CorMedix Inc. Reports Fourth Quarter and Full Year 2020 Financial Results and Provides Business Update

March 30 2021 - 4:05PM

CorMedix Inc. (Nasdaq: CRMD), a biopharmaceutical company focused

on developing and commercializing therapeutic products for the

prevention and treatment of infectious and inflammatory disease,

today announced financial results for the fourth quarter and full

year ended December 31, 2020 and provided an update on recent

business developments.

Recent Corporate

Highlights:

- CorMedix announced in early March

2021 that the US Food and Drug Administration (FDA) cannot approve

the New Drug Application (NDA) for DefenCath in its present

form. FDA noted concerns at the third-party manufacturing

facility after a review of records requested by FDA and provided by

the manufacturing facility, and has requested a manual extraction

study to demonstrate that the labeled volume can be consistently

withdrawn from vials.

- CorMedix continues to work closely

with our third-party manufacturing facility and is planning for a

meeting with the FDA in mid-April to obtain agreement on the

adequacy of our proposed plans for resolution of the

deficiencies.

- CorMedix transitioned to Nasdaq in

early February 2021, which has become the primary trading platform

for biopharmaceutical peers and other growth companies.

- CorMedix has strengthened its

balance sheet via equity financing activity over the past year and

early 2021.

- CorMedix has been approved by the

New Jersey Economic Development Authority (NJEDA) to transfer

substantially all of the $1.3 million of its available tax benefits

to an unrelated, profitable New Jersey corporation pursuant to the

New Jersey Technology Business Tax Certificate Transfer (NOL)

program for State Fiscal Year 2020, for approximately $1.3 million

in net proceeds. Closing is anticipated in 2Q of 2021.

Khoso Baluch, CorMedix CEO commented, “While we

were disappointed that the DefenCath NDA was not approved at its

PDUFA date, we remain confident in our efforts to bring DefenCath

to hemodialysis patients as an important novel antimicrobial

catheter lock solution to reduce catheter related blood stream

infections in patients receiving hemodialysis via central venous

catheters. We believe we have the right team and resources to

accomplish this as we advance DefenCath closer to regulatory

approval.”

4th Quarter 2020 Financial

Highlights

For the fourth quarter of 2020, CorMedix

recorded a net loss of $6.1 million, or $0.19 per share, compared

with a net loss of $5.3 million, or $0.21 per share, in the fourth

quarter of 2019, an increase in net loss of $0.8 million. The

increase in net loss in the fourth quarter of 2020 compared with

2019 was primarily driven by increases in employee costs and market

research costs. Operating expenses during the fourth quarter

of 2020 were $6.1 million, compared with $5.4 million in the fourth

quarter of 2019, an increase of approximately $0.7

million.

Full Year 2020 Financial

Highlights

For the year ended December 31, 2020, CorMedix

recorded a net loss of $22.0 million, or $0.77 per share, compared

with a net loss during the year ended December 31, 2019 of $16.4

million before recognition of deemed dividends, or $0.68 per share,

an increase in net loss of $5.6 million. The increase in net loss

was driven primarily by increases in operating expenses.

Operating expenses during the year ended

December 31, 2020 amounted to $27.3 million compared with $20.9

million during the comparable period in 2019, an increase of $6.4

million, or 30%, due to a 21% increase in R&D expense and 41%

increase in SG&A expense.

Total cash on hand and short-term investments as

of December 31, 2020 amounted to $46.3 million, excluding

restricted cash of $0.2 million. The Company believes that,

based on the Company’s cash resources at year end plus the $41.5

million in net proceeds from ATM issuances since the beginning of

2021, it has sufficient resources to fund operations at least into

the second half of 2022.

Conference Call Information

The management team of CorMedix will host a

conference call and webcast today, March 30, 2021, at 4:30 PM

Eastern Time, to discuss recent corporate developments and

financial results. Call details and dial-in information is as

follows:

