UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(a)

OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment

No. 3)

| Filed

by the Registrant |

☒ |

| Filed

by a Party Other than the Registrant |

☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for use of the Commission only as permitted by Rule 14a-6(e)(2) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Material |

| ☐ |

Solicitation

Material under §240.14a-12 |

GAUCHO

GROUP HOLDINGS, Inc.

(Name

of Registrant as Specified in Its Charter)

Payment

of filing fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total

fee paid: |

| ☐ |

Fee

paid with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, of the Form or Schedule and the date of its

filing. |

| |

1) |

Amount

Previously Paid: |

| |

|

|

| |

2)

|

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

3)

|

Filing

Party: |

| |

|

|

| |

4)

|

Date

Filed: |

PRELIMINARY

PROXY STATEMENT – SUBJECT TO COMPLETION

GAUCHO

Group HOLDINGS, Inc.

112

NE 41st Street, Suite 106

Miami,

FL 33137

NOTICE

OF POSTPONED SPECIAL MEETING OF STOCKHOLDERS AND IMPORTANT NOTICE REGARDING THE AVAILABILITY OF THE COMPANY’S PROXY STATEMENT

On

February 29, 2024

To

our Stockholders:

You

are cordially invited to virtually attend the postponed Special Meeting of Stockholders of Gaucho Group Holdings, Inc. (the “Company”,

or “GGH”) on February 29, 2024, at 12:00 p.m. Eastern Time, via webcast at https://www.cstproxy.com/gauchogroupholdings/sm2024

(the “Special Meeting”). At the Special Meeting the Company will submit the following four proposals to its stockholders

for approval:

| |

1. |

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of our common stock pursuant to that

certain Common Stock Purchase Agreement, dated November 8, 2022 (the “Purchase Agreement”) and that certain Registration

Rights Agreement, dated November 8, 2022 (the “Rights Agreement”) entered into in connection with an equity line of credit

with Tumim Stone Capital LLC (the “ELOC”), without giving effect to the 19.99% cap provided under Nasdaq Listing Rule

5635(d). |

| |

|

|

| |

2.

|

To

grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital

Market) on or before June 30, 2024, to amend the Company’s certificate of incorporation to implement a reverse stock split

of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-ten (1:10), or anywhere between (the “Reverse

Stock Split”), while maintaining the number of authorized shares of common stock required for Nasdaq listing which is 150,000,000

shares. |

| |

|

|

| |

3. |

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of our common stock to be issued

in a private placement of common stock for gross proceeds of up to $7.2 million pursuant to Rule 506(b) of the Securities Act of

1933, as amended, without giving effect to the 19.99% cap provided under Rule 5635(d). |

| |

|

|

| |

4.

|

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance and exercise of shares of our common stock

to be issued pursuant to that certain Securities Purchase Agreement, dated February 21, 2023 (the “Purchase Agreement”),

that certain senior secured convertible promissory note dated February 21, 2023 (the “Note”), that certain common stock

purchase warrant dated February 21, 2023 (the “Warrants”), and that certain Registration Rights Agreement, dated February

21, 2023 (the “Registration Rights Agreement”) by and between the Company and an institutional investor. |

The

discussion of the proposals set forth above is intended only as a summary and is qualified in its entirety by the information contained

in the accompanying Proxy Statement. Only holders of record of our common stock on January 3, 2024 (the “Record Date”) will

be entitled to notice of and to vote at this Special Meeting, and any postponements or adjournments thereof.

The

accompanying Proxy Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(a) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. The

Board will be soliciting your proxy in connection with the matters discussed above. Stockholders who wish to vote on the proposals accordingly

must either attend the Special Meeting and vote during the Special Meeting or otherwise designate a proxy to attend the Special Meeting

and vote on their behalf.

We

are using the “Notice and Access” method of providing proxy materials to stockholders via the internet. We are mailing all

stockholders of record a Notice of Internet Availability of Proxy Materials instead of a paper copy of the proxy materials. Notice and

Access provides a convenient way for stockholders to access the Company’s proxy materials and vote shares on the internet, and

also allows us to reduce costs and conserve resources. The Notice of Internet Availability includes instructions on how to access our

proxy materials and how to vote your shares. The Notice of Internet Availability also contains instructions on how to receive a paper

copy of the proxy materials if you prefer.

The

Company’s Proxy Statement, Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and the other Special Meeting materials are

available on the internet at: https://www.cstproxy.com/gauchogroupholdings/sm2024.

The

Board of Directors recommends that the stockholders vote “FOR” Proposals No. 1, No. 2, No. 3, and No. 4.

Whether

or not you expect to attend the Special Meeting, please vote your shares in advance online to ensure that your vote will be represented

at the Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish

to vote at the Special Meeting, you must obtain a proxy issued in your name from that record holder.

| |

Sincerely, |

| |

|

| |

/s/

Scott L. Mathis |

| |

Scott

L. Mathis, Chairman of the Board and |

| |

Chief

Executive Officer |

GAUCHO

Group HOLDINGS, Inc.

112

NE 41st Street, Suite 106

Miami

Beach, FL 33137

PROXY

STATEMENT

FOR

THE SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on February 29, 2024 at 12:00 p.m. Eastern Time

January

__, 2024

We

are furnishing this Proxy Statement to stockholders of GAUCHO GROUP HOLDINGS, INC. (“we” or “GGH” or the “Company”)

in connection with the postponed Special Meeting of Stockholders (the “Special Meeting”) and at any adjournments or postponements

thereof. We will hold the Special Meeting virtually on February 29, 2024 at 12:00 p.m. Eastern Time, webcast at https://www.cstproxy.com/gauchogroupholdings/sm2024.

The

Special Meeting is being held for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders. As announced

in a press release dated December 19, 2023, this Special Meeting was postponed from the original meeting date of December 28, 2023 to

allow stockholders sufficient time to review newly added Proposal No. 4. The postponement resulted in a new record date for determining

stockholders entitled to notice of and to vote at the Special Meeting, which in turn prompted a new notice mailing on or about January

19, 2024.

This

Proxy Statement (including the Notice of Special Meeting of Stockholders) is first being made available to stockholders beginning on

or about January 19, 2024. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including financial

statements (“Annual Report”), was filed with the Securities and Exchange Commission (the “SEC”) on April 17,

2023. The Company’s quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2023, including financial statements

(“Quarterly Report”), was filed with the SEC on November 17, 2023. Hard copies of this Proxy Statement, the Annual Report,

and the Quarterly Report will be provided to stockholders via U.S. mail only by request, and this Proxy Statement, the Annual Report,

and the Quarterly Report are available on the internet at: https://www.cstproxy.com/gauchogroupholdings/sm2024.

Voting

Securities and Quorum Required.

Holders

of record of our common stock at the close of business on January 3, 2024 (the “Record Date”) will be entitled to vote on

all matters. On the Record Date, we had 4,807,938 shares of common stock issued and 4,807,909 outstanding. Each share of

common stock is entitled to one vote per share. Common stock represents our only class of voting securities outstanding.

