0001847986

false

0001847986

2023-08-21

2023-08-21

0001847986

DFLI:CommonStockParValue0.0001Member

2023-08-21

2023-08-21

0001847986

DFLI:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2023-08-21

2023-08-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 21, 2023

DRAGONFLY

ENERGY HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40730 |

|

85-1873463 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 1190

Trademark Drive, #108 |

|

|

| Reno,

Nevada |

|

89521 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

622-3448

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 |

|

DFLI |

|

The

Nasdaq Global Market |

Redeemable

warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

DFLIW |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

August 21, 2023, Dragonfly Energy Holdings Corp. (the “Company”) issued an earnings disclosing certain information

regarding its results of operations for the second quarter ended June 30, 2023. Following the publication of the press release, the Company

will host an earnings call at 5:00 p.m. (Eastern Time) on August 21, 2023, via a webcast. During the webcast, the Company’s

financial results for the second quarter ended June 30, 2023 will be discussed. A copy of the press release is attached as Exhibit 99.1

to this Current Report on Form 8-K.

Item

7.01. Regulation FD Disclosure.

See

“Item 2.02 Results of Operation and Financial Condition” above.

The

information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained in Exhibit 99.1, is being

furnished to the Securities and Exchange Commission (the “SEC”), and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by a specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

DRAGONFLY

ENERGY HOLDINGS CORP. |

| |

|

|

| |

By: |

/s/

Denis Phares |

| |

Name: |

Denis

Phares |

| |

Title: |

Chief

Executive Officer |

Date:

August 21, 2023

Exhibit

99.1

Dragonfly

Energy Reports Second Quarter 2023 Financial Results

U.S.

lithium battery cell pilot program complete; full cell production expected by year end

RENO,

NEVADA (August 21, 2023) — Dragonfly Energy Holdings Corp. (“Dragonfly Energy” or the “Company”) (Nasdaq:

DFLI), an industry leader in energy storage and producer of deep cycle lithium-ion storage batteries, today reported its financial and

operational results for the second quarter ended June 30, 2023.

Second

Quarter 2023 Financial Highlights

| ● | Net

Sales were $19.3 million, compared to $21.6 million in Q2 2022 |

| ● | Gross

Profit was $4.1 million, compared to $7.0 million in Q2 2022 |

| ● | Operating

expenses were $(12.5) million, compared to $(7.6) million in Q2 2022 |

| ● | Net

Loss of $(11.7) million, compared to a Net Loss of $(1.5) million in Q2 2022 |

| ● | Diluted

Loss per share was $(0.25) compared to $(0.04) in Q2 2022 |

| ● | EBITDA

of $(7.3) million, compared to $(0.3) million in Q2 2022 |

Operational

and Business Highlights

| ● | Announced

completion of U.S. lithium battery cell pilot line and beginning of anode manufacturing at

scale, using patented deposition process |

| ● | Announced

U.S. Patent for innovative battery pack assembly design, enabling flexible custom installation

solutions and increased energy density |

| ● | Announced

partnership with nuCamp, the world’s largest teardrop trailer and small camper manufacturers,

to provide full lithium power systems as standard equipment on 2024 model year products |

| ● | Dragonfly

Energy joined the Russell 2000® Index |

“We

have achieved a number of important milestones since our last call, with our patent pertaining to preparation and powder film deposition

of pre-coated powders and completion of our lithium battery cell pilot program,” said Denis Phares, CEO of Dragonfly Energy. “While

the business continues to experience some near-term market headwinds, Dragonfly Energy is executing our plan; growing our market share

in our core markets, addressing new growth opportunities, and making significant progress on our cell manufacturing goals. We are excited

for what lies ahead and sharing that with you in the coming quarters.”

Second

Quarter 2023 Financial and Operating Results

Dragonfly

generated net sales of $19.3 million in the second quarter, in line with the Company’s $18.0 to $22.0 million revenue guidance.

Our revenue declined by $2.3 million from $21.6 million in the second quarter of 2022 as growth from our OEM customers was offset by

declines in our direct-to-consumer (“DTC”) business.

Gross

profit in the quarter was $4.1 million, compared to $7.0 million in the second quarter of 2022. The decrease in gross profit was primarily

due to the change in revenue mix that included a larger percentage of lower margin OEM sales and a lower percentage of higher margin

DTC sales, as well as an increase in material costs.

Second

quarter 2023 operating expenses of $(12.5) million, were higher compared to $(7.6) million in the second quarter of 2022. Higher professional

services, compliance, and insurance, as well as higher personnel, severance, stock-based compensation and materials costs drove the increase.

