false

0001559998

0001559998

2023-11-29

2023-11-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

November

29, 2023

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

| State

of |

|

Commission

|

|

IRS

Employer |

| Incorporation |

|

File

Number |

|

Identification

No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including Area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO |

|

The

Nasdaq Stock Market LLC |

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As

previously reported in our Current Report on Form 8-K filed on June 6, 2023 and in our Current Report on Form 8-K filed on November 28,

2023, Gaucho Group Holdings, Inc. (the “Company,” “we,” “us” or “our”), received a deficiency

letter on June 1, 2023 from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market (“Nasdaq”)

notifying the Company that, for the preceding 30 consecutive business days, the closing bid price for the Company’s common stock

(the “Common Stock”) was trading below the minimum $1.00 per share requirement for continued inclusion on The Nasdaq Capital

Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Requirement”). In accordance with Nasdaq Rules, the Company

was provided an initial period of 180 calendar days, or until November 28, 2023, to regain compliance with the Bid Price Requirement.

On

November 28, 2023, the Company provided the Staff with notice that it intends to effect a reverse stock split, if necessary to regain

compliance with the Bid Price Requirement, pending stockholder approval on December 28, 2023 at the Company’s Special Stockholder

Meeting.

On

November 29, 2023, the Company received a letter from the Staff notifying the Company that it is eligible for an additional 180 calendar

day period, or until May 28, 2024 to regain compliance (the “Compliance Date”). Provided that the Company meets the continued

listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on the Nasdaq

Capital Market with the exception of the Bid Price Requirement, and the Company provides written notice of its intention to cure the

deficiency during the second compliance period by effecting a reverse stock split, if necessary, then if at any time before the Compliance

Date the closing bid price for the Company’s Common Stock is at least $1.00 for a minimum of 10 consecutive business days, the

Staff will provide the Company written confirmation of compliance with the Bid Price Requirement.

The

notification has no immediate effect on the Company’s Nasdaq listing and the Company’s Common Stock will continue to trade

on Nasdaq under the ticker symbol “VINO.”

If

the Company does not regain compliance with the Bid Price Requirement by the Compliance Date, the Staff will provide written notification

to the Company that its Common Stock will be subject to delisting. At that time, the Company may appeal the Staff’s delisting determination

to a Nasdaq Hearings Panel.

There

can be no assurance that the Company will regain compliance or otherwise maintain compliance with any of the other listing requirements.

Nonetheless, it is the Company’s intention to regain compliance with the Bid Price Requirement through effecting a reverse stock

split if necessary.

Item

8.01 Other Events.

On

November 30, 2023, the Company issued a press release announcing the notice from Nasdaq regarding the second compliance period. The full

text of the press release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

Also

on November 30, 2023, the Company issued a press release announcing the appointment of Doug Casey as the Company’s Lead Business

Advisor - Argentina Investments. The full text of the press release is furnished hereto as Exhibit 99.2 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 30th day of November 2023.

| |

Gaucho

Group Holdings, Inc. |

| |

|

|

| |

By: |

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit

99.1

GAUCHO

HOLDINGS SEIZES NEW OPPORTUNITIES WITH NASDAQ EXTENSION AND ARGENTINE ECONOMIC REVIVAL

A

Decade of Argentine Investment Poised to Deliver in Evolving Market

MIAMI,

FL / November 30, 2023 / Gaucho Group Holdings, Inc. (NASDAQ:VINO), a company that includes a growing collection of e-commerce platforms

with a concentration on fine wines, luxury real estate, and leather goods and accessories (the “Company” or “Gaucho

Holdings”), today announced that it has been granted a 180-day extension by NASDAQ to regain compliance with the exchange’s

listing requirements. This extension provides Gaucho Holdings with crucial time and flexibility to implement strategic initiatives and

take corrective measures aimed at ensuring full compliance with NASDAQ standards.

The

announcement comes at a pivotal time, coinciding with recent elections in Argentina and the potential implications for the country’s

economy. Gaucho Holdings views this political shift not merely as a change in governance but as a significant opportunity for economic

revitalization and investment growth in Argentina. The Company has a longstanding investment presence in the country, dating back to

2007, and is poised to unveil new and exciting initiatives tailored to this evolving landscape.

Gaucho

Holdings’ unique position in the Argentine market, especially in the real estate sector, stems from its early entry into the market

and established operational presence. The Company boasts a diversified portfolio, with all its Argentina-based companies fully operational.

This advantage is further amplified by established synergies among its assets, allowing for streamlined operations across various platforms.

Moreover, Gaucho Holdings benefits from a seasoned management team with deep experience and understanding of the Argentine market.

Scott

Mathis, CEO and Founder of Gaucho Group Holdings, commented on the development, saying, “This extension from NASDAQ is not just

a regulatory respite for us; it’s a strategic opportunity. It arrives at a time when Argentina is on the cusp of an economic resurgence.

We’ve been committed to Argentina since 2007, and our deep-rooted presence there, coupled with our diversified business model,

positions us uniquely to harness the potential of this new economic era. We are excited to advance our plans and contribute significantly

to and benefit from the country’s growth trajectory.”

Gaucho

Holdings’ proactive approach in Argentina’s changing economic environment highlights its commitment to growth, compliance,

and strategic innovation, setting a course for continued success in the region.