Cumulative

voting shall not be allowed in any of the proposals being submitted to the stockholders at the Special Meeting.

For

the transaction of business at the Special Meeting a quorum must be present. A quorum consists of not less than one-third of the shares

entitled to vote at the Special Meeting. In the event there are not sufficient votes for a quorum or to approve any proposals at the

time of the Special Meeting, the Special Meeting may be adjourned to a future time and date.

Revocability

of Proxies

You

can revoke your proxy at any time before it is exercised by timely delivery of a properly executed, later-dated proxy, by delivering

a written revocation of your proxy to our Secretary, or by voting at the Special Meeting via the internet. The method by which you vote

by proxy will in no way limit your right to vote at the Special Meeting if you decide to attend the meeting virtually. If your shares

are held in the name of a bank or brokerage firm, you must obtain a proxy, executed in your favor, from the bank or broker, to be able

to vote at the Special Meeting.

No

Dissenters Rights

The

proposed corporate actions on which the stockholders are being asked to vote are not corporate actions for which stockholders of a Delaware

corporation have the right to dissent under the Delaware General Corporation Law (the “DGCL”).

Proposals

by Security Holders

No

stockholder has requested that we include any additional proposals in this Proxy Statement or otherwise requested that any proposals

be submitted to the stockholders at the Special Meeting.

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Q.

Why am I receiving these materials?

A.

We have sent you these proxy materials because the Board of Directors (the “Board”) of Gaucho Group Holdings, Inc. (sometimes

referred to as the “Company” or “GGH”) is soliciting your proxy to vote at a special meeting of stockholders

(the “Special Meeting”), including at any adjournments or postponements of the Special Meeting. You are invited to attend

the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting

to vote your shares. Instead, you may cast your vote by proxy over the internet by following the instructions provided in the Notice

of Internet Availability, or, if you have requested to receive printed proxy materials, you can also vote by mail pursuant to the instructions

provided on the proxy card.

In

accordance with SEC rules, we may furnish proxy materials, including this Proxy Statement, our Annual Report, and our Quarterly Report,

to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Stockholders will not receive

printed materials unless they request them. Instead, a Notice of Internet Availability is mailed that instructs stockholders as to how

they may access and review all of the proxy materials on the internet. We intend to commence the mailing of the Notice of Internet Availability

on or about January 19, 2024 to all stockholders of record entitled to vote at the Special Meeting.

Q.

How do I attend the Special Meeting?

A.

The Special Meeting will be held virtually on February 29, 2024 at 12:00 p.m. Eastern Time, webcast at https://www.cstproxy.com/gauchogroupholdings/sm2024.

You will receive a link to the webcast and telephone call in instructions.

Q.

Who can vote at the Special Meeting?

A.

Only stockholders of record at the close of business on January 3, 2024 will be entitled to vote at the Special Meeting. On this Record

Date, there were 4,807,909 shares of common stock outstanding and entitled to vote.

Q.

What am I voting on?

A.

There are four (4) matters scheduled for a vote:

| |

1. |

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of our common stock pursuant to that

certain Common Stock Purchase Agreement, dated November 8, 2022 (the “Purchase Agreement”) and that certain Registration

Rights Agreement, dated November 8, 2022 (the “Rights Agreement”) entered into in connection with an equity line of credit

with Tumim Stone Capital LLC (the “ELOC”), without giving effect to the 19.99% cap provided under Nasdaq Listing Rule

5635(d). |

| |

|

|

| |

2.

|

To

grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital

Market) on or before June 30, 2024, to amend the Company’s certificate of incorporation to implement a reverse stock split

of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-ten (1:10), or anywhere between (the “Reverse

Stock Split”), while maintaining the number of authorized shares of common stock required for Nasdaq listing which is 150,000,000

shares. |

| |

|

|

| |

3. |

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of our common stock to be issued

in a private placement of common stock for gross proceeds of up to $7.2 million pursuant to Rule 506(b) of the Securities Act of

1933, as amended, without giving effect to the 19.99% cap provided under Rule 5635(d). |

| |

|

|

| |

4. |

To

approve for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance and exercise of shares of our common stock

to be issued pursuant to that certain Securities Purchase Agreement, dated February 21, 2023 (the “Purchase Agreement”),

that certain senior secured convertible promissory note dated February 21, 2023 (the “Note”), that certain common stock

purchase warrant dated February 21, 2023 (the “Warrants”), and that certain Registration Rights Agreement, dated February

21, 2023 (the “Registration Rights Agreement”) by and between the Company and an institutional investor |

Q.

What if another matter is properly brought before the Special Meeting?

A.

At this time, the Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters

are properly brought before the Special Meeting, it is the intention of the persons named in the accompanying proxy to vote on those

matters in accordance with their best judgment.

Q.

How do I vote and what is the vote required for each proposal?

A.

Section II(J) of our Amended and Restated Bylaws, as amended, provides that subject to Delaware General Corporate Law and our Amended

and Restated Certificate of Incorporation, and the quorum requirement in Section II(H), whenever any corporate action other than the

election of directors is to be taken, it shall be authorized by a majority in voting power of the shares entitled to vote on the subject

matter present at the meeting, whether in person or by proxy.

With

respect to Proposal No. 1 (full issuance of shares pursuant to the ELOC), you may vote “For” or “Against” or

“Abstain” from such proposal. Proposal No. 1 will be approved if a majority of the common stock present at the Special Meeting

is voted in favor of such proposal.

With

respect to Proposal No. 2 (Reverse Stock split), you may vote “For” or “Against” or “Abstain” from

such proposal. Proposal No. 2 will be approved if a majority of the common stock present at the Special Meeting is voted in favor of

such proposal.

With

respect to Proposal No. 3 (full issuance of shares issued pursuant to private placement), you may vote “For” or “Against”

or “Abstain” from such proposal. Proposal No. 3 will be approved if a majority of the common stock present at the Special

Meeting is voted in favor of such proposal.

With

respect to Proposal No. 4 (full issuance of shares pursuant to the Purchase Agreement), you may vote “For” or “Against”

or “Abstain” from such proposal. Proposal No. 4 will be approved if a majority of the common stock present at the Special

Meeting is voted in favor of such proposal.

Q.

What are the effects of abstentions and broker non-votes?

An

abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy

card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record

causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the Special Meeting. As

a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against

a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present and entitled to

vote at the Special Meeting.

A

broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal

because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received

voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum

is present at the Special Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote

will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any proposal.

The

procedures for voting are fairly simple:

Stockholder

of Record: Shares Registered in Your Name

If

on January 3, 2024 your shares were registered directly in your name with GGH’s transfer agent, Continental Stock Transfer &

Trust Company, Inc., then you are a stockholder of record. As a stockholder of record, you may vote online at the Special Meeting or

vote by proxy by visiting https://www.cstproxy.com/gauchogroupholdings/sm2024 and following the instructions provided on the Notice

of Internet Availability. Whether or not you plan to attend the Special Meeting, we urge you to fill out your proxy via the internet

to cast your votes or vote via telephone.

