0001534120false00015341202023-09-222023-09-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 22, 2023

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-37590 | | 45-0705648 |

| (Commission File Number) | | (IRS Employer Identification No.) |

540 Gaither Road, Suite 400, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (410) 522-8707

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 22, 2023, Avalo Therapeutics, Inc. (the “Company”) and the institutional investor parties (the “Holders”) to the Venture Loan and Security Agreement issued on June 4, 2021 (as amended, from time to time, the “Note”) entered into a Payoff Letter (the “Payoff Letter”), pursuant to which the Company repaid all outstanding principal inclusive of the final payment fee and interest on the Note in the aggregate amount of $14,251,320. As a result of the payment, all obligations of the parties under the Note and Note Amendment (defined below) are deemed satisfied. Additionally, the security interest in the Company’s assets under the Note and the Note Amendment was extinguished and the Cash Deposit (defined below) requirement was negated.

As previously disclosed, as of July 20, 2023, the Holders asserted that a default and event of default had occurred due to a material adverse change in the Company’s business (the “Existing Default”). Also as previously disclosed, in connection with the Existing Default, the Company entered into three forbearance agreements (individually, a “Forbearance Agreement,” and collectively, the “Forbearance Agreements”) with the Holders, pursuant to which the Holders agreed to forbear from enforcing their full remedies related to the Existing Default until October 15, 2023. As part of the Forbearance Agreements, the Company agreed to maintain cash on deposit (the “Cash Deposit”) in deposit accounts subject to an Account Control Agreement (as defined in the Note) in favor of the Collateral Agent (as defined in the first Forbearance Agreement) in an amount not less than the sum of $3,000,000, and the Company agreed to amend the Note to grant to the Holders a security interest in the Company’s owned patents and trademarks (the “Note Amendment”).

The foregoing description of the Payoff Letter does not purport to be complete and is subject to, and qualified by, the full text of such document, a copy of which is filed as Exhibit 10.1 and is incorporated by reference herein.

Item 8.01. Other Events.

On September 26, 2023, the Company issued a press release announcing the Payoff Letter described above in Item 1.01. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Based upon preliminary estimates and information available to the Company, after payoff of the Note as reported in Item 1.01 of this report, the Company had approximately $3.7 million in cash and cash equivalents as of September 25, 2023. This estimate of the Company’s cash and cash equivalents as of September 25, 2023 is preliminary, unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements.

As previously reported, on May 4, 2023 and as amended on August 7, 2023, the Company entered into a Sales Agreement (as amended, the “Agreement”) with Oppenheimer & Co. Inc. (“Oppenheimer”), as sales agent, pursuant to which the Company may offer and sell, from time to time through Oppenheimer, shares of the Company’s common stock having an aggregate offering price of $50,000,000 (the “Offering”). The Company previously reported that, pursuant to the Agreement, from May 4, 2023 through September 8, 2023, the Company had raised approximately $12.9 million in net proceeds through the sale of 50,837,984 shares of common stock. From September 11, 2023 through September 21, 2023, the Company has raised approximately $12.9 million in net proceeds through the sale of 84,220,464 shares of common stock. As of September 25, 2023, the Company had 147,091,027 shares outstanding, which reflects share activity through September 21, 2023, including share issuances pursuant to the Agreement. Subsequent to September 21, 2023, the Company sold a total of 20,000,000 shares pursuant to the Agreement for net proceeds of approximately $2.6 million. Settlement for these sales will occur on the second trading day following the date on which the sales were made and are not included in the shares outstanding and cash and cash equivalents number reported above.

As previously reported on Form 8-K filed on August 8, 2023, on August 8, 2023, Nasdaq Stock Market LLC (“Nasdaq”) notified the Company that for the last 30 consecutive business days, the bid price for the Company’s common stock had closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”) and that for the last 30 consecutive business days, the Company’s minimum Market Value of Listed Securities (“MVLS”) was below the minimum of $35 million required for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”). Therefore, in accordance with Listing Rules 5810(c)(3)(A) and 5810(c)(3)(C), the Company was provided 180 calendar days, or until February 5, 2024, to regain compliance with both the Bid Price Rule and the MVLS Rule.

