Rule 497(k)

File No. 333-181507

First Trust

FIRST TRUST Exchange-Traded Fund V

SUMMARY PROSPECTUS

FIRST TRUST MORNINGSTAR MANAGED FUTURES STRATEGY FUND

Ticker Symbol: FMF

Exchange: NYSE Arca, Inc.

Before you invest, you may want to review the Fund's prospectus, which contains

more information about the Fund and its risks. You can find the Fund's

prospectus and other information about the Fund, including the statement of

additional information and most recent reports to shareholders, online at

http://www.ftportfolios.com/retail/ETF/ETFfundnews.aspx?Ticker=FMF. You can also

get this information at no cost by calling (800) 621-1675 or by sending an

e-mail request to info@ftportfolios.com. The Fund's prospectus and statement of

additional information, both dated August 2, 2013, are all incorporated by

reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

First Trust Morningstar Managed Futures Strategy Fund (the "Fund") seeks to

provide investors with positive returns.

August 2, 2013

FEES AND EXPENSES OF THE FUND

The following table describes the fees and expenses you may pay if you buy and

hold shares of the Fund. Investors purchasing and selling shares may be subject

to costs (including customary brokerage commissions) charged by their broker,

which are not reflected in the example below.

SHAREHOLDER FEES (fees paid directly from your investment)

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) None

ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage

of the value of your investment)

Management Fees 0.95%

Distribution and Service (12b-1) Fees (1) 0.00%

Total Other Expenses (2)(3)

Other Expenses of the Fund 0.00%

Expenses of the Subsidiary 0.00%

---------

Total Annual Fund Operating Expenses 0.95%

|

EXAMPLE

The example below is intended to help you compare the cost of investing in the

Fund with the cost of investing in other funds. This example does not take

into account customary brokerage commissions that you pay when purchasing or

selling shares of the Fund in the secondary market.

The example assumes that you invest $10,000 in the Fund for the time periods

indicated and then redeem all of your shares at the end of those periods. The

example also assumes that your investment has a 5% return each year and that

the Fund's operating expenses remain at current levels until July 31, 2014 and

thereafter at 1.20% to represent the imposition of the 12b-1 fee of 0.25% per

annum of the Fund's average daily net assets. Although your actual costs may

be higher or lower, based on these assumptions your costs would be:

1 YEAR 3 YEARS

$97 $356

----------------------

|

(1) Although the Fund has adopted a 12b-1 plan that permits it to pay up to

0.25% per annum, it will not pay 12b-1 fees at any time before July 31,

2014.

(2) The Fund had not fully commenced operations as of the date of this

prospectus. "Total Other Expenses" are estimates based on the expenses

the Fund expects to incur for the current fiscal year.

(3) Pursuant to the Investment Management Agreement, First Trust will manage

the investment of the Fund's assets and will be responsible for the Fund

and the Subsidiary's expenses, including the cost of transfer agency,

custody, fund administration, legal, audit and other services, but

excluding fee payments under the Investment Management Agreement,

interest, taxes, brokerage commissions and other expenses connected with

the execution of portfolio transactions, distribution and service fees

pursuant to a 12b-1 plan, if any, and extraordinary expenses.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or "turns over" its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when

shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the example, affect the Fund's

performance.

PRINCIPAL INVESTMENT STRATEGIES

The Fund is an actively managed exchange-traded fund ("ETF") that seeks to

achieve positive returns that are not directly correlated to broad market equity

or fixed income returns. The Fund uses as a benchmark, the Morningstar

Diversified Futures Index (the "Benchmark"), which is developed, maintained and

sponsored by Morningstar, Inc. ("Morningstar"). The Fund seeks to exceed the

performance of the Benchmark by actively selecting investments for the Fund with

varying maturities from the underlying components of the Benchmark. The Fund is

not an "index tracking" ETF and is not required to invest in all of the

components of the Benchmark. However, the Fund will generally seek to hold

similar instruments to those included in the Benchmark and seek exposure to

commodities, currencies and equity indexes included in the Benchmark.

The Fund is not sponsored, endorsed, sold or promoted by Morningstar.

Morningstar's only relationship to the Fund is the licensing of certain service

marks and service names of Morningstar and of the Benchmark, which is

determined, composed and calculated by Morningstar without regard to the Fund's

advisor or the Fund. Morningstar has no obligation to take the needs of the

Fund's advisor or the Fund into consideration in determining, composing or

calculating the Benchmark. The Benchmark seeks to reflect trends (in either

direction) in the commodity futures, currencies futures and financial futures

markets. The Benchmark is a fully collateralized futures index that includes

highly-liquid futures contracts in commodities, currencies and equity indexes.

