Current Report Filing (8-k)

April 19 2022 - 8:32AM

Edgar (US Regulatory)

0001733257false00017332572022-04-142022-04-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 14, 2022 |

Finch Therapeutics Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40227 |

82-3433558 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

200 Inner Belt Road |

|

Somerville, Massachusetts |

|

02143 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 229-6499 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock $0.001 par value per share |

|

FNCH |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On April 19, 2022, Finch Therapeutics Group, Inc. (the “Company”) announced its implementation of certain expense reduction measures, approved by its board of directors on April 14, 2022, including a reduction of the Company’s workforce by 37 full-time employees, or approximately 20% of the Company (the “Restructuring”). The Restructuring follows the Company’s recent decision to pause its chronic hepatitis B program, and its prior announcement of a clinical hold by the FDA on its investigational new drug application for CP101 and associated delays to the Company’s recurrent Clostridioides difficile infection (CDI) and autism spectrum disorder (ASD) programs. The Company recently submitted a complete response to the FDA in connection with the clinical hold, which is related to the Company's SARS-CoV-2 donor screening protocols and informed consent language, and is currently awaiting feedback. The Company believes the Restructuring will allow it to focus its financial resources on its CDI and ASD programs.

As a result of the Restructuring, the Company estimates that it will incur approximately $1.1 million in costs consisting of one-time severance payments, healthcare coverage, outplacement services and related expenses. The Company expects to record a significant portion of these charges in the second quarter of 2022. The Restructuring is expected to be substantially completed by the end of the second quarter of 2022. The estimates of costs that the Company expects to incur and the timing thereof are subject to a number of assumptions and actual results may differ. The Company may also incur other charges or cash expenditures not currently contemplated in connection with the Restructuring.

Item 8.01 Other Events.

On April 19, 2022, the Company issued a press release related to the Restructuring. A copy of the press release is filed herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Cautionary Note Regarding Forward Looking Statements

This Current Report on Form 8-K (this “Current Report”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements in this Current Report other than statements of historical fact could be deemed forward looking including, but not limited to, statements regarding the timing and estimated cash expenditures associated with the Company’s reduction in force; the likelihood that the clinical hold will be lifted and timing of any such resolution; the Company's communication plans with the FDA related to the clinical hold and the timing for receiving written correspondence from the FDA; and the Company’s ability to realign its financial resources on the development of its CDI and ASD programs. Words such as “plans,” “expects,” “will,” “shall,” “anticipates,” “continue,” “expand,” “advance,” “believes,” “guidance,” “target,” “may,” “remain,” “project,” “outlook,” “intend,” “estimate,” “could,” “should,” and other words and terms of similar meaning and expression are intended to identify forward-looking statements, although not all forward-looking statements contain such terms. The forward-looking statements in this Current Report speak only as of the date of this Current Report and the Company undertakes no obligation to update these forward-looking statements. Forward-looking statements are based on management’s current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the Company’s ability to successfully implement the Restructuring; the impact of the Restructuring on the Company’s business, including estimated costs related thereto; the risk that the Company may not be able to address the FDA's concerns regarding SARS-CoV-2 testing protocols quickly or at all; and the Company’s ability to advance its programs in CDI and ASD and its dependence on the success of its lead product candidate, CP101, including its ability to resolve the FDA clinical hold on the Company’s investigational new drug application for CP101. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company’s actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2022, as updated by the Company’s subsequent filings with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

FINCH THERAPEUTICS GROUP, INC. |

|

|

|

|

Date: |

April 19, 2022 |

By: |

/s/ Mark Smith |

|

|

|

Mark Smith, Ph. D.

Chief Executive Officer |

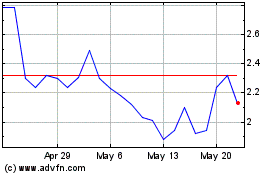

Finch Therapeutics (NASDAQ:FNCH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Finch Therapeutics (NASDAQ:FNCH)

Historical Stock Chart

From Jul 2023 to Jul 2024