Blackbaud, Inc. (the "Company") (NASDAQ:BLKB), the leading provider

of software and services for the global philanthropic

community, today announced financial results for its first quarter

ended March 31, 2016.

"The philanthropic market remains very strong

and the success we're seeing across the portfolio positions us well

for future growth,” said Mike Gianoni, Blackbaud's president and

CEO. "The market is excited about our next generation solutions and

we're just beginning to tap the extraordinary opportunity in the

cloud with Blackbaud SKYTM."

First Quarter 2016

Total revenue was $169.3 million, up 15.1% from

one year ago, with $134.0 million in recurring revenue,

representing 79.2% of total revenue. Income from operations

increased 30.3% to $10.4 million, with operating margin increasing

70 basis points to 6.2%. Net income increased 16.6% to $5.0

million, with diluted earnings per share up $0.02 to $0.11.

- Total non-GAAP revenue was $171.0 million, up from $150.5

million one year ago, an increase of 13.6%, and an increase of 8.6%

on an organic basis adjusted for constant currency.

- Non-GAAP recurring revenue was $135.8 million, up from $114.7

million one year ago, an increase of 18.4%, and an increase of

10.3% on an organic basis adjusted for constant currency.

- Non-GAAP recurring revenue was 79.4% of total non-GAAP revenue,

highest in the Company's history.

- Non-GAAP income from operations was $31.6 million, up from

$26.5 million one year ago, an increase of 19.3%. Non-GAAP

operating margin was 18.5%, up from 17.6% one year ago.

- Non-GAAP net income was $19.6 million, up from $14.9 million

one year ago and an increase of 31.0%. Non-GAAP diluted earnings

per share was $0.42, up from $0.32 one year ago.

- Cash flow from operations was $0.1 million, down from $4.2

million one year ago.

- Blackbaud SKY now powers six next generation solutions and has

delivered nearly 1,000 rapid updates to highly satisfied customers

just six months after its debut. See press release.

- SKY UXTM is now generally available to customers, partners, and

developers.

- Independent commissioned Total Economic ImpactTM (TEI) studies,

conducted by Forrester Consulting, highlighted the tremendous

benefits delivered by Blackbaud fundraising solutions Raiser's Edge

NXTTM and Blackbaud CRMTM.

"The first quarter was a solid start to the

year," said Tony Boor, Blackbaud's executive vice president and

CFO. "We executed well against our strategic plan, keeping us on

track to accelerate revenue growth, improve profitability and

achieve our full year guidance."

Dividend

Blackbaud announced today that its Board of

Directors has declared a second quarter 2016 dividend of $0.12 per

share payable on June 15, 2016 to stockholders of record on

May 27, 2016.

Financial Outlook

No change from the full year financial guidance

issued February 2016.

- Non-GAAP revenue of $725.0 million to $740.0 million

- Non-GAAP income from operations of $141.0 million to $147.0

million

- Non-GAAP operating margin of 19.4% to 19.9%

- Non-GAAP diluted earnings per share of $1.90 to $1.98

- Cash flow from operations of $145.0 million to $155.0

million

Conference Call Details

| What: |

|

Blackbaud's

Fiscal 2016 First Quarter Conference Call |

| When: |

|

April

28 |

| Time: |

|

8:00 a.m.

(Eastern Time) |

| Live Call: |

|

1-800-862-9098 (domestic) or 1-785-424-1051 (international);

passcode 150739. |

| Webcast: |

|

www.blackbaud.com/investorrelations |

| |

|

|

About Blackbaud

Serving the worldwide philanthropic community

for more than 35 years, Blackbaud (NASDAQ:BLKB) combines innovative

software and services, and expertise to help organizations

achieve their missions. Blackbaud works in over 60 countries

to power the passions of approximately 35,000 customers, including

nonprofits, K-12 private and higher education institutions,

healthcare organizations, foundations and other charitable

giving entities, and corporations. The company offers a

full spectrum of cloud and on-premises solutions, as well as a

resource network that empowers and connects organizations of all

sizes. Blackbaud's portfolio of software and services

support nonprofit fundraising and relationship management,

digital marketing, advocacy, accounting, payments and analytics, as

well as grant management, corporate social responsibility, and

education. Organizations use Blackbaud technology to raise, invest,

manage, and award more than $100 billion each year. Recognized as a

top company, Blackbaud is headquartered in Charleston, South

Carolina and has operations in the United States, Australia,

Canada, Ireland, and the United Kingdom. For more information,

visit www.blackbaud.com.

