UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 001-39750

DOCEBO INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

366 Adelaide St. West

Suite 701

Toronto, Ontario, Canada M5V 1R7

(800) 681-4601

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

INCORPORATION BY REFERENCE

Exhibits 99.1, 99.2, 99.4 and 99.5 of this Form 6-K are incorporated by reference to the registrant's Registration Statement on Form F-10 (File No. 333-251046), the registrant’s Registration Statement on Form S-8 (File No. 333-251417) and the registrant’s Registration Statement on Form F-3 (File No. 333-262000).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| | | | | |

| Exhibit | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 99.4 | |

| 99.5 | |

| 101.INS | Inline XBRL Instance Document. |

| 101.SCH | Inline XBRL Taxonomy Schema Linkbase Document. |

| 101.CAL | Inline XBRL Taxonomy Calculation Linkbase Document. |

| 101.DEF | Inline XBRL Taxonomy Definition Linkbase Document. |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | Inline XBRL Taxonomy Presentation Linkbase Document. |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | Docebo Inc. |

| | | | |

| | | | |

| Date: | | November 9, 2023 | | By: | | /s/ Sukaran Mehta |

| | | | | Name: | Sukaran Mehta |

| | | | | Title: | Chief Financial Officer |

0001829959false9/30/202312/3100018299592023-09-30iso4217:USD00018299592022-12-3100018299592023-07-012023-09-3000018299592022-07-012022-09-3000018299592023-01-012023-09-3000018299592022-01-012022-09-30iso4217:USDxbrli:sharesxbrli:shares0001829959ifrs-full:OrdinarySharesMember2021-12-310001829959ifrs-full:AdditionalPaidinCapitalMember2021-12-310001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2021-12-310001829959ifrs-full:RetainedEarningsMember2021-12-3100018299592021-12-310001829959ifrs-full:OrdinarySharesMember2022-01-012022-09-300001829959ifrs-full:AdditionalPaidinCapitalMember2022-01-012022-09-300001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001829959ifrs-full:RetainedEarningsMember2022-01-012022-09-300001829959ifrs-full:OrdinarySharesMember2022-09-300001829959ifrs-full:AdditionalPaidinCapitalMember2022-09-300001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2022-09-300001829959ifrs-full:RetainedEarningsMember2022-09-3000018299592022-09-300001829959ifrs-full:OrdinarySharesMember2022-12-310001829959ifrs-full:AdditionalPaidinCapitalMember2022-12-310001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2022-12-310001829959ifrs-full:RetainedEarningsMember2022-12-310001829959ifrs-full:OrdinarySharesMember2023-01-012023-09-300001829959ifrs-full:AdditionalPaidinCapitalMember2023-01-012023-09-300001829959ifrs-full:RetainedEarningsMember2023-01-012023-09-300001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001829959ifrs-full:OrdinarySharesMember2023-09-300001829959ifrs-full:AdditionalPaidinCapitalMember2023-09-300001829959ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-09-300001829959ifrs-full:RetainedEarningsMember2023-09-300001829959docebo:DoceboSpAMember2023-01-012023-09-30xbrli:pure0001829959docebo:DoceboSpAMember2022-01-012022-12-310001829959docebo:DoceboNAIncMember2023-01-012023-09-300001829959docebo:DoceboNAIncMember2022-01-012022-12-310001829959docebo:DoceboEMEAFZLLCMember2023-01-012023-09-300001829959docebo:DoceboEMEAFZLLCMember2022-01-012022-12-310001829959docebo:DoceboUKMember2023-01-012023-09-300001829959docebo:DoceboUKMember2022-01-012022-12-310001829959docebo:DoceboFranceMember2023-01-012023-09-300001829959docebo:DoceboFranceMember2022-01-012022-12-310001829959docebo:DoceboGermanyMember2023-01-012023-09-300001829959docebo:DoceboGermanyMember2022-01-012022-12-310001829959docebo:DoceboAustraliaPtyLtdMember2023-01-012023-09-300001829959docebo:DoceboAustraliaPtyLtdMember2022-01-012022-12-310001829959docebo:DoceboIrelandLimitedMember2023-01-012023-09-300001829959docebo:DoceboIrelandLimitedMember2022-01-012022-12-310001829959docebo:CirclesCollectiveIncPeerBoardMember2023-01-012023-09-300001829959docebo:CirclesCollectiveIncPeerBoardMember2022-01-012022-12-310001829959docebo:EdugoAIHKLimitedMember2023-01-012023-09-300001829959docebo:EdugoAIHKLimitedMember2022-01-012022-12-310001829959docebo:CirclesCollectiveIncMember2023-04-030001829959ifrs-full:MajorBusinessCombinationMemberdocebo:CirclesCollectiveIncMember2023-04-03iso4217:CADxbrli:shares0001829959ifrs-full:MajorBusinessCombinationMemberdocebo:CirclesCollectiveIncMember2023-04-032023-04-030001829959docebo:CirclesCollectiveIncMember2023-04-032023-04-030001829959docebo:CirclesCollectiveIncMember2023-07-012023-09-300001829959docebo:CirclesCollectiveIncMember2023-01-012023-09-300001829959docebo:EdugoAIHKLimitedMember2023-06-090001829959ifrs-full:MajorBusinessCombinationMemberdocebo:EdugoAIHKLimitedMember2023-06-092023-06-090001829959docebo:EdugoAIHKLimitedMember2023-06-092023-06-090001829959docebo:EdugoAIHKLimitedMember2023-07-012023-09-300001829959docebo:EdugoAIHKLimitedMember2023-01-012023-09-300001829959ifrs-full:TradeReceivablesMember2023-09-300001829959ifrs-full:TradeReceivablesMember2022-12-310001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001829959ifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-09-300001829959ifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-09-300001829959ifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001829959ifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959ifrs-full:LandAndBuildingsMember2022-12-310001829959ifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001829959ifrs-full:LandAndBuildingsMember2023-09-300001829959ifrs-full:OtherPropertyPlantAndEquipmentMember2023-09-300001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959docebo:FurnituresAndOfficeEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959ifrs-full:LeaseholdImprovementsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959ifrs-full:LandAndBuildingsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959docebo:FurnituresAndOfficeEquipmentMember2022-12-310001829959ifrs-full:LeaseholdImprovementsMember2022-12-310001829959ifrs-full:LandAndBuildingsMember2022-12-310001829959docebo:FurnituresAndOfficeEquipmentMember2023-09-300001829959ifrs-full:LeaseholdImprovementsMember2023-09-300001829959ifrs-full:LandAndBuildingsMember2023-09-300001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2022-12-310001829959ifrs-full:GrossCarryingAmountMemberifrs-full:BrandNamesMember2022-12-310001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2023-01-012023-09-300001829959ifrs-full:GrossCarryingAmountMemberifrs-full:BrandNamesMember2023-01-012023-09-300001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:GrossCarryingAmountMember2023-09-300001829959ifrs-full:GrossCarryingAmountMemberifrs-full:BrandNamesMember2023-09-300001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BrandNamesMember2022-12-310001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-01-012023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