Tuesday, March 30th @ 4:30pm

ET Domestic: 877-423-9813 International: 201-689-8573

Conference ID: 13715664 Webcast: Webcast Link

About CorMedix

CorMedix Inc. is a biopharmaceutical company

focused on developing and commercializing therapeutic products for

the prevention and treatment of infectious and inflammatory

diseases. The Company is focused on developing its lead product

DefenCath™, a novel, antibacterial and antifungal solution designed

to prevent costly and life-threatening bloodstream infections

associated with the use of central venous catheters in patients

undergoing chronic hemodialysis. DefenCath has been designated by

FDA as Fast Track and as a Qualified Infectious Disease Product,

which provides an additional five years of marketing exclusivity,

which will be added to the five years granted to a New Chemical

Entity upon approval of the NDA. CorMedix also intends to develop

DefenCath as a catheter lock solution for use in oncology and total

parenteral nutrition patients. It is leveraging its taurolidine

technology to develop a pipeline of antimicrobial medical devices,

with programs in surgical sutures and meshes, and topical

hydrogels. The Company is also working with top-tier

researchers to develop taurolidine-based therapies for rare

pediatric cancers. Neutrolin® is CE Marked and marketed in

Europe and other territories as a medical device. For more

information, visit: www.cormedix.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that are subject to risks and uncertainties. All

statements, other than statements of historical facts, regarding

management’s expectations, beliefs, goals, plans or CorMedix’s

prospects, future financial position, financing plans, future

revenues and projected costs should be considered forward-looking.

Readers are cautioned that actual results may differ materially

from projections or estimates due to a variety of important

factors, including: the results of our discussions with the FDA

regarding the DefenCath development path for marketing

authorization; the resources needed to secure approval of the new

drug application for DefenCath from the FDA; the risks and

uncertainties associated with CorMedix’s ability to manage its

limited cash resources and the impact on current, planned or future

research, including the continued development of

DefenCath/Neutrolin and research for additional uses for

taurolidine; obtaining additional financing to support CorMedix’s

research and development and clinical activities and operations;

preclinical results are not indicative of success in clinical

trials and might not be replicated in any subsequent studies or

trials; and the ability to retain and hire necessary personnel to

staff our operations appropriately. We continue to assess to what

extent the uncertainty surrounding the Coronavirus pandemic may

impact our business and operations. These and other risks are

described in greater detail in CorMedix’s filings with the SEC,

copies of which are available free of charge at the SEC’s website

at www.sec.gov or upon request from CorMedix. CorMedix may not

actually achieve the goals or plans described in its

forward-looking statements, and investors should not place undue

reliance on these statements. CorMedix assumes no obligation and

does not intend to update these forward-looking statements, except

as required by law.

Investor Contact:Dan

FerryManaging DirectorLifeSci Advisors(617) 430-7576

CORMEDIX INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)(Audited)

|

|

|

For the Three Months Ended December 31, |

|

|

For the Years Ended December

31, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

55,713 |

|

|

$ |

24,779 |

|

|

$ |

239,231 |

|

|

$ |

283,266 |

|

|

Cost of sales |

|

(57,233 |

) |

|

|

(46,125 |

) |

|

|

(204,846 |

) |

|

|

(373,234 |

) |

|

Gross profit |

|

(1,520 |

) |

|

|

(21,346 |

) |

|

|

34,385 |

|

|

|

(89,968 |

) |

| Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

(2,294,430 |

) |

|

|

(2,677,007 |

) |

|

|

(13,377,193 |

) |

|

|

(11,052,903 |

) |

|

Selling, general and administrative |

|

(3,788,690 |

) |

|

|

(2,677,470 |

) |

|

|

(13,877,944 |

) |

|

|

(9,865,005 |

) |

|

Total Operating Expenses |

|

(6,083,120 |

) |

|

|

(5,354,477 |

) |

|

|

(27,255,137 |

) |

|

|

(20,917,908 |

) |

| Income (loss) From

Operations |

|

(6,084,640 |

) |

|

|

(5,375,823 |

) |

|

|

(27,220,752 |

) |

|

|

(21,007,876 |

) |

| Other Income

(Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

2,940 |

|

|

|

75,788 |

|

|

|

116,065 |

|

|

|

322,668 |

|

|

Foreign exchange transaction loss |

|

76 |

|

|

|

2,126 |

|

|

|

(59,165 |

) |

|

|

(21,156 |

) |

|

Change in fair value of derivative liability |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Interest and amortization expense |