Also as previously reported on Form 8-K filed on September 13, 2023, on September 12, 2023, the Company received notice from Nasdaq that Nasdaq had determined that as of September 11, 2023, the Company’s securities had a closing bid price of $0.10 or less for ten consecutive trading days triggering application of Listing Rule 5810(c)(3)(A)(iii) which states in part: if during any compliance period specified in Rule 5810(c)(3)(A), a company’s security has a closing bid price of $0.10 or less for ten consecutive trading days, the Listing Qualifications Department shall issue a Staff Delisting Determination under Rule 5810 with respect to that security. As a result, the Staff determined to delist the Company’s securities from Nasdaq, unless the Company timely requests an appeal of the Staff’s determination to a Hearings Panel (the “Panel”), pursuant to the procedures set forth in the Nasdaq Listing Rule 5800 Series.

The Company timely requested an appeal of the Staff’s determination to the Panel and the Panel will hear the Company’s appeal in accordance with Nasdaq procedures.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| | |

| 99.1 | | |

| | |

| 104 | | The cover pages of this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | AVALO THERAPEUTICS, INC. |

| | | |

| Date: September 26, 2023 | | By: | /s/ Christopher Sullivan |

| | | Christopher Sullivan |

| | | Chief Financial Officer |

September 22, 2023

VIA ELECTRONIC AND REGULAR MAIL

Avalo Therapeutics, Inc. (f/k/a Cerecor Inc.)

540 Gaither Road, Suite 400

Rockville, MD 20850

Attn: Garry Neil, Chief Executive Officer

Re: Avalo Therapeutics, Inc. (f/k/a Cerecor Inc.) Payoff Letter

Dear Mr. Neil:

Reference is hereby made to that certain (a) Venture Loan and Security Agreement dated as of June 4, 2021 (as amended from time to time, the “Loan Agreement”) by and among Avalo Therapeutics, Inc. (“Borrower”), Horizon Credit II LLC (“HCII”), as an assignee of Horizon Technology Finance Corporation (“Horizon”), Horizon Funding Trust 2019-1 (“Horizon Trust”), as an assignee of Horizon, Horizon Funding I, LLC (“HFI”), as an assignee of Horizon, and Powerscourt Investments XXV Trust (“PC Trust” and collectively with HCII, HFI and Horizon Trust, “Lenders”), and Horizon as Collateral Agent (“Collateral Agent”), (b) Secured Promissory Note (Loan A) dated June 4, 2021 in the original principal amount of Five Million Dollars ($5,000,000) held by HCII (the “Loan A Note”), (c) Secured Promissory Note (Loan B) dated June 4, 2021 in the original principal amount of Five Million Dollars ($5,000,000) held by Horizon Trust (the “Loan B Note”), (d) Secured Promissory Note (Loan C) dated June 4, 2021 in the original principal amount of Two Million Five Hundred Thousand Dollars ($2,500,000) held by HFI (the “Loan C Note”), (e) Secured Promissory Note (Loan D) dated June 4, 2021 in the original principal amount of Seven Million Five Hundred Thousand Dollars ($7,500,000) held by PC Trust (the “Loan D Note”), (f) Secured Promissory Note (Loan E) dated July 30, 2021 in the original principal amount of Five Million Dollars ($5,000,000) held by HFI (the “Loan E Note”), (g) Secured Promissory Note (Loan F) dated July 30, 2021 in the original principal amount of Five Million Dollars ($5,000,000) held by HCII (the “Loan F Note”), (h) Secured Promissory Note (Loan G) dated September 29, 2021 in the original principal amount of Two Million Five Hundred Thousand Dollars ($2,500,000) held by HCII (the “Loan G Note”), and (i) Secured Promissory Note (Loan H) dated September 29, 2021 in the original principal amount of Two Million Five Hundred Thousand Dollars ($2,500,000) held by HCII (the “Loan H Note”, and collectively with the Loan A Note, Loan B Note, Loan C Note, Loan D Note, Loan E Note, Loan F Note and Loan G Note, the “Notes”). Other capitalized terms used herein, but not defined, shall have the meanings given such terms in the Loan Agreement.

