Filed by BurTech Acquisition Corp. pursuant to

Rule 425 under the Securities Act

of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934, as amended.

Subject Company: BurTech Acquisition Corp.

Commission File No. 001-41139

The following contains communications

Blaize, Inc. (“Blaize”) made to its employees via email on December 22, 2023.

What is a SPAC, and why are

we doing a SPAC?

A special purpose

acquisition company (SPAC) is a company with no commercial operations formed strictly to raise capital through an initial

public offering (IPO) to combine with an existing company -- in our case, BurTech Acquisition

Corp. (NASDAQ: BRKH) (“BurTech”) is the publicly traded SPAC that is combining with Blaize for us to reach the public markets.

By merging with BurTech, we will

be better able to continue to grow our business rapidly. We believe working with a SPAC as a vehicle to enter the public markets is a

streamlined and efficient way to build upon the story of Blaize’s success, brand power, and ongoing potential as we work to ncrease

investment in our proprietary full-stack edge AI solutions to grow both our existing and new markets.

Can I tell others about this

news?

We’re glad you’re

excited and enthusiastic about this news - it’s a big moment for Blaize! That said, there are a lot of eyes on our company at the

moment and there’s a lot we just can’t share as widely as we’d like.

You can confirm

to others, including a prospect or a customer, that our intent to has been announced by the company, but we ask that you refrain from

talking about the news further in person or on your social media. If anyone asks any additional questions, direct them to IR@blaize.com.

As always, anything said in internal discussions or emails (including this one), and any developments with our business, should be kept

strictly confidential unless and until we make the announcement as a company. As we transition to being a public company, this will be

of even greater importance, both for you individually and for us as company. We will follow up with more training on this in the weeks

to come.

If I get a call or meet someone

from the media that knows that I work at Blaize and they ask about the merger, what should I tell them?

You should have

no conversations with the media. Please direct all media inquiries to info@blaize.com, which

is our current policy. Any other response from you could jeopardize yourself and Blaize with the SEC.

Are we going public? Why now?

Announcing the merger

is a major step towards going public. We have reached a scale and business that has created significant value and one that we believe

will be very attractive to public investors once the transaction has closed.

When specifically will we merge?

Though we can’t

provide you with a specific date, we expect that the transaction will close and Blaize will be a publicly traded company in the second

quarter of 2024, and we will keep you apprised as things develop. Closing of the transaction is subject to approval by BurTech’s

and Blaize’s stockholders and the satisfaction of other customary closing conditions.

What does this mean for me?

This doesn’t change

your job. Now more than ever it’s critically important that everyone remain focused on delivering the superior products and platform

Blaize has always been committed to.

What are the rules?

We have to be careful

what we say and don’t say about our Company and products.

The quick summary

- you CAN’T disclose confidential or proprietary information about Blaize and its products that we haven’t already publicly

announced - so financial information, M&A, product roadmaps, or any information that a reasonable person could consider important

in making an investment decision.

This also means

that whether you’re at a BBQ with family and friends, or out and about around town, you need to ensure you aren’t discussing

confidential business matters.

Filed by BurTech Acquisition Corp. pursuant to

Rule 425 under the Securities Act

of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934, as amended.

Subject Company: BurTech Acquisition Corp.

Commission File No. 001-41139

Can we buy stock in BurTech

Acquisition Corp. while we are waiting to complete the merger and become public?

Due to securities

law considerations, you and your family members should not buy shares of the SPAC (either directly or through someone doing it on your

behalf) right now.

What about our

culture?

Culture is constantly

evolving. But our values will not change. We will continue to be all about openness, integrity, trust, excellence, simplicity, ownership,

and customer experience. And just because we are going public doesn’t mean everyone has to come to work uptight and miserable. We’re

not changing, and we hope you don’t either.

What if I have

a question? Who should I go to?

If you have a question,

check with your manager first. They can get more details from our investor relations, legal, or public relations teams if they don't have

the answer.

No Offer or Solicitation

This communication is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and does not

constitute an offer to sell or a solicitation of an offer to buy any securities of BurTech or Blaize, nor shall there be any sale of any

such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act.

Additional Information and Where to Find It

In connection with the Business Combination,

BurTech intends to file with the SEC a Registration Statement on Form S-4 with the U.S. Securities and Exchange Commission (“SEC”),

which will include a preliminary prospectus and proxy statement of BurTech in connection with the Business Combination, referred to as

a proxy statement/prospectus (the “Registration Statement”), and after the Registration Statement is declared effective, BurTech

will mail a definitive proxy statement/prospectus relating to the Business Combination to its stockholders. This communication does not

contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any

investment decision or any other decision in respect of the Business Combination. BurTech may file other documents regarding the Business

Combination with the SEC, and BurTech’s stockholders and other interested persons are advised to read, when available, the preliminary

proxy statement/prospectus and the amendments thereto, the definitive proxy statement/prospectus and the other documents filed in connection

with the Business Combination, as these materials will contain important information about Blaize, BurTech and the Business Combination.