However, the Fund is not obligated to invest in the same instruments included in

the Benchmark. There can be no assurance that the Fund's performance will exceed

the performance of the Benchmark at any time.

Under normal market conditions, the Fund through a wholly-owned subsidiary of

the Fund organized under the laws of the Cayman Islands (the "Subsidiary"),

invests in a portfolio of exchange-listed commodity futures, currency futures

and equity index futures (collectively, "Futures Instruments").

The Fund will not invest directly in Futures Instruments. The Fund expects to

gain exposure to these investments exclusively by investing in the Subsidiary.

The Subsidiary is advised by First Trust Advisors L.P., the Fund's advisor. The

Fund's investment in the Subsidiary is intended to provide the Fund with

exposure to commodity markets within the limits of current federal income tax

laws applicable to investment companies such as the Fund, which limit the

ability of investment companies to invest directly in Futures Instruments. The

Subsidiary has the same investment objective as the Fund, but unlike the Fund,

it may invest without limitation in Futures Instruments. Except as otherwise

noted, for purposes of this prospectus, references to the Fund's investments

include the Fund's indirect investments through the Subsidiary. The Fund will

invest up to 25% of its total assets in the Subsidiary. The Subsidiary's

investments provide the Fund with exposure to domestic and international

markets.

The Benchmark and the Subsidiary's holdings in futures contracts will consist

of, but are not limited to, commodities, equity indexes and currencies (Euro,

Japanese Yen, British Pound, Canadian Dollar, Australian Dollar and Swiss

Franc). The Subsidiary's exposure is generally weighted 50% in commodity

futures, 25% in equity futures and 25% in currency futures. The base weights are

typically rebalanced quarterly to maintain the 50%/25%/25% allocation.

The Fund through the Subsidiary attempts to capture the economic benefit derived

from rising and declining trends based on the "moving average" price changes of

commodity futures, currency futures and equity index futures. Each of the

Subsidiary's investments will generally be positioned long, short or flat based

on its price relative to its average price over a recent period, with the

ability to change positions as frequently as daily if the Benchmark is so

adjusted. As a result, the Fund may frequently trade commodity futures

contracts. To be "long" means to hold or be exposed to a security or instrument

with the expectation that its value will increase over time. To be "short" means

to sell or be exposed to a security or instrument with the expectation that it

will fall in value. To be "flat" means to move a position to cash. The Fund,

through the Subsidiary, will benefit if it has a long position in a security or

instrument that increases in value or a short position in a security or

instrument that decreases in value. Conversely, the Fund, through the

Subsidiary, will be adversely impacted if it holds a long position in a security

or instrument that decreases in value and a short position that increases in

value. The Fund through the Subsidiary may have a higher or lower exposure to

any sector or component within the Benchmark at any time.

The remainder of the Fund's assets will be invested in (1) short-term investment

grade fixed income securities that include U.S. government and agency

securities, sovereign debt obligations of non-U.S. countries and repurchase

agreements, (2) money market instruments, (3) ETFs and other investment

companies and (4) cash and other cash equivalents. The Fund uses fixed income

securities as investments and to collateralize the Subsidiary's commodity

exposure on a day-to-day basis. The Fund may also invest directly in ETFs and

other investment companies, including closed-end funds, that provide exposure to

commodities, equity securities and fixed income securities to the extent

permitted under the Investment Company Act of 1940, as amended (the "1940 Act").

The Fund may enter into repurchase agreements with counterparties that are

deemed to present acceptable credit risks. A repurchase agreement is a

transaction in which the Fund purchases securities or other obligations from a

bank or securities dealer and simultaneously commits to resell them to a

counterparty at an agreed-upon date or upon demand and at a price reflecting a

market rate of interest unrelated to the coupon rate or maturity of the

purchased obligations.

PRINCIPAL RISKS

You could lose money by investing in the Fund. An investment in the Fund is not

a deposit of a bank and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other governmental agency. There can be no

assurance that the Fund's investment objective will be achieved. The risks of

the Fund will result from both the Fund's direct investments and its indirect

investments made through the Subsidiary. Accordingly, the risks that result from

the Subsidiary's activities will be described herein as the Fund's risks.