The

Company had a net loss of $(11.7) million, or $(0.25) per diluted share in the second quarter of 2023, compared to a net loss of $(1.5)

million or $(0.04) per diluted share in the second quarter of 2022. Net income in the second quarter of 2023 was primarily impacted by

lower DTC segment sales, increased cost of goods sold, higher operating expenses, and increased other expenses.

Second

quarter 2023 EBITDA was $(7.3) million, compared to EBITDA of $(0.3) million in the second quarter of 2022. Second quarter 2023 Adjusted

EBITDA, excluding stock-based compensation, costs associated with our offering in June, and the impact of a separation agreement and

changes in fair market value of the Company’s warrants was $(5.5) million in the quarter, compared to $0.2 million in the same

quarter a year ago.

The

Company ended the second quarter of 2023 with $33.0 million in cash. Dragonfly Energy retains strong financial flexibility with access

to a $150 million equity line of credit.

Q3

2023 Outlook

The

Company continues to face headwinds in its core markets, which are dominated by consumer discretionary spending. The RV industry, in

particular, is undergoing more severe unit declines than previously expected, with deliveries expected to fall to volumes not seen in

a decade. As a result of this industry weakness, we were informed in July 2023 that our largest RV customer has instituted a de-contenting

strategy that ultimately changed our storage offering from a standard installation to a dealer option. While this customer is not

moving to a different solution or competitor, we do expect this change in strategy to have a material limiting effect on our revenue

throughout the remainder of 2023. In light of this change, we have removed all previously forecasted revenue from this customer for

the remainder of the year.

| ● | Net

Sales are expected to range between $16.0 - $20.0 million, impacted by overall softer demand

from the RV market |

| ● | Gross

Margin is expected to improve modestly on a sequential basis |

| ● | Operating

Expenses are expected to be in a range of $(10.0) - $(13.0) million |

| ● | Other

Income (Expense) is expected be an expense in the range of $(4.0) - $(4.5) million |

| ● | Net

Losses are expected to be between $(10.0) - $(13.0) million for the quarter, or $(0.21) -

$(0.27) per share based on 48.0 million shares outstanding |

Webcast

Information

The

Dragonfly Energy management team will host a conference call to discuss its first quarter 2023 financial results this afternoon, Monday,

August 21, 2023, at 5:00 pm ET. The call can also be accessed live via telephone by dialing (888) 259-6580 or for international callers

(416) 764-8624, and referencing Dragonfly Energy. Please log in to the webcast or dial in to the call at least 10 minutes prior to the

start of the event. The live webcast of the conference will also be available at https://investors.dragonflyenergy.com/events-and-presentations/default.aspx

on the Events and Presentations page on the Investor Relations section of Dragonfly’s website.

About

Dragonfly

Dragonfly

Energy Holdings Corp. (Nasdaq: DFLI) headquartered in Reno, Nevada, is a leading supplier of deep cycle lithium-ion batteries. Dragonfly

Energy’s research and development initiatives are revolutionizing the energy storage industry through innovative technologies and

manufacturing processes. Today, Dragonfly Energy’s non-toxic deep cycle lithium-ion batteries are displacing lead-acid batteries

across a wide range of end-markets, including RVs, marine vessels, off-grid installations, and other storage applications. Dragonfly

Energy is also focused on delivering an energy storage solution to enable a more sustainable and reliable smart grid through the future

deployment of the Company’s proprietary and patented solid-state cell technology. To learn more, visit www.dragonflyenergy.com/investors.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding the Company’s

intent, belief or expectations, including, but not limited to, statements regarding the Company’s guidance for 2023 results of

operations and financial position, planned products and services, business strategy and plans, market size and growth opportunities,

competitive position and technological and market trends. Some of these forward-looking statements can be identified by the use of forward-looking

words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,”

“could,” “would,” “continue,” “forecast” or the negatives of these terms or variations

of them or similar expressions.

