copy of such notice by a recognized overnight delivery service (charges prepaid), or (b) by registered or certified mail with return receipt requested (postage prepaid), or (c) by a recognized overnight delivery service (with charges prepaid). Any such notice must be sent:

(a) if to the Guarantor, to 21410 N. 19th Avenue, Suite 220, Phoenix, AZ 85027, or such other address as the Guarantor shall have specified to the holders in writing, or

(b) if to any holder, to such holder at the addresses specified for such communications set forth in Schedule A to the Note Agreement, or such other address as such holder shall have specified to the Company in writing, or

(c) Each document, instrument, financial statement, report, notice or other communication delivered in connection with this Guaranty Agreement shall be in English or accompanied by an English translation thereof.

Section 13. Miscellaneous.

Section 13.1. Successors and Assigns. All covenants and other agreements contained in this Guaranty Agreement by or on behalf of any of the parties hereto bind and inure to the benefit of their respective successors and assigns whether so expressed or not.

Section 13.2. Severability. Any provision of this Guaranty Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall (to the full extent permitted by law), not invalidate or render unenforceable such provision in any other jurisdiction.

Section 13.3. Construction. Each covenant contained herein shall be construed (absent express provision to the contrary) as being independent of each other covenant contained herein, so that compliance with any one covenant shall not (absent such express contrary provision) be deemed to excuse compliance with any other covenant. Whether any provision herein refers to action to be taken by any Person, or which such Person is prohibited from taking, such provision shall be applicable whether such action is taken directly or indirectly by such Person.

The section and subsection headings in this Guaranty Agreement are for convenience of reference only and shall neither be deemed to be a part of this Guaranty Agreement nor modify,

Global Water, LLC Guaranty Agreement

define, expand or limit any of the terms or provisions hereof. All references herein to numbered sections, unless otherwise indicated, are to sections of this Guaranty Agreement. Words and definitions in the singular shall be read and construed as though in the plural and vice versa, and words in the masculine, neuter or feminine gender shall be read and construed as though in either of the other genders where the context so requires.

Section 13.4. Further Assurances. The Guarantor agrees to execute and deliver all such instruments and take all such action as the Required Holders may from time to time reasonably request in order to effectuate fully the purposes of this Guaranty Agreement.

Section 13.5. Governing Law. This Guaranty Agreement shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the law of the State of New York, excluding choice-of-law principles of the law of such State that would require or permit the application of the laws of a jurisdiction other than such State.

Section 13.6. Jurisdiction and Process; Waiver of Jury Trial. (a) The Guarantor irrevocably submits to the non-exclusive jurisdiction of any New York State or federal court sitting in the Borough of Manhattan, The City of New York, over any suit, action or proceeding arising out of or relating to this Guaranty Agreement. To the fullest extent permitted by applicable law, the Guarantor irrevocably waives and agrees not to assert, by way of motion, as a defense or otherwise, any claim that it is not subject to the jurisdiction of any such court, any objection that it may now or hereafter have to the laying of the venue of any such suit, action or proceeding brought in any such court and any claim that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum.

(b) The Guarantor consents to process being served by or on behalf of any holder in any suit, action or proceeding of the nature referred to in Section 13.6(a) by hand delivery, delivery by reputable commercial delivery service, charges prepaid, by mailing a copy thereof by registered or certified mail (or any substantially similar form of mail), postage prepaid, return receipt requested, to it at its address specified in Section 12 or at such other address of which such holder shall then have been notified pursuant to Section 12. The Guarantor agrees that such service upon receipt (i) shall be deemed in every respect effective service of process upon it in any such suit, action or proceeding and (ii) shall, to the fullest extent permitted by applicable law, be taken and held to be valid personal service upon and personal delivery to it. Notices hereunder shall be conclusively presumed received as evidenced by a delivery receipt furnished by the United States Postal Service or any reputable commercial delivery service.

(c) Nothing in this Section 13.6 shall affect the right of any holder to serve process in any manner permitted by law, or limit any right that the holders may have to bring proceedings against the Guarantor in the courts of any appropriate jurisdiction or to enforce in any lawful manner a judgment obtained in one jurisdiction in any other jurisdiction.

(d) The Guarantor and the holders (by their acceptance hereof) hereby waive trial by jury in any action brought on or with respect to this Guaranty Agreement or other document executed in connection herewith.