If

you have requested to receive printed copies of the proxy materials by mail, you may vote using the proxy card enclosed with the proxy

materials and returning it by mail. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your

vote is counted. You may still attend the Special Meeting and vote even if you have already voted by proxy.

| |

● |

To

vote at the meeting, attend the Special Meeting and you will be afforded an opportunity to vote via the internet. |

| |

|

|

| |

● |

To

vote your proxy online, follow the instructions on the Notice of Internet Availability mailed to you. |

| |

|

|

| |

● |

If

you have requested to receive your proxy materials by mail, you have the option to vote using the proxy card included in the mailing.

To do so, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If we receive your

signed proxy card before the Special Meeting, we will vote your shares as you direct. |

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

on January 3, 2024 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar

organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded

to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting

at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares

in your account. Simply complete the steps included in the voting instruction form to ensure that your vote is counted.

You

are also invited to attend the Special Meeting. To vote at the Special Meeting, you must obtain a valid proxy from your broker, bank

or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to

request a proxy form.

Q.

How many votes do I have?

A.

On each matter to be voted upon, you have one vote for each share of common stock you own as of January 3, 2024.

Q.

What happens if I do not vote?

Stockholders

of Record: Shares Registered in Your Name

A.

If you are a stockholder of record and do not vote by proxy by accessing https://www.cstproxy.com/gauchogroupholdings/sm2024,

or online at the Special Meeting, or, if you’ve received or requested to receive the proxy materials by mail, and do not complete

and return your proxy card by mail, your shares will not be voted.

Beneficial

Owners: Shares Registered in the Name of Broker or Bank

A.

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether

your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a routine

matter under applicable rules. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect

to matters that are considered to be “routine” under applicable rules but not with respect to “non-routine” matters.

Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights

or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation

(including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation),

and certain corporate governance proposals, even if management-supported. Unless you provide voting instructions to your broker, your

broker or nominee may NOT vote your shares on the approval of the full issuance of shares of the Company’s common stock pursuant

to the ELOC (Proposal No. 1), on the approval of the full issuance of shares of common stock issued pursuant to a private placement (Proposal

No. 3), or on the approval of the full issuance of shares of common stock issued pursuant to the Purchase Agreement (Proposal No. 4),

but may vote your shares on the Reverse Stock Split (Proposal No. 2).

Q.

What if I return a proxy card or otherwise vote but do not make specific choices?

A.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable,

“For” the approval of the full issuance shares of the Company’s common stock pursuant to the ELOC, “For”

the Reverse Stock Split, “For” the approval of the full issuance and exercise of shares of common stock issued

pursuant to a private placement, and “For” the approval of the full issuance and exercise of shares of common stock

issuable pursuant to the Purchase Agreement. If any other matter is properly presented at the Special Meeting, your proxyholder (one

of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Q.

Who is paying for this proxy solicitation?

A.

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, the Company’s directors and

employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid

any additional compensation for soliciting proxies. The Company may also reimburse brokerage firms, banks and other agents for the cost

of forwarding proxy materials to beneficial owners.

Q.

What does it mean if I receive more than one set of proxy materials?

A.

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

follow the voting instructions on each Notice of Internet Availability (or each proxy card in the proxy materials if you have requested

printed proxy materials) to ensure that all of your shares are voted.

Q.

Can I change my vote after submitting my proxy?

All

Stockholders of Record: Shares Registered in Your Name

A.

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the record holder of your shares,

you may revoke your proxy in any one of the following ways:

| 1. |

If

you have requested your proxy materials be mailed to you, you may submit another properly completed proxy card with a later date; |

| |

|

| 2. |

You

may send a timely written notice that you are revoking your proxy to the Company’s legal counsel, Burns Figa & Will, P.C.,

Attn: Victoria Bantz, 6400 S. Fiddlers Green Circle, Suite 1000, Greenwood Village, CO 80111; |

| |

|

| 3. |

You

may change your vote using the online voting method, in which case your latest internet proxy submitted prior to the Special Meeting

will be counted; or |

| |

|

| 4. |

You

may attend the Special Meeting and vote online. Simply attending the Special Meeting will not, by itself, revoke your proxy. |

Your

most current proxy card is the one that is counted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

A.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

Q.

When are stockholder proposals and director nominations due for the 2024 Annual Meeting?

A.

We anticipate that our 2024 Annual Meeting will be held in August 2024. To be considered for inclusion in the 2024 Annual Meeting proxy

materials, your proposal must be submitted in writing to the attention of the Secretary of Gaucho Group Holdings, Inc. c/o Burns Figa

& Will PC, Attn: Victoria Bantz, 6400 S. Fiddlers Green Circle, Suite 1000, Greenwood Village, CO 80111. If you wish to submit a

proposal at the Annual Meeting that is to be included in next year’s proxy materials, you must do so in accordance with the Company’s

amended and restated bylaws (the “Bylaws”), which contain additional requirements about advance notice of stockholder proposals

and director nominations. In addition, you must comply with all applicable requirements of Rule 14a-18 promulgated under the Securities

Exchange Act of 1934.

To

comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s

nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than 60 days prior

to the first anniversary of the preceding year’s annual meeting. Stockholders who intend to solicit proxies in support of director

nominees other than the Company’s nominees at the 2024 Annual Meeting of Stockholders must provide notice that sets forth the information

required by Rule 14a-19 under the Exchange Act to the Corporate Secretary of the Company at the executive offices of the Company no later

than 5:00 pm Eastern Time on June 25, 2024.

We

reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with

these and all other applicable requirements.

Q.

What are “broker non-votes”?

A.

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed by the Nasdaq Capital Market (“Nasdaq”) to be “non-routine,”

the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

Q.

What is the quorum requirement?

A.

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least one-third of

the outstanding common shares entitled to vote are present at the Special Meeting via the internet or represented by proxy. On the Record

Date, there were 4,807,909 common shares outstanding. Thus, the holders of 1,602,637 shares of common stock must be present

or represented by proxy at the Special Meeting to have a quorum.

Your

shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or

other nominee) or if you vote via internet at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum

requirement. If there is no quorum, the chairman of the Special Meeting or the holders of a majority of shares present at the Special

Meeting or represented by proxy may adjourn the Special Meeting to another date.

Q.

How can I find out the results of the voting at the Special Meeting?

A.

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current

report on Form 8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available

to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary

results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Q.

What proxy materials are available on the internet?

A.

The Proxy Statement and the Annual Report are available at: https://www.cstproxy.com/gauchogroupholdings/sm2024.

Forward

Looking Statements

This

Proxy Statement may contain certain “forward-looking” statements, as defined in Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the

Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize

or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking

statements.