These

forward-looking statements are subject to risks, uncertainties, and other factors (some of which are beyond the Company’s control)

which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that

may impact such forward-looking statements include, but are not limited to: headwinds in the Company’s core markets, including

the RV market, the Company’s ability to successfully increase market penetration into target markets; the growth of the addressable

markets that the Company intends to target; the Company’s ability to retain members of its senior management team and other key

personnel; the Company’s ability to maintain relationships with key suppliers including suppliers in China; the Company’s

ability to maintain relationships with key customers; the Company’s ability to access capital as and when needed under its $150

million ChEF Equity Facility; the Company’s ability to protect its patents and other intellectual property; the Company’s

ability to successfully optimize solid state cells and to produce commercially viable solid state cells in a timely manner or at all,

and to scale to mass production; the Company’s ability to achieve the anticipated benefits of its customer arrangements with THOR

Industries and THOR Industries’ affiliated brands (including Keystone RV Company); the impact of the coronavirus disease pandemic,

including any mutations or variants thereof and/or the Russian/Ukrainian conflict; the Company’s ability to generate revenue from

future product sales and its ability to achieve and maintain profitability; and the Company’s ability to compete with other manufacturers

in the industry and its ability to engage target customers and successfully convert these customers into meaningful orders in the future.

These and other risks and uncertainties are described more fully in the sections entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022

and in the Company’s subsequent filings with the SEC available at www.sec.gov.

If

any of these risks materialize or any of the Company’s assumptions prove incorrect, actual results could differ materially from

the results implied by these forward-looking statements. There may be additional risks that the Company presently does not know or that

it currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

All forward-looking statements contained in this press release speak only as of the date they were made. Except to the extent required

by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after

the date on which they were made.

Investor

Relations:

Sioban

Hickie, ICR, Inc.

DragonflyIR@icrinc.com

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Interim Consolidated Statements of Operations

(U.S.

Dollars in Thousands, except share and per share data)

| | |

Three Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| | |

| | |

| |

| Net Sales | |

$ | 19,274 | | |

$ | 21,622 | |

| | |

| | | |

| | |

| Cost of Goods Sold | |

| 15,176 | | |

| 14,594 | |

| | |

| | | |

| | |

| Gross Profit | |

| 4,098 | | |

| 7,028 | |

| | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | |

| Research and development | |

| 1,067 | | |

| 859 | |

| General and administrative | |

| 7,614 | | |

| 3,816 | |

| Selling and marketing | |

| 3,808 | | |

| 2,881 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 12,489 | | |

| 7,556 | |

| | |

| | | |

| | |

| Loss From Operations | |

| (8,391 | ) | |

| (528 | ) |

| | |

| | | |

| | |

| Other (Expense) Income | |

| | | |

| | |

| Interest expense | |

| (4,113 | ) | |

| (1,228 | ) |

| Change in fair market value of warrant liability | |

| 804 | | |

| - | |

| Total Other (Expense) Income | |

| (3,309 | ) | |

| (1,228 | ) |

| | |

| | | |

| | |

| Loss Before Taxes | |

| (11,700 | ) | |

| (1,756 | ) |

| | |

| | | |

| | |

| Income Tax (Benefit) Expense | |

| - | | |

| (287 | ) |

| | |

| | | |

| | |

| Net Loss | |

$ | (11,700 | ) | |

$ | (1,469 | ) |

| | |

| | | |

| | |

| Loss Per Share- Basic | |

$ | (0.25 | ) | |

$ | (0.04 | ) |

| Loss Per Share- Diluted | |

$ | (0.25 | ) | |

$ | (0.04 | ) |

| Weighted Average Number of Shares- Basic | |

| 47,418,269 | | |

| 36,616,430 | |

| Weighted Average Number of Shares- Diluted | |

| 47,418,269 | | |

| 36,616,430 | |

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Interim Consolidated Statements of Operations

(U.S.

Dollars in Thousands, except share and per share data)

| | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| | |

| | |

| |

| Net Sales | |

$ | 38,065 | | |

$ | 39,925 | |

| | |

| | | |

| | |

| Cost of Goods Sold | |

| 29,224 | | |

| 27,402 | |

| | |

| | | |

| | |

| Gross Profit | |

| 8,841 | | |

| 12,523 | |

| | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | |

| Research and development | |

| 1,947 | | |

| 1,198 | |

| General and administrative | |

| 17,109 | | |

| 7,442 | |

| Selling and marketing | |

| 7,992 | | |

| 5,973 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 27,048 | | |

| 14,613 | |

| | |

| | | |

| | |

| Loss From Operations | |

| (18,207 | ) | |

| (2,090 | ) |

| | |

| | | |

| | |

| Other (Expense) Income | |

| | | |

| | |

| Interest expense | |

| (7,928 | ) | |

| (2,491 | ) |

| Change in fair market value of warrant liability | |

| 19,327 | | |

| - | |

| Total Other (Expense) Income | |

| 11,399 | | |

| (2,491 | ) |

| | |

| | | |

| | |

| Loss Before Taxes | |

| (6,808 | ) | |

| (4,581 | ) |

| | |

| | | |

| | |

| Income Tax (Benefit) Expense | |

| - | | |

| (814 | ) |

| | |

| | | |

| | |

| Net Loss | |

$ | (6,808 | ) | |

$ | (3,767 | ) |

| | |

| | | |

| | |

| Loss Per Share- Basic | |

$ | (0.15 | ) | |

$ | (0.10 | ) |

| Loss Per Share- Diluted | |

$ | (0.15 | ) | |

$ | (0.10 | ) |

| Weighted Average Number of Shares- Basic | |

| 46,263,591 | | |

| 36,579,990 | |

| Weighted Average Number of Shares- Diluted | |

| 46,263,591 | | |

| 36,579,990 | |

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Consolidated Balance Sheets

(U.S.

Dollars in Thousands, except share and per share data)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 32,952 | | |

$ | 17,781 | |

| Accounts receivable, net of allowance for credit losses | |

| 2,172 | | |

| 1,444 | |

| Inventory | |

| 44,198 | | |

| 49,846 | |

| Prepaid expenses | |

| 1,199 | | |

| 1,624 | |

| Prepaid inventory | |

| 2,942 | | |

| 2,002 | |

| Prepaid income tax | |

| 529 | | |

| 525 | |

| Other current assets | |

| 239 | | |

| 267 | |

| Total Current Assets | |

| 84,231 | | |

| 73,489 | |

| Property and Equipment | |

| | | |

| | |

| Machinery and equipment | |

| 15,932 | | |

| 10,214 | |

| Office furniture and equipment | |

| 275 | | |

| 275 | |

| Leasehold improvements | |

| 1,727 | | |

| 1,709 | |

| Vehicle | |

| 33 | | |

| 195 | |

| Total | |

| 17,967 | | |

| 12,393 | |

| Less accumulated depreciation and amortization | |

| (2,180 | ) | |

| (1,633 | ) |

| Property and Equipment, Net | |

| 15,787 | | |

| 10,760 | |

| Operating lease right of use asset | |

| 3,912 | | |

| 4,513 | |

| Total Assets | |

$ | 103,930 | | |

$ | 88,762 | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 19,990 | | |

$ | 13,475 | |

| Accrued payroll and other liabilities | |

| 9,758 | | |

| 6,295 | |

| Customer deposits | |

| 152 | | |

| 238 | |

| Uncertain tax position liability | |

| 128 | | |

| 128 | |

| Notes payable, current portion, net of deferred financing fees | |

| 22,372 | | |

| 19,242 | |

| Operating lease liability, current portion | |

| 1,239 | | |

| 1,188 | |

| Total Current Liabilities | |

| 53,639 | | |

| 40,566 | |

| Long-Term Liabilities | |

| | | |

| | |

| Warrant liabilities | |

| 14,637 | | |

| 32,831 | |

| Accrued expenses, long-term | |

| 551 | | |

| 492 | |

| Operating lease liability, net of current portion | |

| 2,890 | | |

| 3,541 | |

| Total Long-Term Liabilities | |

| 18,078 | | |

| 36,864 | |

| Total Liabilities | |

| 71,717 | | |

| 77,430 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Common stock, 170,000,000 shares at $0.0001 par value, authorized, 58,504,541 and 43,272,728 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 6 | | |

| 4 | |

| Preferred stock, 5,000,000 shares at $0.0001 par value, authorized, no shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Additional paid in capital | |

| 66,148 | | |

| 38,461 | |

| Retained deficit | |

| (33,941 | ) | |

| (27,133 | ) |

| Total Equity | |

| 32,213 | | |

| 11,332 | |

| Total Liabilities and Shareholders’ Equity | |

$ | 103,930 | | |

$ | 88,762 | |

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Consolidated Statement of Cash Flows

(U.S.

