Formula Systems (1985) Ltd. (Nasdaq and TASE: FORTY) (“Formula” or

the “Company”), a global information technology group engaged,

through its subsidiaries and affiliates, in providing software

consulting services and computer-based business solutions and

developing proprietary software products, today announced its

results for the second quarter and first half period ended June 30,

2024.

Financial Highlights for the Second

Quarter Ended June 30, 2024

- Revenues for the second quarter

ended June 30, 2024 increased by 1.9% to $667.7 million, compared

to $655.4 million in the same period last year. On a

constant-currency basis (calculated based on average currency

exchange rates for the three months ended June 30, 2023), revenues

for the second quarter of 2024 would have increased by 3.5% to

$678.3 million, compared to the same period last year.

- Operating income for the second

quarter ended June 30, 2024 increased by 8.4% to a second quarter

record breaking $65.0 million compared to $60.0 million in the same

period last year.

- Net income attributable to

Formula’s shareholders for the second quarter ended June 30, 2024

increased by 10.7% to a second quarter record-breaking

$18.8 million, or $1.20 per fully diluted share, compared to

$17.0 million, or $1.11 per fully diluted share, in the same

period last year.

Financial Highlights for the Six

Month-Period Ended June 30, 2024

- Revenues for the first half period ended June 30, 2024

increased by 3.0% to a first-half record-breaking $1.37 billion,

compared to $1.33 billion in the same period last year. On a

constant currency basis (calculated based on average currency

exchange rates for the first half ended June 30, 2023), revenues

for the first half period ended June 30, 2024 would have increased

by approximately 5.0% to $1.39 billion, compared to the same period

last year.

- Operating income for the first half period ended June 30, 2024

increased by 5.7% to a first-half record-breaking $127.6 million,

compared to $120.8 million in the same period last year.

- Net income attributable to Formula’s shareholders for the first

half period ended June 30, 2024 increased by 10.1% to a first-half

record-breaking $36.0 million, or $2.31 per fully diluted

share, compared to $32.7 million, or $2.11 per fully diluted

share, in the same period last year.

- As of June 30, 2024, Formula held 48.21%, 43.54%, 46.71%, 100%,

50%, 90.1%, 80%, 100% and 100% of the outstanding ordinary shares

of Matrix IT Ltd., Sapiens International Corporation N.V., Magic

Software Enterprises Ltd., Michpal Micro Computers (1983) Ltd., TSG

IT Advanced Systems Ltd., Insync Staffing Solutions, Inc., Ofek

Aerial Photography Ltd., ZAP Group Ltd., and Shamrad Electronic

(1997) Ltd., respectively.

- Consolidated cash and cash equivalents and short-term bank

deposits totaled approximately $472.9 million as of June 30,

2024, compared to $528.2 million as of December 31, 2023.

- Total equity as of June 30, 2024 and December 31, 2023 was $1.3

billion (representing 49.1% and 46.5% of the total consolidated

statements of financial position, respectively).

Declaration of Dividend for the First

Half of 2024

- Based on the Company’s results, the

Company’s board of directors approved the distribution of a cash

dividend in an amount of NIS 2.32 per share (approximately $0.63

per share) and in an aggregate amount of approximately NIS 35.6

million (approximately $9.6 million).

- The dividend is payable on

September 26, 2024, to all of the Company’s shareholders of record

at the close of trading on the Nasdaq Global Select Market (or the

Tel-Aviv Stock Exchange, as appropriate) on September 12, 2024.

The dividend will be paid in New Israeli Shekels with

respect to the Company's ordinary shares traded on the Tel Aviv

Stock Exchange and American Depositary Receipts traded on the

Nasdaq Global Select Market.

In accordance with Israeli tax law, the dividend

is subject to withholding tax at source at the rate of 30% (if the

recipient of the dividend is at the time of distribution or was at

any time during the preceding 12-month period the holder of 10% or

more of the Company's share capital) or 25% (for all other dividend

recipients) of the dividend amount payable to each shareholder of

record, subject to applicable exemptions.

Debentures Covenants

As of June 30, 2024, Formula was in compliance

with all of its financial covenants under the debenture series

issued by it, based on the following achievements:

Covenant 1

- Target equity attributable to

Formula’s shareholders (excluding non-controlling interests): above

$215 million.

- Actual equity attributable to

Formula’s shareholders as of June 30, 2024 was $644.0 million.

Covenant 2

- Target ratio of net financial indebtedness to net

capitalization (in each case, as defined under the indenture for

Formula’s Series A and C Secured Debentures): below 65%.