Payment of the sum of (a) $6,254,028.90 to HCII, plus, if payment is made after 10:00 AM Eastern time on September 25, 2023 (“Anticipated Payoff Date”), but prior to 10:00 AM Eastern time on September 30, 2023 $2,353.93 for each day after the Anticipated Payoff Date on which payment is received by HCII (collectively, the “HCII Payoff Amount”), plus (b) $1,970,872.07 to Horizon Trust, plus, if payment is made after 10:00 AM Eastern time on the Anticipated Payoff Date, but prior to 10:00 AM Eastern time on September 30, 2023, $738.49 for each day after the Anticipated Payoff Date on which payment is received by Horizon Trust (collectively, the “Horizon Trust Payoff Amount”), plus (c) $3,070,111.87 to HFI, plus, if payment is made after 10:00 AM Eastern time on the Anticipated Payoff Date, but prior to 10:00 AM Eastern time on September 30, 2023, $1,153.88 for each day after the Anticipated Payoff Date on which payment is received by HFI (collectively, the “HFI Payoff Amount”), plus (d) $2,956,307.53 to PC Trust, plus, if payment is made after 10:00 AM Eastern time on the Anticipated Payoff Date, but prior to 10:00 AM Eastern time on September 30, 2023, $1,107.73 for each day after the Anticipated Payoff Date on which payment is received by PC Trust (collectively, the “PC Trust Payoff Amount”, and collectively with the HCII Payoff Amount, Horizon Trust Payoff Amount, and HFI Payoff Amount, the “Payoff Amount”), will constitute automatically and without any further action on the part of the Borrower or any Lender or the Collateral Agent (i) payment in full of

312 Farmington Avenue, Farmington, CT 06032 (860) 676-8654 Fax (860) 676-8655 horizontechfinance.com

Avalo Therapeutics, Inc. (f/k/a/ Cerecor Inc.)

September 22, 2023

Page 2

all outstanding indebtedness and obligations owing to any Lender and/or the Collateral Agent from the above Borrower in connection with the Loan Agreement, the Notes and any other Loan Documents (excluding the Warrants); (ii) termination of all unfunded commitments to make credit extensions or financial accommodations to Borrower or any other person under the Loan Agreement; (iii) termination and release of all security interests and other liens of every type at any time granted to or held by Collateral Agent and each Lender as security for such indebtedness; (iv) termination, release and discharge of all other obligations of Borrower under the Loan Agreement and all other Loan Documents (excluding the Warrants); and (v) termination of the Notes, which shall be of no further force and effect; provided, however, the obligations set forth in Section 10.3 of the Loan Agreement shall survive pursuant to Section 12.8 thereof, and the Borrower’s obligations under the Warrants shall survive pursuant to their terms.

Upon receipt of the Payoff Amount by wire transfers of freely and immediately available funds as set forth below (the “Payoff Date”), Lenders and Collateral Agent each (a) authorize the Borrower to prepare and file such UCC Termination Statements to terminate all UCC Financing Statements in each Lender’s and Collateral Agent’s favor with respect to the Borrower and the Collateral and all other documents necessary to evidence the release of each Lender’s and Collateral Agent’s liens and security interests in all assets of the Borrower and (b) agree that each will sign and deliver to Borrower, at Borrower’s sole cost and expense, any other documents and take such other actions as Borrower shall reasonably request to terminate all of each Lender’s and Collateral Agent’s liens and security interests in all assets of the Borrower. Other than the transactions evidenced by the Loan Documents, no Lender has any other financing arrangements with Borrower or any of Borrower’s affiliates. Notwithstanding anything in this Letter Agreement, to the extent that any payments or proceeds (or any portion thereof) received by any Lender shall be subsequently invalidated, declared to be fraudulent or a fraudulent conveyance or preferential, set aside or required to be repaid to a trustee, receiver, debtor-in-possession or any other party under any bankruptcy law, state or federal law, common law, equitable cause or otherwise required to be returned for any other reason, then to the extent that the payment or proceeds is rescinded or must otherwise be restored by any Lender, whether as a result of any proceedings in bankruptcy or reorganization or otherwise, any obligations or any part thereof which were intended to be satisfied shall be revived and continue to be in full force and effect against the Borrower and its respective successors and assigns, as if the payment or proceeds had never been received by such Lender, and this letter shall in no way impair the claims of any Lender with respect to any such revived obligations.