Such

forward-looking statements include statements about our expectations, beliefs or intentions regarding actions contemplated by this Proxy

Statement, our potential business, financial condition, results of operations, strategies or prospects. You can identify forward-looking

statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements

relate to anticipated or expected events, activities, trends or results as of the date they are made and are often identified by the

use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” or “will,” and similar expressions or variations. Because

forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties

that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements.

Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking

statements. These factors include those described under the caption “Risk Factors” included in our other filings with the

Securities and Exchange Commission (“SEC”), including the disclosures set forth in Item 1A of our Form 10-K for the year

ended December 31, 2022 and in our Form 10-Q for the period ended September 30, 2023. Furthermore, such forward-looking statements speak

only as of the date of this Proxy Statement. We undertake no obligation to update any forward-looking statements to reflect events or

circumstances occurring after the date of such statements.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS

AND MANAGEMENT

Security

Ownership of Management

As

of January 3, 2024, the Company had 4,807,938 shares of its common stock issued and 4,807,909 shares outstanding. The following

table sets forth the beneficial ownership of the Company’s common as of January 3, 2024 by each person who serves as a director

and/or an executive officer of the Company on that date, and the number of shares beneficially owned by all of the Company’s directors

and named executive officers as a group:

Name and Address of Beneficial Owner | |

Position | |

Amount and Nature of Beneficial Ownership (1) | | |

Percent of Common Stock | |

Scott L. Mathis

1445 16th Street, Suite 403, Miami Beach, FL 33139 | |

Chairman, Class III Director, Chief Executive Officer, President | |

| 44,078 | (2) | |

| 0.9 | % |

| | |

| |

| | | |

| | |

Maria Echevarria

14 Benmore Ter., Bayonne, NJ 07002 | |

Chief Financial Officer, Chief Operating Officer, Secretary, Treasurer and Compliance Officer | |

| 5,731 | (3) | |

| 0.1 | % |

| | |

| |

| | | |

| | |

Peter J.L. Lawrence

5 Landsdowne Crescent, London WII 2NH, England | |

Class II Director | |

| 8,507 | (4) | |

| 0.2 | % |

| | |

| |

| | | |

| | |

Reuben Cannon

280 S. Beverly Drive, #208, Beverly Hills, CA 90212 | |

Class I Director | |

| 8,250 | (5) | |

| 0.2 | % |

| | |

| |

| | | |

| | |

Marc Dumont

43 rue de la Prétaire, CH-1936, Verbier, Switzerland | |

Class I Director | |

| 9,544 | (6) | |

| 0.2 | % |

| | |

| |

| | | |

| | |

William Allen*

23 Corporate Plaza Dr., Suite 150, Newport Beach, CA 92660 | |

Class III Director | |

| 8,048 | (7) | |

| 0.2 | % |

| | |

| |

| | | |

| | |

| All current directors, directors elect, director nominees, executive officers and named executive officers as a group (seven persons) | |

| |

| 84,158 | (8) | |

| 1.8 | % |

Notes

to Security Ownership of Management table shown above:

| |

* |

Mr.

Allen resigned as a director effective December 31, 2023. |

| |

|

|

| |

(1) |

Calculated

in accordance with 1934 Act Rule 13d-3. |

| |

|

|

| |

(2) |

Consists

of (a) 28,282 shares of our common stock owned by Mr. Mathis directly; (b) 2,594 shares owned by The WOW Group, LLC, of which Mr.

Mathis is a controlling member; (c) 10,696 shares owned by Hollywood Burger Holdings, Inc.; (d) 1,028 shares owned by Mr. Mathis’s

401(k) account; and (e) the right to acquire 1,478 shares of common stock subject to the exercise of options. |

| |

(3) |

Consists

of (a) 4,099 shares of our common stock owned by Ms. Echevarria directly; (b) 1,503 shares owned by Mrs. Echevarria’s 401(k)

account; and (c) 129 shares of our common stock issuable upon the exercise of stock options. |

| |

|

|

| |

(4) |

Consists

of (a) 8,342 shares of our common stock owned by Mr. Lawrence directly; (b) 6 shares owned by Mr. Lawrence and his spouse as trustees

for the Peter Lawrence 1992 Settlement Trust; and (c) 159 shares of our common stock issuable upon the exercise of stock options.

|

| |

|

|

| |

(5)

|

Consists

of (a) 8,203 shares owned by Reuben Cannon Productions; and (b) 47 shares issuable upon the exercise of stock options. |

| |

|

|

| |

(6) |

Consists

of (a) 8,048 shares of our common stock owned by Mr. Dumont directly; (b) 1,171 shares held by Mr. & Mrs. Dumont and Patrick

Dumont, JTWROS; (c) 250 shares held by Mr. Dumont and Catherine Dumont, JTWROS; and (d) 75 shares issuable upon the exercise of stock

options. |

| |

|

|

| |

(7) |

Consists

of (a) 8,048 shares of our common stock owned by Mr. Allen owned directly. |

| |

|

|

| |

(8) |

Consists

of 82,270 shares of our common stock and 1,888 shares of our common stock issuable upon the exercise of stock options. |

Security

Ownership of Certain Beneficial Owners

As

of January 3, 2024, the following persons who do not serve as an executive officer or director beneficially own more than 5% of its outstanding

common stock:

Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership (1) | | |

Percent of Common Stock | |

| John I. Griffin, 4221 Way Out West Dr., Suite 100, Houston, TX 77092 | |

| 840,461 | (2) | |

| 17.4 | % |

| | |

| | | |

| | |

| All 5% beneficial owners, as a group | |

| 840,461 | | |

| 17.4 | % |

| |

(1) |

Calculated

in accordance with 1934 Act Rule 13d-3. |

| |

(2) |

Consists

of (a) 29,610 shares of common stock owned by Mr. Griffin directly, (b) 796,776 shares of common stock owned by JLAL Holdings Ltd.,

an entity wholly controlled by Mr. Griffin, (c) 14,000 shares of common stock issuable upon exercise of warrants held by JLAL Holdings

Ltd., and (d) 75 shares of common stock issuable upon exercise of stock options. |

Board

Diversity Matrix for Gaucho Group Holdings, Inc. (as of January 3, 2024)

| |

|

As

of January 3, 2024 |

|

As

of July 7, 2022 |

| Total

Number of Directors |

|

4 |

|

7 |

| |

|

|

|

|

| Part

I: Gender Identity |

|

Female |

|

Male |

|

Non-

Binary |

|

Did

Not

Disclose

Gender |

|

Female |

|

Male |

|

Non-

Binary |

|

Did

Not

Disclose

Gender |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Directors: |

|

0 |

|

3 |

|

0 |

|

1 |

|

1 |

|

4 |

|

0 |

|

2 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Part

II: Demographic Background |

| African

American or Black |

|

0 |

|

1 |

|

0 |

|

0 |

|

0 |

|

1 |

|

0 |

|

0 |

| Alaskan

Native or American Indian |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| Asian |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| Hispanic

or Latinx |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| Native

Hawaiian or Pacific Islander |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| White |

|

0 |

|

2 |

|

0 |

|

0 |

|

1 |

|

3 |

|

0 |

|

0 |

| Two

or More Races or Ethnicities |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| LGBTQ+ |

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

|

|

| Did

Not Disclose Demographic Background |

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

Attendance

at the Special Meeting

Board

members are not required to attend the Special Meeting. This Special Meeting is the Company’s fourth time hosting a special meeting.