- Actual ratio of net financial indebtedness to net

capitalization, as of June 30, 2024 was (0.02%).

Covenant 3

- Target ratio of net financial

indebtedness to EBITDA (based on the accumulated calculation for

the four most recent quarters): below 5.

- Actual ratio of net financial

indebtedness to EBITDA as of June 30, 2024 was (0.001).

Comments of Management

Commenting on the results, Guy

Bernstein, CEO of Formula Systems, said: “I am proud of

Formula’s strong performance in the second quarter and throughout

the first half of 2024 as we reported another second quarter of

record revenues, operating income and net income in the Company’s

history. Our operating income of $65 million in the second quarter

of 2024 was up 8.4% on a year over year basis and 3.9% on a on a

sequential basis, growing our semi-annual operating income to

$127.6 million. These results underscore our commitment to driving

sustained growth and operational excellence across all facets of

our business. We continue to uphold our core values of innovation,

professionalism, agility, and transparency across our entire group.

These principles enable us to consistently create significant value

for our customers by helping them manage, streamline, and

accelerate their operations, ultimately contributing to their

growth.”

“Matrix reported its best second quarter in

history with record-breaking results recorded across all its key

financial indices: revenues, gross profit, operating income, net

income and EBITDA. Matrix revenues for the second quarter grew by

3.6% year over year reaching an all-time second quarter high of NIS

1.33 billion (approximately $357.8 million). Operating income grew

by 13.9%, reaching NIS 111.3 million (approximately $29.9 million).

We are pleased with Matrix’s continued recognition as a market

leader in Israel in the implementation of fastest-growing

technologies, such as cloud, cyber, digital, data, DevOps and AI,

which enable the company to create significant value for its

customers in managing, streamlining, accelerating and making its

businesses thrive. Matrix continues to strengthen its position as a

company executing complex and innovative projects of national

significance – economic, social, and security-related – that are

helping the State of Israel during this challenging period. There

is a strong demand in Israel and in North America for software

services in digital, cloud, cyber, data, and core operating

systems—areas in which Matrix is a market leader, and which are at

the center of the IT market demand even during times of war.”

“Sapiens revenues for the second quarter reached

$137 million, reflecting a 6.6% increase compared to the same

period last year. Sapiens Non-GAAP operating profit totaled $25

million, representing 18.2% of its total revenues. Sapiens results

demonstrate its strong execution capabilities, particularly with

robust growth in North America and Europe. As a global player with

multiple product lines and cloud capabilities and a cost-efficient

operating model which combines off-and on-shore delivery

capabilities, we believe that Sapiens is positioned in a sweet spot

to reap the gains of this opportunity.”

“Magic Software's operational results for the

second quarter and first half of 2024 has been increasingly

improving, underscoring the positive momentum that continues to

drive its business forward. While Magic Software operates in a

dynamic macroeconomic landscape, which has presented challenges for

some of its North American blue-chip clients, particularly in the

face of softer demand and budget constraints, we remain optimistic

about the future. Magic Software’s business is constantly

improving, and its pipeline is robust as the vast majority of its

customers continue to recognize the unique value it brings,

increasingly choosing Magic Software as their preferred partner for

their innovative digital and cloud transformation initiatives. We

are confident that this momentum driven by Magic Software’s ongoing

efforts to cultivate cutting-edge capabilities will continue to

build throughout the year and propel it toward sustained, long-term

profitability and enduring value to its shareholders.”

“Michpal concluded the second quarter with

quarterly consolidated revenues of NIS 37.3 million (approximately

$10.0 million), growing 10.6% year over year on a constant currency

basis. Michpal offers comprehensive proprietary on-premise and

web-based payroll software solutions and related services, as well

as integrated specialized management systems in the field of

financial accounting, taxation and compliance, for accounting

professionals (accountants and tax consultants), bookkeepers,

controllers, and CFOs.”

“TSG’s, a leading provider of defense and

homeland security solutions, reports a strong start as a public

company on the Tel-Aviv Stock Exchange, with notable growth in its

core markets. EBITDA for the second quarter of 2024 increased by

13.3% year over year to NIS 13.0 million compared to NIS 11.5

million in the same period last year. This solid performance

reflects TSG's successful efforts to capitalize on both its

traditional defense sector activities, driven by increasing

geopolitical instability in the Middle East and Europe, and its

growing presence in the Israeli municipal sector. The ongoing

demand for advanced defense and homeland security solutions,

coupled with long-term engagements in municipal projects, continues

to drive TSG’s growth. TSG remains committed to leveraging its

expertise in developing innovative solutions to meet the evolving

needs of its customers.”

