Atour Lifestyle Holdings Limited Announces Pricing of its Initial Public Offering

November 11 2022 - 5:00AM

Atour Lifestyle Holdings Limited (“Atour” or the “Company”)

(NASDAQ: ATAT), a leading hospitality and lifestyle company in

China, announced today that it has priced its initial public

offering of 4,750,000 American Depositary Shares ("ADSs"), each

representing three Class A ordinary shares of the Company, at

US$11.0 per ADS. The ADSs will begin trading on November 11, 2022

on the Nasdaq Global Select Market under the ticker symbol "ATAT."

The offering is expected to close on November 15, 2022, subject to

customary closing conditions.

The Company has granted the underwriters an

option, exercisable within 30 days from the date of the final

prospectus, to purchase up to an aggregate of 712,500 additional

ADSs. The total gross proceeds of the offering are expected to be

approximately US$52.3 million if the underwriters do not exercise

their over-allotment option, and approximately US$60.1 million if

the underwriters choose to exercise their over-allotment option in

full.

BofA Securities, Inc., Citigroup Global Markets

Inc., China International Capital Corporation Hong Kong Securities

Limited and CMB International Capital Limited are acting as

underwriters for the offering. Redbridge Securities LLC and Tiger

Brokers (NZ) Limited are acting as co-managers for the

offering.

A registration statement related to these

securities has been filed with, and declared effective by the U.S.

Securities and Exchange Commission (the "SEC"). This press release

shall not constitute an offer to sell or a solicitation of an offer

to buy the securities described herein, nor shall there be any sale

of these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

This offering is being made only by means of a

prospectus forming a part of the effective registration statement.

Copies of the final prospectus relating to the offering may be

obtained, when available, by contacting the following underwriters:

(1) BofA Securities, Inc., One Bryant Park, New York, NY 10036,

United States of America, or by telephone

at +1-800-294-1322 or by emailing

dg.prospectus_requests@bofa.com; (2) Citigroup Global Markets Inc.,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, New York 11717, or by telephone at +1-800-831-9146, or by

emailing prospectus@citi.com; (3) China International Capital

Corporation Hong Kong Securities Limited, 29th Floor, One

International Finance Centre, 1 Harbour View Street, Central, Hong

Kong, or by telephone at +852-2872-2000; (4) CMB International

Capital Limited, 45F, Champion Tower, 3 Garden Road, Central, Hong

Kong, or by telephone at +852-3761-8990.

About Atour Lifestyle Holdings

Limited

Atour Lifestyle Holdings Limited (NASDAQ: ATAT)

is a leading hospitality and lifestyle company in China, with a

distinct portfolio of lifestyle hotel brands. According to Frost

& Sullivan, Atour is the largest upper midscale hotel chain in

China in terms of room numbers as of the end of 2021, and is the

first Chinese hotel chain to develop a scenario-based retail

business. Atour is committed to bringing innovations to China’s

hospitality industry and building new lifestyle brands around hotel

offerings. For more information, please visit

https://ir.yaduo.com.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the "safe harbor"

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Company's beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement. In some cases, forward-looking

statements can be identified by words or phrases such as "may",

"will", "expect", "anticipate," "target," "aim," "estimate,"

"intend," "plan," "believe," "potential," "continue," "is/are

likely to", or other similar expressions. Further information

regarding these and other risks, uncertainties or factors is

included in the Company's filings with the SEC. All information

provided in this press release is as of the date of this press

release, and the Company does not undertake any duty to update such

information, except as required under applicable law.

Investor Relations Contact

Atour Lifestyle Holdings LimitedEmail:

ir@yaduo.com

The Piacente Group, Inc.Email:

Atour@tpg-ir.comTel: +86-10-6508-0677

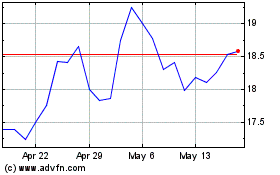

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Jan 2024 to Jan 2025