Global Water, LLC Guaranty Agreement

Section 13.7. Reproduction of Documents; Execution. This Guaranty Agreement may be reproduced by any holder by any photographic, photostatic, electronic, digital, or other similar process and such holder may destroy any original document so reproduced. The Guarantor agrees and stipulates that, to the extent permitted by applicable law, any such reproduction shall be admissible in evidence as the original itself in any judicial or administrative proceeding (whether or not the original is in existence and whether or not such reproduction was made by such holder in the regular course of business) and any enlargement, facsimile or further reproduction of such reproduction shall likewise be admissible in evidence. This Section 13.7 shall not prohibit the Guarantor or any holder of Notes from contesting any such reproduction to the same extent that it could contest the original, or from introducing evidence to demonstrate the inaccuracy of any such reproduction. A facsimile or electronic transmission of the signature page of the Guarantor shall be as effective as delivery of a manually executed counterpart hereof and shall be admissible into evidence for all purposes.

Global Water, LLC Guaranty Agreement

In Witness Whereof, the Guarantor has caused this Guaranty Agreement to be duly executed and delivered as of the date and year first above written.

Global Water, LLC

By: /s/ Michael J. Liebman

Name: Michael J. Liebman

Title: Manager

Guaranty Agreement

Dated as of January 3, 2024

of

Global Water Holdings, Inc.

Table of Contents

Section Heading Page

| | | | | |

Section 1. Guaranty | |

Section 2. Obligations Absolute | |

Section 3. Waiver | |

Section 4. Obligations Unimpaired | |

Section 5. Subrogation and Subordination | |

Section 6. Reinstatement of Guaranty | |

Section 7. Rank of Guaranty | |

Section 8. Term of guaranty agreement | |

Section 9. Survival of Representations and Warranties; Entire Agreement | |

Section 10. Amendment and Waiver | |

Section 10.1. Requirements | |

Section 10.2. Solicitation of Holders of Notes | |

Section 10.3. Binding Effect | |

Section 10.4. Notes held by Guarantor, Company, Etc | |

Section 11. Representations and Warranties of the Guarantor | |

Section 11.1. Organization; Power and Authority | |

Section 11.2. Authorization, Etc | |

Section 11.3. Governmental Authorizations, Etc | |

Section 12. Notices | |

Section 13. Miscellaneous | |

Section 13.1. Successors and Assigns | |

Section 13.2. Severability | |

Section 13.3. Construction | |

Section 13.4. Further Assurances | |

Section 13.5. Governing Law | |

Section 13.6. Jurisdiction and Process; Waiver of Jury Trial | |

Section 13.7. Reproduction of Documents; Execution | |

Guaranty Agreement

This Guaranty Agreement, dated as of January 3, 2024 (this “Guaranty Agreement”), is made by Global Water Holdings, Inc., an Arizona corporation (the “Guarantor”) in favor of the Purchasers (as defined below) and the other holders from time to time of the Notes (as defined below). The Purchasers and such other holders from time to time of the Notes are herein collectively called the “holders” and individually a “holder.”

Preliminary statements:

I. Global Water Resources, Inc., a Delaware corporation (the “Company”), entered into a Note Purchase Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Note Agreement”) with the Persons listed on the signature pages thereto (the “Purchasers”). Capitalized terms used herein have the meanings specified in the Note Agreement unless otherwise defined herein.

II. The Company, the purchasers of the notes issued pursuant to the 2016 Note Purchase Agreement, and U.S. Bank National Association, in its capacity as collateral agent for the benefit of the Secured Parties (as defined therein) (the “Collateral Agent”) have entered into a Third Amended and Restated Collateral Agency Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Collateral Agreement”). On or about the date hereof, the Purchasers have executed and delivered a Joinder Agreement, pursuant to which the Purchasers have become parties to the Collateral Agreement and “Secured Parties” thereunder, all as more particularly provided in such Joinder Agreement.

III. The Company has authorized the issuance, pursuant to the Note Agreement, of 6.91% Senior Secured Notes due January 3, 2034 in the aggregate principal amount of $20,000,000. Pursuant to the Note Agreement, the Company proposes to issue and sell $20,000,000 aggregate principal amount of its 6.91% Senior Secured Notes due January 3, 2034 (the “Initial Notes”). The Initial Notes and any other Notes that may from time to time be issued pursuant to the Note Agreement (including any notes issued in substitution for any of the Notes) are herein collectively called the “Notes” and individually a “Note”.

IV. Pursuant to the Note Agreement, the Company is required to cause the Guarantor to deliver this Guaranty Agreement to the holders.

V. The Guarantor will receive direct and indirect benefits from the financing arrangements contemplated by the Note Agreement. The Board of Directors of the Guarantor has determined that the incurrence of such obligations is in the best interests of the Guarantor.

Now Therefore, in compliance with the Note Agreement, and in consideration of, the execution and delivery of the Note Agreement and the purchase of the Notes by each of the Purchasers, the Guarantor hereby covenants and agrees with, and represents and warrants to each of the holders as follows:

Global Water Holdings, Inc. Guaranty Agreement

Section 1. Guaranty.