Stand-Alone Financial

Measures

This press release presents, further below,

certain stand-alone financial measures to reflect Formula’s

stand-alone financial position in reference to its assets and

liabilities as the parent company of the group. These financial

measures are prepared consistent with the accounting principles

applied in the consolidated financial statements of the group. Such

measures include investments in subsidiaries and a jointly

controlled entity measured at cost adjusted by Formula’s share in

the investees’ accumulated undistributed earnings and other

comprehensive income or loss.

Formula believes that these financial measures

provide useful information to management and investors regarding

Formula’s stand-alone financial position. Formula’s management uses

these measures to compare the Company’s performance in the current

period to that of prior periods for trend analyses. These measures

are also used in financial reports prepared for management and in

quarterly financial reports presented to the Company’s board of

directors. The Company believes that the use of these stand-alone

financial measures provides an additional tool for investors to use

in evaluating Formula’s financial position.

Management of the Company does not consider

these stand-alone measures in isolation or as an alternative to

financial measures determined in accordance with GAAP. Formula

urges investors to review the consolidated financial statements

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate the Company’s business or

financial position.

About Formula

Formula Systems, whose ordinary shares are

traded on the Tel-Aviv Stock Exchange and ADSs are traded on the

Nasdaq Global Select Market, is a global information technology

holding company engaged, through its subsidiaries and affiliates,

in providing software consulting services and computer-based

business solutions and developing proprietary software

products.

For more information, visit

www.formulasystems.com.

Press Contact:

Formula Systems (1985) Ltd. +972-3-5389487

ir@formula.co.il

Forward Looking Statements

Certain matters discussed in this press release

that are incorporated herein and therein by reference are

forward-looking statements within the meaning of Section 27A of the

Securities Act, Section 21E of the Exchange Act and the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995, that are based on our beliefs, assumptions and expectations,

as well as information currently available to us. Such

forward-looking statements may be identified by the use of the

words “anticipate,” “believe,” “estimate,” “expect,” “may,” “will,”

“plan” and similar expressions. Such statements reflect our current

views with respect to future events and are subject to certain

risks and uncertainties. There are important factors that could

cause our actual results, levels of activity, performance or

achievements to differ materially from the results, levels of

activity, performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to: adverse

macro-economic trends and their duration, including inflation,

relatively high interest rates, and supply chain delays, which

trends may last for a significant period and materially adversely

affect our results of operations; the degree of our success in our

plans to leverage our global footprint to grow our sales; the

degree of our success in integrating the companies that we have

acquired through the implementation of our M&A growth strategy;

the degree of our success in developing and deploying new

technologies for software solutions that address the updated needs

of our customers and serve as the basis for our revenues; the

lengthy development cycles for our solutions, which may frustrate

our ability to realize revenues and/or profits from our potential

new solutions; our lengthy and complex sales cycles, which do not

always result in the realization of revenues; the degree of our

success in retaining our existing customers or competing

effectively for greater market share; difficulties in successfully

planning and managing changes in the size of our operations; the

frequency of the long-term, large, complex projects that we perform

that involve complex estimates of project costs and profit margins,

which sometimes change mid-stream; the challenges and potential

liability that heightened privacy laws and regulations pose to our

business; occasional disputes with clients, which may adversely

impact our results of operations and our reputation; various

intellectual property issues related to our business; potential

unanticipated product vulnerabilities or cybersecurity breaches of

our or our customers’ systems particularly in the current hybrid

office/work-from-home environment; risks related to industries,

such as the insurance, healthcare, defense and the telecom, in

which certain of our clients operate; risks posed by our global

sales and operations, such as changes in regulatory requirements,

supply chain disruptions, geopolitical instability stemming from

Russia’s invasion of Ukraine, wide-spread viruses and epidemics or

fluctuations in currency exchange rates; and risks related to our

and our subsidiaries’ principal location in Israel.

While we believe such forward-looking statements

are based on reasonable assumptions, should one or more of the

underlying assumptions prove incorrect, or these risks or

uncertainties materialize, our actual results may differ materially

from those expressed or implied by the forward-looking statements.

