Current Report Filing (8-k)

May 03 2021 - 6:14AM

Edgar (US Regulatory)

FALSE000133349312/3100013334932021-04-302021-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): April 30, 2021

EHEALTH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-33071

|

56-2357876

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

2625 AUGUSTINE DRIVE, SECOND FLOOR

SANTA CLARA, CA 95054

(Address of principal executive offices) (Zip Code)

(650) 584-2700

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

EHTH

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

As previously disclosed, on February 17, 2021, eHealth, Inc. (the “Company”) entered into an Investment Agreement (the “Investment Agreement”) with Echelon Health SPV, LP (the “Investor”), an investment vehicle of H.I.G. Capital. On April 30, 2021 (the “Closing Date”), upon the terms and subject to the conditions set forth in the Investment Agreement, the Company issued and sold to the Investor in a private placement, 2,250,000 shares of the Company’s newly designated Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), at an aggregate purchase price of $225,000,000 (the “Private Placement”).

|

|

|

|

|

|

|

|

|

|

|

Item 3.02

|

|

Unregistered Sales of Equity Securities.

|

The information set forth under the Introductory Note of this Current Report on Form 8-K relating to the issuance and sale of Series A Preferred Stock to the Investor is incorporated herein by reference. A summary of the Investment Agreement and the rights, preferences and privileges of the Series A Preferred Stock was previously disclosed under “Item 1.01 Entry into a Material Definitive Agreement” and a summary of the exemption from registration claimed was previously disclosed under “Item 3.02 Unregistered Sales of Equity Securities” each in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 18, 2021, which are hereby incorporated by reference.

|

|

|

|

|

|

|

|

|

|

|

Item 3.03

|

|

Material Modification to Rights of Security Holders.

|

The information set forth under the Introductory Note, Item 5.03 and Item 8.01 of this Current Report on Form 8-K relating to the issuance and sale of Series A Preferred Stock to the Investor, the filing of the Certificate of Designations (as defined below) and the Waiver Letter (as defined below) in connection with the transaction contemplated by the Investment Agreement is incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

Item 5.03

|

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On the Closing Date, the Company filed the Certificate of Designations with the Secretary of State of the State of Delaware, pursuant to which the Company designated 2,250,000 shares of its authorized and unissued preferred stock as Series A Preferred Stock. A summary of the rights, preferences and privileges of the Series A Preferred Stock was previously disclosed under “Item 1.01 Entry into a Material Definitive Agreement,” in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 18, 2021, which is hereby incorporated by reference.

The foregoing description of the Certificate of Designations contained in or incorporated by reference into this Item 5.03 does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Designations, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

On the Closing Date, the Investor delivered a letter to the Company acknowledging and waiving certain of its rights under the Investment Agreement (the “Waiver Letter”). The Company and its independent auditors, Ernst & Young LLP (“EY”), previously respectively determined that without certain waivers set forth in the Waiver Letter, upon the closing of the Private Placement, the Investor would be considered a “beneficial owner” that “has significant influence” over the Company under Rule 2-01(c)(3) of Regulation S-X (the “Rule”) and, that the direct business relationships that exist between EY and its associated entities, on the one hand, and another entity (the “Entity”) on the other hand would be inconsistent with the Rule and result in EY not being independent of the Company.

Under the Waiver Letter, until such time as (i) EY no longer has a direct or material indirect business relationship with the Entity; (ii) the Investor and its affiliates no longer directly or indirectly own a majority of the outstanding voting interests of, or control the board of directors or similar organizing body of the Entity; (iii) the Company concludes or is informed by EY that the Private Placement, including the rights of the Investor under the Investment Agreement, do not result in EY failing to be considered independent or otherwise disqualify EY from continuing to serve as the Company’s independent registered public accounting firm; or (iv) EY is no longer the Company’s independent auditor, the Investor waives its rights pursuant to the

Investment Agreement (x) to nominate one individual for election to the Company’s board of directors (the “Board”) and certain related rights, including its right to nominate one additional director to the Board if the Company fails to maintain certain levels of commissions receivable and liquidity; (y) to approve the Company’s annual budget or any material deviation therefrom as set forth in the Investment Agreement; and (z) to approve the hiring or firing of the Chief Executive Officer, Chief Financial Officer, Chief Digital Officer or Chief Revenue Officer of the Company as set forth in the Investment Agreement, in the case of each of (y) and (z), at any time during which such approval rights would otherwise be exercisable by the Investor under the Investment Agreement.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which involve risks and uncertainties, including, without limitation, terms, rights and restrictions that will or may exist, pursuant to the Waiver Letter or in furtherance of the transactions contemplated by the Investment Agreement. Forward-looking statements include all statements that are not historical facts and generally can be identified by words such as “could,” “believe,” “expect,” “intend,” “will,” or similar expressions constitute forward-looking statements. Differences in the Company’s actual results from those described in these forward-looking statements may result from actions taken by the Company as well as from risks and uncertainties beyond the Company’s control. Factors that may contribute to such differences include, but are not limited to, market and other general economic conditions and whether the Company or the Investor will amend the terms of the Investment Agreement or the Certificate of Designations. The foregoing list of risks and uncertainties is illustrative, but is not exhaustive. For information about other potential factors that could affect the Company’s business and financial results, please review the “Risk Factors” described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the Securities and Exchange Commission, and in the Company’s other filings with the Securities and Exchange Commission. Except as may be required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.

|

|

|

|

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

3.1

|

|

|

104

|

Cover Page Interactive Data File (formatted as inline XBRL)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

eHealth, Inc.

|

|

Date:

|

April 30, 2021

|

/s/ Derek N. Yung

|

|

|

|

Derek N. Yung

Chief Financial Officer

(Principal Financial Officer)

|

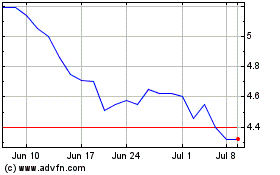

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

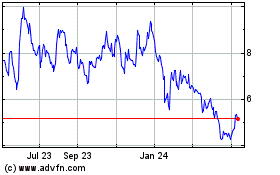

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Apr 2023 to Apr 2024