- BEN’s advanced and engaging consumer AI interfaces support

clients whose priority is to dramatically improve customer service

while driving efficiency in their operations.

- BEN’s human-like experience embeds advanced security,

trained with pre-ingested corporate and customer data, enabling

companies to quickly deploy AI technologies without the concerns of

utilizing Public LLM’s.

- BEN’s proprietary platform enables companies and industries

to expand and improve customer experience, with a focus on those

that have a significant workforce gap such as automotive,

healthcare and customer service.

- Patent portfolio spans conversational AI, sensory-data and

data security features that allow BEN’s AI to enhance

communications and the consumer’s ability to absorb

information.

- The transaction values BEN at a pro-forma enterprise value

and pro-forma equity value of approximately $358 million and $398

million, respectively.

- Any cash proceeds from the transaction are expected to

partially fund growth initiatives, accelerate go-to-market, scale

production and expand the portfolio of BEN’s core solutions through

product development and potential acquisitions.

- An associated investor presentation is available at

https://beninc.ai/investors

Brand Engagement Network (“BEN”), a provider of personalized

customer engagement AI technology and human-like AI avatars, and

DHC Acquisition Corp. (Nasdaq: DHCA) (“DHC”), a special purpose

acquisition company led by veteran technology investors

(“Sponsors”), today announced they have entered into a definitive

business combination agreement that is expected to result in the

combined company (the “Combined Company”) being listed on Nasdaq

under the symbol “BNAI”.

The proposed business combination (“Business Combination”) is

expected to provide BEN with improved access to new sources of

capital, accelerate M&A opportunities, and fund growth

initiatives and development of the core solution portfolio.

Michael Zacharski, CEO of BEN, said:

“The announcement today to agree to go public via this

combination with DHC represents a remarkable milestone in BEN’s

journey. BEN's Al systems bring a deeper level of comprehension,

empathy, and understanding to human-machine interactions. The

backbone of BEN’s success is a rich platform of conversational AI

modules that drive better, more personalized customer experience

and increased operational efficiencies. We expect this transaction,

in partnership with the remarkable team at DHC, to propel our

efforts globally and open a pathway for public investors to

participate in our important work.”

Chris Gaertner, Co-CEO & CFO of DHC, said:

“Our objective since founding DHC has been to both identify and

assist an innovative technology company in its transition to the

public markets, and we firmly believe that BEN is the right fit for

us and the current market backdrop. The impressive leadership team

at BEN has deep expertise in AI, a track record of scaling

disruptive technologies and is well-positioned for sustained

growth.”

BEN Investment Highlights

- Attractive demand backdrop for AI. Significant demand

for next generation AI-powered applications, as they provide

superior user experience relative to legacy solutions in areas

where there are limited resources.

- Enterprise ready AI platform. Enterprise hardened AI

application set optimizes costs and is ready for deployment.

Embedded features are designed to assist compliance and safety,

including by ingesting policies, contracts, master data, and

educational modules.

- Vertically-focused customer acquisition strategy. Early

industry targets include the automotive, healthcare and financial

services sectors. Certain of our early customers are also our

channel partners where BEN can leverage brand recognition and

reach.

- Large, fast growing addressable market. Benefitting from

macro and secular trends, the conversational AI technology market

is expected to grow to ~$30 billion by 2028.

- Patent portfolio. Our proprietary IP delivers “human

like” AI interaction through integrated perception, understanding

and response. Set of patents now includes 21 active patents and 19

patents pending worldwide.

- Industry leading talent. Senior leadership team

possesses decades of experience and successful track record of

M&A and integration.

Transaction Summary

The deal implies a pre-money equity value of $250 million for

BEN. Upon closing of the transaction, and assuming no stockholders

of DHC redeem their shares, BEN is estimated to have $40 million in

pro forma cash on balance sheet, consisting of $7 million in

anticipated new financing proceeds and $49 million in existing cash

(as of 6/30/2023), less $15 million in transaction fees. Existing

BEN shareholders are expected to roll 100% of their equity, and

will own ~63% of the fully diluted shares of the Combined

Company.

The transaction, which has been approved unanimously by the

Boards of Directors of both BEN and DHC, is subject to approval by

DHC’s stockholders and subject to other customary closing

conditions, including the receipt of certain regulatory approvals,

and is expected to close in the first quarter of 2024.

Additional information about the proposed transaction, including

a copy of the business combination agreement will be provided in a

Current Report on Form 8-K to be filed by DHC with the Securities

and Exchange Commission (“SEC”) and will be available at

www.sec.gov

Additional Information about the Transaction and Where to

Find It

In connection with the proposed Business Combination, DHC

intends to file a registration statement on Form S-4 (the

“Registration Statement”) with the SEC, which will include a proxy

statement/prospectus, that will be both the proxy statement to be

distributed to holders of DHC’s ordinary shares in connection with

DHC's solicitation of proxies for the vote by DHC’s shareholders

with respect to the Business Combination and other matters as may

be described in the Registration Statement, as well as the

prospectus relating to the offer and sale of the securities to be

issued to BEN shareholders in the Business Combination. After the

Registration Statement is declared effective, DHC will mail a

definitive proxy statement and other relevant documents to its

shareholders. DHC’s shareholders and other interested persons are

advised to read, when available, the preliminary proxy statement

included in the Registration Statement and the amendments thereto

and the definitive proxy statement, as these materials will contain

important information about BEN, DHC and the Business Combination.