PROPOSAL

NO. 1

APPROVAL

OF THE FULL ISSUANCE OF SHARES OF THE

COMPANY’S

COMMON STOCK PURSUANT TO AN EQUITY LINE OF CREDIT WITH TUMIM

STONE

CAPITAL LLC.

General

Information About the Equity Line of Credit.

As

previously disclosed in a Current Report on Form 8-K filed November 9, 2022, on November 8, 2022, the Company entered into a Common Stock

Purchase Agreement (the “Purchase Agreement”) and a Registration Rights Agreement (the “Registration Rights Agreement”)

with Tumim Stone Capital, pursuant which Tumim Stone Capital agreed to purchase, from time to time at the Company’s election, up

to $44,308,969.30 in shares of our common stock, subject to certain limitations (the “Equity Line of Credit” or “ELOC”).

Under

the applicable rules of The Nasdaq Stock Market LLC (“Nasdaq”), in no event may we issue any shares of common stock pursuant

to the ELOC if the issuance of such shares of common stock would exceed 19.99% of the shares of the common stock outstanding immediately

prior to the execution of the Purchase Agreement (the “Exchange Cap”), unless we obtain stockholder approval to issue shares

of common stock in excess of the Exchange Cap. In any event, we may not issue any shares of our common under the Purchase Agreement if

such issuance or sale would breach any applicable rules or regulations of Nasdaq. While the total number of shares to be issued under

the ELOC is not guaranteed, the Company anticipated issuing in excess of 54,965 shares, which represents 19.99% of the shares of common

stock of the Company outstanding immediately prior to execution of the Purchase Agreement.

At

the Company’s Special Meeting of Stockholders held December 19, 2022, the stockholders approved the issuance of up to 166,667 shares

of our common stock pursuant to the terms of the Purchase Agreement. On December 16, 2022, pursuant to the terms of the Registration

Rights Agreement, we filed a Registration Statement (the “Initial Registration Statement”) under which we registered for

resale 166,667 shares of our common stock issuable under the Purchase Agreement. The initial registration statement became effective

December 23, 2022.

Tumim

Stone Capital has since sold almost all of the shares of common stock registered for resale under the Initial Registration Statement

except for approximately 14,983 shares of Common Stock, and the Company is now required to obtain stockholder approval pursuant to Nasdaq

Listing Rule 5635(d) and file a new registration statement to register for resale an additional 1,000,000 shares authorized for issuance

to Tumim Stone Capital under the Purchase Agreement.

As

a result, the Company is limited in its ability to draw down on the ELOC and issue shares of common stock under the Purchase Agreement

unless and until the stockholders approve the issuance of additional shares, and a new registration statement is filed with the SEC.

Why

Does the Company Need Stockholder Approval?

Our

common stock is listed on The Nasdaq Capital Market and, as such, we are subject to the Nasdaq Stock Market Rules. Nasdaq Stock Rule

5635(d) is referred to as the “Nasdaq 20% Rule.” In order to comply with the Nasdaq 20% Rule and to satisfy conditions under

the Purchase Agreement, we are seeking stockholder approval to permit the potential issuance of more than 19.99% of our outstanding common

stock in accordance with the Purchase Agreement.

The

Nasdaq 20% Rule requires that an issuer obtain stockholder approval prior to certain issuances of common stock or securities convertible

into or exchangeable for common stock at a price less than the greater of market price or book value of such securities (on an as exercised

basis) if such issuance equals 20% or more of the common stock or voting power of the issuer outstanding before the transaction. Upon

entering into the Purchase Agreement, we could not issue or sell any shares of common stock, and Tumim Stone Capital could not purchase

or acquire any shares of common stock pursuant to the Purchase Agreement, to the extent that after giving effect thereto, the aggregate

number of shares of common stock that would be issued pursuant to the Purchase Agreement and the transactions contemplated hereby would

exceed 54,965 shares (representing approximately 19.99% of the shares of common stock issued and outstanding immediately prior to the

execution of the Purchase Agreement) which number of shares is to be reduced, on a share-for-share basis, by the number of shares of

common stock issued or issuable pursuant to any transaction or series of transactions that may be aggregated with the transactions contemplated

by the Purchase Agreement under applicable rules of the trading market (such maximum number of shares, the “Exchange Cap”),

unless the Company’s stockholders approved the issuance of common stock in excess of the Exchange Cap in accordance with the applicable

rules of the trading market. As noted above, the Company previously obtained stockholder approval to issue up to 166,667 shares of common

stock under the Purchase Agreement. Now, the Company cannot issue or sell in excess of 166,667 shares unless and until the Company’s

stockholders approve such issuance. The Company is now requesting that the stockholders approve the issuance of all shares of common

stock issuable under the Purchase Agreement, which is approximately 42,359,613. While the Company is asking the stockholders to approve

the issuance of all shares available under the Purchase Agreement, the Company initially intends to register for resale 1,000,000 shares

of common stock, which would represent approximately 363.6% of the shares of common stock outstanding prior to the execution of the Purchase

Agreement and approximately 40.6% of the shares of common stock outstanding as of November 3, 2023.

To

meet the Nasdaq 20% Rule, we need stockholder approval under the listing rules of Nasdaq to remove the Exchange Cap provisions in the

Purchase Agreement to permit the potential issuance of more than 20% of our outstanding common stock in accordance with the terms of

the Purchase Agreement.

Additionally,

we will not issue or sell, and Tumim Stone Capital will not purchase or acquire, any shares of common stock pursuant to the Purchase

Agreement which, when aggregated with all other shares of common stock then beneficially owned by Tumim Stone Capital and its affiliates

(as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership

by Tumim Stone Capital of more than 4.99% of the outstanding shares of common stock.

What

is the Effect on Current Stockholders if Proposal No. 1 is Approved?

If

our stockholders approve this proposal, we will be able to eliminate the Exchange Cap in the Purchase Agreement and therefore have the

option to issue the maximum number of shares of common stock issuable under the Purchase Agreement which would exceed 19.99% of our issued

and outstanding shares of common stock as of the date we executed the Purchase Agreement. This would allow the Company flexibility in

accessing the equity line of credit to pursue its business growth, current announced partnerships and collaborations. If stockholders

approve the Proposal No. 1, the rights or privileges of our existing stockholders will not be affected, except that the economic and

voting interests of each of our existing stockholders will be significantly diluted should we choose to require Tumim Stone Capital to

purchase those shares pursuant to the Purchase Agreement. Although the number of shares of our common stock that our existing stockholders

own will not decrease, the shares of our common stock owned by our existing stockholders will represent a smaller percentage of our total

outstanding shares of our common stock after any such issuance.

