What's Going on with Tech Earnings? - Analyst Blog

April 17 2013 - 12:36PM

Zacks

Today's negative pre-announcement from Cirrus

Logic (CRUS) adds to the cloudy outlook for

Apple (AAPL). In many ways, Apple's problems are

very company-specific: a function of competitors are

finally catching up to it. Apple's smart-phones and tablets no

longer have the field to themselves. What this means is that

Apple's growth outlook is a lot less certain than was previously

believed.

We will know more about Apple's earnings picture as the company

reports Q1 results after the close on April 23rd. But the current

Zacks Consensus estimate for Q1 is down almost 14% in the last

three months and estimates for the coming quarters likely have more

room to come down. In terms of growth, Apple's total Q1 earnings

are expected to be down roughly -16% from the same period last

year.

The Key Trends

Apple's problems may be company specific, but plenty of its

hitherto high-flying Technology peers are faced with similar

earnings challenges. We saw in Intel's

(INTC) earnings report on Tuesday how the weak PC demand

picture is weighing on its outlook.

The situation isn't much different for other PC centric players

like Hewlett-Packard (HPQ), Dell

(DELL), Microsoft (MSFT) and Advanced

Micro Devices (AMD), to name just a few. Ironically, Apple

played a leading role in bringing the PC market to its knees.

Others are faced with different headwinds that lead to the same

earnigns challenges. Companies with advertizing based business

models like Google (GOOG),

Facebook (FB), Yahoo (YHOO) and

others are struggling with monetizing the secular shift from PC to

mobile devices. This platform shift has material consequences for

these companies' margins, as do the headwinds facing Apple and the

PC players.

Expectations for Q1

These trends are clearly visible in the aggregate earnings

expectations for the sector. And let's not forget, Technology is

the lagest earnigns contributor to the S&P 500. It's not

without basis to say that 'as goes Tech, so goes the S&P

500.' Total earnings for the sector are expected to be down

-8% from the same period last year, which is a big

contributor to the expected -1.6% decline for the S&P 500

as whole.

The revenue picture isn't that bad, with total sector

revenues in Q1 expected to be up +2.8%. And this spotlights the

margin problem we referred to earlier for the individual companies.

Net margins for the sector in Q1 are expected to be down more than

200 basis points from the same period last year and essentially

flat from the preceding quarter.

What About Beyond Q1?

In terms of earnigns, the first and third quarters are typically

the seasonally weak periods for the sector. As such, the

market may be willing to cut the Tech companies some

slack for a weak showing this reporting season. But a lot will

depend on how they guide towards the coming quarters, as

expectations for the coming quarters, particularly the second half

of the year, are for a resumption of strong growth.

Current consensus expectations are for total Tech

sector earnings to increase by +8% in the second half of the

year after declining by -5% in the first half. The second

half recovery is then expected to carry into 2014,

resulting total earnigns growth for the sector of +13.3%.

A big part of these second-half 2013 and full-year

2014 earnings recovery hopes rest on margin expansion. On a

quarterly basis, net margins for the sector peaked in 2012 Q3 and

have yet to get back to those levels.

On an annual basis, the sector's net margins have been

essentially flat since 2011, but are expected to make strong

gains later this year and next year

after contracting in the first half of 2013. Hard to

envision such margin gains given the multiple headwinds facing

them.

Putting It All Together

What all this boils down to is that earnings expectations

for the broader S&P 500 in general and the dominant Technology

sector in particulary remain elevated. I am not talking

about estimates for the currently underway first quarter of 2013,

but the coming quarters, particularly the second half of the year

and next year. Those estimates need to come down and they most

likely willl come down after we hear from management teams.

Tech stocks haven't been the leading stock market

performers this year, up +8.6% year to date vs. the +11.4% gain for

the S&P 500 in that same time period. It is perhaps

reasonable to expect this group to give back some of those gains in

the coming days.

APPLE INC (AAPL): Free Stock Analysis Report

ADV MICRO DEV (AMD): Free Stock Analysis Report

CIRRUS LOGIC (CRUS): Free Stock Analysis Report

DELL INC (DELL): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

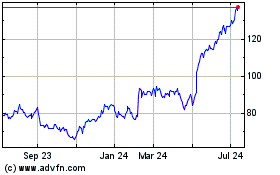

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

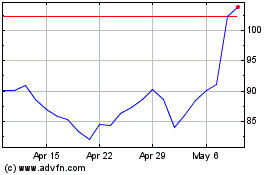

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024