Forward-looking Statements

Except for historical information, all of the

statements, expectations, and assumptions contained in this news

release are forward-looking statements which are subject to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995, including, but not limited to, statements regarding:

expectations that our revenue will continue to grow and that our

operating margins will continue to improve, expectations that we

will achieve our projected 2016 full year financial guidance and

expectations that effectively managing our capital structure will

allow us to seize compelling opportunities that accelerate our

shift to the cloud and are accretive to our financial performance.

These statements involve a number of risks and uncertainties.

Although Blackbaud attempts to be accurate in making these

forward-looking statements, it is possible that future

circumstances might differ from the assumptions on which such

statements are based. In addition, other important factors that

could cause results to differ materially include the following:

management of integration of acquired companies; uncertainty

regarding increased business and renewals from existing customers;

a shifting revenue mix that may impact gross margin; continued

success in sales growth; risks related to our dividend policy and

stock repurchase program, including the possibility that we might

discontinue payment of dividends; and the other risk factors set

forth from time to time in the SEC filings for Blackbaud, copies of

which are available free of charge at the SEC’s website at

www.sec.gov or upon request from Blackbaud's investor relations

department. Blackbaud assumes no obligation and does not intend to

update these forward-looking statements, except as required by law.

All Blackbaud product names appearing herein are trademarks or

registered trademarks of Blackbaud, Inc.

Non-GAAP Financial Measures

Blackbaud has provided in this release financial

information that has not been prepared in accordance with GAAP.

This information includes non-GAAP revenue, non-GAAP recurring

revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP

income from operations, non-GAAP operating margin, non-GAAP net

income and non-GAAP diluted earnings per share. The Company has

acquired businesses whose net tangible assets include deferred

revenue. In accordance with GAAP reporting requirements, the

Company recorded write-downs of deferred revenue to fair value,

which resulted in lower recognized revenue. Both on a quarterly and

year-to-date basis, the revenue for the acquired businesses is

deferred and typically recognized over a one-year period, so

Blackbaud's GAAP revenues for the one-year period after the

acquisitions will not reflect the full amount of revenues that

would have been reported if the acquired deferred revenue was not

written down to fair value. The non-GAAP measures described above

reverse the acquisition-related deferred revenue write-downs so

that the full amount of revenue booked by the acquired companies is

included, which the Company believes provides a more accurate

representation of a revenue run-rate in a given period. In addition

to reversing write-downs of acquisition-related deferred revenue,

non-GAAP financial measures discussed above exclude the impact of

certain items that Blackbaud believes are not directly related to

its performance in any particular period, but are for its long-term

benefit over multiple periods.

In addition, Blackbaud discusses non-GAAP

organic revenue growth, non-GAAP organic revenue growth on a

constant currency basis and non-GAAP organic recurring revenue

growth, which it believes provides useful information for

evaluating the periodic growth of its business on a consistent

basis. Each of these measures of non-GAAP organic revenue growth

excludes incremental acquisition-related revenue attributable to

companies acquired in the current fiscal year. For companies

acquired in the immediately preceding fiscal year, each of these

non-GAAP organic revenue growth measures reflects presentation of

full year incremental non-GAAP revenue derived from such companies

as if they were combined throughout the prior period, and it

includes the non-GAAP revenue attributable to those companies, as

if there were no acquisition-related write-downs of acquired

deferred revenue to fair value as required by GAAP. In addition,

each of these non-GAAP organic revenue growth measures excludes

prior period revenue associated with divested businesses. The

exclusion of the prior period revenue is to present the results of

the divested businesses within the results of the combined company

for the same period of time in both the prior and current periods.