BENCHMARK RISK. The Fund seeks to exceed the performance of the Benchmark. The

Benchmark is entirely model-based. As market dynamics shift over time, the model

may become outdated or inaccurate. The Benchmark and the Fund will take both

long and short positions and should not be used as proxies for taking long-only

positions. The Benchmark and the Fund could lose significant value during

periods when long-only indexes rise. Similarly, the Benchmark and the Fund are

not a substitute for short-only positions. The Benchmark is based on historical

price trends. There can be no assurance that such trends will be reflected in

future market movements. In markets without sustained price trends, or markets

with significant price movements that quickly reverse, the Benchmark and the

Fund may suffer significant losses. The Benchmark is based on the price of

futures contracts. Futures contracts reflect the expected future value of a

commodity, currency or equity index. The Benchmark and the Fund do not reflect

"spot" prices. Spot prices reflect immediate delivery value, not expected future

value.

CASH TRANSACTION RISK. Unlike most ETFs, the Fund currently intends to effect

most creations and redemptions, in whole or in part, for cash, rather than

in-kind, because of the nature of the Fund's underlying investments. As a

result, an investment in the Fund may be less tax efficient than an investment

in a more conventional ETF.

CLEARING BROKER RISK. The failure or bankruptcy of the Fund's and the

Subsidiary's clearing broker could result in a substantial loss of Fund assets.

Under current Commodity Futures Trading Commission ("CFTC") regulations, a

clearing broker maintains customers' assets in a bulk segregated account. If a

clearing broker fails to do so, or is unable to satisfy a substantial deficit in

a customer account, its other customers may be subject to risk of loss of their

funds in the event of that clearing broker's bankruptcy. In that event, the

clearing broker's customers, such as the Fund and the Subsidiary, are entitled

to recover, even in respect of property specifically traceable to them, only a

proportional share of all property available for distribution to all of that

clearing broker's customers.

COMMODITY RISK. The value of Futures Instruments typically is based upon the

price movements of a physical commodity or an economic variable linked to such

price movements. The prices of Futures Instruments may fluctuate quickly and

dramatically and may not correlate to price movements in other asset classes. An

active trading market may not exist for certain commodities. Each of these

factors and events could have a significant negative impact on the Fund.

COUNTERPARTY RISK. The Fund bears the risk that the counterparty to a commodity

derivative or other contract with a third party may default on its obligations

or otherwise fail to honor its obligations. If a counterparty defaults on its

payment obligations, the Fund will lose money and the value of an investment in

Fund shares may decrease. In addition, the Fund may engage in such investment

transactions with a limited number of counterparties.

CREDIT RISK. Credit risk is the risk that an issuer of a security will be unable

or unwilling to make dividend, interest and/or principal payments when due and

the related risk that the value of a security may decline because of concerns

about the issuer's ability to make such payments.

CURRENCY EXCHANGE RATE RISK. The Fund holds investments that are denominated in

non-U.S. currencies, or in securities that provide exposure to such currencies,

currency exchange rates or interest rates denominated in such currencies.

Changes in currency exchange rates and the relative value of non-U.S. currencies

will affect the value of the Fund's investment and the value of your Fund

shares. Currency exchange rates can be very volatile and can change quickly and

unpredictably. As a result, the value of an investment in the Fund may change

quickly and without warning and you may lose money.

ETF RISK. An ETF trades like common stock and represents a portfolio of

securities. The risks of owning an ETF generally reflect the risks of owning the

underlying securities, although lack of liquidity in an ETF could result in it

being more volatile and ETFs have management fees that increase their costs.

FOREIGN COMMODITY MARKETS RISK. The Fund, through the Subsidiary, will engage in

trading on commodity markets outside the United States on behalf of the Fund.

Trading on such markets is not regulated by any United States government agency

and may involve certain risks not applicable to trading on United States

exchanges. The Fund may not have the same access to certain trades as do various

other participants in foreign markets. Furthermore, as the Fund will determine

its net assets in United States dollars, with respect to trading in foreign

markets the Fund will be subject to the risk of fluctuations in the exchange

rate between the local currency and dollars as well as the possibility of

exchange controls. Certain futures contracts traded on foreign exchanges are

treated differently for federal income tax purposes than are domestic contracts.

FREQUENT TRADING RISK. The Fund regularly purchases and subsequently sells, i.e.