BrandNamesMember2023-01-012023-09-300001829959ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-09-300001829959ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BrandNamesMember2023-09-300001829959ifrs-full:CustomerrelatedIntangibleAssetsMember2022-12-310001829959ifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310001829959ifrs-full:BrandNamesMember2022-12-310001829959ifrs-full:CustomerrelatedIntangibleAssetsMember2023-09-300001829959ifrs-full:TechnologybasedIntangibleAssetsMember2023-09-300001829959ifrs-full:BrandNamesMember2023-09-300001829959ifrs-full:GoodwillMember2022-12-310001829959ifrs-full:GoodwillMember2023-01-012023-09-300001829959ifrs-full:GoodwillMember2023-09-3000018299592023-04-2700018299592023-05-152023-05-1500018299592023-05-15docebo:component0001829959us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001829959us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001829959us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001829959us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001829959docebo:DeferredShareUnitsDSUMember2023-07-012023-09-300001829959docebo:DeferredShareUnitsDSUMember2022-07-012022-09-300001829959docebo:DeferredShareUnitsDSUMember2023-01-012023-09-300001829959docebo:DeferredShareUnitsDSUMember2022-01-012022-09-300001829959docebo:RestrictedStockUnitsMember2023-07-012023-09-300001829959docebo:RestrictedStockUnitsMember2022-07-012022-09-300001829959docebo:RestrictedStockUnitsMember2023-01-012023-09-300001829959docebo:RestrictedStockUnitsMember2022-01-012022-09-300001829959docebo:EmployeeSharePurchasePlanMember2023-07-012023-09-300001829959docebo:EmployeeSharePurchasePlanMember2022-07-012022-09-300001829959docebo:EmployeeSharePurchasePlanMember2023-01-012023-09-300001829959docebo:EmployeeSharePurchasePlanMember2022-01-012022-09-300001829959ifrs-full:CostOfSalesMember2023-07-012023-09-300001829959ifrs-full:CostOfSalesMember2022-07-012022-09-300001829959ifrs-full:CostOfSalesMember2023-01-012023-09-300001829959ifrs-full:CostOfSalesMember2022-01-012022-09-300001829959docebo:GeneralAndAdministrativeMember2023-07-012023-09-300001829959docebo:GeneralAndAdministrativeMember2022-07-012022-09-300001829959docebo:GeneralAndAdministrativeMember2023-01-012023-09-300001829959docebo:GeneralAndAdministrativeMember2022-01-012022-09-300001829959docebo:SalesAndMarketingExpenseMember2023-07-012023-09-300001829959docebo:SalesAndMarketingExpenseMember2022-07-012022-09-300001829959docebo:SalesAndMarketingExpenseMember2023-01-012023-09-300001829959docebo:SalesAndMarketingExpenseMember2022-01-012022-09-300001829959docebo:ResearchAndDevelopmentExpensesMember2023-07-012023-09-300001829959docebo:ResearchAndDevelopmentExpensesMember2022-07-012022-09-300001829959docebo:ResearchAndDevelopmentExpensesMember2023-01-012023-09-300001829959docebo:ResearchAndDevelopmentExpensesMember2022-01-012022-09-30utr:Y0001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeOneMember2023-09-300001829959docebo:ExercisePriceRangeOneMemberifrs-full:TopOfRangeMember2023-09-300001829959docebo:ExercisePriceRangeOneMember2023-09-300001829959docebo:ExercisePriceRangeOneMember2023-01-012023-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeTwoMember2023-09-300001829959docebo:ExercisePriceRangeTwoMemberifrs-full:TopOfRangeMember2023-09-300001829959docebo:ExercisePriceRangeTwoMember2023-09-300001829959docebo:ExercisePriceRangeTwoMember2023-01-012023-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeThreeMember2023-09-300001829959docebo:ExercisePriceRangeThreeMemberifrs-full:TopOfRangeMember2023-09-300001829959docebo:ExercisePriceRangeThreeMember2023-09-300001829959docebo:ExercisePriceRangeThreeMember2023-01-012023-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeFiveMember2023-09-300001829959docebo:ExercisePriceRangeFiveMemberifrs-full:TopOfRangeMember2023-09-300001829959docebo:ExercisePriceRangeFiveMember2023-09-300001829959docebo:ExercisePriceRangeFiveMember2023-01-012023-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeOneMember2022-09-300001829959docebo:ExercisePriceRangeOneMemberifrs-full:TopOfRangeMember2022-09-300001829959docebo:ExercisePriceRangeOneMember2022-09-300001829959docebo:ExercisePriceRangeOneMember2022-01-012022-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeTwoMember2022-09-300001829959docebo:ExercisePriceRangeTwoMemberifrs-full:TopOfRangeMember2022-09-300001829959docebo:ExercisePriceRangeTwoMember2022-09-300001829959docebo:ExercisePriceRangeTwoMember2022-01-012022-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeThreeMember2022-09-300001829959docebo:ExercisePriceRangeThreeMemberifrs-full:TopOfRangeMember2022-09-300001829959docebo:ExercisePriceRangeThreeMember2022-09-300001829959docebo:ExercisePriceRangeThreeMember2022-01-012022-09-300001829959ifrs-full:BottomOfRangeMemberdocebo:ExercisePriceRangeFourMember2022-09-300001829959docebo:ExercisePriceRangeFourMemberifrs-full:TopOfRangeMember2022-09-300001829959docebo:ExercisePriceRangeFourMember2022-09-300001829959docebo:ExercisePriceRangeFourMember2022-01-012022-09-300001829959docebo:DeferredShareUnitsDSUMember2022-12-310001829959docebo:DeferredShareUnitsDSUMemberifrs-full:BottomOfRangeMember2023-01-012023-09-300001829959docebo:DeferredShareUnitsDSUMemberifrs-full:TopOfRangeMember2023-01-012023-09-300001829959docebo:DeferredShareUnitsDSUMember2023-09-300001829959docebo:RestrictedStockUnitsMember2022-12-310001829959docebo:RestrictedStockUnitsMemberifrs-full:BottomOfRangeMember2023-01-012023-09-300001829959docebo:RestrictedStockUnitsMemberifrs-full:TopOfRangeMember2023-01-012023-09-300001829959docebo:RestrictedStockUnitsMember2023-09-30docebo:revenue_source0001829959docebo:SubscriptionRevenueMember2023-07-012023-09-300001829959docebo:SubscriptionRevenueMember2022-07-012022-09-300001829959docebo:SubscriptionRevenueMember2023-01-012023-09-300001829959docebo:SubscriptionRevenueMember2022-01-012022-09-300001829959docebo:ProfessionalServicesRevenueMember2023-07-012023-09-300001829959docebo:ProfessionalServicesRevenueMember2022-07-012022-09-300001829959docebo:ProfessionalServicesRevenueMember2023-01-012023-09-300001829959docebo:ProfessionalServicesRevenueMember2022-01-012022-09-300001829959srt:NorthAmericaMember2023-07-012023-09-300001829959srt:NorthAmericaMember2022-07-012022-09-300001829959srt:NorthAmericaMember2023-01-012023-09-300001829959srt:NorthAmericaMember2022-01-012022-09-300001829959docebo:RestOfWorldMember2023-07-012023-09-300001829959docebo:RestOfWorldMember2022-07-012022-09-300001829959docebo:RestOfWorldMember2023-01-012023-09-300001829959docebo:RestOfWorldMember2022-01-012022-09-30

| | |

| |

| DOCEBO INC. |

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION |

|

| (expressed in thousands of United States dollars) |

| | | | | | | | | | | |

| | | |

| September 30, | | December 31, |

| 2023 | | 2022 |

| $ | | $ |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | 170,648 | | | 216,293 | |