Blackbaud believes this presentation provides a more comparable

representation of its current business’ organic revenue growth and

revenue run-rate.

Unaudited calculations of non-GAAP organic

revenue growth, non-GAAP organic revenue growth on a constant

currency basis and non-GAAP organic recurring revenue growth for

the first quarter of 2016, as well as unaudited reconciliations of

those non-GAAP measures to their most directly comparable GAAP

measures, are as follows:

| (dollars in thousands) |

|

Three months ended March

31, |

|

|

2016 |

2015 |

| GAAP revenue |

|

$ |

169,256 |

|

$ |

146,993 |

|

| GAAP revenue

growth |

|

15.1 |

% |

|

| Add: Non-GAAP acquisition-related

revenue (1) |

|

1,786 |

|

12,341 |

|

| Less: Revenue from divested

businesses (2) |

|

— |

|

(395 |

) |

| Total Non-GAAP

adjustments |

|

1,786 |

|

11,946 |

|

| Non-GAAP revenue

(3) |

|

$ |

171,042 |

|

$ |

158,939 |

|

| Non-GAAP

organic revenue growth |

|

7.6 |

% |

|

| |

|

|

|

| Non-GAAP revenue

(3) |

|

$ |

171,042 |

|

$ |

158,939 |

|

| Foreign currency impact

on Non-GAAP revenue (4) |

|

1,527 |

|

— |

|

| Non-GAAP revenue on

constant currency basis (4) |

|

$ |

172,569 |

|

$ |

158,939 |

|

| Non-GAAP

organic revenue growth on constant currency basis |

|

8.6 |

% |

|

| |

|

|

|

| GAAP subscriptions

revenue |

|

$ |

96,851 |

|

$ |

72,513 |

|

| GAAP maintenance

revenue |

|

37,160 |

|

38,896 |

|

| GAAP recurring

revenue |

|

$ |

134,011 |

|

$ |

111,409 |

|

| GAAP recurring

revenue growth |

|

20.3 |

% |

|

| Add: Non-GAAP acquisition-related

revenue (1) |

|

1,781 |

|

11,902 |

|

| Less: Revenue from divested

businesses (2) |

|

— |

|

(245 |

) |

| Total Non-GAAP

adjustments |

|

1,781 |

|

11,657 |

|

| Non-GAAP recurring

revenue |

|

$ |

135,792 |

|

$ |

123,066 |

|

|

Non-GAAP organic recurring revenue growth |

|

10.3 |

% |

|

(1) Non-GAAP acquisition-related revenue excludes incremental

acquisition-related revenue calculated in accordance with GAAP that

is attributable to companies acquired in the current fiscal year.

For companies acquired in the immediately preceding fiscal year,

non-GAAP acquisition-related revenue reflects presentation of

full-year incremental non-GAAP revenue derived from such companies,

as if they were combined throughout the prior period, and it

includes the non-GAAP revenue from the acquisition-related deferred

revenue write-down attributable to those companies. (2) For

businesses divested in the prior fiscal year, non-GAAP organic

revenue growth excludes the prior period revenue associated with

divested businesses. The exclusion of the prior period revenue is

to present the results of the divested business within the results

of the combined company for the same period of time in both the

prior and current periods. (3) Non-GAAP revenue for the prior year

periods presented herein will not agree to non-GAAP revenue

presented in the respective prior period quarterly financial

information solely due to the manner in which non-GAAP organic

revenue growth is calculated. (4) To determine non-GAAP organic

revenue growth on a constant currency basis, revenues from entities

reporting in foreign currencies were translated to U.S. Dollars

using the comparable prior period's quarterly weighted average

foreign currency exchange rates. The primary foreign currencies

creating the impact are the Canadian Dollar, EURO, British Pound

and Australian Dollar.

Additional details of Blackbaud's methodology

for calculating non-GAAP organic revenue growth and non-GAAP

organic revenue growth on a constant currency basis can be found on

the company's investor relations page at

www.blackbaud.com/investorrelations.