In addition, Borrower agrees that, on and after the Payoff Date, Borrower releases each Lender and Collateral Agent, and each of their affiliates and subsidiaries, officers, directors, employees, shareholders, agents and representatives, as well as its successors and assigns, from any and all claims, obligations, rights, causes of action, and liabilities, of whatever kind or nature, whether known or unknown, whether foreseen or unforeseen, arising on or before the date hereof, which Borrower ever had, now has or hereafter can, shall or may have for, upon or by reason of any matter, cause or thing whatsoever, which are based upon, arise under or are related to the Loan Agreement.

Avalo Therapeutics, Inc. (f/k/a/ Cerecor Inc.)

September 22, 2023

Page 3

The HCII Payoff Amount shall be tendered by Borrower to HCII using the following wire instructions:

Credit:

Bank Name:

Accounting No.:

ABA Routing No.:

Reference:

The Horizon Trust Payoff Amount shall be tendered by Borrower to Horizon Trust using the following wire instructions:

Credit:

Bank Name:

Accounting No.:

ABA Routing No.:

Reference:

The HFI Payoff Amount shall be tendered by Borrower to HFI using the following wire instructions:

Credit:

Bank Name:

Accounting No.:

ABA Routing No.:

Reference:

The PC Trust Payoff Amount shall be tendered by Borrower to PC Trust using the following wire instructions:

Credit:

Bank Name:

Accounting No.:

ABA Routing No.:

Reference:

[Remainder of page intentionally blank. Signature page follows.]

Please note that the above Payoff Amount is accurate through September 30, 2023 and assumes no principal paydown or changes in the Loan Rate through such date. If payment is made after such date, principal is paid down before such date, or if there is a change in the Loan Rate, please contact the undersigned for a new payoff amount and per diem rate. Nothing contained herein shall modify or amend the Borrower’s obligation to make the scheduled payments set forth in the Notes, until such time as each Lender has received the Payoff Amount. This Payoff Letter shall be governed by the laws of the State of Connecticut. This Payoff Letter may be executed by any of the parties hereto on separate counterparts, and may be delivered by facsimile transmission or other electronic means, including .pdf, and all of said counterparts taken together shall be deemed to constitute one and the same instrument.

Sincerely yours,

| | | | | | | | |

| LENDERS: |

| |

| HORIZON CREDIT II LLC |

| |

| By: | /s/ Daniel S. Devorsetz |

| Name: | Daniel S. Devorsetz |

| Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| |

| | HORIZON FUNDING TRUST 2019-1 |

| By: | Horizon Technology Finance Corporation, its agent |

| | |

| | By: | /s/ Daniel S. Devorsetz |

| | Name: | Daniel S. Devorsetz |

| | Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| | |

| | HORIZON FUNDING I, LLC |

| | By: | Horizon Secured Loan Fund I LLC, its sole member |

| | |

| | By: | /s/ Daniel S. Devorsetz |

| | Name: | Daniel S. Devorsetz |

| | Title: | Manager |

| | |

| POWERSCOURT INVESTMENTS XXV, TRUST |

| By: | 1485 Management, LLC, as Trust’s Agent |

| | |

| By: | /s/ Glenn Guszkowski |

| Name: | Glenn Guszkowski |

| Title: | Authorized Signatory |

(Signature page to Avalo Payoff Letter)

| | | | | | | | |

| COLLATERAL AGENT: |

| | |

| HORIZON TECHNOLOGY FINANCE CORPORATION |

| | |

| By: | /s/ Daniel S. Devorsetz |

| Name: | Daniel S. Devorsetz |

| Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| | | | | |

|

| Acknowledged and agreed: |

| AVALO THERAPEUTICS, INC. |

| |

| By: | /s/ Garry Neil |

| Name: | Garry Neil |

| Title: | Chief Executive Officer |

(Signature page to Avalo Payoff Letter)