Trade and other receivables (Note 5) | 40,886 | | | 37,527 | |

| Income taxes receivable | 36 | | | 435 | |

| Prepaids and deposits | 7,529 | | | 6,378 | |

| Net investment in finance lease | 81 | | | 174 | |

Contract costs, net | 5,484 | | | 2,778 | |

| 224,664 | | | 263,585 | |

| Non-current assets: | | | |

Contract costs, net | 9,395 | | | 7,931 | |

| Net investment in finance lease | 61 | | | 241 | |

Deferred tax asset | 104 | | | 118 | |

Right-of-use assets, net (Note 6) | 1,563 | | | 2,038 | |

Property and equipment, net (Note 7) | 2,120 | | | 2,624 | |

Intangible assets, net (Note 8) | 6,410 | | | 1,150 | |

Goodwill (Note 9) | 9,858 | | | 5,982 | |

| 254,175 | | | 283,669 | |

| Liabilities | | | |

| Current liabilities: | | | |

| Trade and other payables | 30,576 | | | 26,025 | |

Automatic share repurchase plan liability (Note 11) | 12,763 | | | — | |

| Income taxes payable | 210 | | | 101 | |

Deferred revenue | 64,612 | | | 55,779 | |

| Contingent consideration | 1,153 | | | 1,083 | |

Lease obligations (Note 6) | 1,513 | | | 1,374 | |

| | | |

| 110,827 | | | 84,362 | |

| Non-current liabilities: | | | |

| Acquisition holdback payables | 1,034 | | | — | |

| Contingent consideration | — | | | 1,177 | |

Deferred revenue | 782 | | | 528 | |

Lease obligations (Note 6) | 881 | | | 1,692 | |

Employee benefit obligations | 2,857 | | | 2,423 | |

Deferred tax liability | 2,094 | | | 1,276 | |

| | | |

| 118,475 | | | 91,458 | |

| Shareholders’ equity | | | |

Share capital (Note 11) | 261,643 | | | 268,194 | |

| Contributed surplus | 11,637 | | | 8,458 | |

Accumulated other comprehensive loss | (8,979) | | | (9,571) | |

Deficit | (128,601) | | | (74,870) | |

| Total equity | 135,700 | | | 192,211 | |

| 254,175 | | | 283,669 | |

| | | |

| | | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

1

| | |

| DOCEBO INC. |

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS) |

|

| (expressed in thousands of United States dollars, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

Revenue (Note 14) | 46,506 | | | 36,966 | | | 131,559 | | | 103,957 | |

Cost of revenue (Note 15 and 16) | 8,779 | | | 7,140 | | | 25,243 | | | 20,671 | |

| Gross profit | 37,727 | | | 29,826 | | | 106,316 | | | 83,286 | |

| | | | | | | |

| Operating expenses | | | | | | | |

General and administrative (Note 16) | 8,317 | | | 7,824 | | | 25,218 | | | 22,796 | |

Sales and marketing (Note 16) | 16,221 | | | 15,523 | | | 51,041 | | | 44,150 | |

Research and development (Note 16) | 10,271 | | | 6,105 | | | 26,456 | | | 18,401 | |

Share-based compensation (Note 12) | 1,845 | | | 1,000 | | | 4,438 | | | 3,624 | |

Foreign exchange (gain) loss | (3,092) | | | (10,213) | | | 1,365 | | | (11,676) | |

Depreciation and amortization (Note 6, 7 and 8) | 1,056 | | | 564 | | | 2,587 | | | 1,731 | |

| 34,618 | | | 20,803 | | | 111,105 | | | 79,026 | |

Operating income (loss) | 3,109 | | | 9,023 | | | (4,789) | | | 4,260 | |

| | | | | | | |

Finance income, net (Note 10) | (1,933) | | | (1,325) | | | (6,506) | | | (1,677) | |

Other (income) expense, net | (2) | | | (21) | | | 181 | | | (64) | |

Income before income taxes | 5,044 | | | 10,369 | | | 1,536 | | | 6,001 | |

| | | | | | | |

Income tax expense | 997 | | | 95 | | | 1,918 | | | 583 | |

| | | | | | | |

Net income (loss) for the periods | 4,047 | | | 10,274 | | | (382) | | | 5,418 | |

| | | | | | | |

Other comprehensive loss (income) | | | | | | | |

| Item that may be reclassified subsequently to income: | | | | | | | |

Exchange loss (gain) on translation of foreign operations | 3,776 | | | 10,690 | | | (592) | | | 12,633 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Comprehensive income (loss) | 271 | | | (416) | | | 210 | | | (7,215) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Income per share - basic | 0.12 | | | 0.31 | | | (0.01) | | 0.16 |

| Income per share - diluted | 0.12 | | | 0.30 | | | (0.01) | | 0.16 |

| | | | | | | |

Weighted average number of common shares outstanding - basic (Note 13) | 32,474,975 | | | 33,044,250 | | | 32,907,374 | | | 33,024,887 | |

Weighted average number of common shares outstanding - diluted (Note 13) | 33,513,101 | | | 34,069,688 | | | 32,907,374 | | | 34,032,666 | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

2

| | |

| DOCEBO INC. |

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY |

|

| (expressed in thousands of United States dollars, except number of shares) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share capital | | Contributed surplus | | Accumulated other comprehensive income (loss) | | Deficit | | Total |

| # | | $ | | $ | | $ | | $ | | $ |

| | | | | | | | | | | |

Balance, December 31, 2021 | 32,857,422 | | | 266,119 | | | 4,312 | | | 2,113 | | | (81,888) | | | 190,656 | |

Exercise of stock options (Note 11 and 12) | 9,179 | | | 151 | | | (63) | | | — | | | — | | | 88 | |

Share-based compensation (Note 12) | — | | | — | | | 3,624 | | | — | | | — | | | 3,624 | |

Release of RSUs (Note 11 and 12) | 2,800 | | | 194 | | | (194) | | | — | | | — | | | — | |

| Issuance of common shares related to business combination | 15,364 | | | 700 | | | — | | | — | | | — | | | 700 | |

Share issuance under employee share purchase plan (Note 11 and 12) | 20,814 | | | 762 | | | (126) | | | — | | | — | | | 636 | |

| Comprehensive loss | — | | | — | | | — | | | (12,633) | | | 5,418 | | | (7,215) | |

Balance, September 30, 2022 | 32,905,579 | | | 267,926 | | | 7,553 | | | (10,520) | | | (76,470) | | | 188,489 | |

| | | | | | | | | | | |

Balance, December 31, 2022 | 32,913,955 | | | 268,194 | | | 8,458 | | | (9,571) | | | (74,870) | | | 192,211 | |

Exercise of stock options (Note 11 and 12) | 194,188 | | | 1,018 | | | (318) | | | — | | | — | | | 700 | |

Share-based compensation (Note 12) | — | | | — | | | 4,438 | | | — | | | — | | | 4,438 | |

Share issuance under employee share purchase plan (Note 11 and 12) | 16,685 | | | 614 | | | (90) | | | — | | | — | | | 524 | |

Release of restricted share units (Note 11 and 12) | 19,744 | | | 851 | | | (851) | | | — | | | — | | | — | |

| Shares issued related to contingent consideration | 50,550 | | | 1,625 | | | — | | | — | | | — | | | 1,625 | |

Shares repurchased for cancellation under normal course issuer bid (Note 11) | (1,333,361) | | | (10,659) | | | — | | | — | | | (40,586) | | | (51,245) | |

Share repurchase commitment under the automatic share purchase plan (Note 11) | — | | | — | | | — | | | — | | | (12,763) | | | (12,763) | |

| Comprehensive income (loss) | — | | | — | | | — | | | 592 | | | (382) | | | 210 | |

Balance, September 30, 2023 | 31,861,761 | | | 261,643 | | | 11,637 | | | (8,979) | | | (128,601) | | | 135,700 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

