0000886744false00008867442023-11-262023-11-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): November 26, 2023

GERON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

000-20859 |

75-2287752 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

919 E. HILLSDALE BLVD, SUITE 250

FOSTER CITY, CALIFORNIA 94404

(Address of principal executive offices, including zip code)

(650) 473-7700

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value |

GERN |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of New Director

On November 26, 2023, the Board of Directors (the “Board”) of Geron Corporation (the “Company”), upon the recommendation of the Nominating and Corporate Governance Committee of the Board, appointed Gaurav Aggarwal, M.D. to the Board, effective immediately, as a Class III Board member with a term expiring at the Company’s 2026 annual meeting of stockholders. The Board has determined that Dr. Aggarwal is “independent” as contemplated by the Nasdaq Stock Market and other governing laws and applicable regulations.

Dr. Aggarwal has been an investor in the life sciences sector for more than twenty years. Most recently he served as Managing Director of a global investment firm, Vivo Capital LLC, from 2016 to 2023, and Chief Investment Officer of its U.S. public investment fund, from 2021 to 2023. Dr. Aggarwal previously served as the Chief Business Officer of Ocera Therapeutics, Inc., a publicly traded clinical-stage company developing therapies for orphan liver conditions, from April 2014 through October 2016; as Managing Director of Investor Growth Capital from January 2013 through December 2013; and as a General Partner at Panorama Capital, L.P., a venture capital fund, from August 2006 through December 2012. Earlier in his career, Dr. Aggarwal was an associate with JPMorgan Partners, LLC, a private equity division of JPMorgan Chase & Co.

Dr. Aggarwal has served on the board of directors of Unicycive Therapeutics Inc. since March 2023, and previously served on the boards of directors of Sierra Oncology, Inc. (acquired by GlaxoSmithKline plc), Hyperion Therapeutics, Inc. (acquired by Horizon Pharma plc), and on several privately held biopharmaceutical companies. Dr. Aggarwal received his M.D. from Columbia University, College of Physicians & Surgeons, and his B.S. in Agricultural Economics from Cornell University.

In accordance with the Company’s Non-Employee Director Compensation Policy (the “Policy”), Dr. Aggarwal is eligible to receive automatic grants of nonstatutory stock options to purchase the Company’s common stock under and subject to the terms and conditions of the Company’s 2018 Equity Incentive Plan, as amended (the “2018 Plan”) and the form of Non-Employee Director Stock Option Agreement under the 2018 Plan. Pursuant to the Policy, in connection with his election, the Company granted to Dr. Aggarwal a nonstatutory stock option to purchase 200,000 shares of the Company’s common stock (the “First Option”) at an exercise price equal to $1.97 per share. The First Option will have a maximum term of ten years measured from the grant date, and will vest and be exercisable in a series of three equal consecutive annual installments commencing on the first anniversary of the grant date, subject to Dr. Aggarwal's continuous service (as defined in the 2018 Plan) through each such date.

In addition, as provided by the Policy, on the date of each annual meeting of the Company’s stockholders, commencing with the annual meeting of stockholders in 2024, Dr. Aggarwal will be eligible to receive automatic grants of continuing, annual nonstatutory stock options to purchase 125,000 shares of the Company’s common stock (the “Annual Options”), at an exercise price equal to the closing sales price of the Company’s common stock as reported on the Nasdaq Global Select Market on the date of grant. Each Annual Option will vest and become exercisable in full on the earlier of (i) the date of the next annual meeting of the Company’s stockholders or (ii) the first anniversary of the date of grant, subject to Dr. Aggarwal's continuous service (as defined in the 2018 Plan) through each such date.

Dr. Aggarwal will also receive cash compensation for his services as a non-employee director as described in the Policy. Under the Policy, Dr. Aggarwal is entitled to receive an annual cash retainer of $42,500 for service as a member of the Board. The annual cash retainer will be paid in arrears on a pro-rata basis at the end of each quarter. Dr. Aggarwal will receive a pro-rated retainer amount from the date of his appointment to the end of the quarter ending December 31, 2023.

The foregoing is only a brief description of the terms of the Policy and the related compensatory arrangements, does not purport to be complete, and is qualified in its entirety by reference to (i) the Policy, previously filed as Exhibit 10.20 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 as filed on March 10, 2022, and (ii) the 2018 Plan and the related form of Non-Employee Director Stock Option Agreement under the 2018 Plan, previously filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, as filed on August 11, 2022, and Exhibit 10.13 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, as filed on March 7, 2019, respectively.

There are no arrangements or understandings between Dr. Aggarwal and any other person pursuant to which Dr. Aggarwal was appointed as a director of the Company, and there is no family relationship between Dr. Aggarwal and any of the Company’s other directors or executive officers. Dr. Aggarwal is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

In connection with this appointment, the Company and Dr. Aggarwal will enter into the Company’s standard form of indemnification agreement. Pursuant to the terms of the indemnification agreement, the Company may be required, among other things, to indemnify Dr. Aggarwal for certain expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by him in any action or proceeding arising out of his service as a director of the Company. The foregoing is only a brief description of the terms of the indemnification agreement with Dr. Aggarwal, does not purport to be complete, and is qualified in its entirety by reference to the form of indemnification agreement, previously filed as Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, as filed on March 7, 2012.

|

|

|

|

Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

|

|

|

|

Exhibit No. |

Description |

104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GERON CORPORATION

|

|

|

|

|

Date: |

November 28, 2023 |

|

By: |

/s/ Scott A. Samuels |

|

|

|

Name: |

Scott A. Samuels |

|

|

|

Title: |

Executive Vice President, |

|

|

|

|

Chief Legal Officer and |

|

|

|

|

Corporate Secretary |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

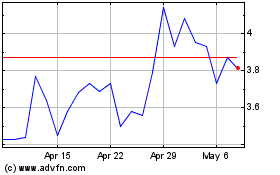

Geron (NASDAQ:GERN)

Historical Stock Chart

From Apr 2024 to May 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

From May 2023 to May 2024