Avalo Therapeutics Successfully Eliminates $35 Million Debt Paving the Way for Future Growth and Innovation

WAYNE, PA AND ROCKVILLE, MD, September 26, 2023 — In a major achievement, Avalo Therapeutics (Nasdaq: AVTX) proudly announces the payoff of the remainder of its $35 million debt owed to Horizon Technology Finance Corporation (Nasdaq: HRZN). This significant milestone not only signifies the company's steadfast commitment to financial stability but also paves the way for future accelerated growth and progress toward executing its ambitious plans to advance its most promising drug candidates, including its anti-LIGHT mAb (quisovalimab or AVTX-002) and its BTLA agonist fusion protein (AVTX-008).

Dr. Garry A. Neil, MD, Chief Executive Officer, and Chairman of the Board at Avalo Therapeutics, expressed his enthusiasm about this crucial financial achievement, stating, “Eliminating our $35 million debt is a testament to the dedication and hard work of our entire team. It is a pivotal moment for Avalo, signaling our readiness to embrace new opportunities and transform the lives of patients with immunological diseases and addressing unmet medical needs. With a strengthened balance sheet, the company is well-positioned to pursue collaborations, expand research efforts, and bring innovative treatments to market. Our lead asset, quisovalimab, is a potential first-in-class fully human mAb against an important immunological target and has already demonstrated clinical proof of concept in both acute and chronic inflammatory diseases. Additionally, we believe AVTX-008, our BTLA agonist fusion protein, has potential to be a best-in-class molecule. It addresses an increasingly recognized and important target for a variety of immune diseases as evidenced by Gilead’s $405 million acquisition of MiroBio. Our highly skilled and capable team are executing well against our plan. We can now turn our attention to moving our development programs forward as well as looking for new opportunities to augment our very promising pipeline.”

Dr. Neil continued, “We’d like to thank our colleagues at our lender, Horizon Technology Finance, who worked professionally, collaboratively and constructively with us to achieve this milestone.”

Gerald A. Michaud, President of Horizon Technology Finance Corporation, said, “We were very impressed with the focus and professionalism that Garry and his management team showed in paying off this debt in full and ahead of schedule in a challenging market environment for biotechnology. Avalo created and executed a coherent and investable strategy that included eliminating non-essential costs, streamlining the pipeline on their most highly valued assets, operational excellence and executing multiple business development transactions that brought in significant non-dilutive funding. We are proud of our role in helping promising emerging companies, like Avalo, achieve their financial goals and wish Avalo Therapeutics much future success.”

About Avalo Therapeutics

Avalo Therapeutics is a clinical stage biotechnology company focused on the treatment of immune dysregulation by developing therapies that target the LIGHT-signaling network.

LIGHT (Lymphotoxin-like, exhibits Inducible expression, and competes with HSV Glycoprotein D for Herpesvirus Entry Mediator (HVEM), a receptor expressed by T lymphocytes; also referred to as TNFSF14) is an immunoregulatory cytokine. LIGHT and its signaling receptors, HVEM (TNFRSF14), and lymphotoxin β receptor (TNFRSF3), form an immune regulatory network with two co-receptors of herpesvirus entry mediator, checkpoint inhibitor B and T Lymphocyte Attenuator (BTLA), and CD160 (the LIGHT-signaling network). Accumulating evidence points to the dysregulation of the LIGHT-signaling network as a disease-driving mechanism in autoimmune and inflammatory reactions in barrier organs. Therefore, we believe reducing LIGHT levels can moderate immune dysregulation in many acute and chronic inflammatory disorders.

Avalo has an experienced leadership team with decades of successful leadership in drug development in the biotech and pharma industry. The team is led by Dr. Garry Neil, MD, Chief Executive Officer and Chairman of the Board, who brings a wealth of experience leading teams who have successfully brought drugs to the market, including serving as Group President, Pharmaceutical R&D and Corporate VP of Science & Technology at Johnson & Johnson. Additionally, Dr. Neil served as Chairman of the Board of Arena Pharmaceuticals Inc., which was acquired by Pfizer Inc. for $6.7 billion in March of 2022. Dr. Neil currently serves on the board of directors of Celldex Therapeutics.