Please read the risks discussed under the heading “Item 3.D Risk

Factors” in our most recent Annual Report on Form 20-F for the year

ended December 31, 2023, filed with the U.S. Securities and

Exchange Commission on May 15, 2024, in order to review conditions

that we believe could cause actual results to differ materially

from those contemplated by the forward-looking statements. You

should not rely upon forward-looking statements as predictions of

future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot

guarantee that future results, levels of activity, performance and

events and circumstances reflected in the forward-looking

statements will be achieved or will occur. Except as required by

law, we undertake no obligation to update publicly any

forward-looking statements for any reason, or to conform those

statements to actual results or to changes in our expectations.

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED CONDENSED STATEMENTS OF PROFIT OR

LOSS U.S. dollars in thousands (except per share

data)

|

|

Three months ended |

|

|

Six months ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Revenues |

|

667,680 |

|

|

|

655,374 |

|

|

|

1,366,081 |

|

|

|

1,325,773 |

|

|

Cost of revenues |

|

501,234 |

|

|

|

494,436 |

|

|

|

1,035,420 |

|

|

|

1,002,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

166,446 |

|

|

|

160,938 |

|

|

|

330,661 |

|

|

|

322,869 |

|

|

Research and development costs, net |

|

20,432 |

|

|

|

19,210 |

|

|

|

40,649 |

|

|

|

38,518 |

|

|

Selling, marketing and general and administrative expenses |

|

80,975 |

|

|

|

81,744 |

|

|

|

162,388 |

|

|

|

163,573 |

|

|

Operating income |

|

65,039 |

|

|

|

59,984 |

|

|

|

127,624 |

|

|

|

120,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses, net |

|

3,829 |

|

|

|

5,612 |

|

|

|

9,431 |

|

|

|

12,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes on income |

|

61,210 |

|

|

|

54,372 |

|

|

|

118,193 |

|

|

|

108,082 |

|

|

Taxes on income |

|

13,650 |

|

|

|

11,380 |

|

|

|

27,108 |

|

|

|

22,870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income after taxes |

|

47,560 |

|

|

|

42,992 |

|

|

|

91,085 |

|

|

|

85,212 |

|

|

Share of profit (loss) of companies accounted for at equity,

net |

|

(135 |

) |

|

|

174 |

|

|

|

(32 |

) |

|

|

209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

47,425 |

|

|

|

43,166 |

|

|

|

91,053 |

|

|

|

85,421 |

|

|

Net income attributable to non-controlling interests |

|

28,586 |

|

|

|

26,145 |

|

|

|

55,055 |

|

|

|

52,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Formula Systems

shareholders |

|

18,839 |

|

|

|

17,021 |

|

|

|

35,998 |

|

|

|

32,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (basic) |

|

1.23 |

|

|

|

1.12 |

|

|

|

2.36 |

|

|

|

2.14 |

|

|

Earnings per share (diluted) |

|

1.20 |

|

|

|

1.11 |

|

|

|

2.31 |

|

|

|

2.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares used in computing earnings per share (basic) |

|

15,304,355 |

|

|

|

15,301,017 |

|

|

|

15,303,811 |

|

|

|

15,300,642 |

|

|

Number of shares used in computing earnings per share

(diluted) |

|

15,624,160 |

|

|

|

15,480,800 |

|

|

|

15,597,645 |

|

|

|

15,472,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

U.S. dollars in thousands

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

408,262 |

|

|

|

451,946 |

|

|

Short-term deposits |

|

64,617 |

|

|

|

76,224 |

|

|

Trade receivables, net |

|

710,299 |

|

|

|

721,008 |

|

|

Prepaid expenses and other accounts receivable |

|

90,274 |

|

|

|

84,670 |

|

|

Inventories |

|

30,189 |

|

|

|

42,008 |

|

|

Total current assets |

|

1,303,641 |

|

|

|

1,375,856 |

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Long-term investments and receivables |

|

52,729 |

|

|

|

52,002 |

|

|

Deferred taxes |

|

46,547 |

|

|

|

46,856 |

|

|

Investments in companies accounted for at equity |

|

18,836 |

|

|

|

20,796 |

|

|

Property, plants and equipment, net |

|

49,731 |

|

|

|

52,931 |

|

|

Right-of-use assets |

|

112,844 |

|

|

|

120,651 |

|

|

Intangible assets, net and goodwill |

|

1,118,288 |

|

|

|

1,143,509 |

|

|

Total non-current assets |

|

1,398,975 |

|

|

|

1,436,745 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

2,702,616 |

|

|

|

2,812,601 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Credit from banks and others |

