UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-33107

CANADIAN SOLAR

INC.

545 Speedvale Avenue West, Guelph,

Ontario, Canada N1K 1E6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F þ

Form 40-F o

CANADIAN SOLAR INC.

Form 6-K

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CANADIAN SOLAR INC. |

| |

|

| |

By: |

/s/ Shawn (Xiaohua) Qu |

| |

Name: |

Shawn (Xiaohua) Qu |

| |

Title: |

Chairman and Chief Executive Officer |

Date: June 20, 2024

EXHIBIT INDEX

Exhibit 99.1 — Recurrent Energy Closes $513 Million in Financing for 1,200 MWh Energy Storage Project in Arizona

Exhibit 99.1

Recurrent Energy Closes $513

Million in Financing for 1,200 MWh Energy Storage Project in Arizona

Papago Storage, the largest

energy storage project in Arizona, holds a 20-year tolling agreement with Arizona Public Service Company.

GUELPH, ON, June

20, 2024 — Recurrent Energy, a subsidiary of Canadian Solar Inc.

("Canadian Solar") (NASDAQ: CSIQ) and a global developer , owner, and operator of solar and energy storage assets, today

announced it has secured $513 million in project financing for its landmark Papago Storage project located in Maricopa County,

Arizona. Construction of the 1,200 MWh Papago Storage is slated to commence in the third quarter of 2024, with commercial operations

expected to begin in the second quarter of 2025. The project holds a 20-year tolling agreement with Arizona Public Service Company

and is expected to create 200 jobs during construction.

Following construction,

Recurrent Energy will own and operate Papago Storage. The project will dispatch enough power for approximately 244,000 homes for four

hours daily, enabling renewable energy to further power Arizona’s growing economy.

MUFG and Nord/LB acted

as coordinating lead arrangers for the Papago Storage project financing. The financing includes a $249 million construction and term loan,

a $163 million tax equity bridge loan, and a $101 million letter of credit facility. Joint lead arrangers for the transaction included

Bank of America, CoBank, DNB, Rabobank, Siemens, and Zions.

Fred Zelaya, Managing

Director of MUFG, commented, “MUFG is pleased to have supported Recurrent Energy on this important project, which will contribute

to the transition to a low-carbon economy. This transaction showcases MUFG's expertise and leadership in financing renewable energy and

energy storage projects across the U.S. and globally. We look forward to collaborating with Recurrent Energy on future developments.”

Sondra Martinez, Managing

Director of Nord/LB, said, “Nord/LB is pleased to have acted as a coordinating lead arranger (CLA) for the successful closing

of Recurrent Energy’s latest landmark project. Papago Storage marks Nord/LB’s 11th standalone storage project in the U.S.,

and we are excited to take lead in financing strategic battery storage assets, supporting the energy transition and mission to achieve

a more reliable, carbon-free grid. We look forward to continuing to support Recurrent Energy’s ambitious growth in the industry.”

Ismael Guerrero,

CEO of Recurrent Energy, added, “When we began developing Papago Storage in 2016, the Arizona storage market was in its infancy.

Today, Arizona is one of the fastest-growing markets for energy storage in the United States, bolstered by the state’s expanding

economy and cost-effective renewable energy resources. Today, we are thrilled to see nearly a decade of planning culminate in the financing

of what will be the largest energy storage project in Arizona. We appreciate the continued support from our partners Nord/LB and MUFG

in our shared mission to advance the clean energy transition.”

recurrentenergy.com

Recurrent Energy is a

leader in solar and energy storage project development. To date, Recurrent Energy has delivered more than 10 GWp of solar power projects

and 3.3 GWh of energy storage projects, boasting a global project development pipeline of 26 GWp and 56 GWh for solar and energy storage

respectively. In North America, Recurrent Energy is actively developing a pipeline of 6.3 GWp of solar projects and 18.9 GWh of battery

energy storage projects.

About Recurrent Energy

Recurrent Energy is one of the world’s largest and most geographically diversified utility-scale solar and energy storage

project development, ownership and operations platforms, with an industry-leading team of in-house energy experts. Recurrent Energy is

a subsidiary of Canadian Solar Inc. Additional details are available at www.recurrentenergy.com.