What

is the Effect on Current Stockholders if the Proposal No. 1 is NOT approved?

If

our stockholders do not approve this Proposal No. 1, we may be limited in the amount of money we can draw down on the line of credit

under the Purchase Agreement. We are not seeking the approval of our stockholders to authorize our entry into the Purchase Agreement

and related transaction documents. The failure of our stockholders to approve the proposal may result in our inability to take full advantage

of the new equity line of credit and severely limit the Company’s ability to grow. Accordingly, if the Company is limited in the

number of shares it can issue under the equity line of credit, dilution to stockholders will be limited and have the effect of limiting

the Company’s growth potential with no additional capital.

Required

Vote

In

accordance with Delaware law, approval of Proposal No. 1 requires the affirmative vote of a majority of the shares of common stock present

or represented by proxy and entitled to vote on this proposal at the Special Meeting. As a result, abstentions will have the same effect

as votes against this proposal.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE FULL ISSUANCE OF SHARES OF THE COMPANY’S

COMMON STOCK IN CONNECTION WITH THE EQUITY LINE OF CREDIT WITH TUMIM STONE CAPITAL LLC.

PROPOSAL

NO. 2

REVERSE

STOCK SPLIT

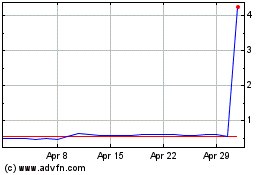

The

Company’s common stock ($0.01 par value, 150,000,000 shares authorized, referred to herein as the “Common Stock”) is

currently listed on the Nasdaq Capital Market (“Nasdaq”). To comply with Nasdaq’s continued listing requirements, the

Company’s Common Stock must maintain a bid price of at least $1.00 per share. On November 3, 2023, the closing price of the Common

Stock was $0.90.

As

reported in our Current Report on Form 8-K filed June 6, 2023, on June 1, 2023, we received a deficiency letter from the Listing Qualifications

Department (the “Staff”) of Nasdaq notifying the Company that, for the preceding 30 consecutive business days, the closing

bid price for the Common Stock was trading below the minimum $1.00 per share requirement for continued inclusion on The Nasdaq Capital

Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Requirement”).

In

accordance with Nasdaq Rules, the Company has been provided an initial period of 180 calendar days, or until November 28, 2023 (the “Compliance

Date”), to regain compliance with the Bid Price Requirement. Generally, if, at any time before the Compliance Date the closing

bid price for the Company’s Common Stock is at least $1.00 for a minimum of 10 consecutive business days (the “Compliance

Period”), the Staff will provide the Company written confirmation of compliance with the Bid Price Requirement.

On

September 25, 2023, the Company, after obtaining the approval of the stockholders at the Company’s 2023 Annual Stockholder Meeting

held August 24, 2023, effected a reverse stock split at an exchange ratio of one post-split share for ten pre-split shares (1:10) (the

“Prior Split”). After effecting the Reverse Split, the Company’s Common Stock maintained a bid price of at least $1.00

per share for 10 consecutive trading days. However, shortly after the 10-day Compliance Period, the price of the Company’s Common

Stock dropped significantly. As a result, Nasdaq extended the Compliance Period for an additional 10 days, requiring the Company’s

Common Stock to maintain a bid price of at least $1.00 per share for 20 consecutive trading days before providing written confirmation

of compliance with the Bid Price Requirement. During the extended Compliance Period, the Company’s Common Stock closed below $1.00,

which restarted the 20-day Compliance Period.

If

the Company does not regain compliance with the Bid Price Requirement by the Compliance Date, the Company may be eligible for an additional

180 calendar day compliance period. To qualify, the Company would then be required to meet the continued listing requirement for market

value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the Bid Price

Requirement, and will need to provide written notice of its intention to cure the deficiency during the additional 180 calendar day compliance

period, which compliance could be achieved by effecting a reverse stock split, if necessary. If the Company does not regain compliance

with the Bid Price Requirement by the Compliance Date and is not eligible for an additional compliance period at that time, the Staff

will provide written notification to the Company that its common stock will be subject to delisting. At that time, the Company may appeal

the Staff’s delisting determination to a Nasdaq Hearings Panel.

The

Board of Directors believes that, if necessary, a reverse stock split will increase the price per share of the Common Stock and assist

in meeting the price per share requirements for maintaining Nasdaq listing and will allow firms and clearing firms to authorize stock

purchases above a certain price threshold.

Therefore,

the Board recommends that the stockholders grant the Board the discretion, on or before June 30, 2024, to effect a reverse stock split

of all the outstanding shares of the Company’s common stock at an exchange ratio ranging from one post-split share for two pre-split

shares (1:2) up to one post-split share for ten pre-split shares (1:10), or anywhere between those ratios, at the Board’s discretion

(the “Reverse Stock Split”) and approve an amendment to Article IV of GGH’s Amended and Restated Certificate of Incorporation

to effect such Reverse Stock Split. The Board may only effect the Reverse Stock Split if it deems it to be reasonably necessary for maintaining

listing on Nasdaq. The Board proposed a wide stock split ratio to give it flexibility in determining the most conservative stock split

ratio possible that will still meet the price per share requirements necessary to prevent delisting.

Except

for adjustments that may result from the treatment of fractional shares, which will be rounded up to the nearest whole number, each stockholder

will beneficially hold the same percentage of common stock immediately following the Reverse Stock Split as such stockholder held immediately

prior to the Reverse Stock Split. Also, proportionate adjustments will be made to the per-share exercise price and the number of shares

covered by outstanding options and warrants to buy common stock, so that the total prices required to be paid to fully exercise each

option and warrant before and after the Reverse Stock Split will be approximately equal.

The

Board does not intend as part of the Reverse Stock Split to reduce the amount of the Company’s authorized shares of common stock.

As of November 3, 2023, the Company has a total of 150,000,000 shares of Common Stock authorized and 2,462,574 shares issued, leaving

147,537,426 shares available for issuance, not including shares reserved for issuance upon exercise of warrants or options, or any other

convertible security. If Proposal No. 2 is approved, the number of unissued, available authorized shares of Common Stock will increase,

as reflected in the following table as if the Reverse Stock Split were to occur on November 3, 2023:

| Ratio | | |

Authorized | | |

Issued pre- Reverse

Stock Split* | | |

Issued post- Reverse

Stock Split** | | |

Increase in

post- Reverse

Stock Split

Shares Available

for Issuance* | |

| 1:2 | | |

| 150,000,000 | | |

| 2,462,574 | | |

| 1,231,287 | | |

| 1,231,287 | |

| 1:5 | | |

| 150,000,000 | | |

| 2,462,574 | | |

| 492,515 | | |

| 1,970,059 | |

| 1:10 | | |

| 150,000,000 | | |

| 2,462,574 | | |

| 246,258 | | |

| 2,216,316 | |

*Does

not reflect shares reserved for issuance upon exercise of warrants or options, or any other convertible security.

**For

purposes of this illustration, fractional shares are rounded.