As previously disclosed, beginning in 2016,

Blackbaud now applies a non-GAAP effective tax rate of 32.0% in its

calculation of the tax impact on non-GAAP adjustments, which

impacts the tax impact related to non-GAAP adjustments, non-GAAP

net income and non-GAAP diluted earnings per share measures. The

non-GAAP effective tax rate utilized will be reviewed annually to

determine whether it remains appropriate in consideration of

Blackbaud's financial results including its periodic effective tax

rate calculated in accordance with GAAP, its operating environment

and related tax legislation in effect and other factors deemed

necessary. All first quarter 2015 measures of the tax impact

related to non-GAAP adjustments included in this news release are

calculated under Blackbaud's historical non-GAAP effective tax rate

of 39.0%.

Blackbaud uses these non-GAAP financial measures

internally in analyzing its financial results and believes they are

useful to investors, as a supplement to GAAP measures, in

evaluating Blackbaud's ongoing operational performance. Blackbaud

believes that these non-GAAP financial measures reflect the

Blackbaud's ongoing business in a manner that allows for meaningful

period-to-period comparison and analysis of trends in its business.

In addition, Blackbaud believes that the use of these non-GAAP

financial measures provides additional information for investors to

use in evaluating ongoing operating results and trends and in

comparing its financial results from period-to-period with other

companies in Blackbaud's industry, many of which present similar

non-GAAP financial measures to investors. However, these non-GAAP

financial measures may not be completely comparable to similarly

titled measures of other companies due to differences in the exact

method of calculation between companies. Non-GAAP financial

measures should not be considered in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures.

| Blackbaud,

Inc. |

| Consolidated

balance sheets |

|

(Unaudited) |

| |

|

(dollars in thousands) |

March 31, 2016 |

December 31, 2015 |

|

Assets |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ |

12,084 |

|

$ |

15,362 |

|

| Restricted cash due to

customers |

115,000 |

|

255,038 |

|

| Accounts receivable, net of

allowance of $4,541 and $4,943 at March 31, 2016 and December 31,

2015, respectively |

78,456 |

|

80,046 |

|

| Prepaid expenses and other current

assets |

48,435 |

|

48,666 |

|

| Total current

assets |

253,975 |

|

399,112 |

|

| Property and equipment, net |

54,543 |

|

52,651 |

|

| Software development costs,

net |

23,021 |

|

19,551 |

|

| Goodwill |

435,994 |

|

436,449 |

|

| Intangible assets, net |

284,188 |

|

294,672 |

|

| Other assets |

20,207 |

|

20,901 |

|

| Total assets |

$ |

1,071,928 |

|

$ |

1,223,336 |

|

| Liabilities and

stockholders’ equity |

|

|

| Current liabilities: |

|

|

| Trade accounts payable |

$ |

18,286 |

|

$ |

19,208 |

|

| Accrued expenses and other current

liabilities |

37,577 |

|

57,461 |

|

| Due to customers |

115,000 |

|

255,038 |

|

| Debt, current portion |

4,375 |

|

4,375 |

|

| Deferred revenue, current

portion |

222,415 |

|

230,216 |

|

| Total current

liabilities |

397,653 |

|

566,298 |

|

| Debt, net of current portion |

417,989 |

|

403,712 |

|

| Deferred tax liability |

28,546 |

|

27,996 |

|

| Deferred revenue, net of current

portion |

6,583 |

|

7,119 |

|

| Other liabilities |

8,000 |

|

7,623 |

|

| Total

liabilities |

858,771 |

|

1,012,748 |

|

| Commitments and contingencies |

|

|

| Stockholders’ equity: |

|

|

| Preferred stock; 20,000,000 shares

authorized, none outstanding |

— |

|

— |

|

| Common stock, $0.001 par value;