About

Gaucho Group Holdings, Inc.

For

more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholdings.com) mission has been to source and develop opportunities in

Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of the

continued and fast growth of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified luxury

goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com

& algodonwines.com.ar), hospitality (algodonhotels.com), and luxury real estate (algodonwineestates.com) associated with our proprietary

Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires™ (gaucho.com),

these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts,

included herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures,

future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other

plans and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be

considered to be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on Edgar. The Company disclaims

any obligation to update any forward-looking statement made here.

Media

Relations:

Gaucho

Group Holdings, Inc.

Rick

Stear

Director

of Marketing

212.739.7669

rstear@gauchoholdings.com

Exhibit 99.2

GAUCHO HOLDINGS WELCOMES DOUG CASEY AS LEAD BUSINESS

ADVISOR, BOLSTERING ARGENTINA INVESTMENT STRATEGY

Renowned Author and Speculator to Guide Company’s

Growth in the Wake of Argentina’s Opportunistic Economic Shift

MIAMI, FL / NOVEMBER 30, 2023 / Gaucho Group Holdings,

Inc. (NASDAQ:VINO), a company that includes a growing collection of e-commerce platforms with a concentration on fine wines, luxury real

estate, and leather goods and accessories (the “Company” or “Gaucho Holdings”), today announced the appointment

of best-selling author, world-renowned speculator, and libertarian philosopher, Doug Casey, as Gaucho Holdings’ Lead Business Advisor

- Argentina Investments. The company believes this appointment can substantially enhance its strategic vision and steer its expansion

in Argentina’s dynamic luxury real estate market.

Doug Casey, bringing his considerable experience and

a profound grasp of the Argentine market, is viewed by the company as a highly suitable advisor for this role. Known for describing Argentina

as ‘the cheapest civilized place on earth,’ Casey brings a unique perspective on the country’s economic potential and

investment opportunities. His insights are particularly valuable in light of the recent political changes in Argentina, which Gaucho Holdings

views not just as a shift, but as a chance for economic revitalization and investment growth.

Casey shared his vision for Argentina’s future,

stating, “If Milei’s reforms stick, within a decade, Argentina could become the most prosperous country in the world. Look

at what Pinochet’s limited reforms did for Chile. It changed from a backward mining province into the most advanced and prosperous

country on the continent. Milei’s reforms could transform Argentina into both the freest and the most prosperous country on the

planet. Argentina has many advantages... It’s the perfect country whose only real problem is its insane government. But that’s

about to change. If he succeeds, I think there will be a rush of millions of Europeans who will see that Argentina has got everything

that Europe does—including the favorable aspects of its culture, but none of the disadvantages.” For more insights into Doug

Casey’s philosophy on investing in Argentina, readers can explore his extensive writings and viewpoints at International Man.

Scott Mathis, CEO and Founder of Gaucho Holdings,

commented on the appointment, saying, “Doug Casey’s deep understanding of the Argentine market and his perspective on its

untapped potential make him an invaluable asset to our team. His guidance will be crucial as we seek to expand and strengthen our presence

in Argentina, taking advantage of the unique investment opportunities this country offers. We are excited to have Doug’s expertise

to guide our initiatives in this new economic landscape.”

With a history of investing in Argentina since 2007,

Gaucho Holdings is uniquely positioned to take advantage of these emerging opportunities, especially in the real estate sector. The company

anticipates announcing advanced plans for innovative initiatives in Argentina, leveraging the opportunities presented by the recent political

shifts and Casey’s expertise in navigating this evolving market.

About Gaucho Group Holdings, Inc.

For more than ten years, Gaucho Group Holdings, Inc.’s

(gauchoholdings.com) mission has been to source and develop opportunities in Argentina’s undervalued luxury real estate

and consumer marketplace. Our company has positioned itself to take advantage of the continued and fast growth of global e-commerce across

multiple market sectors, with the goal of becoming a leader in diversified luxury goods and experiences in sought after lifestyle industries

and retail landscapes. With a concentration on fine wines (algodonfinewines.com & algodonwines.com.ar), hospitality

(algodonhotels.com), and luxury real estate (algodonwineestates.com) associated with our proprietary Algodon brand, as

well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires™ (gaucho.com),

these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary Note Regarding Forward-Looking Statements

The information discussed in this press release includes

“forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of historical facts, included herein concerning, among other things, changes

to exchange rates and their impact on the Company, planned capital expenditures, future cash flows and borrowings, pursuit of potential

acquisition opportunities, our financial position, business strategy and other plans and objectives for future operations, are forward

looking statements. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve

certain assumptions, risks and uncertainties and are not (and should not be considered to be) guarantees of future performance. Refer

to our risk factors set forth in our reports filed on Edgar. The Company disclaims any obligation to update any forward-looking statement

made here.

Media Relations:

Gaucho Group Holdings, Inc.

Rick Stear

Director of Marketing

212.739.7669

rstear@gauchoholdings.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

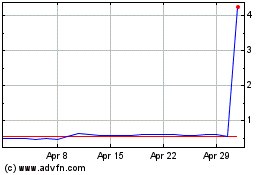

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Apr 2024 to May 2024

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From May 2023 to May 2024