The

increase in the number of shares of common stock available for issuance and any subsequent issuance of such shares could have the effect

of delaying or preventing a change in control of the Company without further action by the stockholders. The Board is not aware of any

attempt to take control of the Company and has not presented this proposal with the intention that the Reverse Stock Split be used as

a type of antitakeover device. Any additional common stock, when issued, would have the same rights and preferences as the shares of

common stock presently outstanding.

Additional

Reasons for the Reverse Stock Split

In

addition to the achievement of a stock price required for listing on a national exchange, there are other reasons the Board believes

the Reverse Stock Split will be beneficial to GGH. One is that the Board believes that the increased market price of the common stock

expected as a result of implementing the Reverse Stock Split will improve the marketability of the common stock and will encourage interest

and trading in the common stock by brokerage houses and institutions that are not currently able or willing to trade the common stock.

Because of the trading volatility often associated with low-priced stocks, many potential investors have internal policies and practices

that either prohibit them from investing in low-priced stocks or that tend to discourage individual brokers from recommending low-priced

stocks to their customers. In addition, low-priced stocks not listed on an exchange are subject to the additional broker-dealer disclosure

requirements and restrictions found in SEC Rule 15g-6.

It

should be noted that the liquidity of the common stock may be adversely affected by the Reverse Stock Split given the reduced number

of shares that would be outstanding after the Reverse Stock Split. The Board anticipates, however, that the expected higher market price

and (if successful) exchange listing will mitigate, to some extent, the effects on the liquidity through the anticipated increase in

marketability discussed above.

The

Board understands that there is a risk that the market price for the common stock may not react proportionally to the Reverse Stock Split.

For example, if GGH accomplishes a 1:10 Reverse Stock Split at a time when the market price is $0.20 per share, there can be no assurance

that the resulting market price will thereafter remain at or above $2.00 per share.

The

Board confirms that the contemplated reverse stock split is not and will not be the first step in a series of plans or proposals of a

“going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Based

upon the foregoing factors and understanding the risks, the Board has determined that granting the Board the discretion to implement

a Reverse Stock Split is in the best interests of the Company and its stockholders.

Required

Vote

In

accordance with Delaware law, approval of Proposal No. 2 requires the affirmative vote of a majority of the shares of common stock present

or represented by proxy and entitled to vote on this proposal at the Special Meeting. As a result, abstentions will have the same effect

as votes against this proposal.

THE

BOARD OF DIRECTORS RECOMMEND A VOTE “FOR” Granting THE Board of Directors discretion (if necessary to Maintain listing

of GGH’s common stock on NASDAQ) on or before June 30, 2024, to Amend the Company’s Certificate of Incorporation to implement

a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-TEN (1:10), or anywhere

between, while maintaining the number of authorized shares of Common Stock.

PROPOSAL

NO. 3

TO

APPROVE FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D), THE FULL ISSUANCE OF SHARES OF OUR COMMON STOCK TO BE ISSUED IN A

PRIVATE PLACEMENT OF COMMON STOCK for gross proceeds of up to $7.2 million PURSUANT TO RULE 506(B) OF THE SECURITIES ACT OF 1933, AS

AMENDED, WITHOUT GIVING EFFECT TO THE 19.99% CAP PROVIDED UNDER RULE 5635(D).

In

order to raise additional capital for the Company, the Board intends to commence a private placement of common stock of the Company for

aggregate proceeds of up to $7.2 million (up to $6 million with a 20% overallotment), at a price per share which equals the Nasdaq Rule

5653(d) Minimum Price definition on the day of commencement of each tranche, but in no event at a price per share lower than $0.60) pursuant

to Rule 506(b) of the Securities Act of 1933, as amended (the “Private Placement”).

Each

participant in the Private Placement will be afforded certain anti-dilution protections for a period of 18 months following each closing

of the Private Placement. If, during the 18-month period following each closing of the Private Placement, the Company issues or sells

any shares of common stock of the Company (a “Dilutive Issuance”), then each participant in the Private Placement will automatically

be issued such number of shares of common stock as is necessary to maintain the percentage ownership that such participant would have

had if the Dilutive Issuance had not occurred.

Assuming

the raise of $7.2 million in proceeds at a price per share of $0.60, we anticipate that the Company will issue no more than 12,000,000

shares, not including any issuance of shares of common stock pursuant to the Dilutive Issuance, which we cannot ascertain at this time.

Proceeds

from the Private Placement will be used to extinguish Company debt. The Company anticipates that the Private Placement will be completed

within three to four months from date of commencement.

Why

Does the Company Need Stockholder Approval?

Our

common stock is listed on The Nasdaq Capital Market and, as such, we are subject to the Nasdaq Stock Market Rules. Nasdaq Stock Rule

5635(d) is referred to as the “Nasdaq 20% Rule.” In order to comply with the Nasdaq 20% Rule, we are seeking stockholder

approval to permit the potential issuance of more than 19.99% of our outstanding common stock outstanding as of immediately prior to

the Private Placement.

The

Nasdaq 20% Rule requires that an issuer obtain stockholder approval prior to certain issuances of common stock or securities issuable

at lower than Minimum Price, as defined in Nasdaq Rule 5653(d) if such issuance equals 20% or more of the common stock or voting power

of the issuer outstanding before the transaction (the “Cap”). “Minimum Price” means a price that is the lower

of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement; or

(ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately

preceding the signing of the binding agreement.

Assuming

the raise of all $7.2 million at a price per share of $0.60, the Company will be required to issue approximately 12,000,000 shares of

the Company’s common stock, which would represent approximately 487% of the shares of common stock outstanding on November 3, 2023.

To

meet the Nasdaq 20% rule, we need stockholder approval under the listing rules of Nasdaq to permit the potential issuance of more than

20% of our outstanding common stock in accordance with the terms of the Private Placement.

What

is the Effect on Current Stockholders if Proposal No. 3 is Approved?

If

our stockholders approve this proposal, we will be able to eliminate the Cap and therefore have the option to issue the maximum number

of shares of common stock issuable pursuant to the terms of the Private Placement which would exceed 19.99% of our issued and outstanding

shares of common stock as of the date we commence the Private Placement. This would allow the Company the ability to raise the entire

$7.2 million under the Private Placement. If stockholders approve the Proposal No. 3, the rights or privileges of our existing stockholders

will not be affected, except that the economic and voting interests of each of our existing stockholders will be significantly diluted.

Although the number of shares of our common stock that our existing stockholders own will not decrease, the shares of our common stock

owned by our existing stockholders will represent a smaller percentage of our total outstanding shares of our common stock after any

such issuance.

What

is the Effect on Current Stockholders if the Proposal No. 3 is NOT approved?

If

our stockholders do not approve this Proposal No. 3, we may be limited in the amount of money we raise under the Private Placement. We

are not seeking the approval of our stockholders to authorize our entry into the Private Placement, only to approve the issuance of shares

beyond the Cap. The failure of our stockholders to approve the proposal may result in our inability to raise money under the Private

Placement. Accordingly, if the Company is limited in the number of shares it can issue under the Private Placement, dilution to stockholders

will be limited and have the effect of limiting the Company’s growth potential with no additional capital.