The Guarantor hereby irrevocably and unconditionally guarantees to each holder, the due and punctual payment in full of (a) the principal of, Make-Whole Amount, if any, and interest on (including, without limitation, interest accruing after the filing of any petition in bankruptcy, or the commencement of any insolvency, reorganization or like proceeding, whether or not a claim for post-filing or post-petition interest is allowed in such proceeding), and any other amounts due under, the Notes when and as the same shall become due and payable (whether at stated maturity or by required or optional prepayment or by acceleration or otherwise) and (b) any expenses, indemnities and other sums which may become due to the holders or the Collateral Agent under the terms and provisions of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document (all such obligations described in clauses (a) and (b) above are herein called the “Guaranteed Obligations”).

The guaranty in the preceding sentence is an absolute, present and continuing guaranty of payment and not of collectability and is in no way conditional or contingent upon any attempt to collect from the Company or any other guarantor of the Notes or other Guaranteed Obligations or upon any other action, occurrence or circumstance whatsoever. In the event that the Company shall fail to pay any of such Guaranteed Obligations, the Guarantor agrees to pay the same when due to the Collateral Agent and/or holders entitled thereto, without demand, presentment, protest or notice of any kind, in lawful money of the United States of America, pursuant to the requirements for payment specified in the Notes, the Note Agreement, the Collateral Agreement and the other Note Documents. Each default in payment of any of the Guaranteed Obligations shall give rise to a separate cause of action hereunder and separate suits may be brought hereunder as each cause of action arises. The Guarantor agrees that the Notes issued pursuant to the Note Agreement may (but need not) make reference to this Guaranty Agreement.

The Guarantor hereby acknowledges and agrees that the Guarantor’s liability hereunder is joint and several with any other Person(s) who may guarantee the Guaranteed Obligations.

Notwithstanding the foregoing provisions or any other provision of this Guaranty Agreement, by their acceptance of this Guaranty, the Purchasers (on behalf of themselves and their successors and assigns) and the Guarantor hereby agree that if at any time the Guaranteed Obligations exceed the Maximum Guaranteed Amount determined as of such time with regard to the Guarantor, then this Guaranty Agreement shall be automatically amended to reduce the Guaranteed Obligations to the Maximum Guaranteed Amount. Such amendment shall not require the written consent of the Guarantor or any holder and shall be deemed to have been automatically consented to by the Guarantor and each holder. The Guarantor agrees that the Guaranteed Obligations may at any time exceed the Maximum Guaranteed Amount without affecting or impairing the obligation of the Guarantor. “Maximum Guaranteed Amount” means as of the date of determination with respect to the Guarantor, the lesser of (a) the amount of the Guaranteed Obligations outstanding on such date and (b) the maximum amount that would not render the Guarantor’s liability under this Guaranty Agreement subject to avoidance under Section 548 of the United States Bankruptcy Code (or any successor provision) or any comparable provision of applicable state law.

Global Water Holdings, Inc. Guaranty Agreement

Section 2. Obligations Absolute.

The obligations of the Guarantor hereunder shall be primary, absolute, irrevocable and unconditional, irrespective of the validity or enforceability of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, shall not be subject to any counterclaim, setoff, deduction or defense based upon any claim the Guarantor may have against the Company or any holder or otherwise, and shall remain in full force and effect without regard to, and shall not be released, discharged or in any way affected by, any circumstance or condition whatsoever (whether or not the Guarantor shall have any knowledge or notice thereof), including, without limitation: (a) any amendment to, modification of, supplement to or restatement of the Notes, the Note Agreement or any other Note Document (it being agreed that the obligations of the Guarantor hereunder shall apply to the Notes, the Note Agreement or any other Note Document as so amended, modified, supplemented or restated) or any assignment or transfer of any thereof or of any interest therein, or any furnishing, acceptance or release of any security for the Notes; (b) any waiver, consent, extension, indulgence or other action or inaction under or in respect of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document; (c) any bankruptcy, insolvency, arrangement, reorganization, readjustment, composition, liquidation or similar proceeding with respect to the Company or its property; (d) any merger, amalgamation or consolidation of the Guarantor or of the Company into or with any other Person or any sale, lease or transfer of any or all of the assets of the Guarantor or of the Company to any Person; (e) any failure on the part of the Company for any reason to comply with or perform any of the terms of any other agreement with the Guarantor; (f) any failure on the part of the Collateral Agent or any holder to obtain, maintain, register or otherwise perfect any security; or (g) any other event or circumstance which might otherwise constitute a legal or equitable discharge or defense of a guarantor (whether or not similar to the foregoing), and in any event however material or prejudicial it may be to the Guarantor or to any subrogation, contribution or reimbursement rights the Guarantor may otherwise have.