"rolls," individual commodity futures contracts throughout the year so as to

maintain a fully invested position. As the commodity contracts near their

expiration dates, the Fund rolls them over into new contracts. This frequent

trading of contracts may increase the amount of commissions or mark-ups to

broker-dealers that the Fund pays when it buys and sells contracts, which may

detract from the Fund's performance.

FUTURES RISK. The Fund invests in futures through the Subsidiary. All futures

and futures-related products are highly volatile. Price movements are influenced

by, among other things, changing supply and demand relationships; climate;

government agricultural, trade, fiscal, monetary and exchange control programs

and policies; national and international political and economic events; crop

diseases; the purchasing and marketing programs of different nations; and

changes in interest rates. In addition, governments from time to time intervene,

directly and by regulation, in certain markets, particularly those in

currencies.

GAP RISK. The Fund is subject to the risk that a commodity price will change

from one level to another with no trading in between. Usually such movements

occur when there are adverse news announcements, which can cause a commodity

price to drop substantially from the previous day's closing price.

INCOME RISK. Income from the Fund's fixed income investments could decline

during periods of falling interest rates.

INTEREST RATE RISK. Interest rate risk is the risk that the value of the

securities in the Fund will decline because of rising market interest rates.

Interest rate risk is generally lower for shorter term investments and higher

for longer term investments.

INVESTMENT COMPANIES RISK. The Fund may invest in securities of other investment

companies, including ETFs. As a shareholder in other investment companies, the

Fund will bear its ratable share of that investment company's expenses, and

would remain subject to payment of the Fund's advisory and administrative fees

with respect to assets so invested. In addition, the Fund will incur brokerage

costs when purchasing and selling shares of ETFs or other exchange-traded

investment companies.

ISSUER SPECIFIC RISK. Issuer specific events, including changes in the financial

condition of an issuer, can have a negative impact on the value of the Fund.

LIQUIDITY RISK. The Fund invests in Futures Instruments, which may be less

liquid than other types of investments. The illiquidity of Futures Instruments

could have a negative effect on the Fund's ability to achieve its investment

objective and may result in losses to Fund shareholders.

MANAGEMENT RISK. The Fund is subject to management risk because it is an

actively managed portfolio. The Advisor will apply investment techniques and

risk analyses in making investment decisions for the Fund, but there can be no

guarantee that the Fund will meet its investment objective.

MARKET RISK. The trading prices of commodities futures, fixed income securities

and other instruments fluctuate in response to a variety of factors. The Fund's

net asset value and market price may fluctuate significantly in response to

these factors. As a result, an investor could lose money over short or long

periods of time.

NEW FUND RISK. The Fund currently has fewer assets than larger funds, and like

other relatively new funds, large inflows and outflows may impact the Fund's

market exposure for limited periods of time. This impact may be positive or

negative, depending on the direction of market movement during the period

affected.

NON-CORRELATION RISK. The Fund's return may not correlate the return of the

Benchmark for a number of reasons. For example, the Fund incurs operating

expenses not applicable to the Benchmark, and may incur costs in buying and

selling securities, especially when rebalancing the Fund's portfolio holdings to

reflect changes in the composition of the Benchmark. In addition, the Fund's

portfolio holdings may not exactly replicate the securities included in the

Benchmark or the ratios between the securities included in the Benchmark.

NON-DIVERSIFICATION RISK. The Fund is classified as "non-diversified" under the

1940 Act. As a result, the Fund is only limited as to the percentage of its

assets that may be invested in the securities of any one issuer by the

diversification requirements imposed by the Internal Revenue Code of 1986, as

amended (the "Code"). The Fund may invest a relatively high percentage of its

assets in a limited number of issuers. As a result, the Fund may be more

susceptible to a single adverse economic or regulatory occurrence affecting one

or more of these issuers, experience increased volatility and be highly

concentrated in certain issuers.

NON-U.S. INVESTMENT RISK. The Fund may invest in commodity futures contracts

traded on non-U.S. exchanges. Transactions on non-U.S. exchanges or with

non-U.S. counterparties present risks because they may not subject to the same

degree of regulation as their U.S. counterparts.

PORTFOLIO TURNOVER RISK. The Fund's strategy may frequently involve buying and

selling portfolio securities to rebalance the Fund's exposure to various market

sectors. Higher portfolio turnover may result in the Fund paying higher levels

of transaction costs and generating greater tax liabilities for shareholders.

Portfolio turnover risk may cause the Fund's performance to be less than you

expect.

