false

0000025895

0000025895

2024-08-13

2024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported): |

August 13, 2024 |

Crown Crafts, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

1-7604 |

58-0678148 |

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

| 916 South Burnside Avenue, Gonzales, LA |

70737 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code: |

(225) 647-9100 |

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

CRWS

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 14, 2024, Crown Crafts, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter of fiscal year 2025, which ended June 30, 2024. A copy of that press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02 and in Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. The information in this Item 2.02 and in Exhibit 99.1 attached hereto shall not be incorporated by reference into any registration statement or document pursuant to the Securities Act of 1933, as amended.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company was held on August 13, 2024 at the Company’s executive offices, located at 916 South Burnside Avenue, Third Floor, Gonzales, Louisiana. The following tables reflect the tabulation of the votes with respect to each proposal submitted to a vote of the Company’s stockholders at the Annual Meeting.

At the Annual Meeting, the Company’s stockholders:

| |

(i)

|

elected two Class II director nominees to the Company’s Board of Directors (the “Board”);

|

| |

(ii)

|

approved (on an advisory basis) the compensation of the Company’s named executive officers; and

|

| |

(iii)

|

ratified the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 30, 2025.

|

PROPOSAL 1: ELECTION OF DIRECTOR

To elect two Class II director to the Company’s Board of Directors (the “Board”) to serve until the Company’s Annual Meeting of Stockholders to be held in 2027 and until their successor is elected and qualified or until their earlier death, resignation or removal from office.

|

Nominee

|

For

|

Authority Withheld

|

Broker Non-Votes

|

|

Michael Benstock

|

4,528,267

|

263,426

|

2,781,940

|

|

Zenon S. Nie

|

4,193,687

|

598,006

|

2,781,940

|

PROPOSAL 2: APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

To approve, on an advisory basis, the compensation of the Company’s named executive officers.

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

4,480,769

|

205,577

|

105,347

|

2,781,940

|

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 30, 2025.

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

7,350,913

|

207,770

|

14,950

|

0

|

Item 9.01. Financial Statements and Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

CROWN CRAFTS, INC.

|

|

|

|

|

|

|

Date: August 14, 2024

|

/s/ Craig J. Demarest

|

|

|

|

CRAIG J. DEMAREST

|

|

|

|

Vice President and Chief Financial Officer

|

|

Exhibit 99.1

| For immediate release |

August 14, 2024 |

Crown Crafts Announces Financial Results for First Quarter Fiscal 2025

Gonzales, Louisiana – Crown Crafts, Inc. (NASDAQ-CM: CRWS) (the “Company”) today reported results for the first quarter of fiscal year 2025, which ended June 30, 2024.

First Quarter Summary

| |

●

|

Net sales of $16.2 million, compared with $17.1 million in the prior-year quarter

|

| |

●

|

Gross profit was 24.5% of net sales in the current quarter, 27.7% in the prior-year quarter

|

| |

●

|

Net loss of $322,000, or $0.03 per share

|

| |

●

|

Net loss includes expenses of approximately $244,000 ($193,000 after tax, or $0.02 per share) associated with the closure of the Company’s subsidiary in the United Kingdom, and approximately $116,000 ($90,000 after tax, or $0.01 per share) of costs associated with the acquisition of Baby Boom Consumer Products (“Baby Boom”)

|

Subsequent to the End of First Quarter

| |

●

|

Declared quarterly dividend of $0.08 per share of Series A common stock

|

“Our first quarter fiscal 2025 results were impacted by the prolonged inflationary pressures facing consumers limiting their discretionary income and certain nonroutine costs that resulted in a small loss for the quarter. We are encouraged by the performance of our bedding segment and we believe that our future holds many exciting opportunities," said Olivia Elliott, President and Chief Executive Officer. “Our acquisition of Manhattan Toy expanded our distribution channels, and we continue to receive positive feedback on the new product development by Manhattan Toy. We also are very excited about our recent acquisition of Baby Boom, which enhances our presence in the toddler bedding segment, and expands our product lineup with the addition of diaper bags. Baby Boom currently licenses some of the most popular brands and we expect the Baby Boom acquisition to be immediately accretive to earnings. Overall, we will continue our efforts to manage our cost structure in the near-term and to position our brands to capitalize when macroeconomic conditions improve.”