Required

Vote

In

accordance with Delaware law, approval of Proposal No. 3 requires the affirmative vote of a majority of the shares of common stock present

or represented by proxy and entitled to vote on this proposal at the Special Meeting. As a result, abstentions will have the same effect

as votes against this proposal.

THE

BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMEND A VOTE “FOR” THE FULL ISSUANCE OF SHARES OF OUR COMMON STOCK

TO BE ISSUED IN A PRIVATE PLACEMENT OF COMMON STOCK for gross proceeds of up to $7.2 million PURSUANT TO RULE 506(B) OF THE SECURITIES

ACT OF 1933, AS AMENDED, WITHOUT GIVING EFFECT TO THE 19.99% CAP PROVIDED UNDER RULE 5635(D).

PROPOSAL

NO. 4

TO

APPROVE FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D), THE FULL ISSUANCE AND EXERCISE OF SHARES OF OUR COMMON STOCK TO BE

ISSUED PURSUANT TO THAT CERTAIN SECURITIES PURCHASE AGREEMENT, DATED FEBRUARY 21, 2023 (THE “PURCHASE AGREEMENT”), THAT CERTAIN

SENIOR SECURED CONVERTIBLE PROMISSORY NOTE DATED FEBRUARY 21, 2023 (THE “NOTE”), THAT CERTAIN COMMON STOCK PURCHASE WARRANT

DATED FEBRUARY 21, 2023 (THE “WARRANTS”), AND THAT CERTAIN REGISTRATION RIGHTS AGREEMENT, DATED FEBRUARY 21, 2023 (THE “REGISTRATION

RIGHTS AGREEMENT”) BY AND BETWEEN THE COMPANY AND AN INSTITUTIONAL INVESTOR.

General

Information about the Securities Purchase Agreement

On

February 21, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with an institutional

investor (the “Investor”), pursuant to which the Company sold to the Investor (the “Initial Closing”) a series

of senior secured convertible notes of the Company in the aggregate original principal amount of $5,617,978 with an original issue discount

of 11% (the “Notes”), and a series of common stock purchase warrants of the Company, which warrants shall be exercisable

into an aggregate of 337,710 shares of common stock of the Company for a term of three years (the “Warrants”).

The

Investor also has an option to enter into an additional Note for $5,617,978 and Warrants to purchase 337,710 shares of common stock,

or if certain equity condition are met, the Company may exercise that option (the “Second Closing”) on the same terms as

the Initial Closing. The maximum amount of the Notes therefore, would be $11,235,956 with total Warrants to purchase 675,420 shares of

common stock.

The

Notes are convertible into shares of common stock of the Company at a conversion price of $4.50 (subject to adjustment). The Notes

are due and payable on the first anniversary of the issuance date and bear interest at a rate of 7% per annum, which shall be payable

either in cash monthly or by way of inclusion of the interest in the Conversion Amount on each Conversion Date (as defined in the Notes).

The Investor is entitled to convert any portion of the outstanding and unpaid Conversion Amount (as defined in the Notes) at any time

or times after the issuance date, but we may not effect the conversion of any portion of the Notes if it would result in the Investor

beneficially owning more than 4.99% of the common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934,

as amended, and Rule 13d-3 thereunder) (the “Beneficial Ownership Limitation”).

The

Company and the Investor executed the Purchase Agreement in reliance upon the exemption from securities registration afforded by Section

4(a)(2) of the Securities Act of 1933, as amended (the “1933 Act”), and Rule 506(b) of Regulation D as promulgated by the

Securities and Exchange Commission under the 1933 Act.

The

Notes rank senior to all outstanding and future indebtedness of the Company and its subsidiaries, and are secured by (i) a security interest

in all of the existing and future assets of the Company, as evidenced by the Security and Pledge Agreement entered into between the Company

and the Investor (the “Security Agreement”); and (ii) a pledge of shares of common stock of the Company held by Scott L.

Mathis, President and CEO of the Company, and other entities managed by him, as evidenced by the Stockholder Pledge Agreements entered

into between the Company, Mr. Mathis and his entities, and the Investor (the “Pledge Agreement”).

In

connection with the foregoing, the Company also entered into a Registration Rights Agreement with the Investor (the “Registration

Rights Agreement”), pursuant to which the Company has agreed to provide certain registration rights with respect to the Registrable

Securities (as defined in the Registration Rights Agreement) under the 1933 Act and the rules and regulation promulgated thereunder,

and applicable state securities laws. The Purchase Agreement and the Registration Rights Agreement contain customary representations,

warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in such

agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such

agreements and may be subject to limitations agreed upon by the contracting parties.

Under

the applicable rules of The Nasdaq Stock Market LLC (“Nasdaq”), in no event may we issue any shares of common stock upon

conversion of the Notes or otherwise pursuant to the terms of the Notes if the issuance of such shares of common stock would exceed 19.99%

of the shares of the common stock outstanding immediately prior to the execution of the Purchase Agreement and the Notes and Warrants

(the “Exchange Cap”), unless we (i) obtain stockholder approval to issue shares of common stock in excess of the Exchange

Cap or (ii) obtain a written opinion from our counsel that such approval is not required. In any event, we may not issue any shares of

our common under the Purchase Agreement or Notes if such issuance or sale would breach any applicable rules or regulations of the Nasdaq.

On

May 22, 2023, pursuant to the terms of the Registration Rights Agreement, we filed a Registration Statement (as it became effective May

26, 2023, the “Original Registration Statement”) under which we registered 2,000,000 shares of our Common Stock issuable

pursuant to the Notes and Warrants, including payment of interest on the notes through February 21, 2024, without regard to any limitations

on conversion, at the floor price of $0.27 (the conversion price applicable upon an event of default).

At

the May 8, 2023 Special Meeting of Stockholders (the “2023 Stockholder Meeting”), the Company then approved the full issuance

of shares of our Common Stock pursuant to the terms of the Purchase Agreement and Notes and Warrants in order to comply with the Exchange

Cap. In connection with the 2023 Stockholder Meeting, the Company explained that if the stockholders approved the proposal, the Company

could potentially issue up to 51,281,876 shares of common stock issuable under the Notes and Warrants (on a post-split basis, a total

of 5,128,187 shares).

Since

the 2023 Special Meeting of Stockholders, the Company has entered into certain amendments and letter agreements with the Investor, which

have lowered the floor price of the Notes to $0.40, and the total number of shares that may be issued upon conversion of the Notes and

exercise of the Warrants is now higher than anticipated when the Company first obtained stockholder approval at the 2023 stockholder

meeting.

As

of January 3, 2024, the Company has issued a total of 3,630,079 shares of common stock pursuant to conversions under the Notes. A total

of $3,333,784 in principal, interest, fees and cash true-ups is outstanding under the Notes. If, pursuant to the Initial Closing, the