Filed by Peoples Financial Services Corp.

(Commission File No. 001-36388)

Pursuant to Rule 425 under the Securities Act of

1933, as amended

and deemed filed pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934, as amended

Subject Company: FNCB Bancorp

(Commission File No. 001-38408)

Date: September 27, 2023

ONE BRAND ONE BANK ONE TEAM Customer Information +

We are excited to announce the strategic combination of Peoples Financial Services Corp. (“PFIS”), the parent company of Peoples Security Bank and Trust Company (“PSBT”), with FNCB Bancorp, Inc., the parent company of FNCB Bank (“FNCB”). The combined company will result in assets of approximately $5.5 Billion; a banking team of 500+ employees; and a branch network serving 13 counties in Pennsylvania; Broome County, New York and Central New Jersey. MANAGEMENT Craig Best will serve as the Chief Executive Officer of the combined Bank and Holding Company. Mr. Best has led PSBT and its predecessor for over seventeen years in this capacity. Jerry Champi will serve as the President of the Bank and Holding Company. Mr. Champi has served as President and Chief Executive Officer at FNCB for over seven years. Thomas Tulaney will serve as the Chief Operating Officer of the Bank and Holding Company. Mr. Tulaney has served in various capacities at PSBT for over twelve years. It is anticipated that twelve months after the close date, Jerry Champi will become the Chief Executive Officer of the Bank and Holding Company and Thomas Tulaney will become the President and Chief Operating Officer of the Bank and Holding Company. John Anderson will serve as the Chief Financial Officer and James Bone will serve as the Chief Operations Officer for the Bank and Holding Company. Mr. Anderson and Mr. Bone both have served in various capacities for more than 30 years with their respective institutions. BOARD OF DIRECTORS The structure of the Holding Company board at closing will be comprised of 16 directors, eight from PFIS and eight from FNCB. William E. Aubrey II will serve as Chairman and Louis DeNaples, Sr. will serve as Vice Chairman for both the Holding Company and Bank boards of director. $5.5 Billion Total Assets $4.7 Billion Total Deposits $4.0 Billion Total Loans +

WITH THE STRATEGIC COMBINATION OF THE TWO BANKS, WHAT COMBINED BRAND WILL WE OPERATE UNDER? Following the closing of the strategic combination, which is anticipated to close in the first half of 2024, the Holding Company will operate as Peoples Financial Services Corp. and the Bank will operate under the Peoples Security Bank and Trust Company brand. The Bank will continue the traditions of both PSBT and FNCB brands that are grounded in relationship banking. Our employees, who embody our company culture and deliver unmatched customer experience, are the driving force behind our success! Together, under one bank and one brand, we will be one banking team striving to positively impact lives. WILL THERE BE ANY BRANCH CONSOLIDATIONS? We will be evaluating the branch structure and some consolidation will likely occur due to the proximity of certain branch locations. Any branch consolidations will be accomplished with careful evaluation and significant consideration to ensure a limited impact on the local community, employees, and our customers. WILL RELATIONSHIP BANKING REMAIN A PRIMARY FOCUS? Relationship Banking has been the foundation and underpinning for both banks throughout the years and will continue to be the driving force in our approach to our business. WILL THERE BE ANY IMPACT TO PRODUCTS AND SERVICES? The merger will create enhanced products, services and technology, which will be of great benefit to our Business and Personal customers alike. A new product guide and information will be presented to our customers prior to the closing date, which is expected to occur in the first half of 2024. +

WHEN WILL THE STRATEGIC COMBINATION OF THE TWO BANKS CLOSE? The transaction is expected to close in the first half of 2024, subject to satisfaction of customary closing conditions, including receipt of regulatory approvals and approval by the shareholders of each company. Bank system conversions will occur simultaneously at closing or shortly thereafter. WHAT IS THE COMBINED FOOTPRINT? The combined markets are well positioned throughout Pennsylvania, including Northeastern Pennsylvania, the Lehigh Valley, Greater Delaware Valley, Central Pennsylvania, the Greater Pittsburgh Region along with portions of New York and New Jersey. +

WHAT WILL BE THE COMBINED MISSION AND VISION? To succeed, we must be constantly aware of the roles played by our stakeholders – our shareholders, our customers, our communities, and our employees. We will work together to: Exceed customers’ expectations as we proactively help them achieve their goals. Create a dynamic environment that promotes life - long learning and personal growth of employees. Help to make our communities better places to live and work by being an important contributor of time, talent and resources. WHAT WILL HAPPEN TO FNCB BANCORP STOCK? At closing, existing FNCB Bancorp, Inc . stock will be converted to shares of Peoples Financial Services Corp . stock . FNCB Bancorp, Inc . shareholders will receive formal instructions on how to convert their shares prior to closing . IF I HAVE ADDITIONAL QUESTIONS, CAN I SPEAK WITH SOMEONE? The officers and employees at our respective banks are an important conduit for communication and leadership. Please feel free to reach out to your Relationship Banker, who will be able to provide answers concerning this announcement. We will keep you informed of the progress of the merger as benchmarks are attained and will follow up with additional FAQs, which will be available to you via email, in person and on our respective bank’s websites. LEARN MORE BY VISITING: www.psbt.com or www.fncb.com +