First Quarter Fiscal 2025 Results

Net sales for the first quarter of fiscal 2025 were $16.2 million, compared with $17.1 million in the prior-year quarter. The decline in sales is primarily due to a major retailer reducing inventory levels and the loss of a program at another major retailer.

Gross profit was 24.5% of net sales, compared with 27.7% in the first quarter of 2024. The reduction in gross profit relates to the timing of purchases, causing an unfavorable change in the absorption of costs into inventory. Marketing and administrative expenses were $4.3 million, compared with $4.0 million in the first quarter of the prior year. Fiscal 2025 includes $244,000 associated with the closure of the Company’s subsidiary in the United Kingdom and $116,000 in costs associated with the Baby Boom acquisition. Net loss for the quarter was $322,000, or $0.03 per share, compared with net income of $366,000, or $0.04 per diluted share in the prior-year quarter.

Quarterly Cash Dividend

The Company also announced that its Board of Directors declared a quarterly cash dividend on the Company’s Series A common stock of $0.08 per share, which will be paid on October 4, 2024 to stockholders of record at the close of business on September 13, 2024.

Conference Call

The Company will host a teleconference today at 8:00 a.m. Central Daylight Time to discuss the Company’s results, during which interested individuals will be given the opportunity to ask appropriate questions. To join the teleconference, dial (844) 861-5504 and ask to join the Crown Crafts call. The teleconference can also be accessed in listen-only mode by visiting the Company’s website at www.crowncrafts.com. The financial information to be discussed during the teleconference may be accessed prior to the call on the investor relations portion of the Company’s website. A telephone replay of the teleconference will be available one hour after the end of the call through 4:00 p.m. Central Daylight Time on November 15, 2024. To access the replay, dial (877) 344-7529 in the United States or (412) 317-0088 from international locations and enter replay access code 1632569.

About Crown Crafts, Inc.

Crown Crafts, Inc. designs, markets and distributes infant, toddler and juvenile consumer products. Founded in 1957, Crown Crafts is one of America’s largest producers of infant bedding, toddler bedding, bibs, toys and disposable products. The Company operates through its three-wholly owned subsidiaries, NoJo Baby & Kids, Inc. and Sassy Baby, Inc. and Manhattan Toy Europe Limited, which market a variety of infant, toddler and juvenile products under Company-owned trademarks, as well as licensed collections and exclusive private label programs. Sales are made directly to retailers such as mass merchants, large chain stores and juvenile specialty stores. For more information, visit the Company’s website at www.crowncrafts.com.

Forward-Looking Statements

The foregoing contains forward-looking statements within the meaning of the Securities Act of 1933, the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Such statements are based upon management’s current expectations, projections, estimates and assumptions. Words such as “expects,” “believes,” “anticipates” and variations of such words and similar expressions identify such forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause future results to differ materially from those suggested by the forward-looking statements. These risks include, among others, general economic conditions, including changes in interest rates, in the overall level of consumer spending and in the price of oil, cotton and other raw materials used in the Company’s products, changing competition, changes in the retail environment, the Company’s ability to successfully integrate newly acquired businesses, the level and pricing of future orders from the Company’s customers, the extent to which the Company’s business is concentrated in a small number of customers, the Company’s dependence upon third-party suppliers, including some located in foreign countries, customer acceptance of both new designs and newly-introduced product lines, actions of competitors that may impact the Company’s business, disruptions to transportation systems or shipping lanes used by the Company or its suppliers, and the Company’s dependence upon licenses from third parties. Reference is also made to the Company’s periodic filings with the Securities and Exchange Commission for additional factors that may impact the Company’s results of operations and financial condition. The Company does not undertake to update the forward-looking statements contained herein to conform to actual results or changes in our expectations, whether as a result of new information, future events or otherwise.