180,000,000 shares authorized, 57,496,559 and 56,873,817 shares

issued at March 31, 2016 and December 31, 2015, respectively |

57 |

|

57 |

|

| Additional paid-in capital |

285,376 |

|

276,340 |

|

| Treasury stock, at cost; 10,007,715

and 9,903,071 shares at March 31, 2016 and December 31, 2015,

respectively |

(205,377 |

) |

(199,861 |

) |

| Accumulated other comprehensive

loss |

(1,091 |

) |

(825 |

) |

| Retained earnings |

134,192 |

|

134,877 |

|

| Total stockholders’

equity |

213,157 |

|

210,588 |

|

| Total

liabilities and stockholders’ equity |

$ |

1,071,928 |

|

$ |

1,223,336 |

|

| |

| Blackbaud,

Inc. |

| Consolidated

statements of comprehensive income |

|

(Unaudited) |

| |

| (dollars in thousands, except per share

amounts) |

|

Three months ended March

31, |

|

|

2016 |

2015 |

|

Revenue |

|

|

|

| Subscriptions |

|

$ |

96,851 |

|

$ |

72,513 |

|

| Maintenance |

|

37,160 |

|

38,896 |

|

| Services |

|

32,414 |

|

31,306 |

|

| License fees and other |

|

2,831 |

|

4,278 |

|

| Total revenue |

|

169,256 |

|

146,993 |

|

| Cost of

revenue |

|

|

|

| Cost of subscriptions |

|

49,672 |

|

36,178 |

|

| Cost of maintenance |

|

5,323 |

|

7,502 |

|

| Cost of services |

|

24,319 |

|

26,971 |

|

| Cost of license fees and other |

|

602 |

|

1,161 |

|

| Total cost of

revenue |

|

79,916 |

|

71,812 |

|

| Gross

profit |

|

89,340 |

|

75,181 |

|

| Operating

expenses |

|

|

|

| Sales, marketing and customer

success |

|

35,614 |

|

28,562 |

|

| Research and development |

|

22,779 |

|

21,276 |

|

| General and administrative |

|

19,756 |

|

16,843 |

|

| Amortization |

|

752 |

|

488 |

|

| Total operating

expenses |

|

78,901 |

|

67,169 |

|

| Income from

operations |

|

10,439 |

|

8,012 |

|

| Interest expense |

|

(2,675 |

) |

(1,686 |

) |

| Other expense, net |

|

(105 |

) |

(287 |

) |

| Income before

provision for income taxes |

|

7,659 |

|

6,039 |

|

| Income tax provision |

|

2,664 |

|

1,754 |

|

| Net

income |

|

$ |

4,995 |

|

$ |

4,285 |

|

| Earnings per

share |

|

|

|

| Basic |

|

$ |

0.11 |

|

$ |

0.09 |

|

| Diluted |

|

$ |

0.11 |

|

$ |

0.09 |

|

| Common shares and

equivalents outstanding |

|

|

|

| Basic weighted average shares |

|

45,967,863 |

|

45,529,668 |

|

| Diluted weighted average

shares |

|

46,757,458 |

|

46,168,096 |

|

| Dividends per

share |

|

$ |

0.12 |

|

$ |

0.12 |

|

| Other

comprehensive (loss) income |

|

|

|

| Foreign currency translation

adjustment |

|

403 |

|

(326 |

) |

| Unrealized loss on derivative

instruments, net of tax |

|

(669 |

) |

(469 |

) |

| Total other comprehensive

loss |

|

(266 |

) |

(795 |

) |

|

Comprehensive income |

|

$ |

4,729 |

|

$ |

3,490 |

|

| |

|

|

|

|

|

|

|

| Blackbaud, Inc. |

| Consolidated statements of cash

flows |

| (Unaudited) |

| |

| |

|

Three months ended March

31, |

|

(dollars in thousands) |

|

2016 |

2015 |

| Cash flows from

operating activities |

|

|

|

| Net income |

|

$ |

4,995 |

|

$ |

4,285 |

|

| Adjustments to reconcile net income

to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

|

17,609 |

|

13,678 |

|

| Provision for doubtful accounts and