Dollars in Thousands)

| | |

Six

Months Ended | |

| | |

June

30, 2023 | | |

June

30, 2022 | |

| Cash

flows from Operating Activities | |

| | | |

| | |

| Net

Loss | |

$ | (6,808 | ) | |

$ | (3,767 | ) |

| Adjustments

to Reconcile Net Loss to Net Cash | |

| | | |

| | |

| Used

in Operating Activities | |

| | | |

| | |

| Stock

based compensation | |

| 5,441 | | |

| 719 | |

| Amortization

of debt discount | |

| 620 | | |

| 1,196 | |

| Change

in fair market value of warrant liability | |

| (19,327 | ) | |

| - | |

| Deferred

tax liability | |

| - | | |

| (819 | ) |

| Non-cash

interest expense (paid-in-kind) | |

| 2,510 | | |

| - | |

| Provision

for doubtful accounts | |

| 93 | | |

| - | |

| Depreciation

and amortization | |

| 593 | | |

| 389 | |

| Loss

on disposal of property and equipment | |

| 116 | | |

| 62 | |

| Changes

in Assets and Liabilities | |

| | | |

| | |

| Accounts

receivable | |

| (821 | ) | |

| (3,876 | ) |

| Inventories | |

| 5,648 | | |

| (15,141 | ) |

| Prepaid

expenses | |

| 425 | | |

| (1,236 | ) |

| Prepaid

inventory | |

| (940 | ) | |

| 4,308 | |

| Other

current assets | |

| 28 | | |

| (1,962 | ) |

| Other

assets | |

| 601 | | |

| 551 | |

| Income

taxes payable | |

| (4 | ) | |

| (973 | ) |

| Accounts

payable and accrued expenses | |

| 6,272 | | |

| 820 | |

| Customer

deposits | |

| (86 | ) | |

| (183 | ) |

| Total

Adjustments | |

| 1,169 | | |

| (16,145 | ) |

| Net

Cash Used in Operating Activities | |

| (5,639 | ) | |

| (19,912 | ) |

| | |

| | | |

| | |

| Cash

Flows From Investing Activities | |

| | | |

| | |

| Purchase

of property and equipment | |

| (2,571 | ) | |

| (4,819 | ) |

| Net

Cash Used in Investing Activities | |

| (2,571 | ) | |

| (4,819 | ) |

| | |

| | | |

| | |

| Cash

Flows From Financing Activities | |

| | | |

| | |

| Proceeds

from public offering, net | |

| 22,002 | | |

| - | |

| Payment

of offering costs | |

| (362 | ) | |

| - | |

| Proceeds

from public offering (ATM), net | |

| 671 | | |

| - | |

| Proceeds

from note payable, related party | |

| 1,000 | | |

| - | |

| Repayment

of note payable, related party | |

| (1,000 | ) | |

| - | |

| Proceeds

from exercise of public warrants | |

| 747 | | |

| - | |

| Proceeds

from exercise of options | |

| 323 | | |

| 200 | |

| Net

Cash Provided by Financing Activities | |

| 23,381 | | |

| 200 | |

| | |

| | | |

| | |

| Net

Increase (Decrease) in Cash | |

| 15,171 | | |

| (24,531 | ) |

| Beginning

cash | |

| 17,781 | | |

| 28,630 | |

| Ending

cash | |

$ | 32,952 | | |

$ | 4,099 | |

Use

of Non-GAAP Financial Measures

The

Company provides non-GAAP financial measures including EBITDA and Adjusted EBITDA as a supplement to GAAP financial information to enhance

the overall understanding of the Company’s financial performance and to assist investors in evaluating the Company’s results

of operations, period over period. Adjusted non-GAAP measures exclude significant unusual items. Investors should consider these non-GAAP

measures as a supplement to, and not a substitute for financial information prepared on a GAAP basis.

Adjusted

EBITDA

Adjusted

EBITDA is considered a non-GAAP financial measure under the rules of the SEC because it excludes certain amounts included in net loss

calculated in accordance with GAAP. Specifically, the Company calculates Adjusted EBITDA by GAAP net loss adjusted to exclude stock-based

compensation expense, business combination related expenses and other one-time, non-recurring items.

The

Company has included Adjusted EBITDA because it is a key measure used by Dragonfly’s management team to evaluate its operating

performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses. As such,

the Company believes Adjusted EBITDA is helpful in highlighting trends in the ongoing core operating results of the business.

Adjusted

EBITDA has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of net loss

or other results as reported under GAAP. Some of these limitations are:

| |

● |

Adjusted

EBITDA does not reflect the Company’s cash expenditures, future requirements for capital expenditures, or contractual commitments; |

| |

|

|

| |

● |

Adjusted

EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs; |

| |

|

|

| |

● |

Adjusted

EBITDA does not reflect the Company’s tax expense or the cash requirements to pay taxes; |

| |

|

|

| |

● |

although

amortization and depreciation are non-cash charges, the assets being amortized and depreciated will often have to be replaced in

the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| |

|

|

| |

● |

Adjusted

EBITDA should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring

items for which the Company may adjust in historical periods; and |

| |

|

|

| |

● |

other

companies in the industry may calculate Adjusted EBITDA differently than the Company does, limiting its usefulness as a comparative

measure.

|

Reconciliations

of Non-GAAP Financial Measures

EBITDA

and Adjusted EBITDA

The

following table presents reconciliations of EBITDA and Adjusted EBITDA to the most directly comparable GAAP financial measure for each

of the periods indicated.