The definitive proxy statement will be mailed to shareholders of

DHC as of a record date to be established for voting on the

Business Combination. Shareholders will also be able to obtain

copies of the proxy statement and other documents filed with the

SEC that will be incorporated by reference in the proxy statement,

without charge, once available, at the SEC’s web site at

www.sec.gov, or by directing a request to: DHC Acquisition Corp.,

1900 West Kirkwood Blvd, Suite 1400B, Southlake, TX 76092.

Participants in the Solicitation

DHC and its directors and executive officers may be deemed

participants in the solicitation of proxies from DHC’s shareholders

with respect to the Business Combination. A list of the names of

those directors and executive officers and a description of their

interests in DHC is contained in DHC’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, which was filed with

the SEC and is available free of charge at the SEC’s web site at

www.sec.gov, or by directing a request to DHC Acquisition Corp.,

1900 West Kirkwood Blvd, Suite 1400B, Southlake, TX 76092.

Additional information regarding the interests of such participants

will be contained in the proxy statement/prospectus for the

Business Combination when available. BEN and its directors and

executive officers may also be deemed to be participants in the

solicitation of proxies from the shareholders of DHC in connection

with the Business Combination. A list of the names of such

directors and executive officers and information regarding their

interests in the Business Combination will be included in the

Registration Statement when available.

Investor Presentation

A copy of the investor presentation can be found here:

https://beninc.ai/investors

Advisors

Cohen & Company Capital Markets, a division of J.V.B.

Financial Group, LLC (“CCM”), is serving as exclusive financial

advisor and lead capital markets advisor to DHC. Klehr Harrison

Harvey Branzburg LLP and Haynes & Boone, LLP are acting as

legal counsel to BEN. Cooley LLP is acting as legal counsel to DHC.

Evora Partners LLC is acting as advisor to DHC.

About BEN

BEN (Brand Engagement Network) is a leading provider of

conversational AI technology and human-like AI avatars

headquartered in Jackson, WY. BEN delivers highly personalized,

multi-modal (text, voice, and vision) AI engagement, with a focus

on industries where there is a massive workforce gap and an

opportunity to transform how consumers engage with networks,

providers, and brands. The backbone of BEN’s success is a rich

portfolio of conversational AI applications that drive better

customer experience, increased automation and operational

efficiencies. Powered by a proprietary large language model

developed based on years of research and development from leading

experts in AI and advanced security methodologies, BEN seeks to

partner with companies with complementary capabilities and networks

to enable meaningful business outcomes.

Additional information about BEN can be found here:

https://beninc.ai

About DHC Acquisition Corp.

DHC Acquisition Corp. (Nasdaq: DHCA) is a special purpose

acquisition company (SPAC) focused on partnering with an innovative

technology company. DHC’s mission is to invest in companies which

are charting the future of how humans and business interact at the

last mile, spanning enterprise infrastructure, industrial IoT,

automation, retail and E-commerce infrastructure, automotive, and

aerospace. We endeavour to enable the applications of innovative

technology and business models which bring goods, people, or

information to its final destination.

DHC’s approach to business is based on teamwork, integrity and

quiet professionalism, qualities we learned during our extensive

training in the military. We bring our unique hybrid experience and

our values into the corporate world, building high performing teams

in a range of specialized industries: technology, consumer,

aviation, defense, automotive, investment banking, capital markets,

and asset management. Our collective experience includes: >25

years as CEOs of public companies, 8 companies founded, 13

companies acquired, and >55 years in military leadership.

Forward Looking Statements

Certain statements made in this release are "forward looking

statements" within the meaning of the "safe harbor" provisions of

the United States Private Securities Litigation Reform Act of 1995.

When used in this press release, the words "estimates,"

"projected," "expects," "anticipates," "forecasts," "plans,"

"intends," "believes," "seeks," "may," "will," "should," "future,"

"propose" and variations of these words or similar expressions (or

the negative versions of such words or expressions) are intended to

identify forward-looking statements. These forward-looking

statements are not guarantees of future performance, conditions or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside DHC’s or BEN’s control, that could cause actual

results or outcomes to differ materially from those discussed in

the forward-looking statements. Important factors, among others,

that may affect actual results or outcomes include the inability to

complete the Business Combination; the inability to recognize the

anticipated benefits of the proposed Business Combination; the

inability to meet Nasdaq’s listing standards; costs related to the

Business Combination; BEN’s ability to manage growth; BEN’s ability

to execute its business plan; impact of BEN’s M&A activity,

including the resources required to complete acquisitions or any

resulting unanticipated losses, costs or liabilities; BEN’s ability

to compete in the global AI market; weak economic conditions or

prolonged economic uncertainties in the markets in which BEN

operates; potential litigation involving DHC or BEN; BEN’s ability

to adequately protect its intellectual property and general

economic and market conditions impacting demand for BEN’s products

and services. Other factors include the possibility that the

Business Combination does not close, including due to the failure

to receive required security holder approvals, or the failure of

other closing conditions. Neither DHC nor BEN undertakes any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Disclaimer

This release shall neither constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which the offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such jurisdiction.

Additional information and disclosures would be required for a more

complete understanding of BEN’s financial position and results of

operations as of, and for the fiscal year ended, December 31,

2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230907573011/en/

Investors: Ryan Flanagan, ICR

ryan.flanagan@icrinc.com

Media: Dan Brennan, ICR dan.brennan@icrinc.com

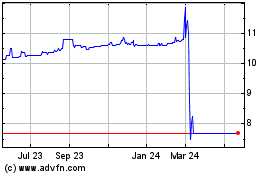

DHC Acquisition (NASDAQ:DHCA)

Historical Stock Chart

From Apr 2024 to May 2024

DHC Acquisition (NASDAQ:DHCA)

Historical Stock Chart

From May 2023 to May 2024