Section 3. Waiver.

The Guarantor unconditionally waives to the fullest extent permitted by law, (a) notice of acceptance hereof, of any action taken or omitted in reliance hereon and of any default by the Company in the payment of any amounts due under the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, and of any of the matters referred to in Section 2 hereof, (b) all notices which may be required by statute, rule of law or otherwise to preserve any of the rights of the Collateral Agent or any holder against the Guarantor, including, without limitation, presentment to or demand for payment from the Company or the Guarantor with respect to any Note, notice to the Company or to the Guarantor of default or protest for nonpayment or dishonor and the filing of claims with a court in the event of the bankruptcy of the Company, (c) any right to require the Collateral Agent or any holder to enforce, assert or exercise any right, power or remedy including, without limitation, any right, power or remedy conferred in the Note Agreement, the Notes, the Collateral Agreement or any other Note Document, (d) any requirement for diligence on the part of the Collateral Agent or any holder and (e) any other act or omission or thing or delay in doing any other act or thing which might in any manner or to any extent vary the risk of the Guarantor or otherwise operate as a discharge of the Guarantor or in any manner lessen the obligations of the Guarantor hereunder.

Global Water Holdings, Inc. Guaranty Agreement

Section 4. Obligations Unimpaired.

The Guarantor authorizes the Collateral Agent and/or the holders (as applicable), without notice or demand to the Guarantor and without affecting its obligations hereunder, from time to time: (a) to renew, compromise, extend, accelerate or otherwise change the time for payment of, all or any part of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document; (b) to change any of the representations, covenants, events of default or any other terms or conditions of or pertaining to the Notes, the Note Agreement, the Collateral Agreement or any other Note Document, including, without limitation, decreases or increases in amounts of principal, rates of interest, the Make-Whole Amount or any other obligation; (c) to take and hold security for the payment of the Notes, the Note Agreement, this Guaranty Agreement or any other Note Document, for the performance of this Guaranty Agreement or otherwise for the Indebtedness guaranteed hereby and to exchange, enforce, waive, subordinate and release any such security; (d) to apply any such security and to direct the order or manner of sale thereof as the Collateral Agent (in accordance with the Collateral Agreement) or the holders in their sole discretion may determine; (e) to obtain additional or substitute endorsers or guarantors; (f) to exercise or refrain from exercising any rights against the Company and others (including other guarantors); and (g) to apply any sums, by whomsoever paid or however realized, to the payment of the Guaranteed Obligations and all other obligations owed hereunder. Neither the holders nor the Collateral Agent shall have any obligation to proceed against any additional or substitute endorsers or guarantors or to pursue or exhaust any security provided by the Company, the Guarantor any other guarantor or any other Person or to pursue any other remedy available to the Collateral Agent or the holders.

If an event permitting the acceleration of the maturity of the principal amount of any Notes shall exist and such acceleration shall at such time be prevented or the right of any holder to receive any payment on account of the Guaranteed Obligations shall at such time be delayed or otherwise affected by reason of the pendency against the Company, the Guarantor or any other guarantor of a case or proceeding under a bankruptcy or insolvency law, the Guarantor agrees that, for purposes of this Guaranty Agreement and its obligations hereunder, the maturity of such principal amount shall be deemed to have been accelerated with the same effect as if the holder thereof had accelerated the same in accordance with the terms of the Note Agreement, and the Guarantor shall forthwith pay such accelerated Guaranteed Obligations.

Section 5. Subrogation and Subordination.

(a) The Guarantor will not exercise any rights which it may have acquired by way of subrogation under this Guaranty Agreement, by any payment made hereunder or otherwise, or accept any payment on account of such subrogation rights, or any rights of reimbursement, contribution or indemnity or any rights or recourse to any security for the Notes or this Guaranty Agreement unless and until all of the Guaranteed Obligations shall have been indefeasibly paid in full in cash.

(b) The Guarantor hereby subordinates the payment of all Indebtedness and other obligations of the Company or any other guarantor of the Guaranteed Obligations owing to the Guarantor, whether now existing or hereafter arising, including, without limitation, all rights and

Global Water Holdings, Inc. Guaranty Agreement

claims described in clause (a) of this Section 5, to the indefeasible payment in full in cash of all of the Guaranteed Obligations. Subject to the Collateral Agreement, if the Collateral Agent or the Required Holders so request, any such Indebtedness or other obligations shall be enforced and performance received by the Guarantor as trustee for the holders and the proceeds thereof shall be paid over to the holders promptly, in the form received (together with any necessary endorsements) to be applied to the Guaranteed Obligations, whether matured or unmatured, as may be directed by the Required Holders, but without reducing or affecting in any manner the liability of the Guarantor under this Guaranty Agreement.