3

| | |

| DOCEBO INC. |

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS |

|

| (expressed in thousands of United States dollars) |

| | | | | | | | | | | |

| Nine months ended September 30, |

| 2023 | | 2022 |

| $ | | $ |

Cash flows from operating activities | | | |

Net (loss) income | (382) | | | 5,418 | |

Adjustments to reconcile net (loss) income to net cash from operating activities: | | | |

| Depreciation and amortization | 2,587 | | | 1,731 | |

| Share-based compensation | 4,438 | | | 3,624 | |

Loss on disposal of asset | 197 | | | 11 | |

Unrealized foreign exchange loss (gain) | 723 | | | (12,215) | |

Income tax expense | 1,918 | | | 583 | |

Finance income, net | (6,506) | | | (1,677) | |

| Changes in non-cash working capital items: | | | |

| Trade and other receivables | (2,321) | | | (3,483) | |

| | | |

| Prepaids and deposits | (1,178) | | | 190 | |

| Contract costs | (4,188) | | | (3,982) | |

| Trade and other payables | 5,201 | | | 1,578 | |

| | | |

| Employee benefit obligations | 461 | | | 467 | |

| Deferred revenue | 9,171 | | | 8,542 | |

| Income taxes (paid) received | (633) | | | (692) | |

Cash from operating activities | 9,488 | | | 95 | |

| | | |

Cash flows used in investing activities | | | |

| Purchase of property and equipment | (386) | | | (860) | |

| | | |

| Payments of contingent consideration from acquisitions | (216) | | | (93) | |

| Acquisition of business, net of cash acquired | (8,671) | | | (1,071) | |

Cash used in investing activities | (9,273) | | | (2,024) | |

| | | |

| Cash flows (used in) from financing activities | | | |

| Payments received on net investment in finance lease | 84 | | | 116 | |

| Repayment of lease obligations | (1,319) | | | (1,044) | |

| Interest received | 5,636 | | | 827 | |

| Proceeds from exercise of stock options | 700 | | | 88 | |

| | | |

| Proceeds from share issuance under employee share purchase plan | 524 | | | 636 | |

| | | |

| Shares repurchased for cancellation under normal course issuer bid | (51,245) | | | — | |

| | | |

| | | |

Cash (used in) from financing activities | (45,620) | | | 623 | |

| | | |

Net change in cash and cash equivalents during the period | (45,405) | | | (1,306) | |

| Effect of foreign exchange on cash and cash equivalents | (240) | | | (1,284) | |

Cash and cash equivalents, beginning of the period | 216,293 | | | 215,323 | |

Cash and cash equivalents, end of the period | 170,648 | | | 212,733 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

4

| | |

| DOCEBO INC. |

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS |

September 30, 2023 |

| (expressed in thousands of US dollars, except share amounts) |

Docebo Inc. (the “Company” or “Docebo”) is a provider of cloud-based learning management systems. The Company was incorporated on April 21, 2016 under the laws of the Province of Ontario. The Company’s head office is located at Suite 701, 366 Adelaide Street West, Toronto, Canada, M5V 1R9.

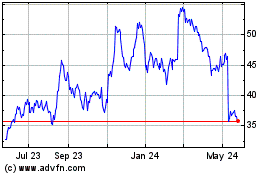

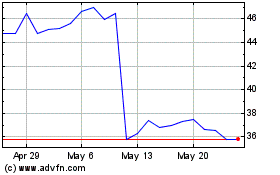

The Company’s shares are listed on both the Toronto Stock Exchange (“TSX”), as of October 8, 2019, and the Nasdaq Global Select Market (“Nasdaq”), as of December 3, 2020, under the stock symbol “DCBO”.

The Company has the following subsidiaries:

| | | | | | | | | | | | | | | | | |

| Entity name | Country | | Ownership percentage September 30, 2023 | | Ownership percentage December 31, 2022 |

| | | % | | % |

| Docebo S.p.A | Italy | | 100 | | 100 |

| Docebo NA, Inc. | United States | | 100 | | 100 |

| Docebo EMEA FZ-LLC | Dubai | | 100 | | 100 |

| Docebo UK Limited | England | | 100 | | 100 |

| Docebo France Société par Actions Simplifiée (“Docebo France”) | France | | 100 | | 100 |

| Docebo DACH GmbH (“Docebo Germany”) | Germany | | 100 | | 100 |

| Docebo Australia Pty Ltd. ("Docebo Australia") | Australia | | 100 | | 100 |

| Docebo Ireland Limited | Ireland | | 100 | | 100 |

| Circles Collective Inc. ("PeerBoard") | United States | | 100 | | — |

| Edugo AI HK Limited | Hong Kong | | 100 | | — |

Statement of compliance

The unaudited condensed consolidated interim financial statements (“financial statements”) have been prepared by management using the same accounting policies and methods as those used in the Company’s consolidated financial statements for the year ended December 31, 2022. These unaudited condensed consolidated interim financial statements have been prepared in accordance with IAS 34 – Interim Financial Reporting. Accordingly, certain disclosures normally included in annual financial statements prepared in accordance with IFRS Accounting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) have been omitted or condensed. These unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s consolidated financial statements for the year ended December 31, 2022.

These financial statements were approved and authorized for issuance by the Board of Directors of the Company on November 8, 2023.

Use of estimates, assumptions and judgments

The preparation of these financial statements in conformity with IFRS requires management to make estimates, assumptions and judgments that affect the application of accounting policies and the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results may differ from those estimates.

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

Estimates are based on management’s best knowledge of current events and actions the Company may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

In preparing these financial statements, the significant judgments made by management in applying the Company’s accounting policies and the key sources of uncertainty are the same as those applied and described in the Company’s annual audited consolidated financial statements for the year ended December 31, 2022.

| | | | | |

| 3 | Summary of significant accounting policies |

The significant accounting policies applied in these financial statements are the same as those applied and described in the Company’s annual audited consolidated financial statements as at and for the year ended December 31, 2022.

Circles Collective Inc.

On April 3, 2023, the Company acquired all of the issued and outstanding shares of Circles Collective Inc. (o/a PeerBoard), a plug and play community-as-a-service platform based in the United States. The acquisition of PeerBoard will expand Docebo’s external training offering and enhance the Company’s social learning capabilities.

Total purchase consideration of $2,991, consisting of: (i) cash paid on closing of $2,526; and (ii) a cash holdback amount of $466 (maximum undiscounted amount of $500) payable on the second year anniversary of the acquisition. The issuance of an additional 26,185 common shares, at a fair value of $40.74 (C$51.68) per share, is payable through April 2026 to an employee of the acquiree contingent on continued employment and is accounted for as compensation for post-acquisition services.

In addition, potential future consideration of up to $4,000 in cash over the three years following the closing date is owing to an employee of the acquiree based on the achievement of both performance milestones and continued employment. Given the continued employment requirement, these earn-out payouts will be accounted for as compensation for post-acquisition services and are not considered purchase consideration in the business combination.

Transaction costs relating to due diligence fees, legal costs, accounting fees, advisory fees and other professional fees for the three and nine months ended September 30, 2023 amounting to $23 and $522, respectively, were incurred in relation to the acquisition. These amounts have been included in general and administrative expenses in the Company's condensed consolidated interim statements of income and comprehensive income (loss).

The acquisition has been accounted for as a business combination in accordance with IFRS 3, Business Combinations, using the acquisition method whereby the net assets acquired and the liabilities assumed are recorded at fair value.