sales returns |

|

1,017 |

|

1,358 |

|

| Stock-based compensation

expense |

|

7,916 |

|

5,102 |

|

| Excess tax benefits from exercise

and vesting of stock-based compensation |

|

(1,137 |

) |

(584 |

) |

| Deferred taxes |

|

558 |

|

(886 |

) |

| Amortization of deferred financing

costs and discount |

|

239 |

|

210 |

|

| Other non-cash adjustments |

|

(217 |

) |

524 |

|

| Changes in operating assets and

liabilities, net of acquisition and disposal of businesses: |

|

|

|

| Accounts receivable |

|

817 |

|

555 |

|

| Prepaid expenses and other

assets |

|

1,846 |

|

3,633 |

|

| Trade accounts payable |

|

139 |

|

(111 |

) |

| Accrued expenses and other

liabilities |

|

(24,795 |

) |

(18,768 |

) |

| Restricted cash due to

customers |

|

141,055 |

|

82,140 |

|

| Due to customers |

|

(141,055 |

) |

(82,140 |

) |

| Deferred revenue |

|

(8,883 |

) |

(4,765 |

) |

| Net cash provided by

operating activities |

|

104 |

|

4,231 |

|

| Cash flows from

investing activities |

|

|

|

| Purchase of property and

equipment |

|

(7,837 |

) |

(2,521 |

) |

| Capitalized software development

costs |

|

(5,798 |

) |

(3,129 |

) |

| Net cash used in investing

activities |

|

(13,635 |

) |

(5,650 |

) |

| Cash flows from

financing activities |

|

|

|

| Proceeds from issuance of debt |

|

74,600 |

|

41,800 |

|

| Payments on debt |

|

(60,494 |

) |

(36,694 |

) |

| Proceeds from exercise of stock

options |

|

3 |

|

11 |

|

| Excess tax benefits from exercise

and vesting of stock-based compensation |

|

1,137 |

|

584 |

|

| Dividend payments to

stockholders |

|

(5,700 |

) |

(5,626 |

) |

| Net cash provided by

financing activities |

|

9,546 |

|

75 |

|

| Effect of exchange rate on

cash and cash equivalents |

|

707 |

|

(105 |

) |

| Net decrease in

cash and cash equivalents |

|

(3,278 |

) |

(1,449 |

) |

| Cash and cash

equivalents, beginning of period |

|

15,362 |

|

14,735 |

|

|

Cash and cash equivalents, end of period |

|

$ |

12,084 |

|

$ |

13,286 |

|

| |

|

|

|

|

|

|

|

| Blackbaud,

Inc. |

|

Reconciliation of GAAP to non-GAAP financial

measures |

|

(Unaudited) |

| |

| (dollars in thousands, except per share

amounts) |

|

Three months ended March

31, |

|

|

2016 |

2015 |

| GAAP

Revenue |

|

$ |

169,256 |

|

$ |

146,993 |

|

| Non-GAAP

adjustments: |

|

|

|

| Add: Acquisition-related deferred

revenue write-down |

|

1,786 |

|

3,522 |

|

| Non-GAAP

revenue |

|

$ |

171,042 |

|

$ |

150,515 |

|

| |

|

|

|

| GAAP gross

profit |

|

$ |

89,340 |

|

$ |

75,181 |

|

| GAAP gross

margin |

|

52.8 |

% |

51.1 |

% |

| Non-GAAP

adjustments: |

|

|

|

| Add: Acquisition-related deferred

revenue write-down |

|

1,786 |

|

3,522 |

|

| Add: Stock-based compensation

expense |

|

872 |

|

901 |

|

| Add: Amortization of intangibles

from business combinations |

|

9,881 |

|

7,639 |

|

| Add: Employee severance |

|

64 |

|

596 |

|

| Subtotal |

|

12,603 |

|

12,658 |

|

| Non-GAAP gross

profit |

|

$ |

101,943 |

|

$ |

87,839 |

|

| Non-GAAP gross

margin |

|

59.6 |

% |

58.4 |

% |

| |

|

|

|

| GAAP income

from operations |

|

$ |

10,439 |

|

$ |

8,012 |

|

| GAAP operating