Dragonfly

Energy Holdings Corp.

Reconciliation

of GAAP to Non-GAAP Measures (Unaudited)

(in

thousands, except share and per share data)

| | |

Three Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Net Income | |

$ | (11,700 | ) | |

$ | (1,469 | ) |

| Interest Expense | |

| 4,113 | | |

| 1,228 | |

| Taxes | |

| - | | |

| (287 | ) |

| Depreciation and Amortization | |

| 296 | | |

| 272 | |

| EBITDA | |

$ | (7,291 | ) | |

$ | (256 | ) |

| | |

| | | |

| | |

| Adjustments | |

| | | |

| | |

| Stock-Based Compensation(1) | |

| 954 | | |

| 431 | |

| Separation Agreement(2) | |

| 720 | | |

| - | |

| June Offering Costs(3) | |

| 904 | | |

| - | |

| Promissory Note Forgiveness(4) | |

| - | | |

| - | |

| Change in Fair Market Value of Warrant Liability(5) | |

| (804 | ) | |

| - | |

| Adjusted EBITDA | |

$ | (5,517 | ) | |

$ | 175 | |

Source:

Dragonfly Energy Holdings Corp.

Dragonfly

Energy Holdings Corp.

Reconciliation

of GAAP to Non-GAAP Measures (Unaudited)

(in

thousands, except share and per share data)

| | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Net Income | |

$ | (6,808 | ) | |

$ | (3,767 | ) |

| Interest Expense | |

| 7,928 | | |

| 2,491 | |

| Taxes | |

| - | | |

| (814 | ) |

| Depreciation and Amortization | |

| 593 | | |

| 389 | |

| EBITDA | |

$ | 1,713 | | |

$ | (1,701 | ) |

| | |

| | | |

| | |

| Adjustments | |

| | | |

| | |

| Stock-Based Compensation(1) | |

| 5,441 | | |

| 719 | |

| Separation Agreement(2) | |

| 720 | | |

| - | |

| June Offering Costs(3) | |

| 904 | | |

| - | |

| Promissory Note Forgiveness(4) | |

| - | | |

| 469 | |

| Change in Fair Market Value of Warrant Liability(5) | |

| (19,327 | ) | |

| - | |

| Adjusted EBITDA | |

$ | (10,549 | ) | |

$ | (513 | ) |

| |

(1) |

Stock-Based

Compensation is comprised of costs associated with option and RSU grants made to our employees, consultants and board members. |

| |

(2)

|

Separation

Agreement is comprised of $720 in cash severance associated with the separation agreement dated April 26, 2023 between us and our

former Chief Legal Officer. |

| |

(3) |

June

Offering Costs is comprised of fees and expenses, including legal, accounting, and other expenses associated with our secondary offering. |

| |

(4) |

Promissory

Note Forgiveness is comprised of the loan that was forgiven, prior to the Business Combination, in connection with the promissory

note, with a maturity date of March 1, 2026, between us and John Marchetti, our former Chief Financial Officer. |

| |

(5) |

Change

in fair market value of warrant liability represents the change in fair value January 1, 2023 through June 30, 2023. |

v3.23.2

Cover

|

Aug. 21, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 21, 2023

|

| Entity File Number |

001-40730

|

| Entity Registrant Name |

DRAGONFLY

ENERGY HOLDINGS CORP.

|

| Entity Central Index Key |

0001847986

|

| Entity Tax Identification Number |

85-1873463

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1190

Trademark Drive

|

| Entity Address, Address Line Two |

#108

|

| Entity Address, City or Town |

Reno

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89521

|

| City Area Code |

(775)

|

| Local Phone Number |

622-3448

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 |

|

| Title of 12(b) Security |

Common

stock, par value $0.0001

|

| Trading Symbol |

DFLI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

| Title of 12(b) Security |

Redeemable

warrants, exercisable for common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

DFLIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DFLI_CommonStockParValue0.0001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DFLI_RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

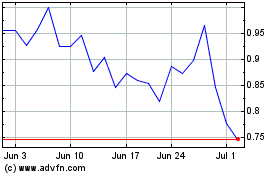

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Apr 2024 to May 2024

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From May 2023 to May 2024