REGULATORY RISK. The CFTC has adopted amendments to CFTC Rule 4.5, which subject

the Fund and the Subsidiary to regulation by the CFTC and may impose additional

disclosure, reporting and recordkeeping rules on the Fund and the Subsidiary.

Compliance with these additional rules may increase Fund expenses. Certain of

the rules that would apply to the Fund and the Subsidiary have not yet been

adopted, and it is unclear what effect such rules would have on the Fund and the

Subsidiary if they are adopted. In addition, certain exchanges may limit the

maximum net long or net short speculative positions that a party may hold or

control in any particular futures or options contracts, and it is possible that

other regulatory authorities may adopt similar limits. Position limits are

currently the subject of disputes being resolved in the U.S. court system. The

Fund's investment decisions may need to be modified, and commodity contract

positions held by the Fund may have to be liquidated at disadvantageous times or

prices, to avoid exceeding any applicable position limits, potentially

subjecting the Fund to substantial losses. The regulation of commodity

transactions in the United States is a rapidly changing area of law and is

subject to ongoing modification by government, self-regulatory and judicial

action. The effect of any future regulatory change on the Fund is impossible to

predict, but could be substantial and adverse to the Fund.

REPURCHASE AGREEMENT RISK. The Fund's investment in repurchase agreements may be

subject to market and credit risk with respect to the collateral securing the

repurchase agreements. Investments in repurchase agreements also may be subject

to the risk that the market value of the underlying obligations may decline

prior to the expiration of the repurchase agreement term.

SHORT SALES RISK. The Fund may engage in "short sale" transactions. The Fund

will lose value if the security or instrument that is the subject of a short

sale increases in value. The Fund also may enter into a short derivative

position through a futures contracts, or short positions on currency futures. If

the price of the security or derivative that is the subject of a short sale

increases, then the Fund will incur a loss equal to the increase in price from

the time that the short sale was entered into plus any premiums and interest

paid to a third party in connection with the short sale. Therefore, short sales

involve the risk that losses may be exaggerated, potentially losing more money

than the actual cost of the investment. Also, there is the risk that the third

party to the short sale may fail to honor its contract terms, causing a loss to

the Fund.

SUBSIDIARY INVESTMENT RISK. Changes in the laws of the United States and/or the

Cayman Islands, under which the Fund and the Subsidiary are organized,

respectively, could result in the inability of the Fund to operate as intended

and could negatively affect the Fund and its shareholders. The Subsidiary is not

registered under the 1940 Act and is not subject to all the investor protections

of the 1940 Act. Thus, the Fund, as an investor in the Subsidiary, will not have

all the protections offered to investors in registered investment companies.

TAX RISK. The Fund intends to treat any income it may derive from Futures

Instruments (other than derivatives described in Revenue Rulings 2006-1 and

2006-31) received by the Subsidiary as "qualifying income" under the provisions

of the Internal Revenue Code of 1986, as amended, applicable to "regulated

investment companies" ("RICs"), based on a tax opinion received from special

counsel which was based, in part, on numerous private letter rulings ("PLRs")

provided to third parties not associated with the Fund or its affiliates (which

only those parties may rely on as precedent). Shareholders and potential

investors should be aware, however, that, in July 2011, the Internal Revenue

Service ("IRS") suspended the issuance of such PLRs pending its re-examination

of the policies underlying them, which was still ongoing at the date of this

prospectus. If, at the end of that re-examination, the IRS changes its position

with respect to the conclusions reached in those PLRs, then the Fund may be

required to restructure its investments to satisfy the qualifying income

requirement or might cease to qualify as a RIC.

If the Fund did not qualify as a RIC for any taxable year and certain relief

provisions were not available, the Fund's taxable income would be subject to tax

at the Fund level and to a further tax at the shareholder level when such income

is distributed. In such event, in order to re-qualify for taxation as a RIC, the

Fund might be required to recognize unrealized gains, pay substantial taxes and

interest and make certain distributions. This would cause investors to incur

higher tax liabilities than they otherwise would have incurred and would have a

negative impact on Fund returns. In such event, the Fund's Board of Trustees may

determine to reorganize or close the Fund or materially change the Fund's

investment objective and strategies.

In the event that the Fund fails to qualify as a RIC, the Fund will promptly

notify shareholders of the implications of that failure.

The Fund may invest a portion of its assets in equity repurchase agreements.