For more information about Avalo, please visit www.avalotx.com.

About quisovalimab (AVTX-002)

AVTX-002 is a fully human monoclonal antibody (mAb), directed against human LIGHT. There is increasing evidence that the dysregulation of the LIGHT-signaling network which includes LIGHT, its receptors HVEM and LTβR and the downstream checkpoint BTLA, is a disease-driving mechanism in autoimmune and inflammatory reactions in barrier organs. Therefore, we believe reducing LIGHT levels can moderate immune dysregulation in many acute and chronic inflammatory disorders. AVTX-002 previously demonstrated proof of concept in COVID-19 induced acute respiratory distress syndrome including reduction in mortality and respiratory failure, as well as a positive signal in Crohn’s Disease.

About AVTX-008

AVTX-008 is a fully human B and T Lymphocyte Attenuator (BTLA) agonist fusion protein in the IND-enabling stage.

About Horizon Technology Finance Corporation

Horizon Technology Finance Corporation (NASDAQ: HRZN), externally managed by Horizon Technology Finance Management LLC, an affiliate of Monroe Capital, is a leading specialty finance company that provides capital in the form of secured loans to venture capital backed companies in the technology, life science, healthcare information and services, and sustainability industries. The investment objective of Horizon is to maximize its investment portfolio’s return by generating current income from the debt investments it makes and capital appreciation from the warrants it receives when making such debt investments. Horizon is headquartered in Farmington, Connecticut, with a regional office in Pleasanton, California, and investment professionals located throughout the U.S. Monroe Capital is a $17 billion asset management firm specializing in private credit markets across various strategies, including direct lending, technology finance, venture debt, opportunistic, structured credit, real estate and equity. To learn more, please visit horizontechfinance.com.

Forward-Looking Statements

This press release may include forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond Avalo’s control), which could cause actual results to differ from the forward-looking statements. Such statements may include, without limitation, statements with respect to Avalo’s plans, objectives, projections, expectations and intentions and other statements identified by words such as “projects,” “may,” “might,” “will,” “could,” “would,” “should,” “continue,” “seeks,” “aims,” “predicts,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “potential,” or similar expressions (including their use in the negative), or by discussions of future matters such as: the future financial and operational

outlook or growth; the development of product candidates or products; timing and success of trial results and regulatory review; potential attributes and benefits of product candidates; and other statements that are not historical. These statements are based upon the current beliefs and expectations of Avalo’s management but are subject to significant risks and uncertainties, including: drug development costs, timing and other risks, including reliance on investigators and enrollment of patients in clinical trials, which might be slowed by COVID-19 or other widespread health events; Avalo's cash position and the need for it to raise additional capital in the near future; reliance on key personnel; regulatory risks; general economic and market risks and uncertainties, including those caused by COVID-19 or other widespread health events; and those other risks detailed in Avalo’s filings with the SEC. Actual results may differ from those set forth in the forward-looking statements. Except as required by applicable law, Avalo expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Avalo’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For media and investor inquiries

Christopher Sullivan, CFO

Avalo Therapeutics, Inc.

ir@avalotx.com

410-803-6793

or

Chris Brinzey

ICR Westwicke

Chris.brinzey@westwicke.com

339-970-2843

v3.23.3

Cover Page Document

|

Sep. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 22, 2023

|

| Entity Registrant Name |

AVALO THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37590

|

| Entity Tax Identification Number |

45-0705648

|

| Entity Address, Address Line One |

540 Gaither Road, Suite 400

|

| Entity Address, City or Town |

Rockville

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20850

|

| City Area Code |

410

|

| Local Phone Number |

522-8707

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

AVTX

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001534120

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

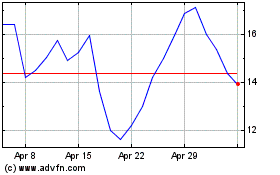

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From Apr 2024 to May 2024

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From May 2023 to May 2024