Contact:

Craig J. Demarest

Vice President and Chief Financial Officer

(225) 647-9118

cdemarest@crowncrafts.com

Investor Relations:

Three Part Advisors

Steven Hooser, Partner, or John Beisler, Managing Director

(817) 310-8776

CROWN CRAFTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

SELECTED FINANCIAL DATA

In thousands, except percentages and per share amounts

(Unaudited)

| |

|

Three-Month Periods Ended

|

|

| |

|

June 30, 2024

|

|

|

July 2, 2023

|

|

|

Net sales

|

|

$ |

16,212 |

|

|

$ |

17,123 |

|

|

Gross profit

|

|

|

3,966 |

|

|

|

4,742 |

|

|

Gross profit percentage

|

|

|

24.5 |

% |

|

|

27.7 |

% |

|

Marketing and administrative expenses

|

|

|

4,263 |

|

|

|

4,046 |

|

|

(Loss) Income from operations

|

|

|

(297 |

) |

|

|

696 |

|

|

(Loss) Income before income tax expense

|

|

|

(386 |

) |

|

|

506 |

|

|

Income tax expense

|

|

|

(64 |

) |

|

|

140 |

|

|

Net (loss) income

|

|

|

(322 |

) |

|

|

366 |

|

|

Basic (loss) earnings per share

|

|

$ |

(0.03 |

) |

|

$ |

0.04 |

|

|

Diluted (loss) earnings per share

|

|

$ |

(0.03 |

) |

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,311 |

|

|

|

10,154 |

|

|

Diluted

|

|

|

10,311 |

|

|

|

10,163 |

|

CONSOLIDATED BALANCE SHEETS

SELECTED FINANCIAL DATA

In thousands

| |

|

(Unaudited)

|

|

|

|

|

|

| |

|

June 30, 2024

|

|

|

March 31, 2024

|

|

|

Cash and cash equivalents

|

|

$ |

1,103 |

|

|

$ |

829 |

|

|

Accounts receivable, net of allowances

|

|

|

15,822 |

|

|

|

22,403 |

|

|

Inventories

|

|

|

30,610 |

|

|

|

29,709 |

|

|

Total current assets

|

|

|

49,037 |

|

|

|

54,824 |

|

|

Operating lease right of use assets

|

|

|

14,071 |

|

|

|

14,949 |

|

|

Finite-lived intangible assets - net

|

|

|

2,724 |

|

|

|

2,872 |

|

|

Goodwill

|

|

|

7,926 |

|

|

|

7,926 |

|

|

Total assets

|

|

$ |

76,359 |

|

|

$ |

82,706 |

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities, current

|

|

|

3,663 |

|

|

|

3,587 |

|

|

Total current liabilities

|

|

|

12,618 |

|

|

|

10,461 |

|

|

Long-term debt

|

|

|

1,466 |

|

|

|

8,112 |

|

|

Operating lease liabilities, noncurrent

|

|

|

11,217 |

|

|

|

12,138 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity

|

|

|

50,656 |

|

|

|

51,601 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

76,359 |

|

|

$ |

82,706 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Crown Crafts, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-7604

|

| Entity, Tax Identification Number |

58-0678148

|

| Entity, Address, Address Line One |

916 South Burnside Avenue

|

| Entity, Address, City or Town |

Gonzales

|

| Entity, Address, State or Province |

LA

|

| Entity, Address, Postal Zip Code |

70737

|

| City Area Code |

225

|

| Local Phone Number |

647-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CRWS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000025895

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

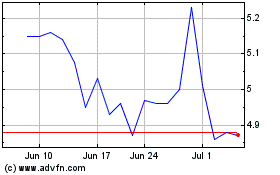

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Jul 2024 to Aug 2024

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Aug 2023 to Aug 2024