About Canadian Solar Inc.

Canadian Solar was founded in 2001 in Canada and is one of the world’s largest solar technology and renewable energy companies.

It is a leading manufacturer of solar photovoltaic modules, provider of solar energy and battery energy storage solutions, and developer

of utility-scale solar power and battery energy storage projects with a geographically diversified pipeline in various stages of development.

Over the past 23 years, Canadian Solar has successfully delivered over 125 GW of premium-quality, solar photovoltaic modules to customers

across the world. Likewise, since entering the project development business in 2010, Canadian Solar has developed, built, and connected

over 10 GWp of solar power projects and 3.3 GWh of battery energy storage projects across the world. Currently, the Company has over 1.2

GWp of solar power projects in operation, 6.5 GWp of projects under construction or in backlog (late-stage), and an additional 19.8 GWp

of projects in advanced and early-stage pipeline. In addition, the Company has 600 MWh of battery energy storage projects in operation

and a total battery energy storage project development pipeline of around 56 GWh, including approximately 4.3 GWh under construction or

in backlog, and an additional 51.6 GWh at advanced and early-stage development. Canadian Solar is one of the most bankable companies in

the solar and renewable energy industry, having been publicly listed on the NASDAQ since 2006. For additional information about the

Company, follow Canadian Solar on LinkedIn or visit www.canadiansolar.com.

Safe Harbor/Forward-Looking Statements

Certain statements in this press release are forward-looking

statements that involve a number of risks and uncertainties that could cause actual results to differ materially. These statements are

made under the "Safe Harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by such terms as "believes," "expects," "anticipates," "intends,"

"estimates," the negative of these terms, or other comparable terminology. Factors that could cause actual results to differ

include general business, regulatory and economic conditions and the state of the solar and battery storage market and industry; geopolitical

tensions and conflicts, including impasses, sanctions and export controls; volatility, uncertainty, delays and disruptions related to

the COVID-19 pandemic; supply chain disruptions; governmental support for the deployment of solar power; future available supplies of

high-purity silicon; demand for end-use products by consumers and inventory levels of such products in the supply chain; changes in demand

from significant customers; changes in demand from major markets, such as Japan, the U.S., China, Brazil and Europe; changes in effective

tax rates; changes in customer order patterns; changes in product mix; changes in corporate responsibility, especially environmental,

social and governance ("ESG") requirements; capacity utilization; level of competition; pricing pressure and declines in or

failure to timely adjust average selling prices; delays in new product introduction; delays in utility-scale project approval process;

delays in utility-scale project construction; delays in the completion of project sales; continued success in technological innovations

and delivery of products with the features that customers demand; shortage in supply of materials or capacity requirements; availability

of financing; exchange and inflation rate fluctuations; litigation and other risks as described in Canadian Solar’s filings with

the Securities and Exchange Commission, including its annual report on Form 20-F filed on April 26, 2024. Although Canadian Solar and

Recurrent Energy believe that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future

results, level of activity, performance, or achievements. Investors should not place undue reliance on these forward-looking statements.

All information provided in this press release is as of today's date, unless otherwise stated, and Canadian Solar and Recurrent Energy

undertake no duty to update such information, except as required under applicable law.

recurrentenergy.com

Canadian Solar Inc. Investor Relations

Contact

Wina Huang

Investor Relations

Canadian Solar Inc.

investor@canadiansolar.com

Recurrent Energy Media Contact

Inés Arrimadas

Recurrent Energy

comms@recurrentenergy.com

Ally Copple

Innovant Public Relations

713-201-8800

Ally@InnovantPR.com

recurrentenergy.com

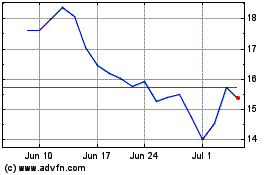

Canadian Solar (NASDAQ:CSIQ)

Historical Stock Chart

From May 2024 to Jun 2024

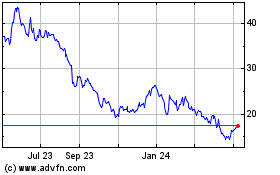

Canadian Solar (NASDAQ:CSIQ)

Historical Stock Chart

From Jun 2023 to Jun 2024