|

150,467 |

|

|

|

145,973 |

|

|

Debentures |

|

64,206 |

|

|

|

72,885 |

|

|

Current maturities of lease liabilities |

|

41,127 |

|

|

|

44,064 |

|

|

Trade payables |

|

199,123 |

|

|

|

258,649 |

|

|

Deferred revenues |

|

147,193 |

|

|

|

137,643 |

|

|

Employees and payroll accrual |

|

197,529 |

|

|

|

209,384 |

|

|

Other accounts payable |

|

76,996 |

|

|

|

73,124 |

|

|

Liabilities in respect of business combinations |

|

5,656 |

|

|

|

7,954 |

|

|

Put options of non-controlling interests |

|

49,400 |

|

|

|

35,987 |

|

|

Total current liabilities |

|

931,697 |

|

|

|

985,663 |

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

Loans from banks and others |

|

63,557 |

|

|

|

90,887 |

|

|

Debentures |

|

194,444 |

|

|

|

231,541 |

|

|

Lease liabilities |

|

79,760 |

|

|

|

84,639 |

|

|

Other long-term liabilities |

|

12,976 |

|

|

|

12,678 |

|

|

Deferred taxes |

|

53,022 |

|

|

|

59,206 |

|

|

Deferred revenues |

|

17,077 |

|

|

|

4,873 |

|

|

Liabilities in respect of business combinations |

|

1,912 |

|

|

|

2,622 |

|

|

Put options of non-controlling interests |

|

11,079 |

|

|

|

21,880 |

|

|

Employees benefit liabilities, net |

|

10,189 |

|

|

|

10,427 |

|

|

Total long-term liabilities |

|

444,016 |

|

|

|

518,753 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

Equity attributable to Formula Systems shareholders |

|

644,022 |

|

|

|

625,762 |

|

|

Non-controlling interests |

|

682,881 |

|

|

|

682,423 |

|

|

Total equity |

|

1,326,903 |

|

|

|

1,308,185 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

2,702,616 |

|

|

|

2,812,601 |

|

|

|

|

|

|

|

|

|

|

FORMULA SYSTEMS (1985) LTD.

STAND-ALONE STATEMENTS OF FINANCIAL POSITION

U.S. dollars in thousands

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

30,524 |

|

|

|

30,082 |

|

|

Dividend receivable |

|

11,277 |

|

|

|

- |

|

|

Other accounts receivable and prepaid expenses |

|

13,175 |

|

|

|

10,326 |

|

|

Total current assets |

|

54,976 |

|

|

|

40,408 |

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Investment in subsidiaries and a jointly controlled entity (*) |

|

|

|

|

|

|

|

|

Matrix IT Ltd. |

|

154,760 |

|

|

|

160,056 |

|

|

Sapiens International Corporation N.V. |

|

255,813 |

|

|

|

251,658 |

|

|

Magic Software Enterprises Ltd. |

|

129,932 |

|

|

|

128,549 |

|

|

Other |

|

141,663 |

|

|

|

147,975 |

|

|

Total investment in subsidiaries and a jointly controlled

entity |

|

682,168 |

|

|

|

688,238 |

|

|

|

|

|

|

|

|

|

|

|

Long term receivables and other investments |

|

24,049 |

|

|

|

22,737 |

|

|

Property, plants and equipment, net |

|

10 |

|

|

|

11 |

|

|

Total non-current assets |

|

706,227 |

|

|

|

710,986 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

761,203 |

|

|

|

751,394 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Loans from banks and others |

|

2,227 |

|

|

|

- |

|

|

Debentures |

|

21,742 |

|

|

|

32,126 |

|

|

Trade payables |

|

198 |

|

|

|

137 |

|

|

Other accounts payable |

|

1,254 |

|

|

|

2,697 |

|

|

Liability in respect of a business combination |

|

257 |

|

|

|

267 |

|

|

Total current liabilities |

|

25,678 |

|

|

|

35,227 |

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

Loans from banks and others |

|

4,064 |

|

|

|

- |

|

|

Debentures |

|

87,439 |

|

|

|

90,405 |

|

|

Total long-term liabilities |

|

91,503 |

|

|

|

90,405 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

644,022 |

|

|

|

625,762 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

761,203 |

|

|

|

751,394 |

|

|

|

|

|

|

|

|

|

|

(*) The investments' carrying amounts are

measured consistent with the accounting principles applied in the

consolidated financial statements of the group and representing the

investments’ cost adjusted by Formula's share in the investees'

accumulated undistributed earnings and other comprehensive income

or loss.

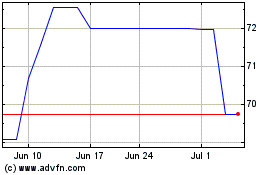

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Dec 2023 to Dec 2024