(c) If any amount or other payment is made to or accepted by the Guarantor in violation of any of the preceding clauses (a) and (b) of this Section 5, such amount shall be deemed to have been paid to the Guarantor for the benefit of, and held in trust for the benefit of, the holders and shall be paid over to the holders promptly (or as otherwise provided in Section 5(b)), in the form received (together with any necessary endorsements) to be applied to the Guaranteed Obligations, whether matured or unmatured, as may be directed by the Required Holders (or as otherwise provided in Section 5(b)), but without reducing or affecting in any manner the liability of the Guarantor under this Guaranty Agreement.

(d) The Guarantor acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated by the Note Agreement and that its agreements set forth in this Guaranty Agreement (including this Section 5) are knowingly made in contemplation of such benefits.

Section 6. Reinstatement of Guaranty.

This Guaranty Agreement shall continue to be effective, or be reinstated, as the case may be, if and to the extent at any time payment, in whole or in part, of any of the sums due to any holder on account of the Guaranteed Obligations is rescinded or must otherwise be restored or returned by a holder upon the insolvency, bankruptcy, dissolution, liquidation or reorganization of the Company or any other guarantor, or upon or as a result of the appointment of a custodian, receiver, trustee or other officer with similar powers with respect to the Company or any other guarantor or any part of its or their property, or otherwise, all as though such payments had not been made.

Section 7. Rank of Guaranty.

The Guarantor will ensure that its payment obligations under this Guaranty Agreement will at all times rank at least pari passu, without preference or priority, with all other unsecured and unsubordinated Indebtedness of the Guarantor now or hereafter existing.

Section 8. Term of guaranty agreement.

This Guaranty Agreement and all guarantees, covenants and agreements of the Guarantor contained herein shall continue in full force and effect and shall not be discharged until such time

Global Water Holdings, Inc. Guaranty Agreement

as all of the Guaranteed Obligations and all other obligations hereunder shall be indefeasibly paid in full in cash and shall be subject to reinstatement pursuant to Section 6.

Section 9. Survival of Representations and Warranties; Entire Agreement.

All representations and warranties contained herein shall survive the execution and delivery of this Guaranty Agreement and may be relied upon by any subsequent holder, regardless of any investigation made at any time by or on behalf of any Purchaser or any other holder. All statements contained in any certificate or other instrument delivered by or on behalf of the Guarantor pursuant to this Guaranty Agreement shall be deemed representations and warranties of the Guarantor under this Guaranty Agreement. Subject to the preceding sentence, this Guaranty Agreement embodies the entire agreement and understanding between each holder and the Guarantor and supersedes all prior agreements and understandings relating to the subject matter hereof.

Section 10. Amendment and Waiver.

Section 10.1. Requirements. Except as otherwise provided in the fourth paragraph of Section 1 of this Guaranty Agreement, this Guaranty Agreement may be amended, and the observance of any term hereof may be waived (either retroactively or prospectively), with (and only with) the written consent of the Guarantor and the Required Holders, except that no amendment or waiver (a) of any of the first three paragraphs of Section 1 or any of the provisions of Section 2, 3, 4, 5, 6, 7, 8, or 12 hereof, or any defined term (as it is used therein), or (b) which results in the limitation of the liability of the Guarantor hereunder (except to the extent provided in the fourth paragraph of Section 1 of this Guaranty Agreement) will be effective as to any holder unless consented to by such holder in writing.

Section 10.2. Solicitation of Holders of Notes.

(a) Solicitation. The Guarantor will provide each holder of the Notes (irrespective of the amount of Notes then owned by it) with sufficient information, sufficiently far in advance of the date a decision is required, to enable such holder to make an informed and considered decision with respect to any proposed amendment, waiver or consent in respect of any of the provisions hereof. The Guarantor will deliver executed or true and correct copies of each amendment, waiver or consent effected pursuant to the provisions of this Section 10.2 to each holder promptly following the date on which it is executed and delivered by, or receives the consent or approval of, the requisite holders of Notes.

(b) Payment. The Guarantor will not directly or indirectly pay or cause to be paid any remuneration, whether by way of supplemental or additional interest, fee or otherwise, or grant any security or provide other credit support, to any holder as consideration for or as an inducement to the entering into by any holder of any waiver or amendment of any of the terms and provisions hereof unless such remuneration is concurrently paid, or security is concurrently granted or other credit support concurrently provided, on the same terms, ratably to each holder even if such holder did not consent to such waiver or amendment.