margin |

|

6.2 |

% |

5.5 |

% |

| Non-GAAP

adjustments: |

|

|

|

| Add: Acquisition-related deferred

revenue write-down |

|

1,786 |

|

3,522 |

|

| Add: Stock-based compensation

expense |

|

7,916 |

|

5,102 |

|

| Add: Amortization of intangibles

from business combinations |

|

10,633 |

|

8,127 |

|

| Add: Employee severance |

|

288 |

|

1,139 |

|

| Add: Acquisition-related

integration costs |

|

383 |

|

484 |

|

| Add: Acquisition-related

expenses |

|

113 |

|

73 |

|

| Subtotal |

|

21,119 |

|

18,447 |

|

| Non-GAAP income

from operations |

|

$ |

31,558 |

|

$ |

26,459 |

|

| Non-GAAP operating

margin |

|

18.5 |

% |

17.6 |

% |

| |

|

|

|

| GAAP net

income |

|

$ |

4,995 |

|

$ |

4,285 |

|

| |

|

|

|

| Shares used in

computing GAAP diluted earnings per share |

|

46,757,458 |

|

46,168,096 |

|

| GAAP diluted earnings per

share |

|

$ |

0.11 |

|

$ |

0.09 |

|

| |

|

|

|

| Non-GAAP

adjustments: |

|

|

|

| Add: Total Non-GAAP adjustments

affecting loss from operations |

|

21,119 |

|

18,447 |

|

| Less: Tax impact related to

Non-GAAP adjustments |

|

(6,544 |

) |

(7,797 |

) |

| Non-GAAP net

income |

|

$ |

19,570 |

|

$ |

14,935 |

|

| |

|

|

|

| Shares used in

computing Non-GAAP diluted earnings per share |

|

46,757,458 |

|

46,168,096 |

|

|

Non-GAAP diluted earnings per share |

|

$ |

0.42 |

|

$ |

0.32 |

|

| |

|

|

|

|

|

|

|

| Blackbaud,

Inc. |

|

Reconciliation of GAAP to Non-GAAP financial measures

(continued) |

|

(Unaudited) |

| |

| (dollars in thousands) |

|

Three months ended March

31, |

|

|

2016 |

2015 |

| Detail of

certain Non-GAAP adjustments: |

|

|

|

| Stock-based compensation

expense: |

|

|

|

| Included in cost of revenue: |

|

|

|

| Cost of subscriptions |

|

$ |

281 |

|

$ |

143 |

|

| Cost of maintenance |

|

123 |

|

161 |

|

| Cost of services |

|

468 |

|

597 |

|

| Total included in cost of

revenue |

|

872 |

|

901 |

|

| Included in operating

expenses: |

|

|

|

| Sales, marketing and customer

success |

|

901 |

|

701 |

|

| Research and development |

|

1,535 |

|

978 |

|

| General and administrative |

|

4,608 |

|

2,522 |

|

| Total included in operating

expenses |

|

7,044 |

|

4,201 |

|

| Total stock-based

compensation expense |

|

$ |

7,916 |

|

$ |

5,102 |

|

| |

|

|

|

| Amortization of intangibles from

business combinations: |

|

|

|

| Included in cost of revenue: |

|

|

|

| Cost of subscriptions |

|

$ |

7,811 |

|

$ |

5,772 |

|

| Cost of maintenance |

|

1,332 |

|

1,153 |

|

| Cost of services |

|

653 |

|

607 |

|

| Cost of license fees and other |

|

85 |

|

107 |

|

| Total included in cost of

revenue |

|

9,881 |

|

7,639 |

|

| Included in operating expenses |

|

752 |

|

488 |

|

|

Total amortization of intangibles from business

combinations |

|

$ |

10,633 |

|

$ |

8,127 |

|

| |

|

|

|

|

|

|

|

Investor Contact:

Mark Furlong

Director of Investor Relations

843-654-2097

mark.furlong@blackbaud.com

Media Contact:

Nicole McGougan

Blackbaud Public Relations

843-654-3307

nicole.mcgougan@blackbaud.com

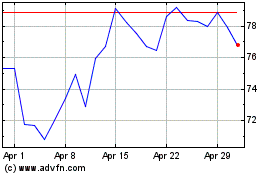

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Jan 2024 to Jan 2025