Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 03 2023 - 4:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the Month of: November 2023

Commission

File Number: 001-40688

DRAGANFLY

INC.

(Translation

of registrant’s name into English)

2108

St. George Avenue

Saskatoon,

Saskatchewan S7M 0K7

Canada

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

DRAGANFLY

INC. |

| |

|

|

| Date:

November 3, 2023 |

By:

|

/s/

Paul Sun |

| |

Name: |

Paul

Sun |

| |

Title: |

Chief

Financial Officer |

Form

6-K Exhibit Index

Exhibit 99.1

FORM

51-102F3

MATERIAL CHANGE REPORT

| Item

1 | Name

and Address of Company |

Draganfly

Inc. (“Draganfly” or the “Company”)

2108

St. George Avenue

Saskatoon,

Saskatchewan S7M 0K7

| Item

2 | Date

of Material Change |

October

26, 2023 and October 30, 2023

On

October 26, 2023 and October 30, 2023 news releases were disseminated through public media and filed on SEDAR+ with applicable securities

commissions.

| Item

4 | Summary

of Material Change |

On

October 30, 2023, the Company announced:

| |

(a) |

it

has completed its previously announced underwritten public offering in the United States of 4,800,000 units of the Company at a price

of US$0.55 per unit and 1,600,000 pre-funded units of the Company at a price of US$0.5499 per pre-funded unit; and |

| |

|

|

| |

(b) |

in

connection with the above-noted offering of units, the Company filed a prospectus supplement to the Company’s short form base

shelf prospectus dated June 30, 2023 in each of the provinces of British Columbia, Ontario and Saskatchewan (the “Prospectus

Supplement”). |

| Item

5 | Full

Description of Material Change |

| 5.1 | Full

Description of Material Change |

On

October 30, 2023, the Company announced it has completed its previously announced underwritten public offering with gross proceeds

to the Company of US$3,520,000, before deducting underwriting discounts and other estimated expenses payable by the Company.

The

offering (the “Offering”) consisted of 4,800,000 units (the “Units”) of the Company at a purchase

price of US$0.55 per Unit and 1,600,000 pre-funded units of the Company (the “Pre-Funded Units”) at a purchase

price of US$0.5499 per Pre-Funded Unit, pursuant to an underwriting agreement dated October 26, 2023 (the “Underwriting

Agreement”) between the Company and Maxim Group LLC (the “Underwriter”). Each Unit consisted of: (i)

one common share in the capital of the Company (each a “Common Share”); and (ii) one common share purchase warrant

in the capital of the Company (each a “Common Warrant”), with each whole Common Warrant entitling the holder

thereof to purchase one Common Share at any time prior to 5:00 p.m. (Toronto time) on October 30, 2028 upon payment of the exercise

price of US$0.6123 per Common Share. Each Pre-Funded Unit consists of: (i) one pre-funded common share purchase warrant (each a

“Pre-Funded Warrant”), with each Pre-Funded Warrant entitling the holder thereof to purchase one Common Share

after October 30, 2023 upon payment of the exercise price of US$0.0001 per Common Share; and (ii) one Common Warrant.

Pursuant to the terms of the Underwriting Agreement, the Company has agreed to issue to the Underwriter (or its duly registered

designated affiliates) 320,000 common share purchase warrants (the “Underwriter’s Warrants”). The

Underwriter’s Warrants will expire on October 30, 2026. Each Underwriter’s Warrant will be exercisable for one Common

Share at a price of US$0.6875.

The

Company intends to use the net proceeds from this offering for general corporate purposes, including to fund its capabilities

to meet demand for its new products including growth initiatives and/or for working capital requirements including the continuing

development and marketing of the Company’s core products, potential acquisitions and research and development.

This

Prospectus Supplement is filed pursuant to (i) accompanying short form base shelf prospectus dated June 30, 2023 to which it relates,

as amended or supplemented filed in the provinces of British Columbia, Saskatchewan and Ontario, and (ii) a short form base shelf prospectus

filed as part of the Company’s registration statement on Form F-10 (File No. 333-271498) (as amended, the “U.S. Registration

Statement”) filed with and declared effective by the U.S. Securities and Exchange Commission (the, “SEC”)

on July 5, 2023, under the United States Securities Act of 1933, as amended. A final prospectus supplement and accompanying prospectus

describing the terms of the proposed offering was filed with the SEC on October 30, 2023, and is available on the SEC’s

website located at http://www.sec.gov.

There

was no offering of the Units or Pre-Funded Units by the Underwriter in Canada.

| 5.2 | Disclosure

for Restructuring Transactions |

Not

applicable.

| Item

6 | Reliance

on subsection 7.1(2) of National Instrument 51-102 |

Not

applicable.

| Item

7 | Omitted

Information |

Not

applicable.

Paul

Sun, Chief Financial Officer & Corporate Secretary

Tel: 1.800.979.9794

November

3, 2023

Forward-Looking

Statements

Certain

statements contained in this material change report may constitute “forward-looking statements” or “forward looking

information” within the meaning of applicable securities laws. Such statements, based as they are on the current expectations of

management, inherently involve numerous important risks, uncertainties and assumptions, known and unknown. In this material change report,

such forward-looking statements include statements regarding the anticipated use of proceeds from the offering. Actual future events

may differ from the anticipated events expressed in such forward-looking statements. Draganfly believes that expectations represented

by forward-looking statements are reasonable, yet there can be no assurance that such expectations will prove to be correct. The reader

should not place undue reliance, if any, on any forward looking statements included in this material change report. These forward-looking

statements speak only as of the date made, and Draganfly is under no obligation and disavows any intention to update publicly or revise

such statements as a result of any new information, future event, circumstances or otherwise, unless required by applicable securities

laws.

Draganfly (NASDAQ:DPRO)

Historical Stock Chart

From Apr 2024 to May 2024

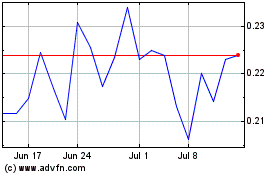

Draganfly (NASDAQ:DPRO)

Historical Stock Chart

From May 2023 to May 2024