Global Water Holdings, Inc. Guaranty Agreement

(c) Consent in Contemplation of Transfer. Any consent made pursuant to this Section 10 by a holder that has transferred or has agreed to transfer its Notes to the Company, or to any Subsidiary or any Affiliate (including the Guarantor) of the Company, and has provided or has agreed to provide such written consent as a condition to such transfer, shall be void and of no force or effect except solely as to such holder, and any amendments effected or waivers granted or to be effected or granted that would not have been or would not be so effected or granted but for such consent (and the consents of all other holders of Notes that were acquired under the same or similar conditions) shall be void and of no force or effect except solely as to such holder.

Section 10.3. Binding Effect. Any amendment or waiver consented to as provided in this Section 10 applies equally to all holders and is binding upon them and upon each future holder and upon the Guarantor without regard to whether any Note has been marked to indicate such amendment or waiver. No such amendment or waiver will extend to or affect any obligation, covenant or agreement not expressly amended or waived or impair any right consequent thereon. No course of dealing between the Guarantor and the holder nor any delay in exercising any rights hereunder or under any Note shall operate as a waiver of any rights of any holder. As used herein, the term “this Guaranty Agreement” and references thereto shall mean this Guaranty Agreement as it may be amended, modified, supplemented or restated from time to time.

Section 10.4. Notes held by Guarantor, Company, Etc. Solely for the purpose of determining whether the holders of the requisite percentage of the aggregate principal amount of Notes then outstanding approved or consented to any amendment, waiver or consent to be given under this Guaranty Agreement, or have directed the taking of any action provided herein to be taken upon the direction of the holders of a specified percentage of the aggregate principal amount of Notes then outstanding, Notes directly or indirectly owned by the Guarantor, the Company or any of their respective Affiliates shall be deemed not to be outstanding.

Section 11. Representations and Warranties of the Guarantor.

The Guarantor represents and warrants to each holder as follows:

Section 11.1. Organization; Power and Authority. The Guarantor has the corporate or similar power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts and proposes to transact, to execute and deliver this Guaranty Agreement and to perform the provisions hereof.

Section 11.2. Authorization, Etc. This Guaranty Agreement has been duly authorized by all necessary corporate or similar action on the part of the Guarantor, and this Guaranty Agreement constitutes upon execution and delivery thereof a legal, valid and binding obligation of the Guarantor enforceable against the Guarantor in accordance with its terms, except as such enforceability may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (b) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

Global Water Holdings, Inc. Guaranty Agreement

Section 11.3. Governmental Authorizations, Etc. No consent, approval or authorization of, or registration, filing or declaration with, any Governmental Authority is required in connection with the execution, delivery or performance by the Guarantor of this Guaranty Agreement.

Section 12. Notices.

All notices and communications provided for hereunder shall be in writing and sent (a) by telecopy or electronic mail if the sender on the same day sends a confirming copy of such notice by a recognized overnight delivery service (charges prepaid), or (b) by registered or certified mail with return receipt requested (postage prepaid), or (c) by a recognized overnight delivery service (with charges prepaid). Any such notice must be sent:

(a) if to the Guarantor, to 21410 N. 19th Avenue, Suite 220, Phoenix, Arizona 85027, or such other address as the Guarantor shall have specified to the holders in writing, or

(b) if to any holder, to such holder at the addresses specified for such communications set forth in Schedule A to the Note Agreement, or such other address as such holder shall have specified to the Company in writing, or

(c) Each document, instrument, financial statement, report, notice or other communication delivered in connection with this Guaranty Agreement shall be in English or accompanied by an English translation thereof.

Section 13. Miscellaneous.

Section 13.1. Successors and Assigns. All covenants and other agreements contained in this Guaranty Agreement by or on behalf of any of the parties hereto bind and inure to the benefit of their respective successors and assigns whether so expressed or not.

Section 13.2. Severability. Any provision of this Guaranty Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall (to the full extent permitted by law), not invalidate or render unenforceable such provision in any other jurisdiction.

Section 13.3. Construction. Each covenant contained herein shall be construed (absent express provision to the contrary) as being independent of each other covenant contained herein, so that compliance with any one covenant shall not (absent such express contrary provision) be deemed to excuse compliance with any other covenant. Whether any provision herein refers to action to be taken by any Person, or which such Person is prohibited from taking, such provision shall be applicable whether such action is taken directly or indirectly by such Person.

The section and subsection headings in this Guaranty Agreement are for convenience of reference only and shall neither be deemed to be a part of this Guaranty Agreement nor modify,

Global Water Holdings, Inc. Guaranty Agreement

define, expand or limit any of the terms or provisions hereof. All references herein to numbered sections, unless otherwise indicated, are to sections of this Guaranty Agreement. Words and definitions in the singular shall be read and construed as though in the plural and vice versa, and words in the masculine, neuter or feminine gender shall be read and construed as though in either of the other genders where the context so requires.