The following table summarizes the preliminary allocations of the consideration paid and the amounts of fair value of the assets acquired and liabilities assumed at the acquisition date:

| | | | | |

| Fair value recognized on acquisition |

| $ |

| Assets | |

| Current assets: | |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

| | | | | |

| Cash and cash equivalents | 2 | |

| |

| |

| 2 | |

| Non-current assets: | |

| |

| |

| |

| Technology | 1,830 | |

| |

| Goodwill | 1,210 | |

| |

| Total assets | 3,042 | |

| |

| Liabilities | |

| Current liabilities: | |

| Trade and other payables | 2 | |

| Deferred revenue | 1 | |

| |

| 3 | |

| Non-current liabilities: | |

| |

| |

| Deferred tax liability | 48 | |

| Total liabilities | 51 | |

| Fair value of net assets acquired | 2,991 | |

| |

| |

| Paid in cash | 2,526 | |

| Holdback payable | 466 | |

| Working capital adjustment | (1) | |

| Total purchase consideration | 2,991 | |

The goodwill related to the acquisition of PeerBoard reflects the benefits attributable to future market development and the fair value of an assembled workforce. These benefits were not recognized separately from goodwill because they did not meet the recognition criteria for identifiable intangible assets. This goodwill is not deductible for income tax purposes.

The technology acquired is amortized on a straight-line basis over the estimated useful life of 5 years.

The allocation of the purchase price to assets acquired and liabilities assumed was based upon a preliminary valuation for all items and may be subject to adjustment during the 12-month measurement period following the acquisition date.

Edugo AI HK Limited

On June 9, 2023, the Company acquired all of the issued and outstanding shares of Edugo AI HK Limited (“Edugo.AI”), a Generative AI-based Learning Technology that uses advanced Large Language Models and algorithms to optimize learning paths and adapt to individual learner needs.

Total purchase consideration of $6,731 consisted of: (i) cash paid on closing of $6,151; (ii) a cash holdback amount of $552 (maximum undiscounted amount of $603) payable on the second year anniversary of the acquisition; and (iii) a pre-closing expense advance and post-close working capital adjustment of $28.

In addition, up to $8,028 of additional cash consideration may be payable over the three years following the closing of the transaction, representing the earn-out portion of the consideration paid by the Company or subsidiary thereof in connection with the transaction, based on the achievement of certain performance milestones and employment obligations. Given the continued employment requirement, these earn-out payouts will be accounted for as compensation for post-acquisition services and are not considered purchase consideration in the business combination.

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

Transaction costs relating to due diligence fees, legal costs, accounting fees, advisory fees and other professional fees for the three and nine months ended September 30, 2023 amounting to $218 and $551, respectively, were incurred in relation to the acquisition. These amounts have been included in general and administrative expenses in the Company's condensed consolidated interim statements of income and comprehensive income (loss).

The acquisition has been accounted for as a business combination in accordance with IFRS 3, Business Combinations, using the acquisition method whereby the net assets acquired and the liabilities assumed are recorded at fair value.

The following table summarizes the preliminary allocations of the consideration paid and the amounts of fair value of the assets acquired and liabilities assumed at the acquisition date:

| | | | | |

| Fair value recognized on acquisition |

| $ |

| Assets | |

| Current assets: | |

| Cash and cash equivalents | 4 | |

| |

| |

| 4 | |

| Non-current assets: | |

| |

| |

| |

| Technology | 4,126 | |

| |

| Goodwill | 2,772 | |

| |

| Total assets | 6,902 | |

| |

| Liabilities | |

| Current liabilities: | |

| Trade and other payables | 171 | |

| |

| |

| |

| |

| |

| |

| |

| Total liabilities | 171 | |

| Fair value of net assets acquired | 6,731 | |

| |

| |

| Paid in cash | 6,151 | |

| Holdback payable | 552 | |

| Pre-funded expenses | 38 | |

| Working capital adjustment | (10) | |

| Total purchase consideration | 6,731 | |

The goodwill related to the acquisition of Edugo.AI reflects the benefits attributable to future market development and the fair value of an assembled workforce. These benefits were not recognized separately from goodwill because they did not meet the recognition criteria for identifiable intangible assets. This goodwill is not deductible for income tax purposes.

The technology acquired is amortized on a straight-line basis over the estimated useful life of 5 years.

The allocation of the purchase price to assets acquired and liabilities assumed was based upon a preliminary valuation for all items and may be subject to adjustment during the 12-month measurement period following the acquisition date.

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

| | | | | |

| 5 | Trade and other receivables |

The Company’s trade and other receivables as at September 30, 2023 and December 31, 2022 include the following:

| | | | | | | | | | | |

| 2023 | | 2022 |

| $ | | $ |

| Trade receivables | 35,023 | | | 29,128 | |

| Accrued revenues | 2,700 | | | 3,288 | |

| Tax credits receivable | 1,984 | | | 3,054 | |

| Interest receivable | 1,087 | | | 1,662 | |

| Other receivables | 92 | | | 395 | |

| 40,886 | | | 37,527 | |

Included in trade receivables is a loss allowance of $986 as at September 30, 2023 and $719 as at December 31, 2022.

The Company’s right-of-use assets by class of assets are as follows:

| | | | | | | | | | | | | | | | | |

| Premises | | Others | | Total |

| $ | | $ | | $ |

| Costs | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Balance – December 31, 2022 | 4,717 | | 382 | | 5,099 |

| Additions | 540 | | — | | 540 |

| | | | | |

| Effects of foreign exchange | (18) | | (5) | | (23) |

Balance – September 30, 2023 | 5,239 | | 377 | | 5,616 |

| | | | | |

| Accumulated amortization | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Balance – December 31, 2022 | 2,796 | | 265 | | 3,061 |

| Amortization | 975 | | 45 | | 1,020 |

| | | | | |

| Effects of foreign exchange | (31) | | 3 | | (28) |

Balance – September 30, 2023 | 3,740 | | 313 | | 4,053 |

| | | | | |

| Carrying value | | | | | |

Net balance – December 31, 2022 | 1,921 | | 117 | | 2,038 |

Net balance – September 30, 2023 | 1,499 | | 64 | | 1,563 |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

The Company’s lease obligations are as follows:

| | | | | | | | | | |

| | 2023 | | |

| | $ | | |

| Balance – January 1 | | 3,066 | | | |

| Additions | | 540 | | | |

| | | | |

| Interest accretion | | 163 | | | |

| Lease repayments | | (1,319) | | | |

| Effects of foreign exchange | | (56) | | | |

| Balance – September 30 | | 2,394 | | | |

| | | | |

| Current | | 1,513 | | | |

| Non-current | | 881 | | | |

| | 2,394 | | | |

Expenses incurred for the three and nine months ended September 30, 2023 relating to short-term leases and leases of low-value assets were $22 and $90, respectively (2022 - $47 and $163).