|

(5,322 |

) |

|

|

(6,276 |

) |

|

|

(33,226 |

) |

|

|

(787,488 |

) |

|

Total Other Income (Expense) |

|

(2,306 |

) |

|

|

71,638 |

|

|

|

23,674 |

|

|

|

(485,976 |

) |

| Net Loss Before Income

Taxes |

|

(6,086,946 |

) |

|

|

(5,304,185 |

) |

|

|

(27,197,078 |

) |

|

|

(21,493,852 |

) |

|

Tax benefit |

|

- |

|

|

|

- |

|

|

|

5,169,395 |

|

|

|

5,060,778 |

|

| Net Loss |

|

(6,086,946 |

) |

|

|

(5,304,185 |

) |

|

|

(22,027,683 |

) |

|

|

(16,433,074 |

) |

|

Other Comprehensive Income (Loss) |

|

2,347 |

|

|

|

(4,745 |

) |

|

|

4,749 |

|

|

|

735 |

|

| Comprehensive Income

(Loss) |

$ |

(6,084,599 |

) |

|

$ |

(5,308,930 |

) |

|

$ |

(22,022,934 |

) |

|

$ |

(16,432,339 |

) |

| Net loss |

|

(6,086,946 |

) |

|

|

(5,304,185 |

) |

|

|

(22,027,683 |

) |

|

|

(16,433,074 |

) |

|

Deemed dividend as a result of warrant modification |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(369,500 |

) |

|

Deemed dividend as a result of exchange of convertible note and

Series C-2, Series D and Series F preferred stock, related

party |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(26,733,098 |

) |

| Net Loss Attributable to

Common Shareholders |

|

(6,086,946 |

) |

|

|

(5,304,185 |

) |

|

|

(22,027,683 |

) |

|

|

(43,535,672 |

) |

| Net Income (Loss) Per

Common Share – Basic and Diluted |

$ |

(0.19 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.77 |

) |

|

$ |

(1.80 |

) |

| Weighted Average Common

Shares Outstanding – Basic and Diluted |

|

32,402,336 |

|

|

|

25,665,619 |

|

|

|

28,561,963 |

|

|

|

24,152,088 |

|

CORMEDIX INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(Audited)

| |

|

December 31, |

|

|

|

December 31, |

|

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

| ASSETS |

|

|

|

|

| Cash, cash equivalents and

restricted cash |

$ |

42,096,783 |

|

|

$ |

16,525,187 |

|

| Short-term investments |

$ |

4,444,072 |

|

|

$ |

11,984,157 |

|

| Total

Assets |

$ |

49,308,303 |

|

|

$ |

29,475,910 |

|

| |

|

|

|

|

|

| Total

Liabilities |

$ |

5,085,291 |

|

|

$ |

5,829,650 |

|

| Accumulated deficit |

$ |

(217,448,855 |

) |

|

$ |

(195,421,172 |

) |

| Total Stockholders’

Equity |

$ |

44,223,012 |

|

|

$ |

23,646,260 |

|

CORMEDIX INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(Audited)

| |

|

Years Ended December 31, |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

| Cash Flows From

Operating Activities: |

|

|

|

| Net loss |

$ |

(22,027,683 |

) |

|

$ |

(16,433,074 |

) |

| Net cash used in operating

activities |

|

(21,967,638 |

) |

|

|

(15,052,024 |

) |

| Cash Flows Used In

Investing Activities: |

|

|

|

| Net cash used in (provided by)

investing activities |

|

7,426,176 |

|

|

|

(12,020,459 |

) |

| Cash Flows From

Financing Activities: |

|

|

|

| Net cash provided by financing

activities |

|

40,099,866 |

|

|

|

25,804,362 |

|

| Foreign exchange effects on

cash |

|

13,192 |

|

|

|

(2,015 |

) |

| Net Increase

(Decrease) in Cash and Cash Equivalents |

|

25,571,596 |

|

|

|

(1,270,136 |

) |

| Cash and Cash

Equivalents and Restricted Cash - Beginning of Period |

|

16,525,187 |

|

|

|

17,795,323 |

|

| Cash -and Cash

Equivalents and Restricted Cash - End of Period |

$ |

42,096,783 |

|

|

$ |

16,525,187 |

|

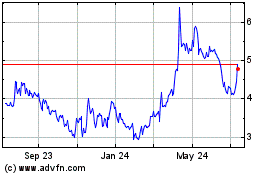

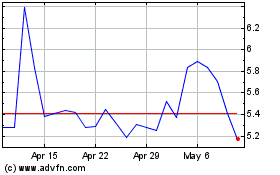

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Sep 2023 to Sep 2024