FORWARD - LOOKING STATEMENTS This communication includes “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of Peoples Financial Services Corp. (together with its subsidiaries, “Peoples”) and FNCB Bancorp, Inc. (together with its subsidiaries “FNCB”) regarding the proposed transaction, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies, returns and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward – looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “will,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward - looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward - looking statements speak only as of the date they are made; and except as may be required by law, Peoples and FNCB do not assume any duty, and do not undertake, to update such forward - looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward - looking statements are subject to assumptions and uncertainties, actual re - sults or future events could differ, possibly materially, from those indicated in or implied by such forward - looking statements as a result of a variety of factors, many of which are beyond the control of Peoples and FNCB. Such statements are based upon the current beliefs and expectations of the management of Peoples and FNCB and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing un - due reliance on forward - looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Peoples and FNCB; the outcome of any legal proceedings that may be instituted against Peoples or FNCB; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposi - tion of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of Peoples and FNCB to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risks related to capital actions of Peoples, FNCB and the combined entity, including related to actions concerning dividends, the risk that any announcements relating to the proposed trans - action could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the an - ticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Peoples and FNCB do business; the risks related to Peoples and FNCB not achieving their estimated financial performance; the risks related to changes in the interest rate environment, including the recent increases in the Board of Governors of the Federal Reserve System benchmark rate and duration at which such increased interest rate levels are maintained, which could adversely affect Peoples’ and FNCB’s revenue and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; risks related to the uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; risks related to the volatility and disruptions in global capital and credit markets; risks related to the movements in interest rates; risks related to reform of LIBOR; the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, and the operational risk of lending activities, including the effectiveness of Peoples’ and FNCB’s underwriting practices and the risk of fraud; risks related to the fluctuations in the demand for loans; risk related to the ability to develop and maintain a strong core deposit base or other low cost funding sources necessary to fund Peoples’ and FNCB’s activities particularly in a rising or high interest rate environment; risks related to the rapid withdrawal of a significant amount of deposits over a short period of time; the risk related to the impact of other bank failures or other adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; risks related to the impact of natural disasters or health epidemics; risks related to data security and privacy, including the impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; risks related to volatility in the trading price of Peoples’ and FNCB’s common stock; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the transaction within the expected timeframes or at all and to successfully integrate FNCB’s operations and those of Peoples; such integration may be more difficult , time - consuming or costly than expected; revenues following the proposed transaction may be lower than expected; Peoples’ and FNCB’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Peoples’ issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of Peoples and FNCB to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; the impacts of continuing inflation and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of Peoples and FNCB; and the other factors discussed in the “Risk Factors” section of Peoples’ and FNCB’s Annual Reports on Form 10 - K for the year ended December 31, 2022, in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of Peoples’ and FNCB’s Quarterly Report on Form 10 - Q for the quarters ended March 31, 2023, and June 30, 2023, and other reports Peoples and FNCB file with the U.S. Securities and Exchange Commission (the “SEC”). ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction, Peoples will file a registration statement on Form S - 4 with the SEC. The registration statement will include a joint proxy statement of Peoples and FNCB, which also constitutes a prospectus of Peoples, that will be sent to shareholders of Peoples and shareholders of FNCB seeking certain approvals related to the proposed transaction. The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solici - tation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF PEOPLES AND FNCB AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S - 4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PEOPLES, FNCB AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about Peoples and FNCB, without charge, at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by Peoples will be made available free of charge in the “Investor Relations” section of Peoples’ website, https://psbt.com/, under the heading “SEC Filings.” Copies of documents filed with the SEC by FNCB will be made available free of charge in the “About FNCB” section of FNCB’s website. PARTICIPATION IN SOLICITATION Peoples, FNCB, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Peoples’ directors and executive officers is available in its definitive proxy state - ment, which was filed with the SEC on April 5, 2023, and certain other documents filed by Peoples with the SEC. Information regarding FNCB’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 10, 2023, and certain other documents filed by FNCB with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph. +

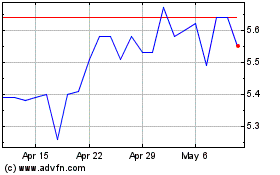

FNCB Bancorp (NASDAQ:FNCB)

Historical Stock Chart

From Apr 2024 to May 2024

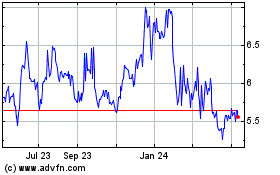

FNCB Bancorp (NASDAQ:FNCB)

Historical Stock Chart

From May 2023 to May 2024