When available, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to

stockholders of BurTech as of a record date to be established for voting on the Business Combination and the other matters to be voted

upon at a meeting of BurTech’s stockholders to be held to approve the Business Combination and such other matters. Such stockholders

will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other

documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to

BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson, Chief Financial Officer.

Filed by BurTech Acquisition Corp. pursuant to

Rule 425 under the Securities Act

of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934, as amended.

Subject Company: BurTech Acquisition Corp.

Commission File No. 001-41139

Before making any voting decision, investors

and security holders of BurTech are urged to read the registration statement, the proxy statement/prospectus, and amendments thereto,

and the definitive proxy statement/prospectus in connection with BurTech’s solicitation of proxies for its stockholders’ meeting

to be held to approve the Business Combination, and all other relevant documents filed or that will be filed with the SEC in connection

with the Business Combination as they become available because they will contain important information about BurTech, Blaize and the Business

Combination.

Participants in Solicitation

BurTech, Blaize, and their respective directors,

executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation

of proxies from BurTech’s stockholders in connection with the Business Combination. Information regarding the persons who may, under

SEC rules, be deemed participants in the solicitation of BurTech’s stockholders in connection with the Business Combination, including

the names of such persons and a description of their respective interests, is set forth in BurTech’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information regarding the interests of those persons and other

persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement regarding

the proposed business combination when it becomes available. Stockholders will be able to obtain copies of the documents described in

this paragraph that are filed with the SEC, once available, without charge at the SEC’s website at www.sec.gov, or by directing

a request to BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson, Chief Financial

Officer.

Filed by BurTech Acquisition Corp. pursuant to

Rule 425 under the Securities Act

of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934, as amended.

Subject Company: BurTech Acquisition Corp.

Commission File No. 001-41139

Forward-Looking Statements Legend

This communication contains forward-looking statements

within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of

the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on beliefs and assumptions and on

information currently available to BurTech and Blaize. In some cases, you can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural

of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking

statements contain these words. Forward-looking statements are predictions, projections and other statements about future events that

are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that

the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of BurTech’s securities;

(ii) the risk that the Business Combination may not be completed by BurTech’s business combination deadline and the potential failure

to obtain an extension of the business combination deadline if sought by BurTech; (iii) the failure to satisfy the conditions to the consummation

of the Business Combination, including the approval of the Business Combination by BurTech’s stockholders, the satisfaction of the

minimum aggregate transaction proceeds amount following redemptions by BurTech’s public stockholders and the receipt of certain

governmental and regulatory approvals; (iv) the failure to obtain financing to complete the Business Combination and to support the future

working capital needs of Blaize and the combined company; (v) the effect of the announcement or pendency of the Business Combination on

Blaize’s business relationships, performance, and business generally; (vi) risks that the Business Combination disrupts current

plans of Blaize and potential difficulties in the retention of Blaize as a result of the Business Combination; (vii) the outcome of any

legal proceedings that may be instituted against BurTech or Blaize related to the Merger Agreement and the Business Combination; (viii)

changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations

or as a condition to obtaining regulatory approval of the Business Combination; (ix) the ability to maintain the listing of BurTech’s

securities on Nasdaq; (x) the price of BurTech’s securities, including volatility resulting from changes in the competitive and

highly regulated industries in which Blaize operates, variations in performance across competitors, changes in laws and regulations affecting

Blaize’s business and changes in the combined capital structure; (xi) the ability to implement business plans, forecasts, and other

expectations after the completion of the Business Combination, including the possibility of cost overruns or unanticipated expenses in

development programs, and the ability to identify and realize additional opportunities; (xii) the enforceability of Blaize’s intellectual

property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or

potential breaches of data security; (xiii) the incurrence of significant expenses to remediate, or damage to Blaize’s reputation

as a result of, any defects in Blaize’s products; and (xiv) other risks and uncertainties set forth in the section entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements” in BurTech’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on the website of the Securities and Exchange Commission

(the “SEC”) at www.sec.gov and other documents filed, or to be filed with the SEC by BurTech, including the Registration Statement.

The foregoing list of factors is not exhaustive. There may be additional risks that neither BurTech nor Blaize presently know or that

BurTech or Blaize currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the definitive

proxy statement to be filed by BurTech with the SEC, including those under “Risk Factors” therein, and other documents filed

by BurTech from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and BurTech and Blaize

assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. Neither BurTech nor Blaize gives any assurance that either BurTech or Blaize will

achieve its expectations.

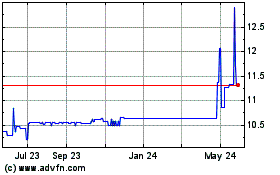

BurTech Acquisition (NASDAQ:BRKHU)

Historical Stock Chart

From Oct 2024 to Nov 2024

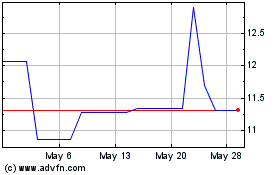

BurTech Acquisition (NASDAQ:BRKHU)

Historical Stock Chart

From Nov 2023 to Nov 2024