Current Report Filing (8-k)

July 30 2021 - 6:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2021 (July 23, 2021)

AvePoint, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-39048

|

83-4461709

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

525 Washington Blvd, Suite 1400

Jersey City, NJ

(Address of principal executive offices)

|

07310

(Zip Code)

|

Registrant’s telephone number, including area code: (201) 793-1111

|

Apex Technology Acquisition Corporation

|

|

533 Airport Blvd, Suite 400, Burlingame, CA 94010

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.0001 per share

|

AVPT

|

The Nasdaq Global Select Market

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

AVPTW

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

On July 26, 2021, AvePoint, Inc., a Delaware corporation (the “Company”), consummated an internal reorganization transaction consisting of the merger (the “Rollup Merger”) of AvePoint US, LLC, a Delaware limited liability company and a wholly owned direct subsidiary of the Company (the “LLC”), with and into the Company, with the Company surviving, pursuant to that certain Agreement and Plan of Merger, dated as of July 23, 2021, by and between the Company and the LLC (“Rollup Merger Agreement”). Pursuant to the terms of the Rollup Merger Agreement, the Rollup Merger became effective upon the filing of the Certificate of Merger with the Delaware Secretary of State.

Substantially simultaneously with the execution of the Rollup Merger Agreement, the Company entered into that certain assignment and assumption agreement (the “Assignment and Assumption Agreement”) by and among the Company, the LLC, and HSBC Ventures USA Inc. (“Bank”), pursuant to which the Company would, at the Effective Time (as defined below) of the Rollup Merger, assume the LLC's obligations as borrower under the previously disclosed and filed loan and security agreement, dated as of April 7, 2020 by and among the Company, AvePoint Public Sector, Inc., AvePoint Holdings USA, LLC (together with AvePoint Public Sector, Inc., the “Guarantors”), and Bank (as amended on July 1, 2021 and as may be further amended, restated, or otherwise modified, the “Loan Agreement”).

On July 26, 2021 (the “Effective Time”), the Certificate of Merger for the Rollup Merger was filed with the Delaware Secretary of State and the Rollup Merger and the Assignment and Assumption Agreement became effective.

Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Rollup Merger Agreement.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Rollup Merger Agreement

On July 23, 2021, the Board of Directors of the Company (the “Board”) and the sole Member of the LLC deemed it advisable and in the best interests of each entity and their respective stockholders and members, as the case may be, that the Company and the LLC combine. In furtherance of that goal, and as directed by the Board and the sole Member of the LLC, the Company and the LLC entered into the Rollup Merger Agreement pursuant to which the Rollup Merger would be consummated.

On July 26, 2021 at the Effective Time, the Certificate of Merger for the Rollup Merger was filed with the Delaware Secretary of State. At the Effective Time, the separate existence of the LLC ceased and the LLC was merged with and into the Company and each LLC membership unit and/or membership interest outstanding immediately prior to the Effective Time was cancelled without consideration. On and after the Effective Time, each outstanding share of Company capital stock remains outstanding and shall continue to represent one share of the capital stock of the Surviving Company (as defined herein), of the same class and series as such share represented (of the Company) prior to the Effective Time. The Company will continue as the surviving company in the Merger (the “Surviving Company”). The Certificate of Incorporation and Bylaws of the Company in effect at the Effective Time shall continue to be the Certificate of Incorporation and Bylaws of the Surviving Company.

A copy of the Rollup Merger Agreement referenced herein is filed as Exhibit 2.1 hereto and is incorporated herein by reference. The above descriptions of the Rollup Merger Agreement and the Certificate of Merger contained herein are qualified in their entirety by the full text of such exhibits.

Loan Agreement – Assignment and Assumption Agreement; Limited Consent

On July 23, 2021, the Company entered into the Assignment and Assumption Agreement pursuant to which the Company would assume the LLC's obligations as Borrower under the Loan Agreement as of the Effective Time (the “Assumption”). The Company, the Guarantors, and the Bank also entered into that certain limited consent, dated as of July 23, 2021 (the “Limited Consent”), whereby the Bank consented to the Rollup Merger and the Assumption, and all other actions taken by or necessary or permissible to be taken by the Company, the LLC, or the Guarantors related thereto, whether occurring prior to, on, or after the Effective Time.

A copy of the Assignment and Assumption Agreement and the Limited Consent referenced herein are filed as Exhibits 10.1 and 10.2, respectively, hereto and are incorporated herein by reference. The above descriptions of the Assignment and Assumption Agreement and the Limited Consent contained herein are qualified in their entirety by the full text of such exhibits.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On July 26, 2021, the Company and the LLC consummated the Rollup Merger at the Effective Time. The information set forth in Item 1.01 relating to the Rollup Merger under the heading “Rollup Merger Agreement” is herein incorporated into this Item 2.01 by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

On July 26, 2021, the Assignment and Assumption Agreement became effective and the Company became the Borrower under the Loan Agreement. The information set forth in Item 1.01 relating to the Loan Agreement and the Assignment and Assumption Agreement under the heading “Loan Agreement – Assignment and Assumption Agreement; Limited Consent” is herein incorporated into this Item 2.03 by reference.

|

Item 9.01

|

Financial Statement and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Incorporated by Reference

|

|

Exhibit

Number

|

|

Description

|

|

Schedule/

Form

|

|

File No.

|

|

Exhibit

|

|

Filing Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.1*

|

|

Agreement and Plan of Merger, dated as of July 23, 2021, by and between AvePoint, Inc. and AvePoint US, LLC

|

|

|

|

|

|

|

|

|

|

10.1*

|

|

Assignment and Assumption Agreement, dated as of July 23, 2021, by and among AvePoint, Inc., AvePoint US, LLC, and HSBC Ventures USA Inc.

|

|

|

|

|

|

|

|

|

|

10.2*

|

|

Limited Consent and Waiver to Loan and Security Agreement, dated as of July 23, 2021, by and among AvePoint, Inc., AvePoint US, LLC, AvePoint Public Sector, Inc., AvePoint Holdings USA, LLC, and HSBC Ventures USA Inc.

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

AvePoint, Inc.

|

|

|

|

|

Dated: July 29, 2021

|

|

|

|

|

|

|

|

By:

|

/s/ Brian Michael Brown

|

|

|

|

|

|

|

|

Brian Michael Brown

|

|

|

|

Chief Operating Officer,

General Counsel, and

Secretary

|

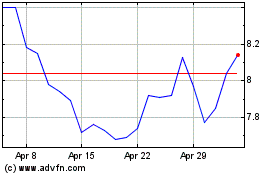

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Apr 2023 to Apr 2024