| | | | | | | | | | | | | | | | | | | | | | | |

| Furniture and office equipment | | Leasehold improvements | | Land and Building | | Total |

| $ | | $ | | $ | | $ |

| Cost | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Balance – December 31, 2022 | 2,983 | | | 1,864 | | | 332 | | | 5,179 | |

| Additions | 334 | | | 52 | | | — | | | 386 | |

| | | | | | | |

| Effects of foreign exchange | (28) | | | (11) | | | (4) | | | (43) | |

Balance – September 30, 2023 | 3,289 | | | 1,905 | | | 328 | | | 5,522 | |

| | | | | | | |

| Accumulated depreciation | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Balance – December 31, 2022 | 1,493 | | | 979 | | | 83 | | | 2,555 | |

| Depreciation | 624 | | | 243 | | | 8 | | | 875 | |

| Effects of foreign exchange | (18) | | | (7) | | | (3) | | | (28) | |

Balance – September 30, 2023 | 2,099 | | | 1,215 | | | 88 | | | 3,402 | |

| | | | | | | |

| Carrying value | | | | | | | |

Balance – December 31, 2022 | 1,490 | | | 885 | | | 249 | | | 2,624 | |

Balance – September 30, 2023 | 1,190 | | | 690 | | | 240 | | | 2,120 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Acquired | | |

| | Customer relationships | | Technology | | Trademarks | | Total |

| | $ | | $ | | $ | | $ |

| Cost | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Balance – December 31, 2022 | | 1,335 | | | 502 | | | 43 | | | 1,880 | |

| Acquisitions through business combinations | | — | | | 5,956 | | | — | | | 5,956 | |

| Effects of foreign exchange | | (15) | | | (5) | | | — | | | (20) | |

Balance – September 30, 2023 | | 1,320 | | | 6,453 | | | 43 | | | 7,816 | |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Acquired | | |

| | Customer relationships | | Technology | | Trademarks | | Total |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Balance – December 31, 2022 | | 483 | | | 218 | | | 29 | | | 730 | |

| Amortization | | 168 | | | 512 | | | 12 | | | 692 | |

| Effects of foreign exchange | | (8) | | | (7) | | | (1) | | | (16) | |

Balance – September 30, 2023 | | 643 | | | 723 | | | 40 | | | 1,406 | |

| | | | | | | | |

| Carrying value | | | | | | | | |

Balance – December 31, 2022 | | 852 | | | 284 | | | 14 | | | 1,150 | |

Balance – September 30, 2023 | | 677 | | | 5,730 | | | 3 | | | 6,410 | |

| | | | | |

| $ |

| |

| |

| |

Balance – December 31, 2022 | 5,982 | |

| Additions | 3,982 | |

| Effects of foreign exchange | (106) | |

Balance – September 30, 2023 | 9,858 | |

| |

Finance income for the three and nine months ended September 30, 2023 and 2022 is comprised of:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| | | | | | | |

| Interest on acquisition related consideration | 28 | | | 28 | | | 64 | | | 83 | |

| Interest on lease obligations | 51 | | | 63 | | | 163 | | | 207 | |

| | | | | | | |

| Interest income | (2,012) | | | (1,416) | | | (6,733) | | | (1,969) | |

| Bank fees and other | — | | | — | | | — | | | 2 | |

| (1,933) | | | (1,325) | | | (6,506) | | | (1,677) | |

| | | | | | | | | | | |

| Authorized: | | | |

| Unlimited common shares with no par value | | | |

| Issued and outstanding: | | | |

| Number of shares | | Amount |

| # | | $ |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

| | | | | | | | | | | |

Balance – December 31, 2022 | 32,913,955 | | | 268,194 | |

| Exercise of stock options | 194,188 | | | 1,018 | |

| Issuance of common shares under employee share purchase plan | 16,685 | | | 614 | |

| Release of restricted share units | 19,744 | | | 851 | |

| Issuance of common shares related to contingent consideration | 50,550 | | | 1,625 | |

| Purchase of common shares held for cancellation under normal course issuer bid | (1,333,361) | | | (10,659) | |

| | | |

Balance – September 30, 2023 | 31,861,761 | | | 261,643 | |

On April 27, 2023, the Company issued a total of 50,550 common shares from treasury as part of the contingent consideration earn-out payments due to the sellers of forMetris Société par Actions Simplifiée for meeting certain revenue conditions in the second year following the date of acquisition. The shares were issued based on the fair value thereof, which was determined to be $32.09 (C$44.74). The equity settlement resulted in a reduction to the contingent consideration balance as at June 30, 2022.

On May 15, 2023, the Company announced the commencement of a normal course issuer bid (“NCIB”) to repurchase and cancel up to 1,650,672 of its common shares, representing approximately 5% of the public float, over the 12-month period commencing May 18, 2023, and ending no later than May 17, 2024. All repurchases are made through the facilities of the Toronto Stock Exchange and are done at market prices. The amounts paid above the average book value of the common shares are charged to retained earnings. During the nine months ended September 30, 2023, the Company repurchased a total of 1,333,361 common shares for cancellation at an average price of $38.43 (C$50.27) per common share for total cash consideration of $51,245. As at September 30, 2023, $831 of consideration related to common share repurchases was recorded in trade and other payables.

In connection with the NCIB, the Company entered into an automatic share purchase plan ("ASPP") with a designated broker for the purpose of allowing the Company to purchase its common shares under the NCIB during self-imposed trading blackout periods. Under the ASPP, the broker is authorized to repurchase common shares during blackout periods, without consultation with the Company, on predefined terms, including share price, time period and subject to other limitations imposed by the Company and subject to rules and policies of the TSX and applicable securities laws, such as a daily purchase restriction.

A liability representing the maximum amount that the Company could be required to pay the designated broker under the ASPP was $12,763 as at September 30, 2023. The amount was charged to retained earnings.

| | | | | |

| 12 | Share-based compensation |

The Company has five components of its share-based compensation plan: stock options, deferred share units (“DSUs”), restricted share units (“RSUs”), performance share units (“PSUs”) and employee share purchase plan (“ESPP”). Share-based compensation expense for the three and nine months ended September 30, 2023 was $1,845 and $4,438, respectively (2022 - $1,000 and $3,624). The expense associated with each component is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Stock options | 743 | | | 607 | | | 1,769 | | | 1,655 | |

| DSUs | 269 | | | 233 | | | 722 | | | 632 | |

| RSUs | 806 | | | 124 | | | 1,862 | | | 1,225 | |

| ESPP | 27 | | | 36 | | | 85 | | | 112 | |

| 1,845 | | | 1,000 | | | 4,438 | | | 3,624 | |

There were no PSUs issued and outstanding for the three and nine months ended September 30, 2023 and 2022.

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

The following table presents share-based compensation expense by function for the three and nine months ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Cost of revenue | 90 | | | 21 | | | 206 | | | 215 | |

| General and administrative | 1,005 | | | 480 | | | 2,530 | | | 2,142 | |

| Sales and marketing | 552 | | | 472 | | | 1,056 | | | 1,225 | |

| Research and development | 198 | | | 27 | | | 646 | | | 42 | |

| 1,845 | | | 1,000 | | | 4,438 | | | 3,624 | |

The changes in the number of stock options during the nine months ended September 30, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Number of options | | Weighted average exercise price | | Number of options | | Weighted average exercise price |

| # | | C$ | | # | | C$ |

| Options outstanding – January 1 | 1,349,001 | | | 13.60 | | | 1,283,088 | | | 12.00 | |

| Options granted | 236,753 | | | 52.15 | | | 168,588 | | | 44.91 | |

| Options forfeited | (98,570) | | | 42.67 | | | (63,415) | | | 46.41 | |

| Options exercised | (194,188) | | | 4.88 | | | (9,179) | | | 14.52 | |

| | | | | | | |

Options outstanding – September 30 | 1,292,996 | | | 19.75 | | | 1,379,082 | | | 14.42 | |

Options exercisable – September 30 | 850,250 | | | 7.59 | | | 887,779 | | | 4.06 | |