Section 13.4. Further Assurances. The Guarantor agrees to execute and deliver all such instruments and take all such action as the Required Holders may from time to time reasonably request in order to effectuate fully the purposes of this Guaranty Agreement.

Section 13.5. Governing Law. This Guaranty Agreement shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the law of the State of New York, excluding choice-of-law principles of the law of such State that would require or permit the application of the laws of a jurisdiction other than such State.

Section 13.6. Jurisdiction and Process; Waiver of Jury Trial. (a) The Guarantor irrevocably submits to the non-exclusive jurisdiction of any New York State or federal court sitting in the Borough of Manhattan, The City of New York, over any suit, action or proceeding arising out of or relating to this Guaranty Agreement. To the fullest extent permitted by applicable law, the Guarantor irrevocably waives and agrees not to assert, by way of motion, as a defense or otherwise, any claim that it is not subject to the jurisdiction of any such court, any objection that it may now or hereafter have to the laying of the venue of any such suit, action or proceeding brought in any such court and any claim that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum.

(b) The Guarantor consents to process being served by or on behalf of any holder in any suit, action or proceeding of the nature referred to in Section 13.6(a) by hand delivery, delivery by reputable commercial delivery service, charges prepaid, by mailing a copy thereof by registered or certified mail (or any substantially similar form of mail), postage prepaid, return receipt requested, to it at its address specified in Section 12 or at such other address of which such holder shall then have been notified pursuant to Section 12. The Guarantor agrees that such service upon receipt (i) shall be deemed in every respect effective service of process upon it in any such suit, action or proceeding and (ii) shall, to the fullest extent permitted by applicable law, be taken and held to be valid personal service upon and personal delivery to it. Notices hereunder shall be conclusively presumed received as evidenced by a delivery receipt furnished by the United States Postal Service or any reputable commercial delivery service.

(c) Nothing in this Section 13.6 shall affect the right of any holder to serve process in any manner permitted by law, or limit any right that the holders may have to bring proceedings against the Guarantor in the courts of any appropriate jurisdiction or to enforce in any lawful manner a judgment obtained in one jurisdiction in any other jurisdiction.

(d) The Guarantor and the holders (by their acceptance hereof) hereby waive trial by jury in any action brought on or with respect to this Guaranty Agreement or other document executed in connection herewith.

Global Water Holdings, Inc. Guaranty Agreement

Section 13.7. Reproduction of Documents; Execution. This Guaranty Agreement may be reproduced by any holder by any photographic, photostatic, electronic, digital, or other similar process and such holder may destroy any original document so reproduced. The Guarantor agrees and stipulates that, to the extent permitted by applicable law, any such reproduction shall be admissible in evidence as the original itself in any judicial or administrative proceeding (whether or not the original is in existence and whether or not such reproduction was made by such holder in the regular course of business) and any enlargement, facsimile or further reproduction of such reproduction shall likewise be admissible in evidence. This Section 13.7 shall not prohibit the Guarantor or any holder of Notes from contesting any such reproduction to the same extent that it could contest the original, or from introducing evidence to demonstrate the inaccuracy of any such reproduction. A facsimile or electronic transmission of the signature page of the Guarantor shall be as effective as delivery of a manually executed counterpart hereof and shall be admissible into evidence for all purposes.

Global Water Holdings, Inc. Guaranty Agreement

In Witness Whereof, the Guarantor has caused this Guaranty Agreement to be duly executed and delivered as of the date and year first above written.

Global Water Holdings, Inc.

By: /s/ Michael J. Liebman

Name: Michael J. Liebman

Title: Manager

Guaranty Agreement

Dated as of January 3, 2024

of

West Maricopa Combine, LLC

Table of Contents

Section Heading Page

| | | | | |

Section 1. Guaranty | |

Section 2. Obligations Absolute | |

Section 3. Waiver | |

Section 4. Obligations Unimpaired | |

Section 5. Subrogation and Subordination | |

Section 6. Reinstatement of Guaranty | |

Section 7. Rank of Guaranty | |

Section 8. Term of guaranty agreement | |

Section 9. Survival of Representations and Warranties; Entire Agreement | |

Section 10. Amendment and Waiver | |

Section 10.1. Requirements | |

Section 10.2. Solicitation of Holders of Notes | |

Section 10.3. Binding Effect | |

Section 10.4. Notes held by Guarantor, Company, Etc | |

Section 11. Representations and Warranties of the Guarantor | |

Section 11.1. Organization; Power and Authority | |

Section 11.2. Authorization, Etc | |

Section 11.3. Governmental Authorizations, Etc | |

Section 12. Notices | |

Section 13. Miscellaneous | |

Section 13.1. Successors and Assigns | |

Section 13.2. Severability | |

Section 13.3. Construction | |

Section 13.4. Further Assurances | |

Section 13.5. Governing Law | |

Section 13.6. Jurisdiction and Process; Waiver of Jury Trial | |

Section 13.7. Reproduction of Documents; Execution | |

Guaranty Agreement

This Guaranty Agreement, dated as of January 3, 2024 (this “Guaranty Agreement”), is made by West Maricopa Combine, LLC, an Arizona limited liability company (the “Guarantor”) in favor of the Purchasers (as defined below) and the other holders from time to time of the Notes (as defined below). The Purchasers and such other holders from time to time of the Notes are herein collectively called the “holders” and individually a “holder.”