Recent changes in the law have the potential of changing the character and

source of such instruments potentially subjecting them to unexpected U.S.

taxation. Depending upon the terms of the contracts, the Fund may be required to

indemnify the counterparty for such increased tax.

U.S. GOVERNMENT AND AGENCY SECURITIES RISK. The Fund may invest in U.S.

government obligations. U.S. government obligations include U.S. Treasury

obligations and securities issued or guaranteed by various agencies of the U.S.

government or by various instrumentalities which have been established or

sponsored by the U.S. government. U.S. Treasury obligations are backed by the

"full faith and credit" of the U.S. government. Securities issued or guaranteed

by federal agencies and U.S. government sponsored instrumentalities may or may

not be backed by the full faith and credit of the U.S. government.

VOLATILITY RISK. The Fund seeks to exceed the performance of the Benchmark. The

Fund and Benchmark are designed to capture the long-term economic benefits of

rising or declining market trends. Frequent or significant short-term price

movements could adversely impact the performance of the Benchmark and the Fund.

In addition, the net asset value of the Fund over short-term periods may be more

volatile than other investment options because of the Fund's significant use of

financial instruments that have a leveraging effect. For example, because of the

low margin deposits required, futures trading involves an extremely high degree

of leverage and as a result, a relatively small price movement in a Futures

Instrument may result in immediate and substantial losses to the Fund.

WHIPSAW MARKETS RISK. The Fund may be subject to the forces of "whipsaw" markets

(as opposed to choppy or stable markets), in which significant price movements

develop but then repeatedly reverse, which could cause substantial losses to the

Subsidiary.

PERFORMANCE

The Fund has not yet commenced operations and, therefore, does not have a

performance history. Once available, the Fund's performance information will be

available on the Fund's website at www.ftportfolios.com.

MANAGEMENT

INVESTMENT ADVISOR

First Trust Advisors L.P. ("First Trust" or the "Advisor")

PORTFOLIO MANAGERS

The Fund's portfolio is managed by a team (the "Investment Committee"). The

Investment Committee consists of:

o John Gambla, CFA, FRM, PRM, Senior Portfolio Manager, Alternatives

Investment Team of First Trust;

o Rob A. Guttschow, CFA, Senior Portfolio Manager, Alternatives

Investment Team of First Trust;

o Daniel J. Lindquist, Chairman of the Investment Committee and Managing

Director of First Trust;

o Jon C. Erickson, Senior Vice President of First Trust;

o David G. McGarel, Chief Investment Officer and Managing Director of

First Trust;

o Roger F. Testin, Senior Vice President of First Trust;

o Todd Larson, CFA, Vice President, Fixed Income Portfolio Manager of

First Trust; and

o Timothy S. Henry, CFA, ETF Portfolio Manager of First Trust.

Each Investment Committee member has served as a part of the portfolio

management team of the Fund since inception.

PURCHASE AND SALE OF FUND SHARES

The Fund issues and redeems shares on a continuous basis, at net asset value,

only in Creation Units consisting of 50,000 shares. The Fund's Creation Units

are issued for securities in which the Fund invests and/or cash, and redeemed

for securities and/or cash. Individual shares may only be purchased and sold on

NYSE Arca through a broker-dealer and large institutional investors that have

entered into participation agreements. Shares of the Fund will trade on NYSE

Arca at market prices rather than net asset value, which may cause the shares to

trade at a price greater than net asset value (premium) or less than net asset

value (discount).

TAX INFORMATION

The Fund's distributions are taxable and will generally be taxed as ordinary

income or capital gains. Distributions on shares held in a tax deferred account,

while not immediately taxable, will be subject to tax when the shares are no

longer held in a tax deferred account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial

intermediary (such as a bank), First Trust and First Trust Portfolios L.P., the

Fund's distributor, may pay the intermediary for the sale of Fund shares and

related services. These payments may create a conflict of interest by

influencing the broker-dealer or other intermediary and your salesperson to

recommend the Fund over another investment. Ask your salesperson or visit your

financial intermediary's website for more information.

FMFSP0080213

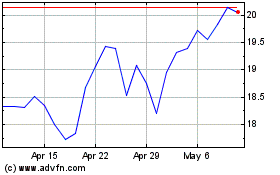

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Sep 2024 to Oct 2024

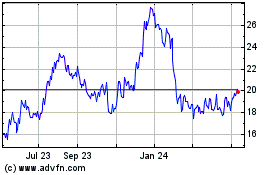

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Oct 2023 to Oct 2024