The weighted average fair value of share options granted during the nine months ended September 30, 2023 and 2022 was estimated at the date of grant using the Black-Scholes option pricing model using the following inputs:

| | | | | | | | | | | |

| |

| 2023 | | 2022 |

| C$ | | C$ |

| Weighted average stock price valuation | $ | 52.15 | | | $ | 44.91 | |

| Weighted average exercise price | $ | 52.15 | | | $ | 44.91 | |

| Risk-free interest rate | 3.11 | % | | 2.58 | % |

| Expected life in years | 4.5 | | 6.25 |

| Expected dividend yield | — | % | | — | % |

| Volatility | 64 | % | | 63 | % |

| Weighted average fair value of options issued | $ | 28.15 | | | $ | 26.94 | |

The following table is a summary of the Company’s stock options outstanding as at September 30, 2023:

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Options outstanding | | Options exercisable |

| Exercise price range | | Number outstanding | | Weighted average remaining contractual life (years) | | Exercise price range | | Number exercisable |

| C$ | | # | | # | | C$ | | # |

0.0001 - 1.09 | | 639,920 | | | 2.13 | | 0.0001 - 1.09 | | 639,920 | |

| | | | | | | | |

8.86 - 11.06 | | 43,811 | | | 7.16 | | 8.86 - 11.06 | | 27,126 | |

15.79 - 16.00 | | 196,930 | | | 6.03 | | 15.79 - 16.00 | | 107,481 | |

26.43 - 95.12 | | 412,335 | | | 6.25 | | 26.43 - 95.12 | | 75,723 | |

| | 1,292,996 | | | 4.21 | | | | 850,250 | |

The following table is a summary of the Company’s stock options outstanding as at September 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Options outstanding | | Options exercisable |

| Exercise price range | | Number outstanding | | Weighted average remaining contractual life (years) | | Exercise price range | | Number exercisable |

| C$ | | # | | # | | C$ | | # |

0.0001 - 1.09 | | 784,368 | | | 4.71 | | 0.0001 - 1.09 | | 748,368 | |

| | | | | | | | |

8.86 - 11.06 | | 51,811 | | | 8.20 | | 8.86 - 11.06 | | 21,084 | |

15.79 - 16.00 | | 268,499 | | | 7.03 | | 15.79 - 16.00 | | 95,969 | |

26.43 - 95.12 | | 274,404 | | | 9.26 | | 26.43 - 95.12 | | 22,358 | |

| | 1,379,082 | | | 6.19 | | | | 887,779 | |

DSUs

The following table presents information concerning the number of DSUs granted by the Company:

| | | | | |

| # |

| |

| |

| |

| |

| |

DSUs – December 31, 2022 | 87,222 | |

Granted (at C$43.93 - $53.15 per unit) | 26,813 | |

| |

| |

DSUs - September 30, 2023 | 114,035 | |

RSUs

The following table presents information concerning the number of RSUs granted by the Company:

| | | | | |

| # |

| |

| |

RSUs – December 31, 2022 | 103,626 | |

Granted (at C$43.55 - $52.38 per unit) | 127,753 | |

Released (at C$40.30 - $86.38 per unit) | (19,744) | |

Forfeited (at C$42.24 - $86.38 per unit) | (40,310) | |

RSUs - September 30, 2023 | 171,325 | |

| | | | | |

| 13 | Net income (loss) per share |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

Basic and diluted net income per share for the three and nine months ended September 30 are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net income (loss) attributable to common shareholders | 4,047 | | | 10,274 | | | $ | (382) | | | $ | 5,418 | |

| | | | | | | |

| Basic weighted average number of common shares outstanding | 32,474,975 | | | 33,044,250 | | | 32,907,374 | | | 33,024,887 | |

| Stock options | 730,652 | | | 815,863 | | | — | | | 850,888 | |

| DSUs | 113,272 | | | 84,254 | | | — | | | 68,749 | |

| RSUs | 194,202 | | | 125,321 | | | — | | | 88,142 | |

| Diluted weighted average number of common shares outstanding | 33,513,101 | | | 34,069,688 | | | 32,907,374 | | | 34,032,666 | |

| | | | | | | |

| Basic net income (loss) per common share | $ | 0.12 | | | $ | 0.31 | | | $ | (0.01) | | | $ | 0.16 | |

| Diluted net income (loss) per common share | $ | 0.12 | | | $ | 0.30 | | | $ | (0.01) | | | $ | 0.16 | |

For the three and nine months ended September 30, 2023, there were 87,867 and all share options and units, respectively, (three and nine months ended September 30, 2022 – nil and 15,991 shares, respectively) that were not taken into account in the calculation of diluted earnings per share because their effect was anti-dilutive.

| | | | | |

| 14 | Revenue and related balances |

Disaggregated revenue

The Company derives its revenues from two main sources, subscription to its SaaS application, and professional services revenue, which includes services such as initial implementation, project management, and training.

The following table presents a disaggregation of revenue for the three and nine months ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Subscription revenue | 43,588 | | | 34,279 | | | 123,278 | | | 95,323 | |

| Professional services | 2,918 | | | 2,687 | | | 8,281 | | | 8,634 | |

| 46,506 | | | 36,966 | | | 131,559 | | | 103,957 | |

The following table represents cost of revenue for the three and nine months ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Employee salaries and benefits | 4,576 | | | 3,873 | | | 13,875 | | | 12,149 | |

| Web hosting fees | 1,299 | | | 1,329 | | | 3,701 | | | 3,589 | |

| Third party service fees | 2,605 | | | 1,763 | | | 6,878 | | | 4,361 | |

| Other | 299 | | | 175 | | | 789 | | | 572 | |

| 8,779 | | | 7,140 | | | 25,243 | | | 20,671 | |

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

The total employee compensation comprising salaries and benefits, and excluding share-based compensation, for the three and nine months ended September 30, 2023 was $27,104 and $81,927, respectively (2022 - $22,954 and $67,543).

Employee compensation costs were included in the following expenses for the three and nine months ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Cost of revenue | 4,576 | | | 3,873 | | | 13,875 | | | 12,149 | |

| General and administrative | 4,089 | | | 3,582 | | | 11,909 | | | 10,328 | |

| Sales and marketing | 11,380 | | | 10,900 | | | 35,957 | | | 31,013 | |

| Research and development | 7,059 | | | 4,599 | | | 20,186 | | | 14,053 | |

| 27,104 | | | 22,954 | | | 81,927 | | | 67,543 | |

| | | | | |

| 17 | Related party transactions |

Key management personnel are those persons having the authority and responsibility for planning, directing and controlling activities of the Company, directly or indirectly. Key management personnel includes the Company’s Directors and Officers.

Compensation awarded to key management personnel for the three and nine months ended September 30, 2023 and 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Salaries and benefits | 1,308 | | | 1,082 | | | 3,589 | | | 2,590 | |

| Share-based compensation | 1,108 | | | 425 | | | 3,245 | | | 2,106 | |

| 2,416 | | | 1,507 | | | 6,834 | | | 4,696 | |

| | | | | |

| 18 | Financial instruments and risk management |

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from deposits with banks and outstanding receivables. The Company trades only with recognized, creditworthy third parties. Due to the Company’s diversified customer base, there is no particular concentration of credit risk related to the Company’s trade and other receivables. Trade and other receivables are monitored on an ongoing basis to ensure timely collection of amounts.

The carrying values of cash and cash equivalents, trade and other receivables, trade and other payables, and ASPP liability approximate fair values due to the short-term nature of these items or being carried at fair value. The risk of material change in fair value is not considered to be significant. The Company does not use derivative financial instruments to manage this risk.

Contingent consideration is classified as a Level 3 financial instrument. The fair value of the contingent consideration was calculated using discounted cash flows. During the three and nine months ended September 30, 2023, there were no transfers of amounts between levels in the fair value hierarchy.