Preliminary statements:

I. Global Water Resources, Inc., a Delaware corporation (the “Company”), entered into a Note Purchase Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Note Agreement”) with the Persons listed on the signature pages thereto (the “Purchasers”). Capitalized terms used herein have the meanings specified in the Note Agreement unless otherwise defined herein.

II. The Company, the purchasers of the notes issued pursuant to the 2016 Note Purchase Agreement, and U.S. Bank National Association, in its capacity as collateral agent for the benefit of the Secured Parties (as defined therein) (the “Collateral Agent”) entered into a Third Amended and Restated Collateral Agency Agreement dated as of October 26, 2023 (as amended, modified, supplemented or restated from time to time, the “Collateral Agreement”). On or about the date hereof, the Purchasers have executed and delivered a Joinder Agreement, pursuant to which the Purchasers have become parties to the Collateral Agreement and “Secured Parties” thereunder, all as more particularly provided in such Joinder Agreement.

III. The Company has authorized the issuance, pursuant to the Note Agreement, of 6.91% Senior Secured Notes due January 3, 2034 in the aggregate principal amount of $20,000,000. Pursuant to the Note Agreement, the Company proposes to issue and sell $20,000,000 aggregate principal amount of its 6.91% Senior Secured Notes due January 3, 2034 (the “Initial Notes”). The Initial Notes and any other Notes that may from time to time be issued pursuant to the Note Agreement (including any notes issued in substitution for any of the Notes) are herein collectively called the “Notes” and individually a “Note”.

IV. Pursuant to the Note Agreement, the Company is required to cause the Guarantor to deliver this Guaranty Agreement to the holders.

V. The Guarantor will receive direct and indirect benefits from the financing arrangements contemplated by the Note Agreement. The Board of Directors of the Guarantor has determined that the incurrence of such obligations is in the best interests of the Guarantor.

Now Therefore, in compliance with the Note Agreement, and in consideration of, the execution and delivery of the Note Agreement and the purchase of the Notes by each of the Purchasers, the Guarantor hereby covenants and agrees with, and represents and warrants to each of the holders as follows:

West Maricopa Combine, LLC Guaranty Agreement

Section 1. Guaranty.

The Guarantor hereby irrevocably and unconditionally guarantees to each holder, the due and punctual payment in full of (a) the principal of, Make-Whole Amount, if any, and interest on (including, without limitation, interest accruing after the filing of any petition in bankruptcy, or the commencement of any insolvency, reorganization or like proceeding, whether or not a claim for post-filing or post-petition interest is allowed in such proceeding), and any other amounts due under, the Notes when and as the same shall become due and payable (whether at stated maturity or by required or optional prepayment or by acceleration or otherwise) and (b) any expenses, indemnities and other sums which may become due to the holders or the Collateral Agent under the terms and provisions of the Notes, the Note Agreement, the Collateral Agreement or any other Note Document (all such obligations described in clauses (a) and (b) above are herein called the “Guaranteed Obligations”).

The guaranty in the preceding sentence is an absolute, present and continuing guaranty of payment and not of collectability and is in no way conditional or contingent upon any attempt to collect from the Company or any other guarantor of the Notes or other Guaranteed Obligations or upon any other action, occurrence or circumstance whatsoever. In the event that the Company shall fail to pay any of such Guaranteed Obligations, the Guarantor agrees to pay the same when due to the Collateral Agent and/or holders entitled thereto, without demand, presentment, protest or notice of any kind, in lawful money of the United States of America, pursuant to the requirements for payment specified in the Notes, the Note Agreement, the Collateral Agreement and the other Note Documents. Each default in payment of any of the Guaranteed Obligations shall give rise to a separate cause of action hereunder and separate suits may be brought hereunder as each cause of action arises. The Guarantor agrees that the Notes issued pursuant to the Note Agreement may (but need not) make reference to this Guaranty Agreement.

The Guarantor hereby acknowledges and agrees that the Guarantor’s liability hereunder is joint and several with any other Person(s) who may guarantee the Guaranteed Obligations.