DOCEBO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(expressed in thousands of US dollars, except share amounts)

The Company reports segment information based on internal reports used by the chief operating decision maker (“CODM”) to make operating and resource allocation decisions and to assess performance. The CODM is the Chief Executive Officer. The CODM makes decisions and assesses performance of the Company on a consolidated basis such that the Company is a single reportable operating segment.

The following tables present details on revenues derived in the following geographical locations for the three and nine months ended September 30, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| North America | 35,462 | | | 28,439 | | | 99,834 | | | 78,731 | |

Rest of World | 11,044 | | | 8,527 | | | 31,725 | | | 25,226 | |

| 46,506 | | | 36,966 | | | 131,559 | | | 103,957 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023

As used in this management’s discussion and analysis of financial condition and results of operations (“MD&A”), unless the context indicates or requires otherwise, all references to the “Company”, “Docebo”, “we”, “us” or “our” refer to Docebo Inc., together with our subsidiaries, on a consolidated basis as constituted on September 30, 2023.

This MD&A for the three and nine months ended September 30, 2023 and 2022 should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and accompanying notes thereto for the three and nine months ended September 30, 2023 and 2022, and the Company's audited annual consolidated financial statements and accompanying notes thereto for the year ended December 31, 2022. The financial information presented in this MD&A is derived from the Company’s unaudited condensed consolidated interim financial statements for the nine months ended September 30, 2023 and 2022 which have been prepared in accordance with IFRS Accounting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). All amounts are in thousands of United States dollars except where otherwise indicated.

This MD&A is dated as of November 8, 2023.

Forward-looking Information

This MD&A contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information may relate to our future financial outlook and anticipated events or results and may include information regarding our financial position, business strategy, macroeconomic conditions and global economic uncertainty, the war in Ukraine and inflation, including actions of Central banks to contain it, on our business, growth strategies, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, information regarding our expectations of future results, performance, achievements, prospects or opportunities or the markets in which we operate is forward-looking information.

In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or, “will”, “occur” or “be achieved”, and similar words or the negative of these terms and similar terminology. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

This forward-looking information includes, but is not limited to, statements regarding the Company’s business; future financial position and business strategy; the learning management industry; our growth rates and growth strategies; addressable markets for our solutions; the achievement of advances in and expansion of our platform; expectations regarding our revenue and the revenue generation potential of our platform and other products; our business plans and strategies; and our competitive position in our industry. This forward-looking information is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions include: our ability to build our market share and enter new markets and industry verticals; our ability to attract and retain key personnel; our ability to maintain and expand geographic scope; our ability to execute on our expansion plans; our ability to continue investing in infrastructure to support our growth; our ability to obtain and maintain existing financing on acceptable terms; our ability to execute on profitability initiatives; our ability to successfully integrate the companies we have acquired and to derive the benefits we expect from the acquisition thereof; currency exchange and interest rates; the impact of inflation and

global macroeconomic conditions; the impact of competition; our ability to respond to the changes and trends in our industry or the global economy; and the changes in laws, rules, regulations, and global standards are material factors made in preparing forward-looking information and management’s expectations.

Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that, while considered by the Company to be appropriate and reasonable as of the date of this MD&A, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to:

•the Company’s ability to execute its growth strategies;

•the impact of changing conditions in the global corporate e-learning market;

•increasing competition in the global corporate e-learning market in which the Company operates;

•fluctuations in currency exchange rates and volatility in financial markets;

•changes in the attitudes, financial condition and demand of our target market;

•the Company’s ability to operate its business and effectively manage its growth under evolving macroeconomic conditions, such as high inflation and recessionary environments;

•developments and changes in applicable laws and regulations;

•fluctuations in the length and complexity of the sales cycle for our platform, especially for sales to larger enterprises;

•issues in the use of AI in our platform may result in reputational harm or liability; and

•such other factors discussed in greater detail under the “Risk Factors” section of our Annual Information Form dated March 8, 2023 (“AIF”), which is available under our profile on SEDAR+ at www.sedarplus.ca.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. The opinions, estimates or assumptions referred to above and described in greater detail in “Summary of Factors Affecting our Performance” and in the “Risk Factors” section of our AIF, should be considered carefully by prospective investors.

Although we have attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this MD&A represents our expectations as of the date specified herein, and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

All of the forward-looking information contained in this MD&A is expressly qualified by the foregoing cautionary statements.

Additional information relating to Docebo, including our AIF, can be found on SEDAR+ at www.sedarplus.ca.

Overview

At Docebo, our mission is to redefine the way enterprises, including their internal and external workforces, partners and customers, learn by applying new technologies to the traditional corporate Learning Management System (“LMS”) market. Founded in 2005, we provide an easy-to-use, highly configurable and affordable learning platform with the end-to-end capabilities and critical functionality needed to train internal and external workforces, partners and customers. Our solution allows our customers to take control of their desired training strategies and retain institutional knowledge, while providing efficient course delivery, tracking of learning progress, advanced reporting

tools and analytics. Our robust platform helps our customers centralize a broad range of learning materials from peer enterprises and learners into one LMS to expedite and enrich the learning process, increase productivity and grow teams uniformly.

Our platform is now used by almost 3,700 companies of all sizes, providing access to learners situated around the world in a variety of languages. Our clients range from select small local businesses, with a focus on mid-sized enterprises, to large multi-nationals, including service, financial, technology and resource-based companies and consulting firms. We have registered offices in Toronto, Canada, Athens, Georgia (USA), Wilmington, Delaware (USA), Biassono, Italy, Dubai, United Arab Emirates, London, England, Paris, France, Frankfurt, Germany, Melbourne, Australia, and Dublin, Ireland. Our platform is sold primarily through a direct sales force located in several of these offices. We also have some relationships with resellers and other channel partners, such as human resource and payroll services providers.

The Docebo Learning Platform currently includes: (i) “Docebo Learn LMS”, (ii) “Docebo Shape”, (iii) “Docebo Content”, (iv) “Docebo Learning Impact”, (v) “Docebo Learn Data”, (vi) “Docebo Connect” and (vii) “Docebo Flow”.

•Docebo Learn LMS is a cloud-based learning technology that allows learning administrators to deliver scalable and flexible personalized learning experiences, from formal training to social learning, to multiple internal, external and blended audiences.

•Docebo Shape is an AI-powered learning content creation tool that enables users to turn internal and external resources into engaging, multilingual microlearning content to share across their business in minutes, without needing months to master the tool.

•With over 200,000 courses and programs, Docebo Content allows learning administrators to unlock the industry’s best-learning content and get high-quality, off-the-shelf learning content from the world’s top publishers in front of your learners. Learning administrators can select the most impactful e-learning content by partnering with a Docebo Content specialist to help curate the right resources.

•Docebo Learning Impact is a learning measurement tool that enables learning administrators to prove and improve the impact of their training programs and validate their company’s investment in learning with optimized questionnaires, learning benchmarks and actionable next steps.

•Docebo Learn Data allows learning administrators to securely integrate their own internal data warehouse and any other business intelligence tool with both the raw data from Docebo Learn LMS and the learning key performance learning analytics to gain a comprehensive view into how their learning programs are powering their business; connecting learning data to business results.

•Docebo Connect enables organizations to seamlessly connect Docebo to any custom tech stack, making integrations faster and more effective.

•Docebo Flow is a product that allows businesses to directly inject learning into other software environments, helping organizations to create contextual in-product training and learning experience.